NVIDIA: Dominating AI, GPUs, and the Future of Computing

Deep Dive into $NVDA: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

NVIDIA: Company overview

About NVIDIA

NVIDIA Corporation, founded in 1993, is a leading American multinational headquartered in Santa Clara, California. The company designs graphics processing units (GPUs), application programming interfaces (APIs) for high-performance computing and data science, and system-on-chip units (SoCs) for mobile and automotive markets. NVIDIA is a pioneer in accelerated computing and artificial intelligence (AI), with a market capitalization exceeding $2.3 trillion and annual revenue of $130.5 billion as of April 2025.

Company Mission

NVIDIA’s mission is to transform industries using visual computing and AI. It focuses on driving breakthroughs in gaming, autonomous vehicles, robotics, healthcare, and virtual reality, aiming to unlock new capabilities for individuals and organizations while supporting broader societal progress.

Sector

Operating within the Information Technology sector, under Semiconductors & Semiconductor Equipment, NVIDIA is a fabless manufacturer. It designs chips internally and outsources production to firms like TSMC, allowing it to focus on innovation and rapid product development.

Competitive Advantage

NVIDIA controls an estimated 95% of the AI accelerator market and more than 80% of the global GPU market. Its proprietary CUDA software ecosystem creates high switching costs for developers, effectively reinforcing vendor lock-in. The company delivers new chips every six months, far exceeding the industry norm of 18 months. Gross margins on top-tier data center GPUs exceed 90%, highlighting strong pricing power and technological dominance.

Total Addressable Market (TAM)

The company’s Total Addressable Market (TAM) is expanding rapidly. Its data center TAM is projected to surpass $1 trillion by 2028 and reach $1.7 trillion by 2035, fueled by the rise of generative AI, robotics, and edge computing. NVIDIA’s entry into the CPU market adds another $35 billion in TAM.

The broader data center market is expected to grow at a 15% compound annual growth rate (CAGR) from 2024 onward. Within this, extreme parallel computing (EPC)—a strategic focus for NVIDIA—is projected to grow at a 23% CAGR, becoming the core of data center silicon investment by the mid-2030s. Meanwhile, the gaming GPU segment is forecasted to grow at a 21% CAGR, adding approximately $49 billion in revenue between 2023 and 2028.

Valuation

Looking at $NVDA Nvidia's valuation through the Forward EV/Sales multiple, it stands at 13.5, approximately in line with the company’s median of 12.1, and significantly lower than the January 2025 peak, when the multiple reached 20, as well as the 2024 high, when it peaked at 25.

$NVDA Nvidia is currently trading at a Forward P/E multiple of 25.2, which is below the median of 33.9. At the beginning of 2024, the Forward P/E stood around 40. The current valuation is near the lows seen between 2020 and 2023, when the Forward P/E bottomed at approximately 20.

The EPS growth forecast for 2026 is 27.3%, with a P/E of 24.8 and a PEG ratio of 0.9.

The EPS growth forecast for 2027 is 15.8%, with a P/E of 19.5 and a PEG ratio of 1.2.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

$NVDA Nvidia is trading at an EV/FCF multiple of 28.1, which is below the median of 35.7 and close to the lows seen between 2019 and 2024.

Valuation comparison

Analysts forecast +59.1% revenue growth for $NVDA in 2025 and +24.6% in 2026. Considering this projection, the valuation based on the P/S multiple seems reasonable compared to other semiconductor companies.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

NVIDIA benefits from significant economies of scale due to its market dominance and large revenue base. In fiscal Q2 2025, the company reported $30 billion in revenue, with the Data Center segment contributing $26.3 billion, or 88% of total revenue. This scale allows efficient allocation of R&D and fixed costs, supporting a high non-GAAP gross margin of 75.7%. Broad partnerships with ODMs and OEMs further improve manufacturing efficiency and global distribution, reinforcing a strong scale advantage.

Network Effect

NVIDIA’s ecosystem shows a moderately strong network effect, primarily through its CUDA software platform, which powers over 600 AI applications and runs on 100 million devices. Growth in the developer base encourages more applications, indirectly increasing the platform's value. While the hardware itself doesn’t benefit directly from user growth, the effect is significant in AI and gaming. It is less pronounced in comparison to direct-user platforms.

Brand

NVIDIA is recognized globally for leadership in AI, high-performance computing, and gaming. Its GeForce GPUs dominate consumer markets, while its enterprise credibility in AI is backed by partners like Microsoft, Meta, and Google. Reputation for reliability and cutting-edge performance drives customer loyalty across key industries. The brand moat is very strong.

Intellectual Property

NVIDIA holds a wide portfolio of patents, including innovations in tensor cores and energy-efficient GPU designs. Its proprietary software stack, such as CUDA, adds a software layer to its hardware advantage. Competitors face major barriers in replicating or licensing this technology. With 90% market share in AI GPUs, NVIDIA’s intellectual property moat is extremely strong.

Switching Cost

Switching away from NVIDIA is costly, especially in AI and data center workloads. Enterprises rely heavily on its GPU infrastructure and CUDA ecosystem. Transitioning would require retraining, replatforming, and significant resource investment. This level of lock-in results in an extremely strong switching cost moat.

NVIDIA possesses a multi-layered economic moat anchored by very strong economies of scale, a globally trusted brand, and extremely strong moats in intellectual property and switching costs. Its high-margin business is supported by a large revenue base and efficient cost distribution, while patented technologies and the CUDA ecosystem create formidable entry barriers. Though the network effect is only moderately strong, NVIDIA’s integration into customer workflows makes it exceptionally difficult for enterprises to switch, reinforcing long-term competitive advantage.

