MongoDB Q3 2024 Earnings Analysis

Dive into $MDB MongoDB’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$529M rev (+22.3% YoY, +12.8% LQ) beat est by 6.8%

↘️GM* (76.6%, -0.8 PPs YoY)🟡

↗️Operating Margin* (19.2%, +1.0 PPs YoY)🟢

↘️FCF Margin (6.5%, -1.5 PPs YoY)🟡

↗️EPS* $1.16 beat est by 70.6%🟢

*non-GAAP

Atlas

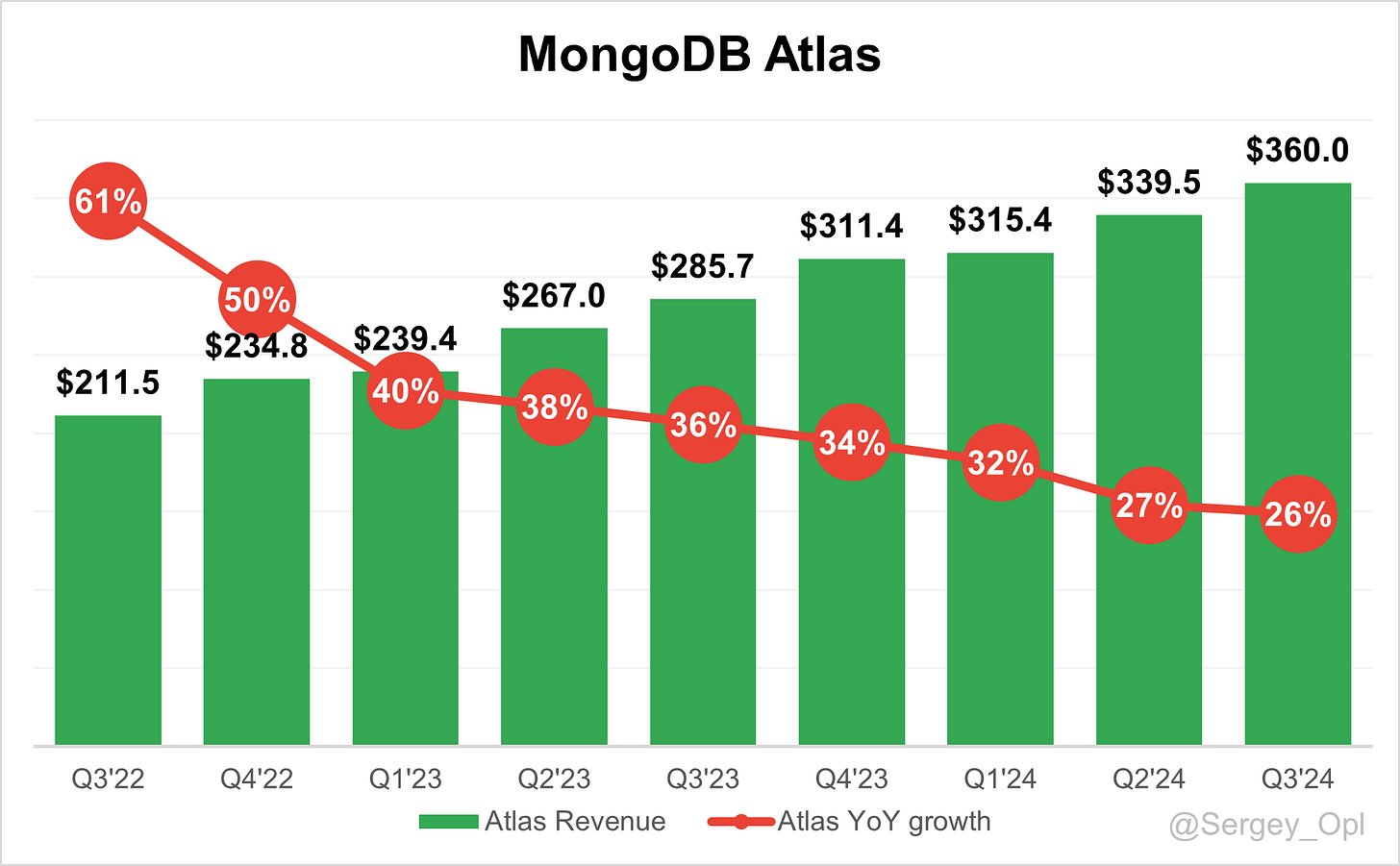

↗️$360M rev (+26.0% YoY, 68% of Rev)

↗️Atlas Net New ARR $82M (+9.7% YoY)

Key Metrics

↗️Net AR Expansion 120% (119% LQ)

↗️Billings $512M (+32.9% YoY)🟢

Customers

↗️51,100 Atlas customers (+13.8% YoY, +1900)

