Netflix Q4 2024 Earnings Analysis

Dive into $NFLX Netflix’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$10.247B rev (+16.0% YoY, +15.0% LQ) beat est by 1.2%

↗️GM (43.7%, +3.8 PPs YoY)

↗️EBIT Margin (22.2%, +5.2 PPs YoY)

↘️FCF Margin (13.4%, -4.5 PPs YoY)🟡

↗️Net Margin (18.2%, +7.6 PPs YoY)

↗️EPS $4.27 beat est by 1.4%

KPI

↗️301.6 Paid memberships at end of period (+15.9% YoY, +18.9 net additions)🟢

↗️8.5% Share of US TV Viewing, (+1 PPs YoY)

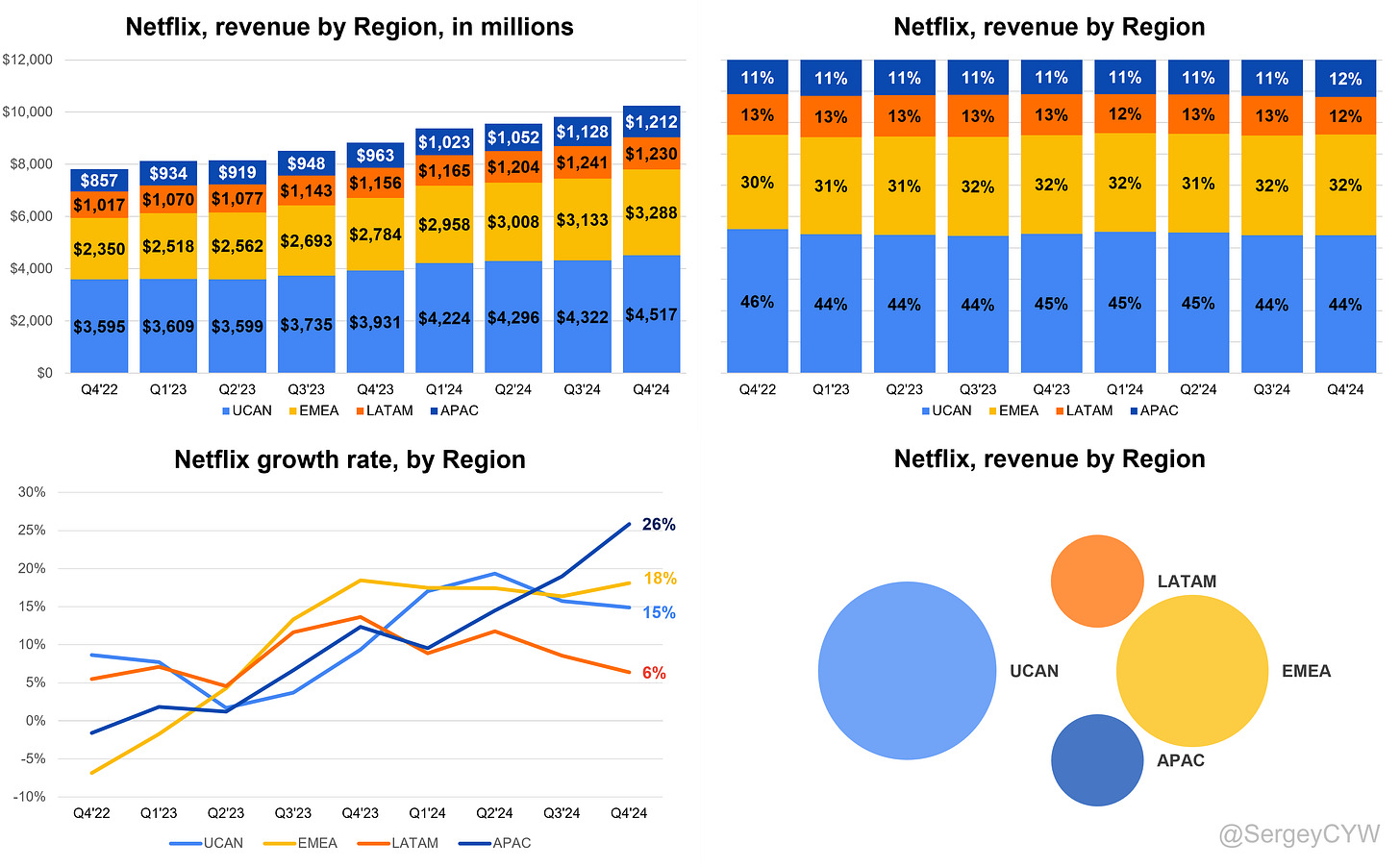

Regional Breakdown

UCAN

↘️$4.517B rev (+14.9% YoY, 44% of Rev)

↗️89.6 Paid memberships at end of period (+11.8% YoY, +4.8 net additions)

↗️$17.3M Average Revenue per Membership (+3.7% YoY)

EMEA

↗️$3.288B rev (+18.1% YoY, 32% of Rev)

➡️101.1 Paid memberships at end of period (+13.9% YoY, +5.0 net additions)