Revenue growth

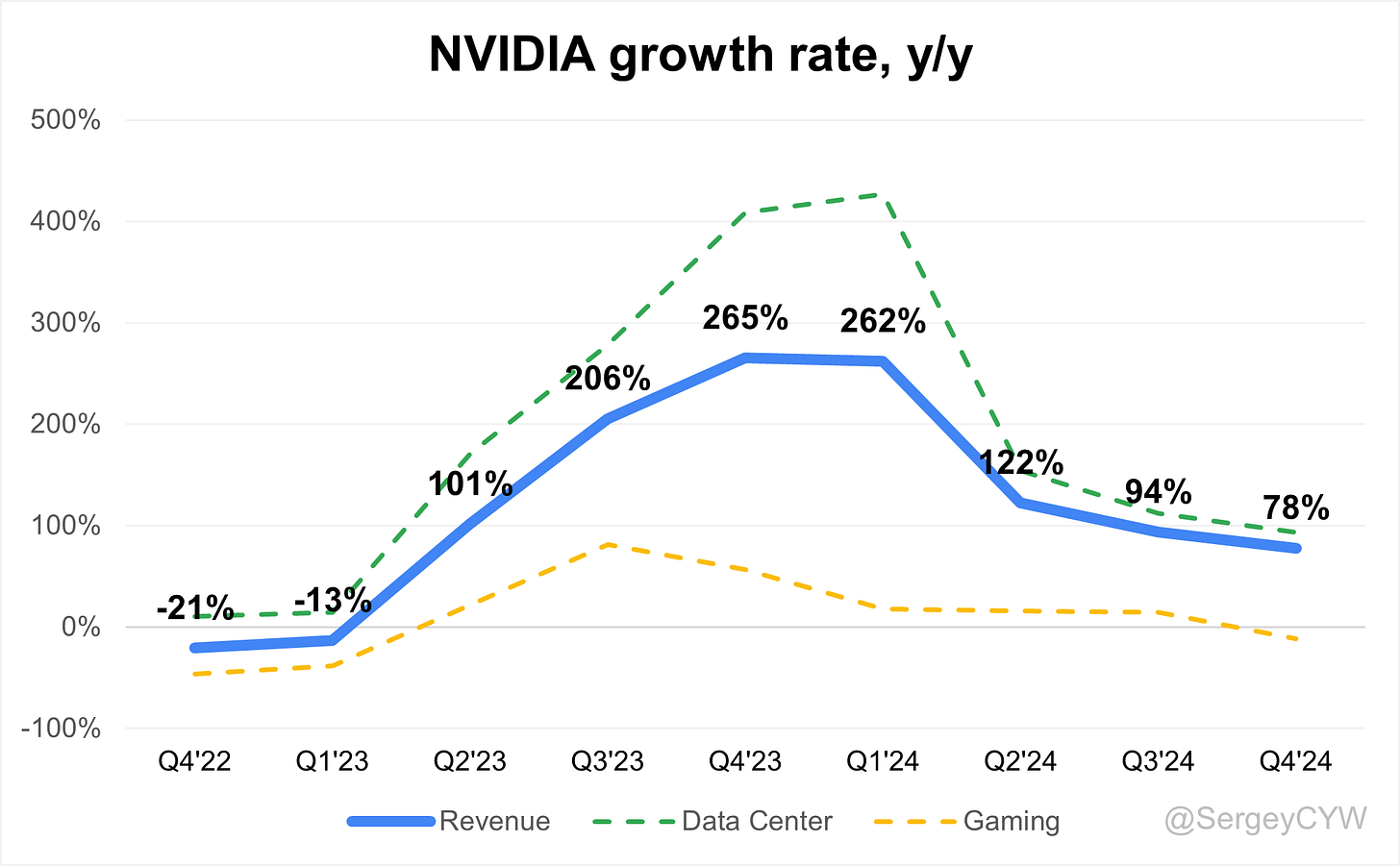

$NVDA Nvidia's revenue growth was an incredible 262% in Q1 2024 and decreased to an equally remarkable 78% in Q4 2024. The primary growth driver is the Data Center segment, whose revenue is outpacing overall revenue growth.

Considering the forecast for the next quarter, if the company exceeds its own expectations by 4.9% as it did in Q4, the Q1 growth would be 73%, indicating a slowdown in revenue growth. However, it’s important to note that such extremely high revenue growth is unsustainable, and a slowdown is to be expected.

