Netflix Q2 2024 Earnings Analysis

Dive into $NFLX Netflix’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

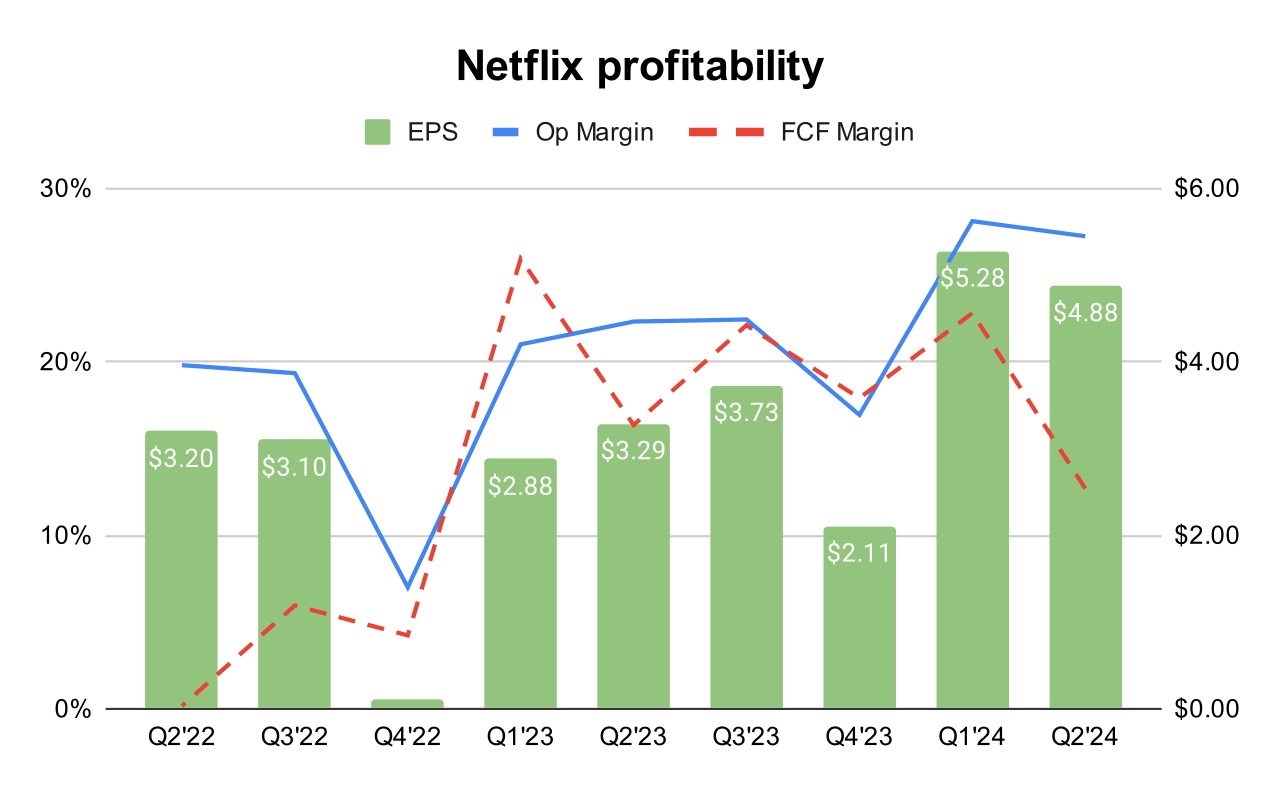

↗️$9.559B rev (+16.8% YoY, +14.8% LQ) beat est by 0.3%

↗️GM (45.9%, +3.0%pp YoY)

↗️EBIT Margin (27.2%, +4.9%pp YoY)

↘️FCF Margin (12.7%, -3.7%pp YoY)

↗️Net Margin (22.5%, +4.3%pp YoY)

↗️EPS $4.88 beat est by 2.7%

KPI

➡️277.6 Paid memberships at end of period (+16.5% YoY, +8.0 net additions)

↗️8.4% Share of US TV Viewing, +0.7pp YoY)

