MongoDB Q3 2025 Earnings Analysis

Dive into $MDB MongoDB’s Q3 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

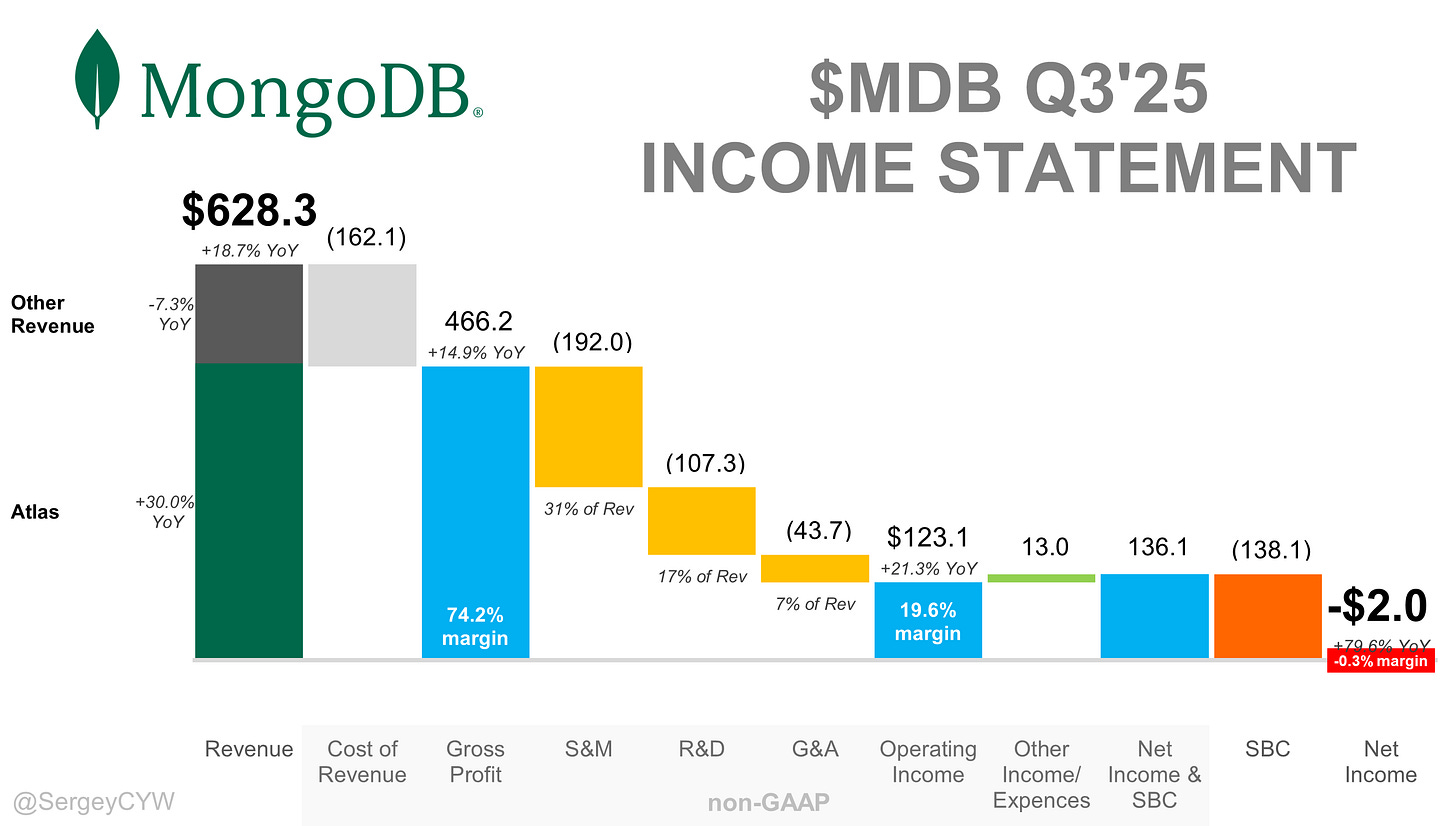

Financial Results:

