Palo Alto Networks Q4 2024 Earnings Analysis

Dive into $PANW Palo Alto’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$2,257.4M rev (+14.3% YoY, +13.9% LQ) beat est by 0.9%

↘️GM* (76.6%, -1.4 PPs YoY)🟡

↘️Operating Margin* (28.4%, -0.2 PPs YoY)🟡

↘️FCF Margin (22.6%, -10.6 PPs YoY)🟡

↘️Net Margin (25.1%, -63.4 PPs YoY)🟡

↗️EPS* $0.81 beat est by 3.8%🟢

*non-GAAP

Revenue By Type

Product

➡️$421.5M rev (+7.9% YoY, +3.7% LQ) 🟡

↘️GM* (76.7%, -1.6 PPs YoY)

Subscription and support

➡️$1,835.9M rev (+15.9% YoY, +16.1% LQ)

↘️GM* (76.6%, -1.4 PPs YoY)

Key Metrics

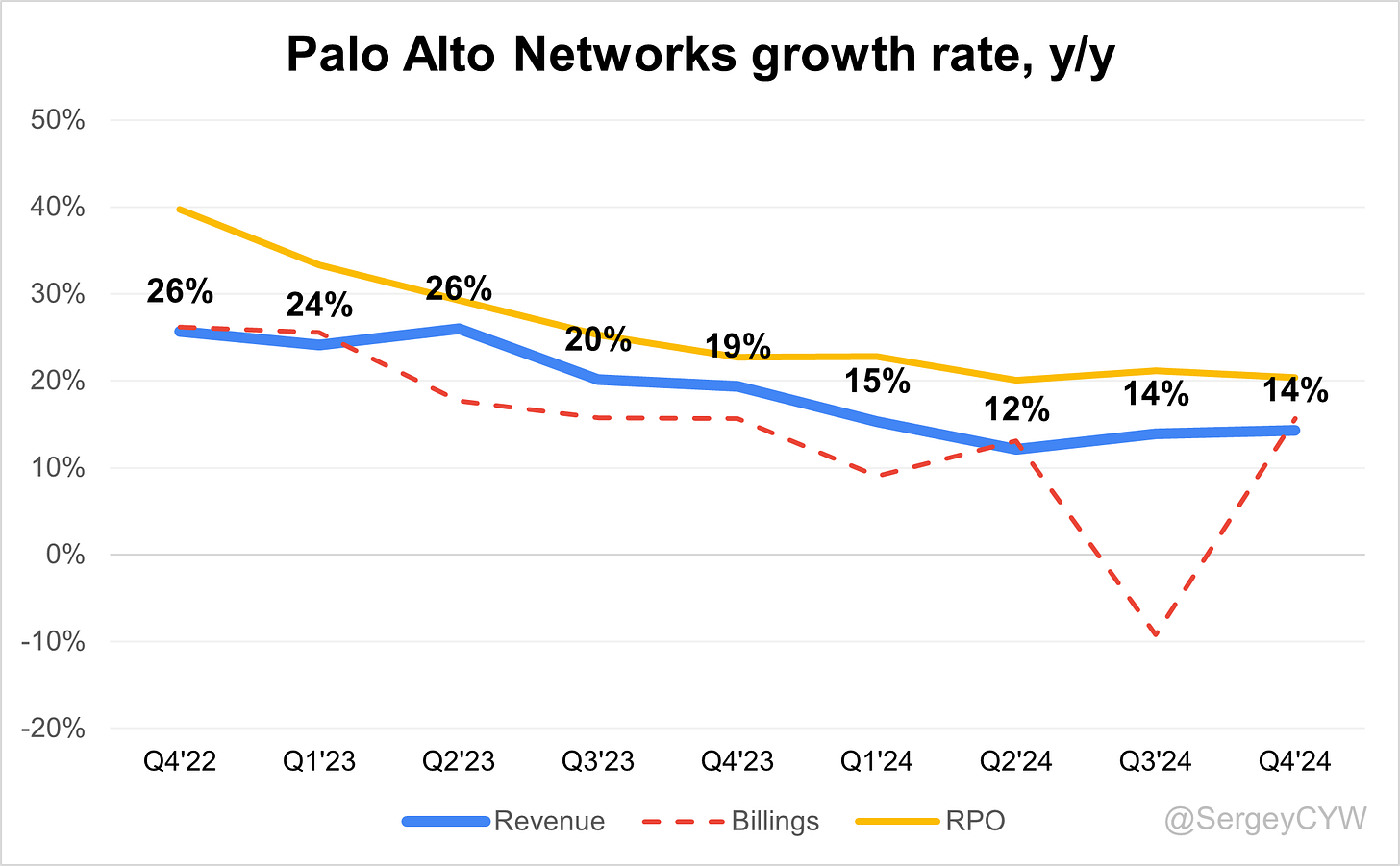

↗️RPO $13.00B (+20.4% YoY)

↗️Billings $2,271M (+15.7% YoY)🟢

↗️NGS ARR $4,780M (+37.0% YoY)

Operating expenses

↘️S&M*/Revenue 28.7% (-0.9 PPs YoY)

↗️R&D*/Revenue 15.8% (+0.5 PPs YoY)

↘️G&A*/Revenue 3.7% (-0.8 PPs YoY)

Quarterly Performance Highlights

➡️Net New ARR $260M ( +0% YoY)

↗️CAC* Payback Period 9.3 Months (+0.9 YoY)🟡

↘️R&D* Index (RDI) 0.92 (-0.26 YoY)🟡

Dilution

↗️SBC/rev 15%, +0.5 PPs QoQ

↘️Basic shares up 3.1% YoY, -2.2 PPs QoQ

↘️Diluted shares down -0.8% YoY, -2.2 PPs QoQ🟢

Guidance

➡️Q1'25$2,260.0 - $2,290.0M guide (+14.6% YoY) in line with est

➡️$9,140.0 - $9,190.0M FY guide (+21.8% YoY) raised by 0.2% in line with est

Key points from Palo Alto’s Fourth Quarter 2024 Earnings Call:

Palo Alto Networks Q2 FY2025 Earnings Report

Financial Performance

