Palantir: Powering Data-Driven Decisions in the Age of AI

Deep Dive into $PLTR: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Palantir: Company overview

About Palantir

Palantir is a software company founded in 2003 by Peter Thiel, Alex Karp, Joe Lonsdale, Stephen Cohen, and Nathan Gettings, headquartered in Denver, Colorado. The company specializes in big data analytics and integration platforms designed to process and interpret vast datasets. Palantir's primary products include Palantir Gotham for government and intelligence agencies, Palantir Foundry for commercial enterprises, Palantir Apollo for continuous software deployment, and the Artificial Intelligence Platform (AIP) for integrating large language models with organizational data.

Mission

Palantir's mission is to empower organizations to make sense of their data to solve complex problems and drive impactful decisions. The company emphasizes human-driven analysis augmented by advanced technology, aiming to enhance decision-making capabilities without replacing human intelligence. Palantir builds software platforms that integrate, manage, and secure data, enabling interactive and intuitive analysis accessible to non-technical users.

Sector

Palantir operates within the technology sector, specifically focusing on software solutions for big data analytics, artificial intelligence (AI), and data integration. The company initially served primarily government agencies but has significantly expanded into commercial sectors such as healthcare, finance, manufacturing, energy, automotive, and pharmaceuticals.

Competitive Advantage

Palantir's competitive advantage lies primarily in its high switching costs and proprietary intellectual property (IP). The company's platforms require extensive customization and integration into client workflows, resulting in substantial switching barriers estimated between $2.5 million to $7.5 million per enterprise client, with implementation periods of 6-9 months. Palantir holds over 3,400 global patents, covering machine learning algorithms, secure multi-party computation methods, predictive analytics models, natural language processing techniques, and advanced visualization tools. Additionally, Palantir's ontology framework differentiates its offerings by transforming complex datasets into actionable insights through AI-driven analytics.

Total Addressable Market (TAM)

Palantir’s current Total Addressable Market (TAM) is widely estimated at over $200 billion and expanding, with a projected CAGR of 18%–25% through 2030, driven by accelerating AI adoption across enterprise and government sectors. The company’s revenue growth and forward guidance support the view that its market is both large and expanding rapidly.

The TAM for AI-driven data analytics and decision platforms, Palantir’s core domain, exceeds $200 billion and is likely trending higher. While prior management commentary and some external forecasts have cited ranges from $120 billion to over $300 billion, these figures are not referenced in the company’s latest filings.

Morningstar projects Palantir’s revenue CAGR at 34% through 2034, with potential to reach $40 billion in annual revenue if it captures its full market opportunity. Other long-term models forecast a CAGR in the low-20% to low-30% range through 2030, with growth expected to moderate as the company scales.

AI adoption remains the primary TAM expansion driver, with Palantir’s AI Platform (AIP) fueling demand in both commercial and government markets. The company’s U.S. commercial revenue grew 71% year-over-year, signaling rapid expansion within its highest-growth verticals.

Valuation

$PLTR Palantir is currently trading at a Forward EV/Sales multiple of 73.9, significantly higher than its median of 16.9 since its IPO, reflecting a substantial premium. Among the SaaS companies I monitor, Palantir is the most expensive based on the Forward EV/Sales multiple.

In January 2023, Palantir’s Forward EV/Sales stood at 5, which has nearly increased 10x to 45.7 today. The forecast for next quarter's revenue growth is 26.4% YoY, positioning Palantir as one of the most expensive SaaS companies based on the Price-to-Sales Growth (PSG) ratio.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$PLTR Palantir is trading at a Forward P/E multiple of 214.0. With 39.3% YoY revenue growth in Q1.

The EPS growth forecast for 2026 is 26.7%, with P/E of 223.7, 2026 PEG ratio of 8.4.

The EPS growth forecast for 2027 is 35.3%, with P/E of 176.6, 2027 PEG ratio of 5.0.

