My Stock Portfolio Review, November 2024

Portfolio Performance Overview and Key Stock Highlights

Hello, Investor,

Each month, I provide a transparent update on my portfolio performance, covering the latest news on core stock positions and analyzing recent developments across each holding.

For more frequent updates, follow me on X/Twitter @Sergey_Opl and on SavvyTrader for portfolio changes.

Portfolio Review

Holdings:

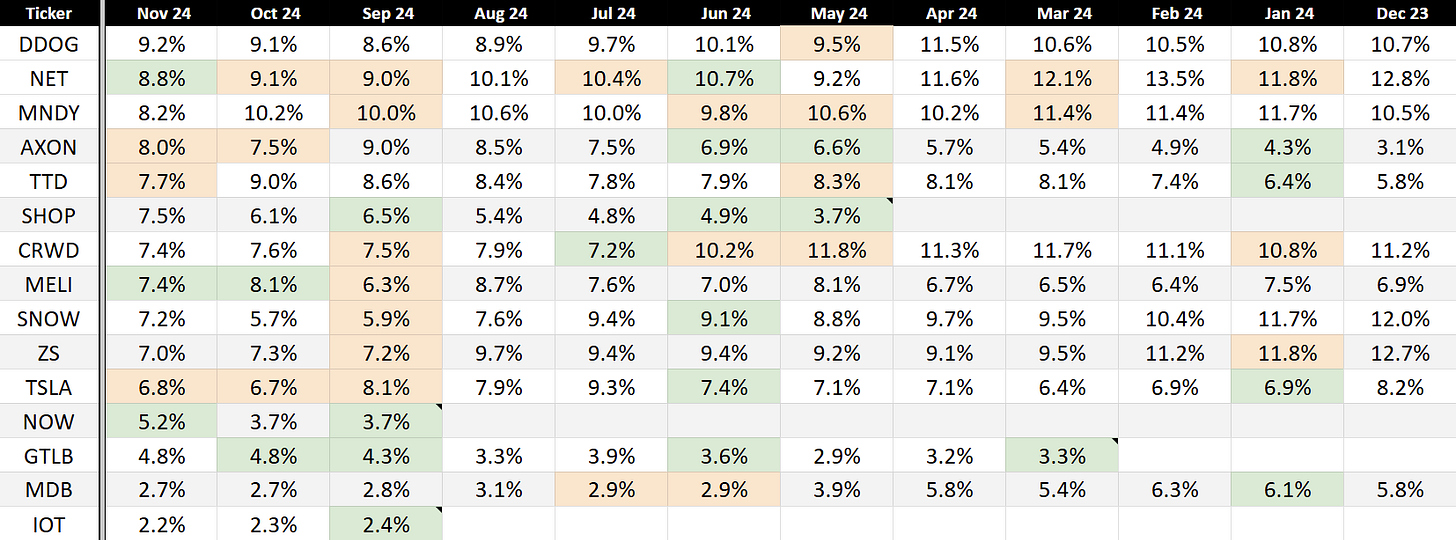

Monthly Allocations:

* green (added), orange (trimmed)

Performance (TWR):

Historical performance (TWR):

2020: +110.2%(since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

Cumulative: +120.7%

A recap of my portfolio in 2024

January:

⬇️ Trim ZS CRWD NET

⬆️Add TSLA TTD MDB AXON

March:

⬇️ Trim NET MNDY

✅ New position GTLB ~3.1% (after -23% on ER)

May:

⬇️ Trim CRWD MNDY DDOG TTD

⬆️ Add AXON

✅ New position SHOP ~3.2%

June:

⬇️ Trim CRWD MNDY MDB

⬆️ Add NET SNOW TSLA AXON SHOP GTLB

July:

⬇️ Trim NET MDB

⬆️ Add CRWD

September:

⬇️ Trim SNOW MELI TSLA NET MNDY ZS CRWD

⬆️ Add SHOP GTLB

✅ New NOW ~3.7%

✅ New IOT ~2.4%

October:

⬇️ Trim AXON NET TSLA

⬆️ Add MELI GTLB

November:

⬇️ Trim AXON TSLA TTD

⬆️ Add MELI NOW NET

I increased my position in $MELI by approximately 1%. On the trading day following its Q3 earnings report, the stock dropped by 16%, while the overall market rose. I believe this was an overreaction. The company’s report was strong. MercadoLibre faces challenges due to currency volatility in its key markets—Brazil, Mexico, and Argentina. However, it remains the market leader in Latin America and is strengthening its position. Mercado Pago's lending services are boosting customer acquisition and retention in the company's fintech and e-commerce sectors.

