MongoDB Q1 2025 Earnings Analysis

Dive into $MDB MongoDB’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$549M rev (+21.8% YoY, +0.1% QoQ) beat est by 4.2%

↘️GM* (74.0%, -0.9 PPs YoY)🟡

↗️Operating Margin* (15.9%, +8.6 PPs YoY)

↗️FCF Margin (19.3%, +5.8 PPs YoY)🟢

↗️Net Margin (-6.8%, +11.0 PPs YoY)

↗️EPS* $1.00 beat est by 53.8%

*non-GAAP

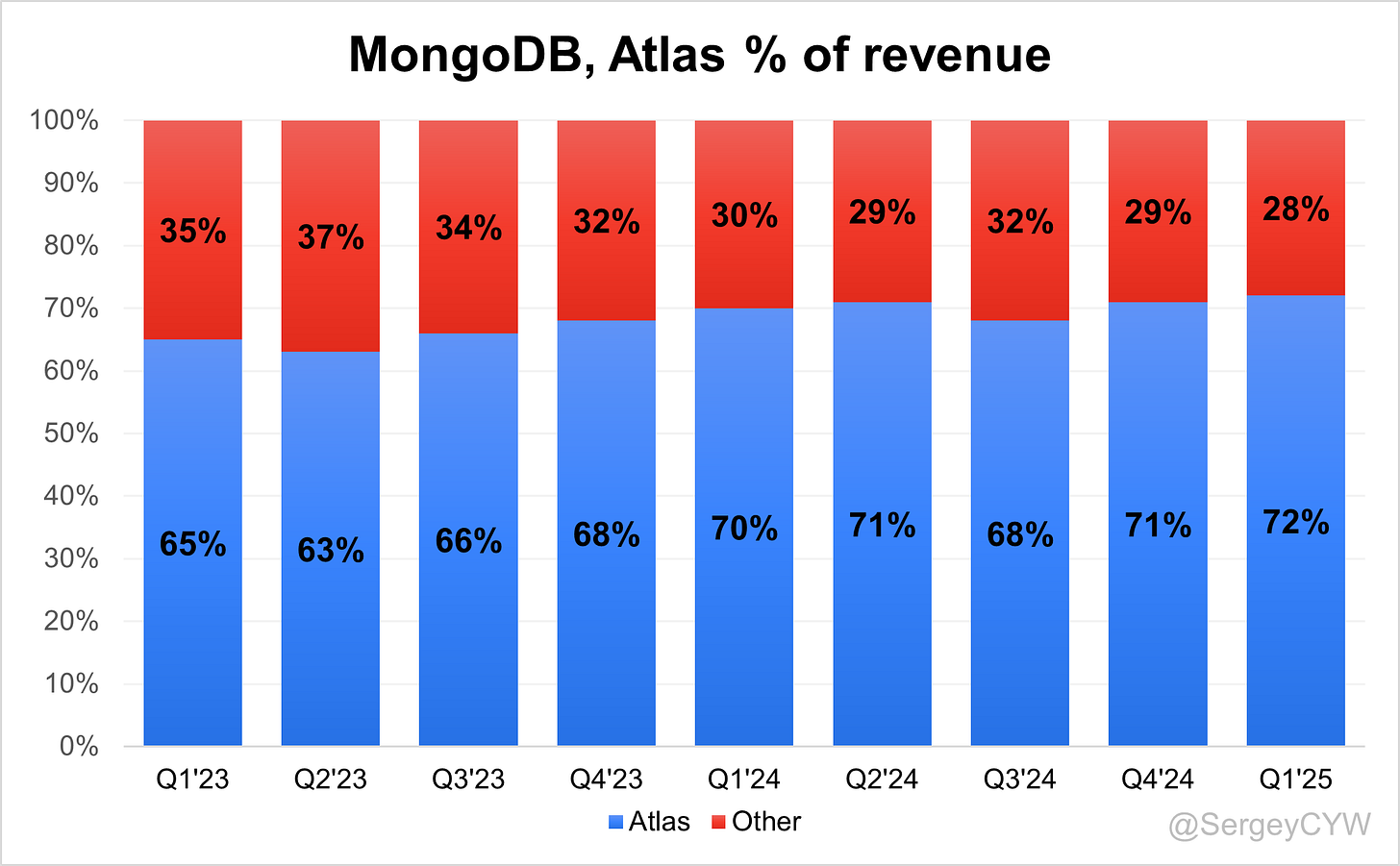

Atlas

↗️$395M rev (+26.0% YoY, 72% of Rev)🟢

↗️Atlas Net New ARR $24M (+48.6% YoY)

