Financial Results:

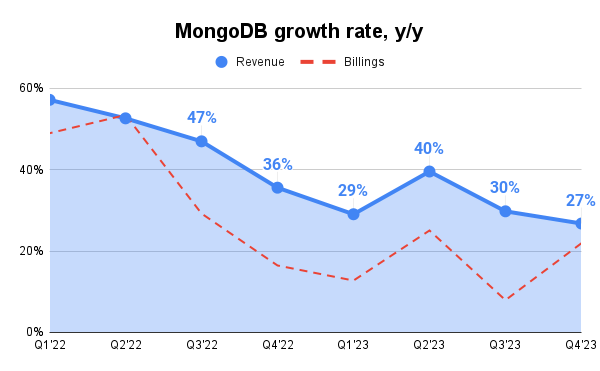

↗️$458M rev (+26.8% YoY, +29.8% LQ) beat est by 5.7%

↘️GM* (77.2%, -0.5%pp YoY)

↗️Operating Margin* (15.1%, +4.8%pp YoY)

↗️FCF Margin 11.0%, +4.4%pp YoY)

↗️EPS* $0.86 beat est by 83.0%

*non-GAAP

Key Metrics

➡️Net AR Expansion 120% (120% LQ)

➡️Billings $515M (+22.0% YoY)🟡

Customers

➡️46,300 Atlas customers (+18.0% YoY, +1400)

➡️7,000 Direct Sales Customers (+9.0% YoY, +100)

➡️47,800 customers (+17.0% YoY, +1400)

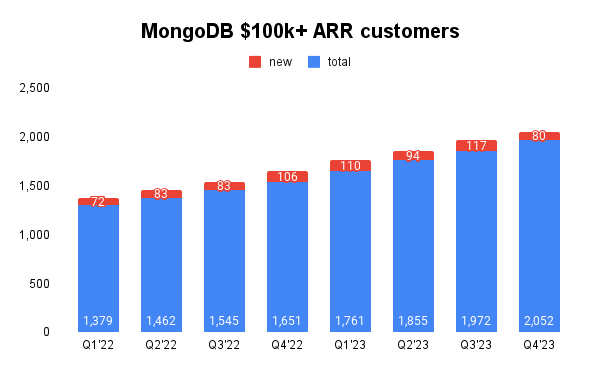

➡️2,052 $100k+ customers (+24.0% YoY, +80)

Operating expenses

↗️S&M*/Revenue 36.1% (34.6% LQ)

↗️R&D*/Revenue 17.9% (17.1% LQ)

↗️G&A*/Revenue 8.1% (7.6% LQ)

↗️Net New ARR $100M ($36 LQ)

↘️CAC* Payback Period 23.2 Months (62.7 LQ)

Dilution

↗️SBC/rev 30%, +2.0%pp QoQ

↗️Dilution at 4.1% YoY, +0.2%pp QoQ🟡

Guidance

↘️Q1'24 $440.0M guide (+19.5% YoY) missed est by -1.7%🔴

↘️$1,930M FY guide (+14.7% YoY) missed est by -4.9%🔴

Key points from MongoDB Fourth Quarter 2023 Earnings Call:

Financial Performance:

MongoDB reported a strong fourth quarter, with revenue of $458 million, representing a 27% year-over-year increase, and exceeded the high end of their guidance.

The company generated non-GAAP operating income of $69.2 million, resulting in a 15% non-GAAP operating margin. They ended the quarter with over 47,800 customers.

Product and Market Strategy:

MongoDB emphasized its focus on capturing a large market opportunity, highlighting the release of innovative product updates such as Vector Search, Queryable Encryption, and the preview of Atlas Stream Processing.

AI seen as a significant long-term growth driver, but still in the early, experimental stages for many enterprises.

The company plans to leverage AI to drive long-term growth, focusing on enabling customers to build AI applications using proprietary data alongside any Large Language Models (LLMs), on any computing infrastructure.

Atlas

Atlas revenue grew 34% year-over-year, now representing 68% of total revenue.

Strong consumption trends observed in Q4, in line with expectations.

Continual emphasis on new workload acquisition within existing Atlas customers.

Atlas Stream Processing:

Currently in public preview, Atlas Stream Processing is focused on real-time data processing for operational workloads, leveraging MongoDB's flexible schema and document model.

The product is designed for developers and aims to simplify the management of streaming data, differentiating itself from traditional rigid schema-based solutions.

Customer Growth and Retention:

Retention rates remained strong, emphasizing the mission-critical nature of MongoDB’s platform to its customers.