↗️$11.1M Average Revenue per Membership (+3.3% YoY)

LATAM

↘️$1.230B rev (+6.4% YoY, 12% of Rev)

↗️53.3 Paid memberships at end of period (+15.9% YoY, +4.1 net additions)

↘️$8.0M Average Revenue per Membership (-7.0% YoY)

APAC

↗️$1.212B rev (+25.9% YoY, 12% of Rev)

↗️57.5 Paid memberships at end of period (+26.9% YoY, +5 net additions)

↗️$7.3M Average Revenue per Membership (+0.4% YoY)

Operating expenses

↘️S&M/Revenue 9.5% (-0.9 PPs YoY)

↘️R&D/Revenue 7.6% (-0.0 PPs YoY)

↘️G&A/Revenue 4.4% (-0.5 PPs YoY)

Dilution

↗️Basic shares down -1.9% YoY, +1.1 PPs QoQ🟢

↗️Diluted shares down -1.5% YoY, +1.2 PPs QoQ🟢

Guidance

↘️$10.416B guide (+11.2% YoY) missed est by -1.5%🔴

Key points from Netflix’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Netflix reported an increase in cash content spending from $17 billion in 2024 to $18 billion projected for 2025. Revenue grew 12-14% YoY, while expenses rose 9%, supporting operating margin expansion. Advertising revenue doubled in 2024, with expectations to repeat this growth in 2025. Expense growth remains below revenue growth, ensuring disciplined resource allocation.

Product Innovations

Netflix is transitioning to a proprietary ad stack, launched in Canada in 2024, with a planned rollout across 12 markets, including the U.S., in April 2025. The shift improves targeting and monetization. In gaming, the platform introduced narrative-driven games, co-op family games, and licensed titles like Grand Theft Auto, driving growth in interactive content.

Wildfires

The Southern California wildfires caused no material impact on the 2025 cash content budget or production schedule. Netflix ensured project continuity and employee safety while supporting affected communities.

Live Events and Sports

Netflix hosted record-breaking NFL games, with 30-31 million average minute audiences. WWE Raw doubled its linear TV audience, attracting 5 million views in its first week. The platform acquired FIFA Women’s World Cup 2027 rights, expanding its live sports portfolio while avoiding full-season sports rights due to challenging economics.

Advertising

Ad-plan membership rose 30% QoQ in Q4 2024, representing 55% of new signups in ad-supported regions. Engagement for ad-plan members matched non-ad-plan members, reflecting strong customer retention. The proprietary ad stack supports ad revenue growth, which is projected to double again in 2025.

Content Production

Netflix is increasing investments in original programming, focusing on scripted series, regional productions, and licensing. Notable returning titles for 2025 include Stranger Things, Wednesday, and Squid Game. The Narnia IMAX release serves as a promotional event for the broader content strategy.

Pricing Strategy

Netflix's entry-level ad-supported plan starts at $7.99 in the U.S., ensuring affordability while supporting revenue growth. Upcoming high-profile releases in 2025 enable incremental price increases. Price adjustments are informed by engagement and retention data.

Video Games

Gaming highlights include Squid Game Unleashed, the platform’s most downloaded game, ranking No. 1 in 107 countries. The strategy includes narrative games, family-friendly options, and licensed titles. Gaming is positively influencing subscriber acquisition and retention, though its current financial contribution is modest.

Competing with Short-Form Video Platforms

Netflix differentiates with high-quality storytelling, attracting younger audiences through programming like Wednesday and Stranger Things. It uses social media for fan engagement and integrates creators from short-form platforms, such as Cobra Kai and Cocomelon.

Subscriber Growth

Netflix added 19 million new subscribers in Q4 2024. Broad-based growth across content categories and regions drove this increase. Events like NFL games and Jake Paul’s fight contributed, but diverse content was the primary driver. Retention metrics remain consistent with historical trends.

Engagement

Members watched an average of 2 hours daily in 2024, totaling 200 billion streaming hours annually. Netflix will release biannual engagement reports starting Q2 2025, improving transparency and tracking growth.

Global Expansion

Netflix is underpenetrated globally, capturing only 6% of its estimated revenue opportunity. Content investments prioritize regional programming, expanding market share in untapped regions and scaling ad-supported offerings.

Future Outlook

Netflix expects long-term growth by leveraging its 2025 content slate, disciplined spending, and advertising and gaming innovations. Focus remains on operating margin improvement and strategic investments in live events, gaming, and global content production.

Management comments on the earnings call.

Product Innovations

Greg Peters, Co-CEO

“We launched our ad tech platform in Canada, and that’s gone well. We’re testing, learning quickly, and preparing to roll it out across the rest of our 12 ad countries, starting with the U.S. in April 2025. This shift enables more flexibility for advertisers and drives increased sales while improving the buyer experience.”

Greg Peters, Co-CEO

“Our proprietary ad tech platform allows us to deliver enhanced targeting, leverage more data sources, and offer better measurement and reporting. It also creates a higher quality experience for our members, increasing relevance for them and value for advertisers.”

