Palantir Q1 2025 Earnings Analysis

Dive into $PLTR Palantir’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$884M rev (+39.3% YoY, +36.0% LQ) beat est by 2.7%

↘️Gross Margin* (82.1%, -1.2 PPs YoY)🟡

↗️Operating Margin* (44.2%, +8.6 PPs YoY)🟢

↗️Adj FCF Margin (41.9%, +18.4 PPs YoY)

↗️Net Margin (24.6%, +7.9 PPs YoY)🟢

➡️EPS* $0.13 in line with est

*non-GAAP

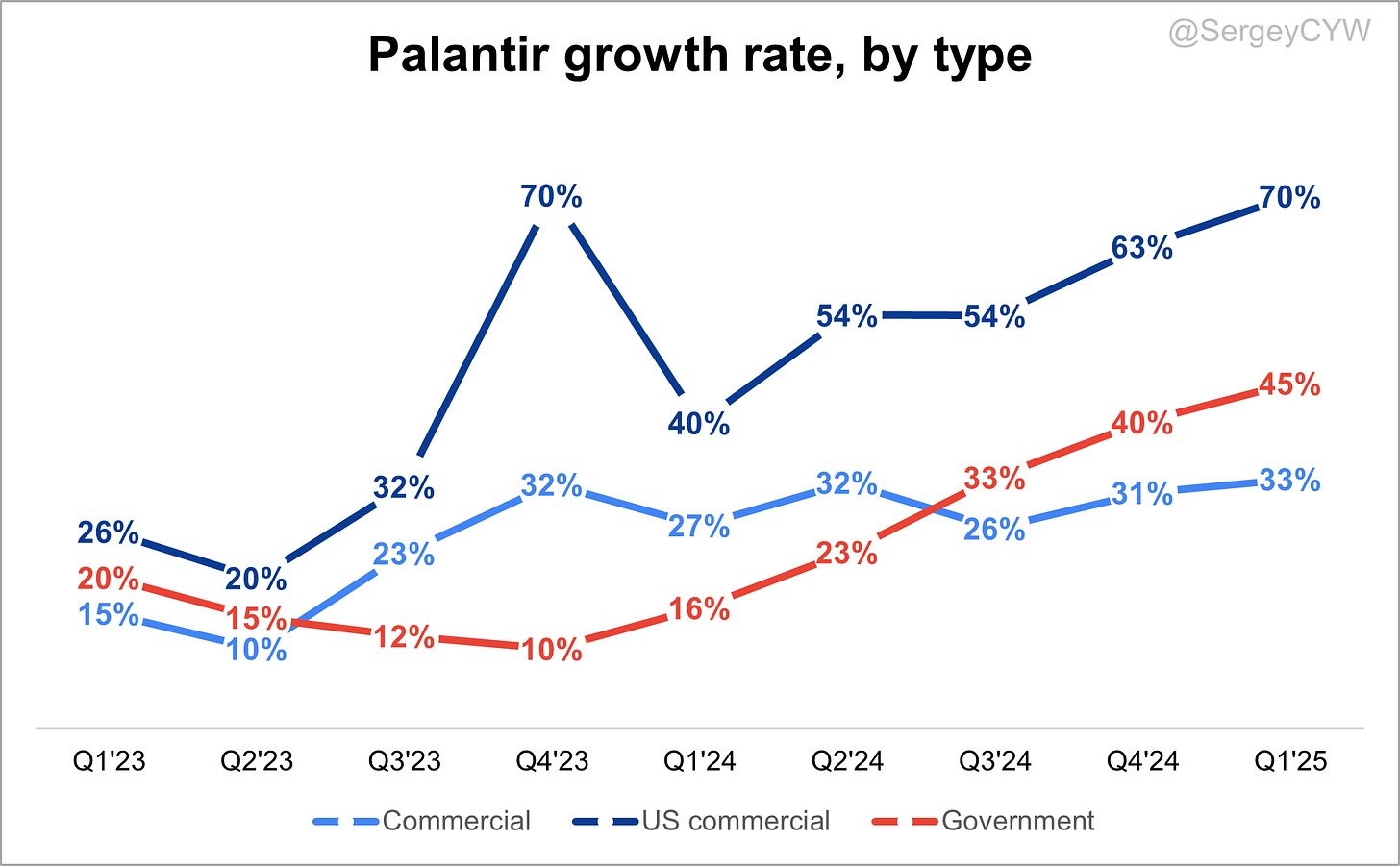

Revenue By Type

➡️Commercial $397M rev (+32.8% YoY, 44.9% Total rev)🟡

↗️US commercial $255M rev (+70.0% YoY)🟢

↗️Government $487M rev (+45.4% YoY, 55.1% Total rev)🟢

Key Metrics

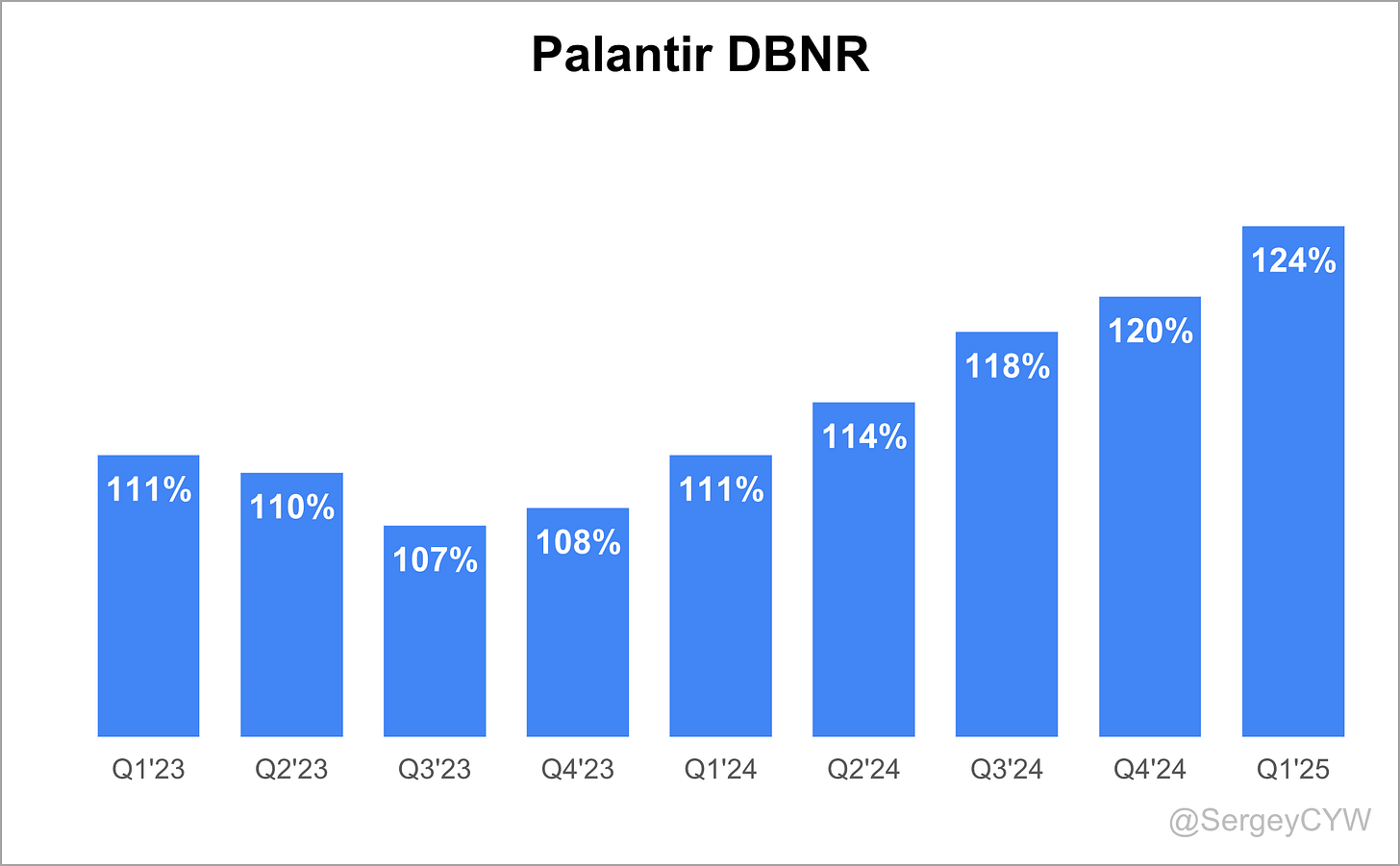

↗️DBNR 124% (120% LQ)

↗️RPO $1.90B (+46.2% YoY)🟢

↗️Billings $905M (+44.8% YoY)🟢

Customers

➡️769 Customers (+38.8% YoY, +58)

➡️622 Commercial Customers (+45.7% YoY, +51)

➡️432 US Commercial Customers (+64.9% YoY, +50)

➡️190 International Commercial Customers (+15.2% YoY, +1)

Operating expenses

↘️S&M*/Revenue 20.8% (-3.0 PPs YoY)

↘️R&D*/Revenue 11.7% (-1.4 PPs YoY)

↘️G&A*/Revenue 12.2% (-1.7 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $225M (+116.8% YoY)

↘️CAC* Payback Period 12.2 Months (-8.9 YoY)🟢

