My Stock Portfolio Review, July 2024

Portfolio Review

Holdings:

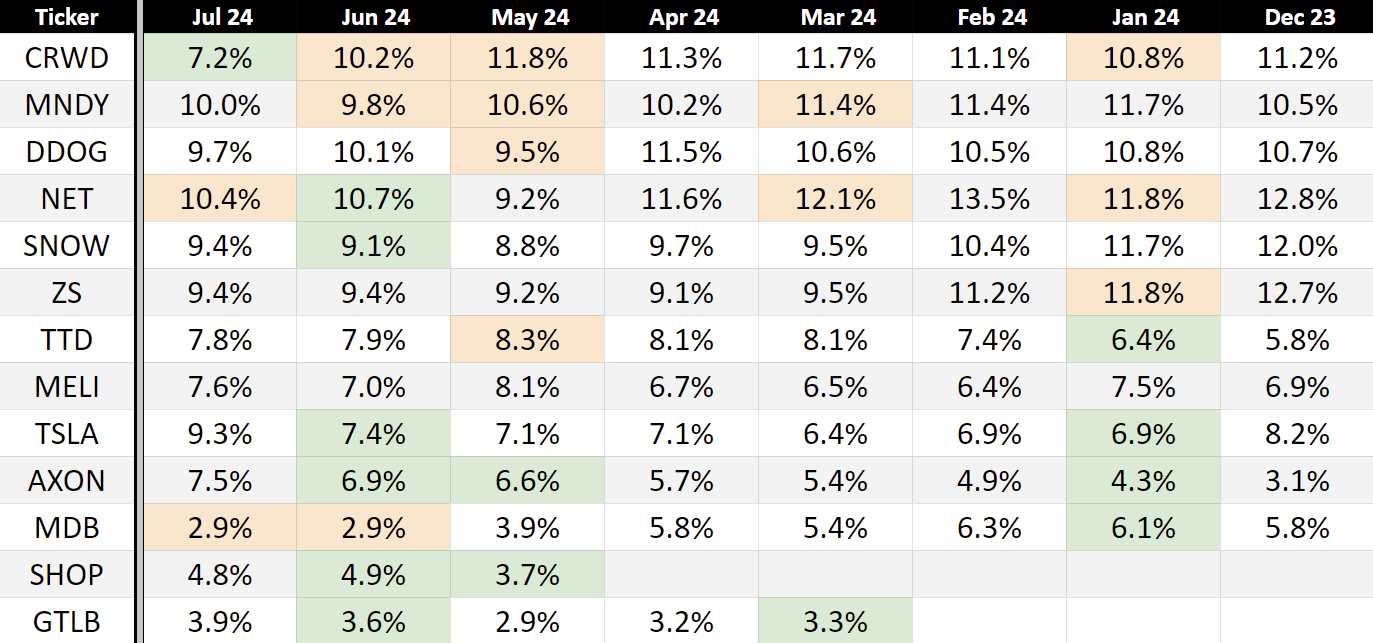

Monthly Allocations:

* green (added), orange (trimmed)