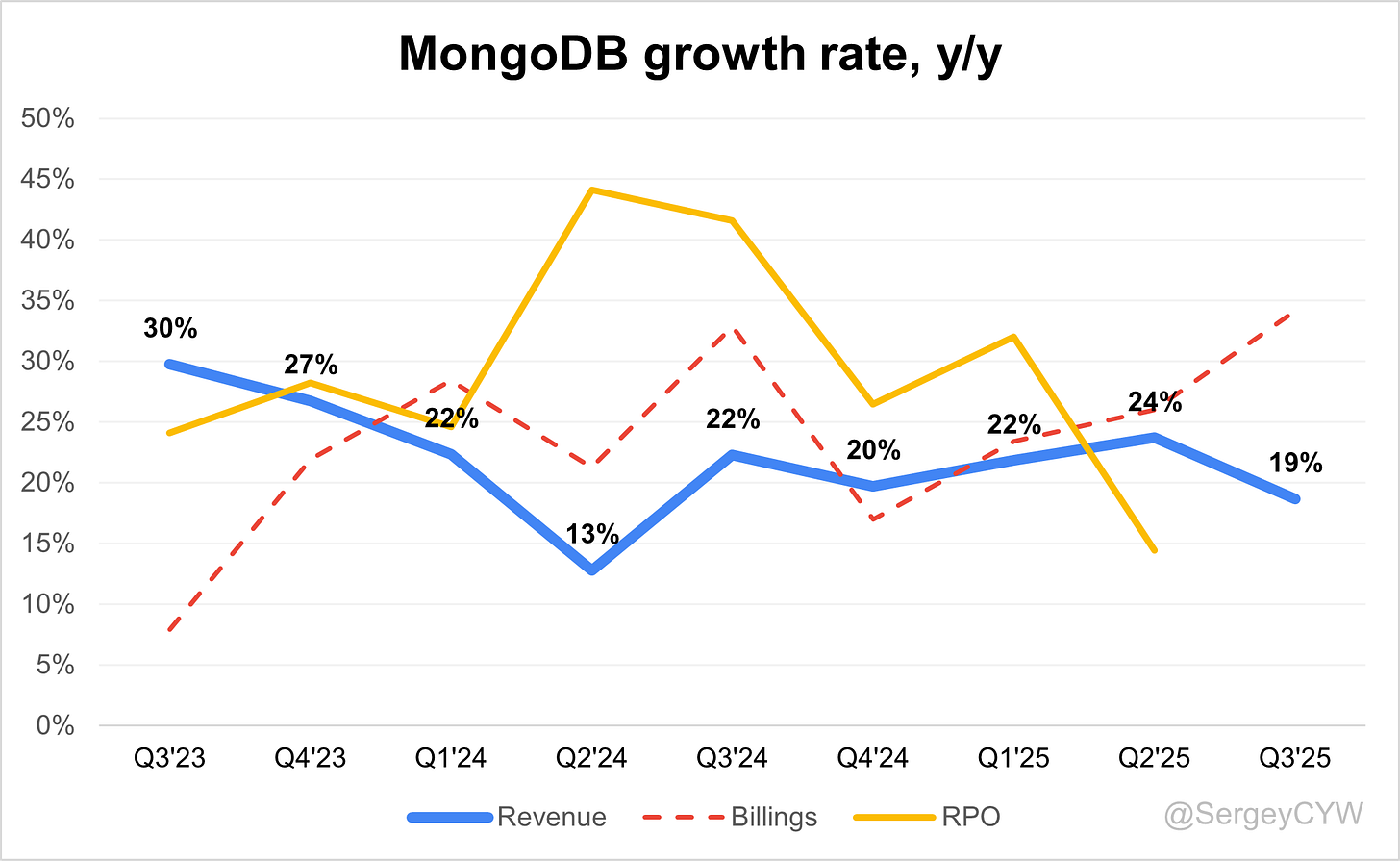

↗️$628M rev (+18.7% YoY, +6.2% QoQ) beat est by 6.2%

↘️GM* (74.2%, -2.4 PPs YoY)🟡

↗️Operating Margin* (19.6%, +0.4 PPs YoY)

