My Stock Portfolio Review, April 2024

Portfolio Review

Holdings:

1. $NET 11.6%

2. $DDOG 11.5%

3. $CRWD 11.3%

4. $MNDY 10.2%

5. $SNOW 9.7%

6. $ZS 9.1%

7. $TTD 8.1%

8. $TSLA 7.1%

9. $MELI 6.7%

10. $MDB 5.8%

11. $AXON 5.7%

12. $GTLB 3.2%

Monthly performance:

Monthly Allocations:

* green (added), orange (trimmed)

Historical performance (TWR):

2020: +110.8% (since 04.2020)

2021: +23.7%

2022: -59.6%

2023: +57.3%

Cumulative: +59.7%

A recap of my portfolio in 2024

January:

⬇️ Trim $ZS $CRWD $NET

⬆️Add $TSLA $TTD $MDB $AXON

March:

⬇️ Trim $NET $MNDY

✅ New position $GTLB ~3.1% (after -23% on ER)

Commentary on my holdings:

Tesla TSLA 0.00%↑ :

Demand:

↘️Cars Delivered (386,810, -8.5% YoY) missed est by -10.3%🔴

↘️Cars Produced (433,371, -1.7% YoY)

↗️Global vehicle inventory 28 days of supply, +13 QoQ

Tesla reported its first quarter results for 2024, and as expected, the report was not the best for the company. The discrepancy between produced and delivered vehicles was 42,593. Global vehicle inventory has significantly increased to 28 days of supply. The company reported delivery problems due to the Red Sea crisis, as well as delays in vehicle production due to the Tesla Gigafactory Berlin being idle after an arson attack, and the introduction of new production lines for the updated Model 3. The launch of production for the updated Model 3 may stimulate demand. The company is restructuring its logistics supply chains in response to the Red Sea crisis, and I expect a stabilization and reduction in the global vehicle inventory.

The company increased the price of the Tesla Model 3 Performance by $1,000 on Apr 26, and Model Y by $1,000 on April 1. In my opinion, this indicates stabilization of demand.

It is worth noting that legacy automakers currently have a record amount of inventory at car dealerships of unsold cars, significantly higher than Tesla.

Thoughts on the earnings report:

🟢Pros:

+Cybertruck is in the ramp-up phase.

+4680 production increased about 18% to 20% from Q4.

+Next-generation vehicle production expected to start earlier, in early 2025.

+Vehicle production capacity now is 2,350,000, which already implies 27% YoY growth; Elon confirmed the expected increase in production from last year.

+Tesla reduced the price for FSD and expects a significant increase in sales.

+Tesla Bot Optimus and FSD could be company growth drivers in the future.

🔴Cons:

-Automotive revenue decreased by 12.9% YoY.

-Tesla Cars Delivered decreased by 8.5% YoY; almost all automakers reported a decline in sales for the 1st quarter.

🟡Neutral:

+- FCF margin is negative, but Tesla expects positive cash flow in the coming quarters.

+- Automotive GM excl. regulatory credits decreased to 16.4% from 17.2% last quarter; Tesla recently reduced prices on almost all of its vehicles, but COGS per unit continued to decline sequentially.

Market reaction on ER: After the publication of the quarterly report, despite the decrease in year-over-year revenue, the company's share price increased by 12%. All the negativity surrounding the company was already factored into the share price. It is worth noting the tone of management during the conference call; Elon Musk’s tone was confident, in contrast to the tone of the report for the previous quarter.

The cost of owning a Tesla car is falling: According to Consumer Reports, Tesla has been named the cheapest car brand to maintain over a 10-year period.

FSD: Tesla has started rolling out the new Supervised FSD v12.3.6. The update comes just a week after the release of FSD v12.3.5. These FSD versions are a significant step forward for the company.

Tesla has reduced the cost of a subscription to FSD to $99 per month and also announced a free one-month trial subscription for cars that meet the requirements for using the new version of FSD. In my opinion, this will significantly increase the demand for the company's autopilot. Additionally, this step will increase the amount of data collected by the company and speed up the learning process to improve FSD.