↗️R&D* Index (RDI) 2.87 (+1.37 YoY)🟢

Dilution

↘️SBC/rev 18%, -16.5 PPs QoQ

↗️Basic shares up 6.1% YoY, +0.7 PPs QoQ🔴

↘️Diluted shares up 6.4% YoY, -0.9 PPs QoQ🟡

Guidance

↗️Q2'25 $934.0 - $938.0M guide (+38.0% YoY) beat est by 3.7%

↗️$3,890.0 - $3,902.0M FY guide (+36.0% YoY) raised by 3.9% beat est by 3.7%

Key points from Palantir’s First Quarter 2025 Earnings Call:

Financial Performance

Palantir reported Q1 2025 revenue of $884M, up +39% YoY and +7% QoQ, exceeding the high end of guidance by ~350bps. Growth accelerated from +18% in Q1 2024.

Adjusted operating income reached $391M for a 44% margin, up +800bps YoY. GAAP operating income was $176M (20% margin); GAAP net income totaled $214M (24% margin).

Adjusted free cash flow was $370M (42% margin). Operating cash flow totaled $310M. Palantir ended the quarter with $5.4B in cash and equivalents.

EPS came in at $0.08 GAAP and $0.13 adjusted. Stock-based compensation was $155M, or approximately 18% of revenue.

Palantir’s Rule of 40 score improved to 83, marking the seventh consecutive quarter of expansion.

Top 20 customer revenue rose +26% YoY to $70M per customer, indicating deeper enterprise penetration.

AIP Platform

AIP underpinned Q1’s outperformance and remains the key growth engine. The platform enables “enterprise autonomy” through AI agents that automate full workflows.

Positioned as a core operating layer, AIP drives up to 50x productivity improvements, not incremental boosts.

In Q1, Palantir entered a new phase of full-scale automation using AI agents built on its ontology infrastructure.

$810M in U.S. commercial TCV was attributed largely to AIP deployments, reflecting +239% YoY growth.

The company doubled its $1M+ deals YoY, a signal of buyer confidence in AIP's production readiness.

Key deployments include AIG’s AI underwriting agent, Tampa General’s sepsis detection agents, and DoD’s intelligence monitoring agents. Walgreens used AIP to automate workflows across 4,000 stores, removing 384B daily manual decisions.

AIP was publicly endorsed by AIG, Citi, BP, Hertz, and L3Harris during their earnings calls.

Adoption remains concentrated in the U.S., as legacy industries and European enterprises continue to lag in adoption readiness.