Regional Breakdown

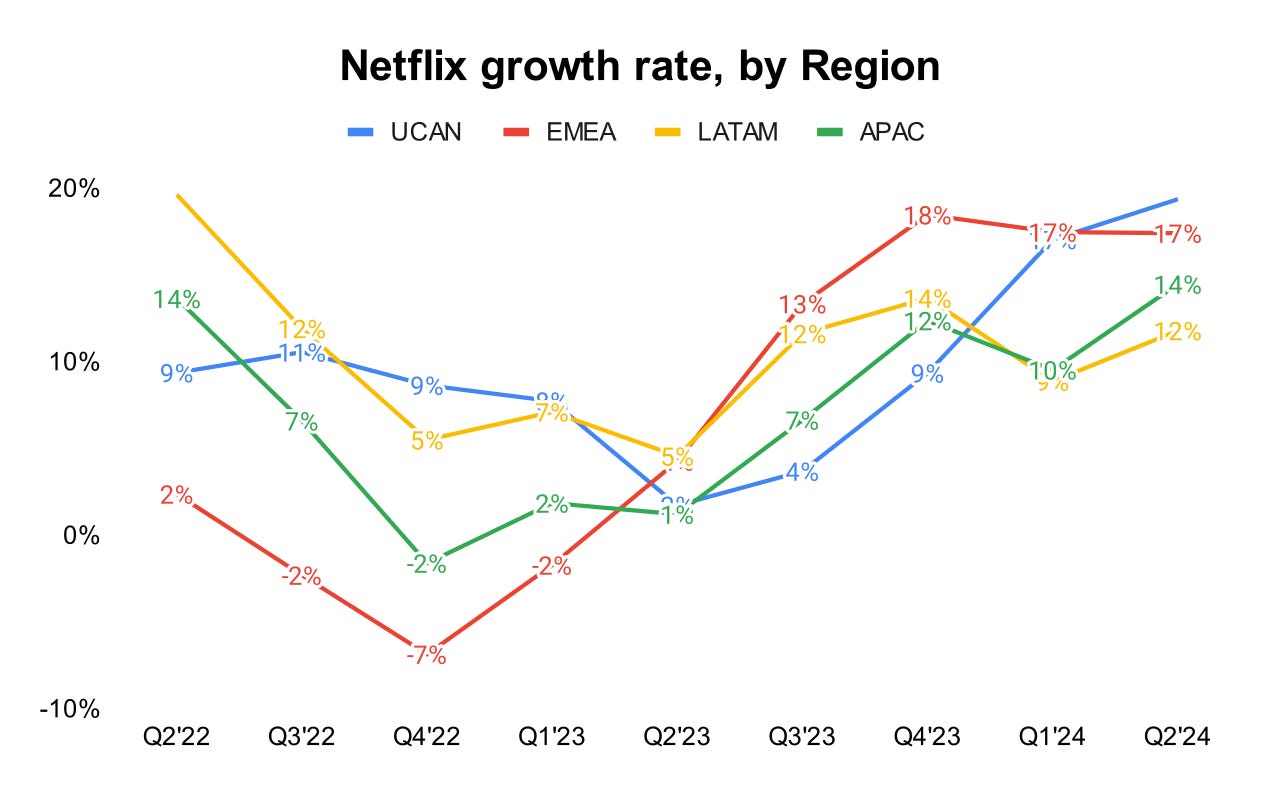

UCAN

↗️$4.296B rev (+19.4% YoY, 45% of Rev)

➡️84.1 Paid memberships at end of period (+11.3% YoY, +1.5 net additions)

↗️$17.2M Average Revenue per Membership+7.3% YoY)

EMEA

↗️$3.008B rev (+17.4% YoY, 31% of Rev)

➡️94.0 Paid memberships at end of period (+17.7% YoY, +2.2 net additions)

↘️$10.8M Average Revenue per Membership-0.6% YoY)

LATAM

↘️$1.204B rev (+11.8% YoY, 13% of Rev)

➡️49.3 Paid memberships at end of period (+16.0% YoY, +1.5 net additions)

