Palo Alto Networks: Platform Strategy Paying Off, But Is the Growth Cycle Re-Accelerating?

Deep Dive into $PANW: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Palo Alto Networks has quietly pulled off a strategic pivot few noticed—offering free products to boost long-term retention, even at the expense of short-term revenue. The company is now showing early signs of renewed growth momentum, backed by platform consolidation, strong leading indicators, and strong margins. With a $110B TAM and only 4% penetration, is this the early innings of a new growth cycle or just a bounce before competition heats up?

Here’s what’s under the hood.

Table of Contents:

Company Overview – A brief summary of the company, including its mission, sector, competitive advantage, and total addressable market (TAM).

Valuation – Analysis of changes in Forward EV/Sales and Forward P/E multiples, along with comparisons to peers within the same sector.

Economic Moat – Evaluation of the company’s moat across five key types: Economies of Scale, Network Effect, Brand, Intellectual Property, and Switching Costs.

Revenue Growth – Review of revenue growth dynamics over the past two years.

Segments and Main Products – Overview of the company’s business segments, latest quarterly performance by segment, product innovation, and revenue growth by region.

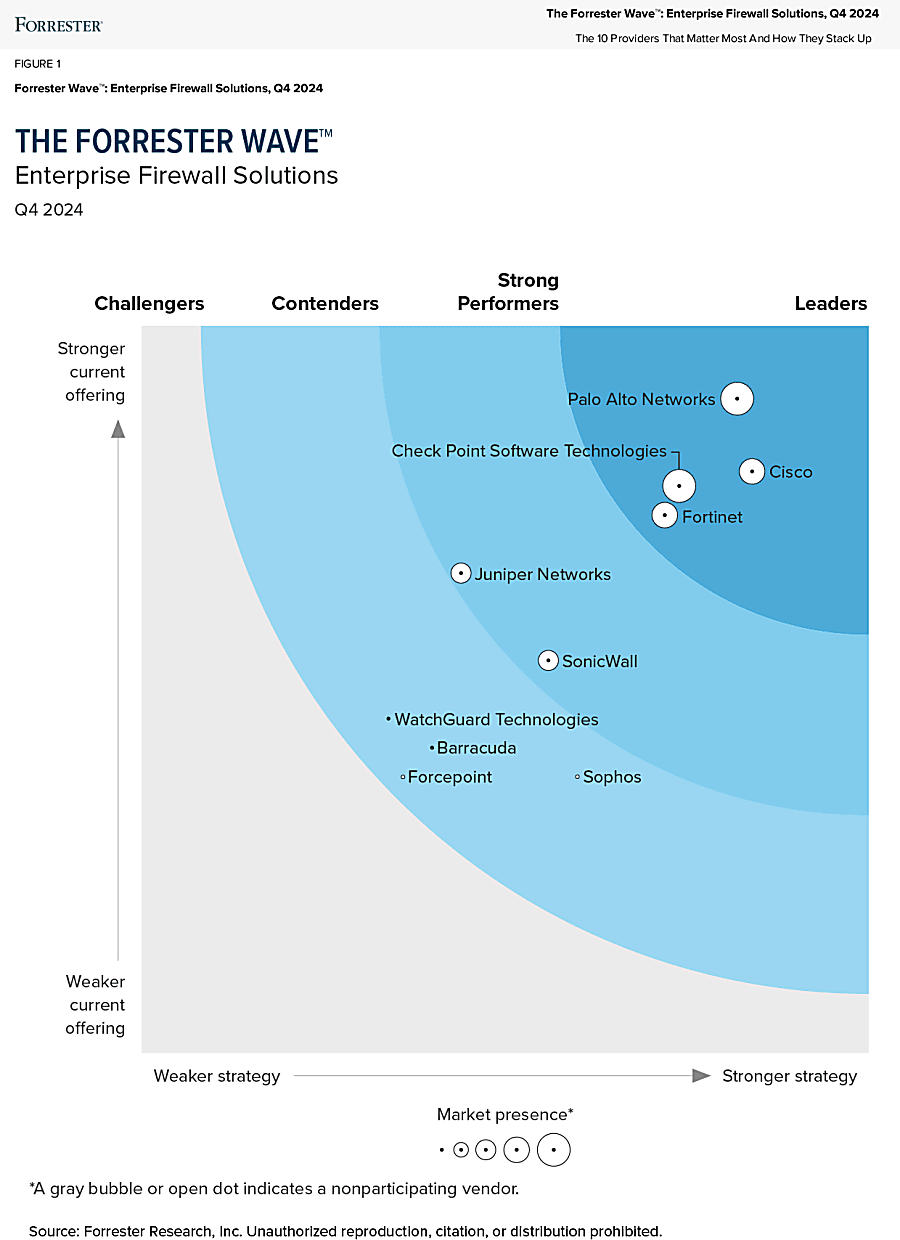

Market Leadership – Assessment of the company’s leadership status in its segment, as recognized by reputable rating agencies like Gartner, The Forrester Wave, etc.

Customers – Analysis of customer growth trends, customer success stories, and major customer wins.

Key Performance Indicators (KPIs) – Review of ARR growth, net new ARR, CAC payback period, RDI score, profitability, operating expenses, balance sheet strength, and shareholder dilution.

Conclusion – Final thoughts and summary based on the above analysis.

1. Company overview

About Palo Alto

Palo Alto Networks is a global cybersecurity leader founded in 2005. The company provides advanced firewalls and cloud-based offerings that extend those firewalls to cover various aspects of security. PANW serves over 85,000 organizations in over 150 countries, including 85% of the Fortune 100. In fiscal year 2024, the company generated $8.03 billion in revenue and $2.58 billion in net income.

Mission

PANW's mission is to prevent successful cyberattacks and enable digital transformation for global organizations. The company focuses on continuous innovation in cloud security, AI-powered threat prevention, and zero trust architecture to achieve this goal.

Sector

PANW operates in the cybersecurity sector, specifically in network security, cloud security, and security operations. The company competes in three main markets: network security (Strata & Prisma SASE), cloud security (Prisma Cloud), and security operations (Cortex).

Competitive Advantage

PANW's competitive advantage lies in its unified control plane across hardware and software, and broad coverage of network, security operations center, applications, and cloud. The company's App-ID technology provides greater visibility into application communication on networks, offering a level of control competitors struggle to match. PANW's understanding of containerization allows its Next-Generation Firewall to be deployed physically, virtually, in a container, or via cloud, providing additional edge.

Total Addressable Market (TAM)

Palo Alto Networks estimates its TAM at $110 billion, presenting a significant expansion opportunity across its core security platforms. With current Annual Recurring Revenue (ARR) at $4.8 billion, the company captures only 4% of this market—highlighting a large gap for future growth.

In Network Security, the Strata platform addresses a market growing at a 9% CAGR from 2021 to 2024. Within this, software firewalls are expanding at a faster 13% CAGR, while the SASE (Secure Access Service Edge) segment leads with 36% CAGR—a clear signal of shifting enterprise priorities.

Prisma Cloud, the company’s cloud security platform, competes in a market valued at $10 billion in 2021 and projected to grow at a 30% CAGR through 2024. Demand is driven by the accelerating pace of cloud migration and the need for scalable, cloud-native security.

In Security Operations, Cortex targets the SIEM market, estimated at $40 billion. The segment is expected to undergo substantial transformation over the next 3–5 years, as legacy systems give way to AI-enhanced platforms and real-time analytics.

Overall, Palo Alto Networks addresses a cybersecurity market growing at a 14% CAGR, fueled by three critical forces: increased adoption of AI-driven security, a surge in cloud-first strategies, and enterprise demand for platform consolidation. The widespread shift to Zero Trust architectures further amplifies the need for integrated, end-to-end security coverage.

2. Valuation

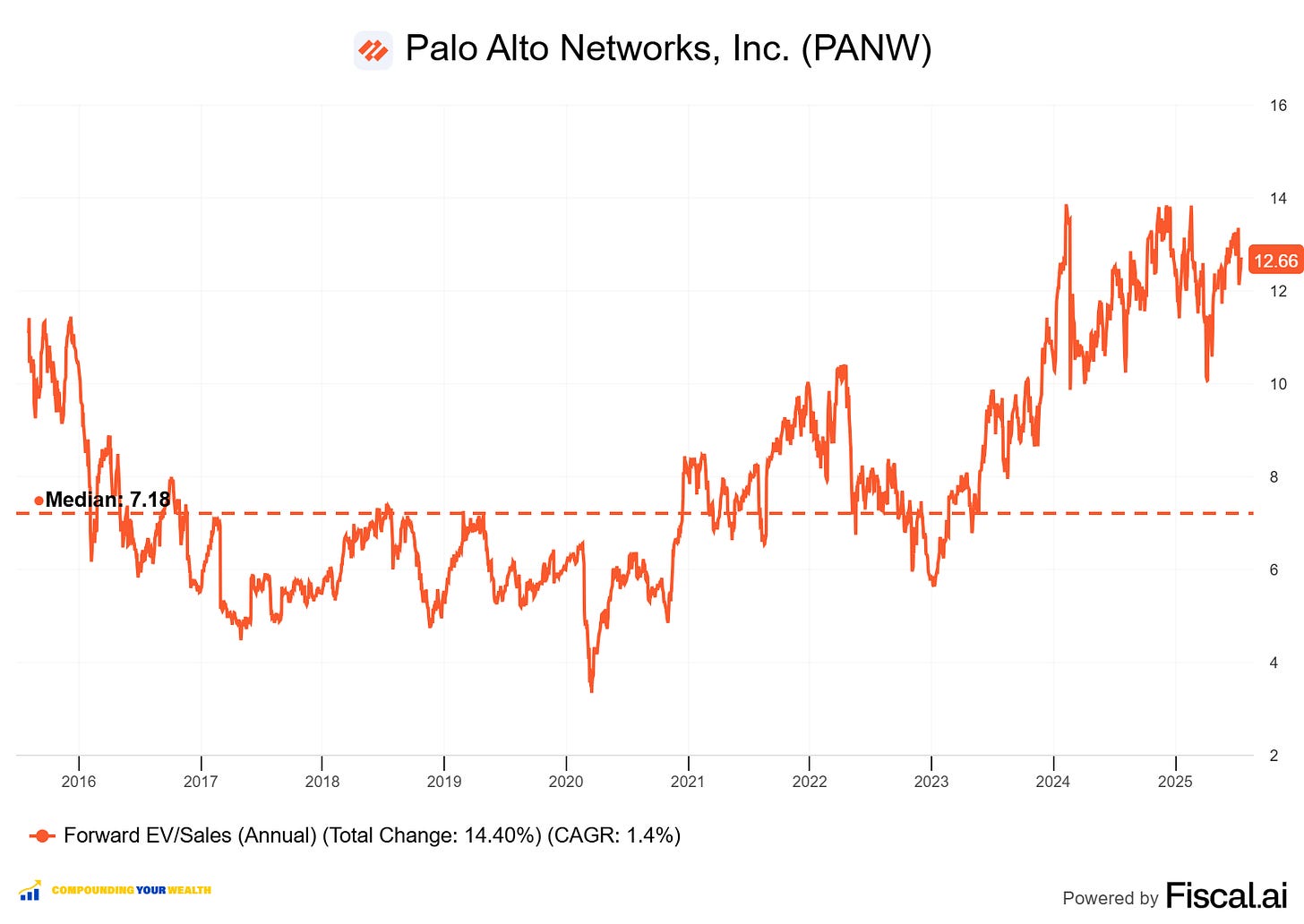

$PANW Palo Alto is trading at a Forward EV/Sales multiple of 12.6, above the median of 7.2. The company's Forward EV/Sales multiple is near its historical highs.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

