MongoDB Q4 2024 Earnings Analysis

Dive into $MDB MongoDB’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$548M rev (+19.7% YoY, +22.3% LQ) beat est by 5.9%

↘️GM* (75.1%, -2.1 PPs YoY)🟡

↗️Operating Margin* (20.5%, +5.4 PPs YoY)🟢

↘️FCF Margin (4.2%, -6.9 PPs YoY)🟡

↗️Net Margin (-2.9%, +9.2 PPs YoY)

↗️EPS* $1.28 beat est by 100.0%🟢

*non-GAAP

Atlas

↗️$389M rev (+24.0% YoY, 71% of Rev)

↗️Atlas Net New ARR $117M (+14.2% YoY)

Key Metrics

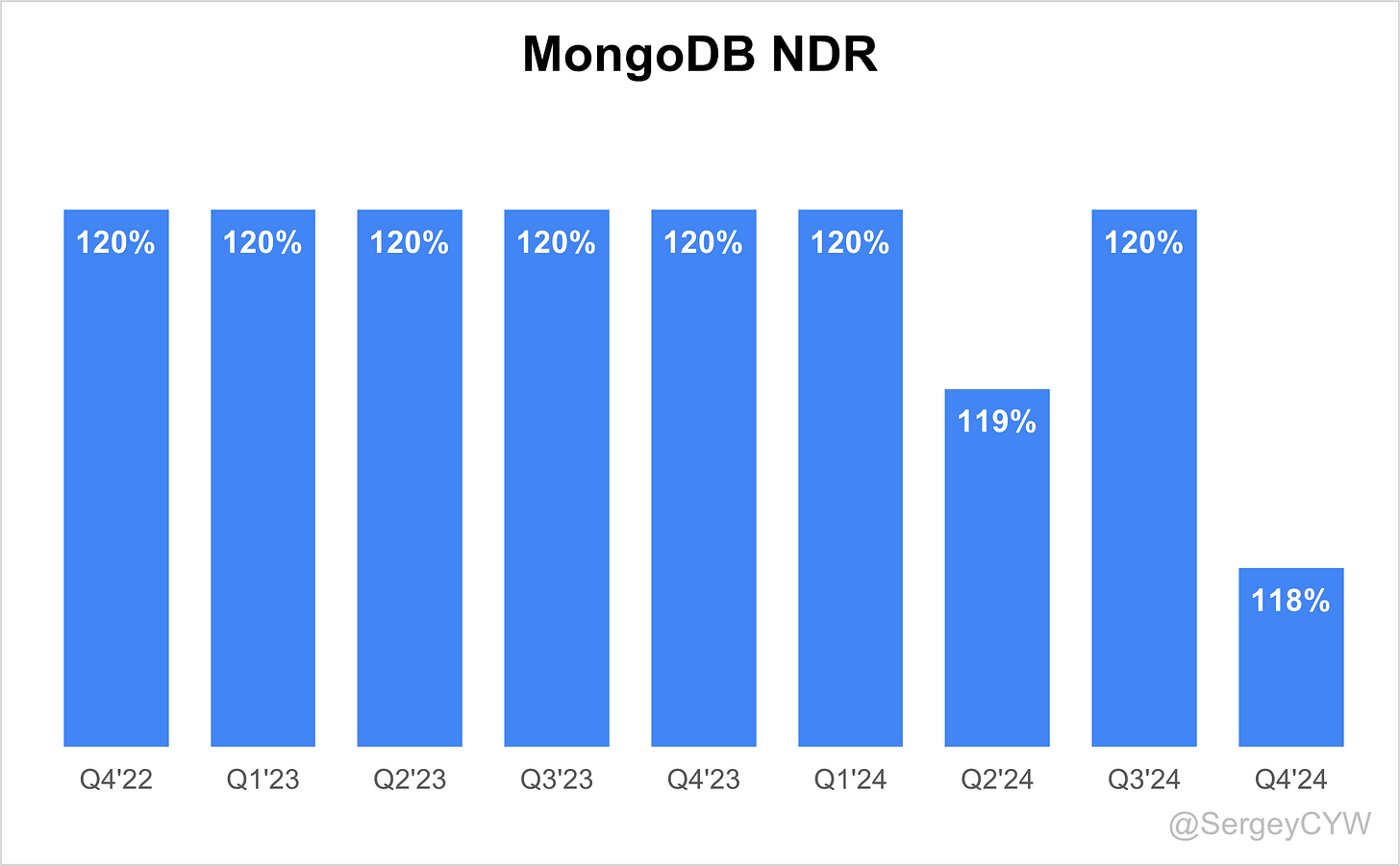

↘️Net AR Expansion 118% (120% LQ)

