Paypal Q2 2024 Earnings Analysis

Dive into $PYPL Paypal’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results

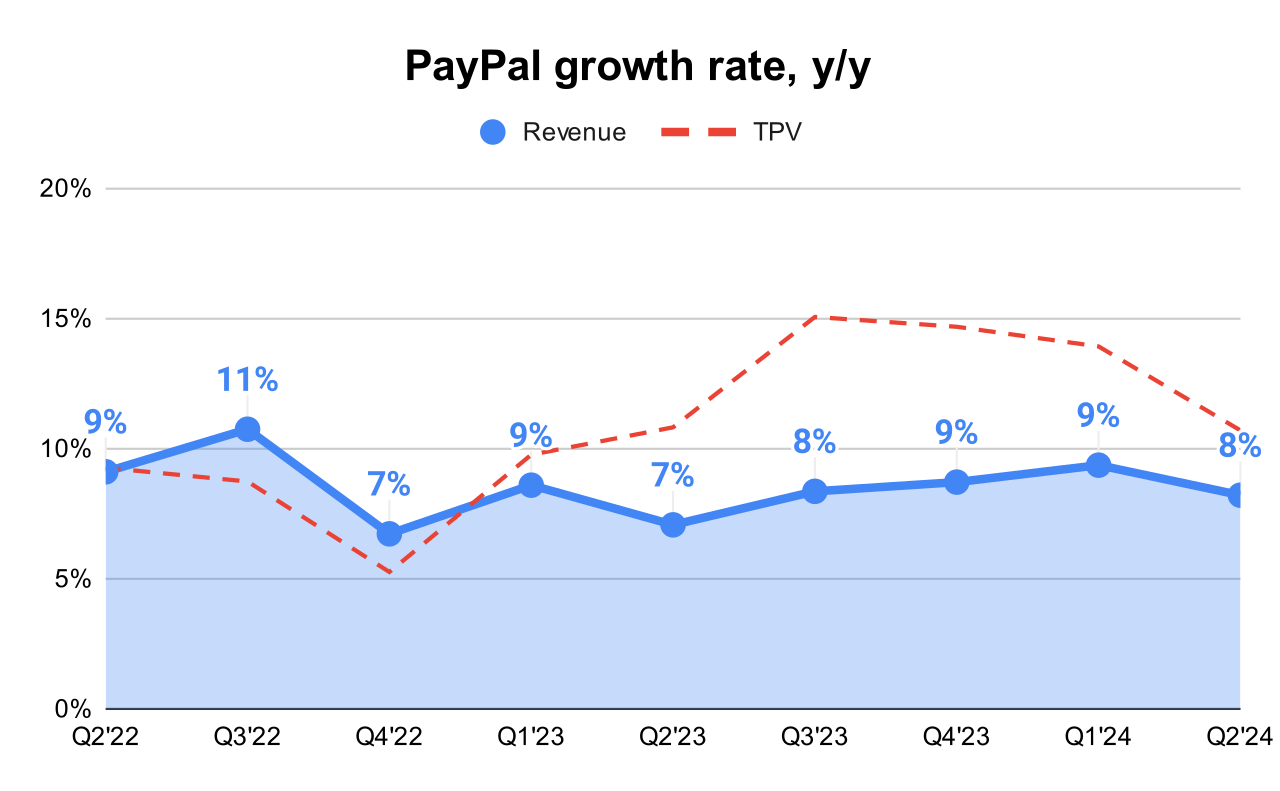

↗️$7,885.0M rev (+8.2% YoY, +9.4% LQ) beat est by 1.0%

↗️FXN Rev (+9.0% YoY, +10.0% LQ)

↗️Operating Margin* (16.8%, +0.6%pp YoY)

↗️FCF Margin (17.3%, +22.2%pp YoY)

↗️Net Margin (14.3%, +0.2%pp YoY)

