My Stock Portfolio Review, Jun 2024

Portfolio Review

Holdings:

1. $NET 10.7%

2. $CRWD 10.2%

3. $DDOG 10.1%

4. $MNDY 9.8%

5. $ZS 9.4%

6. $SNOW 9.1%

7. $TTD 7.9%

8. $TSLA 7.4%

9. $MELI 7.0%

10. $AXON 6.9%

11. $SHOP 4.9%

12. $GTLB 3.6%

13. $MDB 2.9%

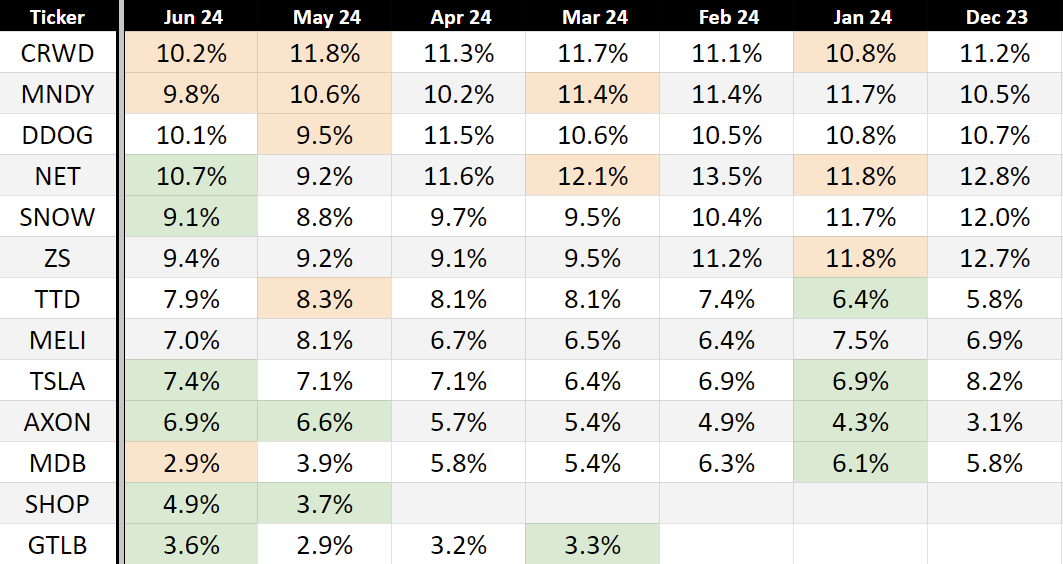

Monthly Allocations:

* green (added), orange (trimmed)