Key Metrics

↗️Net AR Expansion 119% (118% LQ)🟢

↗️Billings $510M (+23.4% YoY)🟢

↗️RPO $774M (+32.0% YoY)🟢

Customers

↗️55,800 Atlas customers (+17.0% YoY, +2700)🟢

↘️7,500 Direct Sales Customers (+5.6% YoY, )🔴

↗️57,100 customers (+16.1% YoY, +2600)🟢

↗️2,506 $100k+ customers (+17.3% YoY, +110)

Operating expenses

↘️S&M*/Revenue 33.0% (-6.4 PPs YoY)

↘️R&D*/Revenue 18.3% (-0.7 PPs YoY)

↘️G&A*/Revenue 6.9% (-2.5 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $2M (+106.3% YoY)

↗️CAC* Payback Period 1,135.4 Months (+1222.2 YoY)🟡

↗️R&D* Index (RDI) 1.22 (+0.07 YoY)🟢

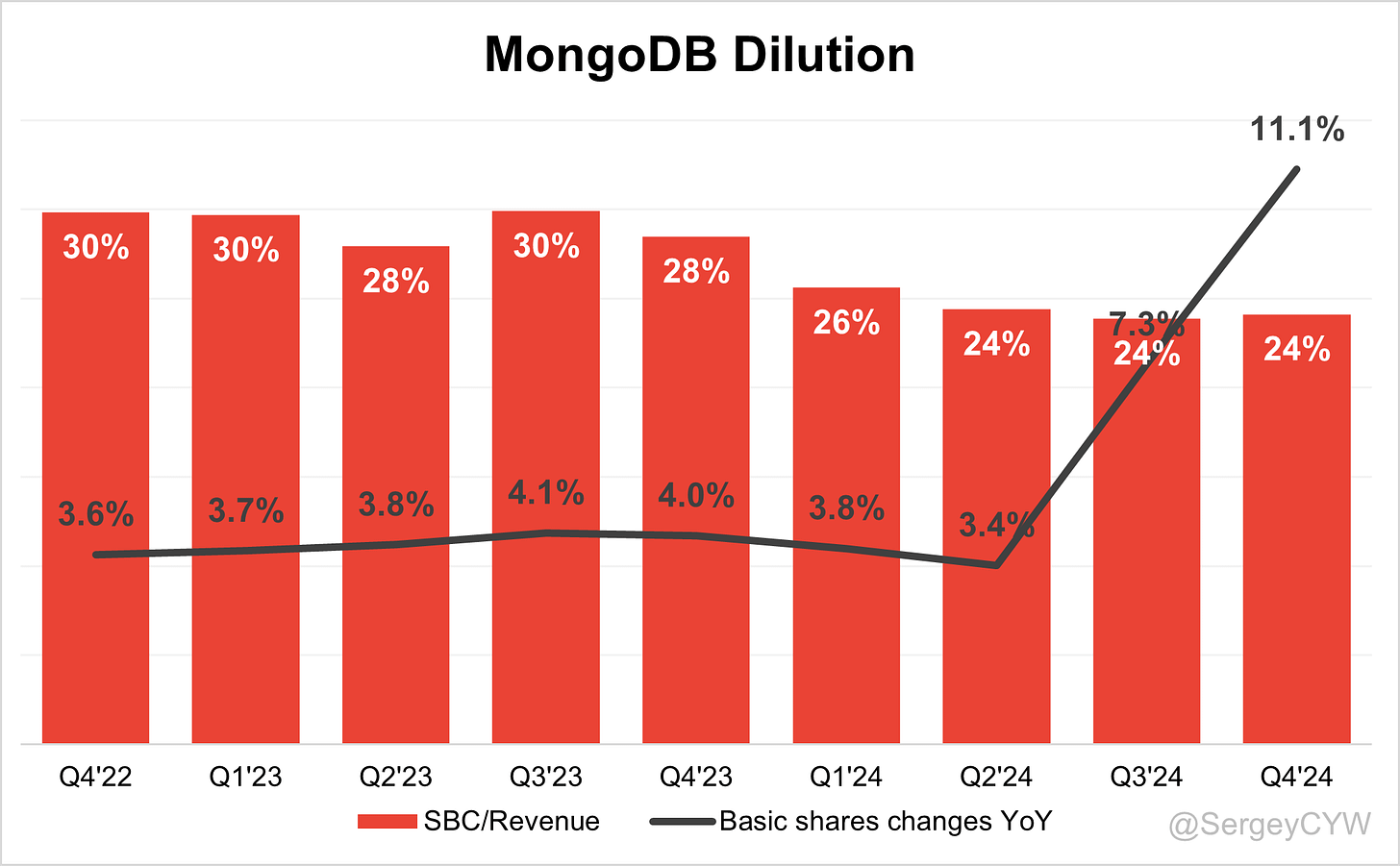

Dilution

↗️SBC/rev 24%, +0.3 PPs QoQ

↗️Basic shares up 11.1% YoY, +3.8 PPs QoQ🔴

↗️Diluted shares up 18.2% YoY, +1.3 PPs QoQ🔴

Guidance

➡️Q2'25 $548.0 - $553.0M guide (+15.1% YoY) in line with est

➡️$2,250.0 - $2,290.0M FY guide (+13.1% YoY) raised by 0.4% in line with est

Key points from MongoDB’s First Quarter 2025 Earnings Call:

Financial Performance

MongoDB reported Q1 FY26 revenue of $549 million, a 22% YoY increase, exceeding the high end of guidance. Non-GAAP operating income reached $87 million, with a 16% margin, up from 7% last year.

Net income rose to $86 million or $1.00 per share, compared to $43 million and $0.51 YoY. Free cash flow totaled $106 million, up from $61 million, driven by operating income and collections.

Total customers grew by 2,600 to 57,100, up from 49,200 a year earlier. Customers with $100K+ ARR increased 17% YoY to 2,506.

Atlas Growth

Atlas contributed $395 million or 72% of revenue, up from 70% YoY. Growth reaccelerated to 26% YoY, driven by enterprise demand and strong self-serve adoption.

February and March saw healthy consumption. April softened due to macro headwinds, but May rebounded, supporting a positive outlook.

MongoDB maintained a 119% net ARR expansion rate. Atlas customer count surpassed 55,800, showing strong cloud adoption. The 2,600 net customer adds marked the highest in over six years.

Atlas Flex

Atlas Flex emerged as a key growth lever in Q1. It enabled efficient customer acquisition in the mid-market via self-serve channels.

80% of Atlas instances were provisioned via code, reflecting strong product-led growth. Flex is replacing mid-market direct sales with lower CAC, enabling MongoDB to serve more accounts without sales team expansion.