➡️7,400 Direct Sales Customers (+7.2% YoY, +100)

↗️52,600 customers (+13.4% YoY, +1900)

↗️2,314 $100k+ customers (+17.3% YoY, +125)🟢

Operating expenses

↘️S&M*/Revenue 33.2% (-1.4 PPs YoY)

↗️R&D*/Revenue 17.4% (+0.3 PPs YoY)

↘️G&A*/Revenue 6.8% (-0.8 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $200M (+523.4% YoY)

↘️CAC* Payback Period 14.0 Months (-48.5 YoY)🟢

↘️R&D* Index (RDI) 1.25 (-0.23 YoY)🟡

Dilution

↘️SBC/rev 24%, -1.2 PPs QoQ

↘️Share count up 3.4% YoY, -0.3 PPs QoQ

Guidance

↗️Q4'24 $515.0 - $519.0M guide (+12.9% YoY) beat est by 2.1%

↗️$1,973.0 - $1,977.0M FY guide (+17.3% YoY) raised by 2.4% beat est by 2.3%

Key points from MongoDB’s Third Quarter 2024 Earnings Call:

Financial Performance

MongoDB delivered a strong Q3 FY2025 with $529 million in revenue, representing a 22% YoY increase, exceeding the high end of guidance. Atlas contributed 68% of revenue, growing 26% YoY, while non-Atlas revenue outperformed expectations due to significant multi-year deals. The company achieved a 19% non-GAAP operating margin, with operating income at $101 million. Customer count rose to 52,600, with 2,314 customers contributing $100,000+ ARR.

Product Innovations

MongoDB 8.0 launched during Q3, achieving 20-60% performance improvements over previous versions. It addressed enterprise demands for security, availability, and performance. Atlas Search Nodes provided asymmetric scaling for search workloads, enhancing cost efficiency and performance. Innovations aligned with MongoDB’s focus on simplifying infrastructure and enhancing the developer experience.

Atlas

Atlas revenue grew 26% YoY, accounting for 68% of total revenue. Q3 consumption slightly exceeded expectations, supported by new workload acquisitions and increased end-user activity. Customer count increased by 6,200 YoY, reaching 51,100, driven by adoption from new and existing EA customers.

Atlas consumption growth remained lower than prior years, influenced by muted seasonal improvements and macroeconomic factors. Seasonal headwinds in Q4 are expected to further impact consumption, slowing projected revenue growth to 22% YoY for Atlas.

Atlas Flex

MongoDB consolidated smaller serverless offerings into Atlas Flex Clusters, simplifying architecture while retaining elasticity features. The migration affects approximately 4,000 low-spending customers, reducing reported customer count but having negligible revenue impact. The transition is expected to streamline product offerings and focus on high-value customer relationships.

MongoDB 8.0

MongoDB 8.0 is the company’s most performant release, achieving 20-60% efficiency gains and enhancing scalability, security, and availability. The upgrade bolstered adoption among enterprise customers, including Victoria’s Secret, which improved e-commerce scalability and performance. Customer adoption of MongoDB 8.0 is expected to drive long-term value despite short-term support costs.

Stream Processing

The Stream Processing product expanded to another hyperscaler in Q3, addressing high-frequency data needs. Customers leveraged its real-time integration capabilities to simplify application development and reduce costs. Financial institutions and analytics platforms adopted the product for real-time decision-making.

Vector Search

Atlas Vector Search adoption increased throughout its first year, supported by 96% memory reduction features that improved efficiency. High-profile customers implemented it for AI-driven use cases, including recommendation engines and fraud detection. A global media company replaced Elasticsearch with Vector Search for its recommendation systems, reflecting MongoDB’s competitive advantage.

Artificial Intelligence

MongoDB positioned itself as a critical AI infrastructure provider, offering rich and complex data query capabilities. AI workloads grew, with one customer’s workload increasing 10x since early 2024. While most applications remain experimental, MongoDB continues to integrate AI features, including partnerships with key frameworks.

Customers

Customer count reached 52,600, with 7,400 direct sales customers. Notable wins included Financial Times, Victoria’s Secret, and Paylocity, which achieved a 5x cost reduction by migrating to MongoDB. Retention rates were strong, highlighting the platform’s mission-critical status in various industries.

Large Customer Wins

Key enterprise wins included Victoria’s Secret, Financial Times, and Paylocity. A global media company used Vector Search for recommendation engines, and TealBook adopted Atlas for AI-enriched supplier data insights. Multi-year agreements contributed significantly to the company’s revenue performance.

Challenges

Atlas consumption growth slowed YoY due to seasonal factors and broader economic pressures. Stock-based compensation accounted for 24% of revenue, with 3.4% dilution YoY, raising concerns about shareholder value. The transition to Atlas Flex is expected to reduce customer count by 4,000 accounts temporarily.