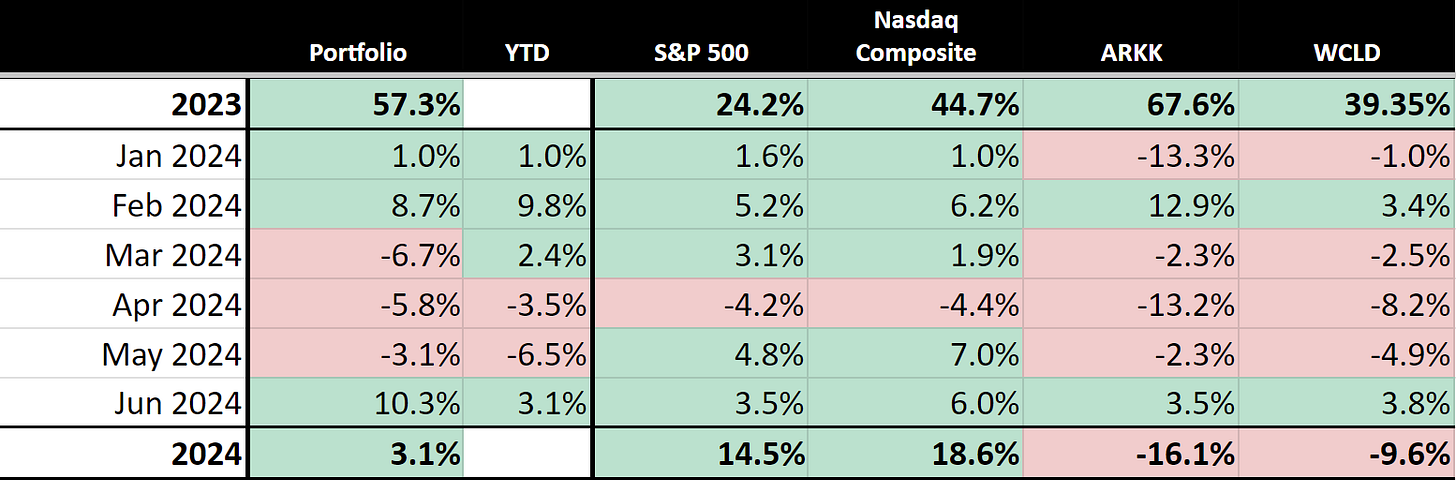

Historical performance (TWR):

2020: +110.2% (since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

Cumulative: +70.2%

A recap of my portfolio in 2024

January:

⬇️ Trim $ZS $CRWD $NET

⬆️Add $TSLA $TTD $MDB $AXON

March:

⬇️ Trim $NET $MNDY

✅ New position $GTLB ~3.1% (after -23% on ER)

May:

⬇️ Trim $CRWD $MNDY $DDOG $TTD

⬆️ Add $AXON

✅ New position $SHOP ~3.2%

June:

⬇️ Trim $CRWD $MNDY $MDB

⬆️ Add $NET $SNOW $TSLA $AXON $SHOP $GTLB

I slightly trim positions in CRWD and MNDY following the rise in their stock prices. MNDY's stock value significantly increased by more than 35% after the earnings report, making the position larger in the portfolio than I would prefer, same for CRWD stock price increased more than 50% YTD and compary trades with rich valuations. Additionally, I decided to reduce my position in MDB after a disappointing quarterly report. The growth results of Atlas were inferior to those of Snowflake, and the growth continued to decelerate. Furthermore, the company reduced its already conservative full-year growth forecast.

I have selectively increased positions in companies where valuation multiples appear more favorable relative to their expected revenue growth trajectories. Notably, I augmented my TSLA stake on June 11, subsequent to a 23% increase from June 1 and over 45% by the time of this portfolio review.

Commentary on my holdings:

CrowdStrike CRWD 0.00%↑

CrowdStrike Falcon Complete MDR sets a new benchmark with the fastest mean time to detect. Detection times are as follows: $CRWD at 4 minutes, $MSFT and $PANW both at 24 minutes, and $S at 47 minutes.

$CRWD has announced a strategic partnership with Hewlett Packard $HPE to enhance AI security, focusing on large language models (LLMs) accelerated by NVIDIA. This collaboration integrates CrowdStrike's Falcon cybersecurity platform with HPE GreenLake cloud services and OpsRamp's AIOps to unify IT operations and cybersecurity, facilitating secure AI innovation. The partnership leverages OpsRamp’s full-stack observability and CrowdStrike’s security capabilities to offer comprehensive protection for AI workloads across HPE’s infrastructure.

CrowdStrike $CRWD has been recognized as a leader in The Forrester Wave: Cybersecurity Incident Response Services for Q2 2024. The report highlights CrowdStrike's strong capabilities in detection and response technology, making it well-suited for handling nation-state-level threats and providing exceptional threat intelligence.

CrowdStrike $CRWD has initiated partnerships with Ingram Micro, M3Corp, and Tecnología Especializada Asociada de México (TEAM Mexico) to promote the adoption of its AI-native CrowdStrike Falcon platform in Latin America. These alliances seek to equip businesses in Mexico, Brazil, and the wider Latin American region with cutting-edge cybersecurity solutions, addressing the rise in eCrime and complex security challenges.

The company reported its first quarter of 2024 results.

Thoughts on CrowdStrike ER CRWD 0.00%↑ :

🟢 Pros:

+ Revenue rose by +33.0% YoY, accelerating from 32.6% in the last quarter.