Flex customers typically start small but grow over time, adding ARR at high margins. The challenge remains onboarding and product education.

Vector Search

Vector Search, embedded into the core platform, now powers retrieval-augmented generation (RAG) and real-time AI apps.

It combines real-time data, vector and text search, and Voyage AI embeddings into one interface. This eliminates the need for separate tools like Pinecone or Elastic.

LG Uplus implemented an AI-powered agent platform with Atlas Vector Search, improving customer response speed and accuracy.

Voyage 3.5 cut storage needs by over 80% and improved LLM accuracy. MongoDB will offer embedding generation inside the database (Q2 preview), enhancing developer velocity.

MongoDB 8.0

Version 8.0 was the most performant release in company history, with 8.2x faster adoption than prior major versions.

The release improved scalability, performance, and resource efficiency for AI and cloud-native apps.

Focus remains on supporting dynamic, nested, and semi-structured data—key to modern application architectures.

Stream Processing

Stream processing is built into MongoDB’s architecture via change streams and caching.

Zepto, a $1.5B Indian quick-commerce platform, migrated from Postgres to Atlas. It reduced latency by 40%, supported 6x more traffic, and accelerated page loads by 14%, leveraging stream capabilities.

Real-time performance is essential for fraud detection, personalization, and operational AI use cases.

Platform Consolidation

MongoDB now delivers embeddings, full-text and vector search, and transactional workloads under a single API.

The unified architecture improves developer efficiency, reduces infrastructure complexity, and supports high-performance AI applications at scale.

Voyage AI Integration

Voyage AI was fully integrated within four months of acquisition.

Its domain-specific embeddings are 80% more storage-efficient and more accurate. Developers can now use MongoDB as a full-stack AI retrieval platform.

Customers

Customer count rose to 57,100, with a 17% YoY increase in $100K+ ARR customers to 2,506. Direct sales accounts held steady at 7,500+, reflecting a strategic shift toward larger accounts.

Atlas supports 55,800 customers, making up nearly the entire base. Growth was led by both enterprise and Flex users.

