Palantir Q4 2024 Earnings Analysis

Dive into $PLTR Palantir’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$828M rev (+36.0% YoY, +30.0% LQ) beat est by 7.4%

↘️Gross Margin* (82.9%, -1.0 PPs YoY)🟡

↗️Operating Margin* (35.4%, +1.0 PPs YoY)

↗️Adj FCF Margin (62.5%, +12.4 PPs YoY)🟢

↘️Net Margin (9.5%, -5.8 PPs YoY)🟡

↗️EPS* $0.14 beat est by 27.3%🟢

*non-GAAP

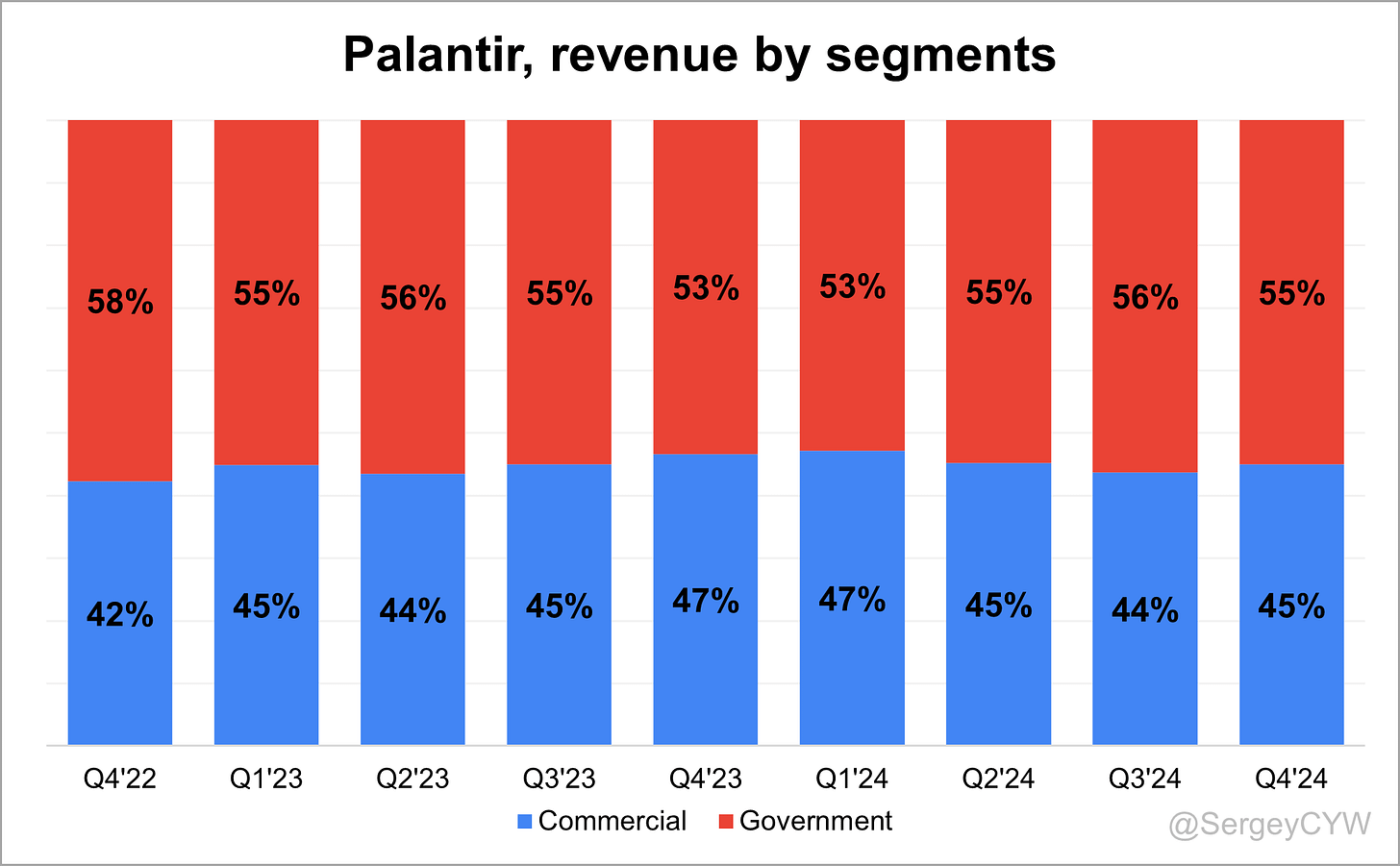

Revenue By Type

➡️Commercial $372M rev (+31.0% YoY, 45.0% Total rev)🟡

↗️US commercial $214M rev (+63.4% YoY)🟢

↗️Government $455M rev (+40.3% YoY, 55.0% Total rev)🟢

Key Metrics

↗️DBNR 120% (118% LQ)

↗️RPO $1.73B (+39.2% YoY)

➡️Billings $779M (+28.7% YoY)🟡

Customers

↗️711 Customers (+43.1% YoY, +82)🟢

↗️571 Commercial Customers (+52.3% YoY, +73)

↗️382 US Commercial Customers (+72.9% YoY, +61)🟢

↗️189 International Commercial Customers (+22.7% YoY, +12)

Operating expenses

↘️S&M*/Revenue 23.0% (-2.3 PPs YoY)

↘️R&D*/Revenue 11.4% (-1.2 PPs YoY)

↘️G&A*/Revenue 13.2% (-0.4 PPs YoY)

