NVDA Q4 2024 Earnings Analysis

Dive into $NVDA Nvidia’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$39.3B rev (+77.9% YoY, +93.6% LQ) beat est by 4.3%

↘️GM (73.0%, -2.9 PPs YoY)🟡

↘️Operating Margin (61.1%, -0.5 PPs YoY)🟡

↘️FCF Margin (39.5%, -11.2 PPs YoY)🟡

↗️Net Margin (56.2%, +0.6 PPs YoY)

↗️EPS $0.89 beat est by 6.0%🟢

Key Metrics

➡️RPO $1.70B (+54.5% YoY)🟡

Segment Revenue

↗️Data Center $35,580M rev (+93.3% YoY)

↘️Gaming $2,544M rev (-11.2% YoY)🟡

➡️Professional Visualization $511M rev (+10.4% YoY)🟡

↗️Auto $570M rev (+102.8% YoY)🟢

➡️OEM & Other $126M rev (+40.0% YoY)🟡

Revenue by Region

➡️United States $19,939M rev (+63.0% YoY, 50.7% of Rev)🟡

↗️China $5,534M rev (+184.4% YoY, 14.1% of Rev)🟢

➡️Taiwan $5,307M rev (+19.6% YoY, 13.5% of Rev)🟡

↗️Other Countries $8,551M rev (+145.4% YoY, 21.7% of Rev)

Operating expenses

↘️SG&A/Revenue 2.5% (-0.7 PPs YoY)

↘️R&D/Revenue 9.4% (-1.7 PPs YoY)

Dilution

↘️SBC/rev 3%, -0.2 PPs QoQ

↘️Basic shares down -0.7% YoY, -0.1 PPs QoQ🟢

↘️Diluted shares down -0.8% YoY, -0.1 PPs QoQ🟢

Guidance

↗️Q1'25 $43.0B guide (+65.1% YoY) beat est by 3.1%

Key points from Nvidia’s Fourth Quarter 2024 Earnings Call:

Financial Performance

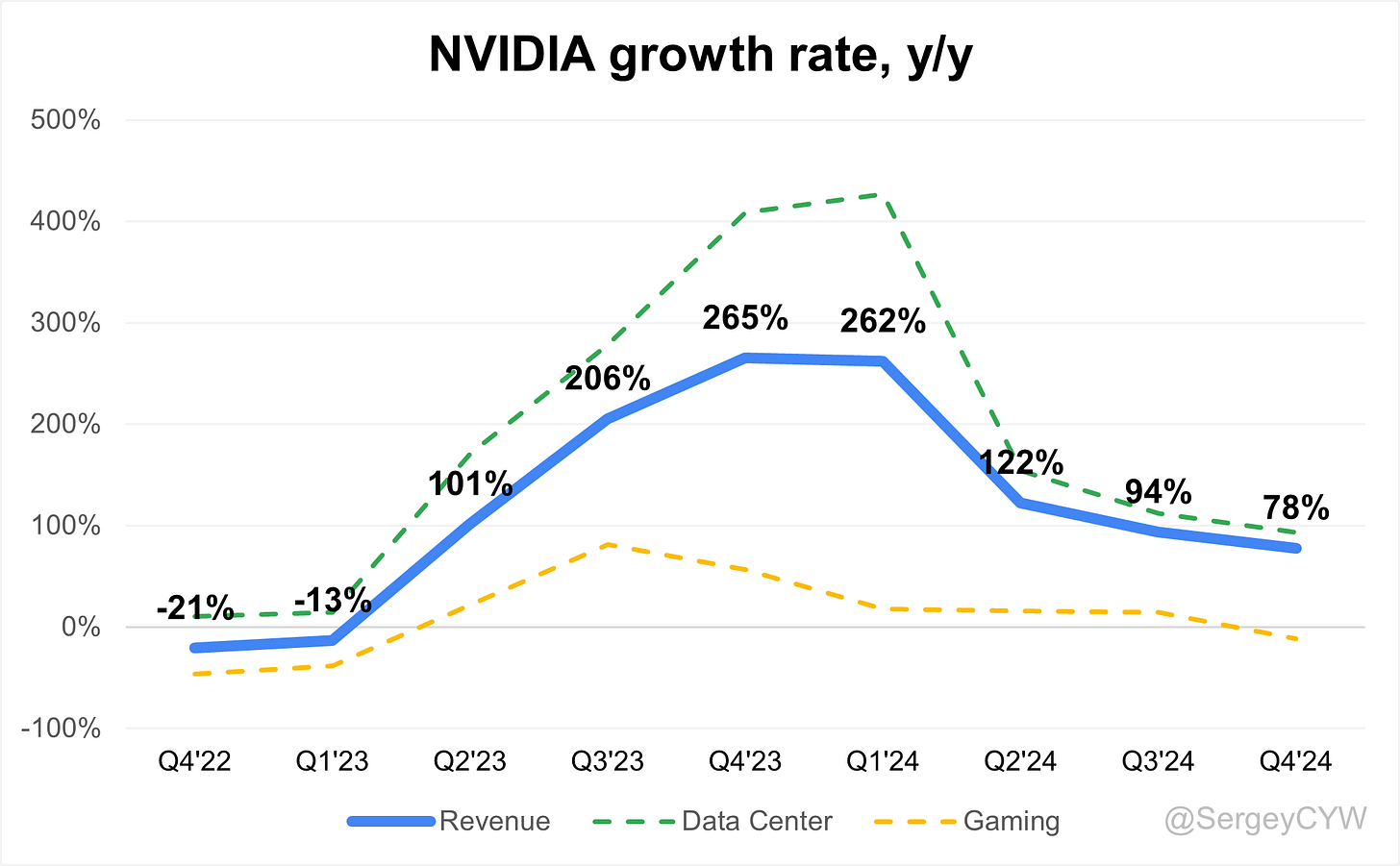

NVIDIA delivered a record-breaking quarter, reporting Q4 revenue of $39.3 billion, up 12% sequentially and 78% year-over-year. Full-year fiscal 2025 revenue reached $130.5 billion, a 114% surge from the prior year. Gross margins were 73% GAAP and 73.5% non-GAAP, slightly lower due to the Blackwell ramp.

The company returned $8.1 billion to shareholders through buybacks and dividends. Q1 fiscal 2026 revenue is projected at $43 billion (+10% QoQ), driven by Blackwell adoption. Gross margins will remain in the low 70s in early 2026 before recovering to the mid-70s with cost optimizations.

AI Scaling

AI workloads are shifting beyond pretraining as post-training and inference scaling drive compute demand. Enterprises use reinforcement learning, fine-tuning, and model distillation to enhance AI models. Reasoning AI models like OpenAI’s Grok 3 and DeepSeq R1 require up to 100x more compute per task than traditional inference.

Blackwell architecture optimizes inference, delivering 25x higher token throughput and 20x lower costs vs. Hopper H100. NVIDIA’s AI software stack, including TensorRT, Triton inference server, and NVLink, reduces inference costs and improves efficiency.

Blackwell Growth

Blackwell ramped at unprecedented speed, generating $11 billion in Q4 revenue. Large-scale deployments at AWS, Azure, GCP, and OCI accelerated adoption. Blackwell is designed for pretraining, post-training, and inference scaling, with NVLink 72 boosting throughput 14x vs. PCIe Gen 5. AI factories now deploy clusters with 100,000+ GPUs.

Custom Chips vs. GPUs

Hyperscalers are exploring custom ASICs, but NVIDIA sees GPUs as the superior choice due to flexibility, ecosystem support, and rapid innovation. GPUs handle vision, multimodal, and autoregressive models without custom silicon redesigns.

Next-Gen AI

Blackwell Ultra launches H2 2025, followed by Vera Rubin in 2026, advancing networking, memory, and compute power. Future upgrades will be streamlined.

Data Centers

NVIDIA’s data center revenue hit $35.6 billion in Q4 (+16% QoQ, +93% YoY), reaching $115.2 billion (+100% YoY) for fiscal 2025. The AI transition is driving hyperscaler growth, with cloud providers representing 50% of data center revenue.

AI factories are scaling rapidly. Blackwell’s scalability and performance drive adoption, but manufacturing challenges persist. Each system involves 1.5 million components across 350 manufacturing facilities, requiring precise coordination.

Enterprise AI adoption doubled YoY, with SAP, ServiceNow, and Mayo Clinic using NVIDIA for AI workflows, fraud detection, and healthcare applications.

U.S. revenue rose $5 billion sequentially. Europe is ramping AI investments, with France committing €200 billion and the EU launching a €200 billion initiative.

Automotive

Q4 automotive revenue hit $570 million (+27% QoQ, +103% YoY), with full-year revenue at $1.7 billion (+55% YoY). Fiscal 2026 automotive revenue is expected to reach $5 billion.

Toyota is adopting NVIDIA Orin for its next-gen vehicles, marking a major AI expansion in the industry. Uber is deploying NVIDIA AI in self-driving technology, and Aurora is scaling autonomous trucking with NVIDIA Drive Hyperion.

At CES 2025, Hyundai Motor Group announced AI adoption for self-driving, robotics, and smart factories. AI is moving from perception-based systems to full reasoning-based autonomy.