Palo Alto Networks reported $2.26 billion in revenue, a 14% YoY increase. Product revenue grew 8% YoY, while services revenue expanded 16% YoY. Subscription revenue increased 20% YoY, and support revenue rose 8% YoY.

Next-Generation Security ARR (NGS ARR) surged 37% YoY to $4.78 billion, driven by adoption of SASE, Cortex, and advanced security subscriptions. Remaining performance obligations (RPO) increased 21% YoY to $13 billion, with current RPO at $6.1 billion (+17% YoY).

Geographically, revenue grew 13% in the Americas, 18% in EMEA, and 17% in JAPAC. The company closed its largest-ever deals in both EMEA and JAPAC, exceeding $50 million each.

Profitability remained strong, with a 76.6% gross margin. Operating expenses as a percentage of revenue declined by 120 basis points YoY. Non-GAAP EPS reached $0.81, and adjusted free cash flow exceeded $590 million.

Product Innovations

Firewall-as-a-Platform bookings grew 21% YoY. Software and SASE solutions accounted for two-thirds of firewall bookings, with SASE bookings increasing over 50% YoY. Prisma Access Browser saw $30 million in Q2 bookings, up 95% QoQ.

Software firewalls recorded 50% bookings growth, with 70% of VM deployments in public cloud. AI-powered security is gaining traction, with the first seven-figure AI firewall deal signed in Q2 and an eight-figure pipeline forming.

AI in Cybersecurity

AI-driven security operations continue to expand. XSIAM surpassed $1 billion in cumulative bookings. AI automation reduced customer support case resolution times by 50% and cut IT contract labor by 50%, contributing to margin expansion.