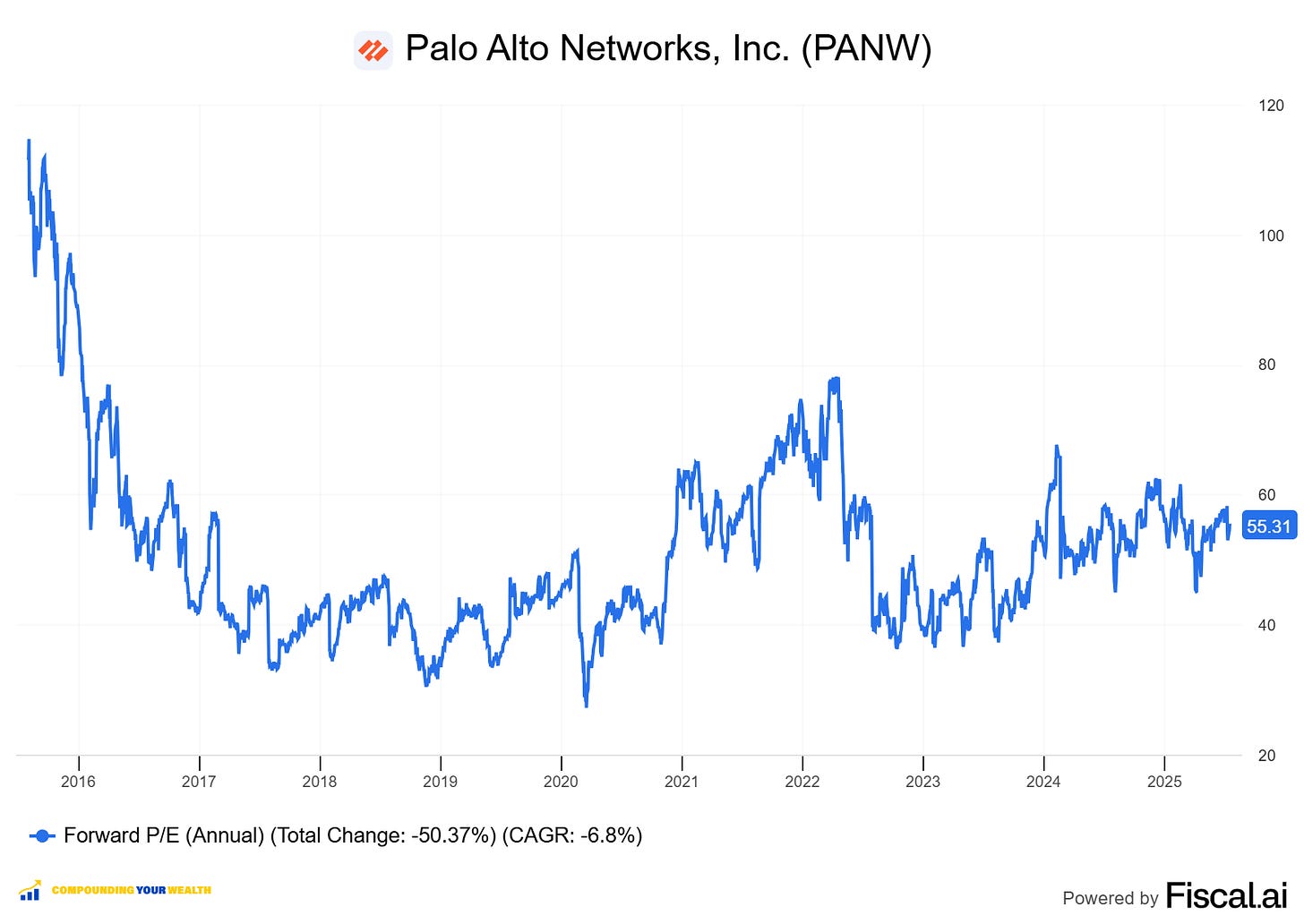

$PANW Palo Alto trades at a Forward P/E of 55.3, with a revenue growth of 15.3% YoY in the last quarter.

The EPS growth forecast for 2026 is 12.4% and P/E of 58.6, with a 2026 PEG ratio of 4.7.

The EPS growth forecast for 2027 is 15.7% and P/E of 52.2, with a 2027 PEG ratio of 3.3.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

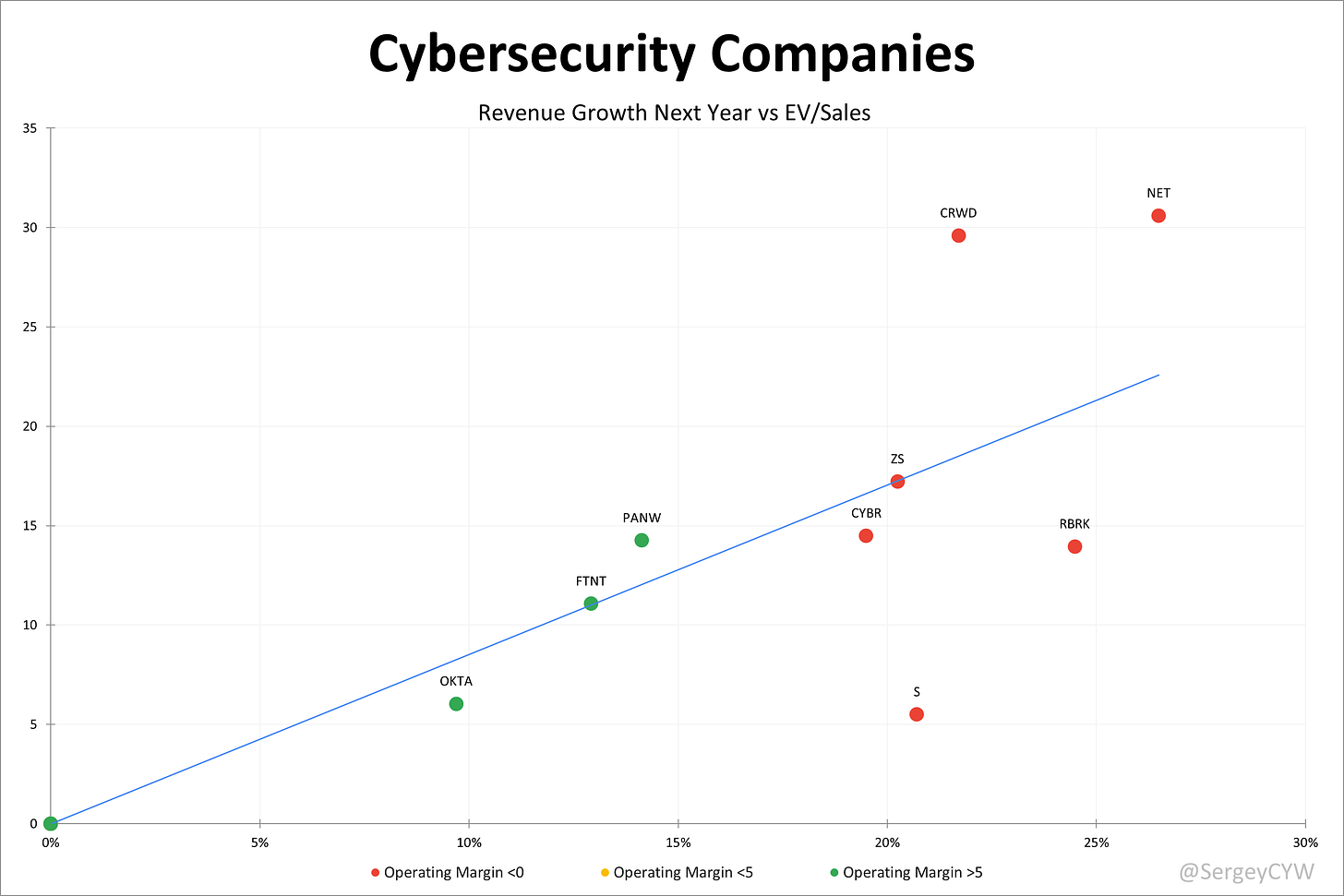

Analysts' revenue growth forecast for $PANW in 2025 is +16.7%, and +14.0% for 2026. Considering this forecast, the valuation based on the EV/Sales multiple appears fair when compared to other companies in the cybersecurity sector.

Analysts expect solid revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

3. Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

Palo Alto Networks demonstrates strong economies of scale, which have strengthened as the company has grown. Non-GAAP gross margin above 70%, reflecting efficiency across a larger revenue base. With over 85,000 organizations globally using its platform, the company secures meaningful cost advantages across R&D, manufacturing, and operations.

This scale enables heavy investment in innovation while maintaining profitability—an edge smaller competitors cannot match. A 22.9% market share in network security further amplifies this advantage by improving supplier relationships and procurement efficiency. As the company grows, its scale moat deepens.

