Financial Results:

⬆️$608M rev (+19.6% YoY, +16.8% LQ) beat est by 1.0%

⬆️GM* (84.0%, +2.4%pp YoY)🟢

⬆️Operating Margin* (34.4%, +11.9%pp YoY)🟢

⬆️Adj FCF Margin 50.1%, +35.2%pp YoY)🟢

⬆️EPS* $0.08 beat est by 14.3%🟢

*non-GAAP

Revenue By Type

⬆️Commercial revenue $284M rev (+32.1% YoY, 46.7% Total rev)🟢

⬆️US commercial revenue $131M rev (+70.1% YoY)🟢

➡️Commercial revenue $324M rev (+10.5% YoY, 53.3% Total rev)🟡

⬆️RPO $1.24B (+28.0% YoY)🟢

⬆️Billings $605M (+56.0% YoY)🟢

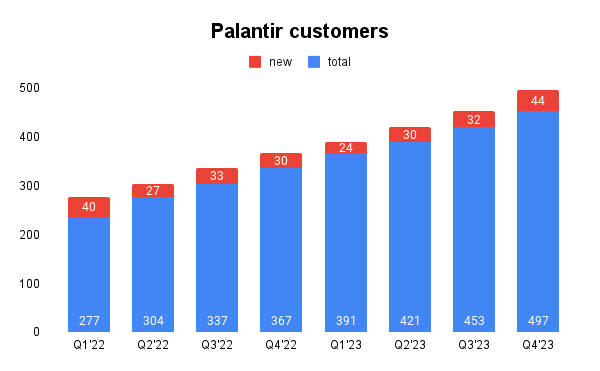

Customer count grew

⬆️497 Customers (+35.0% YoY, +44)🟢

⬆️375 Commercial Customers (+44.0% YoY, +45)

⬆️221 US Commercial Customers (+55.0% YoY, +40)

Operating expenses

⬆️S&M*/Revenue 25.3% (24.5% LQ)

↘️R&D*/Revenue 12.5% (15.0% LQ)

↘️G&A*/Revenue 13.5% (14.9% LQ)

⬆️Net New ARR $201M ($99 LQ)

↘️CAC* Payback Period 15.2 Months (28.1 LQ)

Dilution

⬆️SBC/rev 22%, +1.0%pp QoQ)

⬆️Dilution at 4.6% YoY, +0.3%pp QoQ)🟡

Guidance

↘️Q1'24 $616.0M guide (+17.3% YoY) missed est by -0.2%🔴

➡️$2,668M FY guide (+19.9% YoY)

Key points from Palantir $PLTR Q4 2023 Earnings Call:

Rapid Growth:

The company reported a 20% year-over-year revenue growth in the fourth quarter, with the commercial business surpassing $1 billion in revenue over the last 12 months.

Palantir Technologies has seen unprecedented demand for its AI-powered platform, leading to significant business growth, especially in the US commercial sector. The company's approach to AIP bootcamps has been a game-changer, driving new customer acquisitions and expansions.

Expansion into Government Contracts:

While commercial success has been highlighted, the company also emphasizes its deep involvement with government projects. The expectation is for the US government business to reaccelerate in 2024, driven by the critical nature of Palantir's software in national security and defense.

Strategic Focus on Software over Hardware:

Palantir's focus remains steadfast on software development, with a keen eye on the evolving demands of both the commercial market and government needs. This strategic direction is in contrast to traditional defense contractors and highlights Palantir's unique position in the market.

Internal Alignment and Growth Trajectory:

AIP and bootcamps have accelerated Palantir's business, especially in the US commercial sector, where revenue grew 70% year-over-year in the fourth quarter.

The company has completed over 560 AIP bootcamps across 465 organizations, significantly exceeding its goal of 500 bootcamps within a year.

Management comments on the earnings call.

AIP (Artificial Intelligence Platform):

Alex Karp on AIP's Impact:

"What you see is a convergence of our product being easier to use, an augmentation of its charisma, both driven by developments in AI, large language models, which make the product approachable foundry to the broader market."

Ryan Taylor on Customer Enthusiasm for AIP:

"I've never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial."

Ryan Taylor on AIP's Impact on US Commercial Growth:

"2023 was a tremendous year of opportunity and growth for our company, with US commercial at the forefront, which was meaningfully driven by AIP as the product and bootcamps as the go-to-market motion."

Shyam Sankar on AIP's Role in Enterprise Transformation:

"AIP is the AI-powered operating system for the enterprise, not a Q&A bot, not an agent framework, not a way to dabble, but a way to deliver."

Ryan Taylor on Accelerating New Customer Acquisition through AIP:

"We're already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition."

Alex Karp on AIP's Demand and Company Transformation:

"We don't know how to deal with this demand, and so, we're rebuilding the company. I'm telling our employees in Germany and France it's time to pack up and come to America."

Customer engagement:

Alex Karp on Customer Enthusiasm for AIP:

"I go around the country now telling CEOs, CTOs, and really, whoever has $1 million to buy our product and transform their enterprise, take everything you've done in AI since you started, put your best people on it, and we're going to show up at any time you want, and we're going to run your data at a bootcamp for 10 hours."

Government business:

Shyam Sankar on Government Market Adaptation:

"Unlike the primes, who used to focus on hardware and now responding to software, we've always focused on software... But it's also a function of the department's pace of scaling their AI and software efforts to match the realities of modern combat."