Netflix Q3 2024 Earnings Analysis

Dive into $NFLX Netflix’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

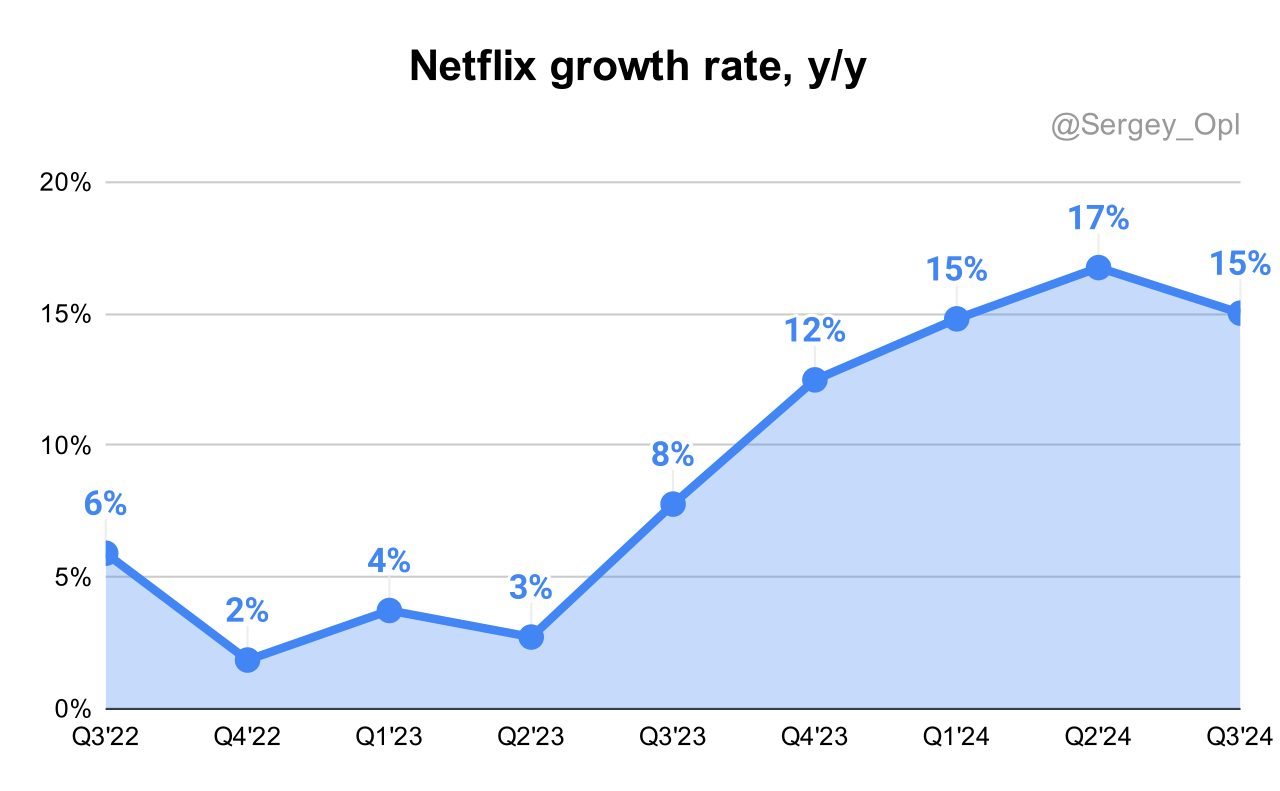

↗️$9.825B rev (+15.0% YoY, +16.8% LQ) beat est by 0.7%

↗️GM (47.9%, +5.6 PPs YoY)🟢

↗️EBIT Margin (29.6%, +7.2 PPs YoY)🟢

↗️FCF Margin (22.3%, +0.2 PPs YoY)

↗️Net Margin (24.1%, +4.4 PPs YoY)

↗️EPS $5.40 beat est by 5.7%🟢

KPI

➡️282.7 Paid memberships at end of period (+14.4% YoY, +5.1 net additions)

Regional Breakdown

UCAN

↗️$4.322B rev (+15.7% YoY, 44% of Rev)

➡️84.8 Paid memberships at end of period (+9.7% YoY, +0.7 net additions)

↗️$17.1M Average Revenue per Membership+4.7% YoY)