I increased my position in $NOW by 1.9%. Since opening my initial position, ServiceNow has reported two quarters, during which I’ve gradually added to my position. The Q3 earnings report was strong, and management provided a solid forecast for the next quarter. The company's revenue growth is accelerating, and margins are improving.

I slightly increased $NET by 0.2%. The stock dropped 6.5% after its earnings report. In my view, the Q3 report was solid; revenue growth is decelerating within expected limits as the company scales. I was impressed by the high RPO growth and the addition of new customers, which will likely positively impact revenue growth over the next few quarters.

I reduced my position in $AXON by 2%. After the Q3 report, the stock surged nearly 30%, so I decided to trim my position. Even before this stock increase, its valuation multiples were at historical highs.

I reduced my position in $TSLA by 0.9%. The stock has gained approximately 60% over the last month, which prompted a small position reduction.

I trimmed $TTD by 0.4%. The Trade Desk is trading at a high valuation even after a 9.8% decline following its earnings report. The company has a significant competitive advantage and excellent management, justifying a premium valuation. After this small reduction, TTD remains my second-largest position.

Most of my portfolio holdings have reported Q3 earnings. I can't identify any clear leaders, as each reported company has some issues. Therefore, I decided to achieve a more balanced allocation, so now the top 10 positions in my portfolio each account for between 7% and 8.6%.

Commentary on my holdings:

Cloudflare NET

The company reported its third quarter of 2024 results.

Thoughts on Cloudflare ER NET:

🟢Pros:

Revenue rose by +28.2% YoY. According to Q3 guidance, if the company beats the forecast by 1.4%, as it did in Q3, revenue growth in Q4 is expected to decline to 26.5% YoY.

RPOs are growing +36.7% YoY faster than revenue.

Company increasing margins and profitability.

Gross margin remains at a high level.

Strong number of total customers added: +11,374.

Record addition of 219 new $100K+ customers.

Visible results from changes in GTM (Go-To-Market) strategy, with CAC Payback Period decreasing to 19,5 months from 26,4 last quarter.

The SASE platform secured a strong $4.2 million contract.

Beat revenue guidance by 1.4%.

FY revenue growth guidance increased by 0.2%.

🟡Neutral:

Weighted-average number of common shares increased by 2.3% YoY.

Dollar-Based Net Retention (DBNR) decreased to 110%; management explains this decline was influenced by an increase in “pool of funds” contracts with large customers.

Stock-Based Compensation (SBC) as a percentage of revenue is 21%.

Billings growth is 24.2% YoY, which is slower than revenue growth.

Market Reaction to Earnings Release: The stock price declined by -6.5% following the earnings release.

The company slightly raised its full-year guidance, and the quarterly report overall was good. Cloudflare added a significant number of new customers, with RPO growth outpacing revenue growth. While billings growth was lower than revenue growth, it accelerated compared to the previous quarter. Management provided a rather weak revenue growth forecast for the next quarter, suggesting a slowdown. However, the growth in customer numbers and the outpacing RPO growth allow for optimism about beating the Q4 forecast.

The company achieved a record net new ARR in Q3 over the past two years, and the CAC payback period improved, indicating the successful restructuring of the sales team.

Cloudflare NET, has been named a Leader in the IDC MarketScape Worldwide Edge Delivery Services 2024 Vendor Assessment. The report highlights Cloudflare’s innovation in edge security, developer-focused tools, and advanced AI/ML technologies. Key strengths include its zero-trust security suite, customizable serverless developer platform, and focus on optimizing performance and reducing IT complexity. Cloudflare continues to empower organizations with secure, fast, and scalable solutions through one of the world’s largest interconnected networks.

Monday MNDY

The company reported its third quarter of 2024 results.

Thoughts on Monday.com ER MNDY :

🟢Pros:

Revenue accelerated to a +32.7% YoY growth rate. If the company beats its forecast by 1.6% as it did this quarter, next quarter's revenue growth will slightly decrease to 31.4%.

Dollar-Based Net Retention (DBNR) increased to 111% for all customers, 115% for $50K+ customers, and 115% for $100K+ customers, up by 1 percentage point sequentially.

