Palantir Q3 2024 Earnings Analysis

Dive into $PLTR Palantir’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$726M rev (+30.0% YoY, +27.2% LQ) beat est by 3.5%

↘️GM* (78.0%, -4.1 PPs YoY)🟡

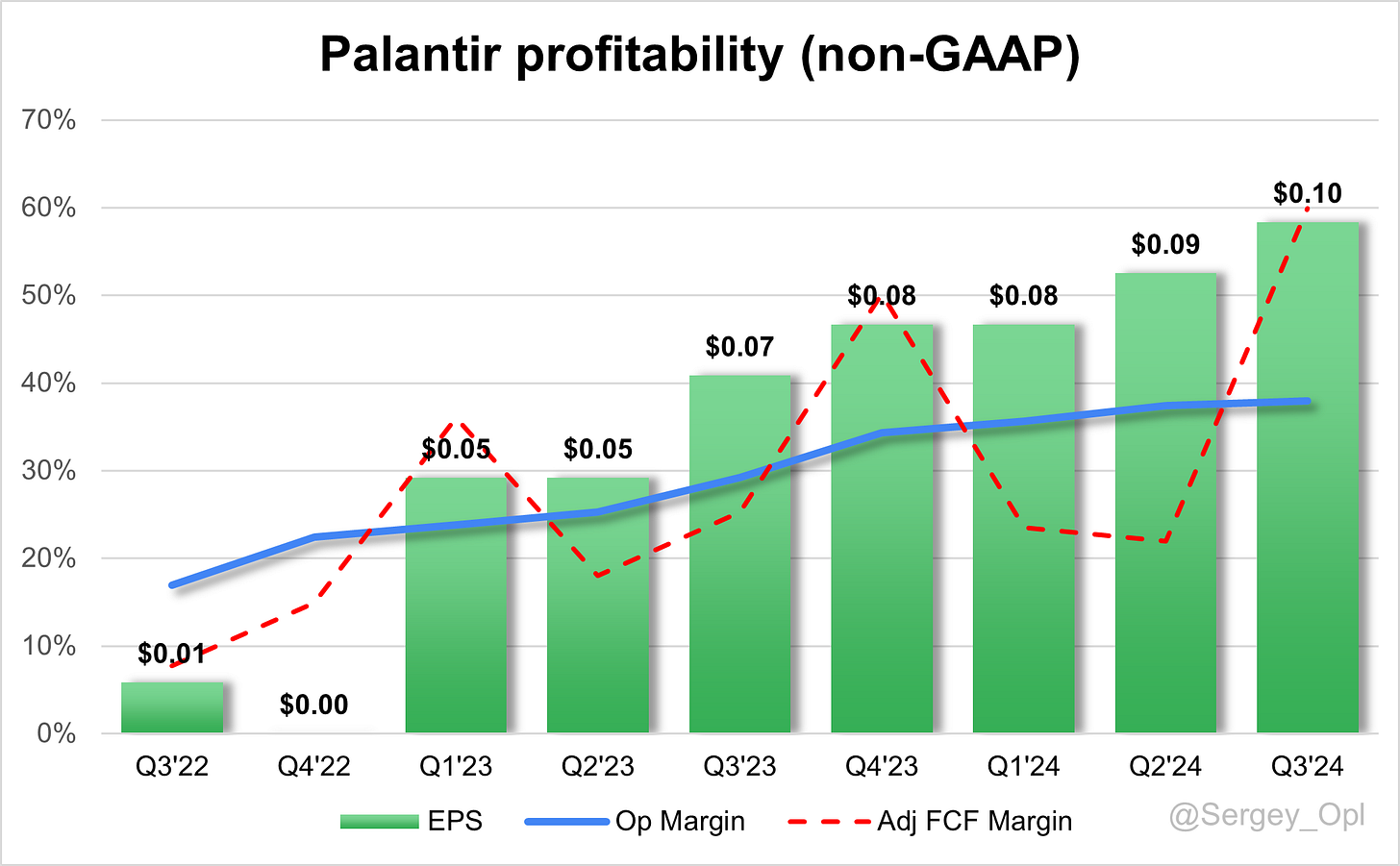

↗️Operating Margin* (38.0%, +8.8 PPs YoY)🟢

↗️Adj FCF Margin (59.9%, +34.6 PPs YoY)🟢

↗️EPS* $0.10 beat est by 11.1%🟢

*non-GAAP

Revenue By Type

➡️Commercial $317M rev (+26.3% YoY, 43.7% Total rev)🟡

↗️US commercial $179M rev (+54.3% YoY)

↗️Government $409M rev (+33.0% YoY, 56.3% Total rev)🟢

Key Metrics

↗️DBNR 118% (114% LQ)

↗️RPO $1.57B (+58.9% YoY)🟢

↗️Billings $823M (+49.6% YoY)🟢

Customers

➡️629 Customers (+38.9% YoY, +36)

➡️498 Commercial Customers (+50.9% YoY, +31)

