My Stock Portfolio Review, May 2024

Portfolio Review

Holdings:

1. $CRWD 11.8%

2. $MNDY 10.6%

3. $DDOG 9.5%

4. $NET 9.2%

5. $ZS 9.2%

6. $SNOW 8.8%

7. $TTD 8.3%

8. $MELI 8.1%

9. $TSLA 7.1%

10. $AXON 6.6%

11. $MDB 3.9%

12. $SHOP 3.7%

13. $GTLB 2.9%

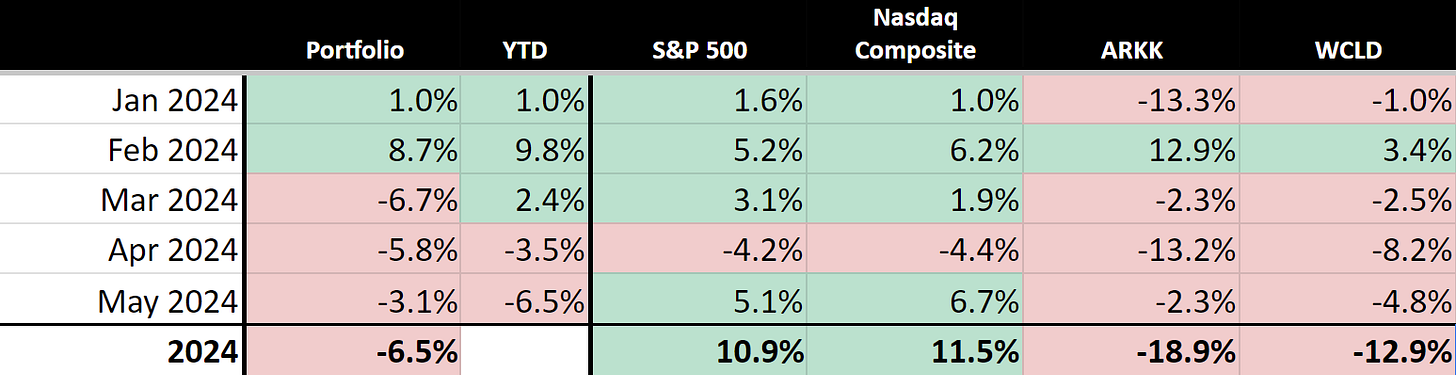

Monthly performance:

Monthly Allocations:

* green (added), orange (trimmed)

Historical performance (TWR):

2020: +110.2% (since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

Cumulative: +54.3%

A recap of my portfolio in 2024

January:

⬇️ Trim $ZS $CRWD $NET

⬆️Add $TSLA $TTD $MDB $AXON

March:

⬇️ Trim $NET $MNDY

✅ New position $GTLB ~3.1% (after -23% on ER)

May:

⬇️ Trim $CRWD $MNDY $DDOG $TTD

⬆️ Add $AXON

✅ New position $SHOP ~3.2%

I decided to add to my position in $AXON following the company's excellent quarterly report, with Axon Cloud accelerating to +51.5% YoY. The introduced "Draft One" could increase the stickiness of the company's product.

After a 20% drop in $SHOP's stock price post-earnings, I am considering opening a new position in my investment portfolio. The company is a leader in eCommerce and is strengthening its position by increasing investments in R&D. Also, the company's valuation after the stock price drop appears reasonable to me.

I slightly trim positions in $CRWD, $MNDY, and $TTD following the rise in their stock prices. $MNDY's stock value significantly increased by 20% after the earnings report, making the position larger in the portfolio than I would prefer. I also cut $DDOG by 1% as the decrease in RPO and less robust outlook for the next quarter concerned me, although $DDOG remains a substantial position in my portfolio.

Commentary on my holdings:

CrowdStrike CRWD 0.00%↑

CrowdStrike and Amazon AWS have deepened their partnership to enhance cloud security and drive AI innovations.

Amazon integrates CrowdStrike Falcon across its operations, providing end-to-end security from code to cloud.

CrowdStrike expands its use of AWS services, including Amazon Bedrock and AWS SageMaker, to pioneer advancements in cloud security and AI-driven cybersecurity solutions.

CrowdStrike's Charlotte AI, powered by AWS, is transforming how organizations manage cybersecurity, making complex processes quicker and more efficient.

AWS, being the largest cloud provider, significantly bolsters CrowdStrike's market position. Strengthening the partnership with Amazon represents a major strategic advancement for CrowdStrike.