Strong addition of $50K+ customers, exceeding the numbers from Q3 last year.

Record number of new CRM accounts added.

Net new ARR added +60 million (+10% YoY growth). Excluding the previous quarter, this is the highest net new ARR addition for the company.

Strong Free Cash Flow (FCF) margin of 32.8%.

Non-GAAP gross margin near a record level at 90.4%.

Full-year 2024 guidance increased by 0.5%.

The recent pricing increase added approximately $30 million in 2024 revenue, with an expected $80 million impact by 2026, driving higher-value acquisitions despite fewer new customer adds.

Introduced Monday Service - currently in beta.

🟡Neutral:

Operating expenses for S&M and G&A increased by 1 percentage point sequentially.

Beat Q3 revenue guidance by 1.6%, which is the smallest guidance beat for the company so far.

+431 new development accounts were added—higher than last year but below the previous two quarters. Management links the slower growth to a focus on larger accounts after introducing the new pricing model.

71 $100K+ customers added, on par with last year.

Billings grew 28.8%, slower than revenue growth.

Stock-Based Compensation (SBC) as a percentage of revenue is 14.0%, down by 1.5 percentage points sequentially.

Weighted-average number of common shares (basic) up by 3.3% YoY.

Market Reaction to Earnings Release: The stock price dropped by 14.7% following the earnings release.

The market was likely spooked by the negative GAAP net margin, weaker-than-usual guidance beat for Q3, and the in-line forecast for the next quarter. The negative net margin was due to a one-time charitable contribution to the foundation amounting to $24.208 million.

Overall, Monday’s report was solid. The company introduced new features for Monday CRM, including email marketing functionality. Monday services are currently in beta and will be fully launched by the end of 2024, along with some updates to Monday Dev. Management noted that Q2 results set a high bar with exceptionally strong performance, likely leading to an elevated forecast for Q3, which they ultimately beat by 1.6%, whereas they typically exceed forecasts by around 3%. Management also highlighted an increase in cross-sales of new products.

Customer additions were at a good level, but I would like to see stronger customer growth next quarter. I also hope to see a return to a 3% forecast beat and strong growth in new Monday CRM accounts. Net new ARR growth was lower than last quarter but 10% higher than last year. In the next quarter, I will be monitoring to ensure that YoY growth in net new ARR continues.

Datadog DDOG

Datadog has launched Kubernetes Active Remediation, an enhancement to its monitoring and security platform aimed at streamlining troubleshooting and remediation in Kubernetes environments. Key features include:

Automated Root-Cause Analysis: Provides actionable recommendations with full contextual data, automatically routed to the correct team.

Direct Repair Capabilities: Allows teams to trigger deployment patches directly within Datadog, based on common troubleshooting patterns.

Enhanced Troubleshooting Speed: Reduces time to detect and resolve issues, increasing efficiency for DevOps and security teams.

This new feature builds on Datadog's Kubernetes Autoscaling, enabling users to identify, understand, and resolve issues directly from Datadog’s unified platform.

The company reported its third quarter of 2024 results.

Thoughts on Datadog ER DDOG :

🟢Pros:

Revenue growth is stabilizing at +26.0% YoY. If the company beats the forecast by 3.9%, as it did in Q3, the growth in Q4 could reach 25.7%.

Dollar-Based Net Retention (DBNR) remains strong at ~115%.

The company is improving margins and profitability on a YoY basis.

Beat revenue guidance by 3.9% and raised the full-year forecast by 1.1%.

The percentage of customers using 6+ and 8+ products increased from the last quarter.

Net New ARR is growing 17.5% YoY.

Investment in R&D is higher than in S&M, indicating a strong focus on developing new products.

The management team was strengthened.

🔴Cons:

Billings are growing at 14% YoY, significantly below the rate of revenue growth.

🟡Neutral:

Gross Margin declined to 81.1% from 82.3% a year earlier.

Remaining Performance Obligations (RPO) grew by +25.5% YoY, which is slower than revenue. However, management noted that adjusted for contract duration changes, RPO growth would have been in the high 30% range. cRPO grew by 27-29%, meaning that adjusted RPO and cRPO growth exceeded revenue growth.

Only 510 new total customers were added, with +100 new >$100K customers; >$100K customers now make up 87% of the customer base. Since the company is focused on attracting large customers, a more important metric is the increase in customers using 6+ and 8+ products.