Network Effect

Palo Alto Networks benefits from a significant network effect, especially in threat detection. Its AI-powered systems process more than 1.5 trillion network events per day, achieving a 99.7% threat detection accuracy. As more customers join, the system becomes smarter—delivering increasing value to all users and raising barriers to entry.

Threat intelligence drawn from 85,000 customers worldwide allows PANW to detect and stop threats—known, unknown, and zero-day—up to 180x faster than competitors. Every additional user strengthens the platform’s effectiveness, reinforcing a moat that grows stronger with scale.

Brand Strength

Palo Alto Networks commands a leading brand in cybersecurity. It is recognized as a Leader in Gartner’s Magic Quadrant for Network Firewalls and holds a Net Promoter Score of 67. The company serves 85 of the Fortune 100 and more than 50% of U.S. federal agencies.

Its global presence spans over 150 countries, and its recognition across 13 categories by industry analysts—up from 9 in 2020—further supports its reputation. Brand strength shortens sales cycles and improves conversion, building a resilient brand moat in enterprise security.

Intellectual Property

The company holds over 1,200 active patents and files around 300 new applications each year. This intellectual property protects innovation across network and cloud security, as well as AI-driven detection.

While the cybersecurity sector faces litigation risk—evidenced by ongoing patent infringement suits—PANW’s growing portfolio forms a solid defense. Its ability to retain technological leadership signals a moderate to strong IP moat.

Switching Costs

Switching away from Palo Alto Networks creates substantial friction, forming one of its most defensible moats. The operational risk alone is high—average downtime costs $5,600 per minute, discouraging disruption.

The integrated nature of its platform, covering network, cloud, and operations, makes replacement not only costly but logistically complex. According to Forrester, customers report a 50% reduction in security stack management effort with PANW's unified architecture. These switching costs create long-term stickiness and reinforce platform loyalty.

Palo Alto Networks' wide economic moat is built on multiple reinforcing competitive advantages, with switching costs and network effects providing the strongest protection. The combination of these moats creates a formidable defensive position that should enable sustained profitability and market leadership in the growing cybersecurity market.

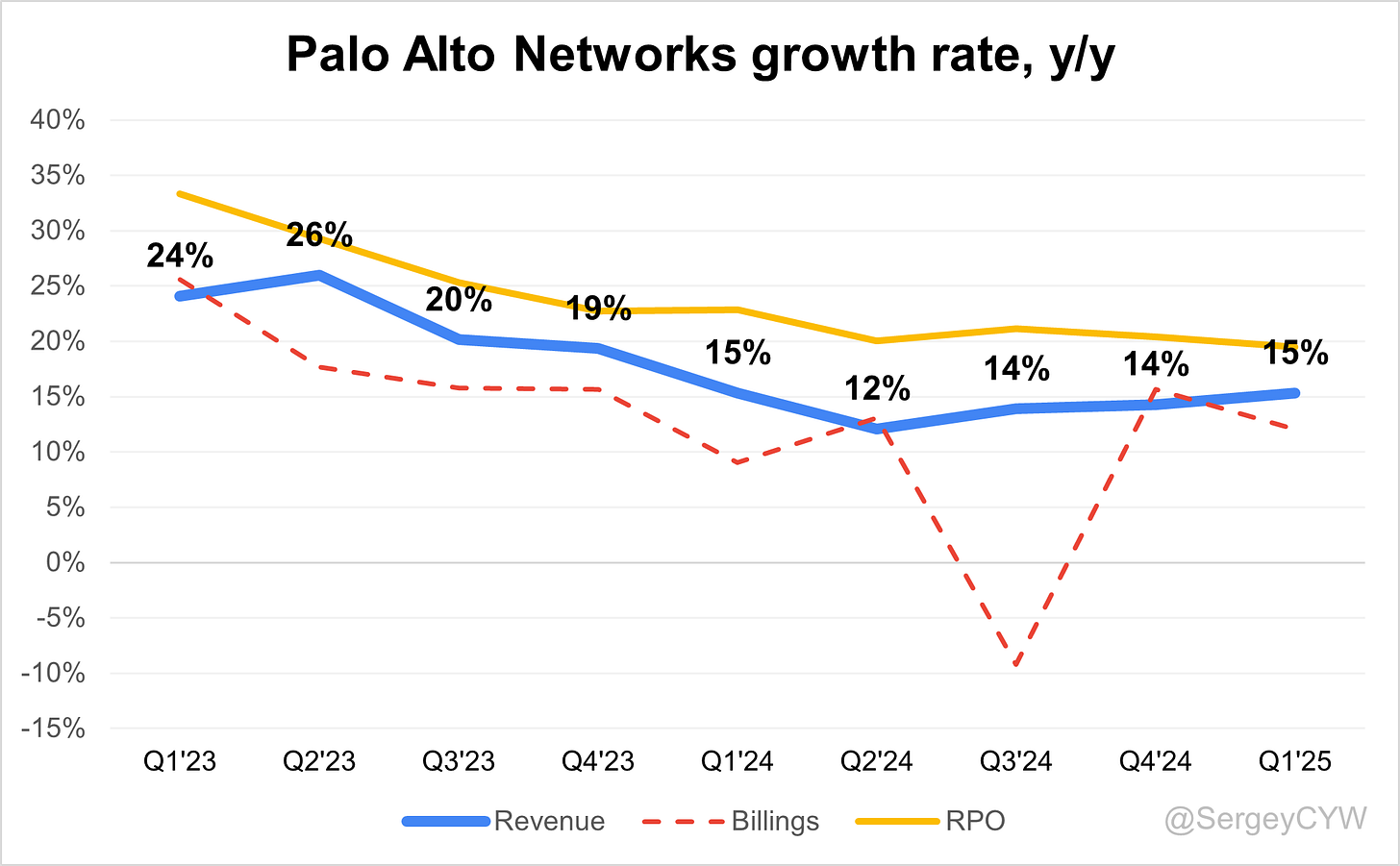

4. Revenue growth

$PANW revenue growth is picking up—Q1 landed at +13.3% YoY. If the company beats next quarter’s guidance by its recent average (+0.4%), we could see Q1 growth hit 15.1%—a real sign of revenue stabilization.

RPO growth in Q1 was +19.5% YoY, comfortably outpacing revenue and suggesting strong forward demand. On the flip side, billings grew +12.1% YoY, slower than last quarter and now trailing revenue growth.

5. Segments and Main Products.

Palo Alto Networks operates across three core segments—Network Security, Cloud Security, and Security Operations—offering integrated solutions for modern enterprise environments.

Network Security provides next-generation firewall solutions, including hardware, virtual, and cloud firewalls, delivering deep traffic visibility and threat prevention.

Cloud Security is delivered through Prisma Cloud, covering posture management, workload protection, network security, and entitlements. Pricing ranges from $2,000 to $10,000+ per year, depending on features and scale.

Security Operations leverages Cortex XDR and Cortex XSOAR. XDR offers AI-powered detection across endpoints and cloud, priced at $81 per endpoint annually. XSOAR automates incident response and SOC workflows.

Prisma SASE combines secure access and networking in one platform—integrating SWG, CASB, ZTNA, and FWaaS. Pricing ranges from $1,000 to $10,000+ per year, based on user count and feature set.

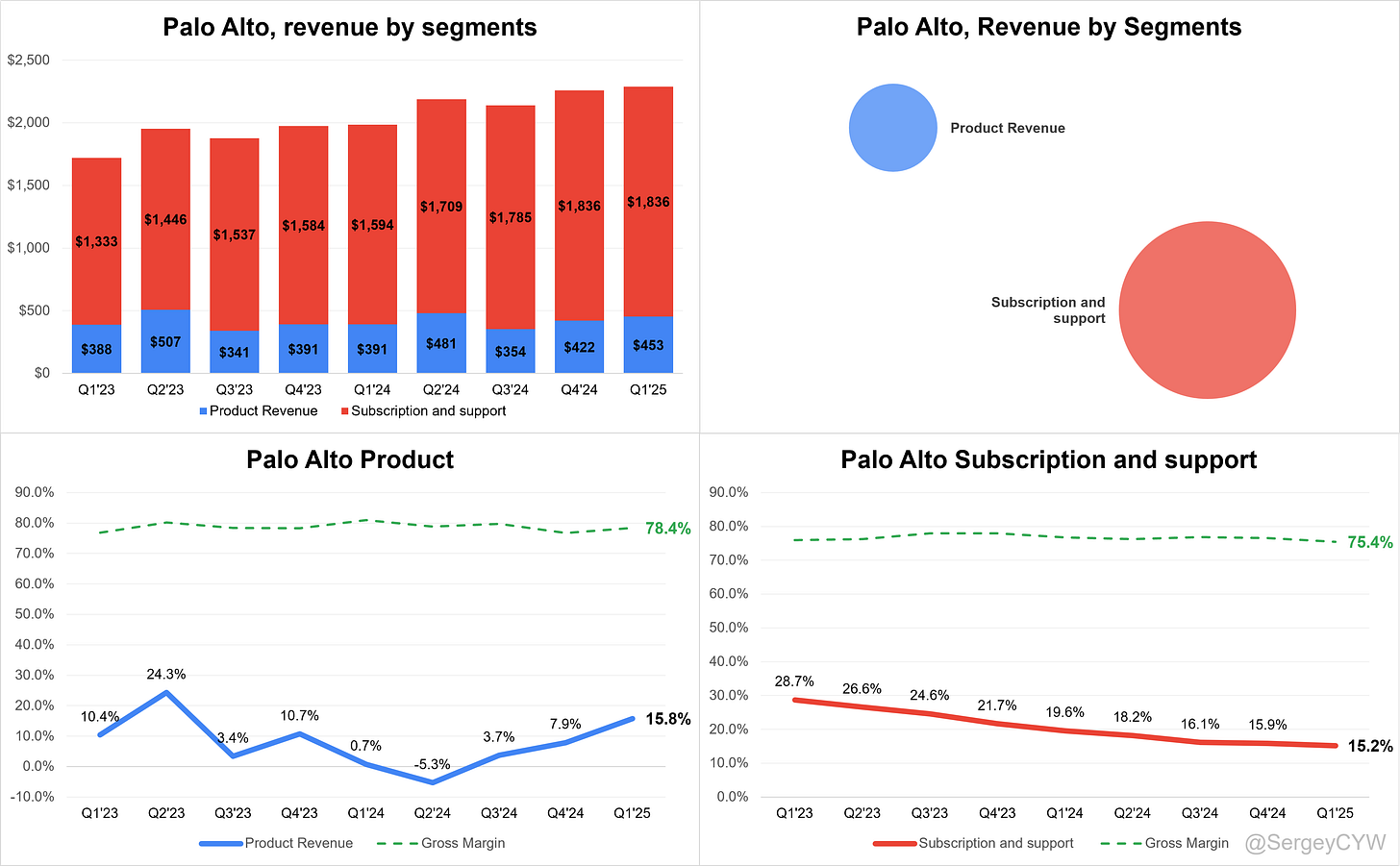

$PANW Revenue by Segment: 80% of the company’s revenue comes from Subscription and Support, while 20% is from Product Revenue.