+ ARR is growing faster than revenue.

+ Strong Net New ARR added (+211M, +22% YoY).

+ Customers are using more modules (5+, 6+, and 7+ modules +1pp QoQ).

+ Use of 8+ modules + 95% YoY.

+ Company increasing margins and profitability.

+ Beat Q4 revenue guidance by 1.7%.

+ FY guidance for 30.7% revenue growth, increased FY guidance by 0.5%.

+ Introduced New Subscription Model - Falcon Flex. The Falcon platform now includes LogScale - Next-Gen SIEM Integration.

🟡 Neutral:

+- SBC/rev at 19.9%. Diluted shares up 4.0% YoY.

+- Total calculated billings growing slower than revenue.

+- Company doesn’t provide RPO and DNBR numbers (“our dollar based gross and net retention rates were consistent with our expectations” - supposedly at 120%).

Market Reaction to Earnings Release: After the earnings report was released, the stock price experienced a 6.7% increase. This reflects a robust quarterly performance. Significant metrics for the company demonstrated notable growth: the number of customers utilizing 5+, 6+, and 7+ modules rose by +1 percentage point QoQ, while usage of 8+ modules surged by +95% YoY. Additionally, ARR growth outpaced revenue, with Net New ARR increasing by +22% YoY.

Cloudflare NET 0.00%↑

On May 30, 2024, during its Investor Day, Cloudflare unveiled several enhancements to its product lineup.

Cloudflare's Workers AI Platform:

This platform is heralded as the first serverless AI platform that streamlines developers' access to AI models. With just an API call, developers can tap into over 100 leading open-source AI models, eliminating the need to manage the underlying infrastructure such as virtual machines. The platform is designed to automatically scale based on demand and charges users solely for their usage, offering a cost-efficient solution for expanding applications.

Cloudflare's AI Firewall:

Tailored to safeguard AI workloads, this firewall is adept at identifying and mitigating new threats and vulnerabilities introduced by AI technologies, ensuring enhanced security.

Cloudflare's AI Gateway:

The AI Gateway aids organizations in managing and scrutinizing their AI-related expenditures. It incorporates features like caching and rate limiting to curb excessive costs. Additionally, it provides comprehensive insights into the utilization of AI budgets, detailing which teams are employing AI resources and which AI models and providers are in use.

Datadog DDOG 0.00%↑

Datadog, has launched the Datadog App Builder, a low-code development tool designed to streamline the integration of custom applications into monitoring systems. This tool enables both technical and business users to rapidly develop and deploy self-service applications that can interact directly with Datadog’s monitoring data to quickly address and remediate issues.

Datadog, has announced the launch of Data Jobs Monitoring, a new tool designed to enhance the management of Spark and Databricks jobs within data pipelines. This product aids data platform teams and data engineers in quickly identifying and resolving issues with failed or long-running jobs, and in optimizing overprovisioned compute resources to cut costs.

Datadog, has introduced Log Workspaces, a new suite of capabilities designed to enhance collaborative analytics across various organizational teams. This powerful platform allows analysts and engineers to connect logs with other datasets and SaaS applications, facilitating the construction of sophisticated multi-stage queries for in-depth analysis of business, security, and application issues.

Datadog, has announced the general availability of LLM Observability, a new tool designed to aid AI application developers and machine learning engineers in monitoring, improving, and securing large language model (LLM) applications. This tool facilitates the efficient scaling and deployment of generative AI applications into production environments. LLM Observability provides comprehensive visibility into each step of the LLM chain, allowing users to identify and address errors, optimize performance metrics such as latency and token usage, and assess application quality to manage security and privacy risks effectively.

Datadog, has introduced Datadog Kubernetes Autoscaling, a set of capabilities designed to intelligently automate resource optimization and enable automatic scaling of Kubernetes environments based on real-time and historical utilization metrics. The new feature addresses common challenges in Kubernetes deployment, such as overprovisioning to avoid capacity issues, which often leads to excessive compute waste and increased cloud costs.