Segments and Main Products

Data Center

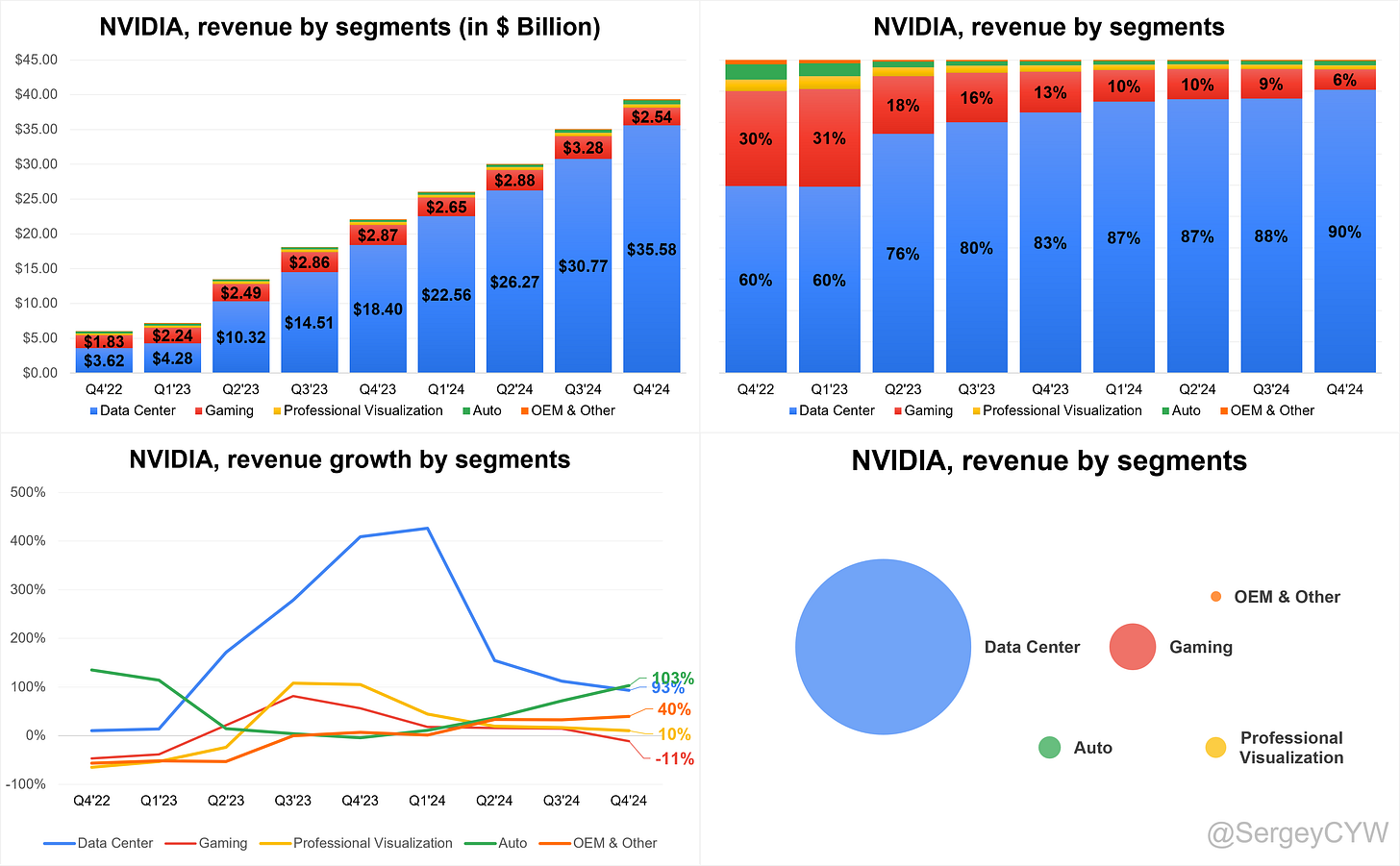

NVIDIA's business is led by its Data Center segment, which contributed 88.27% of total revenue in fiscal year 2025, totaling $115.19 billion. This includes AI and high-performance computing GPUs like the H100 and A100, as well as software offerings such as CUDA, AI Enterprise, and DGX Cloud. NVIDIA's data center products support AI training, inference, and cloud workloads across major hyperscalers.