From a PEG multiple perspective, the stock appears highly valued and high expectations are already priced into the stock.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $PLTR Palantir’s revenue growth at +28.6% for next year, the highest projected growth rate in the segment. Considering this revenue forecast, Palantir is trading at a premium valuation based on the EV/S multiple.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Morningstar now assigns Palantir a narrow economic moat, built on switching costs and intangible assets. Competitive advantages have solidified through 2025, with Q1 revenue up 39% year-over-year to $884 million and an operating margin of 44%.

Switching Costs

Palantir’s strongest moat component. The company embeds a "read-write feedback loop" into client operations, enabling real-time, self-improving decision frameworks. In contrast to traditional IT patchworks, Palantir’s systems scale cleanly, evolve over time, and become central to a customer’s operating structure. The AI Platform (AIP) amplifies this by allowing clients to integrate AI directly into decision-making and task execution. Once integrated, the complexity and cost of replacement are prohibitively high—cementing long-term client reliance.

Intellectual Property

Palantir’s IP moat is medium-to-high strength, rooted in 20+ years of development across AI and data analytics. Its proprietary platforms—Gotham, Foundry, and Apollo—enable complex data integration and decision optimization, with few credible substitutes. Recent moves like the TWG Global and xAI partnerships and the $795 million DoD contract through 2029 underscore the strategic value of Palantir’s technology and its competitive defensibility.

Brand

Palantir’s brand carries high strength, especially within government and defense. Its ability to secure sensitive, mission-critical contracts—like the $30 million deal with ICE and engagement with Fannie Mae’s Crime Detection Unit—reflects unmatched trust in its capabilities. CEO Alex Karp positions the company as delivering the “operating system for the modern enterprise in the era of AI.” While brand strength in commercial sectors is growing, it remains most potent in federal and national security domains.

Network Effects

Palantir’s network effects are emerging, with medium strength. More data across clients feeds better AI models and operational insights, increasing platform value. In Q1 2025, Palantir closed 139 deals over $1 million, including 51 deals above $5 million. US commercial revenue surged 71%, now annualizing at $1 billion. While not as direct as in social or marketplace models, platform value is scaling with adoption—paving the way for compounding advantage.

Economies of Scale

Palantir’s operating model is delivering. With a 44% operating margin alongside 39% revenue growth, the company is scaling profitably. Its $5.23 billion cash reserve and zero debt give it muscle to reinvest and outpace rivals. The Rule of 40 score at 83% signals world-class efficiency. As client count expands—up 39% year-over-year—fixed costs spread wider, margins strengthen, and the flywheel accelerates.

Palantir is no longer just a government contractor. It's evolving into an AI-first infrastructure company with durable competitive advantages and a business model built for scale.

In summary, Palantir has solidified a narrow but strengthening economic moat, anchored by high switching costs and proprietary technology. Its AI platforms are deeply embedded in client operations, making them extremely difficult to replace. The company's 20+ year IP portfolio, led by Gotham, Foundry, and Apollo, provides a defensible technological edge.

Brand trust, especially in sensitive government sectors, adds another durable layer of advantage. While network effects are still developing, rising adoption and data integration are beginning to enhance platform value.

Revenue growth

$PLTR Palantir’s revenue growth has accelerated over the past seven quarters, reaching 39.3% YoY. If the company exceeds its forecast by 2.5%, as it did in Q1, growth could reach approximately 41.8%, further accelerating revenue expansion.

The 46.2% YoY growth in Remaining Performance Obligations (RPO) accelerates in Q1 and higher than current revenue growth, indicating a likely future revenue acceleration. Billings growth also accelerates to +44.8% YoY, which is above revenue growth.

Segments and Main Products.

Palantir operates through two main segments: Government and Commercial. The Government segment primarily serves defense, intelligence, and law enforcement agencies, providing data analytics for national security, counterterrorism, and operational planning. The Commercial segment caters to industries like finance, healthcare, manufacturing, and energy, offering solutions for data integration, analytics, and AI-driven decision-making.

Palantir's flagship products include Gotham, Foundry, and Apollo. Gotham targets government agencies, enabling integration of diverse intelligence sources into actionable insights for strategic decisions and operational execution. Foundry serves commercial enterprises by facilitating seamless data integration and advanced analytics across complex organizational structures. Apollo provides continuous software deployment capabilities, ensuring secure updates across distributed environments.

