Financial Results:

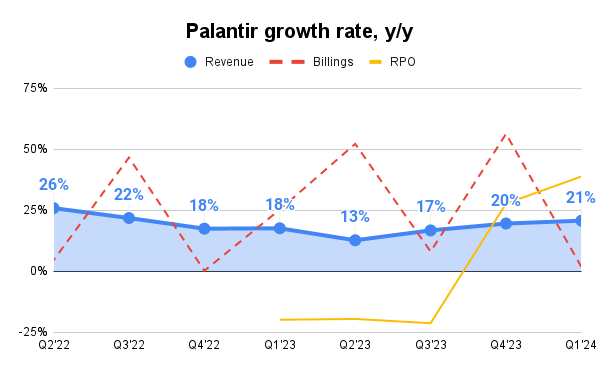

↗️$634M rev (+20.8% YoY, +19.6% LQ) beat est by 1.4%

↗️GM* (83.3%, +2.1%pp YoY)

↗️Operating Margin* (35.6%, +11.8%pp YoY)🟢

↘️Adj FCF Margin (23.5%, -12.5%pp YoY)

➡️EPS* $0.08 in line with est🟢

*non-GAAP

Revenue By Type

↗️Commercial revenue $299M rev (+26.7% YoY, 47.1% Total rev)

↗️US commercial revenue $150M rev (+40.2% YoY)

➡️Commercial revenue $335M rev (+15.8% YoY, 52.8% Total rev)🟡

Key Metrics

↗️RPO $1.30B (+39.0% YoY)🟢

➡️Billings $625M (+2.0% YoY)🟡

Customers

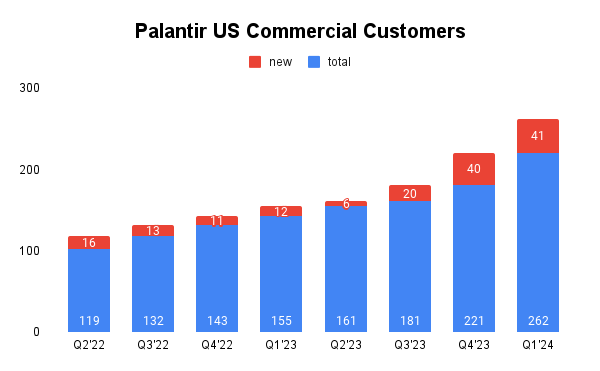

↗️554 Customers (+42.0% YoY, +57)🟢

↗️427 Commercial Customers (+53.0% YoY, +52)

↗️262 US Commercial Customers (+69.0% YoY, +41)

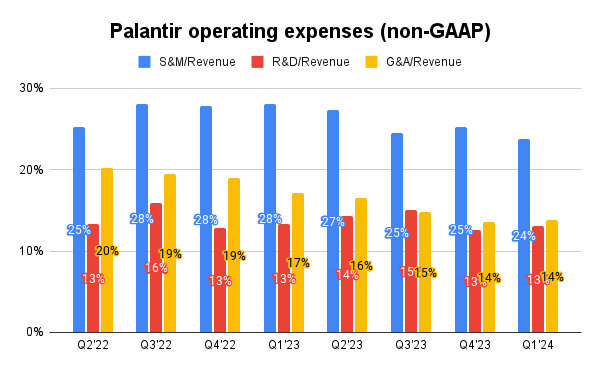

Operating expenses

↘️S&M*/Revenue 23.8% (25.3% LQ)

↗️R&D*/Revenue 13.1% (12.5% LQ)

↗️G&A*/Revenue 13.8% (13.5% LQ)

↘️Net New ARR $104M ($201 LQ)

↗️CAC* Payback Period 36.6 Months (15.2 LQ)

Dilution

↘️SBC/rev 20%, -2.0%pp QoQ

↗️Basic shares up 5.0% YoY, +0.4%pp QoQ🔴

↗️Diluted shares up 8.2% YoY, +1.2%pp QoQ🔴

Guidance

↘️Q2'24 $649.0 - $653.0M guide (+22.1% YoY) missed est by -0.4%🔴

↘️$2,677.0 - $2,689.0M FY guide (+20.6% YoY) raised by 0.8% missed est by -1.0%🔴

Key points from Palantir’s First Quarter 2024 Earnings Call:

Strategic Execution and Business Growth

Palantir reported a strong start to the year with a 21% increase in revenue, reaching $634 million.

