Palantir: Leading AI-Driven Big Data Analytics and Integration

Deep Dive into $PLTR: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Palantir: Company overview

About Palantir

Palantir is a software company founded in 2003 by Peter Thiel, Alex Karp, Joe Lonsdale, Stephen Cohen, and Nathan Gettings, headquartered in Denver, Colorado. The company specializes in big data analytics and integration platforms designed to process and interpret vast datasets. Palantir's primary products include Palantir Gotham for government and intelligence agencies, Palantir Foundry for commercial enterprises, Palantir Apollo for continuous software deployment, and the Artificial Intelligence Platform (AIP) for integrating large language models with organizational data.

Mission

Palantir's mission is to empower organizations to make sense of their data to solve complex problems and drive impactful decisions. The company emphasizes human-driven analysis augmented by advanced technology, aiming to enhance decision-making capabilities without replacing human intelligence. Palantir builds software platforms that integrate, manage, and secure data, enabling interactive and intuitive analysis accessible to non-technical users.

Sector

Palantir operates within the technology sector, specifically focusing on software solutions for big data analytics, artificial intelligence (AI), and data integration. The company initially served primarily government agencies but has significantly expanded into commercial sectors such as healthcare, finance, manufacturing, energy, automotive, and pharmaceuticals.

Competitive Advantage

Palantir's competitive advantage lies primarily in its high switching costs and proprietary intellectual property (IP). The company's platforms require extensive customization and integration into client workflows, resulting in substantial switching barriers estimated between $2.5 million to $7.5 million per enterprise client, with implementation periods of 6-9 months. Palantir holds over 3,400 global patents, covering machine learning algorithms, secure multi-party computation methods, predictive analytics models, natural language processing techniques, and advanced visualization tools. Additionally, Palantir's ontology framework differentiates its offerings by transforming complex datasets into actionable insights through AI-driven analytics.

Total Addressable Market (TAM)

Palantir estimates its current Total Addressable Market (TAM) at approximately $120 billion, projected to expand significantly due to accelerating adoption of AI technologies across industries. Analysts forecast the TAM will grow to around $230 billion by 2025, potentially reaching between $300 billion by 2030 and as high as $1.4 trillion by 2033 under optimistic scenarios. Given Palantir's current revenue of approximately $2.87 billion (2024) and market penetration below 3%, substantial growth opportunities remain available as the company continues expanding into commercial markets globally.

Valuation

$PLTR Palantir is currently trading at a Forward EV/Sales multiple of 52.2, significantly higher than its median of 15.89 since its IPO, reflecting a substantial premium. Among the SaaS companies I monitor, Palantir is the most expensive based on the Forward EV/Sales multiple.

In January 2023, Palantir’s Forward EV/Sales stood at 5, which has nearly increased 10x to 45.7 today. The forecast for next quarter's revenue growth is 26.4% YoY, positioning Palantir as one of the most expensive SaaS companies based on the Price-to-Sales Growth (PSG) ratio.

$PLTR Palantir is trading at a Forward P/E multiple of 154.2. With 27% YoY projected EPS growth in 2026 and a P/E for 2026 at 153, the PEG ratio stands at 5.6, indicating that high expectations are already priced into the stock.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $PLTR Palantir’s revenue growth at +27.9% for next year, the highest projected growth rate in the segment. Considering this revenue forecast, Palantir is trading at a premium valuation based on the P/S multiple.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Palantir holds a narrow yet robust economic moat, primarily driven by high switching costs and intellectual property, complemented by moderate network effects, while economies of scale and brand strength are less pronounced.

Economies of Scale

Economies of scale are moderately beneficial for Palantir. The company's business model involves substantial upfront investment in customer acquisition and integration, leading initially to negative margins. However, as contracts mature into the "scale" phase, incremental costs diminish significantly, allowing positive margins and profitability at scale. Still, compared to traditional software giants with massive global footprints and standardized offerings, Palantir's scale advantage remains moderate rather than exceptional.

Network Effect

Network effects are increasingly evident in Palantir's commercial segment. The introduction of the Artificial Intelligence Platform (AIP) module has significantly lowered technical barriers for Foundry users, enabling rapid adoption through practical boot camps. This strategy has fostered adoption-driven network effects among enterprise executives who advocate Foundry's benefits within industry circles, enhancing its perceived necessity. However, these network effects are still developing and have not yet reached the critical mass seen in platforms like AWS or Salesforce.

Brand Strength

Brand strength is relatively moderate for Palantir. While the company enjoys a strong reputation within government and defense sectors due to its proven effectiveness in high-stakes environments, brand recognition in the broader commercial market is still evolving. Palantir is gradually building its commercial brand through successful case studies and industry-specific solutions but does not yet possess universal brand dominance comparable to established enterprise software leaders.