EMEA

↗️$3.133B rev (+16.3% YoY, 32% of Rev)

➡️96.1 Paid memberships at end of period (+14.8% YoY, +2.2 net additions)

↗️$11.0M Average Revenue per Membership+0.1% YoY)

LATAM

↘️$1.241B rev (+8.6% YoY, 13% of Rev)

↘️49.2 Paid memberships at end of period (+12.7% YoY, -0.07 net additions)

↘️$8.4M Average Revenue per Membership-5.1% YoY)

APAC

↗️$1.128B rev (+19.0% YoY, 11% of Rev)

➡️52.6 Paid memberships at end of period (+24.0% YoY, +2.3 net additions)

↘️$7.3M Average Revenue per Membership-4.1% YoY)

Operating expenses

↘️S&M/Revenue 6.5% (0.0 PPs YoY)

↘️R&D/Revenue 7.5% (-0.2 PPs YoY)

↘️G&A/Revenue 4.2% (-1.4 PPs YoY)

Dilution

↗️Basic shares down -3.0% YoY, +0.1 PPs QoQ🟢

↘️Diluted shares down -2.7% YoY, -0.1 PPs QoQ🟢

Guidance

↗️Q4'24 $10.128B guide (+14.7% YoY) beat est by 0.9%

Key points from Netflix’s Third Quarter 2024 Earnings Call:

Revenue Growth:

Netflix achieved a 9% year-over-year revenue growth in Q3 2024 in the Latin America (LatAm) region, despite temporary dampening of membership growth due to recent price adjustments. The company currently captures only 6-7% of the $600 billion consumer spend in the markets where it operates, signaling significant potential for future revenue growth.

Product Innovations:

Live Programming Expansion: Netflix is expanding into live programming, with upcoming events such as the Tyson Paul fight, NFL on Christmas Day, and WWE programming, which will feature 52 weeks of content starting in 2025.

Gaming: Netflix is making significant investments in gaming, introducing new titles based on Netflix IP (e.g., Squid Game, Virgin River) and classic games like Monument Valley 3. Gaming forms part of Netflix’s broader strategy to enhance its entertainment offering and provide additional value to subscribers, with the potential for incremental growth in the future.

Advertising: Netflix's ad-supported plans are making solid progress, with the ad-tier membership base growing 35% quarter-over-quarter. In Q3 2024, 50% of sign-ups in ad-supported countries were for the ad tier. Netflix is also developing its first-party ad server, which is expected to launch in Canada by the end of 2024, and globally in 2025. Partnerships with The Trade Desk and Google are helping to expand Netflix’s advertising capabilities.

Enhancing the User Experience: Netflix is refining its TV homepage to make it more intuitive and user-friendly. A broader rollout is expected in 2025, aimed at improving overall subscriber satisfaction.

Expanding Content Production:

Netflix continues to leverage over a decade of investments in global content production, creating original programming in more than 50 countries. This enables Netflix to appeal to its global audience of over 600 million people. The 2025 content slate is highly anticipated, featuring new seasons of popular series like Wednesday, Squid Game, and Stranger Things, along with new films such as a Knives Out sequel and Guillermo del Toro’s Frankenstein.

Engagement:

Netflix views engagement as a core metric of member satisfaction. The platform reported an average of 2 hours of viewing per member per day. Engagement remained stable in 2024, with total viewing hours increasing 1% year-over-year in the first half of the year. Netflix is confident in the health of its engagement metrics, particularly with the addition of live events and hit programming.

Pricing Strategy:

Netflix maintains a measured approach to pricing, raising prices only when it believes it is delivering greater value to members. This assessment is based on key indicators like engagement, acquisition, and retention. The company recently increased prices in regions including Scandinavia, Japan, and parts of Europe, and these adjustments have performed in line with expectations. Ad-supported tiers remain priced lower, with plans such as the $6.99 offering in the U.S. delivering excellent value with access to a wide range of content, including two streams and HD. Netflix has also phased out its Basic plan in several countries, including the UK, Canada, U.S., and France, to streamline the options for users.

Capital Allocation:

Netflix prioritizes reinvestment in its growth, while returning excess cash to shareholders through share buybacks. In early 2024, the company raised $1.8 billion in debt to refinance upcoming 2025 maturities and maintain flexibility on its balance sheet.

