Palo Alto Networks Q2 2024 Earnings Analysis

Dive into $PANW Palo Alto’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$2,189.5M rev (+12.1% YoY, 15.3% LQ) beat est by 1.4%

↘️GM* (76.8%, -0.4 PPs YoY)🟡

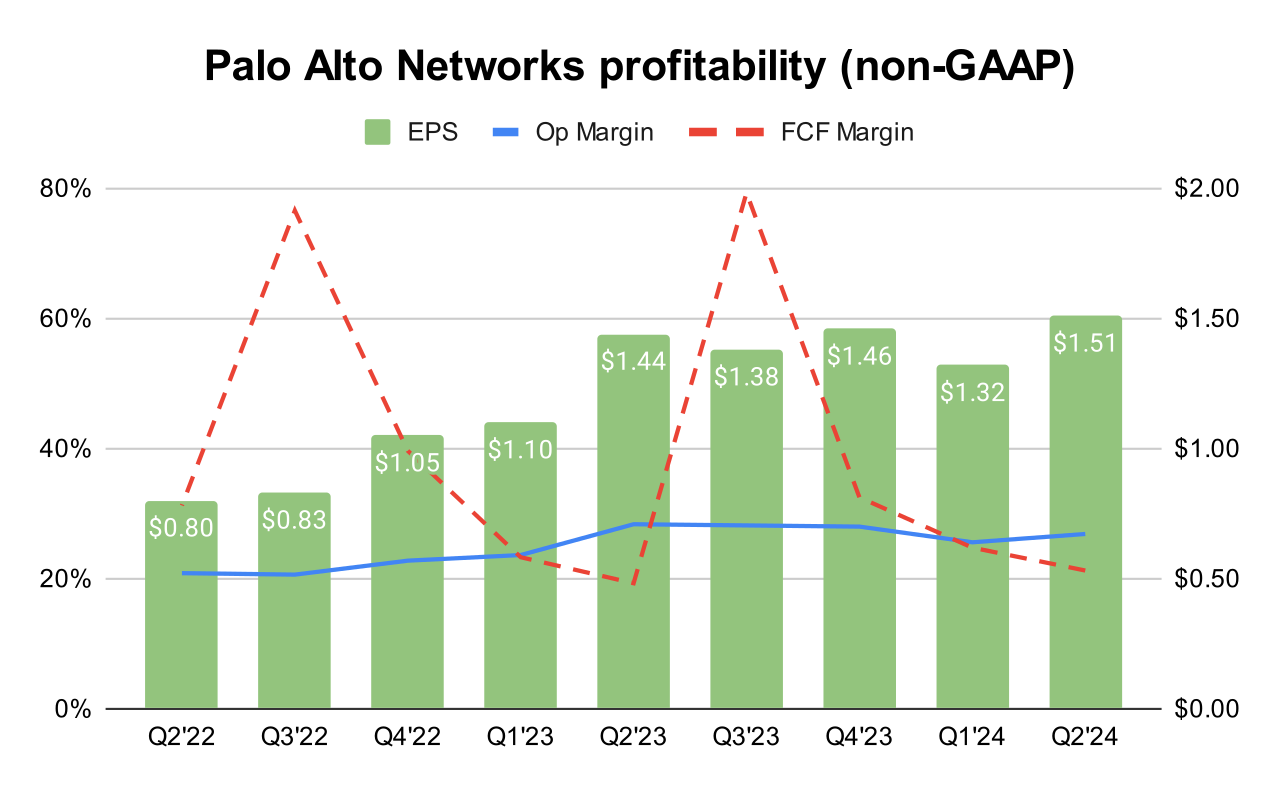

↘️Operating Margin* (26.9%, -1.5 PPs YoY)🟡

↗️FCF Margin (21.3%, +2.0 PPs YoY)

↗️EPS* $1.51 beat est by 7.1%🟢

*non-GAAP

Revenue By Type

Product

➡️$480.5M rev (-5.3% YoY, +0.7% LQ) 🟡

↘️GM* (78.8%, -1.3% PPs YoY)

Subscription and support

➡️$1,709.0M rev (+18.2% YoY, +19.6% LQ)

↗️GM* (76.3%, +0.0% PPs YoY)

Key Metrics

↗️RPO $12.70B (+20.0% YoY)

➡️Billings $3,502M (+11.0% YoY)🟡

↗️NGS ARR $4,200M (+42.0% YoY)

Operating expenses

↗️S&M*/Revenue 30.1% (+0.8 PPs YoY)

↗️R&D*/Revenue 16.0% (+0.9 PPs YoY)

↘️G&A*/Revenue 3.8% (-0.6 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $422M (+11.1% YoY)

↘️CAC* Payback Period 5.8 Months (8.0 LQ)

Dilution

↘️SBC/rev 13%, -1.5 PPs QoQ

↘️Basic shares up 5.7% YoY, -0.5 PPs QoQ🔴

↘️Diluted shares down -0.2% YoY, -3.0 PPs QoQ🟢

Guidance

➡️Q3'24 $2,100.0 - $2,130.0M guide (+12.6% YoY) in line with est

↗️$9,100.0 - $9,150.0M FY guide (+20.6% YoY) beat est by 0.4%

Key points from Palo Alto’s Second Quarter 2024 Earnings Call:

Performance Highlights:

The company reported a revenue of $2.19 billion, representing a 12% growth, with subscription revenue up by 23%.