Platformization Growth

Platformization is accelerating, with 75 new deals in Q2, a 67% YoY increase. Platformized customers among the top 5,000 accounts exceeded 1,150.

Large deals are increasing, with 74 transactions exceeding $5 million (+25% YoY) and 32 transactions surpassing $10 million (+50% YoY).

Cortex Expansion

Cortex bookings grew 50% YoY. The launch of Cortex Cloud, integrating Prisma Cloud and XSIAM, enhances real-time AI-powered threat detection. Cortex XDR adoption is increasing, with hundreds of new customers added in Q2.

Prisma Cloud Performance

Prisma Cloud bookings rose 50% YoY, driven by Data Security Posture Management (DSPM) and API-based AI runtime security. Prisma Cloud now secures nine of the top ten non-security SaaS companies.

Strata Network Security

Firewall-as-a-Platform bookings increased 21% YoY. SASE bookings grew over 50% YoY, with Prisma SASE reaching 5,600+ customers and 23 million seats. Prisma Access Browser surged 95% QoQ to $30 million in bookings.

XSIAM and AI-driven SOC

XSIAM adoption is rising, exceeding $1 billion in cumulative bookings. Organizations moving from legacy SIEM to AI-powered SOCs improved incident response times by 60% and reduced security operations costs by 30%.

IBM Partnership

QRadar-related bookings exceeded $100 million in Q2. A $65 million platformization contract with an Asian bank originated from a QRadar customer migrating to Cortex XSIAM.

Large Customer Wins

A $65 million deal with a leading Asian bank expanded its use of Cortex XSIAM, increasing its NGS ARR fivefold YoY to $12 million.

A $60 million contract with a U.S. municipality renewed its network security and added Cortex and Prisma Cloud. NGS ARR increased 40% YoY to $11 million.

A $25 million deal with a European auto manufacturer enhanced its network and cloud security, reducing security incident resolution times by 60%.

Challenges

Gross margin pressure came from newer SaaS offerings still scaling. One-time inventory costs affected Q2 margins but are not expected to recur. The firewall appliance market remains stable, growing 0%-5% YoY.

Future Outlook

For FY2025, Palo Alto Networks expects:

Revenue: $9.14B - $9.19B (+14% YoY)

NGS ARR: $5.52B - $5.57B (+31%-32% YoY)

RPO: $15.2B - $15.3B (+19%-20% YoY)

Free Cash Flow Margin: 37%-38%

EPS: $3.18 - $3.24 (+12%-14% YoY)

Management remains confident in long-term free cash flow generation and margin expansion, supported by AI-driven efficiencies, large deal growth, and platform adoption.

Management comments on the earnings call.

Product Innovations

Nikesh Arora, Chairman and Chief Executive Officer

"Our AI-powered security capabilities are rapidly evolving, and we continue to lead the market in delivering innovative solutions that seamlessly integrate across network security, cloud security, and security operations. Our customers demand future-proof solutions, and we are responding with continuous enhancements across Prisma Cloud, Cortex, and Strata to ensure they remain protected in an increasingly complex threat landscape."

Lee Klarich, Chief Product Officer

"We are now seeing strong momentum with Prisma Access Browser, AI-driven firewalls, and advanced SASE capabilities. These innovations are ensuring that security is embedded across every touchpoint of an organization’s infrastructure, from cloud to endpoint, while providing automated, AI-powered threat detection and response."

Artificial Intelligence (AI) in Cybersecurity

Nikesh Arora, Chairman and Chief Executive Officer

"AI is fundamentally changing the cybersecurity landscape. Attackers are leveraging AI to automate and scale cyber threats, and our customers must adopt AI-driven defenses to stay ahead. Our AI-powered security platforms ensure that organizations can detect, analyze, and neutralize threats faster and more efficiently than ever before."