Gaming

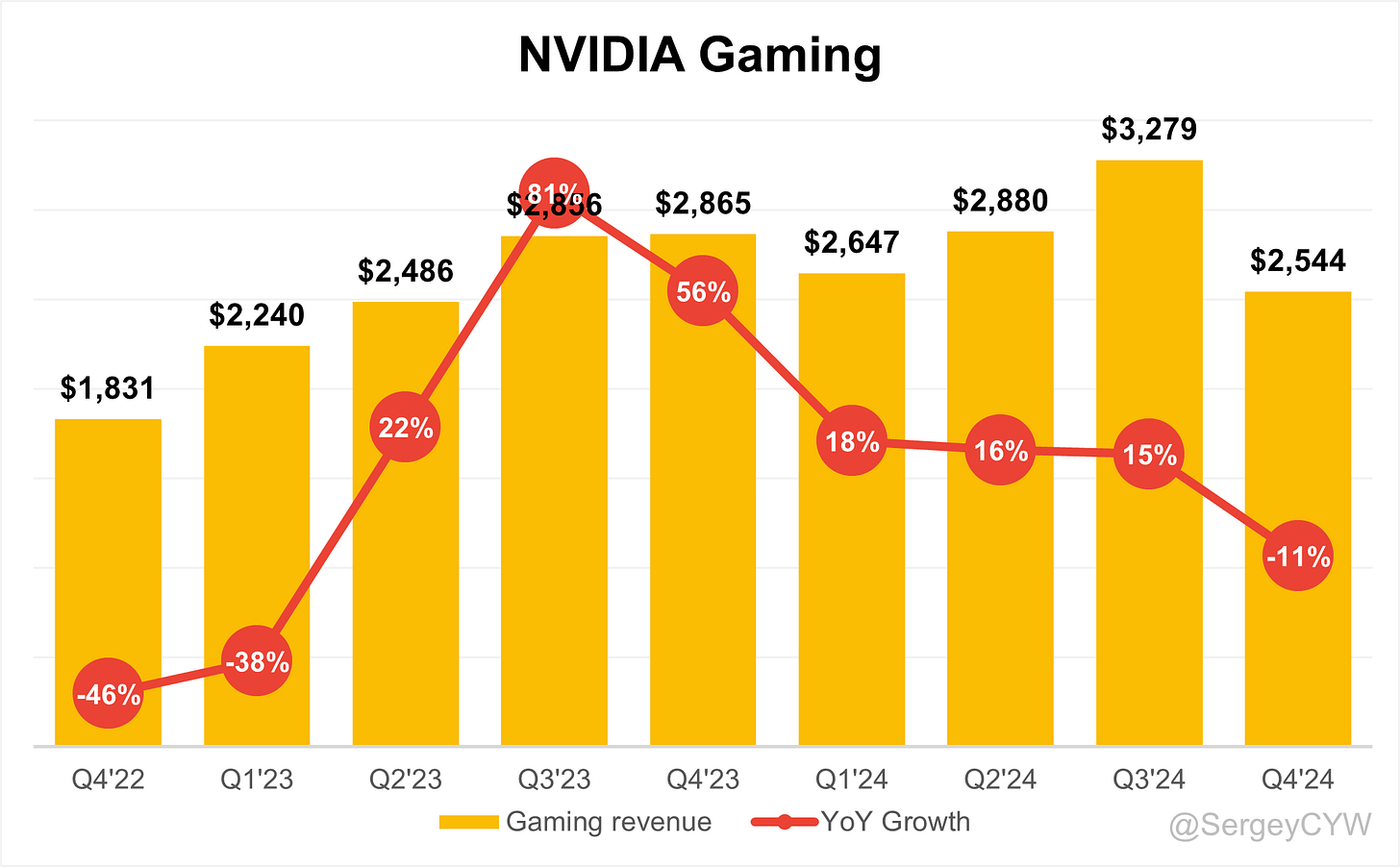

The Gaming segment accounted for 8.7% of revenue in FY2025, generating $11.35 billion. Powered by the GeForce RTX series, this segment remains a leader in consumer graphics with features like ray tracing and DLSS. NVIDIA continues to outperform competitors including AMD's Radeon and Intel's Arc.

Professional Visualization

Professional Visualization made up 1.44% of FY2025 revenue, totaling $1.88 billion. The segment includes RTX professional GPUs, used in architecture, healthcare, and film production. These products support CAD, 3D modeling, and complex simulations across aerospace, automotive, and medical fields.

Automotive

The Automotive segment contributed 1.3% of revenue, reaching $1.69 billion in FY2025. It includes the DRIVE platform, which delivers hardware and software for autonomous driving and infotainment systems. NVIDIA’s solutions process sensor data in real time to support safe and responsive self-driving functionality.

OEM and Other

OEM and Other was the smallest segment at 0.3% of revenue, generating $389 million. It includes legacy GPUs, custom embedded AI solutions, and Tegra processors for mobile and gaming consoles. NVIDIA's focus has shifted toward data center and AI acceleration, which now drive most of its revenue and growth.

Main Products Performance in the Last Quarter

$NVDA Nvidia revenue by segment: Data Center revenue has increased from 60% of total revenue in Q4 2022 to 90% in the most recent quarter, becoming the largest contributor to overall revenue.

While Data Center revenue growth has slowed from an extraordinary +427% YoY in Q1 2024 to +93% this quarter, the growth rate remains exceptionally high and continues to be the primary driver of Nvidia’s overall revenue expansion.

The Automotive segment posted strong growth at +103% YoY, but it still accounts for only 1.4% of total revenue.

The most important contributor to $NVDA Nvidia's overall revenue growth is the Data Center segment, which reported 93% YoY revenue growth. The key question is whether the company can stabilize Data Center revenue growth, and at what level this growth needs to settle to justify Nvidia’s current valuation based on its existing multiples.

The second-largest contributor to $NVDA Nvidia’s overall revenue has been the Gaming segment, though its share has declined significantly from 30% two years ago to just 6%. In the most recent quarter, the segment reported a -11% YoY decline in revenue.

Data Center

Q4 Data Center revenue reached $35.6B, driven by the fastest platform ramp in company history. FY revenue surged to $115.2B, more than 2x YoY. Compute revenue grew +18% QoQ, supported by demand across training, post-training, and inference workloads. Large CSPs—Azure, AWS, GCP, and OCI—accounted for approximately 50% of Data Center revenue, growing 2x YoY. The enterprise segment also doubled, with deployments from SAP, ServiceNow, Mayo Clinic, and IQVIA. U.S. demand led sequential growth, driven by accelerating AI factory deployments. China remained significantly below prior levels due to export controls.

Blackwell Growth

Blackwell generated $11B in Q4 revenue—NVIDIA's fastest platform ramp to date. Now in full production with multiple configurations, Blackwell delivers 25x higher token throughput and 20x lower inference costs compared to Hopper 100. Deployments at CoreWeave, Microsoft, Meta, OpenAI, and XAI are already powering clusters of over 100,000 GPUs.

The company will begin shipping Blackwell Ultra in 2H 2025, maintaining its annual cadence. Blackwell racks integrate 1.5M components, manufactured by 350 suppliers and 100,000 operators, illustrating both complexity and scale.

The GB200 architecture is optimized for reasoning and inference scaling, featuring NVLink 72, FP4 precision, and advanced memory hierarchies. GB200 delivers up to 40x performance improvement over Hopper and was launched in response to rapidly rising demand from models like OpenAI Grok 3 and DeepSeek R1.

NVIDIA also introduced the Kyber system, which extends NVLink scale-up to 576 GPUs per rack, leveraging liquid cooling and high-speed copper interconnects before transitioning to photonics for scale-out.

Dynamo: Inference Optimization

Reasoning models demand 100x more compute than conventional inference due to increased token generation and required throughput speed. NVIDIA’s Dynamo framework allows real-time reconfiguration of compute based on prompt and workload type, significantly improving system utilization. Perplexity AI is among early adopters optimizing inference at scale using Dynamo.

Gaming

Revenue was $2.5B, down -11% YoY due to supply constraints. However, demand remained strong throughout the holidays. NVIDIA expects strong sequential growth in Q1 as supply normalizes. New GeForce RTX 50 series launched, offering up to 2x performance leap and up to 8x frame rate boost using DLSS 4 and AI-driven rendering features. AI TOPS reach up to 3,400, targeting both creators and gamers.