CrowdStrike and Google Cloud Announce Strategic Partnership to Transform AI-Native Cybersecurity

CrowdStrike and Google Cloud have announced an expanded partnership to enhance cloud security, incorporating CrowdStrike's Falcon platform and Google Cloud's Security Operations platform into Mandiant’s Incident Response and Managed Detection services. This collaboration aims to offer comprehensive protection against modern cloud threats, integrating advanced AI and threat hunting capabilities to provide a robust security solution for multi-cloud and multi-vendor environments. The partnership signifies a significant development in cybersecurity, leveraging both companies' technologies and expertise to better protect customers from breaches.

CrowdStrike has expanded its partnerships with major cloud providers, including Google Cloud and Amazon AWS, further solidifying its position as a leader in the cybersecurity sector.

Cloudflare NET 0.00%↑

CrowdStrike and Cloudflare, have announced an expansion of their strategic partnership to enhance cybersecurity from device to network, aiming to accelerate Security Operations Center (SOC) transformations and stop breaches at scale.

This collaboration integrates Cloudflare’s Zero Trust protection and connectivity with CrowdStrike’s AI-native cybersecurity on the Falcon platform.

It addresses the complexity of managing multiple security tools and provides comprehensive protection across network, devices, endpoints, cloud, identity, data, and applications.

Cloudflare, has announced the acquisition of BastionZero, a Zero Trust infrastructure access platform, to enhance the remote access capabilities of its Cloudflare One SASE platform.

The integration of BastionZero will enable more secure, compliant, and controlled access for remote and hybrid IT teams, minimizing the risks associated with traditional VPN setups and providing just-in-time access permissions.

Cloudflare is enhancing its presence in the Zero Trust space through the acquisition of BastionZero and a collaboration with CrowdStrike.

The company reported its first quarter of 2024 results.

Thoughts on Cloudflare ER $NET:

🟢Pros:

+ Revenue rose by +30.5% YoY; according to Q2 guidance, revenue growth will stabilize

+ RPOs are growing +40% YoY faster than revenue

+ Company increasing margins and profitability

+ Gross margin in record level

+ Strong number of total customers added

+ 122 new $100k+ customers added, better than 1Q 2023 (+114)

+ DBNR stabilizing at 115%

+ GTM (Go-To-Market) strategy improvement (increased spending for S&M)

+ Zero Trust secured several strong contracts

🔴Cons:

- Diluted shares count rose by 4.2% YoY

🟡Neutral:

+- SBC/rev 20%

+- Billings are growing slower than revenue

+- FY revenue growth guidance hasn’t increased

Market Reaction to Earnings Release: Following the publication of the report, the company's stock price fell by 14%. The company is expensively valued and trades at high multiples, so the market reacted sharply to the lack of an upgraded forecast for the full year and only a slight beat in the next quarter's forecast. Additionally, the stock price had already factored in an acceleration of revenue growth from Google, Microsoft, and Amazon's cloud services, whereas Cloudflare reported a slowdown in revenue growth from 32% YoY in the previous quarter to 30.5% YoY.

The company added a record number of clients in Q1, with +122 new clients (compared to +114 in Q1 2023, +121 in Q1 2022, and +117 in Q1 2021), indicating robust growth in the total number of clients. The RPO grew significantly more than revenue, DBNR stabilized at 115%, and while billings growth was below revenue growth, both deferred revenue and RPO are growing much faster than revenue. These factors are supportive of the company's revenue growth moving forward and are viewed as positive.

Datadog DDOG 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Datadog ER $DDOG :

🟢Pros:

+ Revenue increased by +27% YoY, accelerating from 25.6% in last quarter.

+ DBNR remains strong at ~115%.

+ RPO grew by +52% YoY, much faster than revenue.

+ The company is increasing margins and profitability.

+ Beat revenue guidance by 3.4%.

+ The percentage of customers using 6+, and 8+ products increased from the last quarter.

+ Net New ARR is growing 76% YoY.

+ Investment in R&D is bigger than in S&M; the company pays great attention to the development of new products.

+ Strong customer growth (+150 >$100K customers); the share of >$100K clients now is 87%.

🔴Cons:

- Billings are growing 21% YoY, slower than revenue

- Diluted shares up 11.5% YoY

🟡Neutral:

+- Stock-Based Compensation (SBC)/revenue is 22%.