Subscription and Support revenue growth continues to slow, reaching +15.2% YoY in Q1, with a gross margin of 75.4%.

Product Revenue growth showed a recovery at +15.8% YoY after a decline in Q2 2024, though the gross margin increased to 78.4%.

Network Security

Product revenue accelerated, supported by strong hardware and software firewall demand. Software firewalls grew ~20% YoY, driven by cloud deployment and AI workloads. Prisma SASE remains the fastest-growing segment with ARR up 36% YoY, outpacing the broader market.

PANW added 1,000+ net new SASE customers YoY, reaching ~6,000 customers, with 40% of them new to the platform. Prisma Access Browser grew 10x YoY, now with ~3 million seats sold in just 18 months. A nine-figure pipeline underscores market demand.

Cortex

Cortex growth is led by XSIAM, the fastest-growing product in company history. ARR grew 200% YoY, with 270+ customers generating more than $1M ARR each. XSIAM bookings are approaching $1B TTM, only 30 months post-launch.

Cortex Cloud integrates posture and SOC data, with a pipeline exceeding nine figures. Cortex is becoming the data analysis hub across cloud, identity, and endpoint telemetry.

Prisma Cloud

While less prominent this quarter, Prisma Cloud remains core to cloud security. Management is shifting focus from posture to runtime protection, especially for AI environments.

Prisma AIRS (AI Runtime Security) was launched for scanning, testing, and securing AI models in production. Backed by an eight-figure pipeline, AIRS addresses growing AI model security needs.

Strata Platform

Strata delivers unified protection across hybrid infrastructure. Hardware firewalls grew 5–8%, while software firewalls now make up ~40% of the product mix on a TTM basis. Cloud adoption, driven by AI demand, continues to boost virtual firewall penetration.

PANW leads in all firewall form factors—physical, virtual, and cloud-delivered.

XSIAM Performance

XSIAM is central to PANW’s platform strategy, now at $400M+ AI ARR with >200% YoY growth. Mean time to respond has dropped from weeks to minutes.

XSIAM ingests ~12 petabytes of data daily, enabling fast threat detection and incident response. Platform consolidation secured major wins: $90M, $46M, and $33M deals with top consulting and financial firms.

AI-Powered SOC

XSIAM is evolving into the AI OS for SecOps. AI is reducing attacker dwell time. PANW simulated an AI-driven ransomware attack in <25 minutes, demonstrating the urgency of real-time response.

XSIAM’s integration of email security and exposure management fuels a data loop: more data, smarter models, stronger security.

Innovation and Product Expansion

XSIAM is scaling into adjacent markets with its telemetry engine. PANW launched Advanced Email Security and Exposure Management as new verticals.

Prisma AIRS now protects AI models in runtime. PANW acquired Protect.ai for $700M, enhancing red-teaming and model scanning.

Talon Secure Browser is being embedded into the platform, serving as a secure interface for AI and SaaS environments.

AI underpins all new product development. PANW is building agentic platforms for autonomous security operations. The Agentics preview showcased self-operating AI agents for enterprises.

XSOAR automation will integrate with agentic systems, using policy engines to manage permissions and reduce risk. This evolution reflects PANW’s shift toward secure, intelligent automation at scale.

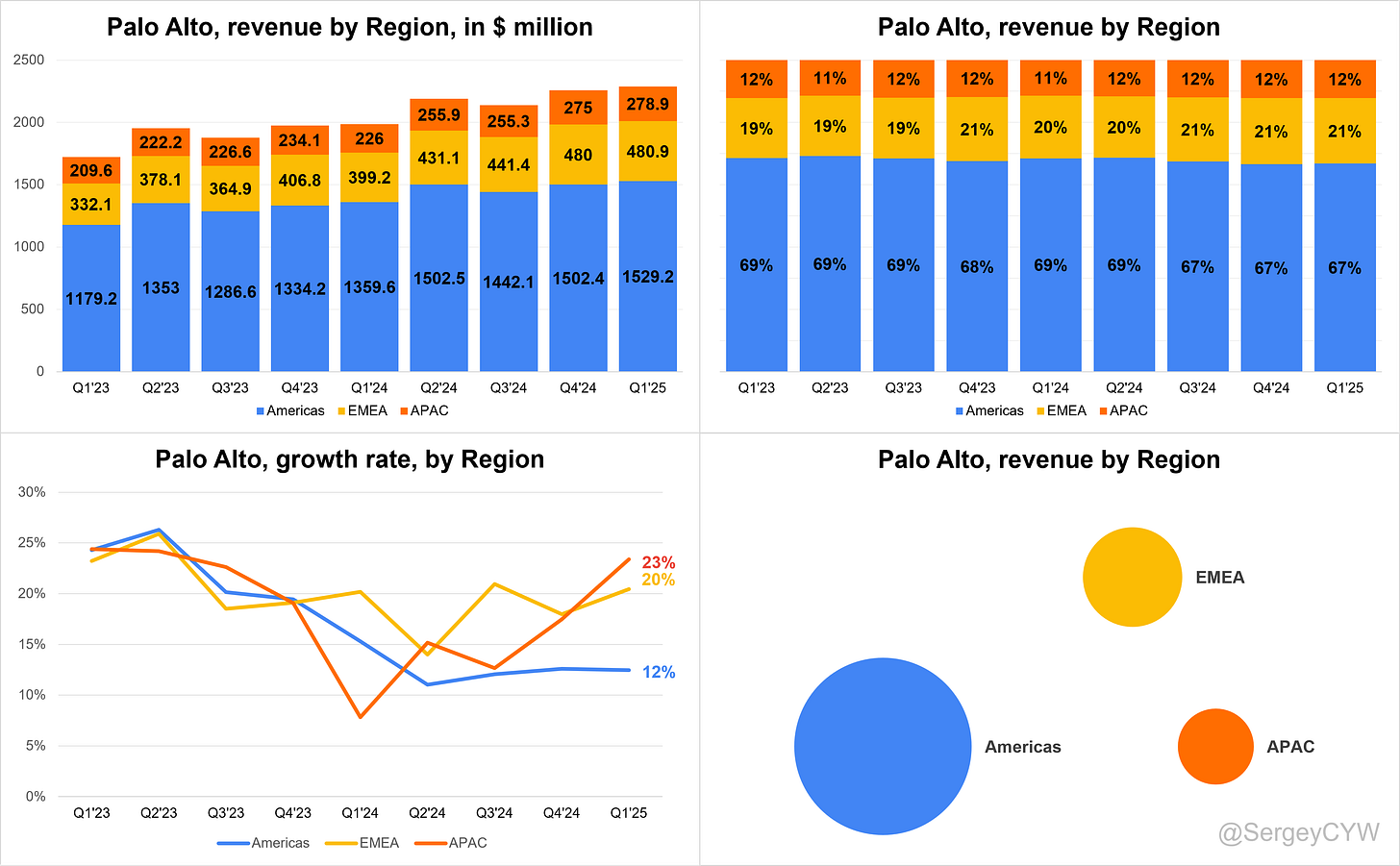

Revenue by Region

The Americas region accounts for 67% of total revenue, making it $PANW Palo Alto’s largest market, with revenue growing +12% YoY in Q1.

The EMEA region contributes 21% of total revenue, with growth accelerating to +20% YoY.

The APAC region remains the smallest by revenue, but its growth also accelerated to +23% YoY.

Both EMEA and APAC are growing faster than the company's overall revenue growth rate — a sign of expanding international momentum.