↗️FCF Margin (22.3%, +15.8 PPs YoY)🟢

↗️Net Margin (-0.3%, +1.5 PPs YoY)🟢

↗️EPS* $1.32 beat est by 69.2%🟢

*non-GAAP

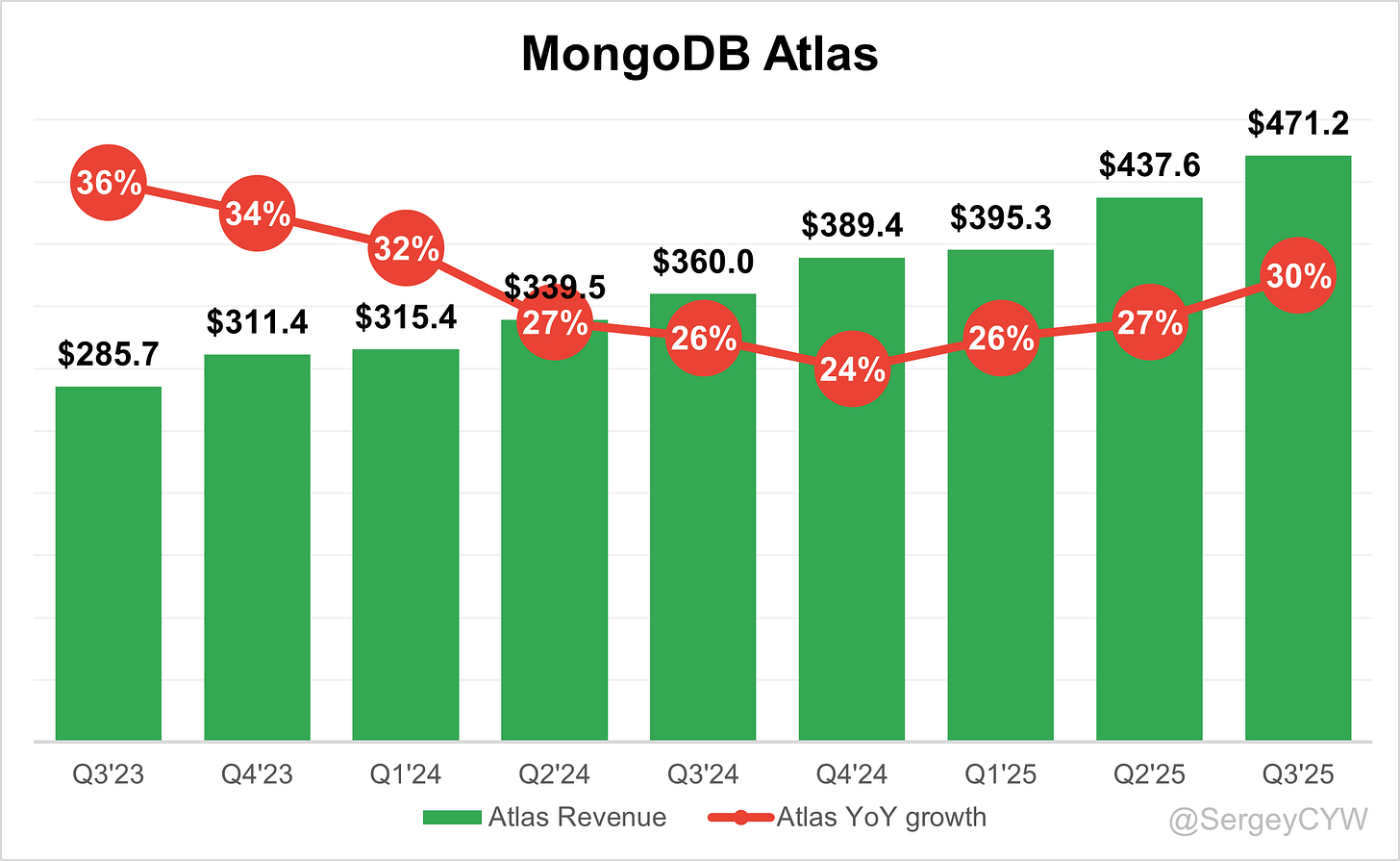

Atlas

↗️$471M rev (+30.0% YoY, 75% of Rev)🟢

↗️Atlas Net New ARR $134M (+63.5% YoY)