Market Reaction to Earnings Report: Following the publication of the report, the company's stock price fell by 11%. The company is highly valued and trades at elevated multiples, so the market reacted negatively when the forecast for the next quarter only met Wall Street analysts' expectations, leading to a decline in shares.

RPO Decline and cRPO Growth: There was a decrease in RPO due to fewer multi-year deals in the first quarter. The growth in cRPO was 40% YoY, consistent with the growth of the previous quarter. The revenue growth forecast for the next quarter is below the forecast for the same quarter a year earlier. However, considering a strong beat of 3.4%, revenue growth next quarter is expected to stabilize.

The share of clients contributing over $100k now stands at 87%, indicating that clients over $100k are no longer considered large for the company, as it focuses on attracting larger clients. Therefore, this metric has become less critical. Currently, it is more important to focus on the growth percentage of customers using products, with the share of customers using 6+ and 8+ products increasing. This metric is most vital for assessing the company's future growth potential.

Snowflake SNOW 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Snowflake ER $SNOW:

🟢Pros:

+ Revenue rose by +32.9% YoY, accelerated from 31.5% in the last quarter.

+ Net New ARR growth accelerated to +48% YoY.

+ Strong DBNR at 128%.

+ Beat Q4 revenue estimates by 5.3%; Snowflake confirmed that guidance was conservative.

+ FY guidance increased by 1.5%.

+ RPO growth increased to 47% YoY, growing faster than revenue.

+ For Q1, it was strong number new customers added (+385).

+ The company is implementing new products and increasing R&D spending; R&D expenses increased by +58% YoY as the company invests in future growth.

🟡Neutral:

+- SBC/rev at 43%, basic shares up 2.9% YoY.

+- Product Gross Margin down 1pp sequentially; the decline was attributed to GPU-related costs which improve the company’s AI functionalities.

+- Margins and profitability declined due to increases operating expenses.

+- Total calculated billings growth declined and is growing slower than revenue.

+- Weak number: +25 $1M+ ARR customers added.

Revenue Growth Acceleration: Revenue rose by +32.9% YoY, accelerated from 31.5% in the last quarter, beating Q4 revenue estimates by 5.3%, confirming that previous guidance was conservative. Overall, the quarterly report was strong, and the company continues to invest in its future growth.

Partnership between Snowflake and Microsoft: Snowflake and Microsoft are enhancing their partnership, driving greater interoperability through support for Apache Iceberg within Microsoft Fabric OneLake. This collaboration enables bidirectional data access, reducing the need for duplicate data and complex pipelines, and optimizing cost efficiency. Although Snowflake will lose 10% of revenue from storage and customers, with Iceberg, its customers now have the capability to process 100 times more data through SNOW, promising substantial future benefits.

Monday com MNDY 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Monday.com ER $MNDY :

🟢Pros:

+- Revenue increased by +33.6% YoY; next quarter's guidance indicates that revenue growth will accelerate

+ DBNR for $50k+ customers at 114%, for $100k+ customers at 113%; decreased 1pp sequentially but remains healthy

+ Strong number of total and $50k+ customers added

+ Record growth in CRM and development accounts

+ Record FCF margin

+ Beat Q1 revenue guidance by 2.8%

+ FY 2024 guidance increased by 1.7%

+ New Pricing Model starts well

+ New product, Monday Service (management is very excited about this new product), is going to launch towards the end of the year

🔴Cons:

- Diluted shares up 8.6% YoY

🟡Neutral:

+- SBC/rev at 12%, increased 1.2%pp sequentially

Market Reaction to Earnings Report: The stock rallied almost 20% following the earnings report. The company's quarterly report was indeed strong, with clients responding well to the new pricing model. There was robust growth in CRM and development accounts, as well as among large clients, suggesting that revenue growth will accelerate in the next quarter. Despite a competitive environment, the company feels confident and is strengthening its competitive position.

The Trade Desk TTD 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Trade Desk ER $TTD :

🟢 Pros:

+ Customer retention remains above 95% for 9 consecutive years.

+ Revenue growth rate accelerating to 28.2% YoY

+ The company is increasing margins and profitability, EBITDA Margin +4.5pp YoY

+ Beat Q1 revenue guidance by 2.7%.