Weighted-average number of common shares is up 3.7% YoY.

Stock-Based Compensation (SBC) as a percentage of revenue is 21%.

Market Reaction to Earnings Release: The stock price increased by 3.5% following the earnings release.

Trade Desk TTD

The company reported its third quarter of 2024 results.

Thoughts on Trade Desk ER TTD :

🟢 Pros:

Customer retention remains above 95% for nine consecutive years.

Revenue growth rate accelerated to 27.4% YoY. If the company beats its forecast by 1.3%, as it did this quarter, next quarter’s growth is projected to be 26.8%.

The company is improving margins and profitability.

Beat Q3 revenue guidance by 1.3%.

Strong Free Cash Flow (FCF) margin of 35.3%.

The company is actively pursuing global expansion, with international growth outpacing North American growth for the seventh consecutive quarter.

The Trade Desk has strengthened partnerships with major retailers like Walmart and Target.

TTD has made significant advancements to the Kokai platform, integrating AI.

🟡 Neutral:

SBC/rev is 20%.

Weighted-average number of common shares increased by 0.4% YoY.

Market Reaction to Earnings Release: The stock price declined by 9.8% following the earnings release.

Despite the drop in stock price, TTD's quarterly report was strong. Revenue growth remains at a high level, and the forecast for the next quarter suggests that this growth will be sustained. The Trade Desk has strengthened partnerships with major retailers and is actively pursuing global expansion.

MercadoLibre MELI

The company reported its third quarter of 2024 results.

Thoughts on MercadoLibre Earnings Report:

Commercial Segment:

🟢 Pros:

The number of successful items sold on the Mercado Libre marketplace increased by 8% QoQ and +28% YoY.

Record number of Unique Marketplace Buyers added.

Commerce Take Rate significantly rose to 24.3%.

🟡 Neutral:

GMV growth slowed to +14% YoY, growing slower than revenue growth in the commercial segment.

Fintech Segment:

🟢 Pros:

TPV growth reached +34%, outpacing fintech revenue growth.

The fintech segment saw record growth in monthly active users.

Credit Portfolio reached a record growth of +76.8% YoY.

Non-performing loans (NPL) for credits are declining across all metrics.

The percentage of problematic credits (NPL >90 days) slightly decreased to 17.9%, down significantly from 20.3% a year earlier.

🟡 Neutral:

Fintech revenue growth slowed to 20% YoY and 3.3% sequentially. FX-neutral revenue growth was 81%, slightly slower than the previous quarter.

Overall business:

🟢 Pros:

MercadoLibre remains the leading e-commerce and fintech player in Latin America.

Revenue growth was +35.3% YoY, lower than the previous quarter's +41.5% but still at a high level. FX-neutral revenue growth was 102.7%, showing a slight slowdown.

Mercado Pago continues to drive growth in both Commercial and Fintech segments, making the company’s products stickier.

🟡 Neutral:

Dilution at 1.4% YoY.

Operating and Net margins decreased compared to last year.

Gross margin slightly declined compared to the last three quarters.

Revenue growth slowed in USD, but the FX-neutral revenue slowdown was significantly less, highlighting currency risks for the company due to currency devaluation in Argentina as well as fluctuations in key markets like Brazil and Mexico.

Market Reaction to Earnings Release: The stock price declined by 8% following the earnings release and fell an additional 16% after the end of the trading day.

The 16% drop in stock price the next trading day seems like an overreaction by the market. MercadoLibre's report was solid, although the company is facing pressure from currency instability in Latin American markets. This has led to a slowdown in revenue growth, which remains high. However, when looking at FX-neutral revenue growth, it appears stable.

Mercado Pago's lending initiative is an excellent strategy for attracting new users and increasing product stickiness. It's clear that the company is the leader in the Latin American market and is strengthening its leadership position. Because of this, I increased my position, although I acknowledge the geopolitical risks the company faces. Valuation based on multiples remains low.

Axon Enterprise AXON

The company reported its third quarter of 2024 results.

Thoughts on Axon Enterprise ER AXON:

🟢 Pros:

Revenue growth rate is +31.6% YoY. If the company beats its forecast by 3.4%, as it did this quarter, next quarter’s growth is projected to be 30.2%.

Full-year 2024 guidance was raised by 1.0%.