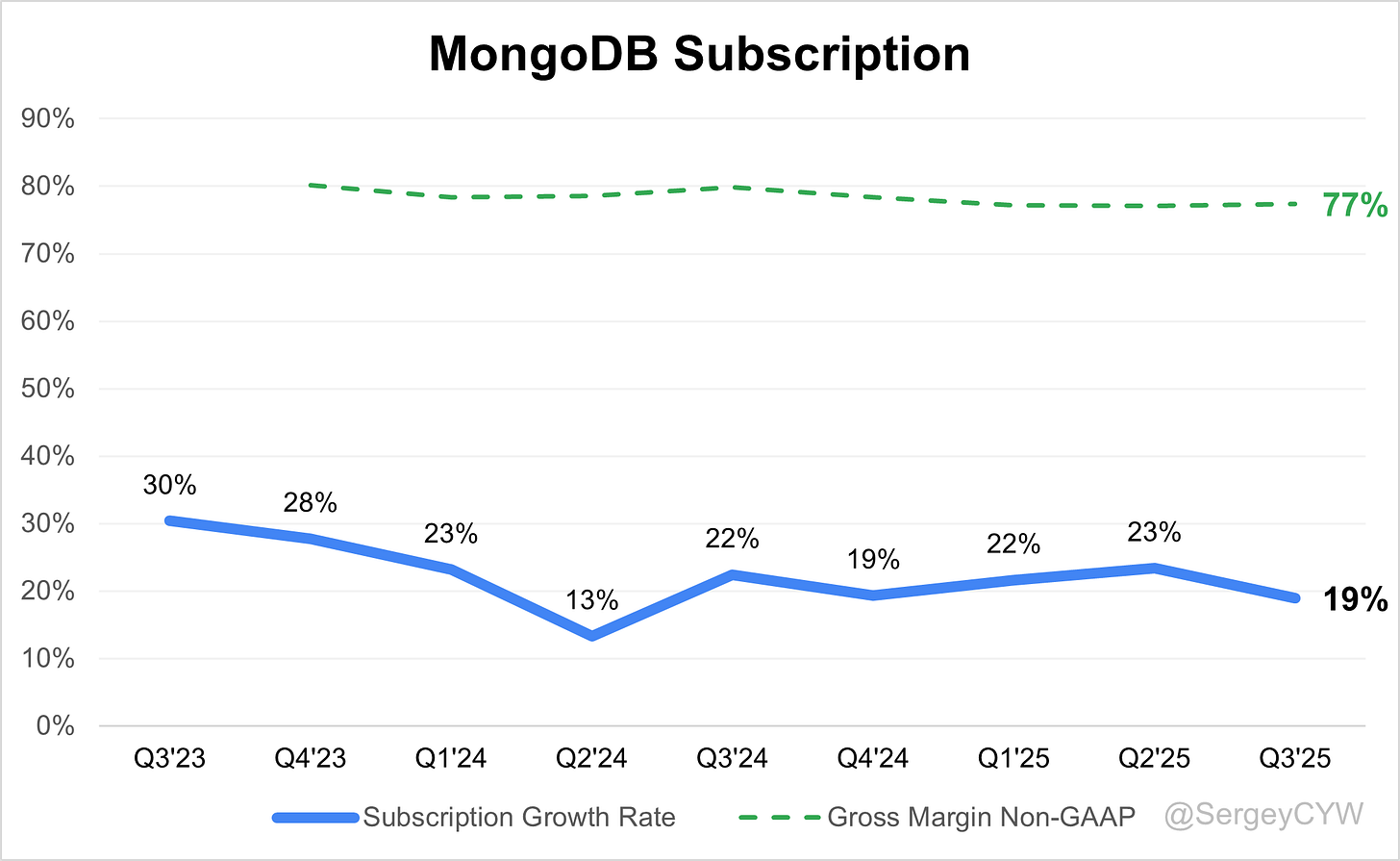

Subscription

↗️$609.1M Subscription rev (+18.9% YoY); 96.9% of Rev

↘️GM* (77.4%, -2.5pp YoY)