Professional Visualization

Q4 revenue reached $511M, up +5% QoQ and +10% YoY. FY revenue totaled $1.9B, a +21% YoY growth. Demand is expanding in automotive and healthcare verticals, driven by AI reshaping engineering, simulation, and design workloads. Key software partners include ANSYS, Cadence, and Siemens, fueling workstation sales.

Automotive

Q4 revenue hit a record $570M, up +27% QoQ and +103% YoY. FY revenue reached $1.7B, growing +55% YoY. Growth was driven by AV and robotaxi ramp. Toyota will build next-gen vehicles on NVIDIA Orin, while Aurora and Continental will deploy driverless trucks at scale. NVIDIA’s full AV stack, DRIVE Hyperion, passed independent safety certifications.

Robotics

NVIDIA launched Cosmos, a foundation model platform for physical AI and robotics, similar in intent to language models for text. Early adopters include Uber and Hyundai, focusing on AV, robotics, and smart factory development. Robotics compute is expected to require 10x more power, using vision transformers, self-supervised learning, and multimodal sensor fusion.

OEM

OEM-specific updates were minimal, but NVIDIA confirmed strong Max-Q laptop GPU refresh. Laptops using the new GeForce Blackwell GPUs will begin shipping in March, promising up to +40% battery efficiency gains and support for high-performance AI/graphics hybrid workloads.

Product and Platform Innovations

The Blackwell platform supports training, post-training, and inference on a unified architecture. Blackwell Ultra retains system design consistency, enabling simplified customer upgrades. Future roadmap includes Vera Rubin, signaling continuity in NVIDIA’s aggressive cadence.

Cosmos World expands NVIDIA’s footprint in robotics and simulation. The Llama Numitron family of AI agents addresses use cases in customer support, supply chain optimization, and fraud detection.

Software innovations such as TensorRT, Triton inference server, and the Dynamo framework continue to reduce inference costs and boost token throughput. Real-world customer impact includes 3x inference cost reduction at Perplexity, 5x speed gains at Microsoft Bing, and 66% cost reduction with 3x throughput at Notion.

To accelerate enterprise AI adoption, NVIDIA launched DGX Spark, DGX Station, and Blackwell-powered modular systems tailored for on-premise deployment. These offerings enable scalable, easily procured AI infrastructure beyond hyperscaler environments.

The company also announced its involvement in 6G AI-driven RAN infrastructure, partnering with T-Mobile and Cisco, reinforcing the expansion of AI computing into telecom infrastructure.

Revenue by Region

The United States accounts for 51% of total revenue, making it $NVDA Nvidia’s largest market, with revenue growing +63% YoY in Q4.

China contributes 14% of total revenue and grew +184% YoY, with a significant acceleration in Q4.

Taiwan accounts for 13%, with a +20% YoY growth rate.

Other Countries make up 22%, with revenue growing +145% YoY.

Revenue growth in China and Other Countries is outpacing Nvidia’s overall revenue growth in Q4.

Market Leader

According to Gartner’s 2024 semiconductor market analysis, NVIDIA advanced two spots to become the No. 3 global semiconductor vendor. Growth was driven primarily by the company’s AI business, which remains its core strength.

In Gartner’s Top 10 Strategic Technology Trends for 2025, NVIDIA is prominently positioned across several critical domains. In Agentic AI, NVIDIA's platforms and frameworks are enabling the development of autonomous AI agents. In Hybrid Computing, Gartner highlights the role of GPUs, which aligns directly with NVIDIA’s foundational business. In Spatial Computing, a market expected to grow from $110 billion in 2023 to $1.7 trillion by 2033, NVIDIA's GPU infrastructure plays a key role in enabling immersive computing environments and simulation.

According to Brand Finance’s 2025 report, NVIDIA remains the world’s most valuable semiconductor brand, with brand value surging +98% YoY to $87.9 billion. It also secured the title of strongest semiconductor brand globally, achieving a Brand Strength Index (BSI) score of 88.9 out of 100, leading Intel by over 7 points.

Mizuho Securities estimates NVIDIA holds between 70% and 95% market share in the AI chip sector. Dominance is built around its flagship H100 GPUs and the CUDA software ecosystem, which together create high switching costs and deep customer dependency. This foundation secures NVIDIA's leadership across AI training and inference workloads.

Customer Success Stories

Perplexity achieved major operational efficiency using NVIDIA’s Triton Inference Server and TensorRT-LLM, reducing inference costs by 3x. Handling 435 million monthly queries, the cost improvement significantly enhances unit economics.

Notion tripled inference throughput and cut costs by 66%, driven by NVIDIA’s full-stack inference platform including TensorRT. This efficiency gain supports rapid feature scaling while maintaining user experience quality.

Microsoft Bing accelerated visual search throughput by 5x, applying TensorRT and NVIDIA acceleration libraries. The outcome enabled cost savings at scale across billions of images, showcasing AI’s direct impact on core consumer-facing services.

Meta's Andromeda advertising engine is powered by NVIDIA’s Grace Hopper Superchip, tripling inference throughput. This enhanced ad personalization and drove monetization efficiency across Instagram and Facebook applications, increasing return on ad spend.

XAI, the AI firm behind Grok, adopted GV200 for training and inference workloads. This positions NVIDIA as the foundational infrastructure partner for future iterations of Grok’s reasoning AI models.

CoreWeave deployed a 100,000 GPU cluster built on NVIDIA’s GV200, with NVLink and Quantum-2 InfiniBand. This rollout represents one of the largest inference-ready infrastructure builds and demonstrates NVIDIA’s scalability.

IQVIA, Mayo Clinic, and Lumenon are leveraging NVIDIA’s healthcare stack for AI-driven genomic research and drug discovery. Enhanced speed and precision through generative and agentic AI improved research workflows.