Ontology

Ontology remains Palantir’s strategic moat, acting as the semantic layer between real-world operations and AI execution.

It enables AI agents to operate with full business context and facilitates interoperability across systems.

Shyam Sankar highlighted that as LLM performance converges, the competitive edge moves to orchestration, where ontology is critical.

Ontology accelerates deployment timelines by embedding enterprise knowledge into structured frameworks.

Customer usage of ontology-driven workflows is increasing, particularly in organizations scaling AI agents into production.

Outside the U.S., the company still faces an education gap, as many regions have yet to internalize the value of ontology as infrastructure.

Product Innovations

Palantir delivered Titan, an AI-powered military vehicle, to the U.S. Army on time and on budget. It was rated a top-performing program.

The Maven Smart System, used in military AI command, has doubled in usage twice over 14 months.

NATO adopted Maven as its AI mission command system across 32 member states.

Warp Speed, the company’s manufacturing OS, is gaining traction in U.S. reindustrialization efforts.

Commercial Growth

Commercial revenue grew +33% YoY to $397M, led by U.S. commercial at $255M (+71% YoY, +19% QoQ).

Excluding strategic contract impacts, U.S. commercial revenue rose +75% YoY and +22% QoQ.

Palantir booked $930M in commercial TCV (+84% YoY), including $810M from U.S. commercial—its highest quarterly TCV ever.

The U.S. commercial customer base grew +65% YoY and +13% QoQ to 432 accounts.

Key deals highlight rapid adoption cycles:

– A healthcare firm moved from bootcamp to a 5-year, $26M ACV in five weeks.

– A global bank expanded from pilot to a 3-year, $19M ACV in four months.

– A Fortune 500 healthcare company converted to a 5-year, $10M ACV within one quarter.

Remaining deal value in U.S. commercial increased +127% YoY and +30% QoQ, supporting long-term visibility.

Government Growth

Government revenue totaled $487M, up +45% YoY and +7% QoQ.

U.S. Government revenue reached $373M (+45% YoY, +9% QoQ), driven by Maven and Titan adoption.

International Government revenue rose to $114M (+45% YoY), led by UK and NATO contracts.

TCV booked reached $1.5B, up +66% YoY, while net dollar retention improved to 124%, a +400bps QoQ gain.

Maven Smart System adoption has scaled across military commands and use cases. NATO selected it as its default operating system for AI command.

Management views budget pressure as a long-term tailwind, as Palantir's software excels in performance-based procurement environments.

International Growth

International commercial revenue declined -5% YoY and -11% QoQ to $141M, impacted by Q4 pull-forward and European softness.

Europe remains slow in AI adoption and digital transformation readiness.

Management noted that 90% of Palantir’s growth now comes from outside continental Europe, with momentum in the U.S., Asia, and the Middle East.

Customer Growth

Total customer count reached 769, up +39% YoY and +8% QoQ.

$1M+ contracts doubled YoY, with rising TCV and faster deal conversion cycles.

Palantir booked $2B+ in U.S. commercial TCV on a trailing 12-month basis.

Top 20 customer spend grew +26% YoY, averaging $70M each.

The business is benefiting from scale economics and deeper wallet share in its core clients.

Customer Success

Customer endorsements signal growing trust in Palantir as a mission-critical platform.

AIG stated that its 5-year CAGR could double through AI underwriting powered by Palantir.

Walgreens deployed AI-enabled workflows across 4,000 stores, replacing what would have required 384 billion manual decisions.

R1 RCM is building automated reimbursement systems with Palantir to tap into a multi-hundred-billion-dollar market.

References to Palantir appeared in earnings calls from Citibank, BP, Hertz, L3Harris, and AIG, validating the platform’s enterprise value.

Challenges

International commercial softness, especially in Europe, is constraining segment growth.

Stock-based compensation remains high at 18% of revenue, contributing to modest dilution (+6.4% YoY diluted share count).

Reliance on U.S. federal contracts raises concerns amid budget tightening, though management views merit-based procurement as a structural advantage.

