Palo Alto Networks Q1 2025 Earnings Analysis

Dive into $PANW Palo Alto’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$2,289.0M rev (+15.3% YoY, +14.3% LQ) beat est by 0.6%

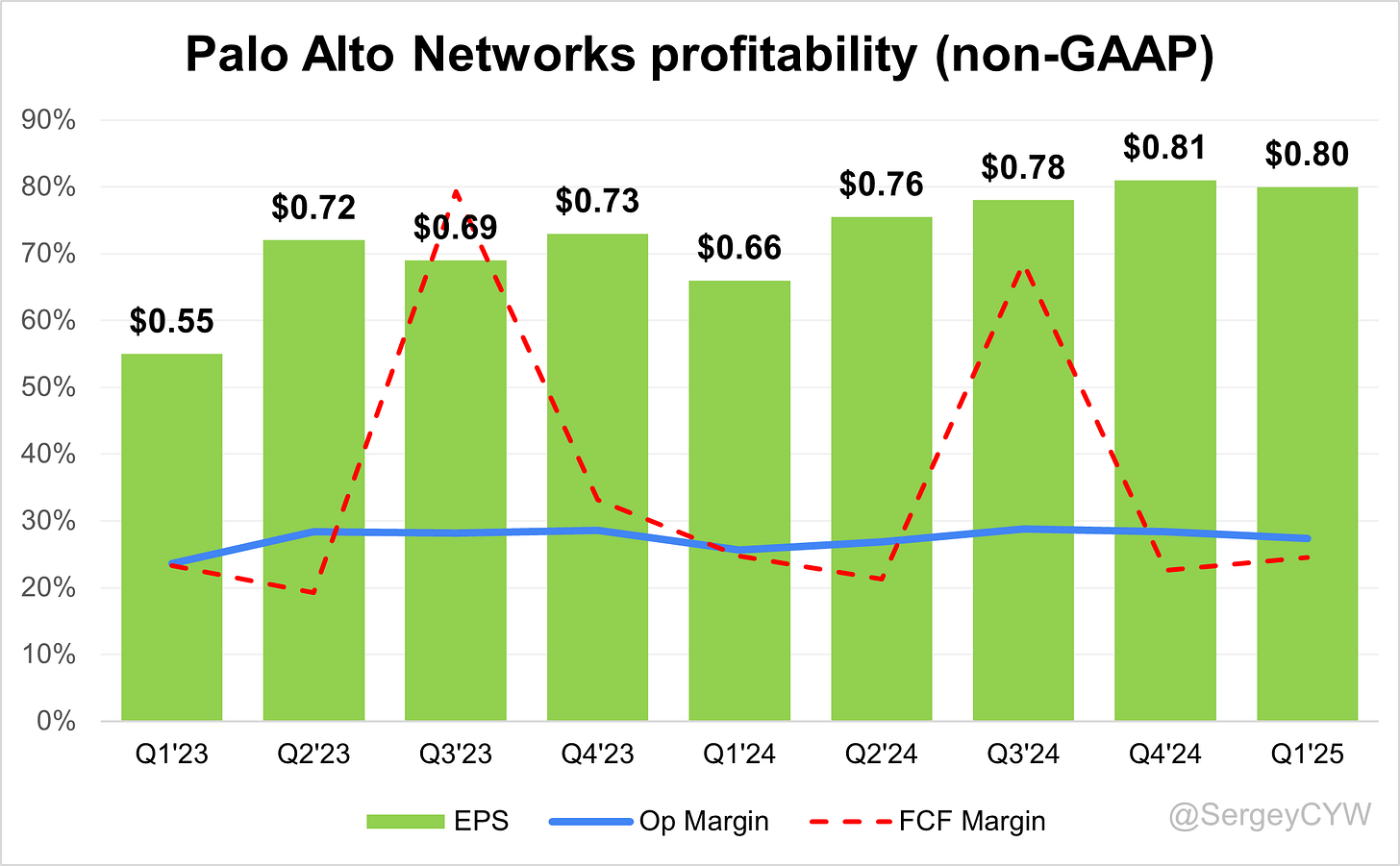

↘️GM* (76.0%, -1.6 PPs YoY)🟡

↗️Operating Margin* (27.4%, +1.8 PPs YoY)

↘️FCF Margin (24.5%, -0.3 PPs YoY)🟡

↘️Net Margin (11.5%, -2.6 PPs YoY)🟡

↗️EPS* $0.80 beat est by 3.9%

*non-GAAP

Revenue By Type

Product

➡️$452.7M rev (+15.8% YoY, +7.9% LQ) 🟢

↘️GM* (78.4%, -2.5 PPs YoY)