➡️Billings $602M (+17.0% YoY)🟡

Customers

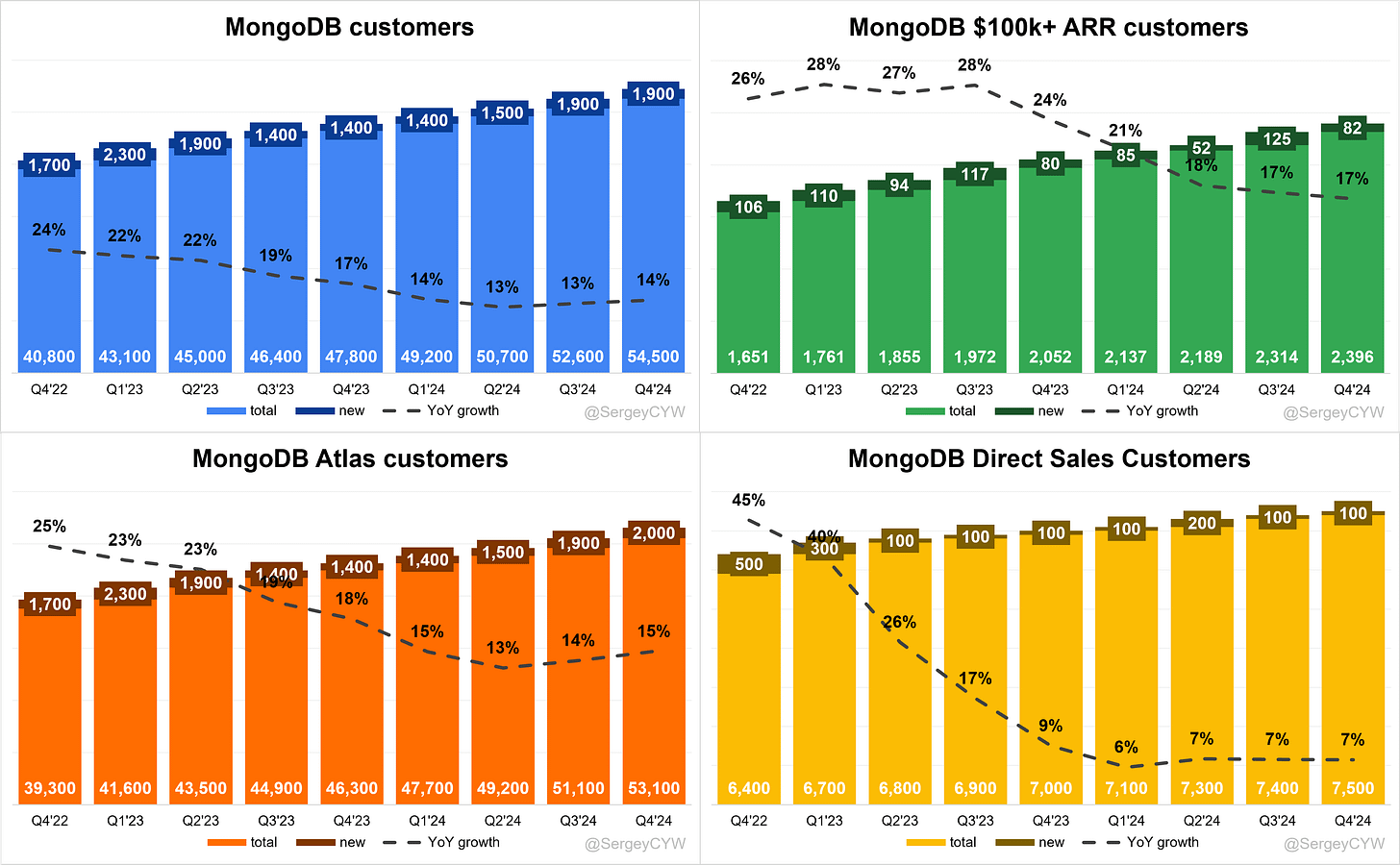

↗️53,100 Atlas customers (+14.7% YoY, +2000)

➡️7,500 Direct Sales Customers (+7.1% YoY, +100)

➡️54,500 customers (+14.0% YoY, +1900)

➡️2,396 $100k+ customers (+16.8% YoY, +82)

Operating expenses

↘️S&M*/Revenue 31.1% (-5.0 PPs YoY)

↘️R&D*/Revenue 16.3% (-1.7 PPs YoY)

↘️G&A*/Revenue 7.2% (-0.9 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $261M (+194.9% YoY)

↗️CAC* Payback Period 36.2 Months (+13.1 YoY)🟡

↘️R&D* Index (RDI) 1.11 (-0.25 YoY)🟡

Dilution

↘️SBC/rev 24%, -0.5 PPs QoQ

↗️Basic shares up 7.3% YoY, +3.9 PPs QoQ🔴

↗️Diluted shares up 16.9% YoY, +13.5 PPs QoQ🔴

Guidance

➡️Q1'25 $524.0 - $529.0M guide (+16.8% YoY) in line with est

↘️$2,240.0 - $2,280.0M FY guide (+12.6% YoY) missed est by -2.6%🔴

Key points from MongoDB’s Fourth Quarter 2024 Earnings Call:

Financial Performance

MongoDB reported Q4 FY25 revenue of $548.4 million, up 20% YoY, exceeding the high end of guidance. Atlas accounted for 71% of revenue, up from 68% YoY. Non-GAAP operating income reached $112.5 million, with a 21% operating margin, up from 15% YoY.

Net income was $108.4 million ($1.28 per diluted share), compared to $0.86 per share YoY. The company ended the quarter with $2.3 billion in cash, maintaining a debt-free position after redeeming its 2026 convertible notes. Operating cash flow stood at $50.5 million, while free cash flow was $22.9 million, impacted by a one-time $24 million IPv4 address purchase.

For FY26, revenue guidance is between $2.24 billion and $2.28 billion, implying 10-12% YoY growth. Non-GAAP operating income is expected to be $210 million to $230 million, with an operating margin of 10%, down from 15% YoY due to increased AI, R&D, and marketing investments.

Atlas Growth

Atlas revenue grew 24% YoY, reaching $390.3 million and contributing 71% of total revenue. The customer base expanded to 53,100, up from 46,300 YoY. The net annualized recurring revenue (ARR) expansion rate was 118%, reflecting a smaller contribution from existing customer expansions.

Large enterprises continued increasing their use of Atlas, with 320 customers now generating over $1 million in ARR, up 24% YoY. Companies in financial services, e-commerce, and AI applications adopted Atlas for mission-critical workloads.

Atlas Flex

MongoDB launched Atlas Flex, a new pricing model designed for greater cost predictability and transparency. The model allows enterprises to optimize cloud spending by aligning database costs with workload usage patterns. While adoption details were not disclosed, management expects Atlas Flex to drive increased migration from on-premise to cloud-based Atlas.

