NVDA Q3 2024 Earnings Analysis

Dive into $NVDA Nvidia’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$35.1B rev (+93.6% YoY, +122.4% LQ) beat est by 6.5%

↗️GM (74.6%, +0.6 PPs YoY)

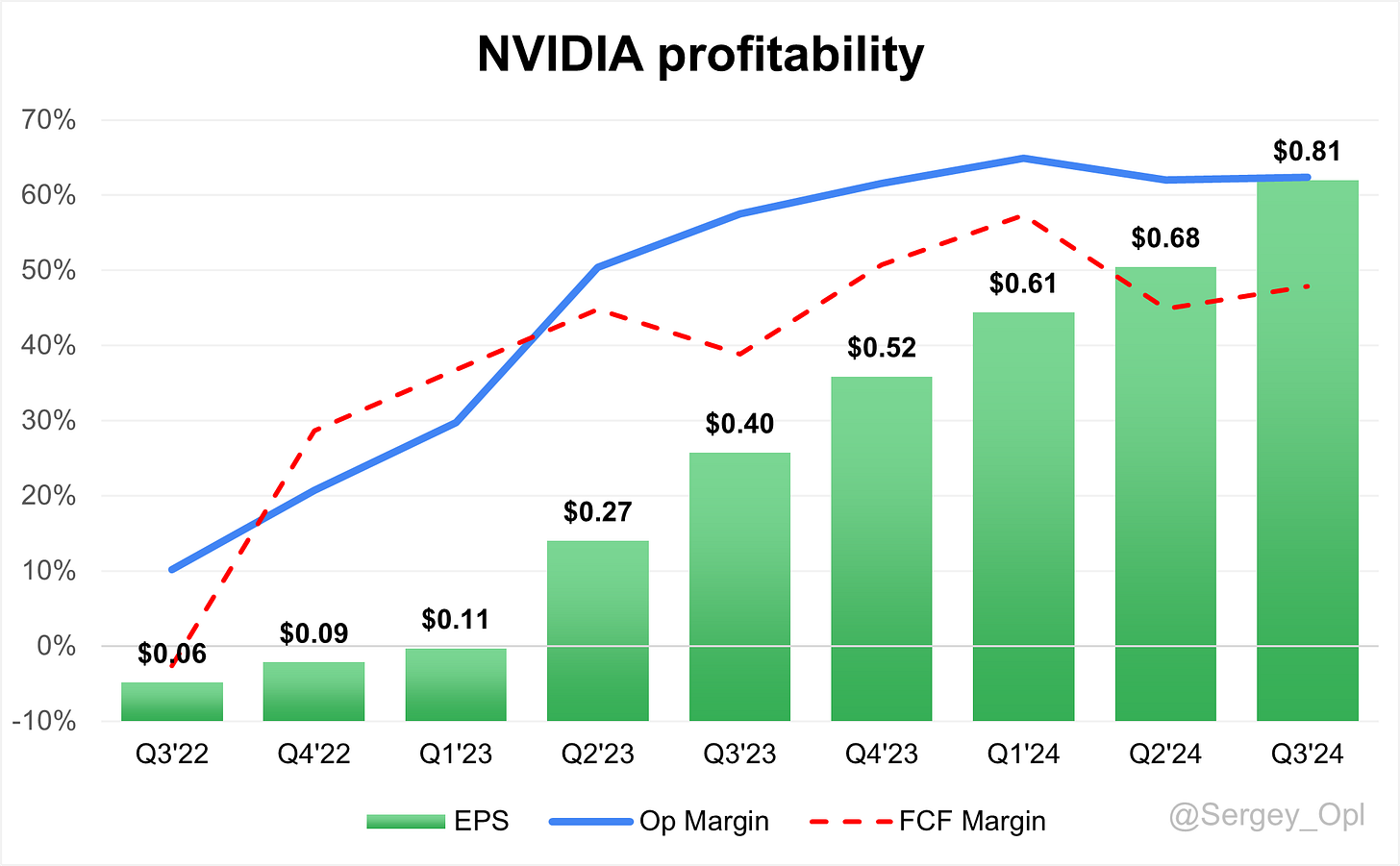

↗️Operating Margin (62.3%, +4.8 PPs YoY)

↗️FCF Margin (47.9%, +9.0 PPs YoY)