Educating legacy organizations and international regions on the ontology-AIP model remains a barrier to faster global adoption.

Future Outlook

Q2 2025 revenue is guided between $934M–$938M, reflecting +18.7% YoY growth at midpoint.

Full-year 2025 guidance was raised:

– Revenue: $3.89B–$3.902B (+36% YoY)

– U.S. Commercial: $1.178B+ (+68% YoY)

– Adjusted Operating Income: $1.711B–$1.723B

– Adjusted Free Cash Flow: $1.6B–$1.8B

– Rule of 40: 80+ for FY25

Management reiterated focus on scaling AIP in production, investing in top-tier technical talent, and driving operational discipline.

Confidence remains strong in long-term durable growth, with U.S. commercial and national security expected to lead performance.

Management comments on the earnings call.

Product Innovations

Shyam Sankar, Chief Technology Officer

“The normative value of AI is the self-driving company. We're not talking about copilots that make you 50% more productive. We're talking about agents that make you 50 times more productive.”

Shyam Sankar, Chief Technology Officer

“Everyday users are building their own agents to realize the potential of enterprise autonomy across both public and private sector.”

Shyam Sankar, Chief Technology Officer

“We delivered our first Titan vehicles to the U.S. Army in Q1 on time, on budget. The Army rated Titan as a top-performing program. And everything about it is heretical—a military vehicle with a software company as the prime contractor.”

Shyam Sankar, Chief Technology Officer

“Maven Smart System adoption continues to grow with usage doubling in the first nine months of 2024 and doubling again in the five subsequent months.”

AIP

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

“As AI models progress and improve, we continue enabling our customers to maximally leverage these models in production, capitalizing upon the rich context within the enterprise through the ontology.”

Shyam Sankar, Chief Technology Officer

“AIP is proving to be the best harness to build, test, evaluate, and deploy agents to eat the elephant of the enterprise.”

Shyam Sankar, Chief Technology Officer

“AIP as a platform enables our customers to rapidly build and deploy AI agents that automate more and more of the enterprise in a continuous fashion.”

Shyam Sankar, Chief Technology Officer

“AI agents are processing vast volumes of intelligence reports in the Department of Defense, finding things humans missed. AI agents are monitoring for sepsis at Tampa General.”

Ontology

Shyam Sankar, Chief Technology Officer

“Our foundational investments in ontology and infrastructure have positioned us to uniquely deliver on AI demand now and into the world ahead.”

Shyam Sankar, Chief Technology Officer

“With ontology as that common intermediary representation of the state of the enterprise, agents are having a transformative impact for our customers now—from targeting our enemies to targeting supply chain opportunities.”

Shyam Sankar, Chief Technology Officer

“You can see this in the sharp opinionation that we’ve earned in the field with our customers and how to get to value in days or weeks.”

Customers

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

“A large healthcare company did a boot camp with us in December and five weeks later converted to a five-year, $26 million ACV enterprise agreement.”

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

“A global bank started a pilot with us in Q4 2024, signed a $2 million engagement a month later, then expanded to a three-year $19 million ACV engagement four months after that.”

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer

“A Fortune 500 healthcare company began working with us in Q2 2024 and last quarter signed a five-year, $10 million ACV conversion deal.”

Shyam Sankar, Chief Technology Officer

“AIG announced the AI underwriting agent. They still can’t get the amount of data I can get within two to three hours through Palantir.”

Commercial

Dave Glazer, Chief Financial Officer

“We achieved a $1 billion annual run rate in our U.S. commercial business for the first time, which grew 71% year over year and 19% sequentially.”

Dave Glazer, Chief Financial Officer

“We closed $930 million in commercial TCV bookings, representing 84% growth year over year.”

Dave Glazer, Chief Financial Officer

“Our U.S. commercial customer count grew to 432 customers, reflecting growth of 65% year over year and 13% sequentially.”

Government

Shyam Sankar, Chief Technology Officer

“AI agents are transforming how we fight. AI agents are analyzing intelligence, finding targets, automating staff functions, and improving the understanding of the battle space.”