Gaming

Q4 gaming revenue fell 22% sequentially, 11% YoY to $2.5 billion, despite full-year growth of 9% to $11.4 billion. Supply constraints impacted shipments.

GeForce RTX 50 series launches in Q1 2026, featuring AI-driven rendering, neural shaders, digital human rendering, and DLSS 4 (8x frame rate boost). AI is reshaping PC gaming, with NVIDIA leading the transition.

Professional Visualization

Q4 revenue reached $511 million (+5% QoQ, +10% YoY), with full-year growth of 21% to $1.9 billion. AI adoption is increasing in automotive, healthcare, and industrial design.

RTX-powered AI visualization solutions are expanding into architecture, product design, and simulation software. Enterprises are adopting cloud-based AI rendering to make high-performance visualization more accessible.

Robotics

NVIDIA is pushing AI into robotics with its Cosmos World foundation model platform. AI-driven robotics is growing in industrial automation, warehouses, and logistics.

Uber is deploying NVIDIA’s AI for logistics automation. Hyundai is integrating AI into smart manufacturing and autonomous robotics.

AI must bridge the gap between digital models trained in data centers and real-world variability in robotics. NVIDIA is using simulation-based AI training with reinforcement learning to ensure real-world adaptability.

Strategic Partnerships

NVIDIA is expanding partnerships across cloud, enterprise AI, automotive, and robotics.

AWS, Microsoft Azure, Google Cloud, and OCI were the first to deploy Blackwell. Microsoft Bing achieved a 5x inference speedup using NVIDIA TensorRT. Meta’s Andromeda ad engine boosted inference throughput by 3x using Grace Hopper Superchip.

SAP and ServiceNow are deploying AI-powered customer support and fraud detection. Mayo Clinic, IQVIA, and Lumenon are advancing AI in healthcare and drug discovery.

Toyota, Uber, and Aurora are scaling AI-driven mobility, while Cisco integrates NVIDIA Spectrum X to expand AI networking solutions for enterprises.

Challenges

Blackwell demand is outpacing manufacturing capacity, requiring coordination across 350 sites to build 1.5 million components per system.

Export controls have cut NVIDIA’s China data center revenue in half, but Europe and North America investments compensate. Supply constraints impacted gaming revenue, with GeForce RTX 50 expected to drive recovery.

Balancing hyperscaler vs. enterprise AI demand is critical. Enterprises seek on-prem AI factories, shifting demand away from cloud-exclusive deployments.

Future Outlook

Q1 fiscal 2026 revenue projected at $43 billion as reasoning AI, post-training, and inference scaling drive AI compute demand.

AI is expanding from consumer applications to enterprise, sovereign, and industrial AI. Data centers are evolving into AI factories, with Blackwell, Blackwell Ultra, and Vera Rubin defining the next wave of AI computing.

NVIDIA is positioned at the center of the AI revolution, powering the next generation of compute, automation, and robotics.

Management comments on the earnings call.

Product Innovations

Jensen Huang, President and Chief Executive Officer

"Blackwell was architected for reasoning AI inference. It supercharges AI models with up to 25 times higher token throughput and 20 times lower cost versus Hopper H100. It is revolutionary."

Colette Kress, Executive Vice President and Chief Financial Officer

"Our focus is on expediting the manufacturing of Blackwell to meet the surging demand. As Blackwell ramps fully, we have many opportunities to improve cost efficiency and gross margins."

Generative AI

Jensen Huang, President and Chief Executive Officer

"Inference demand is accelerating. Long-thinking reasoning AI can require 100 times more compute per task compared to one-shot inferences. We are entering a new era of AI scaling."

"AI models are now generating tokens to train other AI models. This post-training and model customization can demand orders of magnitude more compute than pretraining alone."

Vera Rubin

Jensen Huang, President and Chief Executive Officer

"We've already revealed and been working closely with all of our partners on the click after Blackwell Ultra. That next innovation is called Vera Rubin. Come to GTC, and we’ll show you what’s next."

Data Centers

Jensen Huang, President and Chief Executive Officer

"Customers are racing to scale infrastructure to train the next generation of cutting-edge models. With Blackwell, it will be common for AI clusters to start with 100,000 GPUs or more."

"Large cloud providers were among the first to stand up Blackwell, with Azure, GCP, AWS, and OCI bringing GV200 systems to cloud regions worldwide to meet surging AI demand."

Colette Kress, Executive Vice President and Chief Financial Officer

"We exceeded our expectations in ramping Blackwell. Increasing system availability and offering multiple configurations to customers was a key success in Q4."

Automotive

Jensen Huang, President and Chief Executive Officer

"The automotive industry is transforming with AI. From self-driving cars to AI-powered logistics, every vehicle will have an AI factory behind it. NVIDIA is enabling this shift with our full-stack AI platform."