Enterprise Accounts

75% of Fortune 100 and 50% of Fortune 500 now use MongoDB.

The company is expanding wallet share within large accounts, transitioning from departmental adoption to platform-wide standardization.

Engagements now include CIOs and senior tech leaders from healthcare and financial services.

Customer Success

Zepto achieved 40% lower latency, 6x traffic capacity, and 14% faster pages after migrating from Postgres to Atlas.

CSX modernized a mission-critical rail operations portal (21,000 miles) using Atlas, improving uptime and scalability.

LG Uplus deployed real-time AI agents on Atlas Vector Search, reducing call processing time.

Other users include Cursor, Vonage, Halion, Financial Times, Novo Nordisk, Swisscom, and CentralReach.

Go-to-Market Shift

MongoDB reallocated resources from mid-market to enterprise, driving higher sales productivity.

Self-serve now captures smaller customers, while enterprise teams focus on high-ACV strategic accounts. This shift has improved efficiency and deal sizes.

Global Expansion

MongoDB expanded documentation and onboarding in Mandarin, Korean, Japanese, and Portuguese.

Training and certifications are being scaled globally to grow the developer base and improve onboarding velocity.

Market Challenges

Many developers still perceive MongoDB as competing with relational databases.

Postgres’s JSON feature is framed by MongoDB as validation that traditional schemas are inadequate for modern workloads.

MongoDB is investing in awareness and education to highlight its architectural advantages.

Gross Margin

Gross margin declined slightly to 74%, down from 75% YoY.

The mix shift to Atlas (lower-margin cloud revenue) and the integration of Voyage AI contributed to this expected decline.

Share Repurchase

MongoDB’s Board approved a $1 billion share repurchase program, including $200 million to offset Voyage AI dilution.

No shares were repurchased in Q1 due to the CFO transition. Execution will begin in Q2.

FY26 Outlook

Q2 revenue is guided at $548M–$553M, with non-GAAP operating income of $55M–$59M and EPS of $0.62–$0.66.

Full-year guidance was raised:

Revenue: $2.25B–$2.29B

Operating income: $267M–$287M

EPS: $2.94–$3.12

Non-Atlas revenue is expected to decline high single digits, with a $50 million headwind from multi-year license deals.

Focus remains on expanding margins, reallocating spend to high-ROI initiatives, and delivering durable, efficient growth.

Management comments on the earnings call.

Product Innovations

Dave Ittycheria, President and Chief Executive Officer

"With the release of Voyage 3.5, we've taken another step forward, meaningfully outperforming the next best embedding models while reducing storage costs by more than 80%."

"MongoDB now brings together three things that modern AI powered applications need, real time data, powerful search, and smart retrieval. By combining these into one platform, we make it dramatically easier for developers to build intelligent, responsive apps without stitching together multiple systems."

"Our latest release, MongoDB 8.0, is the most performant release we've ever issued. It has had the fastest uptake of any major release, with customers adopting 8.2 times faster than our last major release."

Atlas

Mike Berry, Chief Financial Officer

"In Q1, consumption growth was in line with our expectations. Specifically, we saw good consumption growth in February and March, some softness in April as macroeconomic volatility increased, followed by a healthy rebound in May."

Dave Ittycheria, President and Chief Executive Officer

"What I would say is that we still talk to customers who have very near needs for running their business… The fact that you can do this all in one platform… just makes MongoDB a very attractive solution."

"We feel really good about the fact that we added a lot of customers. What it really shows is that customers and developers are voting with their feet to really adopt MongoDB."

Vector Search

Dave Ittycheria, President and Chief Executive Officer

"Real world AI applications require high quality, context rich, and often unstructured data to deliver trustworthy outputs… Voyage's leading embedding and re-ranking models allow customers to feed precise and relevant context into LLMs."

"By producing the most contextually rich domain optimized embeddings, MongoDB sits at a gateway of meaning in an AI system."

Stream Processing

Dave Ittycheria, President and Chief Executive Officer

"Zepto overcame these challenges through built in features like in memory caching, sharding, and real time analytics. This transition enabled them to reduce latency by 40%, handle six times more traffic, and improve page load times by 14%."

Go-to-Market Shift

Dave Ittycheria, President and Chief Executive Officer

"The productivity of that team has always been quite high… Our self serve business started to acquire mid market logos, serving them more efficiently without ceding ground to anyone else."

"We're doing larger deals. The productivity of the sales team focused on those accounts is materially higher than the typical sales rep."