Dollar-Based Net Retention (DBNR) increased to 123%.

Annual Recurring Revenue (ARR) is growing at +36%, outpacing revenue growth.

Total company future contracted revenue is growing +32.5%, faster than revenue, though growth has slowed from +40% last quarter.

The company is improving margins and profitability.

Non-GAAP Gross Margin is strong at 63.2%, up from 62.1% in Q3 of last year.

Management noted that Draft One was very well received by customers, introducing the AI Era bundle centered around the Draft 1 transcription tool.

🟡 Neutral:

Axon Cloud revenue growth rate slowed to +37% YoY but remains strong and continues to outpace overall revenue growth.

Weak addition of net new ARR, with only +35 added, a -44% decrease YoY.

Stock-Based Compensation (SBC) as a percentage of revenue increased to 19%, up from 15% last quarter.

Weighted-average number of diluted common shares rose by 2.8% YoY.

Market Reaction to Earnings Release: The stock price increased by 10.9% following the earnings release and rose an additional 30% on the next trading day.

The quarterly report results greatly encouraged the market, and the stock price saw a significant increase.

For me, the company’s report was simply good. Growth in Axon Cloud is noticeably slowing, though it still remains high at +37% YoY and above overall revenue growth. The company showed weak net new ARR additions; I will be monitoring net new ARR additions next quarter. Growth in ARR and total company future contracted revenue has slowed, though it still slightly outpaces revenue growth.

On the positive side, management noted that Draft One was very well received by customers, DBNR (Dollar-Based Net Retention) increased to 123%, and growth in the TASER sector accelerated to +36.4% YoY, confirming that the new TASER 10 was well received by the market.

It’s worth noting that Axon has a strong competitive advantage, a very sticky product, a wide moat, and is working to maintain this moat. However, after the significant increase in stock price, the valuation based on multiples is at a historically high level for the company.

Crowdstrike CRWD

CrowdStrike CRWD has been named a Leader in the 2024 GigaOm Radar Report for Cloud-Native Application Protection Platforms (CNAPPs), with CrowdStrike Falcon Cloud Security achieving perfect 5/5 scores in API Security, Security Automation, Threat Hunting, Anomaly Detection, Scalability, Cost, and Compliance. The report highlights Falcon Cloud Security's strengths in comprehensive cloud protection, consolidating cloud security from code to cloud in a single unified platform to prevent cloud breaches. With advanced runtime protection, identity security, and scalability to manage trillions of events daily, Falcon Cloud Security provides complete hybrid cloud security across both cloud and on-prem environments, setting a high standard for visibility, threat detection, and response.

CrowdStrike announced its acquisition of Adaptive Shield, a leader in SaaS Security, positioning CrowdStrike as the only cybersecurity provider with unified end-to-end protection across the entire cloud ecosystem, from on-premises Active Directory to SaaS applications. This acquisition, revealed at Falcon Europe, strengthens CrowdStrike’s leadership in identity-based protection across complex hybrid environments.

With cloud exploitation and identity-based attacks rising, Adaptive Shield will enhance the CrowdStrike Falcon platform, providing comprehensive SaaS Security Posture Management (SSPM), GenAI Application Security Control, and unified hybrid identity and cloud security. This integration will grant customers visibility over SaaS applications, AI-integrated security, and full protection across hybrid cloud environments, accelerating detection and response across multiple security domains.

CrowdStrike has announced an expanded partnership with Ignition Technology, now bringing the CrowdStrike Falcon cybersecurity platform to Ignition's partner network in Ireland. Building on successful growth in the UK and Nordics, where regional partner business has surged over 85% year-over-year, this expansion aims to drive cybersecurity transformation and platform adoption across European businesses. Ignition will leverage its channel expertise and broad partner network to support unified, AI-native protection for enterprises in Ireland, addressing rising demand for streamlined and effective cybersecurity solutions.

CrowdStrike has launched its AI Red Team Services, aimed at securing AI systems like Large Language Models (LLMs) from emerging threats such as model tampering, data poisoning, and sensitive data exposure. Leveraging CrowdStrike’s threat intelligence and expertise in adversary tactics, this new service provides proactive vulnerability assessments, tailored adversarial attack simulations, and comprehensive security validation. By identifying vulnerabilities and mitigating risks, CrowdStrike’s AI Red Team Services ensure organizations can innovate with AI confidently and securely amidst an evolving threat landscape.

