NVDA Q2 2024 Earnings Analysis

Dive into $NVDA Nvidia’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

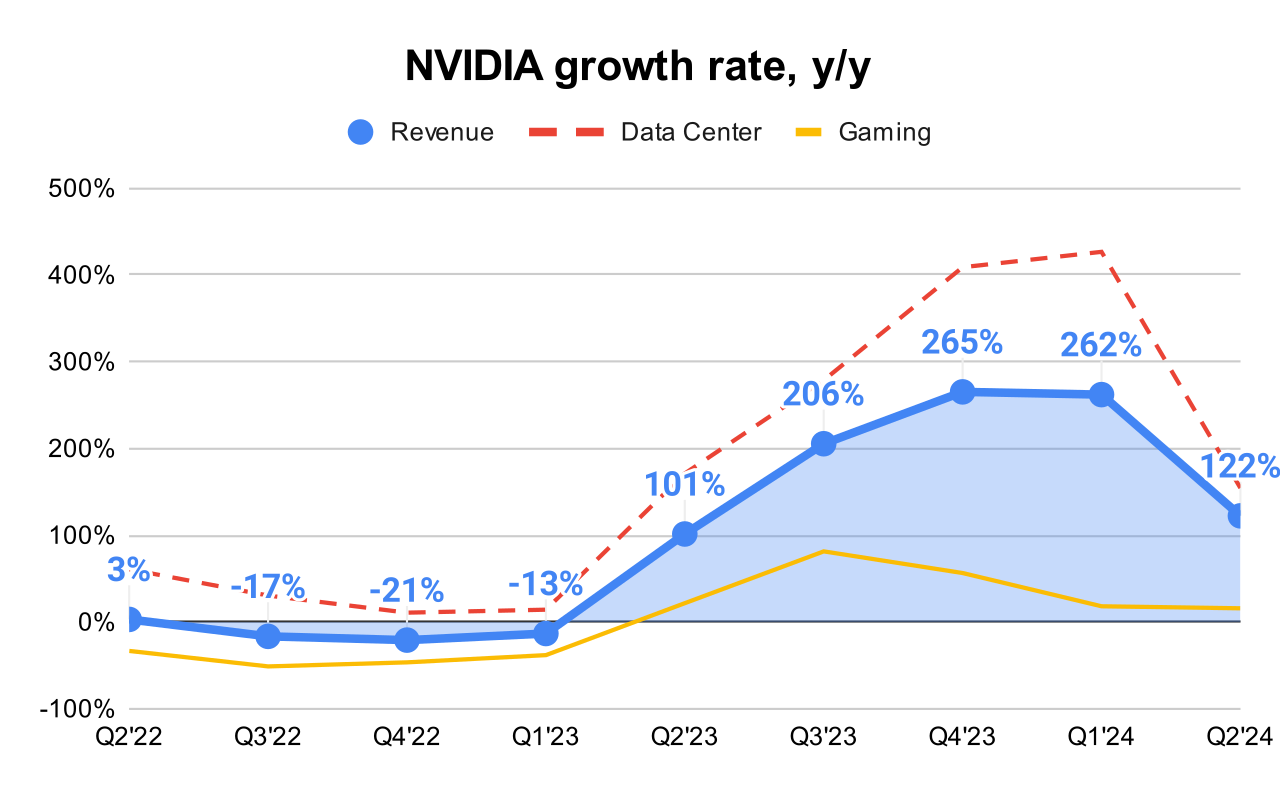

↗️$30.0B rev (+122.4% YoY, +262.1% LQ) beat est by 5.0%

↗️GM (75.1%, +5.1 PPs YoY)

↗️EBIT Margin (66.4%, +8.8 PPs YoY)

↗️FCF Margin (44.9%, +0.1 PPs YoY)

↗️Net Margin (55.3%, +9.4 PPs YoY)

↗️EPS $0.68 beat est by 6.3%🟢

Segment Revenue

↗️Data Center $26,272M rev (+154.5% YoY)