Shyam Sankar, Chief Technology Officer

“Maven has reached Europe, with NATO adopting the capabilities of Maven’s Smart System as its C2 operating system.”

Dave Glazer, Chief Financial Officer

“Our U.S. government business grew 45% year over year and 9% sequentially.”

Dave Glazer, Chief Financial Officer

“First quarter international government revenue grew 45% year over year and 2% sequentially, bolstered by our continued work in UK Healthcare and defense, as well as our new partnership with NATO.”

International Growth

Alex Karp, Chief Executive Officer

“If you take the 90% of our business that is outside of Europe, which is going through very structural change and doesn’t quite get AI, maybe in the near future will get AI, we are hoping and praying, that part of our business grew 49%.”

Shyam Sankar, Chief Technology Officer

“In Europe, there are some green shoots... but I just don’t want to commit. A lot of it is where the customer’s head is at, but we could obviously do a lot to help.”

Shyam Sankar, Chief Technology Officer

“Europe doesn’t get AI yet. At some point in the future, it will.”

Challenges

Shyam Sankar, Chief Technology Officer

“The government has started to resemble a finely marbled Wagyu. The fake projects that do not deliver and will never deliver crowd out and suffocate the things that could actually be excellent. And so we welcome DoD cuts.”

Alex Karp, Chief Executive Officer

“Often get variants of ‘if the institutions are under pressure... how will that affect software sales?’ Palantir does exceptionally well when things are pen tested. We like pressure on the system.”

Future Outlook

Alex Karp, Chief Executive Officer

“There’s a consensus in the market that Palantir owns value creation. It means that when you use our software, when you use AIP, you will get demonstrably more value than what you’re paying for, and you will share some of that value with us.”

Dave Glazer, Chief Financial Officer

“We are raising our full-year 2025 revenue guidance midpoint to $3.896 billion, representing a 36% year-over-year growth rate.”

Dave Glazer, Chief Financial Officer

“We are raising our adjusted free cash flow guidance to between $1.6 billion and $1.8 billion. And we continue to expect GAAP operating income and net income in each quarter of this year.”

Thoughts on Palantir Earnings Report $PLTR:

🟢 Positive

Revenue rose to $884M, up +39.3% YoY and +6.8% QoQ, beating estimates by 2.7%

U.S. Commercial revenue surged +70% YoY to $255M, driven by AIP deployments

Government revenue grew +45.4% YoY to $487M, with strong DoD and NATO traction

Adjusted operating margin expanded +8.6pp YoY to 44.2%

Adj. Free Cash Flow margin reached 41.9%, up +18.4pp YoY

Net Margin improved +7.9pp YoY to 24.6%

Total TCV booked hit $1.5B (+66% YoY); U.S. commercial TCV at $810M, up +239% YoY

DBNR rose to 124%, up from 120% last quarter

Net new ARR reached $225M, up +116.8% YoY

Commercial customer count up +45.7% YoY, led by +64.9% YoY U.S. Commercial growth

CAC payback period improved to 12.2 months, down 8.9 months YoY

FY25 revenue guidance raised to $3.89B–$3.902B (+36% YoY); Q2 guide at $934M–$938M (+38% YoY)

Rule of 40 score hit 83, up from 81 QoQ

🟡 Neutral

Gross margin at 82.1%, declined -1.2pp YoY

Commercial revenue grew +32.8% YoY, but international segment contracted

EPS (adj.) came in at $0.13, in line with expectations

International Government revenue rose +45% YoY, but overall size remains smaller

International Commercial revenue declined -5% YoY and -11% QoQ, impacted by Europe

RPO at $1.9B, strong growth, but still excludes large portions of government business due to contract structure

🔴 Negative

International Commercial growth remains weak, with only +15.2% YoY growth in customer count

Stock-based compensation was 18% of revenue, though down QoQ

Diluted shares up +6.4% YoY, contributing to modest dilution

Adoption lag continues in Europe, posing a challenge for global scaling

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.