Quarterly Performance Highlights

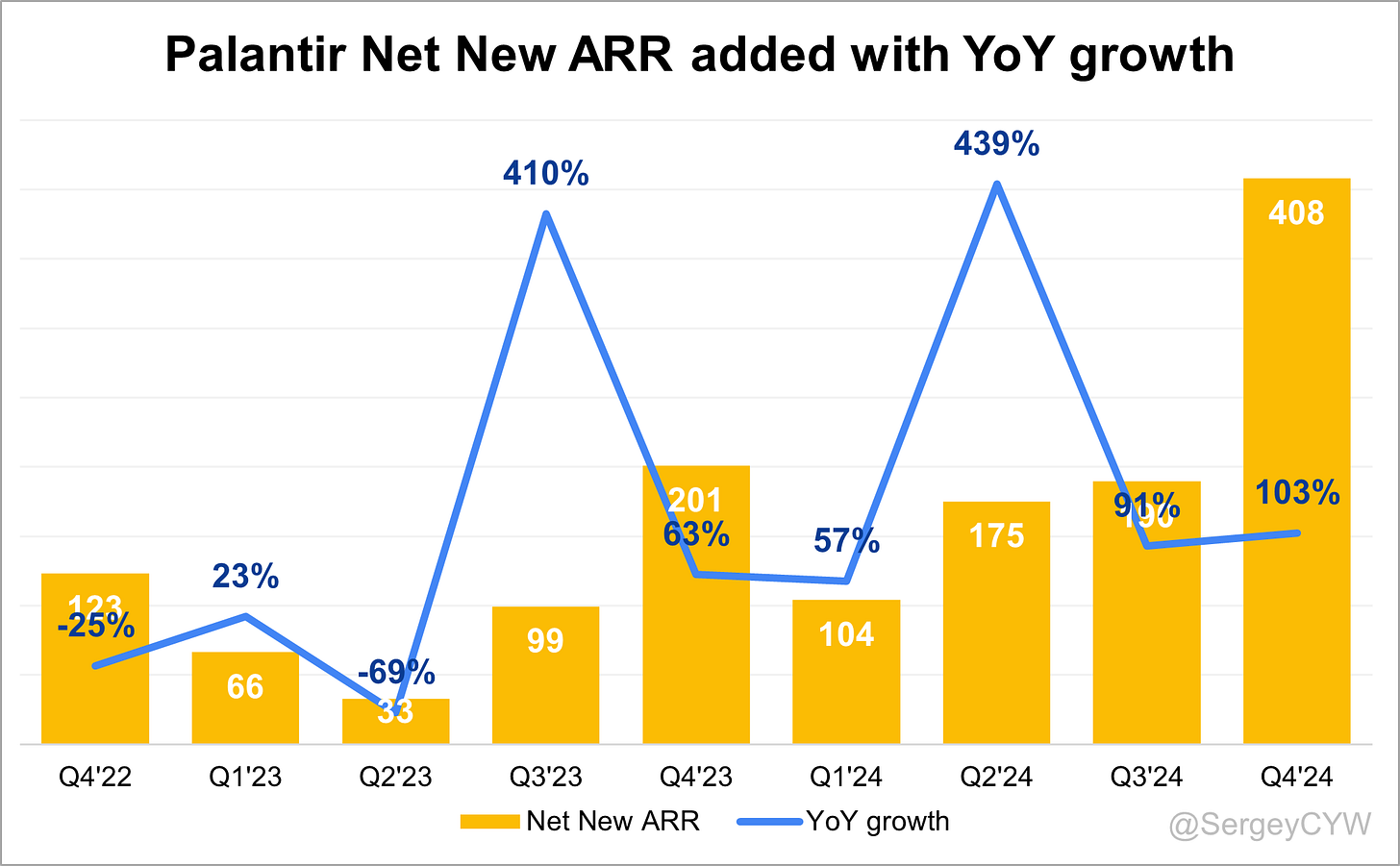

↗️Net New ARR $408M (+103.2% YoY)

↘️CAC* Payback Period 5.7 Months (-4.3 YoY)🟢

↗️R&D* Index (RDI) 2.61 (+1.21 YoY)🟢

Dilution

↗️SBC/rev 34%, +14.4 PPs QoQ

↗️Basic shares up 5.4% YoY, +1.3 PPs QoQ🔴

↗️Diluted shares up 7.2% YoY, +1.5 PPs QoQ🔴

Guidance

↗️Q1'25 $858.0 - $862.0M guide (+35.6% YoY) beat est by 7.4%

↗️$3,741.0 - $3,757.0M FY guide (+30.8% YoY) beat est by 6.5%

Key points from Palantir’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Palantir reported Q4 revenue of $828 million, up 36% YoY and 14% sequentially, exceeding the high end of guidance by 900 basis points. Full-year 2024 revenue reached $2.87 billion, a 29% YoY increase.

The Rule of 40 score surged to 81, up from 68 in Q3. Adjusted operating margin hit 45%, while free cash flow margin soared to 63%, generating $517 million in Q4 adjusted free cash flow. Full-year adjusted free cash flow totaled $1.25 billion (44% margin).

U.S. revenue grew 52% YoY in Q4 and 38% for the full year. The U.S. commercial sector surged 64% YoY and 20% sequentially, while the U.S. government sector increased 45% YoY to $343 million.

Palantir closed $1.8 billion in total contract value (TCV) in Q4, a 56% YoY increase, including 32 deals worth $10 million or more. Total remaining deal value reached $5.43 billion, up 40% YoY.

AI Expansion & Product Innovation

The Artificial Intelligence Platform (AIP) is driving rapid adoption, moving AI from research to deployment. The Ontology framework enables efficient integration of large language models (LLMs).

AIP adoption has led to a 5x increase in U.S. commercial customers over three years. The company launched Warp Speed, an AI-driven American manufacturing operating system. Early adopters Anduril and L3 Harris use it to improve manufacturing efficiency.

AIP Driving Enterprise AI Adoption

AIP is transforming enterprise operations, integrating AI-driven decision-making into business workflows. Many organizations remain in AI experimentation, but Palantir is delivering real-world production environments with measurable impact.

AIP fueled record 64% YoY growth in U.S. commercial revenue. A major U.S. pharmacy signed a $67 million TCV deal after testing AI-powered prescription fulfillment and patient outreach automation. A leading telecom firm expanded its contract by $40 million to optimize network infrastructure and reduce costs.

Palantir is introducing industry-specific AI solutions. Warp Speed is automating manufacturing processes. Companies using AIP are reporting unprecedented efficiency gains, yet some legacy enterprises remain slow to transition from traditional IT systems.