Mike Berry, Chief Financial Officer

"There was nothing that we didn’t pull back or say, don’t hire… We also don’t have any concerns around, does that mean lower, for instance, sales capacity, largely due to what Dave talked about on the go to market."

Competitors

Dave Ittycheria, President and Chief Executive Officer

"Postgres and other relational platforms are now adding JSON… which is a tacit admission that MongoDB's approach of using JSON and the document model is the best way to model real world data."

"Superficial compatibility with modern data types is not the same as deeply integrated production grade functionality… These features may check the box, but they fall apart in production."

Dave Ittycheria, President and Chief Executive Officer

"Building organically an OLTP store is really hard… It's not clear to me why the world needs a fifteenth or sixteenth Postgres derivative database."

"When relational databases start trying to mimic our features, what does that tell you? It tells you that their existing architecture is not designed for this world."

Customers

Dave Ittycheria, President and Chief Executive Officer

"Zepto, an India based quick commerce platform… migrated to MongoDB from Postgres after experiencing scalability challenges… This transition enabled them to reduce latency by 40%, handle six times more traffic, and improve page load times by 14%."

"CSX can now dynamically scale workloads and optimize the database management. With this modernization, CSX is positioned to achieve greater operational performance while driving long term sustainable growth."

"LG U plus… built its agent assist AI solution on MongoDB Atlas… The solution has significantly enhanced customer experiences and decreased the average processing time per call."

Challenges

Dave Ittycheria, President and Chief Executive Officer

"There are some misconceptions about MongoDB that we know we need to address and we're quite excited about the opportunity to do so."

"Postgres popularity is really a function of the consolidation of the SQL market… People are leaving Oracle, leaving SQL Server, leaving MySQL and going to Postgres."

Mike Berry, Chief Financial Officer

"We are also cognizant of April was a little bit soft, May pop back. We'd like to see a couple more months of that going into the year."

Future Outlook

Mike Berry, Chief Financial Officer

"We are raising our expectations for revenue based on our strong start to the year… and we are announcing a significant expansion to our share repurchase program."

"We are raising our non GAAP income from operations expectations by $57 million… and remain committed to a balanced investment approach that supports our key long term growth initiatives."

Dave Ittycheria, President and Chief Executive Officer

"As we look ahead, we're confident MongoDB's combination of architectural advantage, enterprise trust, and broad developer adoption positions us to lead in both the current wave of digital transformation and the next wave powered by AI."

"We’re steadily advancing toward a vision of becoming the go-to platform for enterprises and the first choice for developers creating new applications."

Thoughts on MongoDB Earnings Report $MDB:

🟢 Positive

Revenue grew to $549M (+21.8% YoY, +0.1% QoQ), beating estimates by 4.2%

Atlas revenue reached $395M (+26.0% YoY), representing 72% of total revenue

Net ARR expansion held strong at 119% (+1pp QoQ)

Billings increased to $510M (+23.4% YoY), RPO rose to $774M (+32.0% YoY)

Free Cash Flow margin expanded to 19.3% (+5.8pp YoY)

Operating margin improved to 15.9% (+8.6pp YoY)

EPS (non-GAAP) hit $1.00, beating estimates by 53.8%

$100K+ customers increased to 2,506 (+17.3% YoY, +110 QoQ)

Atlas customers rose to 55,800 (+17.0% YoY, +2,700 QoQ)

Net new ARR added $2M, up 106.3% YoY

R&D Index improved to 1.22 (+0.07 YoY)

Operating efficiency improved: S&M/rev down 6.4pp, G&A/rev down 2.5pp

FY26 revenue guidance raised slightly to $2.25B–$2.29B, a 0.4% increase, tracking consensus

🟡 Neutral

Q2 FY26 revenue guidance of $548M–$553M implies 15.1% YoY growth, in line with expectations

April Atlas consumption was soft due to macro volatility, but May rebounded

Self-serve channel grew strongly, but onboarding challenges persist

SBC/revenue rose slightly to 24% (+0.3pp QoQ)

CAC payback period increased to 1,135 months, distorted by seasonality

🔴 Negative

Gross margin declined to 74.0% (-0.9pp YoY) due to Atlas mix and Voyage AI integration

Direct sales customers grew only +5.6% YoY, remaining flat QoQ at 7,500

Non-Atlas revenue expected to decline high single digits YoY due to $50M license revenue headwind

Dilution impact from share count:

Basic shares up 11.1% YoY, +3.8pp QoQ

Diluted shares up 18.2% YoY, +1.3pp QoQ

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.