SAP and ServiceNow were among the first enterprise providers to implement NVIDIA’s new Llama Numitron models, streamlining deployment of AI agents in operational workflows like customer support and supply chain.

Toyota will base its next-gen vehicles on NVIDIA Orin, accelerating development across AV, robotics, and smart factories. Orin’s adoption signals an important design win in mass automotive platforms.

Aurora and Continental will deploy driverless trucks at scale using NVIDIA DRIVE 4, a full-stack AV system. DRIVE Hyperion has cleared industry safety assessments, strengthening NVIDIA’s credibility in autonomous driving.

Strategic Partnerships

Cisco announced a strategic integration of Spectrum-X into its Ethernet networking portfolio. This positions NVIDIA's AI-optimized Ethernet technology to reach global enterprise clients through Cisco’s channel, driving enterprise AI infrastructure deployment.

Microsoft Azure, OCI, and Fortease are building AI factories on Spectrum-X, highlighting its effectiveness in Ethernet environments for large-scale AI workloads. Spectrum-X has emerged as a growth driver in data center networking.

Hyundai Motor Group adopted NVIDIA technologies to accelerate development in AV, robotics, and smart factories. This expands NVIDIA’s reach into industrial automation through physical AI use cases.

OpenAI continues deploying NVIDIA systems at scale. The company’s infrastructure for next-gen models like Grok 3 and custom training clusters depend on NVIDIA’s performance and system architecture.

France and the EU announced AI infrastructure initiatives totaling over €400 billion, with NVIDIA playing a key role in hardware supply and deployment consulting. These investments are foundational for Sovereign AI.

NVIDIA’s deep collaboration with cloud hyperscalers—Azure, AWS, GCP—has made them first movers in Blackwell adoption. This accelerates time-to-market for new models and increases NVIDIA’s share of cloud-based AI workloads.

Each of these partnerships either scales NVIDIA’s technology across industries or enables fast deployment of transformative AI infrastructure, cementing the company’s strategic role in the global AI supply chain.

Profitability

Over the past year, $NVDA Nvidia has experienced changes in its margins and profitability:

– Gross Margin decreased from 75.9% to 73.0%.

– EBIT Margin decreased from 61.6% to 61.1%.

– Free Cash Flow (FCF) Margin declined from 50.7% to 39.5%.

– Net Margin slightly improved from 55.6% to 56.0%.

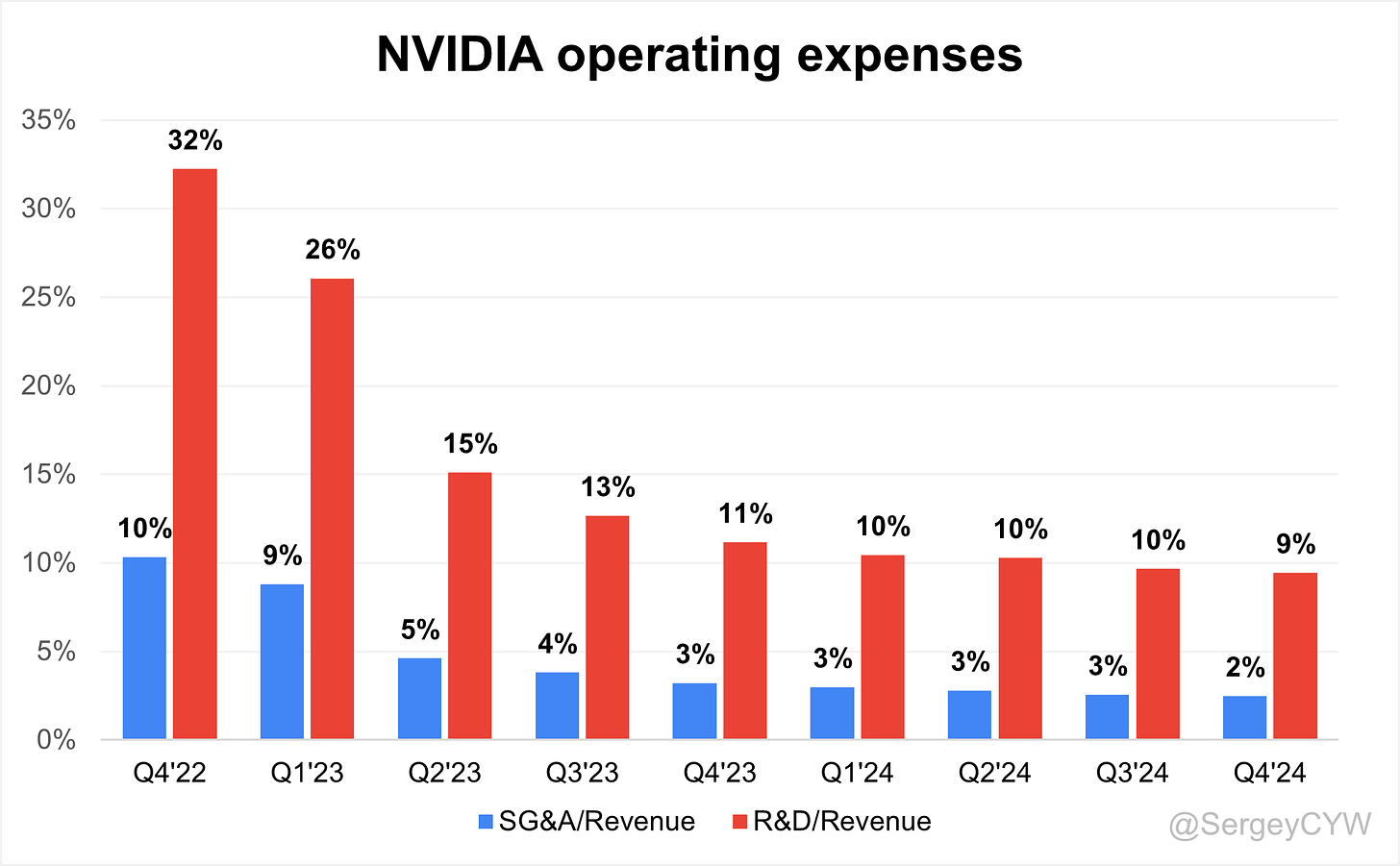

Operating expenses

Operating expenses have gradually decreased. Notably, $NVDA Nvidia spends more on R&D than on S&M and G&A combined, enabling the company to continuously improve its products and expand market share. R&D expenses remain high at 9% of revenue, while SG&A expenses have declined to 2%.

