Financial Results:

$MDB Q1'24 Results:

↗️$451M rev (22.3% YoY, +26.8% LQ) beat est by 2.5%

↘️GM* (75.0%, -1.0%pp YoY)

↘️Operating Margin* (7.3%, -4.6%pp YoY)

↘️FCF Margin (13.5%, -0.5%pp YoY)

↗️EPS* $0.51 beat est by 27.5%

*non-GAAP

Atlas

↗️$315M rev (+32.0% YoY, 70% of Rev)

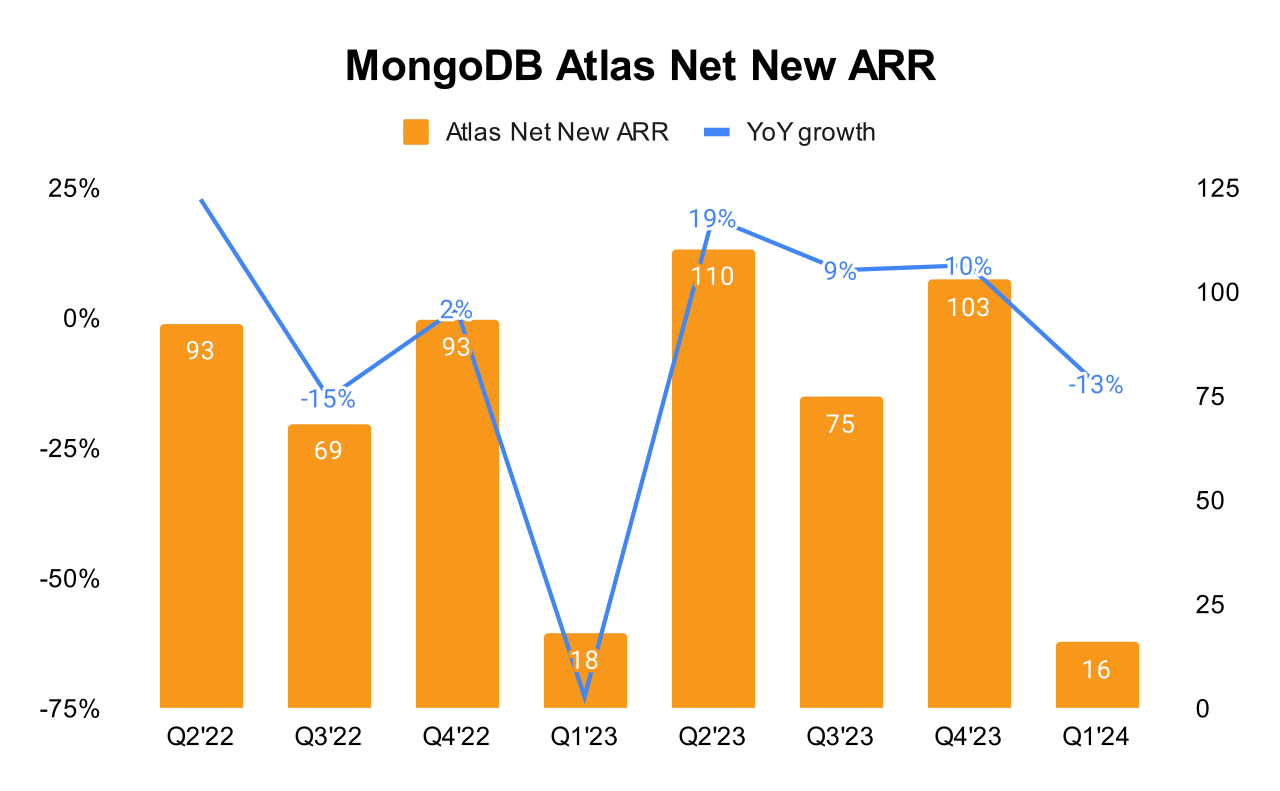

↗️Atlas Net New ARR $16M (-12.5% YoY)

Key Metrics

➡️Net AR Expansion 120% (120% LQ)

