Monday.com Q4 2024 Earnings Analysis

Dive into $MNDY Monday’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$268.0M rev (+32.3% YoY, +32.7% LQ) beat est by 2.6%

↘️GM* (89.2%, -0.5 PPs YoY)🟡

↗️Operating Margin* (15.0%, +4.6 PPs YoY)

↘️FCF Margin (27.1%, -0.2 PPs YoY)🟡

↗️Net Margin (8.6%, +2.5 PPs YoY)🟢

↗️EPS* $1.08 beat est by 36.7%🟢

*non-GAAP

Net dollar retention rate

↗️NDR 112% (111% LQ)

↗️NDR 10+ users 115% (114% LQ)

➡️NDR $50k+ ARR 115% (115% LQ)

↗️NDR $100k+ ARR 116% (115% LQ)

Customers

➡️245,000 customers (+8.8% YoY, +19769)

↗️3,201 $50k+ customers (+39.5% YoY, +294)🟢

↗️1,207 $100k+ customers (+44.9% YoY, +127)🟢

Key Metrics

➡️27,756 CRM accounts (+12.2% QoQ, +3021)

➡️3,433 dev accounts (+9.0% QoQ, +283)

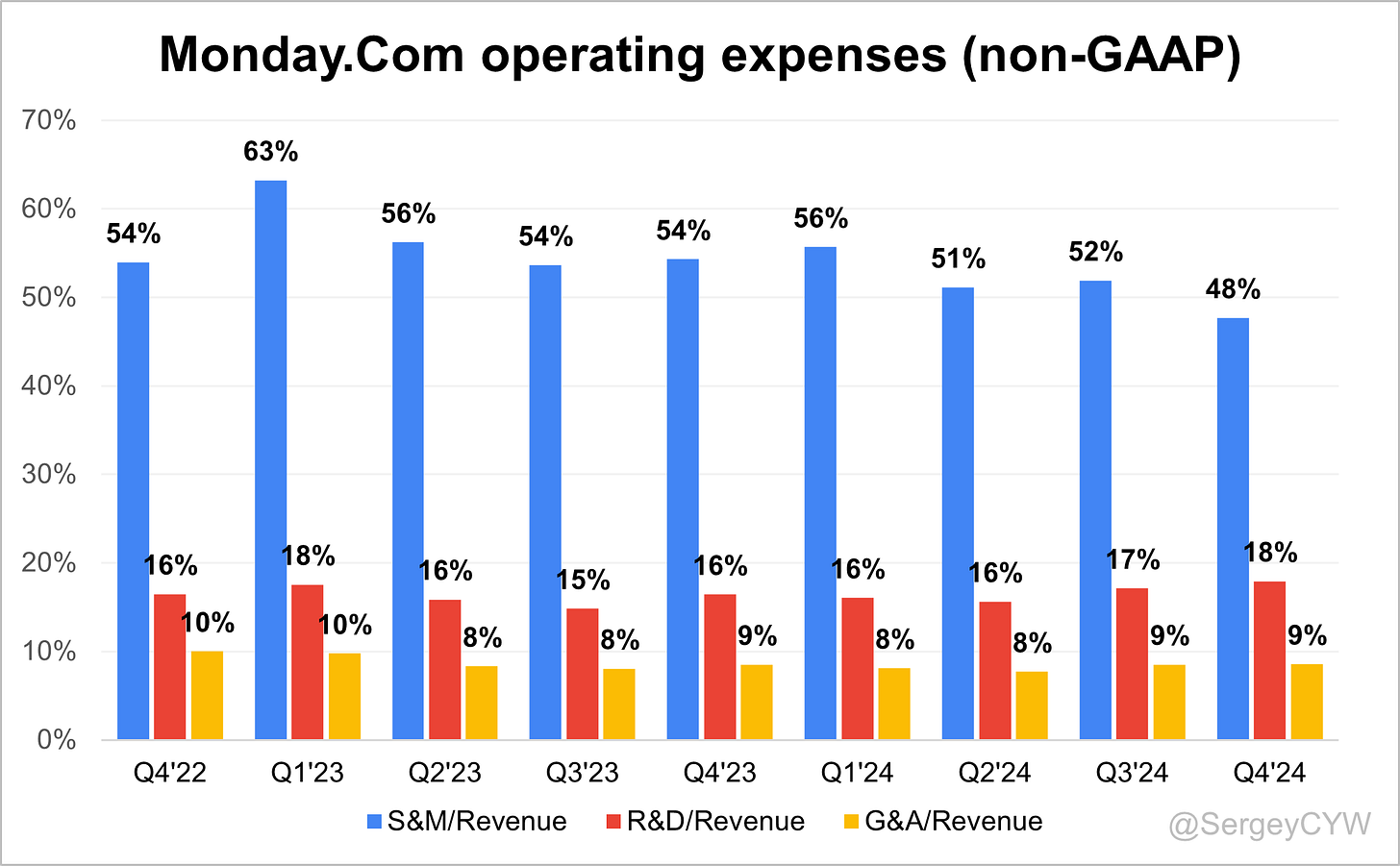

Operating expenses

↘️S&M*/Revenue 47.7% (-6.6 PPs YoY)

↗️R&D*/Revenue 17.9% (+1.5 PPs YoY)

↗️G&A*/Revenue 8.6% (+0.0 PPs YoY)

