Financial Results:

⬆️$202.6M rev (+35.2% YoY, +38.2% LQ) beat est by 2.3%

↘️GM* (89.7%, -0.3%pp YoY)

⬆️Operating Margin* (10.5%, +0.9%pp YoY)

⬆️FCF Margin 27.4%, +7.6%pp YoY)

⬆️EPS* $0.65 beat est by 103.1%🟢

*non-GAAP

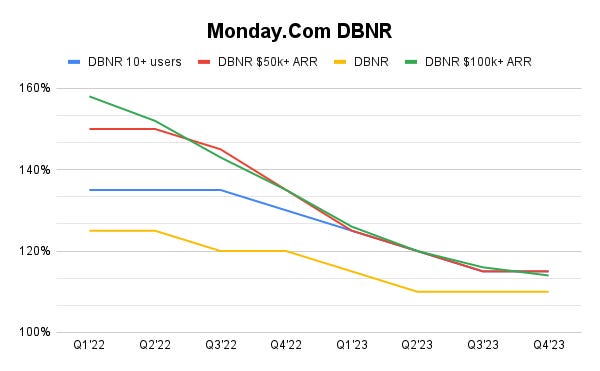

➡️DBNR 110% (110% LQ)

➡️DBNR 10+ users 115% (115% LQ)

➡️DBNR $50k+ ARR 115% (115% LQ)

↘️DBNR $100k+ ARR 114% (116% LQ)

Customers

⬆️225,231 customers (+21.0% YoY, +38754)🟢

⬆️2,295 $50k+ customers (+56.0% YoY, +218)🟢

➡️833 $100k+ customers (+58.0% YoY, +84)

➡️13,318CRM accounts+21.0% QoQ, +2293)

⬆️1,448dev accounts+39.0% QoQ, +406)🟢

Operating expenses

⬆️S&M*/Revenue 54.3% (53.6% LQ)

⬆️R&D*/Revenue 16.4% (14.8% LQ)

⬆️G&A*/Revenue 8.5% (8.0% LQ)

↘️Net New ARR $54M ($54 LQ)

⬆️CAC* Payback Period 25.3 Months (24.4 LQ)

Dilution

↘️SBC/rev 11%, -3.0%pp QoQ)

↘️Dilution at 2.4% YoY, -4.3%pp QoQ)

Guidance

⬆️Q4'23 $211.0M guide (+30.0% YoY) beat est by 0.8%

➡️$932M FY guide (+27.7% YoY)

Key points from Monday.com's Fourth Quarter 2023 Earnings Call:

Strong Growth and Performance:

Monday.com reported a remarkable 41% revenue growth for fiscal year 2023, driven by strong customer acquisition and expansion, particularly with larger accounts. The company also reported record annual non-GAAP operating margin and free cash flow.

Commitment to Innovation, Ai:

AI is being integrated across the monday.com platform, with the launch of mondayAI and continued investment in AI capabilities seen as crucial for the platform's evolution. AI is being democratized for customers, allowing them to build and utilize AI in their workflows, enhancing automation and the overall efficiency of processes. AI is viewed as a significant growth driver for the company, with plans to monetize these capabilities in the future and use AI to penetrate new market segments and add value to existing products.

Product Enhancements, mondayDB:

The infrastructure upgrade with mondayDB, which boosted board performance by 5x, continues to exceed expectations and is on schedule for its next phase. This enhancement focuses on the most complex work scenarios, enabling customers to build and manage workflows at scale without performance constraints.

CRM:

The CRM product from monday.com is gaining traction, driven by a focus on enhancing the sales and customer relationship management processes within organizations. The company is seeing a shift towards centralized buying decisions, indicating that monday.com's CRM is increasingly being adopted as a strategic tool by management teams, not just departmental decisions. This shift towards management-driven adoption is expected to contribute to sustained growth and deeper penetration within enterprises.