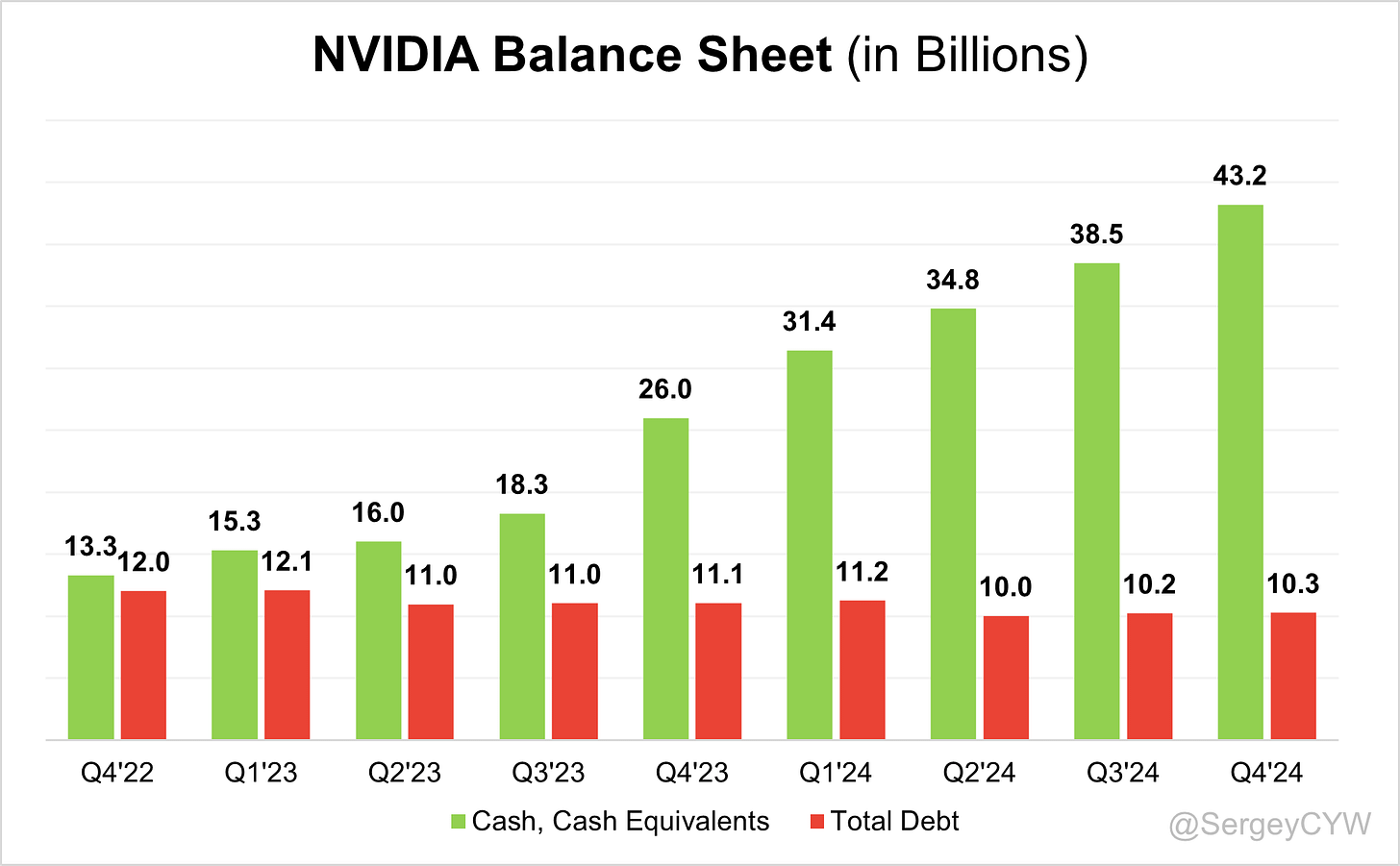

Balance Sheet

$NVDA Balance Sheet: Total debt stands at $10.3B, while Nvidia holds $43.2B in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