Quarterly Performance Highlights

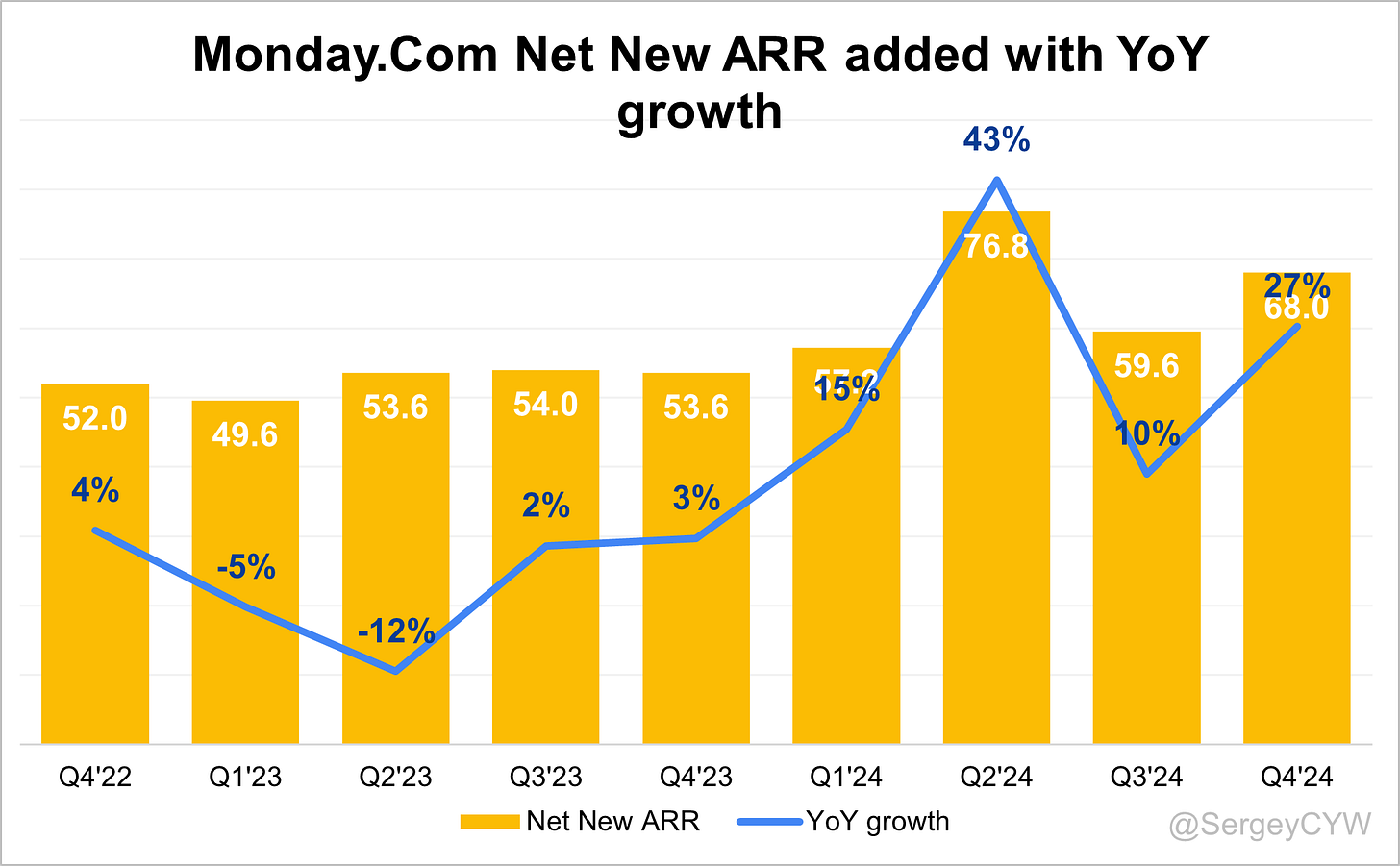

↗️Net New ARR $68M (+26.9% YoY)

↗️CAC* Payback Period 25.8 Months (+0.5 YoY)🟡

↗️R&D* Index (RDI) 2.00 (+0.06 YoY)🟢

Dilution

↘️SBC/rev 11%, -2.6 PPs QoQ

↗️Basic shares up 3.7% YoY, +0.4 PPs QoQ

↗️Diluted shares up 2.6% YoY, +0.3 PPs QoQ

Headcount

↗️2,508 Total Headcount (+35.3% YoY, +203 added)

Guidance

↗️Q1'25 $274.0 - $276.0M guide (+26.8% YoY) beat est by 0.6%

➡️$1,208.0 - $1,221.0M FY guide (+24.9% YoY) in line with est

Key points from Monday’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Monday.com reported Q4 2024 revenue of $268M, up 32% YoY. Fiscal year revenue reached $972M, growing 33% YoY. Gross margin remained strong at 89%, and free cash flow hit $295.8M for the year, with a 30% margin. Q4 net income increased to $57.3M, from $33.7M in Q4 2023.

FY 2025 guidance projects revenue between $1.208B-$1.221B, reflecting 24%-26% YoY growth. Free cash flow is expected to be $300M-$308M, with a 25% margin. Pricing adjustments are projected to contribute $40M in revenue in 2025 and $80M from 2024-2026.

Product Innovations

Monday.com expanded its product suite in 2024, integrating AI, automation, and enterprise scalability. AI Blocks and the digital workforce (Monday Expert, Deal Facilitator, and Service Analyzer) were introduced to enhance automation.

The launch of Monday Service, an AI-first enterprise service management solution, has driven strong adoption. CRM and Dev solutions continue gaining traction, strengthening the multi-product strategy.

Monday CRM

Monday CRM added a record number of net new accounts in 2024, contributing significantly to ARR and revenue. The platform integrates with WorkOS, allowing businesses to unify sales and operations.

New capabilities focus on marketing automation and lead management. Enterprise adoption is rising, with CRM playing a key role in cross-selling Monday Work Management. Net new customer growth slowed in Q4 due to seasonal marketing adjustments, but CRM’s revenue contribution is expected to increase in 2025.

Monday Dev

Monday Dev gained traction among software development teams, benefiting from AI integrations, automation, and agile collaboration features. While not yet a major revenue driver, enterprise adoption is growing.

Customer additions slowed in Q4 due to seasonal factors, but the product remains a long-term growth engine. Future enhancements will focus on AI, version control, and advanced collaboration tools.