Intellectual Property

Intellectual property (IP) is a significant contributor to Palantir's moat. The company holds an extensive patent portfolio with over 3,400 patents globally, covering critical areas such as machine learning data integration, secure multi-party computation, predictive analytics algorithms, natural language processing, and advanced visualization techniques. Palantir's proprietary "ontology framework," which organizes complex datasets into actionable insights using AI-driven analytical models, differentiates its offerings substantially from competitors. This robust IP foundation provides a durable competitive advantage by protecting core technological innovations.

Switching Costs

Switching costs represent Palantir's strongest economic moat component. Its platforms—Gotham for government and Foundry for commercial enterprises—require extensive customization and deep integration into customers' operational workflows. Transitioning away from Palantir involves substantial financial outlays (estimated between $2.5 million to $7.5 million per enterprise client), lengthy implementation periods (6-9 months), significant procedural complexity, and potential operational disruption. Consequently, customer retention rates remain exceptionally high due to these prohibitive switching barriers.

In summary, Palantir's economic moat is strongest in switching costs and intellectual property protection—both providing durable competitive advantages difficult for rivals to replicate or overcome quickly. Network effects and economies of scale contribute moderately but continue to strengthen with business growth and market penetration. Brand strength remains comparatively weaker but is gradually improving as commercial adoption expands.

Revenue growth

$PLTR Palantir’s revenue growth has accelerated over the past six quarters, reaching 36% YoY. If the company exceeds its forecast by 7.3%, as it did in Q4, growth could reach approximately 45.9%, further accelerating revenue expansion.

The 39.2% YoY growth in Remaining Performance Obligations (RPO) slowed in Q4 but is still slightly higher than current revenue growth, indicating a likely future revenue acceleration or stabilization. Billings growth slowed to +28.7% YoY, which is below revenue growth.

Segments and Main Products.

Palantir operates through two main segments: Government and Commercial. The Government segment primarily serves defense, intelligence, and law enforcement agencies, providing data analytics for national security, counterterrorism, and operational planning. The Commercial segment caters to industries like finance, healthcare, manufacturing, and energy, offering solutions for data integration, analytics, and AI-driven decision-making.

Palantir's flagship products include Gotham, Foundry, and Apollo. Gotham targets government agencies, enabling integration of diverse intelligence sources into actionable insights for strategic decisions and operational execution. Foundry serves commercial enterprises by facilitating seamless data integration and advanced analytics across complex organizational structures. Apollo provides continuous software deployment capabilities, ensuring secure updates across distributed environments.

Artificial Intelligence Platform (AIP)

Palantir's Artificial Intelligence Platform (AIP) accelerates AI adoption by enabling rapid integration of large language models and AI-driven analytics into organizational workflows. AIP simplifies deployment through user-friendly boot camps, allowing enterprises to operationalize AI use-cases within days. In 2025, robust adoption of AIP is driving significant revenue growth in the commercial sector, with a projected 54% year-over-year increase.

Ontology

The Palantir Ontology forms the operational backbone of its software ecosystem by creating a unified semantic layer that maps enterprise data to real-world entities like assets, transactions, and processes. It integrates data, logic, and actions into a dynamic decision-making framework, enhancing organizational agility and precision. Ontology enables AI-driven workflows across over 50 sectors, facilitating real-time operational decisions with comprehensive security controls and auditability.

Main Products Performance in the Last Quarter

$PLTR Palantir generates 55% of its revenue from the Government sector and 45% from the Commercial sector. Over the past two years, the Commercial segment has slightly increased its share of total revenue. However, in the last three quarters, the Commercial segment's share decreased from 47% to 45%.