Key Metrics

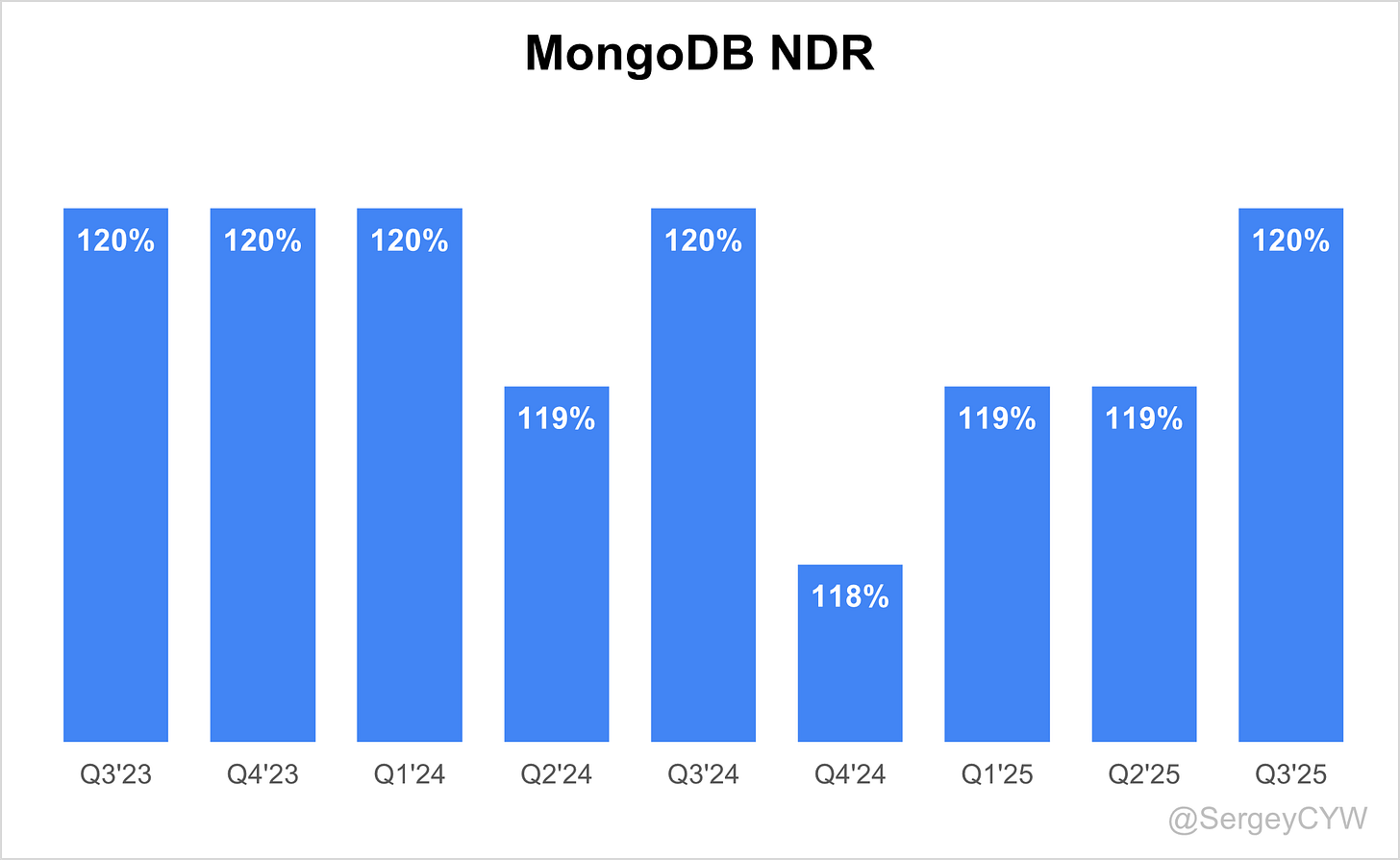

↗️Net ARR Expansion 120% (119% LQ)🟢

↗️Billings $686M (+34.1% YoY)🟢

Customers

➡️60,800 Atlas customers (+19.0% YoY, +2500)

↘️7,000 Direct Sales Customers (-5.4% YoY, -300)🔴

➡️62,500 customers (+18.8% YoY, +2600)

↗️2,694 $100k+ customers (+16.4% YoY, +130)🟢

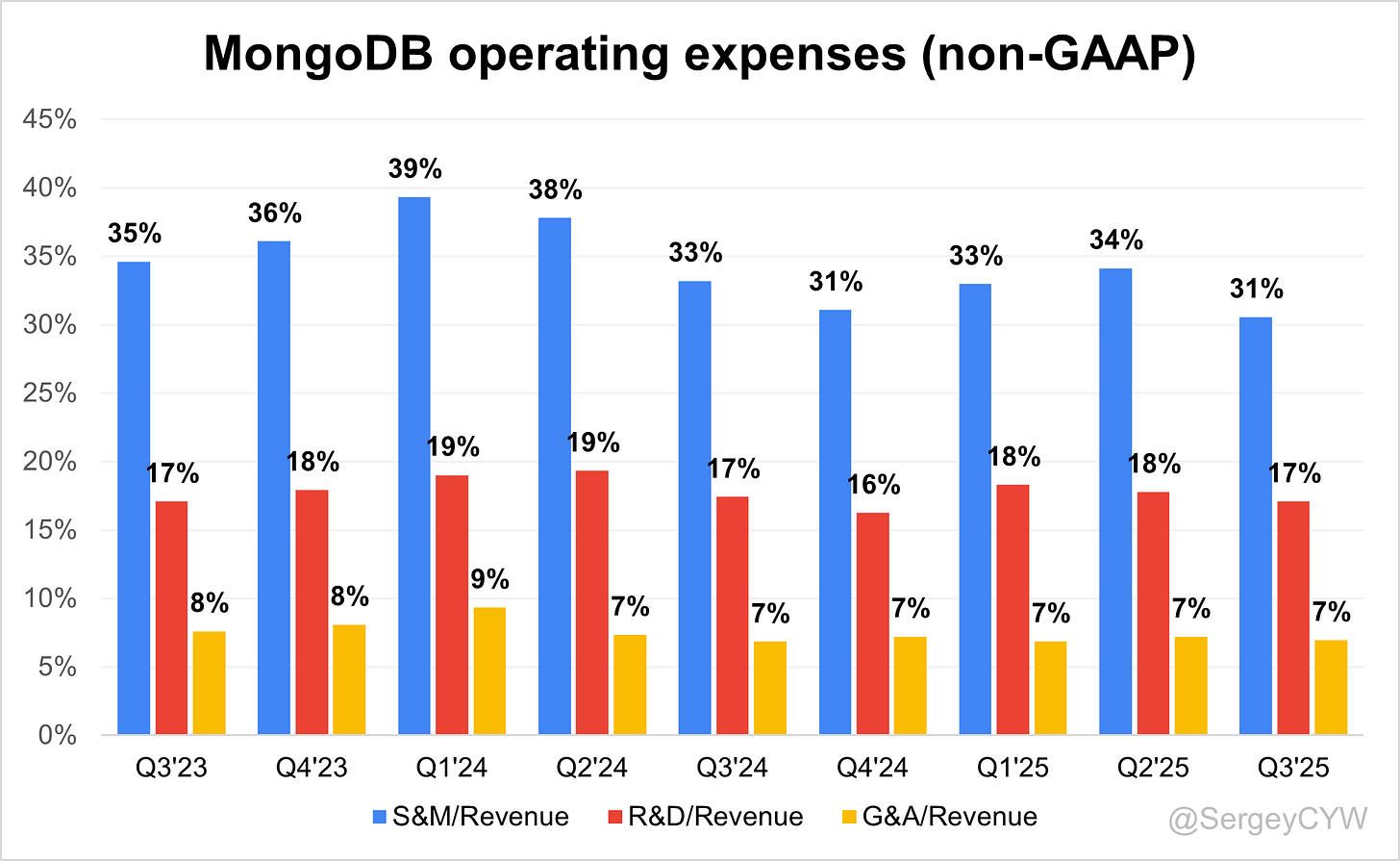

Operating expenses

↘️S&M*/Revenue 30.6% (-2.6 PPs YoY)

