Monday.com Q3 2024 Earnings Analysis

Dive into $MNDY Monday’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$251.0M rev (+32.7% YoY, +34.4% LQ) beat est by 2.0%

↗️GM* (90.4%, +1.1 PPs YoY)

↗️Operating Margin* (12.8%, +0.1 PPs YoY)

↘️FCF Margin (32.8%, -1.5 PPs YoY)🟡

↗️EPS* $0.85 beat est by 34.9%

*non-GAAP

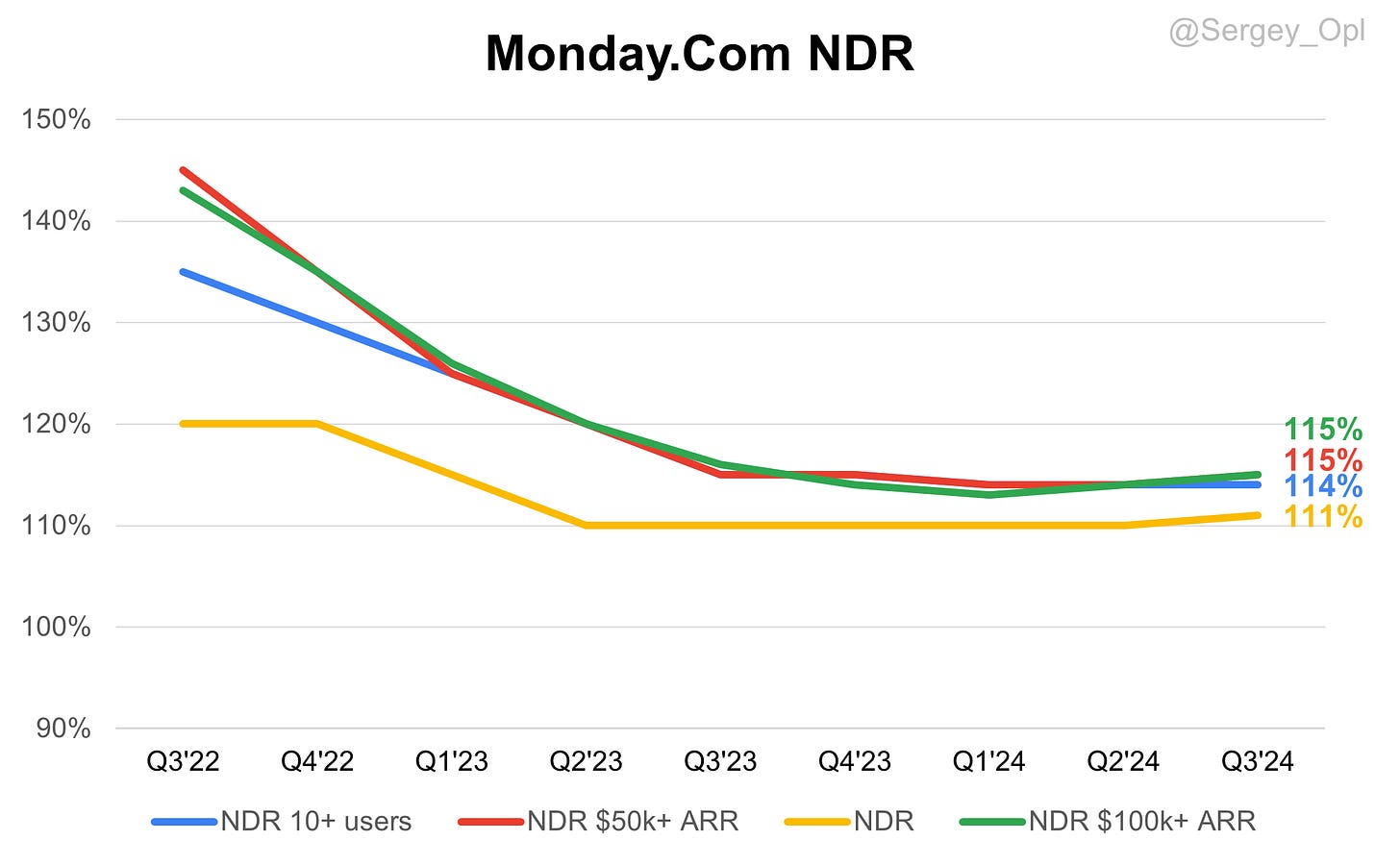

Net dollar retention rate

↗️NDR 111% (110% LQ)

➡️NDR 10+ users 114% (114% LQ)

↗️NDR $50k+ ARR 115% (114% LQ)

↗️NDR $100k+ ARR 115% (114% LQ)

Customers

➡️2,907 $50k+ customers (+40.0% YoY, +194)

➡️1,080 $100k+ customers (+44.2% YoY, +71)

Key Metrics

↗️24,735 CRM accounts (+19.1% QoQ, +3965)🟢

➡️3,150 dev accounts (+15.9% QoQ, +431)