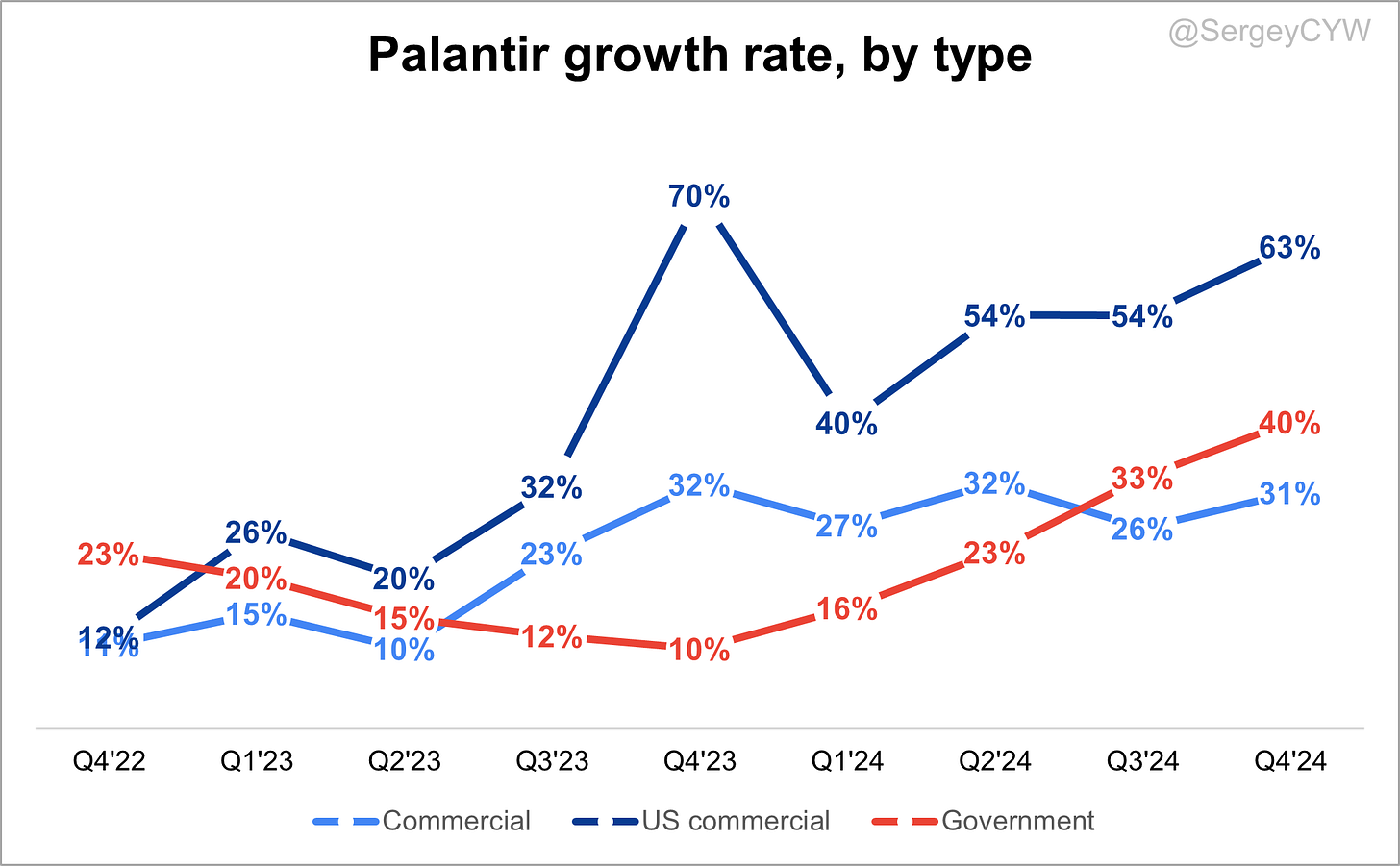

Breaking down $PLTR Palantir's revenue growth by segment, last quarter all segments saw an acceleration in growth.

Government revenue growth increased to 40% YoY.

Commercial revenue growth also accelerated to 31% YoY.

U.S. Commercial revenue grew by 63%, outpacing the growth of International Commercial revenue.

Artificial Intelligence Platform (AIP)

AIP is accelerating Palantir's revenue growth and customer acquisition. U.S. commercial revenue surged 64% YoY, with AIP driving fivefold growth in U.S. commercial customers over three years. AI is now a core enterprise tool, shifting from model supply to operational execution. AIP’s impact is visible across industries: a $67M contract with a top pharmacy for prescription automation, a $40M telecom expansion for network decommissioning, and an $11M expansion with a leading insurer cutting underwriting time from two weeks to three hours. U.S. businesses are scaling AIP aggressively, seeking rapid efficiency gains and competitive advantage.

Ontology

Ontology has become the backbone of AI enterprise adoption. It enables LLMs to function within structured business environments by connecting workflows, processes, and decision-making. Companies relying solely on raw AI models struggle to operationalize them effectively. Palantir’s decade-long investment in ontology provides a major competitive moat. AI automation through ontology is driving real impact: a multinational bank cut back-office processing from five days to three minutes, an automotive supplier automated 100-hour engineering tasks, and a construction firm slashed risk identification time across technical documents from months to minutes. Palantir’s approach enables AI to function with governance, security, and scalability—something competitors struggle to replicate.