6. Market Leadership

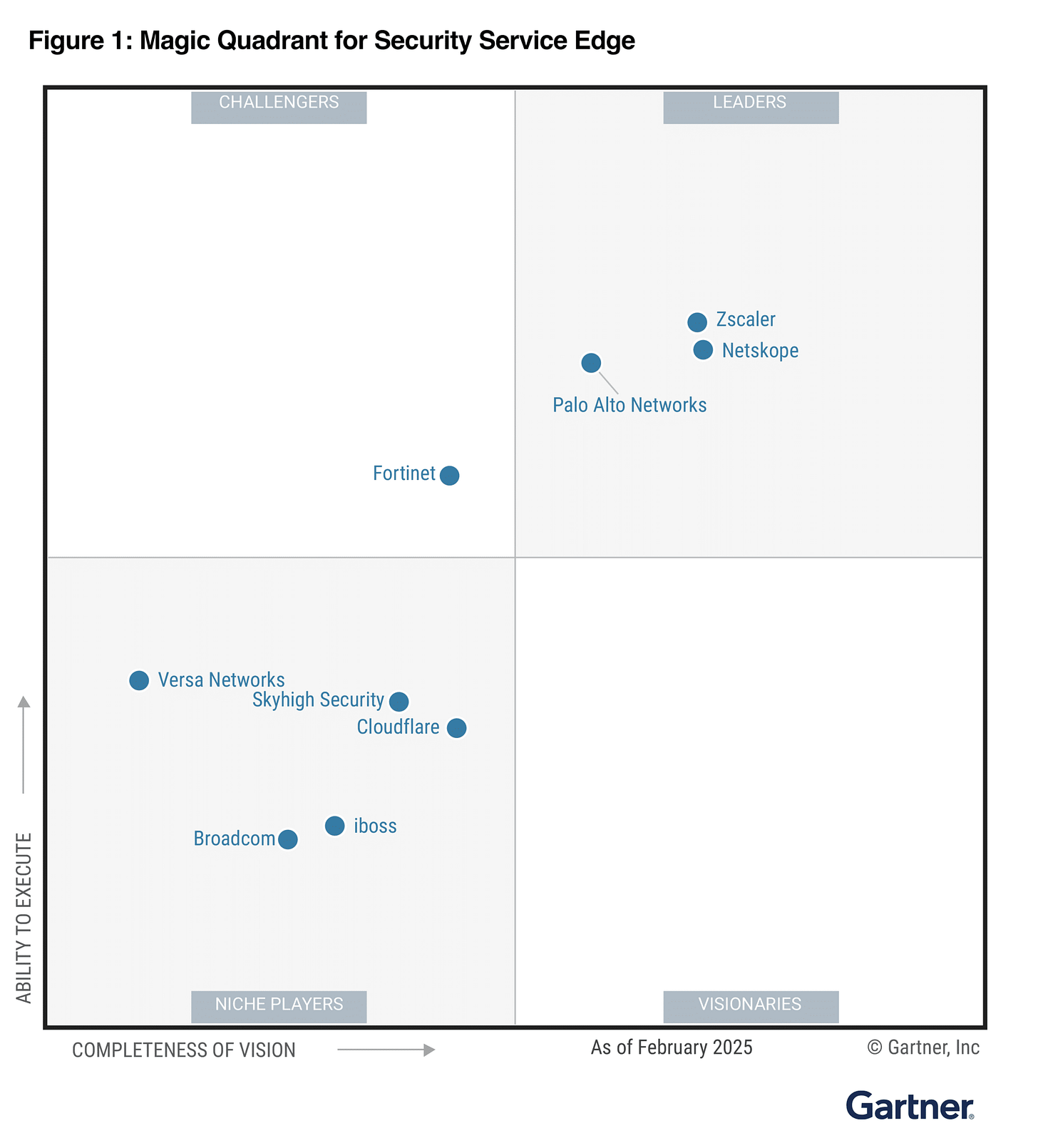

Palo Alto Networks maintains dominant market leadership across cybersecurity categories through consistent recognition from premier industry analysts. The company's comprehensive platform approach delivers sustained competitive advantages validated by multiple rating agencies.

Palo Alto Networks is the only vendor recognized as a Leader for the third consecutive year in the 2025 Gartner Magic Quadrant for SASE Platforms. Industry trends show 30% of large organizations will consolidate to a single SASE platform by 2028.

Prisma SASE delivers a fully integrated, cloud-native platform with advanced SSE and SD-WAN features, providing secure, efficient access to applications and data for users everywhere.

Palo Alto Networks received the highest overall score for Prisma Access in the Advanced SSE use case. Also named a Leader in the 2025 Gartner Magic Quadrant for Security Service Edge for the third year in a row.

Recognized as a Leader in all three major Gartner Magic Quadrant reports—SSE (2025), Single-Vendor SASE (2024), and SD-WAN (2024)—Palo Alto Networks demonstrates sustained innovation in unified cloud security, precision AI, and threat intelligence.

Palo Alto Networks is named a Leader in the 2025 Gartner Magic Quadrant for Endpoint Protection Platforms for the third consecutive year, driven by its AI-powered Cortex XDR solution. Cortex XDR achieved 100% detection with technique-level detail in the latest MITRE ATT&CK evaluation — completed in real time with zero configuration changes. Customers rated Palo Alto Networks 98% “Willingness to Recommend” on Gartner Peer Insights, based on 198 reviews as of January 2025.

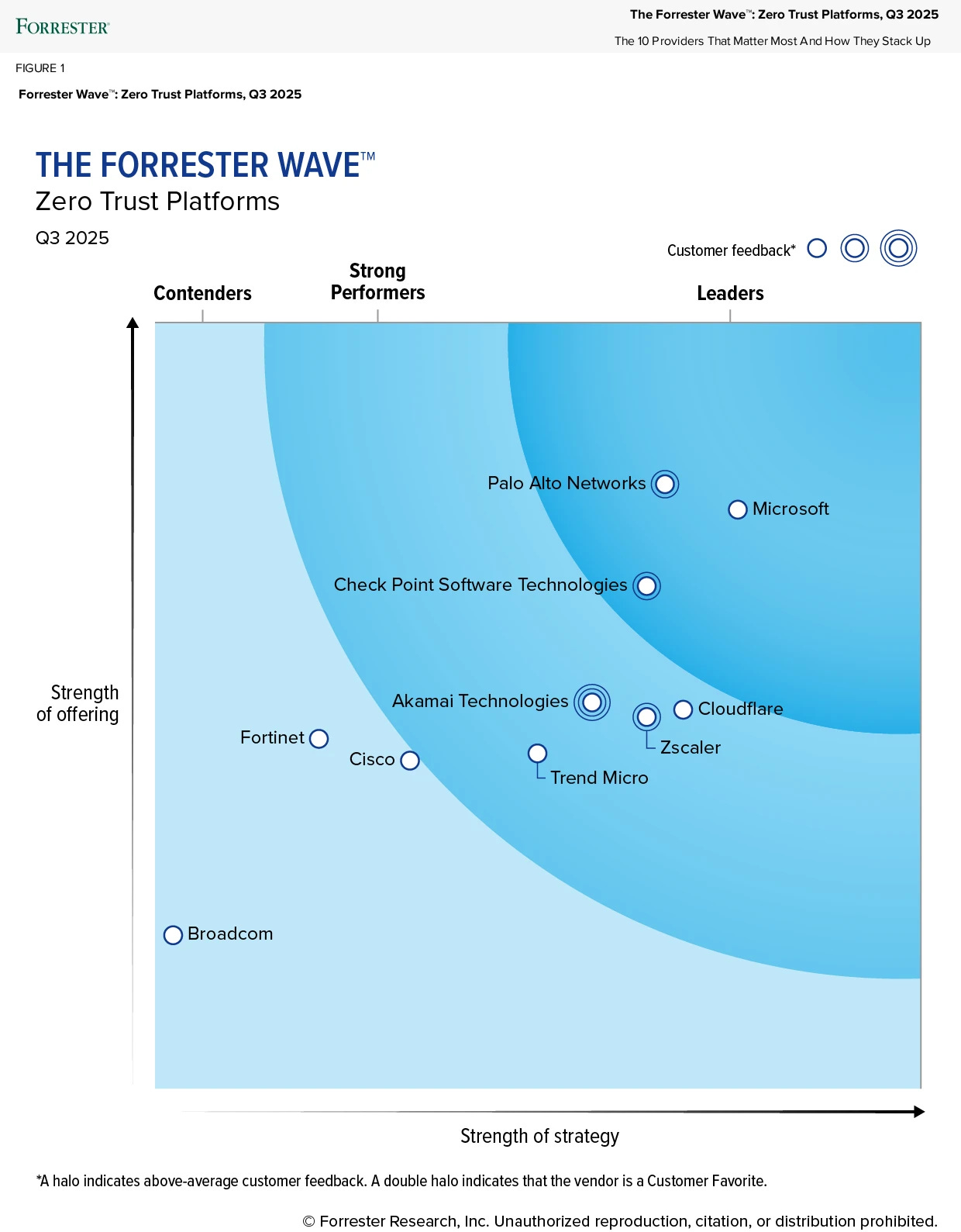

Palo Alto Networks is recognized as a Leader in The Forrester Wave: Zero Trust Platforms, Q3 2025, earning the highest score in the Current Offering category.

The platform received a score of 5—the highest possible—in 11 criteria, including innovation, workforce security, identity, and analytics.

With a unified approach to zero trust, SASE, and network security, Palo Alto Networks continues to set benchmarks for proactive cyber defense and operational resilience.

Palo Alto Networks is named a Leader in The Forrester Wave: Enterprise Firewall Solutions, Q4 2024, with top scores in Current Offering, Vision, Innovation, and Roadmap.

Pioneered next-generation firewall (NGFW); continuously adapts to evolving network security.

Strata Network Security Platform delivers centralized management for both hardware and software firewalls, supporting hybrid enterprise environments.

Precision AI system automates security tasks with advanced machine learning, deep learning, and AI—driving a roadmap aligned with secure, future-ready enterprise needs.

7. Customers

Customer Success Stories

Customer outcomes underline the value proposition of platformization and AI-driven security. Mean time to respond (MTTR) has been materially reduced—from weeks to minutes—across several deployments using XSIAM. Advanced email security and exposure management capabilities are now in production, delivering demonstrable improvement in threat detection and incident response. Adoption rates for newly launched products are strong, with early feedback pointing to improved operational efficiency and a lower total cost of ownership for customers embracing a consolidated platform approach.

Platform customers are rapidly expanding their relationship with Palo Alto Networks. The number of customers leveraging multiple platform solutions grew nearly 70% year-over-year. Cortex, now central to many enterprise security architectures, has seen the number of customers with multiple platformizations triple. Each XSIAM customer averages over $1 million in ARR, reflecting both product value and customer confidence. Customer sentiment is increasingly aligned with Palo Alto's vision of unified, data-driven security, reinforcing long-term partnership and upsell potential.

Large Customer Wins

Recent quarters featured significant multi-year, multi-product wins with high-profile global organizations. A leading global consulting firm signed a transaction valued at over $90 million in Q3. This engagement included full Cortex platformization, replacement of a legacy SIEM provider, and consolidation of four distinct products. As a result, next-generation security ARR with this customer nearly doubled year-over-year.

A top-tier financial services company closed a $46 million transaction, driven by the recognized value of XSIAM and a migration away from incumbent EDR and SIEM vendors. Four separate products were consolidated under the Palo Alto umbrella, and the customer expanded its investment in network security.

A major U.S. financial services firm committed to a $33 million transaction, consolidating cloud security vendors and streamlining the cybersecurity stack per a company-wide mandate. This deal also involved four-product consolidation onto Palo Alto’s network security platform.

Multi-platform customers now drive the majority of incremental ARR growth. Large enterprise clients demonstrate confidence in Palo Alto’s unified, AI-powered approach by expanding wallet share and displacing legacy solutions. The average size and sophistication of customer engagements continues to rise, setting the foundation for accelerated ARR expansion and improved margin leverage as the company scales toward its long-term targets.