Datadog, has expanded its security product portfolio with the introduction of Agentless Scanning, Data Security, and Code Security, catering to the needs of DevOps and security teams in securing code, cloud environments, and production applications. Datadog's new offerings, currently in beta, include Agentless Scanning for vulnerability monitoring in cloud resources, Data Security for identifying sensitive data in Amazon S3 buckets, and an Interactive Application Security Testing (IAST) solution called Code Security, which offers real-time vulnerability detection and remediation in application code.

Datadog, announced the appointment of David Galloreese as Chief People Officer. Galloreese brings over 20 years of human resources experience from significant roles at prominent companies including Figma, Wells Fargo, Walmart, Medallia, and Caesars Entertainment. Most recently serving as a Senior Advisor at McKinsey & Company, his extensive background also includes leadership positions such as Chief Human Resources Officer at Figma and Wells Fargo, and Chief People Officer at Sam's Club.

This month, Datadog reaffirmed its status as a highly innovative company by introducing a larger number of updates and new products, as well as strengthening its management team.

Zscaler ZS 0.00%↑

Zscaler, has deepened its partnership with Google to enhance organizations' approach to Zero Trust security. This collaboration integrates Zscaler with Chrome Enterprise and Google Workspace, providing advanced threat and data protection for enterprise users without the need for traditional VPNs or additional browsers. This enhanced cooperation between Zscaler and Google supports enterprises in adopting a zero trust model by moving away from legacy VPN solutions and promoting secure, browser-based access to corporate resources.

Zscaler, has announced a collaboration with NVIDIA to enhance AI-powered copilot technologies, leveraging advanced AI capabilities to improve security and user experience for enterprises. This partnership integrates NVIDIA's AI technologies, including NIM inference microservices, NeMo Guardrails, and the Morpheus framework, into Zscaler's offerings. These integrations will enable Zscaler to enhance its Zero Trust Exchange™ platform's ability to proactively defend against cyber threats and simplify IT and network operations. Through this initiative, Zscaler is positioning itself to harness AI's potential more effectively in cybersecurity, enhancing its capabilities to detect and respond to threats at scale.

Snowflake SNOW 0.00%↑

At the annual Snowflake Summit 2024, Snowflake announced a series of new tools and integrations aimed at streamlining the development of enterprise-grade pipelines, models, and applications within the AI Data Cloud. These innovations include Snowflake Notebooks, Snowflake Trail, DevOps tools, and enhancements that accelerate the development process on Snowflake’s unified platform. Key features introduced are aimed at empowering developers to leverage Snowflake’s capabilities for building and deploying large language model-powered applications efficiently.

The updates include real-time data transformation capabilities, integrative development environments, and expanded observability tools to improve data quality and application performance monitoring. Additionally, Snowflake revealed the Native App Framework integration with Snowpark Container Services, enabling developers to build and distribute AI-powered applications across different clouds and regions via the Snowflake Marketplace.

These advancements are designed to help enterprises harness AI technologies more effectively, ultimately speeding up the time from prototype to production and facilitating the creation of innovative data-driven applications.

Snowflake announced a new collaboration with NVIDIA to enhance AI data application development on the Snowflake platform, utilizing NVIDIA AI technologies.

This partnership includes integrating NVIDIA's NeMo Retriever microservices into Snowflake's Cortex AI and supporting Snowflake Arctic with NVIDIA TensorRT-LLM software for optimized performance. This collaboration enables enterprises to create customized, highly accurate AI applications by linking custom models with business data seamlessly.

Snowflake also introduced Arctic as an NVIDIA NIM inference microservice, making it more accessible to developers.

Tesla TSLA 0.00%↑

$TSLA has published its Q2'24 Demand results.

↘️Cars Delivered (443,956, -4.8% YoY) beat est by 1.4%

↗️S/X and others Delivered (21,551, +12.0% YoY)

↘️3/Y Delivered (422,405, -5.5% YoY)

↘️Cars Produced (410,831, -14.4% YoY)

↗️S/X and others Produced (24,255, +24.0% YoY)

↘️3/Y Produced (386,576, -16.0% YoY)

The company significantly exceeded analyst forecasts, and importantly, Cars Delivered exceeded Cars Produced by 33,125 units, indicating that inventories are being sold off and demand for Tesla vehicles remains high.