Gotham

Gotham remains a key driver in U.S. government contracts. The platform continues to power mission-critical defense and intelligence operations. U.S. government revenue jumped 45% YoY to $343M in Q4, with expansion into new areas such as Mission Manager for Special Operations and CJADC2 for military integration. Project Maven, Palantir’s AI-driven battlefield analytics, expanded into contested logistics and international deployments. Gotham has seen real-world adoption in border security, airspace surveillance, and international military coordination. As geopolitical tensions rise, demand for Gotham is set to increase further.

Foundry

Foundry continues to transform commercial operations with AI-driven automation and operational intelligence. Customer growth surged, with U.S. commercial revenue climbing 54% YoY to $702M. Panasonic Energy uses Foundry to assist 350 technicians producing 5.5M batteries per day, reducing downtime and boosting throughput. In manufacturing, Anduril and L3Harris leverage Foundry for Warp Speed, Palantir’s AI-powered modern American manufacturing system. Foundry's growing traction in commercial sectors highlights the increasing shift toward AI-powered decision-making and process automation.

Apollo

Apollo is playing a crucial role in Palantir’s cloud and AI deployment strategy. Palantir secured FedRAMP High approval for its FedStart offering, allowing software vendors to integrate with government environments at unprecedented speed. Apollo is enabling faster AI deployment across both commercial and defense sectors, reducing implementation timelines from years to months. As AI adoption scales, Apollo ensures seamless software updates and integration into highly sensitive environments.

Government

Government remains a core growth driver. Revenue climbed 45% YoY in the U.S. and 28% YoY internationally, reaching $455M in Q4. The U.S. Army extended its Vantage program for up to four years, reinforcing Palantir’s dominance in military data platforms. The NHS in the U.K. onboarded 87 hospitals and 28 care boards into its Federated Data Platform. AI-driven intelligence operations are expanding rapidly with Maven's adoption in Spacecom, SOUTHCOM, AFRICOM, and Stratcom. Government TCV hit $1.79B, up 56% YoY. Despite political uncertainties, Palantir remains a preferred AI partner for the defense sector.

Commercial

Palantir’s commercial business is scaling rapidly, fueled by AIP. Revenue rose 31% YoY to $372M, with U.S. commercial leading at 63% YoY growth. Total commercial TCV booked hit $995M, up 42% YoY. New customer acquisition is at record levels, with U.S. commercial customers growing 73% YoY. Palantir is seeing strong deal momentum, including a $803M U.S. commercial TCV booking, the highest in company history. International commercial growth remains slow, at 3% YoY, but select markets like Asia and the Middle East show potential. The U.S. remains the core focus, with U.S. commercial revenue projected to surpass $1.079B in 2025.

Innovation & Product Updates

Last quarter, $PLTR released several important updates and reported some achievements:

Palantir is aggressively investing in AI-driven automation, self-learning systems, and secure cloud deployment. Warp Speed is redefining U.S. manufacturing by integrating AI into production lines, enabling 200x efficiency gains. FedStart accelerates AI adoption for government vendors, cutting compliance costs and time-to-market. Palantir's AI-powered decision systems are being integrated into highly sensitive defense operations, creating an irreplaceable data advantage. The company remains deeply embedded in U.S. national security, with an increasing role in autonomous AI-powered warfare.

Market Leader

Palantir has been recognized as a Leader in AI/ML software platforms by Forrester in its Q3 2024 Forrester Wave report, ranking highest for Current Offering. The report highlights Palantir’s strong AI/ML capabilities, emphasizing its ontology-driven approach, AI pipelining, and human-machine decision-making model. Palantir AIP, together with Foundry and Apollo, powers real-time AI-driven decision-making across industries. The recognition underscores Palantir’s sustained growth, investment in accessibility, and leadership in enterprise AI adoption.

Customers

$PLTR Palantir added 82 total customers, a 43% YoY increase, marking a record-high customer addition. The company also added a record 73 commercial customers, surpassing last year’s level, with 52% YoY growth. This was a very strong customer expansion across all segments.

Customer Success Stories

Major U.S. Pharmacy Expands AI Integration

One of America's largest pharmacy chains signed a $67M total contract value (TCV) deal with Palantir. After a successful pilot, the pharmacy is now using AI-powered workflows to automate prescription fulfillment, balance inventory loads, and optimize patient outreach. The implementation significantly improves efficiency and enhances patient service speed.

Telecom Giant Optimizes Network Decommissioning

A leading American telecom provider expanded its partnership with a $40M TCV deal. Palantir's AI-driven software now streamlines the decommissioning of outdated network technologies and equipment, delivering substantial cost savings. The automation enables faster transitions to modern infrastructure while reducing operational inefficiencies.