Subscription and support

➡️$1,836.3M rev (+15.2% YoY, +15.9% LQ) 🟡

↘️GM* (75.4%, -1.3 PPs YoY)

Key Metrics

↗️RPO $13.50B (+19.5% YoY)

➡️Billings $2,507M (+12.1% YoY)🟡

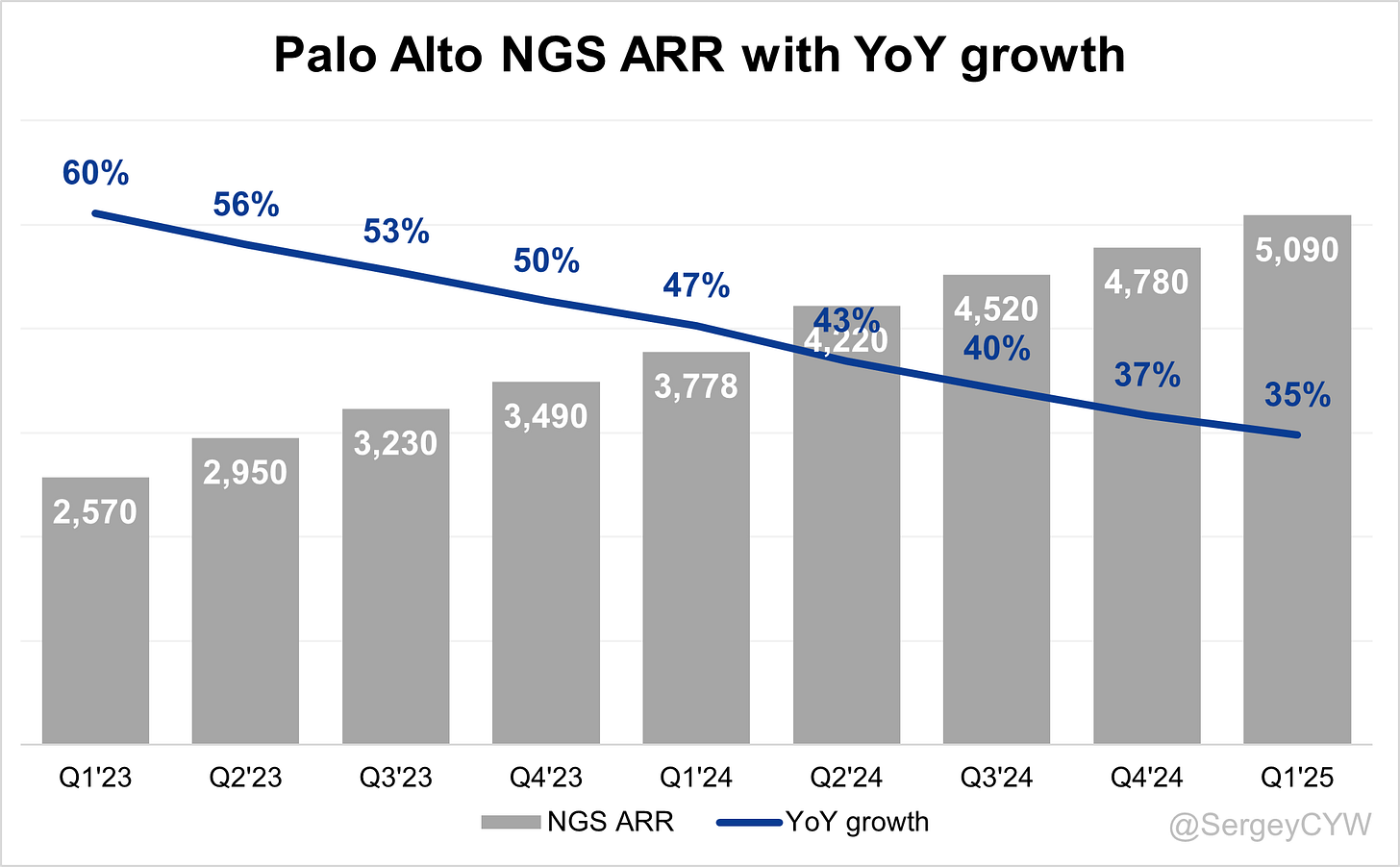

↗️NGS ARR $5,090M (+34.7% YoY)

Operating expenses

↘️S&M*/Revenue 29.7% (-2.2 PPs YoY)