Notably, their next generation security (NGS) annual recurring revenue (ARR) grew by 43%, surpassing $4 billion.

The Board of Directors approved an additional $500 million buyback authorization, increasing the total authorization to $1 billion available through December 2025.

Platformization Strategy:

The company has significantly expanded its platformization strategy, adding over 90 new platformizations in Q4, leading to a total of over 1,000 among their largest customers. This approach integrates various security solutions into a unified platform, increasing customer engagement and annual recurring revenue (ARR).

AI Integration and Security:

Palo Alto Networks is heavily investing in AI to enhance its cybersecurity products and operational efficiencies. AI has been integrated across their security platforms to anticipate security needs and automate responses, which is particularly evident in their AI Access and AI Firewall services.

AI Access allows organizations to safely use AI tools by providing security teams with visibility, control, data protection, and proactive threat prevention measures.

XSIAM Platform:

XSIAM, introduced as a transformation platform for security operations, has achieved significant growth with $500 million in bookings for FY '24, a doubling from the previous fiscal year. XSIAM helps reduce the time to discover and remediate security events, contributing to a drastic decrease in median resolution time for security incidents.

SASE and Prisma Access:

The Secure Access Service Edge (SASE) offerings continue to grow, driven by integrations such as the enterprise browser obtained through the Talon acquisition. This integration not only enhances SASE but also adds protections specific to AI tool usage.

Prisma Access has seen the introduction of AI Access, offering robust controls and data protection for organizations utilizing AI tools, enhancing the security capabilities of their SASE product line.

Prisma Cloud Innovations:

Prisma Cloud has expanded with new modules like data security posture management and AI security posture management, addressing the need for comprehensive cloud security solutions.

The cloud detection response capabilities integrate aspects of Prisma Cloud and Cortex to provide real-time threat detection and remediation, marking significant enhancements in cloud security management.

Firewall and Network Security Enhancements:

The company reported strong growth in firewall platform billings, driven by the adoption of software-based and virtual firewall solutions.

Customer Engagement

Palo Alto Networks highlighted several high-value deals that demonstrate deep customer engagement and trust.

High Eight-Figure Deal:

An existing firewall and XSOAR customer expanded their firewall footprint and implemented Prisma Access and Prisma Cloud, moving towards a Zero Trust network security model. Their SIEM systems were also upgraded to the AI-powered XSIAM, exemplifying comprehensive platform integration.

Global Semiconductor Manufacturer:

In a mid-eight figure deal, this customer, building on a five-year relationship, transitioned their network security to a Zero Trust architecture using Palo Alto Networks' Cortex platform, opting for a unified security solution over disjointed products from competitors.

Global Media Company:

The company fully platformized across all network security form factors to support a mobile workforce and manage merger complexities. They adopted Zero Trust architecture, utilizing XSOAR and XSIAM to enhance security automation and intelligence, culminating in a nine-figure deal.

U.S. Financial Services Firm:

Moving 90% of applications to the cloud, this firm consolidated their security solutions by expanding their Cortex XDR and XSOAR usage to include XSIAM and adding Prisma Cloud for enhanced cloud-native application security.

Future Outlook:

The platformization strategy is seen as a key driver for future growth, with the company expecting this approach to help achieve their goal of $15 billion in NGS ARR by 2030.

The anticipated closure of the acquisition of IBM’s QRadar SaaS assets by the end of September is expected to further enhance their security operations offerings and contribute to revenue growth.

Management comments on the earnings call.

Platformization:

Nikesh Arora (CEO): "Our strategy to deliver a comprehensive approach towards network security with hardware software form factors for both on-prem and cloud, and an industry's leading SASE solution is working."

Nikesh Arora (CEO): "AI adoption is proceeding at a rapid pace faster than honestly I've seen any other new technology. However, it is following a typical pattern. Innovation is driving the speed of adoption while security might be an afterthought."

Customers:

Nikesh Arora (CEO): "We're delighted with our Q4 results. We drove the top line ahead of the overall cybersecurity market and delivered improved profitability and strong cash generation."

Nikesh Arora (CEO): "After a strong addition of approximately 65 new platformizations in Q3, we added over 90 new platformizations in Q4, now have well over 1,000 total platformizations amongst our 5,000 largest customers as we exit FY '24."

Challenges:

Nikesh Arora (CEO): "Geopolitical tensions remain at high levels as evidenced by multiple regional conflicts in the news. Cybersecurity activity is often elevated in these environments, and we see multiple non-government agencies impacted by this nation state activity."

Nikesh Arora (CEO): "This complexity is additive with old technologies that have not been retired. Meanwhile, a multitude of uncoordinated security defenses are simply layered on."