Deepak Golecha, Chief Financial Officer

"We are deploying AI across multiple facets of our business—not just in security products but also in internal efficiencies. We’ve seen AI-driven automation cut our IT contract labor costs by 50% and reduce case resolution times in our customer support division by nearly the same margin. These AI-driven efficiencies allow us to scale profitably while continuing to invest in innovation."

Platformization Strategy and Success

Nikesh Arora, Chairman and Chief Executive Officer

"Platformization is not just a strategy—it is a fundamental shift in how enterprises approach cybersecurity. We are seeing customers consolidate their security operations under a single AI-driven platform, which enables them to detect threats faster, improve operational efficiency, and reduce total cost of ownership. The number of multi-platform customers is increasing rapidly, validating our belief that security must be unified rather than fragmented across multiple vendors."

Deepak Golecha, Chief Financial Officer

"Large enterprises are recognizing the value of platformization, as evidenced by our 74 deals over $5 million and 32 deals exceeding $10 million in Q2. These multi-year commitments reinforce the long-term value our customers see in our integrated cybersecurity approach."

Cortex and AI-Driven Security Operations

Nikesh Arora, Chairman and Chief Executive Officer

"The future of cybersecurity is AI-driven automation, and Cortex XSIAM is leading this transformation. Enterprises are moving away from legacy SIEM solutions in favor of AI-powered SOCs that can autonomously detect, prioritize, and respond to threats in real time. This shift is driving exponential growth in XSIAM, with over $1 billion in cumulative bookings."

Lee Klarich, Chief Product Officer

"Cortex Cloud represents a major milestone for the industry. By integrating Prisma Cloud with Cortex XSIAM, we are providing enterprises with a fully AI-powered cloud security and SOC solution that bridges cloud security posture management, real-time threat detection, and automated incident response in one unified platform."

Prisma Cloud and Cloud Security Innovation

Nikesh Arora, Chairman and Chief Executive Officer

"Enterprises are rapidly adopting Prisma Cloud because they recognize that cloud security must evolve to keep pace with hyperscale cloud adoption and AI workloads. With DSPM integration, runtime security, and AI-driven monitoring, Prisma Cloud is now the industry’s most comprehensive cloud security platform."

Lee Klarich, Chief Product Officer

"The shift in cloud security is moving towards real-time protection and AI-driven automation. Organizations need visibility, control, and continuous monitoring across their cloud environments, and Prisma Cloud is delivering these capabilities at scale. Our API-based AI runtime security and expanded DSPM capabilities are setting new standards for how cloud security should be managed."

XSIAM and the Future of AI-Driven Security Operations

Nikesh Arora, Chairman and Chief Executive Officer

"XSIAM is reshaping security operations by eliminating the inefficiencies of traditional SIEMs. Organizations are recognizing that AI-driven SOCs provide better outcomes, reduce analyst workload, and enhance real-time security monitoring. This is why XSIAM adoption continues to accelerate among large enterprises, including financial institutions and government agencies."

Deepak Golecha, Chief Financial Officer

"With XSIAM, we are seeing security operations centers transition from reactive, manual workflows to fully automated, AI-driven environments. Our customers are experiencing faster threat resolution and reduced operational costs, which is driving strong adoption across all verticals."

Competitive Landscape

Nikesh Arora, Chairman and Chief Executive Officer

"Many vendors claim to offer security platforms, but true platformization requires deep integration across security layers, AI-driven threat intelligence, and a unified data architecture. Enterprises are choosing our platform because they need a security solution that delivers real-time response, reduces complexity, and scales with their digital transformation."

Customer Success and Large Enterprise Wins

Nikesh Arora, Chairman and Chief Executive Officer

"We continue to see strong adoption from large enterprises across all sectors. A major Asian bank expanded its Cortex XSIAM deployment in a $65 million deal, increasing its NGS ARR fivefold year-over-year. A U.S. municipality signed a $60 million contract to further integrate Prisma Cloud and Cortex into its security infrastructure. These deals highlight how enterprises are consolidating security under our platform to drive better security outcomes and cost efficiencies."