Vector Search

Vector Search adoption is growing, particularly among AI-driven applications requiring semantic and lexical search for large-scale data retrieval. MongoDB integrated Vector Search directly into Atlas, eliminating reliance on third-party vector databases.

The Voyage AI acquisition enhances retrieval-augmented generation (RAG) capabilities, improving embedding and re-ranking models to reduce AI hallucinations and improve accuracy. MongoDB expects accelerated enterprise adoption, particularly among AI-driven SaaS providers, financial institutions, and content-heavy businesses.

MongoDB 8.0

The upcoming MongoDB 8.0 release introduces performance upgrades, workload orchestration enhancements, and automation tools. It aims to improve developer efficiency and scalability for AI-driven applications.

With MongoDB 8.0, the company strengthens its position against relational databases, offering a more adaptable solution for AI-powered applications. Management expects this release to increase enterprise adoption, especially in data-intensive workloads.

Stream Processing

MongoDB expanded into Stream Processing, enabling real-time data processing for industries like financial services, IoT, and high-frequency trading. The capability enhances MongoDB’s ability to handle high-volume, low-latency workloads, positioning it against traditional event-driven architectures.

Management views Stream Processing as a long-term growth driver, allowing MongoDB to capture workloads in industries demanding real-time analytics and automation.

Voyage AI Acquisition

MongoDB acquired Voyage AI for $220 million, with a $200 million stock buyback to offset dilution. Voyage AI's embedding and re-ranking models are among the highest-rated in the Hugging Face community, strengthening MongoDB’s AI-powered search and retrieval capabilities.

AI adoption is progressing, but most enterprises remain in the early stages of experimentation. Management expects modest revenue contributions in FY26, with meaningful AI-driven growth in FY27 and beyond.

Customer Growth

MongoDB added 1,900 net new customers in Q4, reaching 54,500 total customers, up from 47,800 YoY. Enterprise adoption strengthened, with large accounts expanding workloads across multiple business units.

The high-value customer segment grew significantly, with 320 customers exceeding $1 million in ARR, up 24% YoY.

Large Customer Wins

Grab migrated its Grab Kios application to Atlas, cutting database maintenance time by 50% while improving scalability and automation.

Urban Outfitters adopted MongoDB to modernize its infrastructure, integrating Atlas and AI-powered personalization for better omnichannel experiences.

Swisscom deployed a new generative AI application in 12 weeks, using MongoDB’s built-in vector search to improve data retrieval across its East Foresight Library.

Lombard Odier, a global private bank, modernized its core banking infrastructure with MongoDB, improving transaction speed and efficiency.

The Associated Press leveraged MongoDB for AI-driven content discovery, improving search relevance and news automation.

Go-To-Market Strategy

MongoDB’s enterprise sales focus is driving higher revenue per customer. Sales teams shifted focus from mid-market to large enterprises, increasing sales productivity.

The company is investing in marketing and developer education to expand awareness of MongoDB’s full platform capabilities.

Challenges

MongoDB faces a $50 million revenue headwind in FY26 from fewer multi-year non-Atlas renewals. This is due to a smaller renewal base rather than a change in customer behavior.

Non-Atlas ARR growth slowed to mid-single digits, as more customers move incremental workloads to Atlas. This transition, while beneficial for long-term cloud revenue, increases short-term revenue variability.

Gross Margin Decline

Gross margin declined to 75% in Q4 FY25, down from 77% YoY, as Atlas grew as a percentage of total revenue. Atlas’ higher cloud infrastructure costs put pressure on gross margins, but MongoDB maintains strong operational efficiency.

Operating margins are projected to decline to 10% in FY26, reflecting increased investments in AI, R&D, and marketing. Management expects profitability to scale as revenue grows.

Future Outlook

MongoDB is positioned for long-term growth, driven by AI adoption, workload automation, and cloud migration.