MercadoLibre MELI 0.00%↑

S&P Global Ratings has revised Mercado Libre's outlook to positive while maintaining its 'BB+' credit ratings, acknowledging the company's commitment to a conservative balance sheet and improved operating performance. The company has demonstrated considerable strength in its financial metrics, which are expected to remain robust. S&P projects continued revenue growth for Mercado Libre, driven by its integrated ecosystem and the region's growing access to e-commerce and digital banking, potentially leading to a credit rating upgrade within the next year.

Maintaining a robust credit rating remains a critical priority for MELI.

Axon AXON 0.00%↑

Axon, announced that the United States Marshals Service (USMS) has deployed its latest less-lethal energy weapon, TASER 10, and is piloting Axon's VR Training solution. The TASER 10, which can deploy 10 targeted probes at a range of up to 45 feet, aims to enhance decision-making and safety during operations. It will replace the USMS's existing TASER X26P units and be used primarily in fugitive apprehension, judiciary security, and witness protection. TASER 10 will integrate with Axon's body-worn cameras, automatically activating them when the weapon is drawn, thereby enhancing accountability and situational awareness.

Axon and Skydio have launched a comprehensive Drone as First Responder (DFR) solution aimed at enhancing public safety. This partnership integrates Skydio's advanced drone technology with Axon’s public safety products, allowing emergency services to deploy drones for quicker, safer, and more informed responses to incidents. The DFR program facilitates real-time situational awareness, supports various operations from locating individuals to evidence collection, and enables drones to operate beyond visual line of sight with integrated control software and deconfliction technologies.

GitLab GTLB 0.00%↑

The company reported its first quarter of 2024 results.

Thoughts on Gitlab ER $GTLB :

🟢Pros:

+ Revenue rose by +33.3% YoY, revenue growth rate is stabilizing.

+ Strong DBNR at 129%.

+ Strong FCF margin at 22%.

+ Increased FY guidance by 0.8%.

+ Strong next quarter guidance.

+ RPO and cRPO are growing faster than revenue.

+ Added strong number of $1M+ ARR customers.

+ New ARR growth 35% YoY.

+ New product release, announced GitLab 17.

+ Expanded partnerships with Google Cloud and AWS.

🔴Cons:

- SBC/rev at 25%. Share count up 4.3% YoY.

🟡Neutral:

+- Operating margin became negative due to G&A spending increase.

+- Gross margin slightly declines from last quarter.

+- Beat Q4 revenue estimates by 1.9%.

+- Billings growth rate decline from last quarter and Billings growing slower than revenue.

Market Reaction to Earnings Release: The stock price showed negligible change following the earnings release, marginally declining by 1%. The company's quarterly report was robust, underscored by high customer retention with a Dollar-Based Net Retention rate (DBNR) of 129%.

Revenue growth has stabilized, with the company issuing a strong outlook for the upcoming quarter. Net New Annual Recurring Revenue (ARR) grew by 35% YoY, and the growth in Remaining Performance Obligations (RPO) surpassing revenue growth signals promising prospects for future revenue expansion.

Additionally, the company unveiled new products, including GitLab 17, and expanded its collaborations with Google Cloud and AWS.

MongoDB MDB 0.00%↑

Bendigo and Adelaide Bank, in partnership with MongoDB, has significantly advanced its core banking technology modernization by adopting MongoDB Atlas as part of its application modernization initiative. This collaboration has enabled the bank to reduce the development time required to migrate core banking applications from a legacy relational database to MongoDB Atlas by up to 90%, and at one-tenth the cost of traditional migrations.

The bank utilized MongoDB’s Relational Migrator and AI-powered tooling to streamline this process, which included automating developer tasks and drastically reducing the time spent on application testing. This transformation has not only improved the bank's operational efficiency but also enhanced its ability to innovate by freeing up developer resources for more strategic projects.