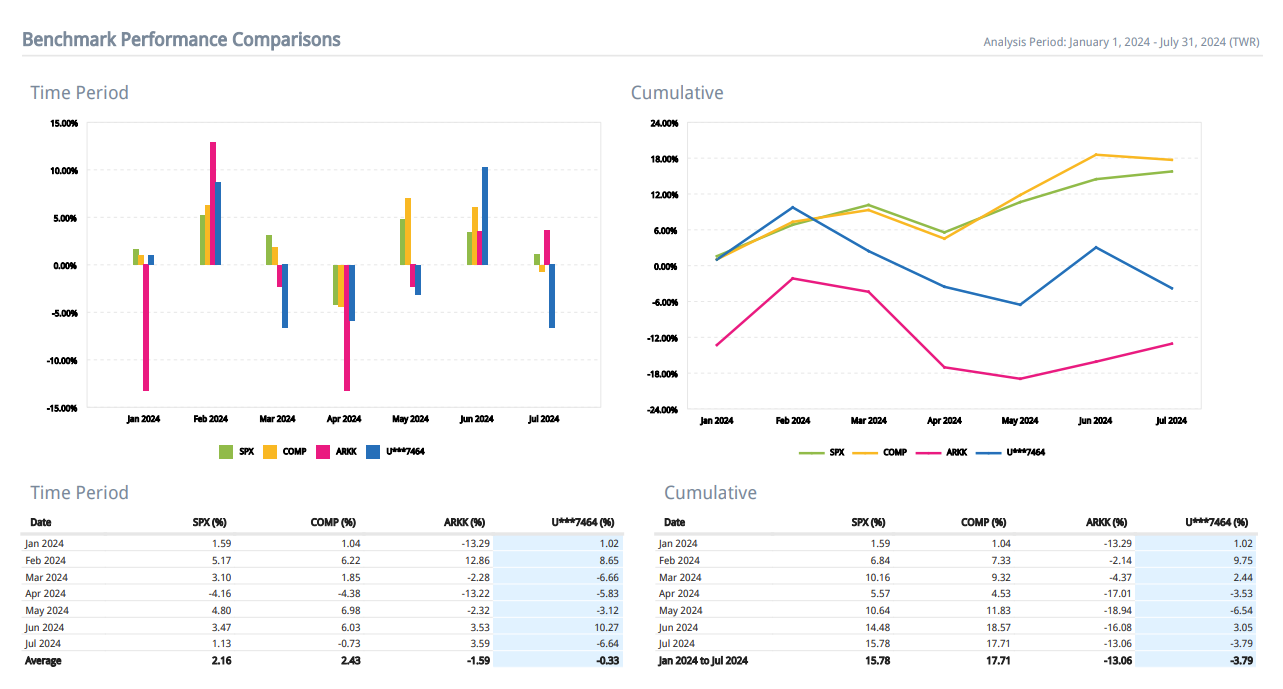

Performance (TWR):

Historical performance (TWR):

2020: +110.2%(since 15.04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

Cumulative: +59.0%

A recap of my portfolio in 2024

January:

⬇️ Trim $ZS $CRWD $NET

⬆️Add $TSLA $TTD $MDB $AXON

March:

⬇️ Trim $NET $MNDY

✅ New position $GTLB ~3.1% (after -23% on ER)

May:

⬇️ Trim $CRWD $MNDY $DDOG $TTD

⬆️ Add $AXON

✅ New position $SHOP ~3.2%

June:

⬇️ Trim $CRWD $MNDY $MDB

⬆️ Add $NET $SNOW $TSLA $AXON $SHOP $GTLB

July:

⬇️ Trim $NET $MDB

⬆️ Add $CRWD

I slightly trimmed $NET following a rise in their stock price, and trimmed $MDB after a disappointing quarterly report to increase my position in $CRWD. The price of $CRWD fell by 15% after a serious incident involving Windows updates that led to the shutdown of 8.5 million computers and servers worldwide. The issue that caused the shutdown of the Windows machines was related to an update, not a hack or cybersecurity failure, though the incident had serious consequences and damaged CrowdStrike's brand. Nonetheless, in terms of cybersecurity, CrowdStrike remains a leader. Addressing similar issues with updates in the future is not a complex task, and the company has already tightened control over the release and gradual deployment of updates, which is why I decided to slightly increase my position in $CRWD by about 0.5%.

Commentary on my holdings:

CrowdStrike CRWD 0.00%↑

Approximately 8.5 million of Microsoft devices Crashes affected by CrowdStrike. This was unwelcome news for CRWD shareholders, as the stock price fell by 15% at the opening of the trading session, and then dropped an additional 13% the following Monday when it became apparent that the incident was more extensive than initially thought. Many analysts downgraded their ratings and target prices for the stock, undoubtedly damaging CrowdStrike's brand. However, such incidents are not new in the world of cybersecurity or software in general. Similar issues were experienced by Okta and Cloudflare, after which their stocks recovered and their businesses continued to thrive. In my view, some customers may move to competitors like SentinelOne or PaloAlto, while others may demand additional discounts. It's possible that CrowdStrike might have to pay compensations to those affected through lawsuits. There are many speculations about the company's future, but I do not want to make decisions based on guesses. I prefer to wait for the Q2 report, review the company's forecast for the next quarter, listen to management's comments regarding customer demand, and compare the forecast with competitors like SentinelOne and PaloAlto. In my opinion, CrowdStrike has already taken measures to prevent similar issues, and management knows what to do, as customers still choose CrowdStrike as a leader in cybersecurity, with its Falcon software remaining a robust solution.

Prior to the mentioned incident, CrowdStrike was recognized as a Customers’ Choice in the 2024 Gartner Peer Insights 'Voice of the Customer' Endpoint Protection Platforms report, achieving a 99% Willingness to Recommend score based on 524 responses. The company was praised for its AI-native platform, Falcon, which offers advanced threat detection, prevention, and response capabilities. Customers from various industries, including software, manufacturing, and IT services, commended the effectiveness of the Falcon platform in providing daily protection and its adaptability through continuous improvements and integrations of new features.

However, it's worth noting that this incident has exposed the vulnerabilities of cybersecurity companies, where a breach could jeopardize the future of the company. Therefore, I am considering diversifying my portfolio by reallocating a portion of my $CRWD position into competitors like SentinelOne or PaloAlto, despite CrowdStrike being a leader in cybersecurity."

