MongoDB Q2 2024 Earnings Analysis

Dive into $MDB MongoDB’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$478M rev (+12.8% YoY, 22.3% LQ) beat est by 3.0%

↘️GM* (75.5%, -2.2 PPs YoY)🟡

↘️Operating Margin* (11.0%, -7.7 PPs YoY)🟡

↗️FCF Margin (-0.8%, +5.6 PPs YoY)

↗️EPS* $0.70 beat est by 42.9%

*non-GAAP

Atlas

↗️$339M rev (+27.0% YoY, 71% of Rev)

↗️Atlas Net New ARR $96M (-12.9% YoY)

Key Metrics

↘️Net AR Expansion 119% (120% LQ)

↗️Billings $461M (+21.0% YoY)

Customers

➡️49,200 Atlas customers (+13.0% YoY, +1500)

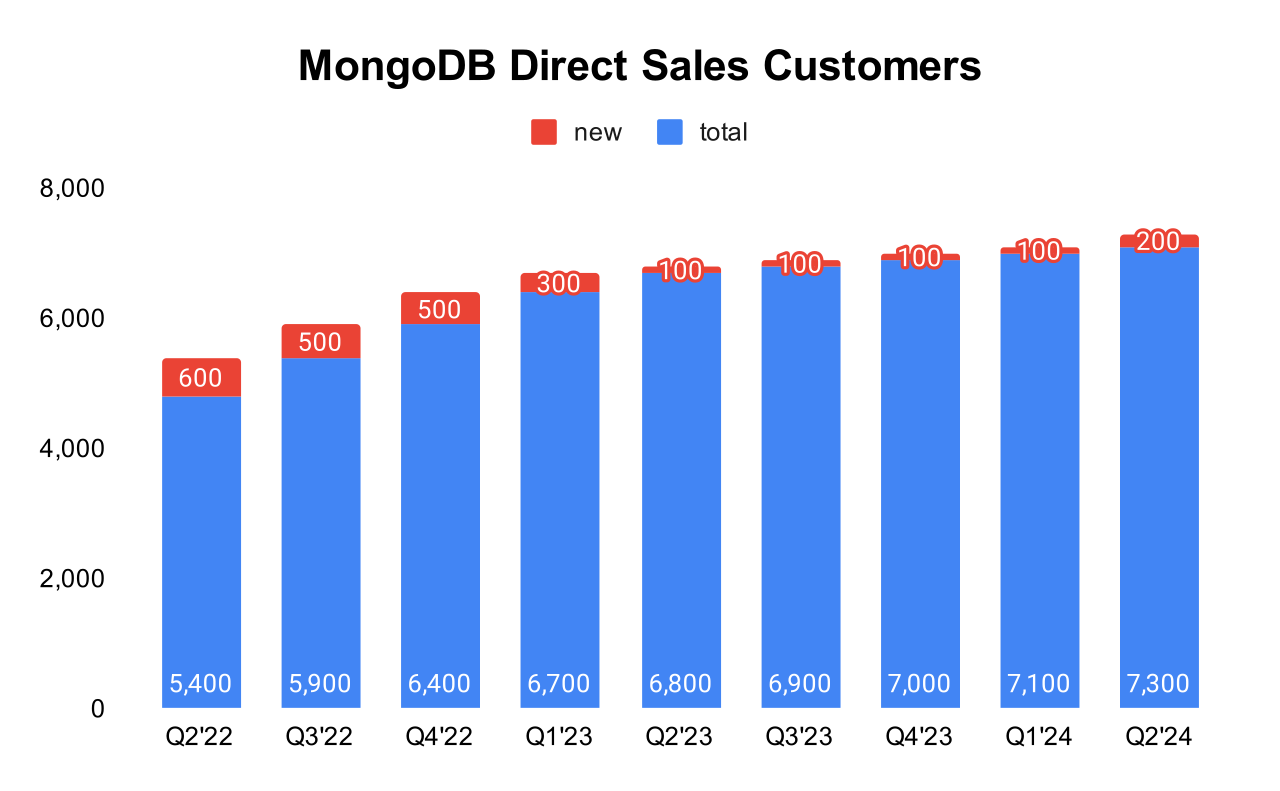

↗️7,300 Direct Sales Customers (+7.0% YoY, +200)

➡️50,700 customers (+13.0% YoY, +1500)

➡️2,189 $100k+ customers (+18.0% YoY, +52)

Operating expenses

↗️S&M*/Revenue 37.8% (+3.1 PPs YoY)

↗️R&D*/Revenue 19.3% (+2.1 PPs YoY)

↗️G&A*/Revenue 7.4% (+0.4 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $96M (-51.0% YoY)

↗️CAC* Payback Period 25.8 Months (-86.8 LQ)

Dilution

↘️SBC/rev 26%, -2.9 PPs QoQ

↘️Share count up 3.8% YoY, -0.2 PPs QoQ

Guidance

↗️Q3'24 $493.0 - $497.0M guide (+14.3% YoY) beat est by 3.2%

↗️$1,920.0 - $1,930.0M FY guide (+14.4% YoY) raised by 1.6% beat est by 1.3%

Key points from MongoDB’s Second Quarter 2024 Earnings Call:

Financial Performance:

MongoDB reported a revenue of $478 million for the quarter, a 13% year-over-year increase, with Atlas revenue growing 27% and representing 71% of total revenue.

AI and New Business Initiatives:

MongoB has launched the MongoDB AI Applications Program (MAP) to support customers in building and deploying AI applications. This program involves collaborations with major cloud providers and AI companies.

The company is seeing AI as a long-term growth opportunity, although immediate monetization from AI remains in the early stages.