Monday Service

Monday Service launched in 2024, delivering AI-powered enterprise service management. The product has the highest ACV of all Monday.com offerings and 60% of customers were already using Monday Work Management, highlighting strong cross-sell potential.

Despite its success, broader enterprise penetration will require more investment in go-to-market strategies and partnerships. Future improvements will expand AI-driven insights and automation capabilities.

Monday AI

Since launching, users have performed 10M+ AI actions, demonstrating strong adoption. AI Blocks automate workflows, while AI-powered pricing is consumption-based, offering 500 free actions per month, with additional actions available for purchase.

AI revenue was not included in 2025 guidance, indicating a cautious approach to monetization. AI’s 2025 roadmap includes deeper integration into WorkOS, CRM, and Service, enhancing automation and analytics.

Monday DB 2.0

Scalability improved with Monday DB 2.0, enabling larger, more complex enterprise use cases. The system upgrade played a key role in winning Monday.com’s largest customer (80,000 seats).

Continued investment is required to maintain speed, reliability, and security. The focus remains on query optimization and enhanced automation support.

Consumption-Based Pricing

The AI consumption model allows organizations to scale based on usage, providing 500 free actions with paid tiers for additional usage. AI pricing was not factored into 2025 revenue guidance, offering potential upside if adoption grows.

Retention and Expansion

Net Dollar Retention (NDR) reached 112% in Q4, expected to remain stable in 2025. Pricing adjustments will contribute 100 basis points to reported NDR.

Total customers reached 245,000, with the focus shifting to expansion within existing accounts and enterprise growth.

Customers and Market Position

Enterprise is the fastest-growing segment, with increasing seat counts. CRM and Service demonstrated high cross-sell potential, driving customer expansion.

Monday.com gained market share from competitors by offering flexibility and AI automation, making it a strong alternative to legacy solutions.

Customer Success

A multinational company scaled from collaboration to AI-driven automation and enterprise service management, improving response times and workflow efficiency.

A large tech firm transitioned from legacy DevOps to Monday Dev, citing flexibility, AI insights, and scalability. The company reduced project completion times and improved team collaboration.

Macro Trends

Demand remained strong in North America, while Europe stabilized after some volatility in November. 65% of revenue is USD-based, with FX headwinds expected to impact revenue by 100-200 basis points in 2025.

Future Outlook

Monday.com enters 2025 with strong momentum, driven by enterprise expansion, AI, and product growth. Revenue is projected to reach $1.208B-$1.221B (+24%-26%), with operating margins improving.

The company plans a 30% increase in hiring, focusing on sales, R&D, and product teams. AI will continue expanding through Blocks, digital workforce, and automation tools.

A combination of high-margin subscriptions, enterprise adoption, and AI-driven growth positions Monday.com for sustained long-term success.

Management comments on the earnings call.

Product Innovations

Roy Mann, Co-CEO

"2024 has been a period of transformation and growth, with our business reaching new heights across every area. We’ve made substantial progress in solidifying our market leadership while driving innovation to meet the evolving needs of our customers."

Eran Zimmerman, Co-CEO

"We continue to make considerable progress in our multi-product strategy. Our focus remains on building a platform that is not only powerful but also adaptable to various business needs, and the recognition we received in the Gartner Magic Quadrant validates that strategy."

Monday CRM

Eran Zimmerman, Co-CEO

"Monday CRM has exceeded expectations, and we added a record number of net new accounts for both CRM and Dev during the year. As CRM adoption grows, it is becoming a more significant contributor to our ARR."

Monday Dev

Eran Zimmerman, Co-CEO

"Monday Dev has continued to gain traction, particularly as we move upmarket. The flexibility of the platform allows development teams to collaborate more effectively while leveraging AI-powered automation for greater efficiency."

Monday Service

Eran Zimmerman, Co-CEO

"Monday Service is now officially available to all customers. It is an AI-first enterprise service management solution designed to help teams deliver exceptional support faster through smart AI-powered automations. Initial demand has been very strong, with Monday Service already showing the highest cross-sell and ACV of any product in our suite."

