Palantir Q2 2024 Earnings Analysis

Dive into $PLTR Palantir’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$678M rev (+27.2% YoY, +20.8% LQ) beat est by 4.0%

↗️GM* (82.9%, +1.4 PPs YoY)

↗️Operating Margin* (37.4%, +12.1 PPs YoY)🟢

↗️Adj FCF Margin (21.9%, +3.9 PPs YoY)

↗️EPS* $0.09 beat est by 12.5%🟢

*non-GAAP

Revenue By Type

↗️Commercial $307M rev (+32.3% YoY, 45.3% Total rev)🟢

↗️US commercial $159M rev (+54.4% YoY)🟢

➡️Government $371M rev (+23.2% YoY, 54.7% Total rev)🟡

Key Metrics

↗️DBNR 114% (111% LQ)

↗️RPO $1.37B (+42.0% YoY)🟢

➡️Billings $718M (+19.0% YoY)🟡

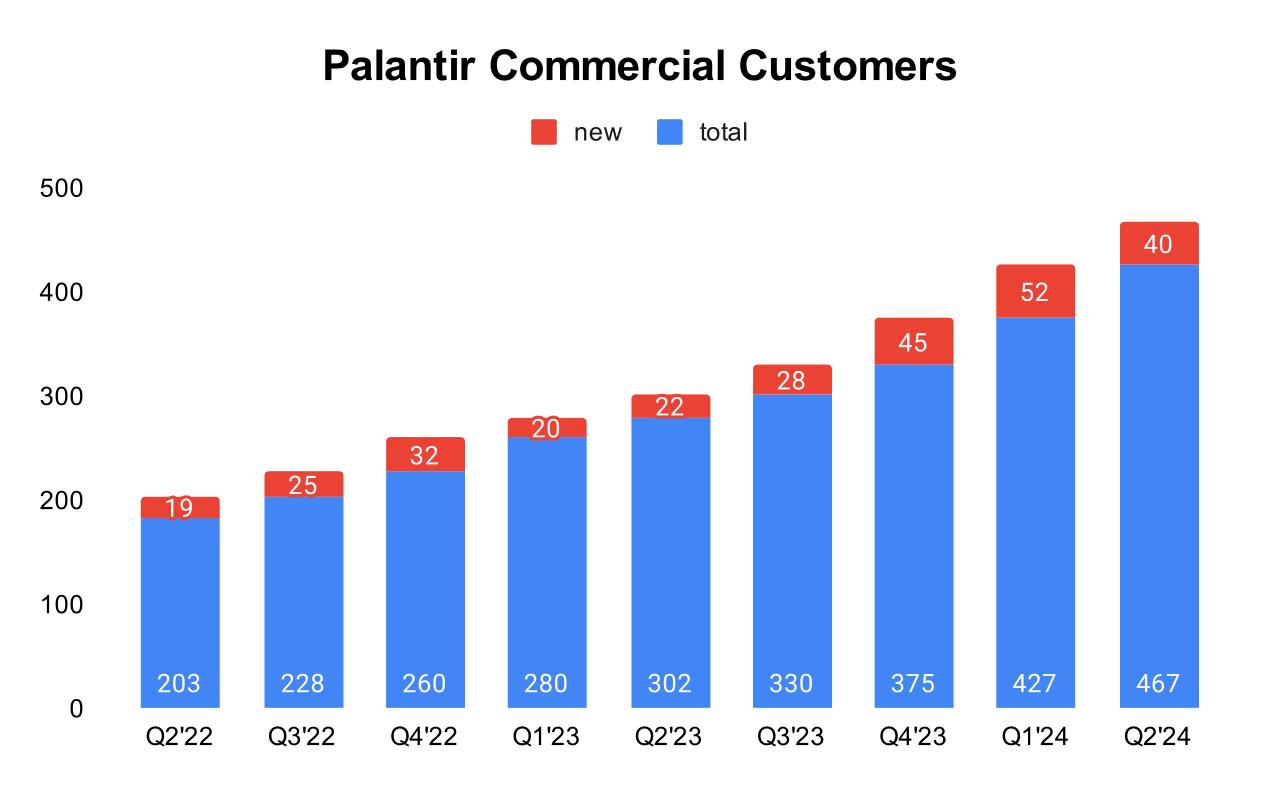

Customers

➡️593 Customers (+41.0% YoY, +39)

➡️467 Commercial Customers (+55.0% YoY, +40)

➡️295 US Commercial Customers (+83.0% YoY, +33)

Operating expenses

↘️S&M*/Revenue 21.9% (-5.5 PPs YoY)

↘️R&D*/Revenue 11.6% (-2.7 PPs YoY)