Artificial Intelligence Platform (AIP)

Palantir's Artificial Intelligence Platform (AIP) accelerates AI adoption by enabling rapid integration of large language models and AI-driven analytics into organizational workflows. AIP simplifies deployment through user-friendly boot camps, allowing enterprises to operationalize AI use-cases within days. In 2025, robust adoption of AIP is driving significant revenue growth in the commercial sector, with a projected 54% year-over-year increase.

Ontology

The Palantir Ontology forms the operational backbone of its software ecosystem by creating a unified semantic layer that maps enterprise data to real-world entities like assets, transactions, and processes. It integrates data, logic, and actions into a dynamic decision-making framework, enhancing organizational agility and precision. Ontology enables AI-driven workflows across over 50 sectors, facilitating real-time operational decisions with comprehensive security controls and auditability.

Main Products Performance in the Last Quarter

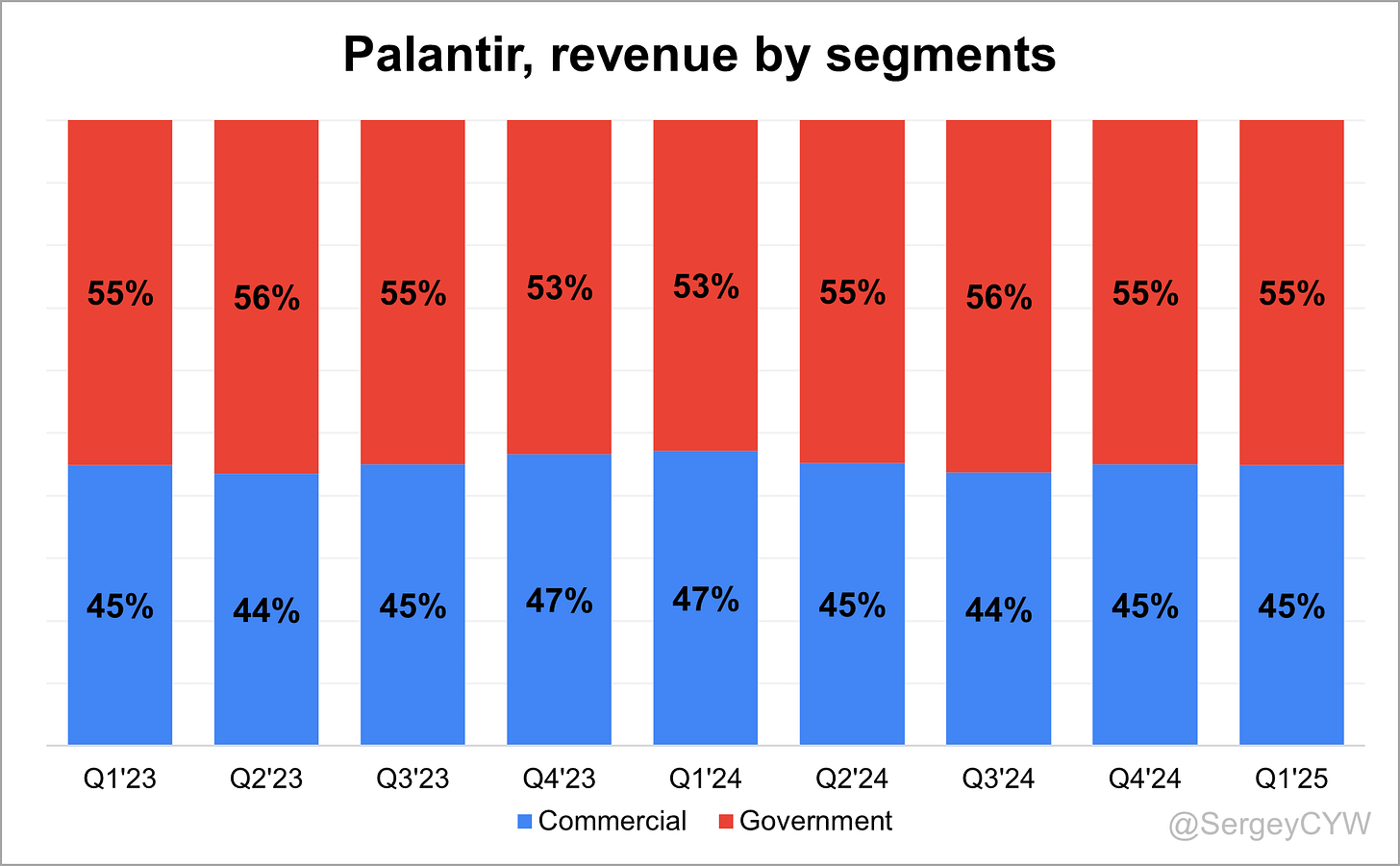

$PLTR Palantir generates 55% of its revenue from the Government sector and 45% from the Commercial sector. In the last year, the Commercial segment's share decreased from 47% to 45%.

Breaking down $PLTR Palantir's revenue growth by segment, last quarter all segments saw an acceleration in growth.

Government revenue growth increased to 45% YoY.

Commercial revenue growth also accelerated to 33% YoY.

U.S. Commercial revenue grew by 70%, outpacing the growth of International Commercial revenue.

Artificial Intelligence Platform (AIP)

AIP is now Palantir’s engine of growth. It crossed a $1B annual run rate in US commercial revenue, up 71% YoY, 19% sequentially. Enterprise autonomy is the new frontier—customers aren’t building copilots; they’re deploying agents that make teams 50x more productive. AIG’s AI underwriting agent, Tampa General’s sepsis monitoring agent, and Department of Defense AI agents are all live use cases in production. $810M in US commercial TCV was booked in Q1, up 239% YoY.

Adoption is accelerating. Customers like Walgreens rolled out AIP-powered workflows to 4,000 stores in 8 months, automating what would have been 384 billion human decisions/day. Demand is outpacing seasonality.

Ontology