8. KPI

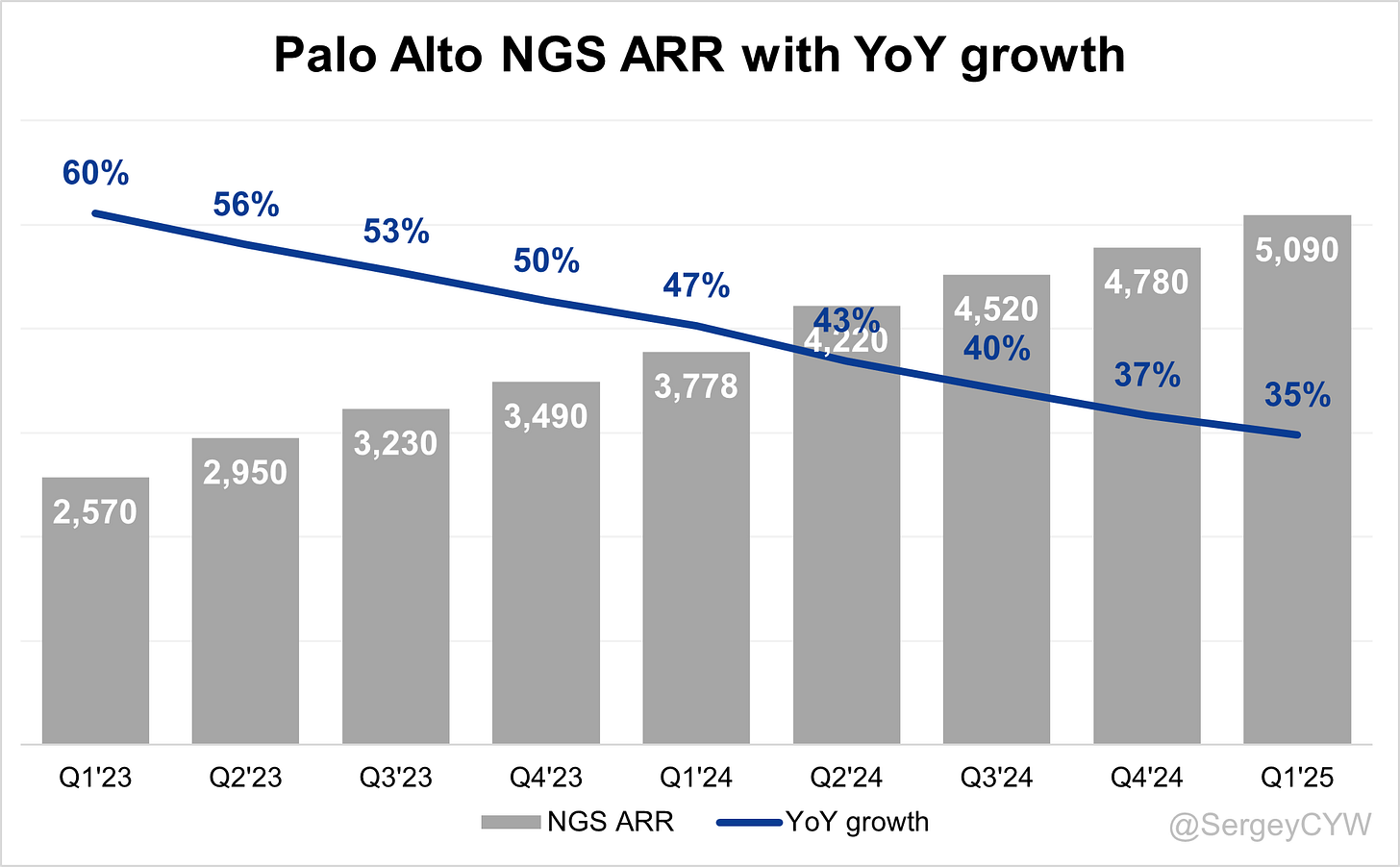

ARR Growth

Palo Alto $PANW NGS ARR growth is slowing, reaching +35% YoY in Q1, which is above the company’s revenue growth.

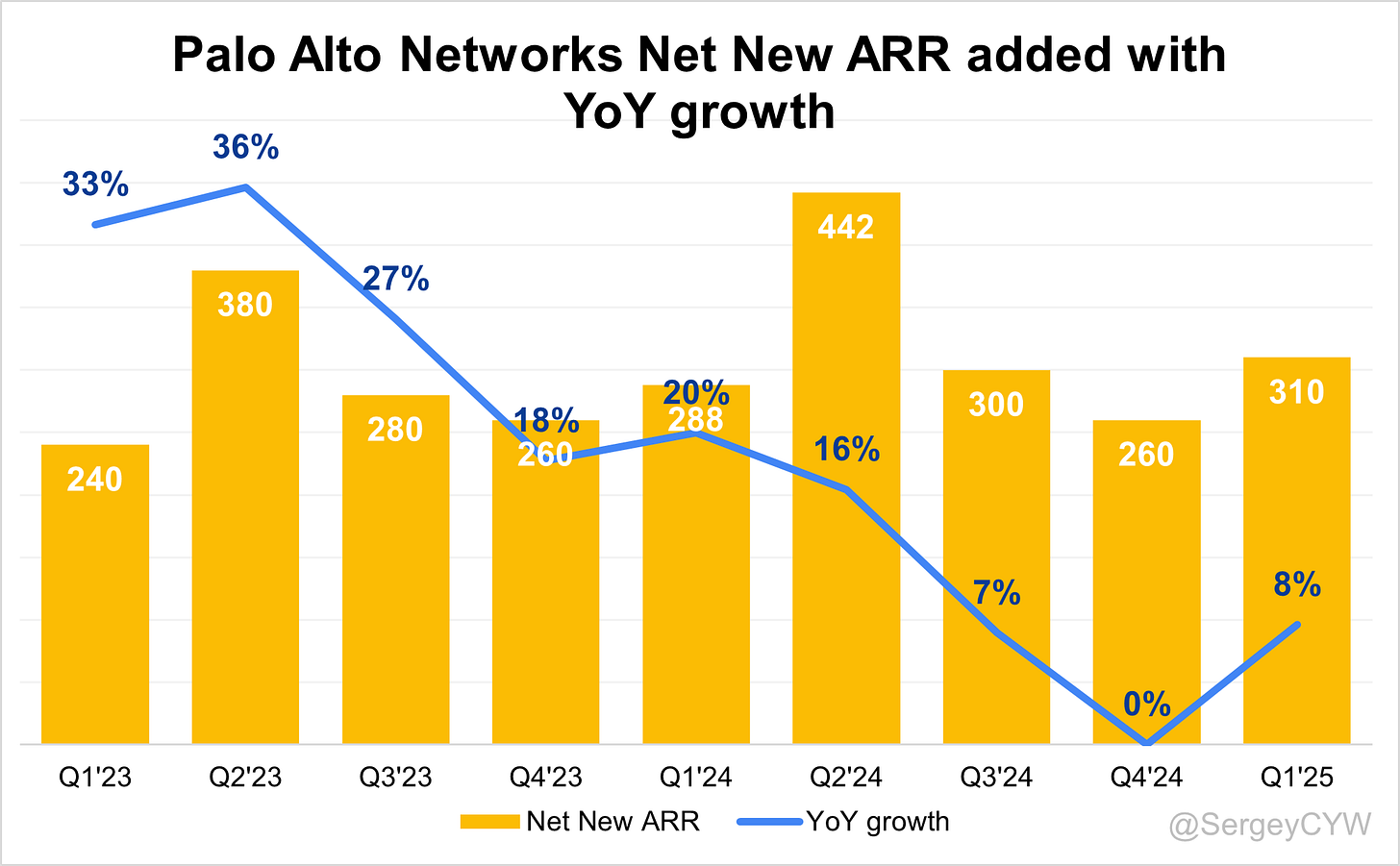

Net new ARR

Palo Alto $PANW added $310 million in net new NGS ARR in Q1 FY2025, reflecting +8% YoY growth.