Global Insurer Accelerates Underwriting with AI

A major insurance company expanded its use of Palantir’s AI to cut underwriting workflows from two weeks to three hours. The successful deployment led to an $11M annual contract value (ACV) expansion in Q4. The company continues scaling AI across additional underwriting processes to improve speed and accuracy.

Panasonic Energy Increases Production Throughput

Panasonic Energy North America expanded its AI-driven manufacturing system to support 350 technicians producing 5.5 million batteries daily. Using Palantir’s technology, Panasonic reduced machine downtime and accelerated technician training, boosting operational efficiency. AI-powered predictive maintenance now prevents disruptions before they occur.

Engineering and Construction Firm Automates Risk Detection

A top global engineering and construction firm replaced manual document reviews with AI-powered risk analysis. Tens of thousands of technical documents are now processed within minutes instead of months. The automation enhances decision-making speed and allows engineers to focus on high-impact problem-solving.

Automotive Supplier Transforms Manufacturing Validation

An automotive manufacturer automated 100-hour engineering validation processes using Palantir’s AI. AI agents now analyze CAD files for compliance with engineering standards and manufacturability, significantly cutting production cycle times. The result is faster design approvals and improved quality control.

Large Customer Wins

Record-Breaking TCV of $1.8 Billion

Palantir closed $1.8 billion in total contract value across commercial and government customers in Q4, a 56% year-over-year increase. The surge highlights growing enterprise adoption of AI solutions across industries.

U.S. Commercial Business Adds Customers at Unprecedented Pace

The U.S. commercial segment continues to dominate, growing 64% YoY. Palantir now serves nearly five times the number of U.S. commercial customers compared to three years ago. The pipeline remains strong, with AI adoption accelerating across multiple industries.

Government Contracts Surge with U.S. Army and Special Operations Command

The U.S. Army extended its long-term partnership for data analytics, securing the Vantage program for up to four additional years. Palantir also expanded into U.S. Special Operations Command, deploying Mission Manager to support high-stakes military operations.

UK NHS Adopts AI for Healthcare Operations

The NHS in the U.K. onboarded 87 hospitals and 28 integrated care boards to Palantir’s Federated Data Platform. AI-powered automation improves hospital efficiency, patient management, and resource allocation across the healthcare system.

Rio Tinto Extends AI-Driven Mining Operations

Global mining giant Rio Tinto renewed its partnership with Palantir for an additional four years. AI now powers automated quality inspections and dynamic production scheduling, enabling Rio Tinto to manage mining operations with real-time intelligence.

Anduril and L3Harris Join Warp Speed AI Manufacturing

Defense technology leaders Anduril and L3Harris implemented Warp Speed, Palantir’s AI-driven manufacturing system. Anduril reports up to 200x efficiency gains in supply chain management. AI-powered automation streamlines quality inspections and accelerates defense production timelines.

International Expansion with New AI Deployments

Palantir’s international government revenue grew 28% YoY, driven by expansion in U.K. defense and healthcare. The AI revolution is reshaping global public-sector operations, with Palantir leading in high-stakes deployments. The company remains focused on strategic markets in Asia, the Middle East, and Europe.

U.S. AI Adoption Drives Massive Growth in TCV

The U.S. commercial segment booked a record $803M TCV, growing 134% YoY and 170% sequentially. The pipeline remains robust, with rapid AI adoption in healthcare, finance, telecommunications, and manufacturing. Customers are moving beyond pilot phases and scaling AI-driven decision-making across operations.

Retention

$PLTR Palantir's Retention Rate (DBNRR) has been growing over the last five quarters, reaching 120%, and remains at a high level, above the median of 117% for the SaaS companies I monitor.

Net new ARR

$PLTR Palantir added $408 million in net new ARR (Annual Recurring Revenue) in Q4 2024, representing a 103% YoY increase, demonstrating strong momentum in ARR growth.

This was the largest net new ARR addition in the company's history.

CAC Payback Period and RDI Score

$PLTR Palantir's return on Sales & Marketing (S&M) spending is 5.7 months, one of the best figures in the company's history since its IPO and among top-performing SaaS companies.

The Customer Acquisition Cost (CAC) Payback Period is healthy compared to other SaaS companies, with the median for the SaaS companies I track being 20.8 months.

The R&D Index (RDI Score) for Q4 increased and is now at 2.61, the highest among the SaaS companies I monitor and significantly above the median of 1.2.

An RDI Score above 1.4 is considered best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

Over the past year, $PLTR Palantir margins have changed:

• Gross Margin slightly decrease from 83.9% to 82.9%.

• Operating Margin increased from 34.3% to 35.4%.

• Adjusted Free Cash Flow Margin increased from 50.1% to 62.5%.