↘️R&D*/Revenue 17.1% (-0.3 PPs YoY)

↗️G&A*/Revenue 7.0% (+0.1 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $147M (-24.1% YoY)

↗️CAC* Payback Period 22.2 Months (+8.2 YoY)🟡

↘️R&D* Index (RDI) 1.02 (-0.24 YoY)🟡

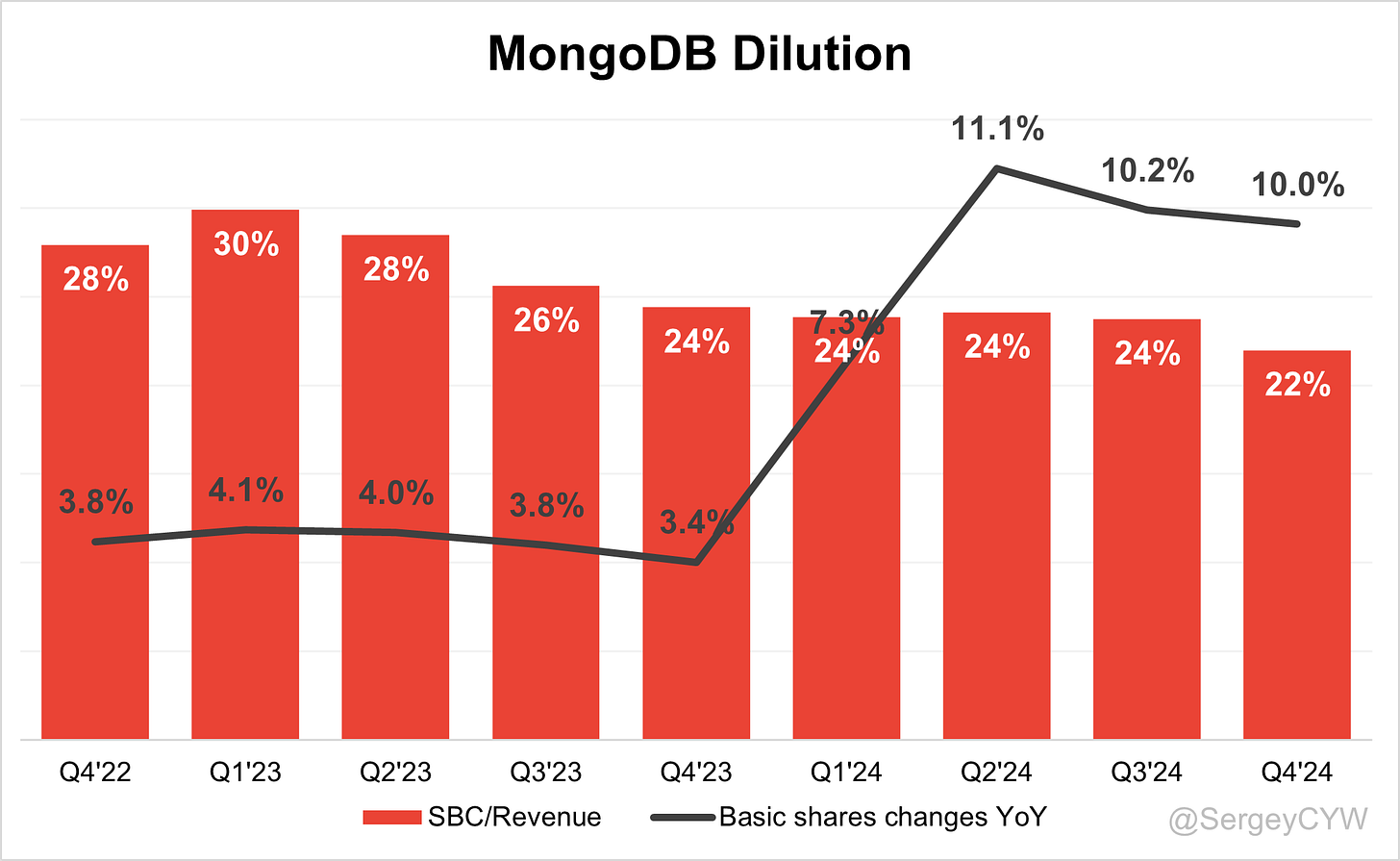

Dilution

↘️SBC/rev 22%, -1.8 PPs QoQ

↘️Basic shares up 10.0% YoY, -0.3 PPs QoQ🔴

↘️Diluted shares up 10.0% YoY, -0.3 PPs QoQ🔴

Guidance

↗️Q4’25 $665.0 - $670.0M guide (+21.7% YoY) beat est by 7.0%

↗️$2,434.0 - $2,439.0M FY guide (+21.4% YoY) raised by 3.3% beat est by 3.4%

Key points from MongoDB Third Quarter 2025 Earnings Call:

Financial Performance

MongoDB delivered $628M in Q3 FY26 revenue, +19% YoY, above the high end of guidance. Non-GAAP operating income reached $123M for a 20% margin, up from 19% a year ago. Gross profit was $466M, with a 74% gross margin versus 77% last year due to higher cloud mix. Non-GAAP net income came in at $115M or $1.32 per diluted share on 86.9M shares. Operating cash flow climbed to $144M and free cash flow to $140M, up from $37M and $35M a year earlier. Total cash and investments ended the quarter at $2.3B.