The company reported its third quarter of 2024 results.

Thoughts on CrowdStrike ER CRWD :

🟢 Pros:

Revenue rose by +28.5% YoY. If the company beats guidance in Q4 by 2.6%, as it did this quarter, revenue growth for Q4 will be 25.7%, indicating a deceleration in growth.

Billings and RPO increased by +35.4% and +45.9%, respectively, both outpacing revenue growth and accelerating compared to the previous quarter.

More customers are using additional modules, with adoption of 6+ and 7+ modules growing by +2pp QoQ.

Usage of 8+ modules reached 20% of subscription customers.

The company raised its FY revenue forecast by 0.7%.

Beat Q3 revenue guidance by 2.6%, marking the largest beat in the last two years.

Management noted that over half deals delayed from Q2 were closed in Q3.

🟡 Neutral:

ARR grew by +27.4%, below revenue growth.

Net New ARR added was weak at +153M (-31% YoY), impacted by the July 19 incident.

DBNR came in at 115%, down from approximately 120% earlier, temporarily impacted by the incident but reflecting customers' continued commitment to CrowdStrike. Gross retention remained strong at 97%, slightly down <0.5pp.

Non-GAAP gross margin remained flat YoY but declined compared to the previous quarter.

Operating margin declined YoY as the company increased S&M expenses to 33.3% of revenue.

Net margin turned negative due to July 19 incident-related costs of $33,922K. Without these costs, net margin would have been positive.

SBC/revenue was at 20.7%. Diluted shares increased by +0.7% YoY.

Market Reaction to Earnings Release: The stock price declined by -1.5% following the earnings release.

Overall, the quarterly report was strong, considering how severe the expected consequences of the incident were. It can now be said that management acted effectively, the company’s product proved sticky enough, and the impact was not catastrophic. However, the company will continue to feel the negative effects of the incident in subsequent quarters.

GAAP net income turned negative due to July 19 incident-related costs of $33.922M. Without these costs, the net margin would have been positive. The company achieved a record Q3 revenue guidance beat by 2.6%. Gross retention slightly declined by 0.5 percentage points but remained strong at 97%.

Net New ARR added was weak at +$153M (-31% YoY). However, if the company similarly beats its Q4 forecast, Net New ARR growth would reach $265M, which would be nearly a record for the company.

Zscaler ZS

Zscaler's New Zero Trust Segmentation Solution

Zscaler, announced Zero Trust Segmentation solution, designed to securely connect users, devices, and workloads across branches, factories, campuses, data centers, and public clouds without relying on traditional firewalls, SD-WAN, or VPNs. By segmenting devices and workloads, Zscaler minimizes ransomware spread, simplifies network infrastructure, and reduces costs by up to 50%.

The solution replaces complex security architectures with Zscaler's Zero Trust Exchange platform, which enforces business policies and secures communications across distributed locations. It enhances security for IoT and OT devices in branch and factory environments and eliminates firewall dependency in multi-cloud data centers, supporting AWS and Azure, with GCP support expected in February 2025.

Shopify SHOP

The company reported its third quarter of 2024 results.

Thoughts on Shopify ER SHOP:

🟢 Pros:

Revenue growth rate at 26.1% YoY. If the company beats the forecast similarly to this quarter by 3.0%, growth could accelerate to 28.2% next quarter.

The company is increasing margins and profitability on YoY basics and sequentially.

Beat Q3 revenue guidance by 3.0%.

Gross Merchandise Volume (GMV) growing at 24% YoY, and Gross Payment Volume (GPV) is growing 31% YoY, accelerating compared to last quarter. GPV is growing faster than revenue.

Merchant solutions revenue growing at 26.4%, a significant acceleration from the 18.6% growth last quarter, with a solid gross margin of 40%.

🟡 Neutral:

Subscription solutions revenue has slightly decelerated to 25.5%, with a gross margin close to a record level of 82.3%.

SBC/rev is 5%.

Diluted shares are up 0.4% YoY.

Market Reaction to Earnings Release: The stock price increased by 20% following the earnings release.

The market's reaction to the company's report was very optimistic. I didn't make any changes to my position in SHOP, as I had previously increased it, believing the stock price to be fair. The company significantly beat its Q3 forecast, and revenue growth is likely to continue accelerating in Q4. Merchant Solutions revenue growth accelerated to 26.4% YoY. The company's report was strong.