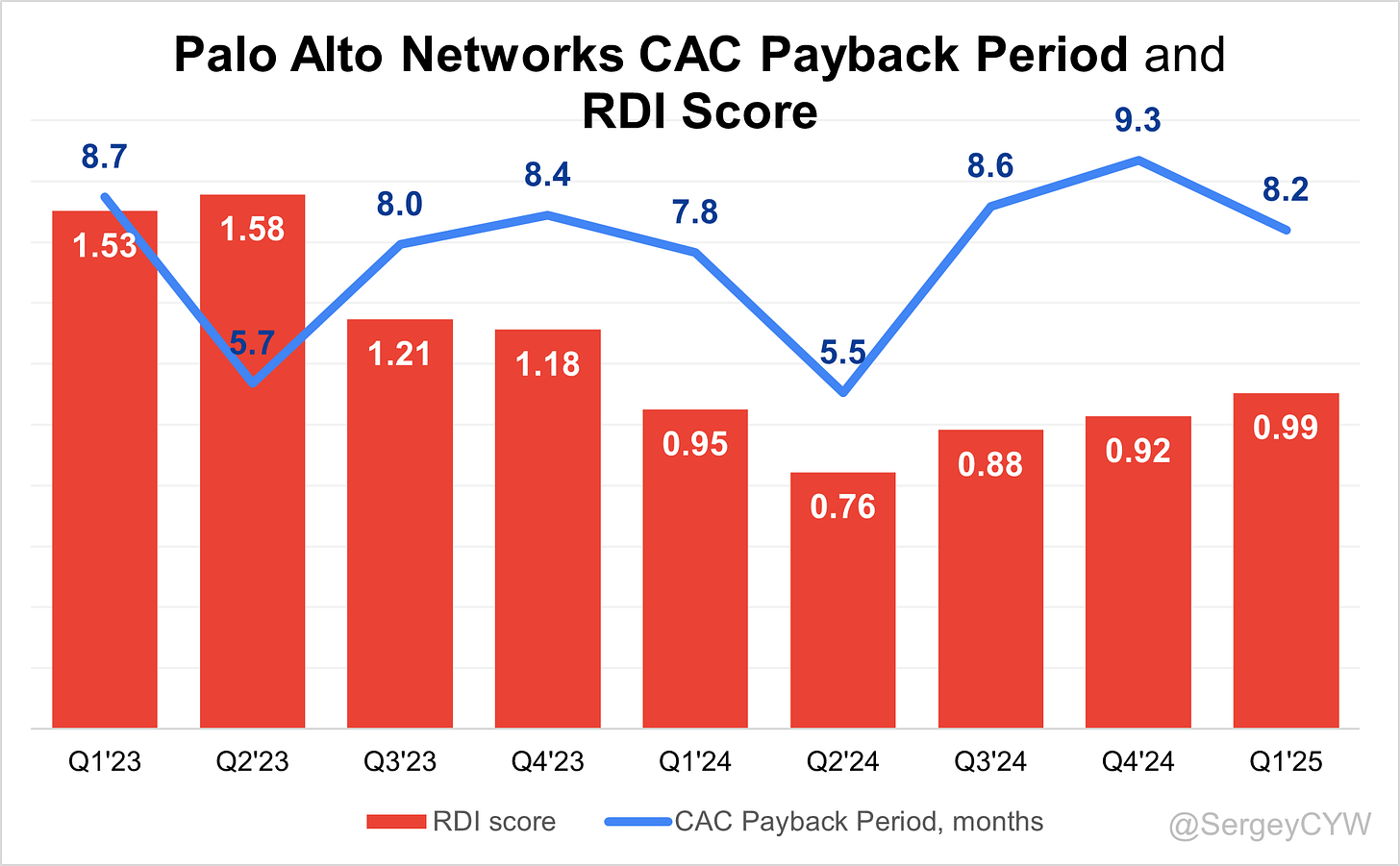

CAC Payback Period and RDI Score

$PANW's return on S&M spending is 8.2. The CAC Payback Period has slightly improved compared to the previous quarter and remains better than the average for SaaS companies (the median among those I track is 26.9 months).

The R&D Index (RDI Score) has significantly declined over the past two years and currently stands at 0.99 for Q1, which is below the median of 1.1 for the SaaS companies I monitor but above the industry median of 0.7.

An RDI Score above 1.4 is considered indicative of best-in-class performance. The low industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

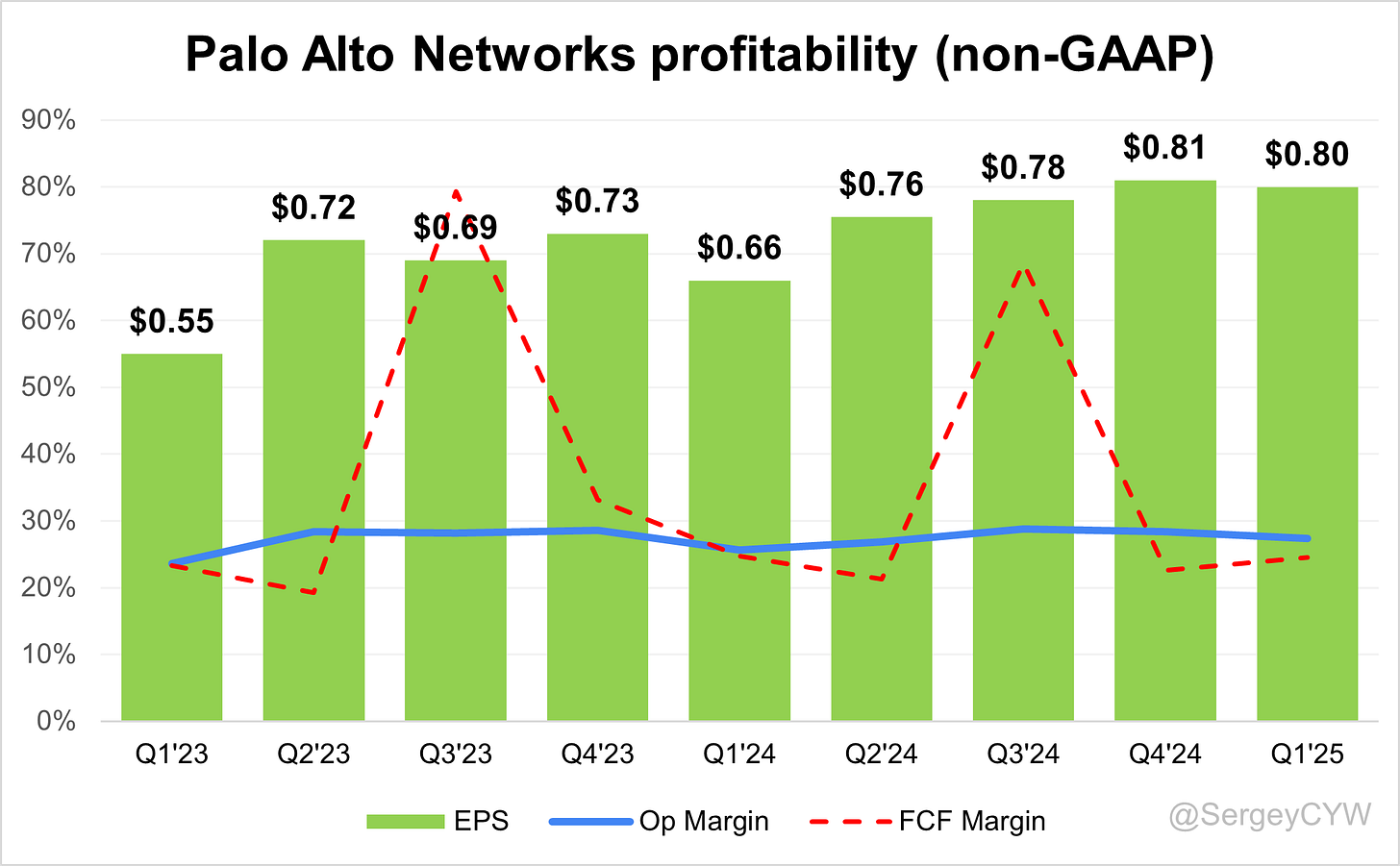

Over the past year, $PANW Palo Alto margins has changed:

Gross Margin decreased from 77.6% to 76.0%.

Operating Margin slightly increased from 25.6% to 27.4%.

Free Cash Flow (FCF) Margin increased from 25.6% to 27.4%.

Operating expenses

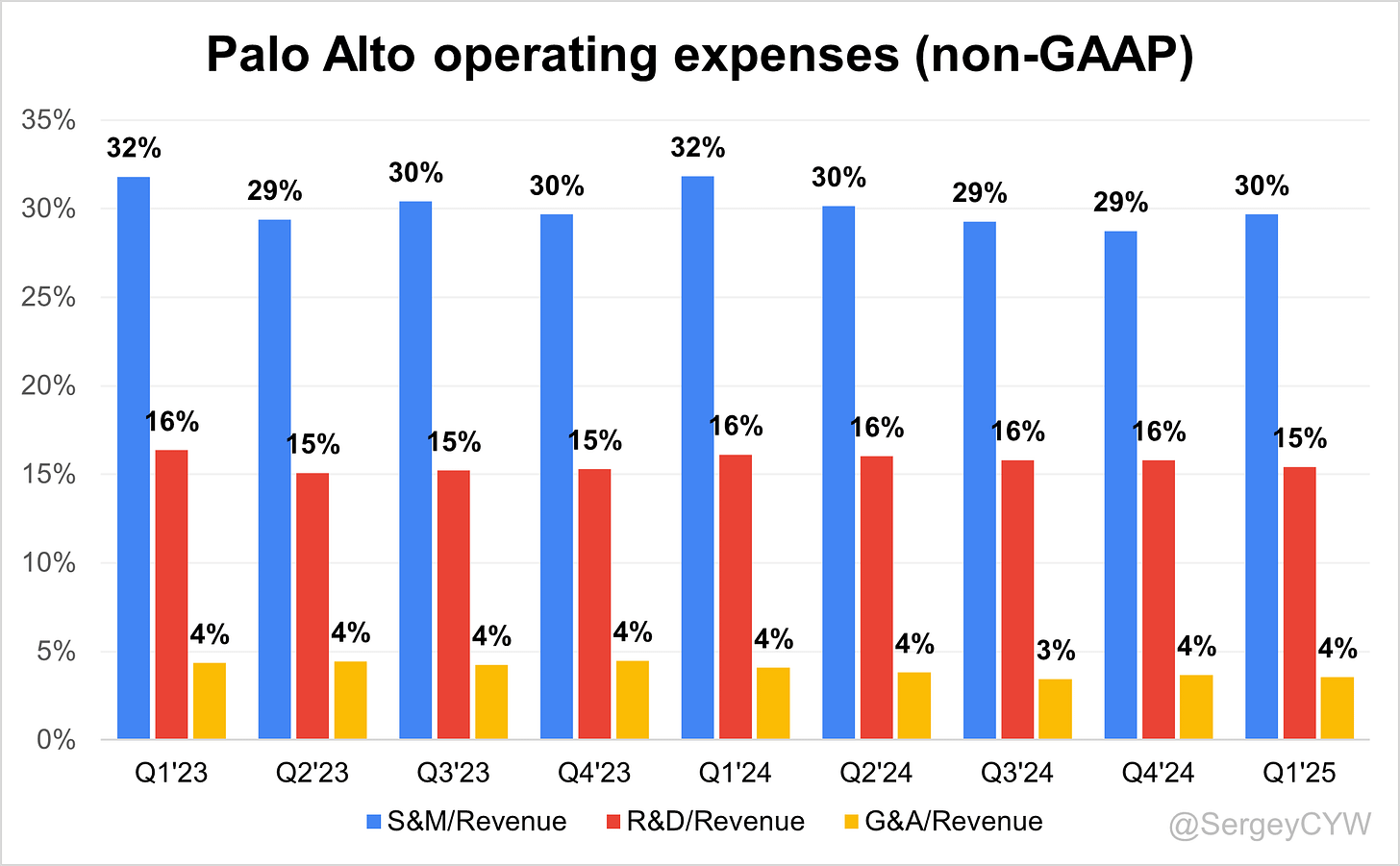

$PANW's non-GAAP operating expenses have decreased, primarily due to reduced Sales & Marketing (S&M) spending, which declined from 32% two years ago to 30%.

R&D expenses remain high at 15%, as the company continues to invest in future growth through product enhancements and updates.

General & Administrative (G&A) expenses have slightly decreased and are now at a relatively low level of 4%.