Monday AI

Roy Mann, Co-CEO

"We are committed to making AI accessible to everyone on our platform. AI Blocks allow our customers to build automated workflows with ease, and since launching, users have performed approximately 10 million AI actions."

Eran Zimmerman, Co-CEO

"To make AI more accessible, we introduced a flexible, consumption-based pricing model for AI Blocks, offering a baseline level of free usage for all plans. Organizations with larger AI needs can scale up through additional purchases, making it easier for businesses of all sizes to integrate AI into their operations."

Competitors

Eliran Glaser, Chief Financial Officer

"We are gaining market share as our platform’s flexibility and AI-driven automation continue to differentiate us from competitors. Some of our rivals have shifted focus to enterprise-only solutions, which has created an opportunity for us to capture mid-market and SMB customers looking for scalable work management tools."

Customers

Eran Zimmerman, Co-CEO

"Enterprise has been our fastest-growing segment, and we have seen growth accelerate within this market. We successfully grew our largest seat count to 80,000, signaling strong adoption and deeper enterprise customer engagement."

Challenges

Eliran Glaser, Chief Financial Officer

"While we are encouraged by our progress, we remain mindful of macroeconomic uncertainties, including currency fluctuations and geopolitical factors. We are taking a prudent approach to forecasting, ensuring that our business remains resilient and positioned for long-term growth."

Future Outlook

Roy Mann, Co-CEO

"As we look ahead to 2025, we remain focused on continuing this momentum, building on our achievements, and further expanding our reach and impact. With a strong foundation in place, we are excited for the opportunities to come."

Eliran Glaser, Chief Financial Officer

"We expect revenue to be in the range of $1.208 billion to $1.221 billion, representing 24% to 26% year-over-year growth. Our disciplined approach to growth, combined with strategic investments in AI and enterprise expansion, positions us well for continued success in the coming year."

Thoughts on Monday Earnings Report $MNDY:

🟢 Positive

Revenue: $268M (+32.3% YoY, +32.7% QoQ), exceeding estimates by 2.6%

Net Income: $57.3M in Q4, up from $33.7M in Q4 2023

Net Dollar Retention (NDR): 112% overall, 115% for $50K+ ARR, 116% for $100K+ ARR

Large Customers: $50K+ ARR customers +39.5% YoY (3,201), $100K+ ARR customers +44.9% YoY (1,207)

EPS: $1.08, beating estimates by 36.7%

Operating Margin: 15.0% (+4.6 PPs YoY)

Net New ARR: $68M (+26.9% YoY)

CRM Accounts: 27,756 (+12.2% QoQ)

Monday Dev Accounts: 3,433 (+9.0% QoQ)

Hiring: 2,508 employees (+35.3% YoY, +203 QoQ)

Q1 2025 Revenue Guidance: $274M - $276M (+26.8% YoY), beating estimates by 0.6%

AI Monetization Not Yet Reflected: AI revenue not included in 2025 guidance, representing a potential but unrealized upside.

🟡 Neutral

Gross Margin: 89.2% (-0.5 PPs YoY)

Free Cash Flow Margin: 27.1% (-0.2 PPs YoY)

Q4 Customer Growth: 245,000 total customers (+8.8% YoY, +19,769 added)

R&D Investment: 17.9% of revenue (+1.5 PPs YoY)

Q1 2025 Guidance: $1.208B - $1.221B (+24.9% YoY), in line with estimates

SBC/Revenue: 11%, down 2.6 PPs QoQ

Customer Acquisition Cost (CAC) Payback Period: 25.8 months (+0.5 YoY)

🔴 Negative

Sales & Marketing Spend: 47.7% of revenue (-6.6 PPs YoY), but still high

Stock Dilution: Basic shares up 3.7% YoY, diluted shares up 2.6% YoY

FX Headwinds: Expected to impact 2025 revenue by 100-200 basis points

Thank u !!