Ontology remains Palantir's secret weapon in translating raw LLM capability into outcomes. It’s the core differentiator for AIP’s success. Ontology enables AI-human mixed teams and powers real business transformation. Shyam positioned Ontology as the common state representation of the enterprise, enabling LLMs to interface with live data and workflows. Value creation is compounding because Ontology isn't shelfware—it’s immediately functional, opinionated, and operational from day one.

Gotham

Gotham saw growth through expanding use in defense environments, particularly under Maven and TITAN programs. It supports AI agents across defense workflows—intelligence targeting, battle space awareness, and logistics. Titan, rated a top-performing program by the Army, was delivered on time and on budget. NATO is now adopting the Maven Smart System, powered by Gotham, across its 32 member states. Adoption doubled in first 9 months of 2024, then doubled again in next 5 months.

Foundry

Foundry continues to be the foundation for enterprise transformation. It underpins success stories across commercial verticals. A Fortune 500 healthcare firm, Walgreens, AIG, and R1 RCM cited rapid time-to-value and major cost-saving workflows. AIG expects Foundry-powered tech to double their 5-year CAGR. Foundry also remains central in reindustrialization efforts—supporting AI-powered, real-time manufacturing insights through Warp Speed, Palantir’s operating system for modern American manufacturing.

Apollo

Apollo’s role was less front-and-center this quarter but remains essential in deploying and orchestrating updates across client environments. It's the delivery backbone enabling customers to rapidly roll out AIP agents in secure, complex infrastructure—especially relevant in government and defense sectors.

Government

Government remains a pillar, with 45% YoY revenue growth, both in US and international. Maven Smart System saw wider rollout across US combatant commands, services, and into NATO. Demand is strong despite budget scrutiny, because Palantir delivers battle-tested, production-ready AI systems, not theoretical frameworks.

Palantir’s government wins are driven by results and pressure. As Alex Karp said, “We do well when the system is stress-tested.” No shelfware. Just outcomes.

Palantir also delivered TITAN vehicles, again emphasizing its unique position as a software-first prime contractor in hardware-centric defense programs.