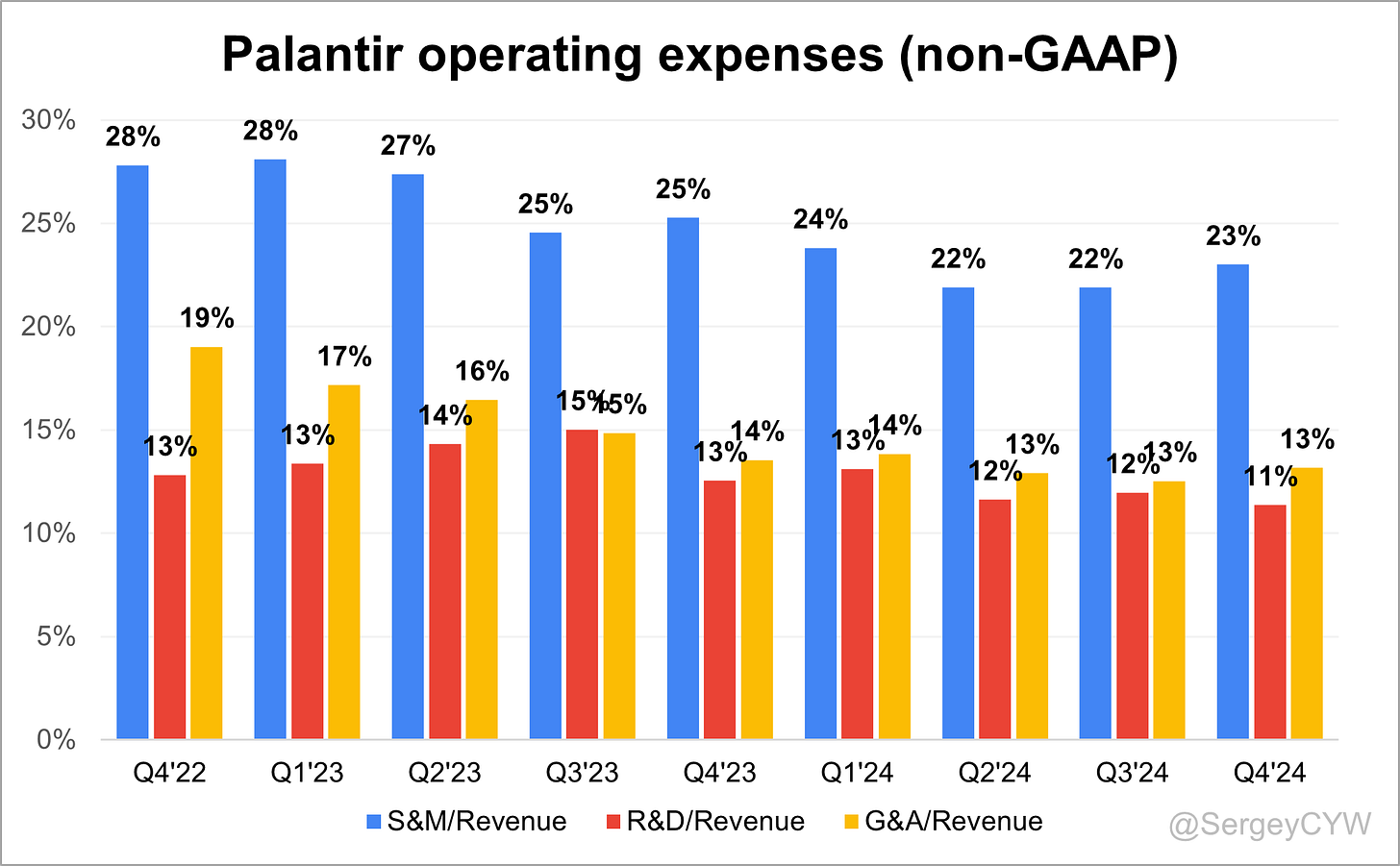

Operating expenses

$PLTR Palantir has slightly reduced its operating expenses over the last two years.

Sales & Marketing (S&M) expenses were reduced from 28% to 23% of revenue.

Research & Development (R&D) expenses slightly decreased from 13% to 11%.

General & Administrative (G&A) expenses were reduced from 19% to 13%, which is still higher than R&D expenses.