Global Expansion:

Netflix has been actively investing in original content from over 50 countries for more than a decade, demonstrating its commitment to global reach. The company plans to further build on this strategy in 2025 by continuing to create stories that resonate with a global audience. Recent successful releases from countries like Japan, Korea, Thailand, India, Brazil, and others reflect Netflix’s long-term investment in local creative communities. Upcoming titles such as "Cena" from Brazil, "100 Years of Solitude" from Colombia, and films from Mexico highlight Netflix’s focus on expanding its presence in Latin America and other emerging markets. Regional content will remain a key driver of future growth as Netflix continues to cater to local tastes and preferences.

Competitors:

Netflix identifies YouTube as a significant competitor, especially in vying for user attention on TV screens. However, Netflix emphasizes that its premium content model sets it apart from YouTube's user-generated content. Netflix's focus on high-quality storytelling and production is a core differentiator, providing a competitive advantage over YouTube.

In the broader streaming industry, many legacy media companies are relying on bundled services to boost growth. Netflix, however, remains committed to increasing value through its content offering rather than following a bundling strategy. While Netflix competes with various streaming platforms, its diverse portfolio of premium series, films, games, and live events positions it as a leading platform for high-quality entertainment.

Future Outlook:

Netflix projects continued strong growth into 2025, with expected revenues of $43-44 billion, representing an 11-13% year-over-year growth. This growth is expected to be driven primarily by membership growth and ARM (Average Revenue per Member) increases, alongside a more significant contribution from advertising.

The company’s strategy is to expand its core offering, continuing to invest in global content while exploring new initiatives such as live programming and gaming. These initiatives, along with Netflix’s commitment to global content production, will drive membership growth, particularly in underpenetrated regions. Netflix also sees a significant untapped market of hundreds of millions of non-members, providing substantial growth opportunities for the future.

Management comments on the earnings call.

Product Innovations:

"We've got initiatives like games. We're excited about games based on Netflix IPs. We've got a Squid Game game coming. We've got a Virgin River Christmas. We've got the Ultimatum. We've got games based on storied game classics like Monument Valley 3 that's coming out." – Ted Sarandos, Co-CEO.

"We're also expanding into live. We've got the Tyson Paul fight, NFL in December. We've got 52 weeks of WWE coming in January, John Mulaney, and more and more." – Greg Peters, Co-CEO.

"We tested a new, more intuitive version of our TV homepage. We're excited with the progress that we've seen there. So we're polishing it up and we're excited to bring that to our subscribers around the world." – Ted Sarandos, Co-CEO.

Competitors:

"We compete directly with YouTube for people's time, for the time they spend on that TV screen. But we have very different strengths. And we continue to invest in ambitious premium content to grow our share of engagement." – Ted Sarandos, Co-CEO.

"While YouTube and Netflix compete for time spent, we see ourselves as complementary in some ways. For instance, our trailers on YouTube drive viewership to Netflix, and both platforms provide value for creators." – Greg Peters, Co-CEO.

"We're seeing a lot of our competitors use bundles to find growth in their businesses. What we're focused on is adding more and more value to this package—amazing series, films, and now games—all at a remarkably low price, all in one place." – Greg Peters, Co-CEO.

Engagement:

"Engagement, which we view as our best proxy for member happiness, is strong. About 2 hours of viewing per member per day, and engagement on a per-owner household is up through the first three quarters of 2024." – Ted Sarandos, Co-CEO.

"We view engagement as super healthy. Total hours were up roughly 1% in the first half of the year compared to the same period last year, and we’re excited about adding even more live events to increase engagement." – Greg Peters, Co-CEO.

"Our ads plan members are watching a similar amount of view hours and similar titles compared to non-ads plan members, which shows how well the engagement is holding up." – Greg Peters, Co-CEO.

Challenges:

"It takes time to build these new initiatives to the point where they’re significant, given that we already have a fairly large core business." – Greg Peters, Co-CEO, on scaling new initiatives like gaming and advertising.

"The amount of margin growth each year will bounce around a bit based on the strategic opportunities in a given year, FX moves, and things like that, but we'll aim to increase each year." – Spence Newman, CFO.

"AI needs to pass a very important test. Can it help make better shows and films? That’s the key challenge, but we benefit greatly from improving the quality of content, much more so than making them a little cheaper." – Ted Sarandos, Co-CEO.