↗️Net Margin (55.0%, +4.0 PPs YoY)

↗️EPS $0.81 beat est by 9.5%🟢

Segment Revenue

↗️Data Center $30,771M rev (+112.0% YoY)

➡️Gaming $3,279M rev (+14.8% YoY)🟡

➡️Professional Visualization $486M rev (+16.8% YoY)🟡

➡️Auto $449M rev (+72.0% YoY)🟡

➡️OEM & Other $97M rev (+32.9% YoY)🟡

Operating expenses

↘️SG&A/Revenue 2.6% (-1.2 PPs YoY)

↘️R&D/Revenue 9.7% (-3.0 PPs YoY)

Dilution

↘️SBC/rev 4%, -0.3 PPs QoQ

↗️Basic shares down -0.6% YoY, +0.0 PPs QoQ🟢

↘️Diluted shares down -0.7% YoY, -0.1 PPs QoQ🟢

Guidance

↗️Q4'24 $37.5B guide (+69.7% YoY) beat est by 2.5%

Key points from Nvidia’s Third Quarter 2024 Earnings Call:

Financial Performance

NVIDIA achieved record-breaking Q3 revenue of $35.1 billion, a 17% sequential increase and a 94% YoY surge, surpassing its guidance of $32.5 billion. The data center segment contributed $30.8 billion, growing 112% YoY, while gaming revenue reached $3.3 billion, up 15% YoY. Non-GAAP gross margin stood at 75%, with expected moderation to the low 70s in early 2025. NVIDIA returned $11.2 billion to shareholders through buybacks and dividends.

Product Innovations

NVIDIA introduced GeForce RTX AI PCs, delivering up to 321 AI TOPS to power gaming, creative, and AI workflows. The Omniverse platform is enabling industrial AI through digital twins and automation, reducing Foxconn's Mexico facility energy usage by 30%.

NVIDIA Hopper H200

Hopper H200 GPUs saw exceptional demand, with sales doubling sequentially. The H200 offers 2x faster inference performance and a 50% reduction in TCO. Major CSPs, including AWS and Microsoft Azure, deployed Hopper at scale, making it the dominant platform for inference workloads. Performance optimizations boosted throughput by 5x over the year, with the upcoming NIM release projected to improve it by 2.4x.

Blackwell Architecture

Blackwell GPUs represent a 2.2x performance gain over Hopper and a 4x cost reduction in training models like GPT-3. Oracle is deploying over 131,000 Blackwell GPUs in the world’s first Zettascale AI cluster. Microsoft and Google Cloud are preparing to launch Blackwell-powered instances, with deployments expected to scale significantly in Q4.

NVIDIA Networking

Networking revenue increased 20% YoY, supported by a 3x YoY growth in AI-specific Ethernet deployments. The SpectrumX Ethernet platform maintained 95% data throughput for large-scale AI workloads, outperforming traditional Ethernet solutions. CSPs and supercomputing centers are rapidly adopting these systems.

Generative AI

Generative AI drove widespread adoption of NVIDIA infrastructure. NVIDIA AI Enterprise revenue doubled YoY to $1.5 billion, with a forecast to exit the year at $2 billion annualized. Startups and enterprises deployed multimodal AI models and co-pilot solutions, leveraging NVIDIA’s ecosystem.

NIM and NIM Agent Blueprints

NVIDIA NIM is set to enhance inference efficiency by 2.4x. Nearly 1,000 companies have adopted NIM to create AI agents for tailored workflows, fueling demand for NVIDIA AI Enterprise and foundational infrastructure.

Data Centers

NVIDIA’s data center revenue hit $30.8 billion, rising 17% sequentially and 112% YoY. Strong demand for Hopper GPUs and Blackwell’s initial deployments were key drivers. Regional cloud revenue doubled in North America, India, and Asia Pacific, supported by sovereign cloud and AI factory deployments. Blackwell offers significant advantages, including 2.2x performance gains and improved efficiency for power-limited data centers. Supply constraints remain a challenge, but partnerships with TSMC, SK Hynix, and Foxconn are scaling production.

Automotive

Automotive revenue reached a record $449 million, growing 30% sequentially and 72% YoY. NVIDIA Orin and DriveOS platforms powered next-generation autonomous vehicles for customers like Nio and XPeng. Simulation tools supported by Omniverse enabled faster prototyping. NVIDIA is expanding partnerships with automakers to meet increasing demand.