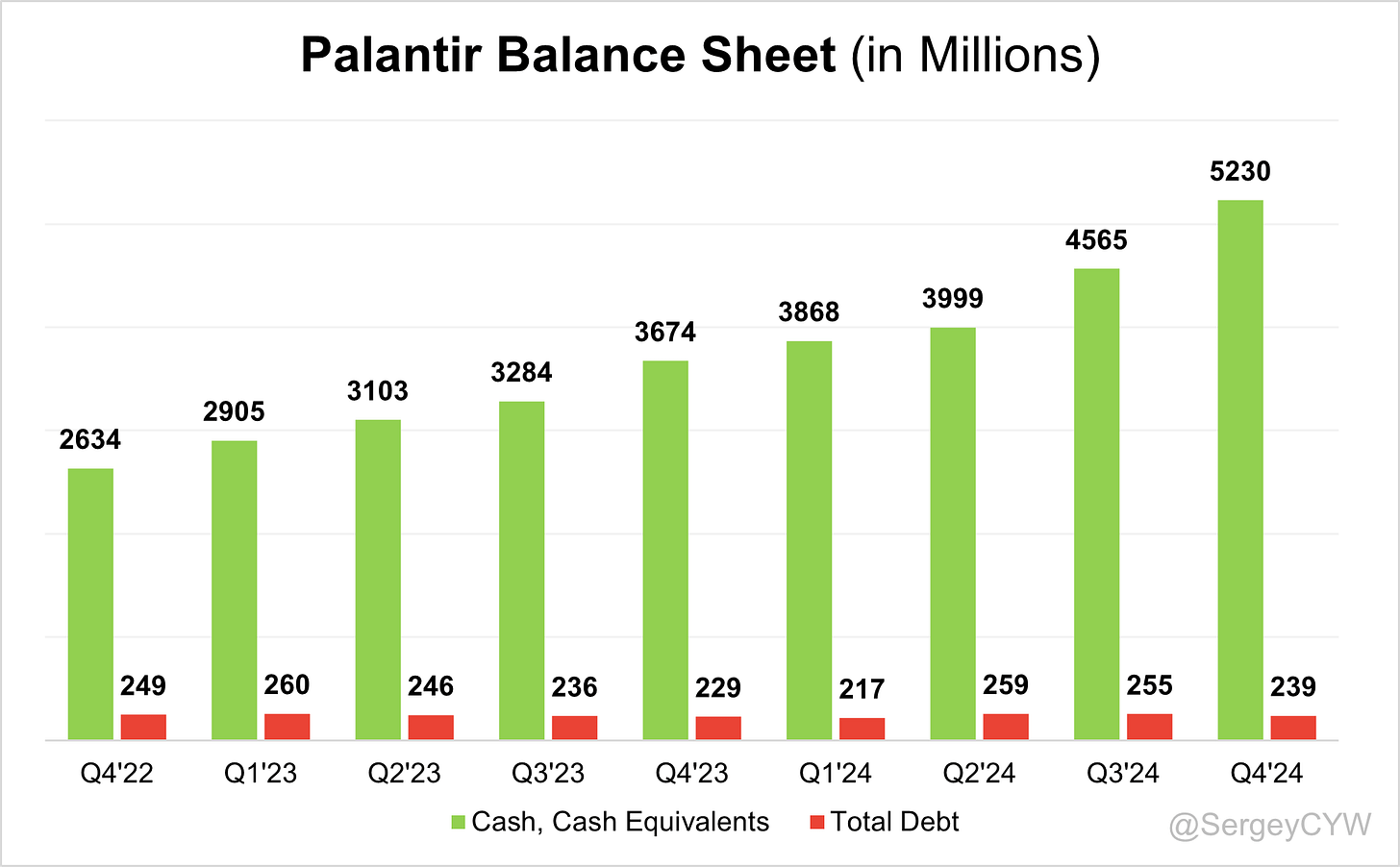

Balance Sheet

$PLTR Balance Sheet: Total debt stands at $239M, while Palantir holds $5,230M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