+ Strong FCF margin at 35%

+ Basic shares down 0.2% YoY

+ The company is actively pursuing Global Expansion, international revenue growth outpacing that of North America

+ This political season is expected to generate substantial advertising revenue

+ The Trade Desk has formed strategic partnerships with CTV providers: Disney, NBCU, and Roku

+ AI-driven platform, Kokai, has received significant enhancements

🟡 Neutral:

+- SBC/rev is 23%

Market Reaction to Earnings Report: The response to the earnings report was positive. The company's quarterly report was genuinely strong. The tone from management during the conference call was optimistic. Revenue growth has accelerated, with the company increasing margins and profitability. The Trade Desk has formed strategic partnerships with CTV providers including Disney, NBCU, and Roku.

Future Outlook for CTV Ad Spend: US Connected TV (CTV) advertising spending is expected to continue growing from 2024 through 2027, with The Trade Desk poised to be one of the larger beneficiaries of this long-term tailwind.

MercadoLibre MELI 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on MercadoLibre Earnings Report $MELI:

🟢 Pros:

+ MercadoLibre remains the preeminent e-commerce and fintech player in Latin America

+ Revenue increased by +42.7% YoY, accelerating from the previous quarter's +41.7%

+ Strong FCF margin

+ Both commerce and fintech revenues showed acceleration

+ The take rates for commerce and fintech increased from the previous quarter

+ The fintech segment experienced strong growth in monthly active users

+ Credits NPL >90 is declining

🔴 Cons:

- High currency risks and the credit portfolio may become problematic (inflation in Argentina)

- GMV declined -16% QoQ

🟡 Neutral:

+- Dilution at 0.9% YoY

+- The number of successful items sold on the Mercado Libre marketplace decreased by 7% QoQ, and the number of marketplace buyers also declined, indicating a greater seasonal effect than in Q1 2023

+- Gross margin slightly decreased from Q1 2023 due to higher rates but showed a slight improvement from the previous quarter

Market Reaction to Earnings Report: The stock rose by +8%. The company exceeded Wall Street estimates by 11.7%. MercadoLibre remains the top e-commerce and fintech player in Latin America. Issues noted in the quarterly report are primarily related to inflation in Argentina. However, in all other areas, the company is demonstrating exceptionally strong results. MercadoLibre faces high currency risks, and its credit portfolio could also pose problems in the form of non-performing loans amid worsening macroeconomic conditions in Latin America. Due to these risks, the exposure to this stock in the portfolio is limited.

Shopify SHOP 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Shopify ER $SHOP :

🟢 Pros:

+ Revenue growth rate stabilizing at 23.4% YoY (adj Rev growth at 29% YoY)

+ The company is increasing margins and profitability on YoY basics

+ Beat Q1 revenue guidance by 2.8%.

+ Diluted shares down 0.3% YoY

+ Attach Rate increased +2 bps y/y

+ GMV growth is accelerating to 23% YoY from 15% year ago, in Europe GMV growth is strong +38% YoY

+ GPV is growing 32% YoY, faster than revenue

+ The company is actively pursuing Global Expansion in Japan, Spain, Italy and Australia

🟡 Neutral:

+- SBC/rev is 23%

Market Reaction to Earnings Report: The stock tumbled 20% following the earnings report as the company missed the quarter's estimates by -0.7%. The company is facing softness in demand in some markets, and management commented on the next quarter's forecast, noting, "We have headwinds in European consumer spending in our Q2 outlook." The company is dependent on consumer demand, but as soon as it recovers, the company's revenue growth is also expected to accelerate. The company increased R&D spending to strengthen its competitive position in the future, investing in its future growth.

Axon Enterprise AXON 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Axon Enterprise ER $AXON:

🟢 Pros:

+ Revenue accelerates to +34.3% YoY.

+ FY 2024 guidance increased by 2.6%.

+ Axon Cloud revenue growth rate accelerates to +51.5% YoY.

+ Dollar-Based Net Retention (DBNR) is stabilizing at 122%.

+ Annual Recurring Revenue (ARR) and Total company future contracted revenue are growing faster than revenue.

+ Recorded a record number of net new ARR.

+ The company is increasing margins and profitability.

+ TASER 10 has shown robust demand.

+ The company introduced "Draft One," which leverages AI to produce police reports from body cameras.

🟡 Neutral:

+- SBC/rev increased to 16%.

+- Gross Margin dropped to 56.4% due to increased stock-based compensation. Adjusted gross margin for the quarter was 63.2%, up from 61.5% in Q4.