Commercial

US commercial exploded—71% YoY revenue growth, 19% sequential, with customer count up 65% YoY. Deals are not only bigger (more $1M+ contracts closed than last year), they’re faster. A healthcare client moved from boot camp to $26M, 5-year agreement in 5 weeks. A global bank scaled from pilot to $19M, 3-year engagement in 4 months. Total commercial TCV booked hit $930M in Q1, up 84% YoY.

International commercial declined 5% YoY, due to European headwinds and Q4 revenue catch-up. Palantir is focusing resources on high-velocity US opportunities, while continuing targeted growth in Asia and the Middle East.

Product Innovation

Palantir is evolving from copilots to enterprise autonomy, deploying AI agents at scale across sectors. AIP enables self-service agent development by end users, not just developers. AI agents are now replacing workflows, not just enhancing them.

TITAN is a leading example of software redefining hardware categories. Palantir is showing that building lethal software first—and wrapping hardware around it—produces faster, cheaper, and more effective systems.

In healthcare, Palantir is partnering with R1 RCM to automate reimbursement, unlocking a multi-$100B opportunity. Retail, finance, manufacturing, and defense are all becoming Palantir-native workflows.

Market Leader

Palantir has been recognized as a Leader in AI/ML software platforms by Forrester in its Q3 2024 Forrester Wave report, ranking highest for Current Offering. The report highlights Palantir’s strong AI/ML capabilities, emphasizing its ontology-driven approach, AI pipelining, and human-machine decision-making model. Palantir AIP, together with Foundry and Apollo, powers real-time AI-driven decision-making across industries. The recognition underscores Palantir’s sustained growth, investment in accessibility, and leadership in enterprise AI adoption.

Customers

$PLTR Palantir added 58 total customers, a 39% YoY increase, in line with the pace from last year.

The company also added a record 51 commercial customers, matching the addition in Q1 of the previous year, with 46% YoY growth.

U.S. commercial customer growth was impressive, with 50 customers added in Q1, nearly a record for the company, representing +65% YoY growth.

However, international commercial customer growth was weak, with just 1 customer added — the lowest in the past two years, and growth slowed to +15% YoY.

Customer Success Stories

Walgreens deployed Foundry and AIP across 4,000 stores in under 8 months, automating an estimated 384 billion decisions per day. Executives confirmed the shift to AI-powered end-to-end workflows, indicating transformative value at scale.

AIG implemented an AI underwriting agent via AIP. The agent compresses weeks of underwriting analysis into hours. The firm expects Palantir-driven digital transformation to double its five-year CAGR. Leadership described the outcome as “unbelievable,” citing a multi-order-of-magnitude productivity increase.

Tampa General Hospital deployed agents for real-time sepsis monitoring, enabling clinicians to act on insights not visible through human review. Palantir is now embedded in operational healthcare workflows where seconds matter.

R1 RCM, a healthcare revenue cycle firm, is working with Palantir to automate reimbursement operations. Leadership sees a multi-$100B industry-wide opportunity to unlock value and reinvest in patient care.

Supply Chain Teams across sectors are building and deploying AIP agents to identify cost savings, mitigate risk, and increase throughput. Real-time decisions are being made using data previously trapped in silos.

Defense personnel developed a Hurricane Helene rescue COP (Common Operating Picture) in five days using Palantir. With agents, the same build would take five minutes, signaling a structural productivity shift in mission-critical operations.

Large Customer Wins

A major US healthcare company ran a Palantir boot camp in December, followed by a $26M ACV, five-year enterprise deal within five weeks. Compressed sales cycle, high-value contract.

A global bank started a pilot in Q4 2024, signed a $2M deal a month later, and scaled to a $19M ACV, three-year agreement within four months. Fast conversion, rapid scaling, tangible ROI.

A Fortune 500 healthcare company signed a $10M ACV, five-year contract last quarter after starting collaboration in Q2 2024. Pace and scale suggest early success with strong expansion potential.

Palantir closed $810M in US commercial TCV in Q1, up 239% YoY on a dollar-weighted duration basis. The company doubled the number of $1M+ deals compared to Q1 last year.

Government wins include an expanded footprint with the Department of Defense under the Maven Smart System, now deployed across combatant commands and key services. NATO has adopted Maven across 32 member states, creating a strategic Western-wide standard for AI-enabled command and control.