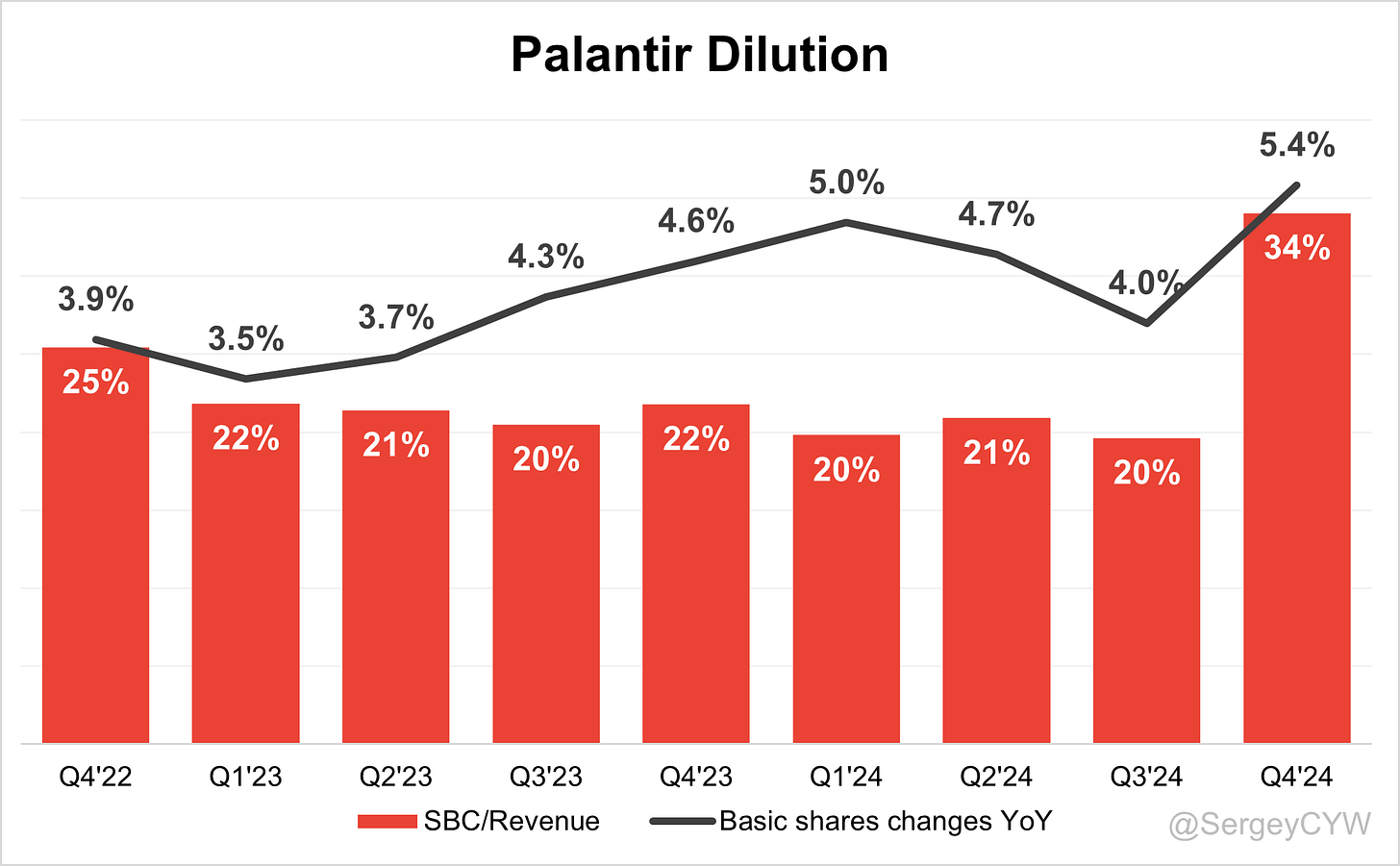

Dilution

$PLTR Palantir's stock-based compensation (SBC) expenses surged to 34% of revenue, a significant increase.

Shareholder dilution remains extremely high, with the weighted-average number of basic common shares outstanding rising by 5.4% YoY. Dilution accelerated significantly in Q4.

Conclusion

This was a very strong quarter for Palantir $PLTR as the company enhances its platform and benefits from AI advancements.

Leading Indicators

RPO growth has slowed but still exceeds revenue growth.

Billings growth has also slowed and is now below revenue growth.

Record net new ARR added in Q4, increasing +103% YoY.

Record customer additions in Q4, with an acceleration in YoY growth.

Key Indicators

Net Dollar Retention (NDR) remains above the SaaS average and increased last quarter.

CAC Payback Period improved, ranking among the best in the SaaS industry.

RDI Score significantly improved and is now the best among SaaS peers.

Both Government and Commercial segments accelerated growth in Q4.

Management provided a strong forecast for the next quarter. If Palantir beats its estimate by 7.3%, similar to Q4, YoY revenue growth could accelerate to +45.9%. If the company beats its estimate by 3.5%, the average over the past year, revenue growth would reach +40.6%, still indicating an acceleration.

Valuation remains extremely high, reflecting expectations of continued revenue acceleration. While Palantir's execution in Q4 was flawless, with its 7.3% forecast beat being the largest in two years, high valuation presents elevated risks. Sustaining 40-45% revenue growth becomes increasingly difficult as revenue scales. The Government segment's acceleration is also uncertain, and I believe commercial growth is more critical due to its larger market opportunity.

I remain on the sidelines and do not hold $PLTR due to its extremely high valuation and associated risks.