The company is targeting Java applications running on Oracle for modernization, using AI-powered tools to accelerate migrations. Revenue contributions from legacy modernization are expected to increase meaningfully in FY27.

MongoDB is aggressively investing in AI-native capabilities, supporting enterprises as they scale AI-driven applications. Management remains confident in MongoDB’s role as a leading AI-driven database provider.

Management comments on the earnings call.

Product Innovations

Dave Idicheria, President and CEO

“Our focus on innovation continues to differentiate our platform. With the upcoming release of MongoDB 8.0, we are making significant enhancements in performance, workload orchestration, and automation to ensure enterprises can scale their applications seamlessly. We are bringing AI-driven capabilities directly into our database, eliminating the complexity of integrating multiple solutions.”

Atlas

Dave Idicheria, President and CEO

“Atlas continues to be the core growth engine of our business, representing 71% of total revenue. Our customer base in Atlas has expanded to over 53,100, with large enterprises increasingly relying on it for mission-critical workloads. The stability of Atlas consumption trends, coupled with strong new workload acquisition, reinforces our confidence in its long-term growth potential.”

Serge Tonja, Interim Chief Financial Officer

“We expect Atlas consumption growth in fiscal 2026 to remain stable, driven by stronger contributions from workloads acquired in fiscal 2025. The changes we made to our sales compensation structure last year are yielding results, as we are now seeing higher-value workload expansion within our existing customer base.”

Atlas Flex

Dave Idicheria, President and CEO

“The introduction of Atlas Flex reflects our commitment to providing customers with more predictable and transparent pricing. Enterprises require cost predictability when scaling workloads, and Atlas Flex ensures that they have greater control over their database expenses while benefiting from the full capabilities of our cloud platform.”

Voyage AI

Dave Idicheria, President and CEO

“With the acquisition of Voyage AI, we are redefining what it means to be a database in the age of AI. By integrating state-of-the-art embedding and re-ranking models, we make AI applications more trustworthy, reducing hallucinations and ensuring highly relevant and accurate results. This acquisition strengthens our leadership in AI-powered data infrastructure.”

Serge Tonja, Interim Chief Financial Officer

“Our investment in Voyage AI is a strategic decision to ensure MongoDB is at the forefront of AI-driven applications. We are integrating its models into our platform to provide enterprises with best-in-class AI retrieval capabilities, which will be critical as AI adoption accelerates.”

AI

Dave Idicheria, President and CEO

“We are in the early innings of enterprise AI adoption, but the shift is inevitable. AI will fundamentally reshape industries, and companies that fail to adapt will fall behind. Our document-based data model, integrated vector search, and AI-native capabilities uniquely position us to support businesses as they transition from AI experimentation to full-scale deployment.”

Dave Idicheria, President and CEO

“The real challenge for enterprises is not just building AI models, but ensuring they are reliable and accurate. Our AI-powered vector search and Voyage AI’s leading embedding models give customers confidence in the quality of AI-generated responses, making MongoDB the go-to platform for AI-driven applications.”

Competitors

Dave Idicheria, President and CEO

“There is a common misconception that MongoDB competes directly with Postgres. The reality is that our platform offers far more than just an OLTP database. We provide an all-in-one solution, integrating document-based flexibility, vector search, and AI retrieval, eliminating the need for multiple disparate systems.”

Dave Idicheria, President and CEO

“Our win rates against Postgres are exceptionally high when customers understand the full breadth of our capabilities. The challenge is awareness—many developers still default to Postgres simply because they are unfamiliar with MongoDB’s strengths. That’s why we are investing more in customer education and developer engagement.”

Customers

Dave Idicheria, President and CEO

“We continue to see strong expansion among our enterprise customers. Large organizations like Grab, Urban Outfitters, and Swisscom are leveraging MongoDB to modernize their applications and enable AI-driven capabilities. The number of customers generating over $1 million in annual recurring revenue grew by 24% year-over-year, demonstrating our increasing relevance in large-scale deployments.”