↗️EPS* $1.19 beat est by 21.4%🟢

*non-GAAP

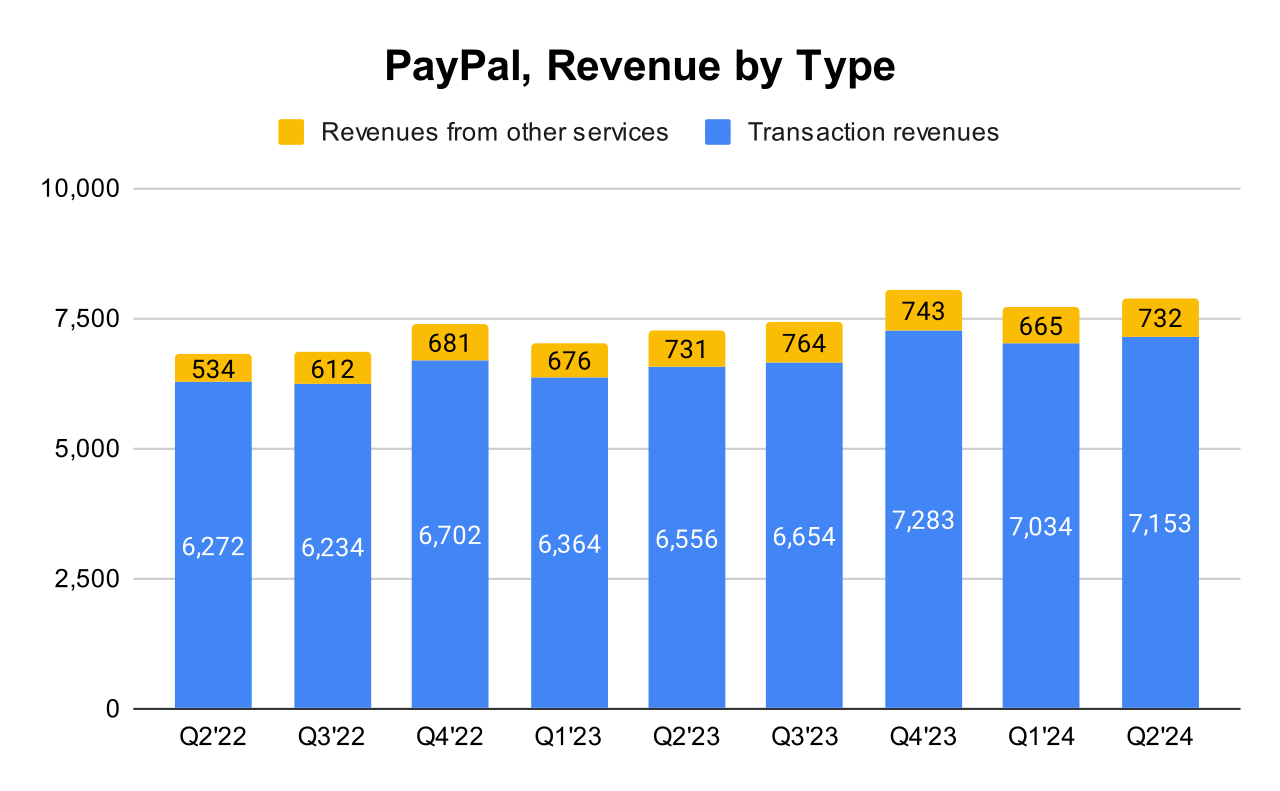

Revenues by Type

↗️Transaction $7,153M rev (+9.1% YoY, 90.7% of Rev)

➡️Other services $732M rev (+0.1% YoY, 9.3% of Rev)🟡

Revenues by Geography

➡️U.S. $4,550M rev (+8.1% YoY, 57.7% of Rev)🟡

↗️International $3,335M rev (+8.4% YoY, 42.3% of Rev)

Key Metrics

↘️429 Active accounts (-0.5% YoY, -2 YoY)

➡️6,580 Number of payment transactions (+8.3% YoY, +506 YoY)🔴

↗️Payment transactions per active account 60.90 (+11.3% YoY)

↗️TPV 416,814 (+10.7% YoY)