TITAN, a software-first battlefield system, was delivered on time and on budget to the US Army. The program was ranked as a top-performing Army initiative, reinforcing Palantir’s position as a prime contractor in hybrid software/hardware systems.

Enterprise AI adoption is visible across earnings calls of AIG, Citibank, BP, L3Harris, and Hertz, all of whom publicly acknowledged Palantir’s role in mission-critical operations and digital transformation.

Retention

$PLTR Palantir's Retention Rate (DBNRR) has been growing over the last six quarters, reaching 124%, and remains at a high level, above the median of 119% for the SaaS companies I monitor.

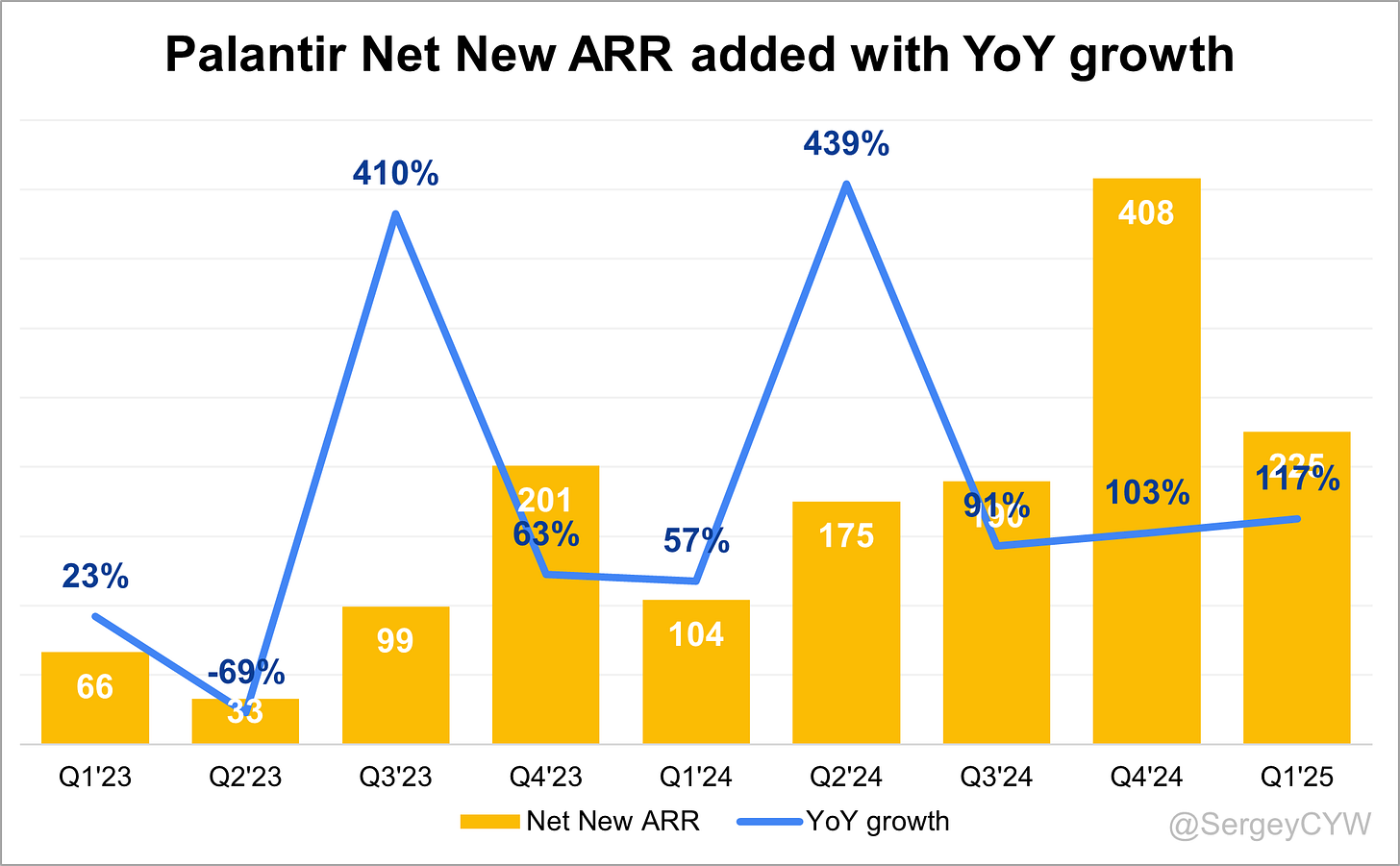

Net new ARR

$PLTR Palantir added $225 million in net new ARR (Annual Recurring Revenue) in Q1 2025, representing a 1173% YoY increase, demonstrating strong momentum in ARR growth.

This was the largest net new ARR addition for Q1 in the company's history.

CAC Payback Period and RDI Score

$PLTR Palantir's return on Sales & Marketing (S&M) spending is 12.2 months, one of the best among top-performing SaaS companies.

The Customer Acquisition Cost (CAC) Payback Period is healthy compared to other SaaS companies, with the median for the SaaS companies I track being 26.9 months.

The R&D Index (RDI Score) for Q1 increased and is now at 2.87, the highest among the SaaS companies I monitor and significantly above the median of 1.1.

An RDI Score above 1.4 is considered best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

Over the past year, $PLTR Palantir margins have changed:

• Gross Margin slightly decrease from 83.3% to 82.1%.

• Operating Margin increased from 35.6% to 44.2%.

• Adjusted Free Cash Flow Margin increased from 23.5% to 41.9%.

Operating expenses

$PLTR Palantir has reduced its operating expenses over the last two years.

Sales & Marketing (S&M) expenses were reduced from 28% to 21% of revenue.

Research & Development (R&D) expenses slightly decreased from 13% to 12%.

General & Administrative (G&A) expenses were reduced from 17% to 12%, which is at the same level with R&D expenses.

Balance Sheet

$PLTR Balance Sheet: Total debt stands at $245M, while Palantir holds $5,431M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$PLTR Palantir's stock-based compensation (SBC) expenses decrease to 18% of revenue.