Mike Berry, CFO “Free cash flow is scaling with discipline; collections and working-capital hygiene were clear tailwinds this quarter.”

Atlas Growth

Atlas revenue grew 30% YoY and expanded to 75% of total revenue, up from 74% last quarter and 68% a year ago. Consumption trends remained stable with strength in large U.S. accounts and broad EMEA adoption. Net ARR expansion improved to 120%, while customers surpassed 62,500, growing by 2,600 sequentially and 8,000 year to date. Atlas customers exceeded 60,800 versus ~51,100 last year. Customers generating at least $100K ARR rose to 2,694, a 16% YoY increase. Releases of MongoDB 8.0 and 8.2 improved price-performance and reduced onboarding friction, accelerating self-serve adoption. Q4 Atlas growth is guided to 27% YoY, with holiday seasonality noted as the main variability factor.

Adoption broadened across large enterprises. A global insurer expanded Atlas usage across policy administration, analytics rating, unstructured repositories, and hundreds of supporting services. Following migration, the insurer shifted from a regional rollout to nationwide deployment and accelerated new product launches, citing improved scalability and development velocity.

CJ Desai, President and CEO “Larger customers are expanding for longer durations, reflecting Atlas’ strategic role in their stacks.”

CJ Desai, President and CEO “Standardizing on a single data platform is compressing time-to-market for regulated enterprises.”

Vector Search and Voyage AI

MongoDB advanced its AI data-platform strategy by integrating operational document storage, Search, Vector Search, and Voyage AI embeddings into one stack. Voyage AI models ranked #1 on the Hugging Face retrieval benchmark, and MongoDB held the #1 vector database ranking on DB-Engines. The unified stack reduces architectural complexity and improves retrieval accuracy with smaller, more efficient embeddings.

In AI-native markets, Mercor uses Atlas with Voyage embeddings and Vector Search while scaling at ~50% MoM growth. Another high-growth AI company migrated from Postgres and Redis after hitting scaling limits. In the enterprise, a global media company replaced Elasticsearch with Atlas Vector Search and Voyage models, achieving 90% lower latency, 65% lower operational costs, and 35% higher click-through rates across 70+ properties.

Dev Ittycheria, Former President and CEO; Board Member “A unified retrieval layer next to operational data is proving more reliable than stitched point solutions.”

Mike Berry, CFO “AI-native logos are landing through embeddings and expanding into full-stack workloads on Atlas.”

Product Innovations

MongoDB 8.0 and 8.2 improved system performance, reduced onboarding friction, and reinforced the platform strategy of consolidating operational and AI retrieval workloads. Developers gained faster iteration cycles without relying on multiple external components.

Dev Ittycheria, Former President and CEO; Board Member “Price-performance gains in 8.x are accelerating new-customer time-to-value.”

AI Strategy

Management emphasized three lanes of demand. Enterprise modernization continues for five to seven years, positioning MongoDB as core infrastructure before AI layers accelerate. AI-native and digital-native companies increasingly standardize on MongoDB when unstructured and fast-evolving workloads break relational models. Large enterprises continue AI pilots but face governance, audit, and performance constraints before deploying production agents at scale. The integrated retrieval stack aims to deliver lower cost, higher accuracy, and fewer hallucinations relative to fragmented solutions.

CJ Desai, President and CEO “Enterprises want AI that is governed, auditable, and grounded; our stack is built for that bar.”

Customer Base

Total customers surpassed 62,500, driven mainly by self-serve acceleration. Atlas customers grew to 60,800, while $100K+ customers reached 2,694. MongoDB maintains reach across 70%+ of the Fortune 100. Large customers are “growing for longer,” and several Global 2000 organizations are expanding usage across core systems. A major telecom migrating 1,300+ applications is evaluating broader MongoDB standardization.

Mike Berry, CFO “Self-serve is scaling efficiently while enterprise continues to broaden platform standardization.”

Additional Customer Wins

A global insurer standardized multiple mission-critical systems on Atlas, improving nationwide scalability and accelerating product rollout. A global media company achieved significant cost and latency gains with Atlas Vector Search and Voyage AI. Mercor scaled rapidly using the unified AI stack with minimal engineering headcount.

CJ Desai, President and CEO “Customer results are quantifiable—faster rollouts, lower costs, and measurable engagement lift.”

Go-to-Market Strategy

Self-serve continued expanding as friction decreased. Direct sales focused on the U.S. and EMEA enterprise segments. The company reinvested into Bay Area developer and AI communities through the “Reclaim the Bay” initiative and revived the .local event in San Francisco scheduled for January 15. Some engineering and sales investments shifted into Q4 and FY27, supporting current-year margin outperformance.