➡️321 US Commercial Customers (+77.3% YoY, +26)

➡️177 International Commercial Customers (+18.8% YoY, +5)

Operating expenses

↘️S&M*/Revenue 21.9% (-2.7 PPs YoY)

↘️R&D*/Revenue 12.0% (-3.0 PPs YoY)

↘️G&A*/Revenue 12.5% (-2.3 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $190M (+90.7% YoY)

↗️CAC* Payback Period 11.3 Months (-10.3 YoY)🟢

↗️R&D* Index (RDI) 2.16 (+0.96 YoY)🟢

Dilution

↘️SBC/rev 20%, -1.3 PPs QoQ

↘️Basic shares up 4.0% YoY, -0.7 PPs QoQ🟡

↘️Diluted shares up 5.8% YoY, -0.2 PPs QoQ🟡

Guidance

↗️Q4'24 $767.0 - $771.0M guide (+26.4% YoY) beat est by 3.7%

↗️$2,805.0 - $2,809.0M FY guide (+26.2% YoY) raised by 2.1% beat est by 1.7%

Key points from Palantir’s Third Quarter 2024 Earnings Call:

Financial Performance

Palantir reported strong financial results in Q3 2024, with revenue increasing 30% year-over-year, fueled by robust U.S. market demand. The adjusted operating margin expanded to 38%, marking the eighth consecutive quarter of margin growth, while adjusted free cash flow reached $435 million (a 60% margin). Cash flow from operations totaled $420 million, contributing to a Rule of 40 score of 68. These figures reflect Palantir’s effective growth strategy, particularly within its U.S. segments. The company raised its full-year revenue guidance to $2.805 billion to $2.809 billion, signaling confidence in sustained growth.

Product Innovations

Palantir’s AIP Platform is a core component of its innovation strategy, designed to address enterprise AI needs by integrating AI-driven workflows into production for enhanced automation and real-time insights. In one case, a major U.S. insurance company reduced underwriting times from weeks to hours using AIP, increasing its responsiveness and competitiveness. Palantir’s focus remains on delivering actionable AI applications that yield immediate value for clients, rather than merely developing model-based solutions.

New Developments in Defense Technology

Palantir continues to lead in defense technology innovation with tools like the Maven Smart System, which streamlines complex targeting operations, allowing for significant manpower reduction. The system powers the U.S. military’s Targeting Node through the Titan program, enhancing AI capabilities across the Army, Air Force, Space Force, Navy, and Marine Corps. This advanced deployment underscores Palantir’s role in developing mission-critical applications that drive operational effectiveness in defense.

Expansion of Developer Capabilities

Palantir introduced new tools for developers, including an enhanced OSDK, ergonomic compute modules, and a multimodal data plane, to accelerate application development across sectors. The upcoming DevCon event will showcase these tools, fostering greater integration of AIP in client projects. This developer focus positions Palantir to meet growing demand for adaptable, enterprise-ready AI applications across industries.

Warp Speed for Manufacturing

The recently launched “Warp Speed” initiative aims to revitalize U.S. manufacturing capabilities. Designed as an American manufacturing operating system, Warp Speed helps companies use AI-driven production workflows to improve efficiency and competitiveness. Collaborating with both defense startups and established industry players, Palantir is reinforcing its role in enhancing U.S. industrial and defense readiness through advanced manufacturing applications.

AIP (Artificial Intelligence Platform)

Palantir’s AIP Platform underpins its growth across commercial and government sectors, providing scalable AI applications that drive cost efficiency and operational improvements. For example, AIP reduced underwriting times for a major U.S. insurer and improved on-time delivery rates for Associated Materials from 40% to 90%. AIP’s integration with existing enterprise systems and its ability to capitalize on large language models make it a leading solution in the fast-evolving AI market, particularly in the U.S., where AIP adoption contributed significantly to Palantir’s 54% year-over-year growth.

U.S. Commercial Sector

Palantir’s U.S. commercial sector exhibited strong performance in Q3 2024, with revenue growing 54% year-over-year and 13% sequentially. The adoption of AIP enabled clients to improve productivity and streamline operations, with several seven-figure deals secured rapidly after initial engagement. The U.S. commercial sector’s total contract value (TCV) reached nearly $300 million, highlighting Palantir’s capacity to address critical business needs with AI solutions, supporting robust growth in the U.S. market.

Overall Commercial Sector

Palantir’s commercial segment achieved a 27% year-over-year revenue increase in Q3, with sequential growth of 3%. Excluding strategic contract revenue, growth reached 30% year-over-year. TCV in this segment rose significantly to $612 million, up 52% year-over-year and 62% sequentially. The adoption of AIP across industries showcases Palantir’s competitive advantage in providing production-ready AI solutions, with strong growth in the U.S. and ongoing expansion of partnerships with international clients, such as BP.