↘️R&D*/Revenue 15.4% (-0.7 PPs YoY)

↘️G&A*/Revenue 3.5% (-0.5 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $310M (+7.7% YoY)

↗️CAC* Payback Period 8.2 Months (+0.4 YoY)🟡

↗️R&D* Index (RDI) 0.99 (+0.05 YoY)🟢

Dilution

↗️SBC/rev 16%, +0.3 PPs QoQ

↘️Basic shares up 3.0% YoY, -0.2 PPs QoQ

↗️Diluted shares down -0.3% YoY, +0.6 PPs QoQ🟢

Guidance

➡️Q2'25 $2,490.0 - $2,510.0M guide (+14.2% YoY) in line with est

➡️$9,170.0 - $9,190.0M FY guide (+22.0% YoY) in line with est

Key points from Palo Alto’s First Quarter 2025 Earnings Call:

Financial Performance

Palo Alto Networks reported Q3 FY2025 revenue of $2.29 billion, up 15% year-over-year, hitting the high end of guidance. Product revenue rose 16%, while services revenue grew 15%, driven by subscription growth of 18% and support revenue up 10%.

Operating margin expanded by 340 basis points YoY, reflecting scale across sales, R&D, and G&A. Non-GAAP EPS was $0.80, and GAAP EPS $0.37, the 12th consecutive GAAP profitable quarter. Adjusted free cash flow totaled $578 million, despite increased demand for annual payments.

Remaining performance obligation (RPO) reached $13.5 billion, up 19% YoY. Current RPO rose 16% to $6.2 billion.

Strata

Strata product revenue grew 16% YoY, driven by both hardware and software. Hardware demand remained stable within a 0–5% growth range. Software firewalls now account for ~40% of product mix and software firewall ARR grew ~20% YoY, supported by accelerated cloud migration due to AI adoption.

AI workloads are prompting enterprises to modernize infrastructure, benefiting Palo Alto’s software firewall business. However, hardware growth remains modest, reflecting the longer-term challenge in refreshing legacy appliances.

Prisma SASE

SASE ARR grew 36% YoY, outperforming both the market and key competitors. Customer base expanded to ~6,000, up 22%, with 40% of new customers net new to the company.

Prisma Access Browser sold 3 million license seats, a 10x increase YoY, now comprising one-third of Prisma Access seat volume. The browser has become a strategic anchor as enterprises shift toward cloud-based, AI-enabled environments.

Customer education on browser use within broader security stacks remains an ongoing focus. Bundling strategies are being used to expand browser deployments into platform-level deals.

Cortex and XSIAM

Cortex gained traction across its portfolio, with XSIAM emerging as the fastest-growing product in company history. ARR from XSIAM exceeded $1 million per customer on average, with 270+ customers onboarded and ARR up 200% YoY. Trailing 12-month bookings are approaching $1 billion.

Major wins included:

$90M deal with a global consulting firm replacing a legacy SIEM and consolidating four tools.

$46M deal with a financial services provider displacing EDR and SIEM incumbents.

$33M deal with a U.S. financial firm consolidating four cloud security vendors.

XSIAM now ingests ~12 petabytes of telemetry daily, powering additional modules such as advanced email security and exposure management. The platform is positioned as a data engine for building multi-context, AI-powered tools.

Challenges include transitioning legacy SIEM customers. An IBM partnership is underway to migrate on-prem QRadar users to XSIAM.

Agentic AI

Agentic AI is a strategic priority as AI evolves from assistant to autonomous decision-maker. Palo Alto is developing Agentics, an agentic framework built on its XSOAR platform, designed to automate and secure enterprise AI systems using real-time controls and programmable permissions.

Agentics benefits from the company's deep integration capabilities and traffic visibility. Customer interest at RSA 2025 was strong, though market education and standards remain under development.

Product Innovation

Q3 product launches included:

Advanced email security to preempt threats before inbox delivery.

Exposure management to prioritize and act on high-risk vulnerabilities.

Both innovations are powered by XSIAM telemetry and illustrate Palo Alto’s strategy to leverage data for continuous product expansion. Enhancements to AI firewall and Prisma Access Browser further solidify the company’s positioning in cloud-first, AI-centric security environments.

Protect.ai Acquisition

Palo Alto announced its intent to acquire Protect.ai for $700 million in cash and equity. Protect.ai provides AI model scanning and red teaming capabilities, aimed at securing AI pipelines end-to-end. Its team will lead Palo Alto's AI security business post-integration, expanding the company’s presence in AI runtime security.