Dev Ittycheria, Former President and CEO; Board Member “Local community investment is already translating into healthier early-stage pipelines.”

CEO Strategic Focus

CJ Desai is emphasizing deeper penetration into Fortune 500 and Global 2000 accounts through long-standing C-suite relationships. He is also strengthening MongoDB’s role as the default platform for AI-native builders, leveraging networks across the Bay Area startup ecosystem and using Voyage embeddings as a natural entry point into the broader Atlas platform.

CJ Desai, President and CEO “We will meet enterprises and AI startups where they build—boardrooms and hackathons alike.”

Gross-Margin Compression

Gross margin declined to 74% from 77% due to Atlas mix expansion. Management noted continued improvement in Atlas margins, which should counterbalance the mix shift over time.

Mike Berry, CFO “Mix effects are dilutive near term, but Atlas unit economics are trending up.”

Challenges

Q4 carries seasonal consumption variability. Enterprise AI workloads remain mostly in pilot phases due to strict governance requirements. Relational-first narratives persist in certain developer communities. Forecasting of multi-year deals remains conservative to reduce volatility.

CJ Desai, President and CEO “Production-grade AI means governance first; we’re pacing customers from pilots to scale.”

Shareholder Dilution

MongoDB repurchased $145M of stock (~514,000 shares) under its $1B authorization. The company began settling RSU tax withholding in cash rather than shares and expects over 1M shares from cap calls tied to the 2026 notes, offsetting dilution.

Mike Berry, CFO “We’re actively managing share count to align durable growth with disciplined ownership.”

Future Outlook

Q4 revenue is guided to $665–$670M (21–22% YoY), with non-GAAP operating income of $139–$143M at ~21% margin. FY26 revenue is guided to $2.434–$2.439B (21–22% YoY), up $79M from prior guidance. FY26 non-GAAP operating income is expected at $436.4–$440.4M, raised by $109M, for an ~18% margin. Non-GAAP EPS is projected at $4.76–$4.80, and free cash flow conversion is expected to exceed 100%.

For FY27, management reaffirmed its long-term model of 100–200 bps average operating margin expansion and 80–100% free cash flow conversion, with increased engineering and sales investment. Non-Atlas multi-year transactions are not expected to affect FY27 materially.

Mike Berry, CFO “We plan to keep investing while expanding margins—scale is doing the heavy lifting.”

Thoughts on MongoDB Earnings Report $MDB:

🟢 Positive

• Revenue $628M (+18.7% YoY, +6.2% QoQ) beat expectations by 6.2%, showing resilient top-line growth.

• Atlas revenue $471M (+30% YoY) now forms 75% of total revenue, driven by strong enterprise and EMEA adoption.

• Billings $686M (+34.1% YoY) highlight accelerating demand and robust customer expansion.

• Operating margin 19.6% (+0.4 pps YoY) and FCF margin 22.3% (+15.8 pps YoY) demonstrate efficient cost leverage.

• Non-GAAP EPS $1.32 beat consensus by 69.2%, confirming strong profitability momentum.

• Net ARR expansion 120% (119% LQ) reflects healthy existing customer growth.

• $100K+ customers 2,694 (+16.4% YoY) show increasing enterprise penetration.

• Guidance raised: FY26 revenue $2.434–$2.439B (+21.4% YoY); Q4 outlook $665–$670M (+21.7% YoY) both above estimates.

• S&M expense ratio 30.6% (-2.6 pps YoY) indicates improved go-to-market efficiency.

• SBC/revenue down 1.8 pps QoQ and repurchases of $145M stock offset dilution.

🟡 Neutral

• Gross margin 74.2% (-2.4 pps YoY) declined due to Atlas mix, though underlying Atlas margins are improving.

• Net margin -0.3% (+1.5 pps YoY) remains near breakeven, reflecting reinvestment in growth.

• R&D/revenue 17.1% (-0.3 pps YoY) and G&A/revenue 7.0% (+0.1 pps YoY) were stable, suggesting balanced cost control.

• CAC payback 22.2 months (+8.2 YoY) and R&D index 1.02 (-0.24 YoY) indicate normalizing efficiency metrics as growth stabilizes.

• Enterprise AI adoption remains in pilot phase, with large customers testing production readiness.

• Holiday seasonality expected to impact short-term consumption visibility.

🔴 Negative

• Net new ARR $147M (-24.1% YoY) showed slower incremental growth versus prior year.

• Direct sales customers 7,000 (-5.4% YoY, -300 QoQ) declined, partly offset by self-serve momentum.

• Gross margin compression continues to weigh on overall profitability as Atlas mix rises.

• Basic and diluted shares up 10% YoY, though marginally lower QoQ, remain a dilution concern.

• AI workloads in enterprises are still early-stage, delaying meaningful revenue contribution.

• Seasonal and consumption volatility in Q4 could affect sequential momentum.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.