↗️Transaction Expense Rate 0.95% (+1 bps YoY)🟢

↘️Transaction and Credit Loss Rate 0.08% (-3 bps YoY)🟡

↘️Transaction Margin 45.80% (-0.1 pp YoY)🟡

Operating expenses

↗️S&M*/Revenue 5.2% (4.9% LQ)

↗️R&D*/Revenue 7.7% (7.7% LQ)

↗️G&A*/Revenue 6.1% (4.9% LQ)

Dilution

↘️SBC/rev 4%, -1.0%pp QoQ

↘️Basic shares down -6.2% YoY, -0.5%pp QoQ🟢

↘️Diluted shares down -6.0% YoY, -0.5%pp QoQ🟢

Guidance

↘️Q3'24 $7,788.9M guide (+5.0% YoY) missed est by -2.3%🔴

Key points from Paypal’s Second Quarter 2024 Earnings Call:

Strong Performance Metrics:

PayPal reported an 11% increase in total payment volume, reaching $417 billion. Revenue grew by 9% on a currency neutral basis, and non-GAAP earnings per share increased by 36% year over year.

Strategic Investments:

PayPal plans to increase its investments in strategic growth initiatives, focusing on expanding omnichannel capabilities and offering more value-added services for consumers and merchants.

A significant ramp-up in marketing spend is planned for the second half of the year to promote new and improved features across both PayPal and Venmo platforms.

Innovation

Fastlane:

This new product is a significant innovation targeting the guest checkout process, where it aims to improve the checkout conversion rate substantially. Fastlane is designed to recognize returning users, boosting their checkout conversion to nearly 80% compared to the industry average of about 50%. PayPal plans to make Fastlane generally available to U.S. merchants in August, including integration with platforms like Braintree and partnerships with Salesforce, Adobe, and BigCommerce.

Braintree Enhancements:

Braintree has begun to significantly contribute to transaction margin dollar growth for the first time in over two years, reflecting improvements and integrations that enhance its value proposition to merchants.

Venmo Developments:

Venmo's momentum continues with new features such as the introduction of Venmo teen accounts and push provisioning of the Venmo debit card to Apple and Google wallets. These features aim to expand Venmo’s addressable market and deepen user engagement.

Advertising Platform Expansion:

PayPal is in the early stages of building a new ads platform, which aims to leverage their two-sided network to provide targeted and effective advertising solutions, further integrating and enhancing the ecosystem for both consumers and merchants.

Mobile and SMB Focus:

PayPal emphasized its ongoing work to improve mobile experiences and its value proposition for small and medium-sized businesses (SMBs). This includes integrating new technologies and designs to enhance branded checkout flows on mobile devices, which have shown significant conversion improvements in testing phases.

Global E-Commerce Integration:

The company is building an end-to-end platform that spans the entire commerce journey, aiming to provide superior customer experiences and sales conversions from start to finish.

Competition and Market Evolution:

PayPal acknowledges the intense competition in the payments space and the need to continuously innovate to maintain its market leader status.

Financial Outlook and Guidance:

With the strong performance in the first half of the year, PayPal raised its full-year guidance for transaction margin dollars and earnings per share. They also plan to continue investing in key growth areas, which they expect will drive long-term profitable growth.

Management comments on the earnings call.

Product Innovations:

Alex Kris, CEO: "Fastlane is designed to dramatically improve the checkout conversion rate for returning users...We're also rolling out a new pay sheet experience overall, which simplifies, gives customers still the choice of whether they're using PayPal balance or any instrument they want as well as buy now, pay later."

Competitors:

Alex Kris, CEO: "We play in a massive multi-trillion-dollar market and it's not a zero-sum game...We've held share despite competition. Our focus is on continuing to improve and provide a better experience for our consumers."

Challenges:

Alex Kris, CEO: "We are still early in our transformation and while pleased with our progress in many areas, we know there is much more we can do and with greater speed."

Financial Outlook:

Jamie Miller, CFO: "Given the strong start to the year, we are raising our 2024 free cash flow guidance to approximately $6 billion...Our investment spending will ramp as the year progresses to support our highest priority growth initiatives."