Gaming

Gaming revenue rose to $3.3 billion, driven by back-to-school demand and strong GeForce RTX GPU sales. The launch of RTX AI PCs marked a major innovation, delivering high performance for gaming and creative applications. NVIDIA expects supply constraints to ease in early 2025.

Professional Visualization

The professional visualization segment posted revenue of $486 million, up 7% sequentially and 17% YoY. RTX workstations remained the preferred choice for professionals, while generative AI applications drove additional demand. Omniverse adoption across industries accelerated workflows and enhanced productivity.

Robotics

NVIDIA’s robotics initiatives gained momentum, with Omniverse enabling AI-powered industrial applications. Foxconn’s adoption of digital twins optimized production and reduced energy usage by 30%. The use of reinforcement learning and synthetic data is driving innovation across industries.

China & Regulatory Compliance

NVIDIA’s export-compliant Hopper products supported sequential revenue growth in China, although levels remain below pre-regulation figures. Sovereign AI initiatives in India and Japan gained traction as countries prioritized domestic AI infrastructure.

Geographical Expansion

In India, CSPs like Tata Communications are deploying tens of thousands of NVIDIA GPUs, boosting GPU capacity tenfold by year-end. Japan is building its most powerful AI infrastructure with Blackwell GPUs. These efforts underscore NVIDIA’s focus on sovereign AI and regional cloud growth.

Strategic Partnerships

Partnerships with hyperscalers like Oracle, Microsoft, and Google Cloud are accelerating AI adoption. Accenture is training 30,000 professionals to deploy NVIDIA AI. Foxconn’s Omniverse adoption is improving operational efficiency.

Future Outlook

NVIDIA projects Q4 revenue of $37.5 billion (+/-2%), driven by Hopper and Blackwell demand. Gross margins are expected to recover to mid-70% levels by late 2025. The company remains confident in the modernization of $1 trillion in global data center infrastructure and generative AI’s potential to drive multi-trillion-dollar opportunities.

Management comments on the earnings call.

Product Innovations

Jensen Huang, President and Chief Executive Officer:

"Our ability to innovate at every level of computing, from AI PCs delivering up to 321 AI TOPS to platforms like Omniverse enabling industrial AI, is driving efficiencies and unlocking new opportunities across industries."

Blackwell

Colette Kress, Executive Vice President and Chief Financial Officer:

"As we ramp Blackwell with its seven custom chips and diverse configurations, our focus remains on meeting staggering demand while balancing initial gross margin pressure during this transition."

Generative AI

Jensen Huang, President and Chief Executive Officer:

"Generative AI is not just a new software capability but a new industry, with AI factories manufacturing digital intelligence and creating a multi-trillion-dollar market opportunity."

Data Centers

Jensen Huang, President and Chief Executive Officer:

"The $1 trillion worth of traditional data centers globally is undergoing modernization, transitioning from coding to machine learning to meet the demands of AI and generative workloads."

Geographical Expansion

Colette Kress, Executive Vice President and Chief Financial Officer:

"Our strategic investments in India and Japan are reshaping regional AI infrastructures, with tenfold GPU capacity growth in India and the deployment of Japan's most powerful AI supercomputers."

Strategic Partnerships

Jensen Huang, President and Chief Executive Officer:

"Collaborations with industry leaders like Oracle, Microsoft, and Accenture are enabling the rapid deployment of AI solutions across enterprises, accelerating innovation and adoption at scale."

International Growth

Colette Kress, Executive Vice President and Chief Financial Officer:

"With sovereign AI initiatives gaining momentum globally, we’re supporting countries in building localized AI infrastructures to meet their unique cultural and economic needs."

Challenges

Jensen Huang, President and Chief Executive Officer:

"While demand for Hopper and Blackwell far exceeds supply, we are scaling production through partnerships across the supply chain, ensuring we meet our customers’ needs efficiently."

Future Outlook

Colette Kress, Executive Vice President and Chief Financial Officer:

"We are confident in our ability to maintain strong growth as demand for AI infrastructure continues to rise, with a clear path to gross margin recovery and mid-70% levels by late 2025."

Thx! Good work! The graphics are great.