Pricing Model Update:

monday.com introduced an updated pricing model ahead of schedule, reflecting the enhanced value of their Work Operating System platform and products, expected to contribute an estimated $15 million to $20 million of revenue in fiscal year 2024.

Investment in R&D and Sales Teams:

monday.com plans to increase investment in R&D and sales teams as it continues to build out its platform and product suites, focusing on top-line growth and innovation.

Net Dollar Retention Rate (NDR) and Customer Growth:

NDR for Q4 2023 was reported at 110%, reflecting continued macroeconomic headwinds. It is anticipated to begin recovery in the second half of fiscal year 2024, indicating a stabilization phase. The company highlighted that overall gross retention has seen slight improvement, suggesting a positive outlook for NDR as the year progresses, supported by updated pricing models and further scaling of mondayDB and product suites.

The company continues to add a significant number of high-value customers and is well-positioned for future growth.

Management comments on the earnings call.

Net Dollar Retention (NDR) Strategy

Eliran mentioned, "As a reminder, our net dollar retention rate is a trailing four-quarter weighted average calculation... We currently anticipate reported NDR to begin to recover in the second half of fiscal year '24."

Leveraging CRM for Deeper Customer Engagements

On the topic of CRM, Eran Zinman, Co-CEO, highlighted the product's impact, "CRM and dev are seeing different competitors compared to work management... we continue to see good momentum in our pipelines... definitely a very good momentum in the pipeline."

"This quarter, we're excited to announce the launch of monday code. Monday code provides a secure, serverless environment within the Work OS platform where developers can host and run apps with monday's security and compliance standards built in." - Eran Zinman, Co-CEO

Innovating with AI for Enhanced Workflows

Roy Mann, Co-CEO, discussed the integration of AI into their platform, "AI is a core part of the way we see the platform evolve... we're putting a lot of emphasis there as we think this will allow us to grow a lot and again like democratize AI and give it to our customers."

mondayDB: A Milestone in Infrastructure Enhancement

Eran Zinman, Co-CEO, shared progress on mondayDB, "In 2023, we upgraded our infrastructure with mondayDB, which boosted Board performance by 5x... We are now entering phase 2.0 with a focus on the most complex work scenarios, allowing customers to build and manage workflows at scale without being limited by performance constraints."

Commitment to R&D for Future Growth

On the importance of R&D, Eliran Glazer, CFO, outlined the company's investment strategy, "Research and development expense was $33.3 million in Q4 '23... We plan to increase investment in R&D for the foreseeable future as we build out our product suite and scale our work operating system platform both horizontally and vertically."

"We said that our number one focus for 2024 is going to be increasing top line throughout the investment... We said that the focus is going to be on top line and we are not going to improve operating margin in the way we did in the past."

2024 FY and next quarter guidance:

Eliran further elaborated on the assumptions behind the guidance, "And then we would like to make sure that we understand what would be the impact throughout the year. With regard to the demand that we already took into account, nothing has changed much from what we saw in Q4 of last year. Still some headwinds in the macroeconomy environment and we assume this will continue also in Q1 and Q2."

Thoughts on monday.com ER $MNDY :

🟢Pros:

+ DBNR for $50k+ customers remains strong at 115%, and begin to recover in the second half of 2024

+ Record number of $50k+ customers added

+ Strong growth in CRM and development accounts

+ Strong FCF margin

+ Beat Q3 revenue guidance by 2.3%

+ FY 2024 guidance indicates a 27.7% revenue growth rate

+ The company plans to increase investment in R&D, which will improve the company's competitive position in the market

🟡Neutral:

+- Revenue increased by +35.2% YoY, indicating that revenue growth is slowing compared to last quarter

+- dilution at 2.4% YoY

+- DBNR for $100k+ customers decreased from 116% in the last quarter to 114%

+- The company continues to feel pressure from the macroeconomic environment and expects improvement only in the second half of 2024