"NVIDIA's automotive vertical revenue is expected to grow to approximately $5 billion this fiscal year, as AI-powered autonomy expands across cars, trucking, and industrial robotics."

Competitors

Jensen Huang, President and Chief Executive Officer

"We build very different things than custom ASICs. Our architecture is general-purpose, accelerating every AI model, ensuring large infrastructure investments against obsolescence in rapidly evolving markets."

"Performance per watt translates directly to revenues in AI factories. If our performance is four times or eight times higher, the revenue from that AI data center is also four to eight times greater."

Customers

Jensen Huang, President and Chief Executive Officer

"Enterprises are rapidly adopting AI. We are seeing demand for AI-powered applications across every sector—healthcare, finance, robotics, manufacturing, and retail. AI is no longer just for cloud providers."

Colette Kress, Executive Vice President and Chief Financial Officer

"Enterprise AI revenue doubled year over year, demonstrating the increasing deployment of AI workloads beyond hyperscalers. Businesses are integrating AI across customer support, fraud detection, and supply chains."

Strategic Partnerships

Jensen Huang, President and Chief Executive Officer

"Our partnership with Cisco will bring NVIDIA’s AI networking technology to enterprise data centers globally. As AI becomes mainstream, having the right networking backbone is critical."

"From healthcare leaders like Mayo Clinic to hyperscalers like AWS and Azure, NVIDIA’s AI solutions are being deployed at an unprecedented scale. The AI transformation is well underway."

International Growth

Jensen Huang, President and Chief Executive Officer

"AI has gone mainstream. Every industry, every country, every major economic sector is integrating AI. Governments worldwide are making AI a priority, fueling investments in AI infrastructure."

"Countries across the globe are building their AI ecosystems. France’s €200 billion AI investment and the EU’s €200 billion Invest AI initiative offer a glimpse into the AI infrastructure expansion coming in the years ahead."

Challenges

Jensen Huang, President and Chief Executive Officer

"Nothing is easy about what we’re doing. Scaling Blackwell requires coordinating 350 manufacturing plants and assembling 1.5 million components per system. But we are executing at speed."

Colette Kress, Executive Vice President and Chief Financial Officer

"Blackwell’s manufacturing complexity temporarily impacts gross margins, but as we optimize production, we expect to return to mid-70% gross margins later this year."

Future Outlook

Jensen Huang, President and Chief Executive Officer

"We are at the start of the AI era. Multimodal AI, enterprise AI, sovereign AI, and physical AI are right around the corner. AI factories will define the next decade of computing."

"Going forward, data centers will dedicate most of their capital expenditures to accelerated computing and AI. Every company will have an AI factory, either rented or self-operated."

Thoughts on Nvidia Earnings Report $NVDA:

🟢 Positive

Q4 revenue hit $39.3B (+78% YoY, +12% QoQ), exceeding estimates by 4.3%

Data Center revenue soared to $35.6B (+93% YoY, +16% QoQ), driving overall growth

Automotive revenue surged +103% YoY to $570M, with expectations to reach $5B in fiscal 2026

EPS of $0.89 beat expectations by 6%

Net margin expanded to 56.2% (+0.6 PPs YoY), demonstrating strong profitability

Blackwell ramp exceeded forecasts, generating $11B in Q4 revenue

GeForce RTX 50 series launching in Q1 2026, set to drive gaming recovery

$8.1B returned to shareholders via buybacks and dividends

Q1 fiscal 2026 revenue guidance of $43B (+65% YoY) exceeded expectations by 3.1%

🟡 Neutral

Gross margins declined to 73% (-2.9 PPs YoY) due to Blackwell ramp impact

Operating margin at 61.1% (-0.5 PPs YoY) remains strong but slightly compressed

R&D spending down to 9.4% of revenue (-1.7 PPs YoY) as AI investment efficiencies improve

Gaming revenue fell to $2.54B (-11.2% YoY, -22% QoQ) due to supply constraints but expected to recover

China revenue at $5.53B (+184% YoY, 14.1% of total), but risks remain due to export controls

Free cash flow margin fell to 39.5% (-11.2 PPs YoY) despite strong overall earnings

🔴 Negative

Blackwell demand outpacing production capacity, requiring tight supply chain coordination across 350 sites

Export controls cut China’s data center revenue in half, shifting focus to Europe and North America

AI hyperscaler vs. enterprise demand balance remains a challenge as enterprises move toward on-prem AI factories

Gaming faced supply constraints, delaying GeForce shipments despite strong consumer demand

Manufacturing complexity of 1.5M components per system poses ongoing operational risks