Operating expenses

↘️S&M*/Revenue 51.9% (-1.7 PPs YoY)

↗️R&D*/Revenue 17.1% (+2.3 PPs YoY)

↗️G&A*/Revenue 8.5% (+0.5 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $60M (+10.3% YoY)

↗️CAC* Payback Period 26.8 Months (+2.4 YoY)🟡

↘️R&D* Index (RDI) 2.03 (-0.07 YoY)🟡

Dilution

↘️SBC/rev 14%, -1.4 PPs QoQ

↗️Basic shares up 3.3% YoY, +0.2 PPs QoQ

↘️Diluted shares up 2.3% YoY, -6.0 PPs QoQ

Headcount

↗️2,305 Total Headcount (+32.2% YoY, +195 added)

Guidance

➡️Q4'24 $260.0 - $262.0M guide (+28.8% YoY) in line with est

↗️$964.0 - $966.0M FY guide (+32.2% YoY) raised by 0.5% beat est by 0.5%

Key points from Monday’s Third Quarter 2024 Earnings Call:

Financial Performance

monday.com achieved robust results in Q3 2024, with revenue reaching $251 million, marking a 33% year-over-year increase. The company surpassed the $1 billion Annual Recurring Revenue (ARR) milestone, underscoring its expanding adoption and scalability. Total revenue guidance for fiscal year 2024 was updated to $964 million to $966 million, projecting annual growth of 32%. Gross margin remained strong at 90%, with a stable long-term projection in the high-80% range. Non-GAAP net income rose to $45 million from $33 million in Q3 2023, while free cash flow stood at $82.4 million, reflecting a 33% margin.

monday CRM

monday.com’s CRM product has become integral to its product suite, enabling businesses to manage customer relationships within the platform. In Q3, monday.com introduced email marketing functionality, enhancing CRM by allowing marketing and sales teams to manage campaigns directly. monday CRM has seen strong adoption, especially among mid-market and enterprise clients seeking a unified solution to centralize sales, marketing, and support functions. Its flexibility and integration within monday.com’s Work OS make it a compelling choice, although competition from established CRM providers presents ongoing challenges.

monday Dev

monday Dev, tailored for software development teams, has seen gradual adoption with measured growth in new accounts, particularly among enterprise clients that require longer integration periods. The product saw updates to project tracking, version control, and collaboration tools, meeting development teams' complex needs. monday Dev’s traction among larger organizations reflects the value of cross-departmental collaboration within monday.com’s platform. While customer acquisition slowed due to the focus on larger clients, each new account represents high-value, long-term engagements.

monday Service

Currently in beta, monday Service supports internal service functions like IT, HR, and operations ticketing. In Q3, it received positive customer feedback, showing strong cross-sell potential within existing accounts. monday Service is positioned to launch by the end of 2024, with demand expected to grow as it integrates into monday.com’s Work OS, providing a seamless experience for managing support tickets alongside other workflows.

monday AI

monday.com’s AI capabilities saw rapid adoption in Q3, with AI actions increasing by 250% and the use of AI blocks up by 150% quarter-over-quarter. monday AI’s no-code building blocks allow users to automate tasks, enhance data analysis, and improve decision-making. Management is considering monetization strategies, with potential revenue streams from AI features expected as early as 2025.

monday DB 2.0

monday DB 2.0, an infrastructure upgrade, enhances scalability to support enterprise clients. The update enables boards to handle up to 100,000 items and dashboards up to 500,000 items, appealing to large clients looking to centralize data. The scalability enhancements contributed to notable expansions, including a client increasing its seat count to 6,000 over two years.

Pricing Model and Retention

The recent pricing increase contributed approximately $30 million in fiscal year 2024, with an anticipated $80 million impact through 2026. While affecting net new customer adds, the change resulted in higher-value acquisitions and strong retention, evidenced by an uptick in Net Dollar Retention (NDR) to 111%. The company expects NDR to remain stable through Q4, potentially rising in 2025 as enterprise clients expand their product usage.

Operating Expenses

Operating expenses were strategically managed. Sales and Marketing costs were $130.3 million, representing 52% of Q3 revenue, a slight reduction from 54% in Q3 2023. Research and Development increased to $43 million or 17% of revenue, reflecting a focus on innovation. General and Administrative expenses were $21.4 million, maintaining a 9% revenue ratio.

Large Customer Wins and Enterprise Adoption

monday.com’s upmarket move yielded substantial wins among large enterprise clients. The company observed significant seat expansions, with its second-largest customer increasing usage, driving growth and customer lifetime value. This enterprise adoption aligns with monday.com’s focus on high-value accounts, supported by the scalability of monday DB 2.0.

Customer Engagement and Expansion Strategy

Product cross-sell opportunities, especially with monday CRM and monday Service, have grown in Q3. monday.com’s strategy of deepening engagement within existing accounts has gained traction, with an increasing portion of revenue from expanding customer relationships. Recent hires in account management and sales aim to support this enterprise expansion.