Improvements were noticeable across all key metrics compared to the previous quarter: acceleration in GMV, GPV, and MRR growth, while the attach rate increased to a record 3.1% over the past two years.

Snowflake SNOW

Snowflake unveiled Unistore at its BUILD 2024 conference, a unified platform combining transactional and analytical data powered by Hybrid Tables (now generally available on AWS). This innovation allows organizations to consolidate data, improving performance, security, and governance without needing separate transactional and analytical databases. Hybrid Tables enable fast, high-concurrency operations, supporting real-time insights and diverse applications such as:

State Management: Real-time application state maintenance.

Data Serving: Low-latency data access without database switching.

Lightweight Transactional Apps: Simplifies app development and architecture.

Key customers like careviso, Gatehouse Bio, and Mutual of Omaha praised Hybrid Tables for streamlining operations, reducing costs, and enabling faster, more reliable insights across industries.

Snowflake announced advancements to enable enterprises to bring trustworthy, efficient AI to production within their data cloud.

Key updates include:

Conversational AI Development: New tools in Snowflake Cortex AI allow companies to build reliable, multimodal conversational apps with high accuracy and reduced manual integration.

LLM Batch Inference for NLP: Batch processing with large language models (LLMs) supports scalable NLP, offering more customization options for cost-effective, high-performance data processing.

Custom Model Training: GPU-powered containers in Snowflake ML allow teams to train and deploy models more efficiently using any Python framework, with support for both CPUs and GPUs.

Enhanced Monitoring and Explainability: New observability features and model explainability allow users to monitor AI model performance and understand the influence of each data feature on model outcomes.

These innovations aim to streamline AI development, reduce costs, and ensure that enterprises maintain security and trust in their AI operations.

Snowflake announced new innovations that enhance cross-cloud collaboration, enabling secure sharing of data, AI models, and apps within and between organizations.

Key features include:

Internal Marketplace: Allows teams to securely share data and AI products internally, streamlining collaboration and reducing data duplication.

Snowflake Native App Framework: Supports faster app development and deployment across clouds, with enhanced security and governance.

Snowpark ML Modeling API and Secure Model Sharing: Enables model development and secure sharing directly within Snowflake, using popular Python frameworks.

Egress Cost Optimizer: Reduces cross-region data-sharing costs for developers, maximizing resource allocation.

These advancements aim to simplify AI app development, enhance data collaboration, and ensure secure, compliant data handling across Snowflake’s AI Data Cloud.

Snowflake SNOW has announced its acquisition of Datavolo, an open data integration platform powered by Apache NiFi, to enhance its AI Data Cloud capabilities. This acquisition will:

Simplify Data Engineering: Integrate Datavolo's multimodal data pipeline technology to simplify and accelerate data engineering tasks, enabling seamless handling of structured and unstructured data.

Expand the Data Lifecycle: Strengthen Snowflake's position in the "bronze layer" of the data lifecycle by providing flexible, reusable data pipelines for batch and streaming data from various sources.

Support Open Standards: Maintain and grow the Apache NiFi open-source project while ensuring interoperability across cloud, on-premises, and hybrid environments.

Boost Public Sector Presence: Leverage Datavolo’s widespread use in federal organizations to expand Snowflake’s public sector business.

This acquisition aligns with Snowflake’s mission to simplify data processes, reduce costs, and enhance scalability for enterprise AI and machine learning applications.

The company reported its third quarter of 2024 results.

Thoughts on Snowflake ER SNOW:

🟢 Pros:

Revenue increased by +28.3% YoY. If the company exceeds its Q4 forecast by the same 5.3% as it did in Q3, revenue growth for Q4 could reach 29.6%, signaling a potential reversal of the slowing growth trend.

Strong DBNR (Dollar-Based Net Retention) stabilized at 127%.

Q3 revenue beat estimates by 5.3%.

FY guidance increased by 2.2%.

RPO growth accelerated to 54.1% YoY, outpacing revenue growth.

Total calculated billings growth increased to +30.9%, also exceeding revenue growth.

Record Net New ARR added: $284M, representing a +22% YoY growth.

Strong enterprise traction: +32 customers with $1M+ ARR were added.

R&D expenses now account for 23.8% of revenue, reflecting significant investment in future growth.