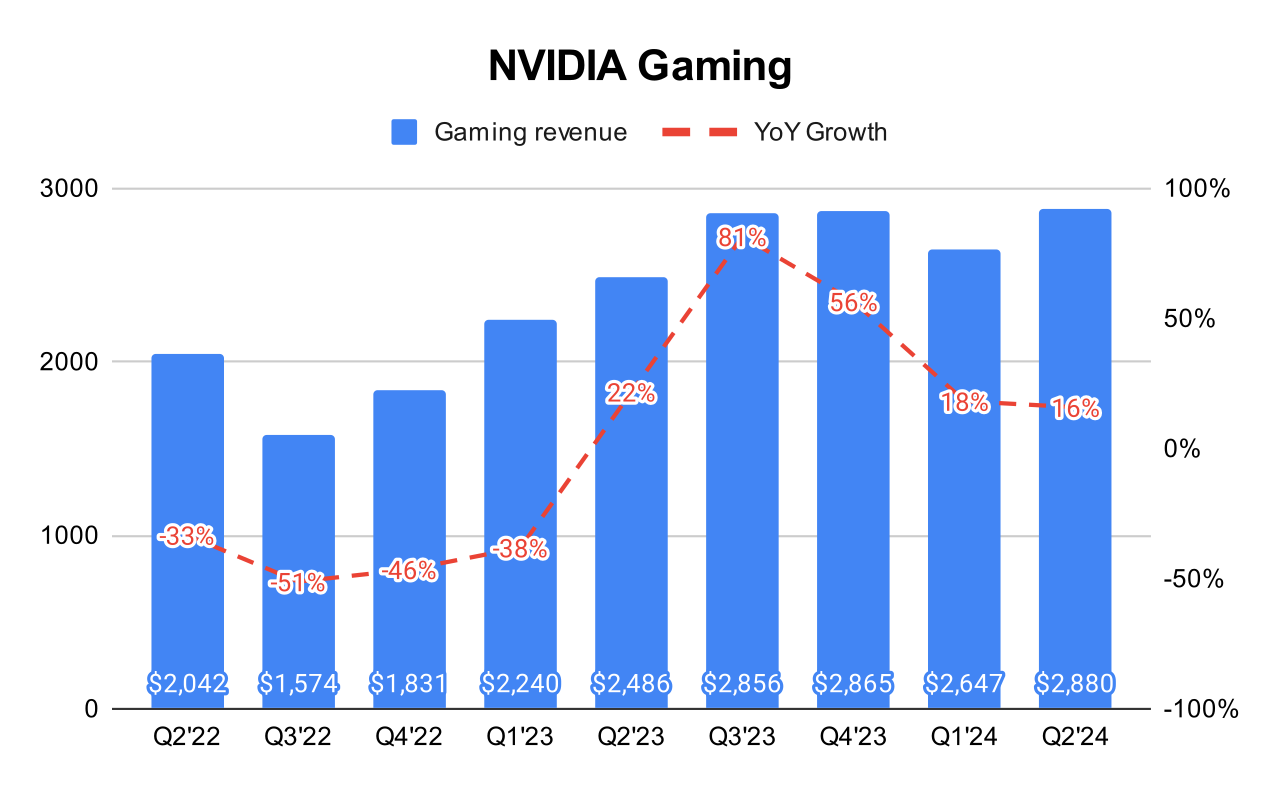

➡️Gaming $2,880M rev (+15.8% YoY)🟡

➡️Professional Visualization $454M rev (+19.8% YoY)🟡

➡️Auto $346M rev (+36.8% YoY)🟡

➡️OEM & Other $88M rev (+33.3% YoY)🟡

Operating expenses

↘️S&M+G&A/Revenue 2.8% (-1.8 PPs YoY)

↘️R&D/Revenue 10.3% (-4.8 PPs YoY)

Dilution

↘️SBC/rev 4%, 0.0 PPs QoQ

↘️Basic shares down -0.6% YoY, -0.3 PPs QoQ🟢

↘️Diluted shares down -0.6% YoY, -0.5 PPs QoQ🟢

Guidance

↗️Q3'24 $32.5B guide (+79.4% YoY) beat est by 2.8%

Key points from NVIDIA’s Second Quarter 2024 Earnings Call:

Financial Performance:

NVIDIA reported a record revenue of $30 billion for Q2, marking a 122% year-on-year increase. This performance was driven by strong demand across various sectors, particularly in their data center segment.

Data Centers:

Compute revenue grew more than 2.5 times year-on-year, and networking revenue also saw a significant increase.

The growth in data center revenue was largely driven by key workloads including generative AI, model training, inferencing, and AI-driven data pre and post-processing.