International Expansion

International commercial revenue grew by 3% year-over-year in Q3, with a 7% sequential decline due to economic challenges in Europe and the Middle East. Additionally, a reduction in revenue from certain Middle Eastern government contracts affected results. Despite these headwinds, Palantir remains committed to pursuing growth opportunities in Asia, the Middle East, and other regions. The recent renewal of a multi-year contract with BP demonstrates Palantir’s ongoing commitment to international client relationships.

Government and Defense Partnerships

The government and defense sectors remain essential for Palantir, with U.S. government revenue increasing by 40% year-over-year in Q3. Key partnerships include a multi-year contract expanding Maven Smart System AI capabilities across U.S. military branches. Palantir’s defense solutions drive efficiency and reduce manpower needs, offering strategic advantages in targeting and situational awareness. These developments reinforce Palantir’s leadership in national security and defense AI applications.

Customer Growth and Expansion

Palantir’s customer base grew 39% year-over-year in Q3 2024, reaching 629 clients, with substantial expansion in the U.S. commercial segment, where customer count increased by 77%. Palantir closed 104 deals over $1 million, reflecting strong market demand for its AI solutions. The U.S. commercial sector’s total contract value reached approximately $300 million, underscoring Palantir’s effective customer acquisition and expansion strategy.

Customer Success Stories

Palantir’s AIP platform has demonstrated tangible value across multiple industries. A major U.S. insurance company used AIP to streamline underwriting workflows, cutting response times from weeks to hours. In another case, Associated Materials improved on-time delivery rates from 40% to 90% with AIP’s assistance. These success stories illustrate AIP’s ability to deliver operational efficiency and a competitive advantage, highlighting its transformative impact in real-world applications.

Notable Large Customer Wins

Palantir secured prominent client expansions, including a major U.S. equipment rental company that increased its annual recurring revenue (ARR) twelvefold within eight months of signing an enterprise contract. Other significant wins included seven-figure deals with a bottled water manufacturer, a pharmaceutical company, and an agricultural software provider, all of which rapidly expanded engagements following initial boot camp training. These large customer wins showcase Palantir’s capacity to deliver swift, substantial value across diverse sectors.

U.S. Government and Defense Clients

Palantir’s role with government clients continues to grow, particularly in defense, where the Maven Smart System enhances military targeting efficiency. The company’s multi-year contract to expand AI across the Army, Air Force, and Space Force underscores Palantir’s significance in national security. Palantir’s AI solutions support mission-critical defense operations, securing lasting partnerships with top defense organizations.

Challenges

Palantir faces challenges in international markets, with international government revenue declining by 5% sequentially due to economic issues in Europe and the Middle East. Revenue from strategic commercial contracts is expected to decline, contributing only a small portion of Q3 revenue. While these contracts represent a minor segment, they highlight the impact of economic and geopolitical factors on Palantir’s international growth trajectory.

Future Outlook

Palantir raised its full-year guidance, expecting U.S. commercial revenue growth of at least 50% and adjusted free cash flow exceeding $1 billion. CEO Alex Karp reiterated Palantir’s commitment to maintaining high margins while pursuing strategic growth, focusing on high-value partnerships in the U.S. market. Palantir views AIP as central to its expansion strategy, with broad applications across commercial and government sectors, positioning the company for continued success in a rapidly advancing AI landscape.

Management comments on the earnings call.

Product Innovations

Alex Karp, Chief Executive Officer

"We've been building the infrastructure for AI-driven applications at scale, enabling our customers to integrate these capabilities seamlessly into production workflows. This approach is essential not just for technology adoption but for creating a substantial impact on operational efficiency and competitive edge."

AIP (Artificial Intelligence Platform)

Shyam Sankar, Chief Technology Officer

"The ability to fully leverage AI models within the enterprise context is what distinguishes the AI leaders from the rest. With AIP, our focus is on delivering real results, not just proof of concept, through a comprehensive platform that integrates AI applications across the workflow layer."

Large Language Models (LLM)

Alex Karp, Chief Executive Officer

"The value isn’t in the large language model alone; it’s in how you manage and apply these models within the enterprise infrastructure. The models themselves are rapidly becoming commoditized, but true differentiation comes from how these technologies are deployed and integrated to solve specific, high-impact use cases."

Customers

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

"The rapid expansion of our customer engagements is a testament to the measurable impact of our platform. Clients are seeing immediate, transformative benefits from AIP deployments—whether it’s reducing underwriting response times from weeks to hours or doubling on-time delivery rates across complex supply chains."

Challenges

David Glazer, Chief Financial Officer

"While international growth has faced headwinds from economic challenges in certain regions, we’re committed to expanding our market footprint. Our approach remains focused on building sustainable relationships, even as we navigate external pressures and work toward capturing long-term opportunities globally."

Future Outlook

Alex Karp, Chief Executive Officer

"Our strategic focus on high-margin, high-value partnerships allows us to balance growth with profitability. By continuing to prioritize product depth over breadth and investing in areas like AIP, we are positioned to achieve sustainable expansion while meeting the growing demand for advanced AI-driven solutions across industries."