↗️Billings $413M (+28.0% YoY)🟢

Customers

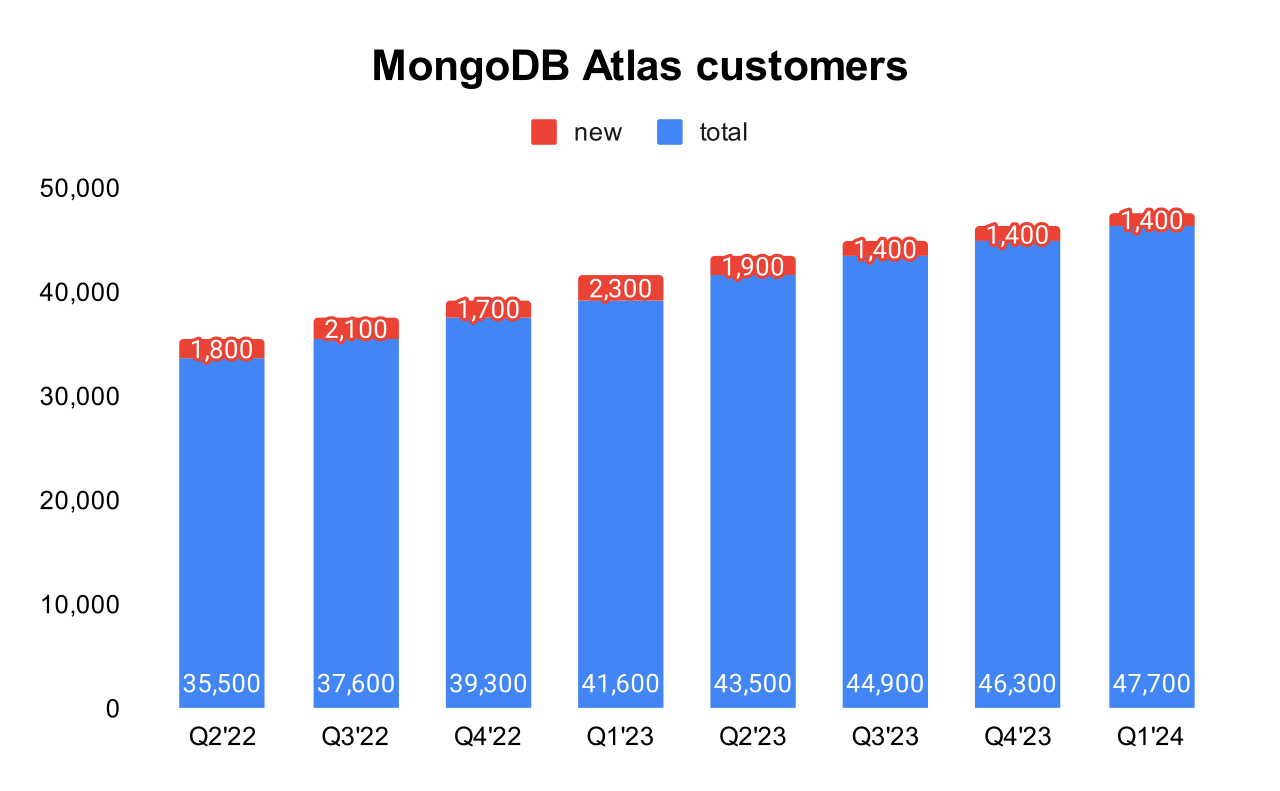

➡️47,700 Atlas customers (+15.0% YoY, +1400)

➡️7,100 Direct Sales Customers (+6.0% YoY, +100)

➡️49,200 customers (+14.0% YoY, +1400)

➡️2,137 $100k+ customers (+21.0% YoY, +85)

Operating expenses

↗️S&M*/Revenue 39.3% (36.1% LQ)

↗️R&D*/Revenue 19.0% (17.9% LQ)

↗️G&A*/Revenue 9.3% (8.1% LQ)

↘️Net New ARR -$30M ($100 LQ)

↘️CAC* Payback Period -86.8 Months (23.2 LQ)

Dilution

↘️SBC/rev 28%, -1.4%pp QoQ

↘️Share count up 4.0% YoY, -0.1%pp QoQ🟡

Guidance

↘️Q2'24 $460.0 - $464.0M guide (+9.0% YoY) missed est by -1.8%🔴

↘️$1,880.0 - $1,900.0M FY guide (+12.3% YoY) lowered by -1.6% missed est by -2.1%🔴

Key points from MongoDB's First Quarter 2024 Earnings Call:

Financial Performance:

MongoDB reported Q1 revenue of $451 million, marking a 22% year-over-year increase, which was above their guidance.

Gross Margin Decline:

MongoDB reported a slight decline in gross margin from 76% in the previous year to 75% in Q1 2025. This decline is primarily attributed to the increasing share of Atlas in the company's revenue mix, as Atlas has different cost structures compared to other products.

Product Innovations:

MongoDB 8.0: MongoDB announced the introduction of MongoDB 8.0, which promises significant enhancements in performance and functionality. This new version is expected to deliver up to a 60% performance improvement over the previous release and has materially enhanced sharding functionality, allowing customers to build highly performant, scalable, and resilient applications.

Full Text and Vector Search: MongoDB announced plans to bring full text search and vector search to its community server offering. This expansion showcases MongoDB's commitment to its open-source community and enhances the platform's capabilities to handle diverse data types which are crucial for modern applications, including those driven by AI.