Deepak Golecha, Chief Financial Officer

"The demand for AI-driven security is evident in our large deal activity, with 32 transactions over $10 million in Q2. Customers are making long-term commitments to Palo Alto Networks because they recognize the value of consolidating security operations under a unified, AI-powered platform."

Strategic Partnerships and IBM Integration

Nikesh Arora, Chairman and Chief Executive Officer

"Our partnership with IBM and the QRadar acquisition have been instrumental in expanding our enterprise security footprint. This quarter, we closed multiple large deals where former QRadar customers transitioned to Cortex XSIAM. We are seeing significant traction in co-selling opportunities, and IBM’s security relationships are proving to be a major growth driver."

Deepak Golecha, Chief Financial Officer

"The IBM partnership is exceeding our expectations. The QRadar acquisition is not only strengthening our security operations business but also opening up new large-scale enterprise opportunities. With $100 million in QRadar-related bookings in Q2, we are confident this partnership will continue to accelerate."

International Growth and Market Expansion

Nikesh Arora, Chairman and Chief Executive Officer

"Our international growth remains strong, with revenue increasing 18% in EMEA and 17% in JAPAC. This quarter, we secured our largest-ever deals in both regions, exceeding $50 million each. These wins demonstrate our ability to execute at scale globally while addressing regional cybersecurity needs."

Challenges and Market Dynamics

Deepak Golecha, Chief Financial Officer

"As we continue scaling our SaaS offerings, gross margins are temporarily impacted due to the early-stage costs associated with these services. However, as we achieve greater scale in cloud and AI-driven security, we expect operating efficiencies to improve further, driving long-term profitability."

Future Outlook and Growth Strategy

Nikesh Arora, Chairman and Chief Executive Officer

"Cybersecurity demand remains strong, and our AI-driven, platformized approach positions us well for long-term growth. We are raising our guidance and remain confident in delivering 37%-38% free cash flow margins through FY2027. Our ability to innovate, execute large deals, and drive AI adoption will continue to fuel our momentum."

Thoughts on Palo Alto Earnings Report $PANW:

🟢 Positive

Revenue reached $2.26B (+14.3% YoY, +13.9% QoQ), exceeding estimates by 0.9%.

NGS ARR surged +37.0% YoY to $4.78B, driven by SASE, Cortex, and advanced security subscriptions.

Billings increased +15.7% YoY to $2.27B.

Large deals growing: 74 transactions over $5M (+25% YoY) and 32 transactions over $10M (+50% YoY).

EPS (non-GAAP) reached $0.81, beating estimates by 3.8%.

Cortex bookings up +50% YoY, with XSIAM surpassing $1B in cumulative bookings.

Prisma Cloud bookings up +50% YoY, securing 9 of the top 10 SaaS companies.

IBM Partnership contributing: QRadar-related bookings exceed $100M.

🟡 Neutral

Gross margin (non-GAAP) at 76.6%, down -1.4 PPs YoY, impacted by early-stage SaaS offerings.

Operating margin (non-GAAP) at 28.4%, down -0.2 PPs YoY.

Free cash flow margin at 22.6%, down -10.6 PPs YoY, affected by deferred payment structures.

Net new ARR flat at $260M YoY.

Guidance in line with estimates: FY revenue projected at $9.14B - $9.19B (+14% YoY).

Customer acquisition cost (CAC) payback period increased to 9.3 months (+0.9 YoY).

🔴 Negative

Net margin declined -63.4 PPs YoY to 25.1%, largely due to one-time tax valuation effects from FY2024.

SBC/revenue increased to 15%, up +0.5 PPs QoQ.

Basic shares outstanding up +3.1% YoY, slightly diluting EPS growth.