Platformization

90+ net new platform deals were signed, bringing the total to ~1,250 platformized customers among the top 5,000 accounts. Customers with multiple platformizations increased 70% YoY, with Cortex-led deals tripling, largely driven by XSIAM.

Management indicated that reaching 2,500–3,500 platformized customers could support the company’s $15B ARR goal by FY2030, assuming 60–70% of NGS ARR originates from these customers.

Large Customers

Customer momentum continued among large enterprises:

130 customers now generate over $5M in NGS ARR, up 40% YoY.

44 customers exceed $10M in NGS ARR, up 60% YoY.

Deals are characterized by multi-product consolidation (3–5 tools) and replacement of legacy vendors. Customers cite AI transformation, simplified security stacks, and operational efficiency as key drivers for consolidation.

Execution Amid Volatility

April introduced macro headwinds including tariff concerns and geopolitical instability, impacting late-quarter deal execution. Teams executed through the uncertainty, drawing on pandemic-era discipline.

Contract durations declined modestly, though demand remained strong and most bookings followed annual payment terms. Early convertible debt conversions reduced the company’s debt by $151 million, with the remainder due in Q4.

Outlook

Palo Alto reaffirmed its $15 billion ARR target by FY2030, driven by:

AI-first architecture adoption.

Growth in SASE, Cortex, and Agentic AI.

Platformization across large enterprise accounts.

Q4 revenue is projected to exceed $4 billion, with 80% of collections already booked. Management expects new market offerings (XSIAM, SASE, AIRS) to be the primary drivers of future ARR, shifting reliance away from mature firewall subscriptions and positioning the company for multi-year sustainable growth.

Management comments on the earnings call.

Product Innovations

Nikesh Arora, Chairman and Chief Executive Officer

"Every byte on nearly 12 petabytes of telemetry we ingest daily around cloud, identity, endpoints, e-mail and more act as high-octane fuel. This massive data stream isn't just powering XSIAM, it's igniting our ability to identify and accelerate our entry into entirely new markets."

"We launched advanced e-mail security to help stop threats before they reach the inbox and our exposure management capability was launched as well, designed to cut through the noise and focus security on the risks that truly matter."

Strata

Nikesh Arora, Chairman and Chief Executive Officer

"We highlighted software firewalls in our prepared remarks for a reason. We think the software firewall business is going to inflect."

"Even the most reluctant of organizations are going to have to move to the cloud to be able to leverage the AI models that are coming out fast and furious. Now, the moment you say, I have to go in the cloud, I have to go deploy real-time in the cloud, you have to secure it. And today, we have the best technology in multi-cloud basis for cloud network traffic in our software firewalls."

Prisma SASE

Nikesh Arora, Chairman and Chief Executive Officer

"In Q3, our SASE ARR grew 36% year-over-year, more than twice as fast as the overall market and ahead of our key SASE competitors."

"As AI drives more data and applications to the cloud, the browser is becoming the primary interface to accessing these resources, acting as the application runtime environment. Prisma Access Browser's native controls and real-time visibility are designed to help ensure that sensitive data remains safeguarded during browsing sessions regardless of the user location or the application they're accessing."

Cortex and XSIAM

Nikesh Arora, Chairman and Chief Executive Officer

"XSIAM is not only our fastest-growing product ever, it is now more impactful to our overall growth rate. I believe that from a strategic perspective, XSIAM has the potential of being the game changer for both the industry and Palo Alto."

"Three years into our XSIAM journey, our sustained strong momentum bolsters our confidence in a long growth runway as we increasingly tap into this estimated $40 billion SecOps TAM."

Dipak Golechha, Chief Financial Officer

"Our AI ARR is now approximately $400 million in Q3, up over 2.5 times year-over-year. On a trailing 12-month basis, XSIAM bookings are now approaching $1 billion."

Agentic AI

Lee Klarich, Chief Product Officer

"With agentic AI, I think the way I think about it starts with this idea that AI is going to move from being a sort of helper function to having autonomy... There’ll have to be certain guardrails and constraints on that from an enterprise perspective and certainly from a cybersecurity perspective."

"Our XSOAR platform has over a thousand integrations. We know how to integrate with all the different systems in enterprise. We know how to programmatically approach this in a consistent, reliable way."

Nikesh Arora, Chairman and Chief Executive Officer

"By definition, it means you should have some version of agentic AI securing your perimeter five years from now. That requires that agentic AI to have access to all the data across all your endpoints."