Record Marketplace Listings increased by +143, representing +26% YoY growth.

Data sharing adoption rose to 36%, an increase of 2 percentage points sequentially.

🟡 Neutral:

SBC (Stock-Based Compensation)/Revenue stands at 40%, with basic shares up 0.7% YoY.

A solid number of new customers were added (+369), roughly the same as last year (+370).

Product Gross Margin declined by 2 percentage points YoY but remained consistent with the previous quarter. The decline was attributed to GPU-related costs associated with enhancing the company’s AI functionalities.

Margins and profitability were impacted by higher operating expenses. Operating margin decreased from 9.8% to 6.25%.

Market Reaction to Earnings Release: The stock price increased by 19.8% following the earnings release.

The SNOW report was indeed strong. The company significantly exceeded its Q3 forecast, and if it similarly beats its Q4 forecast, revenue growth will accelerate, reversing the negative trend of slowing revenue growth. Net New ARR growth was +22% YoY. A significant number of large customers were added. Data sharing reached 36%, increasing by 2 percentage points sequentially, while +143 new Marketplace Listings were added. Although this is lower than the previous quarter, it remains a strong figure for the company.

Data sharing and Marketplace Listings are important metrics, as they demonstrate the strengthening of SNOW's network effect moat.

Mongodb MDB

MongoDB MDB has expanded its collaboration with Microsoft, introducing new capabilities to enhance AI and data solutions for joint customers:

Integration with Azure AI Foundry: MongoDB Atlas can now serve as a vector store for retrieval-augmented generation (RAG) applications, enabling businesses to combine proprietary data with advanced AI tools for chatbots, copilots, and enterprise apps.

Real-Time Insights with Microsoft Fabric: Open Mirroring syncs MongoDB Atlas data with Microsoft Fabric's OneLake in near real-time, enabling faster analytics, AI predictions, and business intelligence.

Flexibility with MongoDB Enterprise Advanced: Available on Azure Marketplace, it allows deployment across on-premises, multi-cloud, and hybrid Kubernetes environments, providing robust scalability and centralized management with Azure Arc.

This collaboration empowers customers to innovate with AI, synchronize data efficiently, and deploy applications across diverse environments. Early adopters, like Trimble and Eliassen Group, highlight the benefits of integrating MongoDB and Microsoft's tools to drive AI innovation and operational flexibility.

Samsara IOT

Samsara, revealed new product innovations at its "Go Beyond" conference in London, aiming to enhance operational visibility and insights with AI-powered solutions. Key updates include:

Connected Training: Provides data-driven, remote training for drivers, reducing safety incidents.

Low Bridge Strike Alerting: Alerts drivers of low bridges to avoid costly collisions.

Electronic Brake Performance Monitoring System (EBPMS): Helps fleets maintain brake standards in line with upcoming UK regulations.

Privacy Mode: Allows selective video recording while enabling real-time AI safety alerts.

Additionally, Samsara announced a strategic partnership with ACSS, integrating advanced camera solutions into its platform to provide 360° vehicle coverage, real-time cargo monitoring, and enhanced safety and visibility for fleet operators.

Veikul Achieves 60% Reduction in Fleet Accidents with Samsara Integration

Veikul, a mobility solutions company for independent workers and logistics services, has significantly improved road safety by reducing fleet accidents by 60% through Samsara’s Connected Operations Cloud. Key highlights:

Improved Safety: AI-powered dash cameras, telematics, and panic buttons enhance driver and vehicle monitoring, reducing accidents.

Cost Savings: Optimized maintenance and accident prevention have lowered operational costs.

Efficiency Boost: Streamlined fleet management and driver identification processes have increased operational efficiency.

Co-founder and CEO Sebastián Peña Laris emphasized Samsara’s scalability and ease of use as critical to Veikul’s success. The company plans to continue leveraging Samsara’s data for further improvements in safety, maintenance, and resource optimization.

Thank you for reading!

Follow me on X/Twitter for frequent updates on key news: @Sergey_Opl

For portfolio changes, follow me on SavvyTrader, where you'll find: current portfolio holdings, portfolio performance, trade alerts, and trade history.

Past recaps:

October 2024

September 2024

August 2024

July 2024

June 2024

May 2024

April 2024

March 2024

Disclaimer: This portfolio summary is for informational purposes only and not investment advice. Opinions are my own; please conduct your own due diligence.