The departure of CFO Michael Gordon after a decade introduces leadership uncertainty. The company faces headwinds from macroeconomic pressures, including reduced application activity during the holiday season, impacting Atlas consumption further.

Future Outlook

MongoDB projects Q4 FY2025 revenue between $515-$519 million, with full-year revenue at $1.97 billion. Non-GAAP operating income is expected to be $55-$58 million in Q4 and $242-$245 million for the year. Strategic investments in AI, legacy modernization, and enterprise accounts aim to sustain growth despite near-term challenges. Revenue growth for Q4 is projected at 18.7% YoY, marking a deceleration from Q3's 22.3% YoY.

Management comments on the earnings call.

Product Innovations

Dave Ittycheria, President and CEO

“MongoDB 8.0 performs 20% to 60% better against industry benchmarks, delivering on our customers’ most stringent security, resiliency, availability, and performance requirements. These innovations simplify back-end infrastructure, offering a unified developer experience.”

Atlas

Michael Gordon, COO and CFO

"Atlas consumption has been slightly ahead of expectations, driven by strong new workload acquisition and increased end-user activity, even in a challenging macroeconomic environment. With over 51,100 customers now on Atlas, it remains our flagship managed cloud database."

Artificial Intelligence

Dave Ittycheria, President and CEO

“Our platform is uniquely equipped to query rich and complex data structures critical for AI applications. As AI technology matures, we’re confident MongoDB will capture a significant share of successful AI workloads.”

Competitors

Dave Ittycheria, President and CEO

“Since day one, hyperscalers have bundled database offerings with their cloud services. Despite this, we’ve continued to execute well, proving that databases are a critical, deliberate decision where customers value our differentiated capabilities.”

Customers

Dave Ittycheria, President and CEO

"Paylocity achieved a fivefold cost reduction and significantly faster development cycles after migrating to MongoDB. We’re seeing customers in diverse industries recognize the value of our flexible, high-performance platform."

Strategic Partnerships

Dave Ittycheria, President and CEO

“Our partnerships with AWS, Azure, and GCP remain strong. For instance, with AWS, we’re deeply integrated into their new offerings like Bedrock, and our field collaboration has led to closing several large deals this quarter.”

International Growth

Dave Ittycheria, President and CEO

“Regional dynamics vary significantly. For example, European enterprises, particularly in banking, often prefer on-prem deployments due to regulatory constraints, while in Asia, adoption of cloud solutions is more aggressive.”

Challenges

Michael Gordon, COO and CFO

"We’ve experienced lower year-over-year Atlas growth, reflecting the broader macroeconomic conditions and muted seasonal improvement in Q3. Additionally, the transition to Atlas Flex will have a temporary negative impact on customer count."

Future Outlook

Dave Ittycheria, President and CEO

“We’re making the necessary investments in enterprise growth, AI, and legacy modernization, all of which position MongoDB for significant long-term growth. While near-term challenges exist, the market opportunity remains immense.”

Thoughts on MongoDB Earnings Report $MDB:

🟢 Pros:

Revenue increased by +22.3% YoY, accelerating from 12.8% growth in the previous quarter.

Total calculated billings growth accelerated to +32.9% YoY, growing faster than revenue.

Net ARR Expansion reached 120%, recovering from 119% last quarter.

Record Net New ARR added +199.7 million.

Non-GAAP gross margin recovered to 76.6%, improving from the prior quarter.

The company is showing improved margins and profitability.

A record number of $100k+ customers, with +125 new additions.

MongoDB raised its full-year guidance by +2.4%.

MongoDB exceeded its Q3 revenue forecast by +6.5%.

MongoDB introduced MongoDB 8.0 during Q3, delivering 20-60% performance improvements over prior versions.

Notable large enterprise wins included Financial Times, Paylocity, and TealBook.

🟡 Neutral:

While MongoDB exceeded analyst expectations for Q3, its Q4 guidance was conservative despite strong Q3 performance.

Revenue growth is expected to decelerate to 18.7% YoY if the company beats its Q4 forecast by its average overperformance for the last year.

Atlas revenue grew +26% YoY (accounting for 68% of total revenue), similar to Snowflake’s +28.3% YoY growth. However, while Snowflake’s revenue growth is forecast to accelerate next quarter, Atlas revenue growth is projected to slow to +22% YoY.

CFO Michael Gordon announced his departure after a decade of service.

Stock-based compensation (SBC) as a percentage of revenue is 24%, with dilution at +3.4% YoY.

Atlas Net New ARR added grew by +10% YoY, which aligns with the average addition level over the past two years.