Ontology: Competitive Differentiation & AI Scalability

Ontology is central to AI operationalization, allowing enterprises to integrate AI automation at scale. Unlike competitors focused on model development, Palantir delivers actionable AI solutions.

A global bank reduced a 5-day process to 3 minutes, and an automotive supplier automated a 100-hour engineering process. Deep enterprise integration and secure access to organizational data make Ontology difficult to replicate.

Traditional enterprises face challenges transitioning from legacy IT, but demonstrated cost savings and efficiency improvements are driving demand.

U.S. Commercial Growth

The U.S. commercial business remains the fastest-growing segment, generating $214 million in Q4 revenue, up 64% YoY and 20% sequentially.

Palantir added 73% more U.S. commercial customers YoY, reaching 382 customers. TCV bookings hit $803 million, up 134% YoY and 170% sequentially.

Key contract expansions include a $67 million pharmacy deal for AI-driven prescription fulfillment, a $40 million telecom deal for network automation, and an $11 million insurance deal for AI underwriting automation.

Government Expansion

The U.S. government sector delivered $343 million in Q4 revenue, up 45% YoY. The international government segment grew 28% YoY, driven by UK healthcare and defense contracts.

Key contracts include a multi-year U.S. Army extension for the Army Vantage platform and a U.S. Special Operations Command expansion for Mission Manager. The UK’s NHS adopted Palantir’s Federated Data Platform, with 87 Acute NHS Trusts and 28 Integrated Care Boards onboarded.

Defense & AI Warfare

Palantir is strengthening its role in military AI and defense logistics. The Maven AI program is gaining traction across the Army, Air Force, and Space Force, integrating AI-driven battlefield decision-making.

FedRAMP High authorization is accelerating adoption of Palantir’s software in federal agencies, particularly in national security and defense applications.

International Growth

International commercial revenue grew just 3% YoY to $158 million in Q4, significantly lagging U.S. growth. Asia and the Middle East show stronger demand, while Europe remains slow due to outdated IT strategies and low AI adoption rates.

China’s DeepSeq R1 Model & AI Competition

The launch of China’s DeepSeq R1 AI model underscores an accelerating AI arms race. Intellectual property theft, GPU supply chain manipulation, and model distillation have fueled China’s AI growth.

Palantir remains committed to equipping the U.S. and its allies with cutting-edge AI technologies to maintain a competitive edge in AI warfare.

Commercial Customers & AI Expansion

The U.S. commercial sector led Palantir’s expansion, with total Q4 commercial revenue reaching $372 million (+31% YoY, +17% sequentially).

Palantir’s U.S. commercial customer base grew 73% YoY to 382 customers, while U.S. commercial TCV surged 134% YoY to $803 million.

Major contract expansions include:

$67 million deal with a leading pharmacy for AI prescription fulfillment automation

$40 million telecom contract expansion for network decommissioning automation

$11 million AI expansion deal with a global insurer to automate underwriting workflows

Panasonic Energy expanded AI deployment for 5.5 million daily battery production

Government Customers & Defense AI Growth

The government sector delivered a record $455 million in Q4 revenue (+40% YoY, +11% sequentially).

The U.S. Army extended its partnership for the Army Vantage platform, while Special Operations Command expanded its use of Mission Manager across Special Forces units.

Maven AI adoption is accelerating across the Army, Air Force, and Space Force, while UK’s NHS is scaling Palantir’s AI-driven data platform.

Challenges & Future Outlook

Despite strong growth, scaling AI adoption remains a challenge. Legacy enterprises are slow to transition from outdated IT systems, and government procurement processes remain complex.

Palantir projects 2025 revenue of $3.74–$3.76 billion (+31% YoY), with U.S. commercial revenue expected to exceed $1.08 billion (+54% YoY).

The company is investing in AI talent, technical infrastructure, and new product development while maintaining cost efficiency and strong margins. Palantir is well-positioned to lead in AI-driven enterprise transformation over the next 3-5 years.

Management comments on the earnings call.