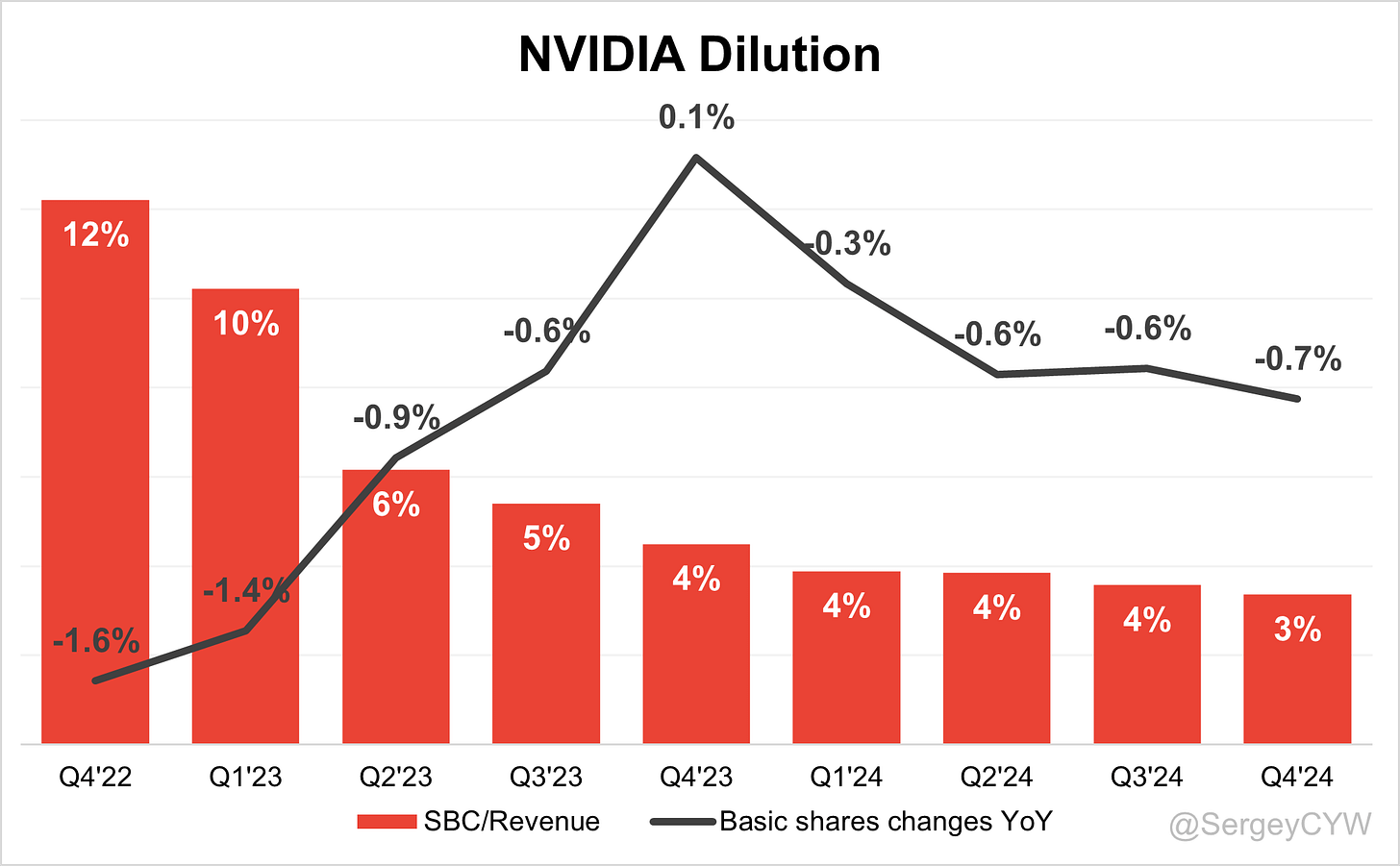

Dilution

$NVDA Shareholder Dilution: Nvidia’s stock-based compensation (SBC) expenses declined in the last quarter, reaching 3% of revenue.

Shareholder dilution remains under control, as the weighted-average number of basic common shares outstanding decreased by 0.7% YoY, due to the company actively repurchasing its shares.

In Q4 2024, Nvidia returned $8.1 billion to shareholders through share repurchases and cash dividends.

Conclusion

$NVDA Nvidia has established itself as a highly innovative leader in the chipmaking industry. The company has effectively capitalized on the adoption of AI technologies, with the launch of ChatGPT-4 serving as a catalyst for explosive growth in its Data Center segment.

Revenue growth remains exceptionally high at +78% YoY, with the Data Center segment growing +93% YoY, outpacing total revenue and acting as the primary growth engine. However, growth is gradually decelerating. If Nvidia exceeds its Q1 forecast by the same margin as in Q4 (which was +4.9%, the lowest beat in two years compared to +7.9% in Q3), Q1 growth would reach +73%. Expectations remain high, making it increasingly difficult for the company to continue outperforming them.

Nvidia is a cyclical business, and Data Center revenue growth is slowing. The company is actively trying to extend the current growth cycle by launching new products. The Auto segment showed impressive +103% YoY growth in Q4, though it still represents just 1.4% of total revenue.

Analysts forecast +59.1% revenue growth in 2025 and +24.6% in 2026, making it critical for Nvidia to meet these targets to justify its current valuation. While valuation multiples like Forward EV/Sales, Forward P/E, and EV/FCF are now near their 2019–2024 lows, and the net profit margin of 56% in Q4 is extremely high for a chipmaker, it raises the question of whether such margins can be sustained.

The PEG ratio for 2026 is 0.9, which suggests undervaluation, but for 2027 it's 1.2, reflecting expectations of a decline in profit margins, which seems reasonable.

Nvidia remains the clear market leader, supported by a 56% net margin and 73% gross margin. As long as the company maintains its leadership and the current demand cycle for AI and Data Center chips continues, it is likely to sustain high profitability. However, there are concerns that new competitors may enter the market and that the AI demand cycle could peak, putting pressure on margins—a trend already visible in Q4, where the gross margin declined -3 percentage points YoY, operating margin fell -0.5 percentage points, and FCF margin dropped -11 percentage points.

Investors should closely monitor capital expenditures from large tech companies like $META, $MSFT, $GOOGL, and $AMZN, which signal continued demand for chips and potential extension of the current cycle. Additionally, attention should be paid to Nvidia’s upcoming product launches for AI and Data Center workloads, as well as growth in new segments like Auto, which, despite its current small share, shows strong potential.