Automotive:

Automotive was a key growth sector this quarter, with revenue up 37% year-on-year.

There is increased demand for AI cockpit solutions, which are being integrated more extensively across various automotive applications.

Gaming:

Every PC equipped with RTX is considered an AI PC. RTX PCs can deliver up to 1,300 AI TOPS, supporting over 200 RTX AI laptop designs from leading PC manufacturers.

The GeForce NOW library continues to expand, now featuring over 2,000 titles, making it the cloud gaming service with the most content.

Professional Visualization and Robotics:

The growth in this sector is being driven by AI and graphic use cases, including model fine-tuning and Omniverse-related workloads, with automotive and manufacturing as key industry verticals.

Companies are racing to digitalize workflows to drive efficiency across operations. Notably, Foxconn is using NVIDIA Omniverse to power digital twins of physical plants producing NVIDIA Blackwell systems.

NVIDIA's Isaac Robotics platform is being used for a variety of robotic applications, including autonomous robot arms, humanoids, and mobile robots. Companies like Austin Dynamics, BYD Electronics, and Teradyne Robotics are integrating this technology into their development efforts.

Hopper Architecture:

The Hopper GPU architecture continued to drive NVIDIA's growth, particularly within the data center segment. The company reported strong demand for the Hopper architecture, supporting a range of AI workloads including generative AI, model training, and inferencing.

Product innovations

Blackwell Architecture:

Looking forward, NVIDIA is gearing up for the adoption of their new Blackwell architecture, which is expected to start production in the fourth quarter of fiscal 2025 and continue into fiscal year '26. The Blackwell architecture is anticipated to offer significant advancements over Hopper, with over 40% more memory bandwidth than its predecessor, H100. This new platform is designed to handle next-generation AI models that require 10 to 20 times more compute to train, addressing the rapidly growing demand for more powerful AI computing solutions.

AI and Networking Platforms:

NVIDIA’s advancements in AI and networking platforms are significant, with their Ethernet for AI revenue, which includes the Spectrum-X end-to-end Ethernet platform, doubling sequentially. The company highlighted the broad market support for Spectrum-X from OEM and ODM partners and its adoption by CSPs and GPU cloud providers.

NVIDIA H200 Platform:

The introduction of the NVIDIA H200 platform marks a significant development in NVIDIA's product offerings. This platform builds upon the strength of the Hopper architecture and began ramping in Q2, shipping to large CSPs, consumer Internet, and enterprise companies.

NVIDIA Networking:

The company's networking revenue increased by 16% sequentially, driven by its Ethernet for AI revenue and the adoption of its Spectrum-X platform. Spectrum-X is designed to supercharge Ethernet for AI processing, delivering 1.6 times the performance of traditional Ethernet.

NIM and NIM Agent Blueprints:

NVIDIA introduced NIM and NIM agent blueprints, which are a catalog of customizable reference applications that include a full suite of software for building and deploying enterprise generative AI applications.

Geographical Expansion:

While there was a sequential decline in the United States, revenue from China and other Asian geographies increased significantly, indicating a strong market presence and growth in these regions.

Future Outlook:

NVIDIA plans to ramp up the production of the Blackwell architecture in Q4 FY2025, which is expected to significantly impact data center growth.

NVIDIA anticipates strong demand for Blackwell will continue into the next year, underscoring a robust future growth trajectory for the company.

Management comments on the earnings call.

NVIDIA H200:

Colette Kress: "The NVIDIA H200 builds upon the strength of our Hopper architecture and offering, over 40% more memory bandwidth compared to the H100."

Data Centers:

Jensen Huang: "Demand for NVIDIA is coming from frontier model makers, consumer Internet services, and tens of thousands of companies and startups building generative AI applications for consumers, advertising, education, enterprise and healthcare, and robotics."

Automotive:

Colette Kress: "Automotive was a key growth driver for the quarter as every automaker developing autonomous vehicle technology is using NVIDIA in their data centers."

Gaming:

Colette Kress: "Gaming revenue of $2.88 billion increased 9% sequentially and 16% year-on-year. We saw sequential growth in console, notebook, and desktop revenue and demand is strong and growing and channel inventory remains healthy."

Future Outlook:

Jensen Huang: "Hopper shipments are expected to increase in the second half of fiscal 2025. Hopper supply and availability have improved. Demand for Blackwell platforms is well above supply, and we expect this to continue into next year."