Tesla has won Beijing's approval to roll out its Full Self-Driving (FSD) software in China, which is a significant success for the company because the Chinese market is one of the key ones for Tesla.

Hyperscalers:

Microsoft and Google reported for the first quarter of 2024. Google Cloud growth accelerated to 28% YoY, while Microsoft Cloud growth was 23% (GAAP). In constant currency, Microsoft Cloud growth accelerated from 22% in the previous quarter to 23% YoY. Amazon AWS growth rate also accelerated from 13.2% in the previous quarter to 17.2% YoY

The acceleration in growth of cloud giants is a tailwind for cloud infrastructure companies such as Cloudflare, Datadog, Snowflake, and MongoDB, as well as positive for cloud cybersecurity firms like Crowdstrike and Zscaler.

Zscaler ZS 0.00%↑ :

For the last three years, Zscaler has been a leader in the Gartner quadrant, which is a great achievement. It is also worth noting that since 2022, competitors Palo Alto and Netskope have closed the gap with Zscaler and come close.

Zscaler unveiled the ZDX Copilot: first-of-its-kind AI assistant designed to enhance IT support and operations. This AI tool analyzes data across users, devices, networks, and applications, providing actionable insights and facilitating deep analysis to quickly resolve issues.

Alongside the Copilot, Zscaler has introduced Hosted Monitoring, which allows continuous monitoring of application performance and SLA compliance from Zscaler’s global cloud.

Snowflake SNOW 0.00%↑ :

Snowflake has announced the launch and open-sourcing of its Snowflake Arctic embed family of models under the Apache 2.0 license.

These models are designed to deliver leading retrieval performance, providing organizations with a competitive edge when integrating proprietary datasets with large language models (LLMs) for Retrieval Augmented Generation (RAG) or semantic search services. The embedding models are a direct implementation of the technical expertise, proprietary search knowledge, and research and development acquired from Neeva in May of the previous year. Snowflake claims that these models are unparalleled in terms of quality and total cost of ownership (TCO), catering to enterprises of any size seeking to enhance their embedding workflows.

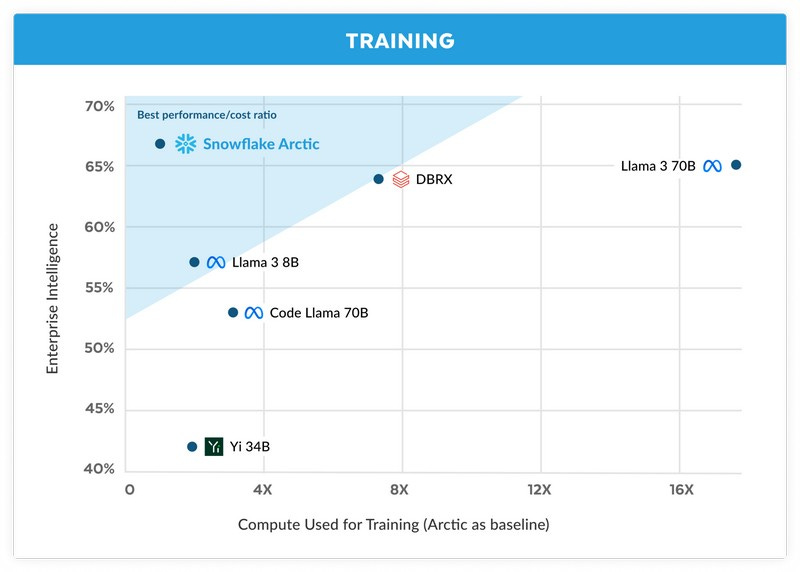

Snowflake has introduced Snowflake Arctic, an enterprise-focused LLM that advances cost-effective training and openness in model development.

According to the company, Arctic surpasses other open-source models trained with similar compute budgets and excels in enterprise intelligence compared to models trained with substantially higher budgets. The high training efficiency of Arctic allows Snowflake customers and the broader AI community to train custom models more affordably. Employing a unique Dense-MoE Hybrid transformer architecture, Arctic stands out for its innovative design.

