Financial Results:

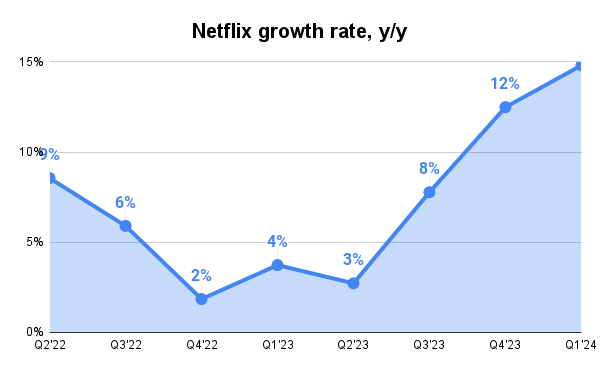

↗️$9.370B rev (+14.8% YoY, +12.5% LQ) beat est by 0.8%

↗️GM (46.9%, +5.7%pp YoY)🟢

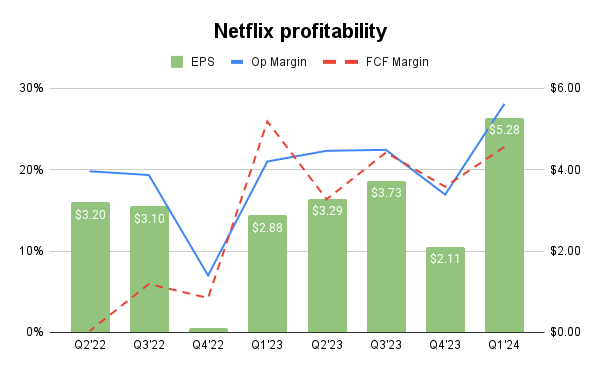

↗️EBIT Margin (28.1%, +7.1%pp YoY)🟢

↘️FCF Margin (22.8%, -3.1%pp YoY)

↗️Net Margin (24.9%, +8.9%pp YoY)🟢

↗️EPS $5.28 beat est by 16.3%🟢

KPI

➡️269.6 Paid memberships at end of period (+16.0% YoY, +9.3 net additions)

Operating expenses

↘️S&M/Revenue 7.0% (10.4% LQ)

↘️R&D/Revenue 7.5% (7.6% LQ)

↘️G&A/Revenue 4.3% (5.0% LQ)

Dilution

↘️Basic shares down -3.0% YoY, -0.9%pp QoQ🟢

↘️Diluted shares down -2.4% YoY, -0.8%pp QoQ🟢

Guidance

↘️Q2'24 $9.491B guide (+15.9% YoY) missed est by -0.4%🔴

Key points from Netflix’s First Quarter 2024 Earnings Call:

Shift in Reporting Metrics:

Netflix is planning to stop reporting quarterly membership and average revenue per member (ARM) data from 2025, focusing instead on revenue, operating income (OI), OI margin, net income, earnings per share (EPS), and free cash flow as their main metrics.

Membership and Revenue Growth:

Despite stopping the addition of new members two years ago, Netflix has seen significant improvements in membership growth, attributed to the consistent release of popular content across various formats, including films, series, and games. The company emphasizes that successful content drives member engagement, retention, and acquisition.

Engagement as a Key Metric:

Netflix maintains a strong focus on viewer engagement, reporting it biannually and considering it a primary indicator of member satisfaction and a predictor for retention and acquisition. High engagement is linked to higher revenue and profit, reinforcing the importance of delivering quality content.

Future Revenue and Subscription Guidance:

For the full year, Netflix expects revenue growth of 13% to 15%, with the potential for usual seasonal patterns affecting subscriber numbers.

Advertising Tier Strategy:

Netflix is actively working to scale its advertising tier, considering various strategies including partner bundles, pricing adjustments, and enhancing the viewing experience despite the presence of ads. The company aims to balance subscriber growth with ad monetization, leveraging its popular content and engaged user base to attract advertisers.

Sports Content Strategy:

While historically cautious about investing in sports content due to profitability concerns, Netflix is exploring opportunities that align with their goals for growth, engagement, and profitability. Their approach remains focused on profitable growth opportunities within the sports entertainment domain.

Use of Technology:

Netflix continues to integrate advanced technologies, such as machine learning, into its services for improving content recommendations and operational efficiencies.

Short-Form Video Consumption:

Netflix acknowledges the competitive impact from platforms like YouTube and TikTok. They see some short-form content as complementary, helping to boost fandom for Netflix shows, while recognizing that it also competes for viewer attention.

Financial Strategy:

Netflix has achieved an investment-grade status, which has slightly altered its capital allocation strategy, focusing on maintaining a healthy balance sheet while continuing to invest in content and technology to drive growth and return excess cash to shareholders through share repurchases.

Global Expansion and Localization:

Continued emphasis on local content to capture diverse markets worldwide, recognizing the importance of local relevance in programming to drive subscriber growth.

Management comments on the earnings call.

Product Innovations

Greg Peters: "We're excited to continue to evolve and develop our revenue model and add things like advertising and our extra member feature, things that aren't directly connected to a number of members."

Customers

Greg Peters: "So each incremental member has a different business impact. And all of that means that historical simple math that we all did, number of members times the monthly price is increasingly less accurate in capturing the state of the business."

Advertising

Greg Peters: "We've got much, much more to do in terms of scaling. We've got more to do in terms of effective go-to-market, more technical features, more ads products."

Sports Content

Ted Sarandos: "We believe that these kind of eventized cultural moments like the Jake Paul and Mike Tyson fight are just that kind of television that we want to be part of winning over those moments with our members as well."

YouTube and TikTok

Ted Sarandos: "Our version of short-form is more like giving our members the ability to watch 10 minutes of an episode of a series that they're binging right now if they only have 10 minutes."

Financial Strategy

Spence Neumann: "We're still going to have the same financial policies and principles in terms of prioritizing profitable growth by reinvesting in our core business, maintaining a healthy balance sheet with ample liquidity and returning excess cash beyond several billion dollars on the balance sheet of minimum cash and anything that we use for selective M&A to return to shareholders through share repurchase."

Global Expansion

Greg Peters: "We're lesser than 10% of TV share in every country in which we operate. There's still hundreds of millions of homes that are not Netflix members and we're just getting started on advertising."

Challenges

Ted Sarandos: "We're in the very early days of developing our live programming... But there's also something incredibly magic about folks gathering around the TV together in the living room to watch something all at the same time."