Q2 Momentum and Q3 Outlook

Q2 2024 delivered exceptionally strong results, setting a high benchmark for Q3. Revenue grew 33% year-over-year in Q3 to $251 million. Despite steady demand, growth stabilized in Q3 due to macroeconomic pressures and seasonal factors, especially impacting enterprise customer additions. However, monday.com remains optimistic for Q4, with revenue projected between $260 million and $262 million and anticipated growth of 28%-29%. Non-GAAP operating income is expected to range from $29 million to $31 million, with free cash flow estimated at $63 million to $66 million.

Macroeconomic Environment

Macroeconomic headwinds introduced some “choppiness,” particularly in the enterprise segment, leading to softer customer additions. Nevertheless, monday.com’s high retention and pricing strategy have helped maintain resilience in a cautious spending climate. The company’s performance in Q2 2024, which included a notable expansion of larger accounts, increased ARR to over $1 billion and set a high bar. Q3 saw tempered but stable growth, supported by demand across business segments, reinforcing management's confidence in sustaining growth amid broader economic challenges.

Future Outlook

monday.com remains optimistic for fiscal year 2025, expecting sustained NDR improvements driven by price increases and expanding product use. The company’s strategic focus on product innovation, pricing optimization, and targeted hiring positions it for continued growth.

Management comments on the earnings call.

Product Innovations

Roy Mann, Co-CEO:

“monday.com’s ongoing commitment to innovation is visible in our suite-wide AI integration and infrastructure upgrades like monday DB 2.0, which enables boards to handle up to 100,000 items and dashboards to reach 500,000 items. This infrastructure investment reinforces our platform’s ability to scale with enterprise needs.”

Product Expansion

Roy Mann, Co-CEO:

“With the addition of monday CRM and monday Service, we’re expanding monday.com’s capabilities to create a unified ecosystem that supports teams across departments—be it CRM, service management, or development. Our products are built to evolve, meeting the demands of organizations that need a flexible and scalable platform.”

Customers

Roy Mann, Co-CEO:

“Our recent customer expansions, including one of our largest clients who grew their seat count to 6,000, highlight the growing trust in monday.com as a scalable solution for organizations looking to consolidate their tech stack across consulting, finance, and operations.”

Challenges

Eran Glaser, CFO:

“We’ve seen some macroeconomic choppiness impacting enterprise additions in Q3, particularly within the U.S. and European markets. Despite these challenges, demand remains stable across segments, and we are prudently managing our operating expenses to ensure continued profitability.”

Macroenvironment

Eran Glaser, CFO:

“Our pricing adjustments this year reflect a response to the broader macroenvironment. While the price changes have impacted net new customer additions, they’ve driven higher-value acquisitions and strengthened retention. This shift aligns with our strategy to capture long-term, high-value engagements.”

Future Outlook

Roy Mann, Co-CEO:

“As we look ahead to fiscal year 2025, we’re encouraged by the positive trends in Net Dollar Retention and expanding enterprise adoption. With continued investment in R&D and strategic hiring, we’re positioning monday.com to drive sustained growth and meet the evolving needs of a dynamic market.”

Thoughts on Monday.com ER MNDY :

🟢Pros:

+ Revenue accelerated to a +32.7% YoY growth rate. If the company beats its forecast by 1.6% as it did this quarter, next quarter's revenue growth will slightly decrease to 31.4%.

+ Dollar-Based Net Retention (DBNR) increased to 111% for all customers, 115% for $50K+ customers, and 115% for $100K+ customers, up by 1 percentage point sequentially.

+ Strong addition of $50K+ customers, exceeding the numbers from Q3 last year.

+ Record number of new CRM accounts added.

+ Net new ARR added +60 million (+10% YoY growth). Excluding the previous quarter, this is the highest net new ARR addition for the company.

+ Strong Free Cash Flow (FCF) margin of 32.8%.

+ Non-GAAP gross margin near a record level at 90.4%.

+ Full-year 2024 guidance increased by 0.5%.

+ The recent pricing increase added approximately $30 million in 2024 revenue, with an expected $80 million impact by 2026, driving higher-value acquisitions despite fewer new customer adds.

+ Introduced Monday Service - currently in beta.

🟡Neutral:

+- Operating expenses for S&M and G&A increased by 1 percentage point sequentially.

+- Beat Q3 revenue guidance by 1.6%, which is the smallest guidance beat for the company so far.

+- +431 new development accounts were added—higher than last year but below the previous two quarters. Management links the slower growth to a focus on larger accounts after introducing the new pricing model.

+- 71 $100K+ customers added, on par with last year.

+- Billings grew 28.8%, slower than revenue growth.

+- Stock-Based Compensation (SBC) as a percentage of revenue is 14.0%, down by 1.5 percentage points sequentially.

+- Weighted-average number of common shares (basic) up by 3.3% YoY.