Dave Idicheria, President and CEO

“Grab reduced database maintenance time by 50% after migrating key applications to Atlas. Swisscom deployed a generative AI application in just 12 weeks using MongoDB’s vector search. These examples highlight how companies across industries are choosing MongoDB for speed, scalability, and AI-driven transformation.”

Strategic Partnerships

Dave Idicheria, President and CEO

“Our relationships with hyperscalers remain strong. We continue to work closely with AWS, Azure, and Google Cloud to expand our reach and bring MongoDB to more customers. While they offer first-party database services, the reality is that our differentiated feature set and developer experience drive significant adoption on their platforms.”

International Growth

Dave Idicheria, President and CEO

“We are seeing strong adoption in international markets, particularly in Europe and Asia. Large financial institutions and government entities in these regions are leveraging MongoDB to modernize their legacy applications and enable real-time AI-driven decision-making.”

Challenges

Serge Tonja, Interim Chief Financial Officer

“We expect a $50 million headwind in fiscal 2026 due to fewer multi-year non-Atlas deals. This is not a change in customer behavior, but rather a function of the strong multi-year contracts we signed in the previous two years, creating a more limited renewal base this year.”

Dave Idicheria, President and CEO

“As Atlas grows as a percentage of our revenue, we are seeing a slight impact on gross margins due to cloud infrastructure costs. However, we remain confident in our long-term ability to scale operating margins as we continue to grow.”

Future Outlook

Dave Idicheria, President and CEO

“I have never been more excited about the future of MongoDB. AI is creating a once-in-a-generation shift in software development, and we are positioned at the center of it. Our investments in AI, workload automation, and application modernization will drive the next phase of our growth.”

Serge Tonja, Interim Chief Financial Officer

“Our fiscal 2026 guidance reflects a transition year as we scale investments in AI, strategic sales expansion, and product innovation. While we expect some near-term variability, we remain focused on maximizing long-term shareholder value.”

Thoughts on MongoDB Earnings Report $MDB:

🟢 Positive

Revenue: $548M (+19.7% YoY), beating estimates by 5.9%.

Atlas Growth: $389M revenue (+24.0% YoY), 71% of total revenue.

Operating Margin: 20.5% (+5.4 PPs YoY).

EPS: $1.28, beating estimates by 100%.

Net New ARR: $261M (+194.9% YoY).

Enterprise Expansion: 320 customers with $1M+ ARR, up 24% YoY.

New Pricing Model: Atlas Flex launched to optimize cloud spending.

New AI Capabilities: Voyage AI acquisition enhances vector search and retrieval accuracy.

MongoDB 8.0: Performance and automation upgrades for scalability in AI applications.

🟡 Neutral

Net AR Expansion: 118%, down from 120% QoQ.

Billings: $602M (+17.0% YoY), in line with growth but slightly lagging revenue.

Guidance for Q1 FY26: $524M - $529M (+16.8% YoY), meeting expectations.

CAC Payback Period: 36.2 months, up 13.1 months YoY.

Stock-Based Compensation (SBC)/Revenue: 24%.

Operating margin expected to decline to 10% in FY26 due to AI, R&D, and marketing.

🔴 Negative

Gross Margin: 75.1%, down 2.1 PPs YoY, impacted by higher Atlas infrastructure costs.

Free Cash Flow Margin: 4.2%, down 6.9 PPs YoY, affected by $24M IPv4 purchase.

FY26 Revenue Guidance: $2.24B - $2.28B (+12.6% YoY), missing estimates by -2.6%.

Multi-Year Deal Impact: $50M headwind expected in FY26 from fewer renewals in non-Atlas contracts.

Share Dilution: Basic shares up 7.3% YoY, diluted shares up 16.9% YoY.

Thanks for sharing! Any idea why the share count went up like crazy this Q?