Atlas Search Improvements:

The introduction of "search nodes" allows customers to optimize their search deployments by asymmetrically scaling specific nodes dedicated for search tasks, separate from other data operations. This feature enhances performance for search-intensive applications and simplifies workload management.

Vector Search Capabilities:

MongoDB has continued to enhance its vector search capabilities, which are instrumental in building applications that require high-performance, real-time search functionalities. This feature is designed to handle complex queries efficiently, facilitating more dynamic and responsive application interactions.

Stream Processing:

MongoDB has officially launched stream processing capabilities, which became generally available at their ".local New York" event in May. This new feature addresses the needs of industries that manage streaming data, allowing them to process and take actions on this data in real time. The company has seen interest from a variety of industries, including automotive, retail, and transportation.

Customer Growth:

MongoDB ended the quarter with over 50,700 customers, showing substantial growth and a strong rate of new customer acquisition, driven primarily by its Atlas product.

Fanatics Betting and Gambling:

MongoDB highlighted how Fanatics Betting and Gambling, a division of the sports ecosystem company Fanatics, leveraged MongoDB Atlas to enhance the user experience of their mobile app. Initially, the team launched the platform on Postgres but faced scalability, flexibility, and complexity issues. After migrating to MongoDB Atlas, they also integrated Atlas Search to provide users with a better experience in finding all available betting options. This shift allowed developers to focus more on writing code and improving user experience, especially as they prepare for high-demand events like the NFL season.

L'Oréal's Tech Accelerator:

L'Oréal's tech accelerator utilized MongoDB for an application designed to accelerate the process of bringing products and solutions to market while improving employee efficiency. The previous database solution at L'Oréal had limited functionality and struggled with complex calculations and data retrieval from large datasets. By migrating to MongoDB Atlas, L'Oréal achieved a 40-fold performance improvement, simplifying their application architecture and easing maintenance for developers.

Delivery Hero:

A long-time MongoDB Atlas customer, Delivery Hero, a leading global local delivery platform, uses MongoDB to power its quick commerce service. This service enables customers to order fresh produce from local grocery stores, with about 10% of the inventory being fast-moving perishable items. To minimize revenue loss and customer churn from out-of-stock items, Delivery Hero implemented state-of-the-art AI models in MongoDB Atlas Vector Search to offer hyper-personalized alternatives to customers in real time.

Macro Environment:

MongoDB observed a mixed macro environment but noted a modest improvement in Atlas consumption growth over Q1, suggesting some resilience in their business model against broader economic pressures.

While the broader macroeconomic environment has shown signs of impacting customer consumption patterns, particularly in Q1, MongoDB reported that the improved performance in Q2 was broad-based and not necessarily indicative of a macroeconomic recovery. This suggests a cautious but slightly improving outlook.

Future Outlook:

MongoDB emphasized its strategic focus on AI, anticipating long-term growth opportunities.

The company sees potential in helping customers modernize legacy applications using AI tools, which could lead to significant reductions in time and cost. This focus is expected to attract more customers seeking to modernize their IT infrastructure and leverage MongoDB's capabilities.

Management comments on the earnings call.

Product Innovations

Dave Ittycheria, President and CEO: "Our flexible document model is uniquely positioned to help customers build sophisticated AI applications because it is designed to handle different data types, source data, vector data, metadata, and generated data right alongside your live operational data."

Atlas

Michael Gordon, COO and CFO: "Atlas grew 27% in the quarter compared to the previous year and now represents 71% of the total revenue. We recognize Atlas revenue primarily based on customer consumption of our platform and that consumption is closely related to end-user activity of their applications."

Competitors

Dave Ittycheria, President and CEO: "In terms of why do we compete or why do we win, I would say it's a few things. One, our schema flexibility, it's a very MongoDB has a very flexible schema allowing you to store documents in a JSON-like format. So this is beneficial for application structures that evolve over time."

Customers

Dave Ittycheria, President and CEO: "Customers across industries and around the world are running mission-critical projects on MongoDB Atlas, leveraging the full power of our developer data platform, including Fanatics, Occidental Petroleum, and Indeed."

Challenges

Dave Ittycheria, President and CEO: "As a reminder, when thinking of the macro influence on our business, it's important to distinguish between consumption of existing workloads and new business... Our usage trends suggest a similar macro environment in Q2 as in Q1 even though Q2 Atlas consumption growth was modestly ahead of our expectations."

Thoughts on MongoDB ER $MDB:

🟢 Pros:

+ Revenue rose by +12.8% YoY, with next quarter's revenue growth forecast accelerating to +18.3% YoY if it beats the forecast by 3.0%

+ Atlas revenue grew +27% YoY (71% of total revenue), comparable to Snowflake +29 % growing at the same rate.

+ Total calculated billings growth slightly decreased to 21.3% YoY, but is still growing faster than revenue.

+ Net ARR Expansion remains above 119%, slightly down from 120% last quarter.

+ R&D expenses remain high, with reductions in S&M and G&A expenses as the company invests in new product development.

+ MongoDB raised full-year guidance by 1.6%.

+ MongoDB exceeded its Q2 revenue forecast by 3%.

+ MongoDB has launched the MongoDB AI Applications Program (MAP) to support customers in building and deploying AI applications, which could drive future revenue growth.

🔴 Cons:

- Weak number of new customers $100k+ added, only +52.

🟡 Neutral:

+- SBC/rev is 26%, dilution at 3.8% YoY.

+- Non-GAAP gross margin recovered to 75.5% from last quarter but is still below last year's 77.6%.

+- Atlas Net New ARR added declined by -13%, but overall, it’s not bad, given the forecast that Atlas Net New ARR growth will accelerate next quarter.

+- Slightly more total customers added compared to last quarter.