Product Innovations: AI-Powered Transformation

Alex Karp, Chief Executive Officer

"We have taken a long bet over decades around the assumption that if we built the products that our partners ought to build—not what they wanted us to build, not what investors or analysts expected us to build—then we would generate massive value. We did that with a symbiotic relationship between data, AI, and large language models, made possible by the ontology framework. Now, our solutions are proving indispensable to organizations looking to operationalize AI at scale."

Shyam Sankar, Chief Technology Officer

"Chat was always a dead end. Instead, we viewed large language models as a new runtime for AI labor. To capture the productive value of AI labor, enterprises need an intermediate representation that AI can interact with. That’s where our Ontology comes in. It’s the secret to our meteoric rise, enabling organizations to weave AI seamlessly into their operations and achieve enterprise autonomy."

Artificial Intelligence Platform (AIP): Leading the AI Revolution

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

"The AI revolution continues to transform industries, and those who fail to act will be left behind. While others focus on AI model supply, we are creating measurable value by turning AI into finished goods and services. Companies that have crossed the chasm with us are already driving real impact and unlocking exceptional efficiency gains with AIP."

Shyam Sankar, Chief Technology Officer

"From the beginning, AIP was built for a world where AI models are improving and converging in performance while costs per token for inference are plummeting. We built our platform to be agnostic to the underlying AI models, allowing enterprises to harness AI labor at scale. The result is quantified exceptionalism—delivering AI-driven transformation at an unprecedented pace."

Large Language Models (LLM): AI Operationalization at Scale

Alex Karp, Chief Executive Officer

"There are billions of dollars being poured into large language models, but the true power lies not in the models themselves, but in how they are operationalized. Our Ontology and infrastructure enable organizations to move from theory to execution, ensuring that AI delivers real business impact."

Shyam Sankar, Chief Technology Officer

"The world focused on AI supply—on models—but the real challenge is AI demand. How do enterprises apply AI to core functions like inventory allocation, claims processing, and customer onboarding? That’s where we’ve invested for years, and it’s why we’re now seeing explosive growth in AI adoption."

Ontology: Competitive Differentiation in AI Deployment

Shyam Sankar, Chief Technology Officer

"Ontology is what makes AI operational at scale. It acts as the intermediary representation that enables AI to function reliably and securely within an enterprise. While others struggle with fragmented AI initiatives, we are delivering AI-driven enterprise autonomy, turning users into supervisors of AI agents rather than manual task performers."

Alex Karp, Chief Executive Officer

"Taking Ontology from an internal tool to a productized solution was one of the hardest things we’ve ever done. But it’s also what makes our AI deployments unique. While our competitors are still trying to figure out how to make AI work in the enterprise, we’re already proving its value in production environments across industries."

U.S. Commercial Sector: Unprecedented Growth and Demand

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

"Our U.S. commercial business is seeing unprecedented demand, with AIP driving both new customer acquisitions and major expansion deals. In Q4 alone, we closed record-setting contracts, including a $67 million deal with a leading pharmacy and a $40 million expansion with a telecom giant. Companies are looking for AI solutions that actually work, and they are choosing us."

Alex Karp, Chief Executive Officer

"In America, companies are pragmatic. They try multiple solutions, and when they see ours delivering real results in a fraction of the time, they expand their partnerships with us. This is why U.S. commercial growth has been extraordinary—54% growth last year and strong momentum heading into 2025."

Government Sector: Expanding AI-Driven Defense and Public Sector Solutions

Shyam Sankar, Chief Technology Officer

"Our government partnerships are growing rapidly as AI becomes an essential tool for defense and national security. The U.S. Army has extended its partnership with us for the Army Vantage platform, and Special Operations Command has deployed our Mission Manager solution for their forces. AI is no longer a concept for the future—it is actively reshaping defense operations today."

Alex Karp, Chief Executive Officer

"We are making America more lethal, ensuring that our adversaries are increasingly hesitant to act against U.S. interests. Our AI solutions are being deployed across the Department of Defense, intelligence agencies, and battlefield operations. This is not just about technology—it’s about maintaining superiority in an AI-driven world."