↘️G&A*/Revenue 12.9% (-3.5 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $175M (+438.6% YoY)

↘️CAC* Payback Period 12.4 Months (21.1 LQ)

Dilution

↗️SBC/rev 21%, +1.1 PPs QoQ

↘️Basic shares up 4.7% YoY, -0.3 PPs QoQ🟡

↘️Diluted shares up 6.0% YoY, -2.2 PPs QoQ🟡

Guidance

↗️Q3'24 $697.0 - $701.0M guide (+25.2% YoY) beat est by 2.9%

↗️$2,742.0 - $2,750.0M FY guide (+23.4% YoY) raised by 2.3% beat est by 1.7%

Key points from Palantir’s Second Quarter 2024 Earnings Call:

Growth and Performance

Palantir reported a year-over-year revenue growth of 27%, with a particularly strong performance in the US commercial sector, which saw a 70% increase excluding strategic commercial contracts.

The company achieved its seventh consecutive quarter of GAAP profitability with $134 million in GAAP net income and a 37% adjusted operating margin.

Customer Growth:

Palantir reported a significant increase in customer counts, particularly in the U.S. commercial sector, with an 83% growth year-over-year in the last quarter.

Applications and Impact of AIP:

Healthcare: Tampa General used AIP to deploy a care coordination operating system, reducing patient length of stay by 30%.

Energy: Panasonic Energy of North America utilized AIP across multiple functions including finance, quality control, and manufacturing operations.

Manufacturing and Infrastructure: Kinder Morgan employed AIP for enhancing storage optimization, pipeline integrity monitoring, and power optimization.

Strategic Deals:

Palantir closed 27 deals worth $10 million or more and nearly $1 billion in Total Contract Value (TCV) in Q2 alone, demonstrating strong market demand and the high value placed on their solutions.

Noteworthy expansions were noted with existing customers, who are significantly increasing their commitment to Palantir's solutions, highlighting the effectiveness and essential nature of their software in operational contexts.

Product Innovations:

Warp Speed, Introduced as a new product aimed at powering American reindustrialization. It is designed as an operating system for modern American manufacturers, integrating ERP, MES, PLM, and interacting directly with factory floor systems. Warp Speed is built on Palantir's AIP and leverages ontology for a comprehensive manufacturing solution.

Ontology SDK, Allows customers to build pro-code applications supported by Palantir’s ontology, crucial for harnessing LLMs (Large Language Models) in the enterprise. This SDK is part of the strategic tools provided to transition from prototype to production effectively.

Developer Engagement and Support:

Through platforms like bill.palantir.com, Palantir is encouraging a growing developer community by providing access to a free developer tier, tutorials, and quick start guides.

Integration with Government:

A contract awarded by the Department of Defense’s CDAO to deploy and scale an AI-enabled operating system across the DoD is a key example of AIP’s strategic importance in high-stakes fields like national defense.

Challenges in Transitioning from Prototype to Production:

A major challenge highlighted by Palantir is the industry-wide bottleneck in moving AI projects from prototype to production stages. Many companies can build prototypes, but scaling these to full production efficiently and effectively remains a significant hurdle.

Palantir has positioned itself as uniquely capable of overcoming this challenge by leveraging its advanced enterprise AI technologies and extensive experience in high-stakes environments such as defense and intelligence.

Financial Outlook:

Increased the full-year revenue guidance midpoint to $2.746 billion, anticipating a continued strong performance.

Palantir plans to continue investing in its product pipeline and addressing hard technical problems that facilitate the journey from prototype to production. This includes developing new products and enhancing existing ones to better serve both commercial and government sectors.

Management comments on the earnings call.

Product Innovations

Shyam Sankar, CTO: "The journey to production as the market is now discovering is fraught and requires a foundational set of technologies that we have uniquely invested in, creating the product pipeline that's needed to harvest economic value from AI."

Customers

Ryan Taylor, CRO & CLO: "One of the most notable indicators of our delivery is the volume of existing customers who are signing expansion deals, many of which are a direct result of AIP."

Strategic Deals

Ryan Taylor, CRO & CLO: "Last quarter, we signed 27 deals worth $10 million or more and closed nearly $1 billion of TCV. This exceptional result is a reflection of a market that is quickly awakening to a reality that our customers have already known: we stand alone in our ability to deliver enterprise AI production impact at scale."

Challenges

Alex Karp, CEO: "The standard playbook does not and will not work. It cannot solve this problem. While many companies can build prototypes, the leap from prototype to production is substantial."

Future Outlook

Alex Karp, CEO: "We're charging full steam ahead, leading our customers across the bridge from prototype to production with our ever expanding product capabilities laying the paths for that journey."