Live Events and Sports

Ted Sarandos, Co-CEO

“The NFL games were the two most streamed NFL games ever, with an average minute audience of 30 to 31 million. These events set a high bar for future live programming.”

Ted Sarandos, Co-CEO

“While sports are an important part of our live events strategy, full-season sports rights remain economically challenging. We’ll continue to explore opportunities where we can bring value to both us and the leagues.”

Advertising

Greg Peters, Co-CEO

“Our Q4 ads plan represented over 55% of sign-ups across our ads countries. Membership on ad-supported plans increased 30% quarter over quarter, and engagement metrics remain strong, with view hours similar to non-ads plans.”

Greg Peters, Co-CEO

“We exceeded our ad revenue target in Q4, doubling our ad revenue year over year. We expect to double it again this year, demonstrating solid progress and a clear runway for growth.”

Content Production

Ted Sarandos, Co-CEO

“Our 2025 content slate includes returning seasons of our biggest shows ever, such as Stranger Things, Wednesday, and Squid Game. We’re also working on Narnia with Greta, an exciting project that exemplifies our commitment to quality storytelling.”

Spence Neumann, CFO

“Our cash content spending will increase from $17 billion in 2024 to $18 billion in 2025. We are focusing on big scripted series, regional productions, and impactful licensing opportunities, all while maintaining disciplined financial management.”

Pricing Strategy

Greg Peters, Co-CEO

“Our pricing philosophy hasn’t changed. We continually provide more value to our members, and when we achieve that increase in value, we ask them to pay a bit more to keep the cycle going.”

Ted Sarandos, Co-CEO

“When you ask for a price increase, you must ensure you have the engagement to back it up. With our 2025 slate, including some of our biggest shows and movies ever, we’re confident we do.”

Video Games

Greg Peters, Co-CEO

“Squid Game Unleashed reached No. 1 in action games across 107 countries and is on pace to become our most downloaded game. This validates our approach to creating synergy between linear content and games.”

Greg Peters, Co-CEO

“Our strategy includes narrative games based on Netflix IP, party co-op games, and licensed titles like Grand Theft Auto. While gaming is still a modest investment compared to our overall budget, it is already showing positive impacts on acquisition and retention.”

Competitors

Ted Sarandos, Co-CEO

“We focus on professional, longer-form storytelling, which differentiates us from short-form platforms. Shows like Stranger Things and Wednesday attract younger audiences and dominate cultural conversations.”

Greg Peters, Co-CEO

“We see ourselves as a specific, differentiated player in the ecosystem, supporting creative partners and delivering great movies and TV shows with a unique user experience.”

Subscriber Growth

Greg Peters, Co-CEO

“Subscriber additions in Q4 were broad-based, driven by our diverse content portfolio across all regions. While events like NFL games and live fights brought in new members, the majority joined for our overall slate.”

Ted Sarandos, Co-CEO

“Retention behavior for new subscribers who joined for specific events was consistent with those who joined for other big titles, proving the value of our entire service.”

International Growth

Spence Neumann, CFO

“We are less than 50% penetrated into connected households globally and capture only 6% of the estimated revenue opportunity. Regional programming remains a priority as we expand our market share in untapped regions.”

Challenges

Spence Neumann, CFO

“We view hedging as a short- to medium-term solution to manage FX volatility. Our focus remains on the underlying operating results of the business through pricing and cost structure adjustments over time.”

Future Outlook

Spence Neumann, CFO

“There’s a long runway for growth. We align our cash content spending with revenue growth, investing in high-impact projects like scripted series, live events, and gaming, while maintaining disciplined expense management.”

Greg Peters, Co-CEO

“We expect sustained revenue growth, driven by our focus on engagement, quality programming, and the expansion of our advertising and gaming capabilities. We see clear paths for innovation and monetization in the years to come.”

Thoughts on Netflix Earnings Report $NFLX:

🟢 Positive

Revenue increased 12-14% YoY in 2024, with 9% expense growth, supporting operating margin expansion.

Advertising revenue doubled in 2024, with expectations to replicate this growth in 2025.

Netflix added 19 million subscribers in Q4 2024, driven by strong content performance and retention.

Cash content spending increased from $17 billion in 2024 to $18 billion projected for 2025.

Members streamed an average of 2 hours daily, totaling 200 billion hours annually.

Squid Game Unleashed ranked No. 1 in 107 countries, becoming Netflix's most downloaded game.

NFL games achieved 30-31 million average minute audiences, and WWE Raw attracted 5 million views in its first week.

Ad-plan memberships grew 30% QoQ, representing 55% of signups in ad-supported regions.

🟡 Neutral

Southern California wildfires caused no financial or production delays, though industry workers were affected.

Gaming contributed positively to retention but remains a minor part of overall financial impact.

Netflix competes with short-form platforms through professional storytelling and creator integration.

🔴 Negative

Full-season sports rights remain economically challenging, limiting Netflix's expansion into larger sports deals.

Global penetration is only 6% of the estimated revenue opportunity, indicating untapped growth potential.