Customers: AI Transforming Enterprise Operations

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

"Our customers are not just testing AI—they are deploying it at scale and seeing transformational results. One of America’s largest pharmacies signed a $67 million contract after a pilot that automated prescription fulfillment and patient outreach. A leading insurer reduced underwriting from two weeks to three hours using our AI. These are real-world applications, delivering immediate value."

Alex Karp, Chief Executive Officer

"The companies we work with don’t have time for science projects. They need AI solutions that deliver real impact, and they are turning to us because we operationalize AI better than anyone else."

International Growth: Slower European Adoption, Strength in Asia & Middle East

Alex Karp, Chief Executive Officer

"In the U.S., companies are focused on results. In Europe, we see resistance to change and outdated approaches to technology adoption. While the U.S. commercial sector is growing at 54%, our European business is stagnating at 4%. The difference is clear—those who embrace AI are pulling ahead, while those who hesitate are being left behind."

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

"While Europe lags behind in AI adoption, we are seeing targeted growth in Asia and the Middle East. Organizations in these regions understand the competitive edge that AI provides, and they are moving quickly to implement our solutions."

Challenges: Scaling AI Adoption in Traditional Enterprises

Alex Karp, Chief Executive Officer

"The biggest challenge is getting traditional enterprises to break away from outdated IT frameworks. Many companies are still approaching AI with multi-year plans that become obsolete in weeks. Those who act quickly are gaining a competitive edge, while others risk falling behind permanently."

Future Outlook: Positioned for AI Leadership

Dave Glaser, Chief Financial Officer

"We are guiding to a full-year 2025 revenue midpoint of $3.75 billion, representing a 31% YoY growth rate. U.S. commercial revenue is expected to exceed $1.08 billion, reflecting at least 54% growth. Our profitability continues to strengthen, with record adjusted operating margins and free cash flow."

Alex Karp, Chief Executive Officer

"We are at the very beginning of this AI revolution. The next 3-5 years will determine which companies lead the AI economy, and we plan to be the cornerstone company in driving this transformation. We have built our business around the idea that AI will fundamentally reshape industries, and the results speak for themselves."

Thoughts on Palantir Earnings Report $PLTR:

🟢 Positive

Q4 revenue of $828M (+36.0% YoY, +30.0% LQ) beat estimates by 7.4%.

Adjusted FCF margin reached 62.5% (+12.4 PPs YoY), showing strong cash flow efficiency.

U.S. commercial revenue surged 63.4% YoY to $214M, driving record growth.

Government revenue increased 40.3% YoY to $455M, contributing 55% of total revenue.

EPS of $0.14 exceeded estimates by 27.3%.

711 total customers, up 43.1% YoY (+82 new customers).

Enterprise expansion: DBNR of 120%, RPO of $1.73B (+39.2% YoY), and Billings of $779M (+28.7% YoY).

Significant U.S. commercial TCV growth to $803M (+134% YoY, +170% sequentially).

Net new ARR doubled to $408M (+103.2% YoY), highlighting strong demand.

Q1’25 revenue guidance of $858M - $862M (+35.6% YoY) beat estimates by 7.4%.

Full-year 2025 revenue guidance of $3.74B - $3.76B (+30.8% YoY) exceeded expectations by 6.5%.

🟡 Neutral

Gross margin of 82.9% (-1.0 PPs YoY) remains strong but slightly lower than last year.

Net margin declined to 9.5% (-5.8 PPs YoY), though still positive.

International commercial revenue grew only 3% YoY to $158M, significantly lagging U.S. growth.

R&D spending declined to 11.4% of revenue (-1.2 PPs YoY), indicating cost efficiency but potential slower innovation scaling.

🔴 Negative

Stock-based compensation (SBC) increased to 34% of revenue, up 14.4 PPs QoQ.

Basic shares outstanding rose 5.4% YoY, and diluted shares increased 7.2% YoY, leading to dilution.

Europe remains slow in AI adoption, with Palantir struggling to accelerate growth in the region.

Legacy enterprises continue slow AI adoption, delaying larger-scale deployments.

Thanks for the quick write-up Sergey!