Competitors

Nikesh Arora, Chairman and Chief Executive Officer

"This is the moment of the SIEM market. It's a $40 billion TAM. I think in the next three to five years, it will get replaced. It will be replaced by new-age players. The legacy players will drive their darndest to hang on to it, but the architectures are fundamentally different."

"We were able to go with IBM to many of their large customers and work them through the transformation of going from an on-premise SOC to what is effectively now a cloud-delivered SOC."

Customers

Nikesh Arora, Chairman and Chief Executive Officer

"As AI becomes more deeply integrated into our customers' businesses, the need to protect the underlying data, models, and infrastructure will become paramount."

"Customers are not just exploring AI—they are investing urgently in secure AI infrastructure, which requires cloud-native, data-driven security platforms."

Dipak Golechha, Chief Financial Officer

"Customers continue to make significant commitments to Palo Alto through our platformization deals, particularly when adopting XSIAM to transform their security operations center."

Protect.ai Acquisition

Nikesh Arora, Chairman and Chief Executive Officer

"In the firewall sort of AI business, we've actually doubled down on the production capabilities. So, we are aggressively starting with runtime security... We found Protect. We were lucky the founders found a fit with our team... and that team is actually going to run our AI security business."

Dipak Golechha, Chief Financial Officer

"We announced our intention to acquire Protect AI for a total consideration of $700 million in cash and replacement equity awards. We expect the transaction to close by our first quarter of fiscal year 2026."

International Growth

Dipak Golechha, Chief Financial Officer

"We saw double-digit growth across all theaters with the Americas growing 12%, EMEA up 20%, and JAPAC growing 23%."

Challenges

Nikesh Arora, Chairman and Chief Executive Officer

"It was not an easy quarter to execute. Had we not had the tariff conversations, the geopolitical tensions, it'd be much easier to sell through it... We had to go back and pull up our shorts and execute the same practices that we did then."

Dipak Golechha, Chief Financial Officer

"We continue to see increasing demand for annual payments, particularly deals over $1 million, but we are absorbing this transition while maintaining the high end of our fiscal year ’25 adjusted free cash flow margin guidance."

Future Outlook

Nikesh Arora, Chairman and Chief Executive Officer

"We're encouraged by the early customer feedback and look forward to continuing to discuss this more in the future... We look for our first north of $4 billion quarter."

"Our platform approach is working well with customers slowly and steadily. Our approach, which favors better and speedier security outcomes and lower cost of ownership, is being adopted by more and more of our customers."

Dipak Golechha, Chief Financial Officer

"It is this dynamic that gives us confidence in our long-term targets... We expect to see the new market business to be the stronger driver of net new ARR dollars."

Thoughts on Palo Alto Earnings Report $PANW:

🟢 Positive

Revenue reached $2,289M, up +15.3% YoY, beating estimates by 0.6%

Non-GAAP EPS was $0.80, exceeding estimates by 3.9%

Operating margin improved to 27.4%, up +1.8 points YoY

NGS ARR rose to $5,090M, up +34.7% YoY

RPO grew to $13.50B, up +19.5% YoY

Net new ARR was $310M, up +7.7% YoY

SASE ARR increased +36% YoY, with customer count at ~6,000 (+22% YoY); 40% were new logos

XSIAM ARR grew +200% YoY with 270+ customers; TTM bookings nearing $1B

Platformization added 90+ deals, bringing total to ~1,250; customers with multiple platforms grew +70% YoY

Prisma Access Browser sold 3M licenses, up 10x YoY

Product revenue up +15.8% YoY to $452.7M

Diluted share count down -0.3% YoY, offsetting dilution pressures

🟡 Neutral

Billings reached $2,507M, up +12.1% YoY

Subscription and support revenue grew +15.2% YoY to $1,836M

Guidance for Q4 and FY remains in line with consensus estimates

R&D index (RDI) rose to 0.99, up +0.05 YoY

Contract durations declined modestly, but demand quality held steady

Customer education remains in progress around new browser and agentic AI offerings

SBC as % of revenue at 16%, up +0.3 points QoQ

🔴 Negative

Gross margin declined to 76.0%, down -1.6 points YoY

Product GM fell to 78.4%, down -2.5 points YoY

Services GM dropped to 75.4%, down -1.3 points YoY

Free cash flow margin at 24.5%, down -0.3 points YoY

Net margin decreased to 11.5%, down -2.6 points YoY

Customer acquisition cost (CAC) payback extended to 8.2 months, up +0.4 YoY

Basic shares outstanding increased +3.0% YoY, pressuring EPS leverage

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.