The growth was primarily driven by the momentum of AIP (Artificial Intelligence Platform) and robust performance in the U.S. commercial sector.

Customers

In Q1, Palantir added 41 net new customers in the US commercial sector alone.

Lowe's

Accelerated its engagement with Palantir from no prior AI use to utilizing production-level AI for over 1,000 customer service agents.

Achieved a 75% reduction in overdue tasks.

This enhancement was implemented in just four months, with 1,000 users onboarded within three weeks of rollout.

Cleveland Clinic

Committed to a 10-year expansion deal with Palantir to deploy their systems more broadly across its network of hospitals.

This long-term engagement reflects the deep integration and crucial role of Palantir's technology in Cleveland Clinic’s operations.

General Mills

Expanded the scope of its work with Palantir further in the last quarter.

Noted by their Senior Director, the implementation of Palantir’s solutions is saving approximately $14 million annually.

Currently, the deployment is only partial within their network, indicating potential for further expansion.

AIP (Artificial Intelligence Platforms)

AIP continues to drive substantial growth for Palantir. It has been instrumental in accelerating customer acquisition and expanding engagements with existing customers, especially in the U.S. commercial sector.

Palantir's strategy includes conducting bootcamps that have seen significant participation, aiding in rapid conversion of participants to customers. These bootcamps are critical in demonstrating the capabilities of AIP and shortening deal cycles.

Government and Defense Initiatives

TITAN Program. Palantir was awarded over $178 million to be the sole prime contractor for building a next-generation targeting node under the TITAN program by the US Army.

Internationally, Palantir continues to expand its defense and governmental services, citing the example of the UK NHS Federated Data Platform.

Product Innovations

Mission Manager and First Breakfast. These products are part of Palantir's offerings that focus on enhancing capabilities both in the commercial and government sectors. The Mission Manager is particularly geared towards expanding to the Edge with EdgeX infrastructure.

Builder Bootcamps. These are designed to empower developers and builders within organizations to leverage AIP effectively, enhancing the DIY capabilities of enterprises.

Leadership and Company Culture

CEO Alex Karp discussed the unique positioning of Palantir in the market, emphasizing no direct competition in their core areas due to their advanced AI and infrastructure capabilities.

Challenges

Scaling Operations. As demand grows, particularly from the bootcamps, Palantir faces the challenge of scaling operations effectively to meet the heightened demand.

European Market. There are ongoing headwinds in Europe due to economic conditions, which could affect growth and expansion in this region.

Management comments on the earnings call.

Government Contracts

"Last quarter, we were honored the US Army awarded Palantir over $178 million to be the sole prime contractor to build a next-generation targeting node under the TITAN program." - Ryan Taylor

AIP (Artificial Intelligence Platform)

"The clear signal from AIP bootcamps is that AI is for builders... We have pioneered the approach to getting beyond chat and unlocking the value of LLMs in the enterprise." - Shyam Sankar

"AIP is driving both new customer conversions and existing customer expansions in US." - Dave Glazer

Customers

"In Q1, our US commercial business had customers from 56 of the 74 GICS industries... we are seeing those customers expanding their work with us." — Ryan Taylor

"Existing customers such as Lowe's, Cleveland Clinic, and General Mills are realizing the extensive possibilities of AIP within their own enterprises and increasing their scope accordingly." — Ryan Taylor

Product Innovations

"We continue to invest in Mission Manager and we'll be extending it to the Edge with our EdgeX infrastructure in US government." — Shyam Sankar

"Taking a health claims denial and programmatically generating the documentation and supporting evidence from the clinical records and contracts. Automating P&C insurance claims processing..." — Shyam Sankar

Future Growth

"Looking at our business and its impact broadly, I'm invigorated about the year ahead. We have never had more conviction about AIP and the power of our software, as well as our continued efforts supporting the most critical missions around the globe." - Ryan Taylor

Challenges

"We do have headwinds in Europe, 16% of our business in Europe. Europe is gliding towards zero percent GDP growth over the next couple of years. That is a problem for us. There is no easy remedy for that." - Alex Karp