Atlas Stream Processing: The general availability of Atlas Stream Processing was announced, which extends MongoDB's capabilities in handling real-time, distributed data across a broad range of industries.

Atlas Platform:

Growth and Revenue: Atlas revenue grew 32% year-over-year, now representing 70% of MongoDB's total revenue.

Customer Stories: Highlighted use cases include Toyota Connected, which relies on Atlas for over 150 microservices with benefits such as ease of deployment, reliability, and multi-cloud capabilities. Additionally, Sega Europe migrated from Amazon DynamoDB to MongoDB Atlas due to its flexibility in handling complex queries and schema variations, significantly improving their capability to analyze extensive data.

Challenges:

Atlas Consumption Growth: Atlas consumption was below expectations due to less seasonal improvement, impacting customers across all sectors and geographies. This indicates broader issues such as potentially weaker end-user activity.

New Business Performance: MongoDB experienced a slow start in new business performance during the quarter, partially due to operational delays in organizing the sales structure and finalizing quotas. While they caught up by the end of the quarter, it did not fully meet expectations.

Workload Growth Rate: The growth rate for more recently acquired workloads began to slow down earlier than anticipated, which the company attributes to changes in the go-to-market strategies implemented the previous year.

Strategic Focus Areas:

MongoDB plans to increase investments in the enterprise channel, where they see the best returns at the high end of the market.

The company is optimistic about accelerating legacy application modernization using AI, aiming to reduce the time, cost, and risk of modernizing legacy relational applications by approximately 50%.

Future Outlook:

The company now expects full-year revenue to be between $1.88 billion and $1.9 billion. This adjustment is largely due to weaker than expected Atlas consumption growth and a challenging macroeconomic environment affecting customer behaviors.

The guidance also factors in the absence of over $40 million in revenue related to unused Atlas commitments, which makes for tough year-over-year comparisons.

Management comments on the earnings call.

Product Innovations:

Dev Ittycheria, CEO: "Early this month at our New York user conference, we announced a number of innovations to address important customer needs. We introduced MongoDB 8.0, which will deliver up to a 60% performance improvement over our last release while also materially enhancing our [sharding] functionality."

Atlas:

Michael Gordon, COO and CFO: "Following our guide in March, week-over-week consumption growth was below our expectations. Consumption improved compared to Q4, but was below the seasonal strength we saw in Q1 of last year."

Gross Margin:

Michael Gordon, COO and CFO: "Gross profit in the first quarter was $337.8 million, representing a gross margin of 75%, which is down from 76% in the year-ago period. Our year-over-year margin decline is primarily driven by Atlas growing as a percent of the overall business."

Competitors:

Dev Ittycheria, CEO: "Our relationship with our hyperscalers is actually very strong. We partner very closely with AWS, Azure, and GCP in the field. And in fact, they're coming to us to partner on deals more frequently than we've seen in the past. And our win rates, frankly, are very high."

Customers:

Dev Ittycheria, CEO: "Customers across industries around the world are running mission critical projects on MongoDB Atlas, leveraging the full power of our developer data platform, including Michelin, Meltwater, and Toyota Connected."

Challenges:

Dev Ittycheria, CEO: "First, Atlas consumption growth was below our expectations in the first quarter. We saw less seasonal improvement than expected, and this dynamic was true with customers across tenure, industry, size, and geography."

Future Outlook:

Dev Ittycheria, CEO: "We are focusing more resources on the high end of the market, accelerating legacy app modernization using AI, and cementing our position as the platform of choice for next-generation AI applications. And we'll invest judiciously in these priorities through the rest of this year."

Dev Ittycheria, CEO: "We are well positioned to be a key beneficiary as organizations embed AI into the next generation of software applications that transform their business."

Thoughts on MongoDB ER $MDB:

🟢 Pros:

+ Revenue rose by +22.3% YoY.

+ Atlas revenue grew +32% YoY (70% of total revenue), comparable to Snowflake growing at the same rate.

+ Net ARR Expansion remains at >120%.

+ Total calculated Billings growth accelerated to 28% YoY, faster than revenue growth.

+ Strong FCF margin of 14%.

+ The company announced MongoDB 8.0

🔴 Cons:

- Weak guidance for the next quarter; revenue growth will slow down significantly.

- Cut FY guidance.

🟡 Neutral:

+- SBC/rev is 28%, dilution at 4.0% YoY.

+- Atlas Net New ARR added declined by -13%, but overall, it’s not bad.

+- Beat Q1 revenue estimates by 2.4%, the smallest beat in the past few years.

+- The company is increasing R&D and S&M expenses, but will the company be able to benefit from this?

+- Weak number of new customers added.