Balance Sheet

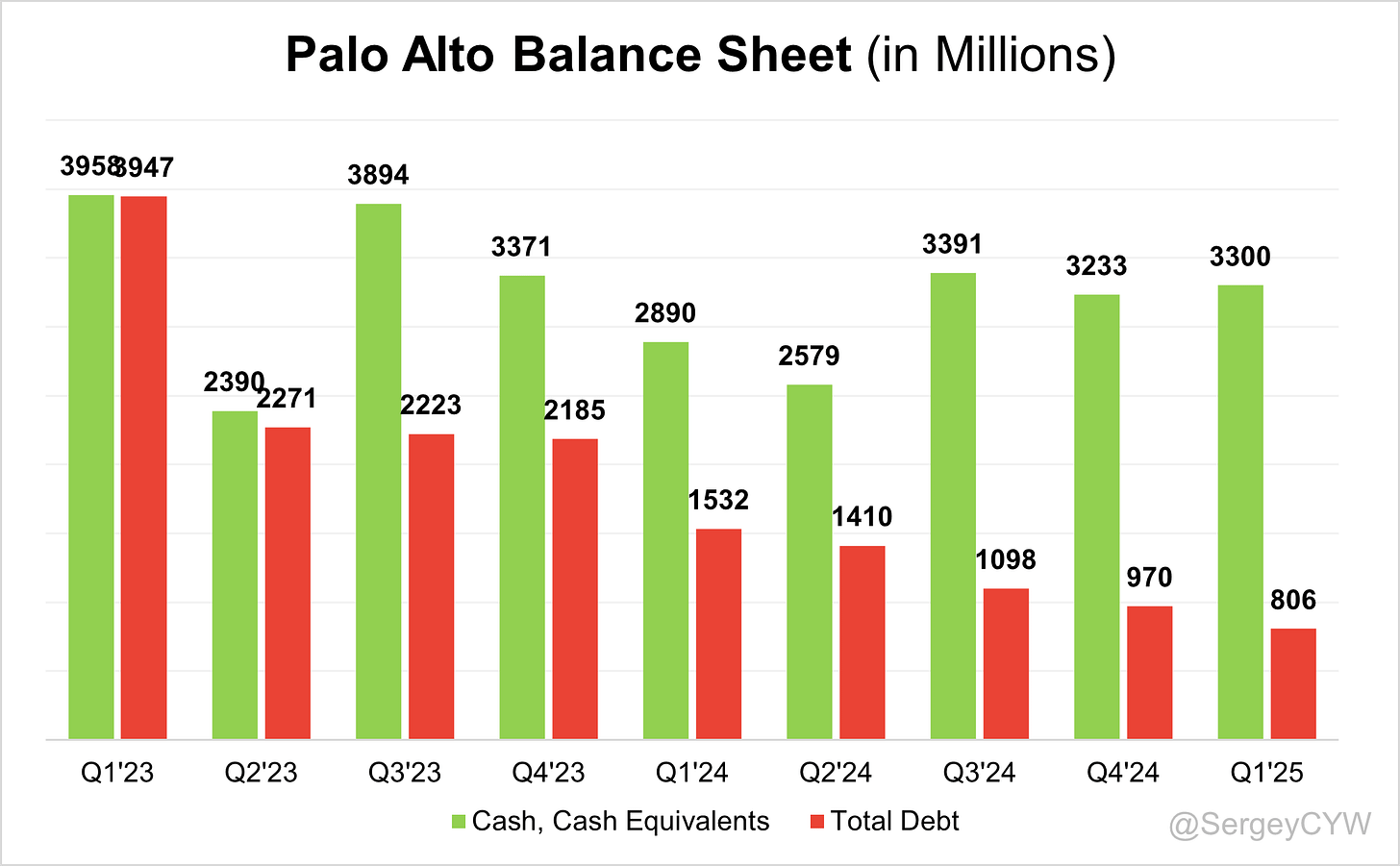

$PANW Balance Sheet: Total debt stands at $806M, while Palo Alto holds $3,300M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

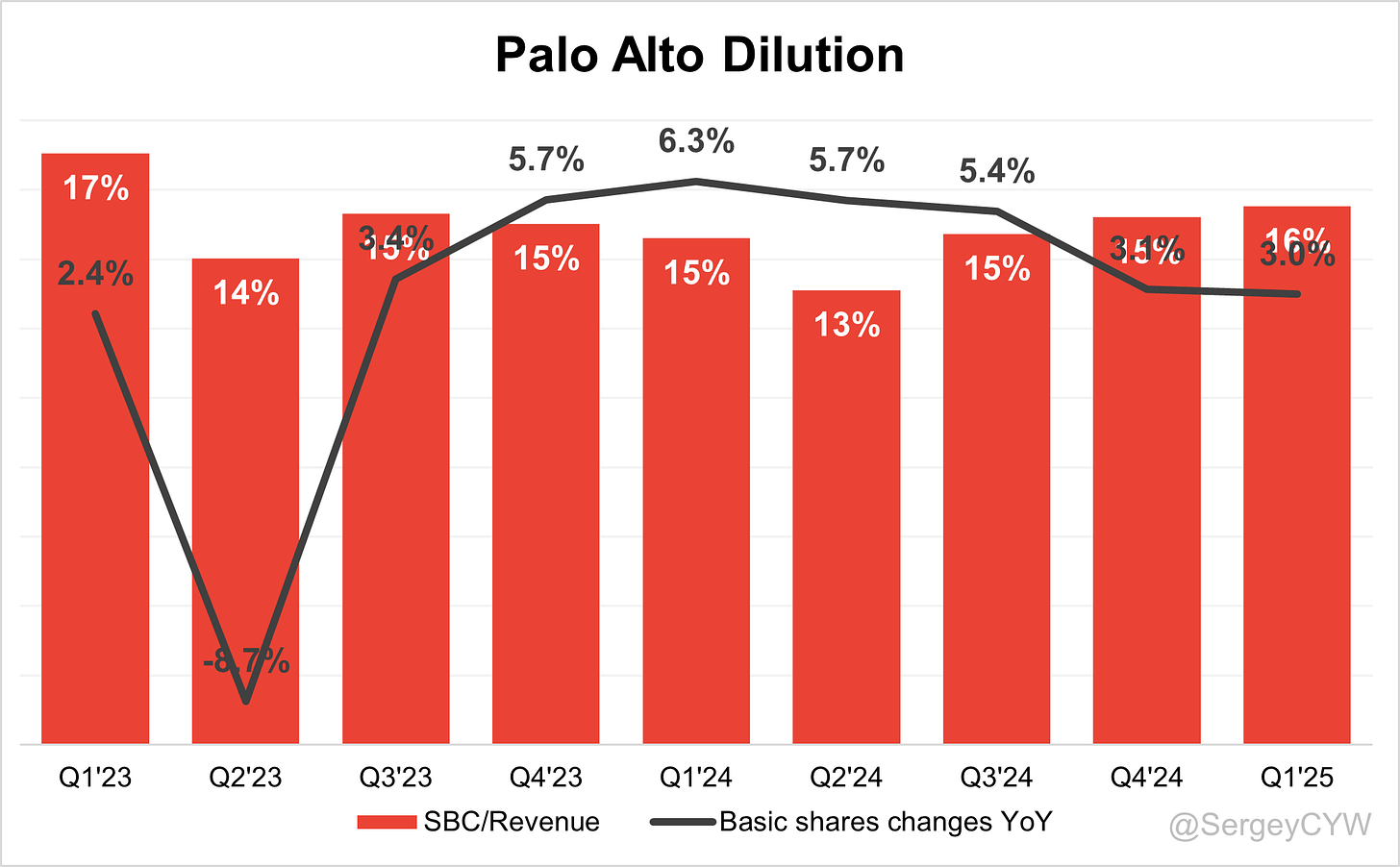

$PANW Shareholder Dilution: Palo Alto's stock-based compensation (SBC) expenses have slightly increased over the past two quarters, reaching 16% of revenue in the last quarter, which is relatively low for SaaS companies.

Shareholder dilution also remains elevated—despite a slight decline, the weighted-average number of basic common shares outstanding is still relatively high, having increased by 3.0% YoY.

9. Conclusion

$PANW is leaning into platformization—offering select products for free short-term to drive long-term lock-in. The strategy appears to be working: revenue growth has re-accelerated over the past two quarters.

With a $110B TAM growing at +14% CAGR, and just 4% market capture via $4.8B in ARR, Palo Alto Networks has room to run.

Its wide economic moat—built on switching costs, network effects, and deep integration across cloud, network, and security ops—continues to be its strongest defense in an increasingly competitive space.

Leading Indicators:

• RPO growth of +19.5% outpaced revenue growth

• Billings grew +12.1%, lower than revenue growth

• Net new ARR additions strong +8 YoY, while NGS ARR grew +35% YoY, outpacing total revenue growth

Key Indicators

• CAC Payback Period slightly improved to 9.3 months, which is much better than average

• RDI Score increased slightly to 0.99, but remains below the median of other SaaS companies I track

The forecast for next quarter points to a stabilization in revenue growth, supported by leading indicators such as RPO and NGS ARR growth outpacing revenue, and a net new ARR increase of +8% YoY.

Improvements in the CAC Payback Period and RDI Score suggest meaningful progress. It’s likely that the slowest revenue growth point (+12.1% YoY in Q2 FY2024) is behind us, as Palo Alto’s platformization strategy starts to show real traction.

The company is trading at a Forward EV/Sales multiple above its historical average, and near all-time highs. Still, valuation appears fair relative to peers, given the company’s long-term growth outlook.

Palo Alto is leaning hard into platformization—offering some products temporarily for free to drive customer retention and long-term growth, even if it means deferring some revenue today.

This shift has clearly contributed to the noticeable revenue growth slowdown over the past year, but the recent positive inflection in revenue suggests that platformization was not just a defensive move under competitive pressure—but a strategic pivot that's beginning to pay off.

That said, there are still concerns: subscription and support revenue growth slowed to +15.2% YoY, and gross margin in this segment dipped slightly to 75.4%.

I’m currently on the sidelines with $PANW, but closely tracking the company’s performance. I believe cybersecurity remains one of the most attractive sectors for long-term investing.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.