↘️$8.3M Average Revenue per Membership-3.5% YoY)

APAC

↘️$1.052B rev (+14.5% YoY, 11% of Rev)

↗️50.3 Paid memberships at end of period (+24.1% YoY, +2.8 net additions)

↘️$7.2M Average Revenue per Membership-6.4% YoY)

Operating expenses

↘️S&M/Revenue 6.7% (7.0% LQ)

↘️R&D/Revenue 7.4% (7.5% LQ)

↗️G&A/Revenue 4.5% (4.3% LQ)

Dilution

↘️Basic shares down -3.1% YoY, -0.2%pp QoQ🟢

↘️Diluted shares down -2.6% YoY, -0.2%pp QoQ🟢

Guidance

↘️Q3'24 $9.727B guide (+13.9% YoY) missed est by -0.7%🔴

Key points from Netflix’s Second Quarter 2024 Earnings Call:

Membership and Revenue Growth

Netflix experienced strong performance with 17% reported revenue growth driven by increased subscriber numbers and profit growth.

Growth was attributed to the success of the content slate, effective implementation of paid sharing strategies, and attractive pricing for the ad-supported plan.

Operating income margins increased by 5 percentage points year-over-year, contributing to healthy profit growth.

Product and Platform Developments

Netflix plans the biggest update in a decade to its homepage to improve user experience and accommodate a wider array of content types, including games and live events.

The new structure aims to allow more flexible promotion and access to diverse content types, enhancing user navigation between different types of entertainment.

Engagement

Subscriber engagement remains robust, with growth even in segments not affected by paid sharing initiatives.

High-quality and diverse content offerings continue to drive subscriber engagement across various regions and demographics.

Advertising

While advertising is not a primary revenue driver yet, it is scaling up and expected to contribute significantly in the future.

Efforts are underway to improve direct sales capabilities and integrate more third-party demand sources to enhance ad revenue.

Global Expansion

Notable growth in India, driven by strong local content and successful series that resonated with the audience.

Success in various regions such as France, Spain, and Korea highlights the effectiveness of Netflix’s strategy to produce localized content that can also appeal globally.

Future Outlook

Netflix plans to continue its focus on creating diverse content that appeals to global audiences, including an exciting slate of upcoming series and movies.

Future growth strategies include expanding the ads business and scaling up gaming initiatives to enhance overall platform engagement and revenue.

Management comments on the earnings call.

Product Innovations

Greg Peters: "It's hard to know exactly at this moment how much benefit that new homepage will derive. It's more about creating a structure that allows us to evolve and advance more freely than the current structure does... We want to provide exactly the right discovery and choosing experience for different moments."

Greg Peters: "Our expectation is that this new structure will allow us to deliver as the old structure did for a decade, multiple repetitive material benefits to users in terms of engagement, which lead into retention and then revenue."

Customers

Ted Sarandos: "We're in live because our members love it and it drives a ton of engagement and excitement. And those two things are very valuable."

Engagement

Ted Sarandos: "Competition for entertainment is super intense... we also anticipated some headwinds in our engagement because of paid sharing... but now we look forward a quarter... that segment's engagement is actually not just steady, but up year-on-year."

Advertising

Greg Peters: "Our number-one priority, first priority is scale, so we've been heavily focused on that... We've been scaling our ads member base very quickly from zero two years ago to where we are today."

Global Expansion

Ted Sarandos: "We certainly compete with Hollywood to make the best and most popular programming in the world. But we're also doing that in India, in Spain, in France, in Italy, in Germany, in Korea and Japan, all over Southeast Asia and Mexico and Colombia."

Future Outlook

Greg Peters: "We've got years of work to do, but that's the line that we're moving forward with... bringing what has been amazing about digital advertising in terms of targeting relevance, measurement, etc., and what we think is amazing about TV advertising."

Ted Sarandos: "Our slate coming up is unbelievable... This week, we kicked-off the finale of Cobra Kai, which is going to blow your mind. August 8th, we've got the finale of Umbrella Academy kicking off and a brand-new series that we're also thrilled about."