Added over 7,000 customers in fiscal 2024, ranging from AI startups to Fortune 500 companies.

Customers turning to MongoDB for innovation and cost savings, with specific mentions of ZF, Forbes, Swiss Federal Railways, Anywhere Real Estate, Samsung Electronics, and others.

Competitors

High win rates against competitors, with rare competition from legacy database providers or niche database players.

Main competition comes from cloud providers, but MongoDB competes effectively due to its flexible and scalable document architecture, developer popularity, and avoidance of lock-in.

Future Growth:

Sees stable consumption growth and opportunities to win new business as key drivers for fiscal 2025.

MongoDB is optimistic about the role of AI in driving future growth, positioning itself to benefit from the deployment of AI applications by offering differentiated capabilities in the AI stack, despite current enterprises being in early stages of AI adoption.

MongoDB aims to capitalize on the large market opportunity by continuing to innovate its product offerings, focusing on workload acquisition, expanding sales capacity, and becoming a standard within customer organizations.

Management comments on the earnings call.

Atlas:

"Atlas revenue grew 34% year-over-year, representing 68% of revenue. We had a healthy quarter of new business led by continued strength in new workload acquisition within our existing Atlas customers." - Dev Ittycheria

AI:

"While I strongly believe that AI will be a significant driver of long-term growth for MongoDB, we are in the early days of AI... MongoDB’s strategy is to enable customers to build AI applications by using their own proprietary data together with any LLM, close or open source, on any computing infrastructure." - Dev Ittycheria

Product Innovations:

"We had a record year of fast-paced innovative product releases such as Vector Search, Queryable Encryption, and the preview of Atlas Stream Processing, reinforcing why so many customers and developers choose MongoDB's developer data platform." - Dev Ittycheria

Competitors:

"Our win rates remain very high across all competitors... Our main competition remains the cloud players... We compete well against these players due to the flexibility and scalability of our document architecture." - Dev Ittycheria

Customers:

"We ended the quarter with over 47,800 customers... ranging from AI startups to Fortune 500 companies." - Dev Ittycheria

Atlas Stream Processing:

"We announced the private preview of Stream Processing where we ended up having hundreds of development teams use the product... We feel really well positioned because most of the alternatives have a very rigid or fixed schema." - Dev Ittycheria

Future Growth:

"As we look into fiscal ‘25, let me share with you what I see in the market. First, I'm excited about our opportunity to win new business... Second, I see stable consumption growth going into next year... Third, while I strongly believe that AI will be a significant driver of long-term growth for MongoDB." - Dev Ittycheria

Go-To-Market Investments:

"We will continue pressing our product advantage in the core database, and remain singularly focused on new workload acquisition as the key long-term driver of our business. We will continue fine-tuning incentives to ensure that our entire go-to-market organization is focused on identifying and sourcing new workload opportunities." - Dev Ittycheria

Thoughts on MongoDB ER $MDB :

🟢Pros:

+ Revenue rose by +26.8% YoY; according to Q1 guidance, revenue growth will be stabilizing.

+ Atlas revenue is growing +34% YoY and comprises 68% of total revenue.

+ Net ARR Expansion remains at >120%.

+ The company is increasing margins and profitability.

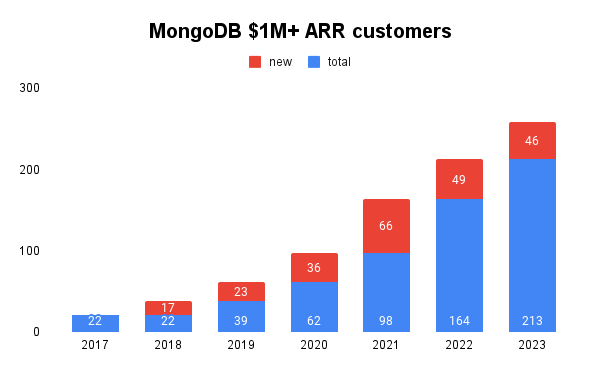

+ Added 46 $1M+ ARR customers.

+ Beat Q3 revenue estimates by 5.8%.

+ Product releases such as Vector Search, Queryable Encryption, and the preview of Atlas Stream Processing.

🔴Cons:

- Weak FY and next quarter guidance.

🟡Neutral:

+- SBC/rev is 28%, dilution at 3.8% YoY.

+- Weak number of customers added.

+- Total calculated Billings growth is accelerating to 22% YoY but is still slower than revenue growth.