Cloudflare NET 0.00%↑

The company's rating on Glassdoor has increased to 3.4, and CEO Matthew Prince's approval has risen to 57% from a previous rating of 3.3 and a CEO approval of 55% in May 2024. Cloudflare is restructuring its sales department and go-to-market strategy. Such internal restructurings can negatively impact the company and CEO approval ratings, as some employees are laid off and others may leave due to dissatisfaction with the new direction. However, improvements in employee approval ratings for the CEO suggest that the company is moving in the right direction and is improving relations with its employees.

Datadog DDOG 0.00%↑

Datadog, announced the appointment of David Galloreese as Chief People Officer. Galloreese brings over 20 years of human resources experience from significant roles at prominent companies including Figma, Wells Fargo, Walmart, Medallia, and Caesars Entertainment. Most recently serving as a Senior Advisor at McKinsey & Company, his extensive background also includes leadership positions such as Chief Human Resources Officer at Figma and Wells Fargo, and Chief People Officer at Sam's Club.

This month, Datadog reaffirmed its status as a highly innovative company by introducing a larger number of updates and new products, as well as strengthening its management team.

Snowflake SNOW 0.00%↑

Snowflake has announced a significant partnership with Meta to host and optimize the Llama 3.1 collection of large language models (LLMs) within its Snowflake Cortex AI platform. This collaboration introduces Meta's powerful and large-scale LLM, Llama 3.1 405B, enhancing real-time, high-throughput inference capabilities and democratizing access to advanced natural language processing and generation applications. Snowflake's AI Research Team has optimized this model for both inference and fine-tuning, supporting a large 128K context window and delivering performance improvements over existing solutions, including up to 3x lower latency and 1.4x higher throughput.

The partnership aims to provide easy and efficient ways for enterprises to access, fine-tune, and deploy these advanced AI models, focusing on creating a trustworthy and responsible AI environment. Snowflake is also introducing Cortex Guard to ensure safety across all LLM applications developed within its platform. This move is expected to empower various industries by providing access to cutting-edge AI tools that enhance decision-making and operational efficiencies.

Tesla TSLA 0.00%↑

The company reported its second quarter of 2024 results.

Thoughts on Tesla ER $TSLA:

🟢Pros:

+ Cybertruck is in the ramp-up phase (S/X and others produced increased +24% YoY).

+ 4680 production increased about 51% sequentially.

+ Next-generation vehicle production expected to start in the first half of 2025.

+ Tesla Bot Optimus and FSD could be company growth drivers in the future.

+ Global vehicle inventory decreased to 18 (delivered 33,125 more than produced in Q2).

+ Energy generation and storage revenue increased +99.7% YoY; gross margin increased by +6.1 pp YoY.

+ Services Revenue increased by +21.3% YoY.

+ FCF margin is 5.3%, +1.2%pp YoY.

🔴Cons:

- Automotive revenue decreased by 6.5% YoY.

- Tesla cars delivered decreased by 4.8% YoY.

🟡Neutral:

+- Auto gross margin declined to 14.6%. Tesla introduced competitive financing options which affected revenue per unit in Q2 and are expected to continue into Q3.

+- Gross margin, operating margin, and net margin are declining.

Market Reaction to Earnings Release: The stock price fell by 7.7% following the earnings release. The likely causes for the decline were an EPS miss by -16.1%, a continued decrease in Auto gross margin to 14.6%, and a 6.5% YoY decrease in Automotive revenue.

Although the drop in Automotive revenue was anticipated, a significant positive surprise was the substantial growth in Energy generation and storage revenue, which increased by 99.7% YoY, along with an increase in the gross margin for this segment.

Personally, I noted the growth in S/X and others produced, which increased by 24% YoY, suggesting a successful Cybertruck ramp-up. I expect the Cybertruck to become a highly profitable model for the company in the future.

Additionally, it's important to note that 4680 production increased about 51% sequentially; this new type of battery may allow for reduced costs in electric vehicle production and increased profitability.

In my view, Tesla is doing well in the automotive business compared to its competitors, understanding that the entire automotive industry has faced weakening demand due to high lending rates. Another key point is that the global vehicle inventory decreased to 18 days of supply, indicating demand stabilization, whereas legacy automakers have accumulated record vehicle inventories at dealerships.

Monday MNDY 0.00%↑

$MNDY has announced the full release of its Portfolio management solution, a new addition to its monday work management product suite aimed at enterprise customers. This solution provides portfolio managers and executives with a clear, visual overview of all projects through a user-friendly interface, eliminating the need to navigate complex reports. It integrates seamlessly with Monday's existing workflow tools and automation features, allowing for easy project intake, approval, and standardized template use. The release is part of monday com’s strategy to expand its multi-product offerings and help enterprise customers streamline and scale their project management processes.