Market Reaction to Earnings Report: The market reacted neutrally to the quarterly report. The company's quarterly report was truly strong. The new TASER 10 product was well received by the market. The company introduced "Draft One," which could further enhance product stickiness for consumers; currently, the company already boasts a high Dollar-Based Net Retention (DBNR) rate of 122%. Revenue growth for Axon Cloud accelerated to +51.5% YoY.

GitLab GTLB 0.00%↑

GitLab's products encompass the entire software toolchain, unlike most of its competitors who offer point solutions. GitLab is positioned as a consolidator in the DevSecOps landscape and is likely to benefit from the significant generative AI-led product cycle that is emerging.

GitLab has announced the launch of GitLab Duo Enterprise, an AI-driven add-on for its DevSecOps platform that enhances every phase of the software development lifecycle. This new product offers features like vulnerability management, AI-powered root cause analysis for CI failures, and an AI Impact Dashboard for measuring ROI on AI investments. The company also introduced a CI/CD catalog to improve workflow efficiency and standardization across organizations. Additionally, upcoming features for GitLab 17 include a Native Secrets Manager, dedicated hosting on Google Cloud, enhanced static application security testing, product analytics, observability capabilities, enterprise agile planning tools, and a Model Registry for AI/ML models. These innovations aim to streamline how organizations build, test, secure, and deploy software, providing comprehensive tools to support advanced DevSecOps tasks.

Zscaler ZS 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Zscaler ER $ZS:

🟢Pros:

+ Revenue rose by +32% YoY.

+ DBNR at 116%, a slight decrease from last quarter.

+ Strong customer growth with $1M+ ARR added: +26.

+ Strong customer growth with $5M+ ARR 43% YoY.

+ Company increasing margins and profitability.

+ Beat Q4 revenue guidance by 3.2%.

+ Raised FY guidance by 1%.

+ Billings growth accelerated to 30% YoY from 27% in the last quarter.

+ Zscaler sees a significant expansion in its TAM

+ Introduced new products, Data Security Posture Management and GenAI App Security, which will contribute to future revenue growth.

+ Zscaler's acquisition of Avalor and Airgap Networks further enhances the company's cloud security capabilities.

🟡Neutral:

+- SBC/rev at 22%, Basic shares up 3.4% YoY.

+- Weak Net New ARR added: (+113, -10% YoY).

+- Q2 guide: +2.5% QoQ, revenue growth is still slowing down.

+- RPO and billings are growing slower than revenue.

Market Reaction to Earnings Report: The stock saw a significant jump, increasing by +16%. The company's quarterly report was favorable, leading to an upward revision of the full-year guidance. The company is enhancing its competitive edge through the acquisition of Avalor and Airgap Networks, as well as by introducing several product updates, such as Data Security Posture Management and GenAI App Security. Billing growth, which had previously raised concerns about the company’s future growth potential, accelerated to 30% YoY.

MongoDB MDB 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on MongoDB ER $MDB:

🟢 Pros:

+ Revenue rose by +22.3% YoY.

+ Atlas revenue grew +32% YoY (70% of total revenue), comparable to Snowflake growing at the same rate.

+ Net ARR Expansion remains at >120%.

+ Total calculated Billings growth accelerated to 28% YoY, faster than revenue growth.

+ Strong FCF margin of 14%.

+ The company announced MongoDB 8.0

🔴 Cons:

- Weak guidance for the next quarter; revenue growth will slow down significantly.

- Cut FY guidance.

🟡 Neutral:

+- SBC/rev is 28%, dilution at 4.0% YoY.

+- Atlas Net New ARR added declined by -13%, but overall, it’s not bad.

+- Beat Q1 revenue estimates by 2.4%, the smallest beat in the past few years.

+- The company is increasing R&D and S&M expenses, but will the company be able to benefit from this?

+- Weak number of new customers added.

Market Reaction to Earnings Report: The stock plummeted by -23%. The company's report was disappointing, prompting a cut in the full-year forecast, which was already quite low and was expected to be significantly surpassed, as indicated by the company's high valuation multiples. The company announced the launch of MongoDB 8.0. It's noteworthy that Atlas is growing at a rate comparable to Snowflake's, but while Snowflake's revenue growth has accelerated compared to the previous quarter, Atlas's growth is decelerating and, according to the forecast, will continue to slow down. The company is increasing R&D and S&M expenses, which I usually view positively as an investment in future growth. However, in this case, it's debatable whether the company will benefit from this investment. Currently, after the stock price drop, the position accounts for 3.8% of the portfolio.