In my assessment, Snowflake Arctic represents a significant product for the company. It is poised to contribute to revenue growth and strengthen Snowflake's competitive position in the market.

Here is a comparison of Arctic with multiple open source models across enterprise and academic metrics:

Axon AXON 0.00%↑ :

Axon unveiled a new AI tool that drafts police reports, boosting efficiency while maintaining quality. Officers review & approve before release. Initial tests show AI matches human quality on several metrics. Agency trials have resulted in roughly one hour of time saved per day on paperwork. For every eight officers who use Draft One during their day, that translates to an extra eight-hour shift or more.

Cloudflare NET 0.00%↑:

Cloudflare appeared in the niche players category of the Gartner quadrant. Gartner notes the significant progress the company has made in the Security Service Edge.

Cloudflare anounces Partnership with Hugging Face:

Cloudflare has announced that developers can now deploy AI applications on Cloudflare’s global network directly from Hugging Face with one simple click.

Workers AI is now available for general use, allowing for the deployment of AI models globally. Cloudflare has GPUs deployed in over 150 cities worldwide, making it easier and more affordable for developers to deploy AI applications without managing infrastructure.

Developers can deploy AI models with one click from Hugging Face to Cloudflare’s global network of GPUs.

Cloudflare has enhanced the developer experience for Cloudflare Workers and D1 by integrating Prisma ORM. This improvement notably reduces the time developers spend managing infrastructure and deploying applications, facilitating a more efficient interaction with data. The collaboration between Cloudflare and Prisma significantly simplifies the deployment of globally available applications, emphasizing an optimized developer experience.

CrowdStrike CRWD 0.00%↑:

CrowdStrike has been named a Leader in the IDC MarketScape.

The IDC MarketScape report also noted, “Falcon Complete offers a unique flat analyst operating model for MDR by eliminating analyst tiers and forming interchangeable ‘Fire Teams’ — with each respective Fire Team capable of operating independently and delivering MDR services to customers 24x7.”

The IDC MarketScape report went on to say, “IDC recognizes that there is a push ‘to the platform’ that is occurring in cybersecurity. This is worthy of mention as CrowdStrike has a wide depth and breadth of capabilities built into its Falcon platform that provides the technology muscle for its MDR offering.”

Gitlab GTLB 0.00%↑ :

In its Q4 2023 report, Microsoft disclosed that GitHub's revenue grew by 40%, accelerating to over 45% YoY in Q1 2024. In contrast, GitLab reported a 33% revenue growth in Q4 2023. Notably, GitLab's revenue is half that of GitHub and is growing at a slower pace. Operating under Microsoft's umbrella, GitHub presents a formidable competitor, thus rendering GitLab’s position in the portfolio relatively risky, which is why it accounts for only 3% of the portfolio.

However, with GitHub's accelerated growth in Q1 2024, there is an expectation for GitLab’s revenue growth to also accelerate.

GitLab has announced the general availability of GitLab Duo Chat, which integrates AI into software development through a unified, natural language interface, enhancing DevSecOps workflows and productivity. Available within the GitLab Duo Pro add-on, Duo Chat connects workflows across the software development lifecycle, boosting developer efficiency and collaboration.

Additionally, GitLab has been named the Google Cloud Technology Partner of the Year for DevOps. This past year, GitLab expanded its partnership with Google Cloud to deliver secure AI capabilities to enterprises, utilizing the Vertex AI Model Garden for AI-powered features in its DevSecOps platform with a privacy-first approach.

MongoDB MDB 0.00%↑:

MongoDB has announced an expanded partnership with Google Cloud, featuring the general availability of MongoDB Atlas Search Nodes on Google Cloud. These nodes offer dedicated infrastructure tailored for generative AI and relevance-based search workloads, leveraging MongoDB Atlas Vector Search and MongoDB Atlas Search. This deeper integration includes a dedicated Vertex AI extension, simplifying the use of large language models (LLMs) from providers such as Anthropic, Google Cloud, Meta, and Mistral. Developers can now seamlessly interact with LLMs without the need to transform data or manage data pipelines between MongoDB Atlas and Google Cloud.