But Shareholder dilution remains extremely high, with the weighted-average number of basic common shares outstanding rising by 6.1% YoY. Dilution accelerated significantly in Q4 2024 and in Q1 2025.

Conclusion

This was another very strong quarter for Palantir $PLTR, with excellent execution as the company continues to enhance its platform and benefit from AI advancements.

Leading Indicators

• RPO growth accelerated to +46.2% YoY, exceeding revenue growth.

• Billings growth also accelerated to +44.8% YoY, now outpacing revenue growth.

• Net new ARR added in Q1 increased +117% YoY, a strong performance.

• Customer additions in Q1 were strong, especially among U.S. Commercial customers.

Key Indicators

• Net Dollar Retention (NDR) remains above the SaaS average and rose last quarter to 124%.

• CAC Payback Period stands at 12.2 months, ranking among the best in the SaaS industry.

• The R&D Index (RDI Score) significantly improved and is now one of the best among SaaS peers.

Both the Government and Commercial segments showed growth acceleration in Q1, with a particularly strong acceleration in U.S. Commercial.

Management provided a strong outlook for next quarter. If Palantir beats its estimate by 2.5%, as it did in Q1, YoY revenue growth could accelerate to +41.8%.

However, it's worth noting that the Q1 beat of 2.5% was the weakest in the past year. For comparison, Q4 was beaten by 7.5%. As expectations rise, it becomes increasingly difficult for the company to consistently exceed them.

Regarding valuation, it remains extremely high, reflecting strong expectations of continued revenue acceleration. However, this elevated valuation poses risk. While revenue growth is accelerating, sustaining 40–45% growth becomes more challenging at scale.

I believe Commercial growth is more important given the larger market opportunity. While the company is clearly executing well in the U.S. Commercial segment, international commercial growth lags. The number of new international commercial customers added was very low. It will be important to watch how this segment expands going forward, as it also represents a large and critical market for Palantir.

At the moment, I remain on the sidelines and do not hold $PLTR, due to its high valuation and already elevated expectations being priced into the stock.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

This is an incredible report