Monday.com Q2 2025 Earnings Analysis

Dive into $MNDY Monday’s Q2 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

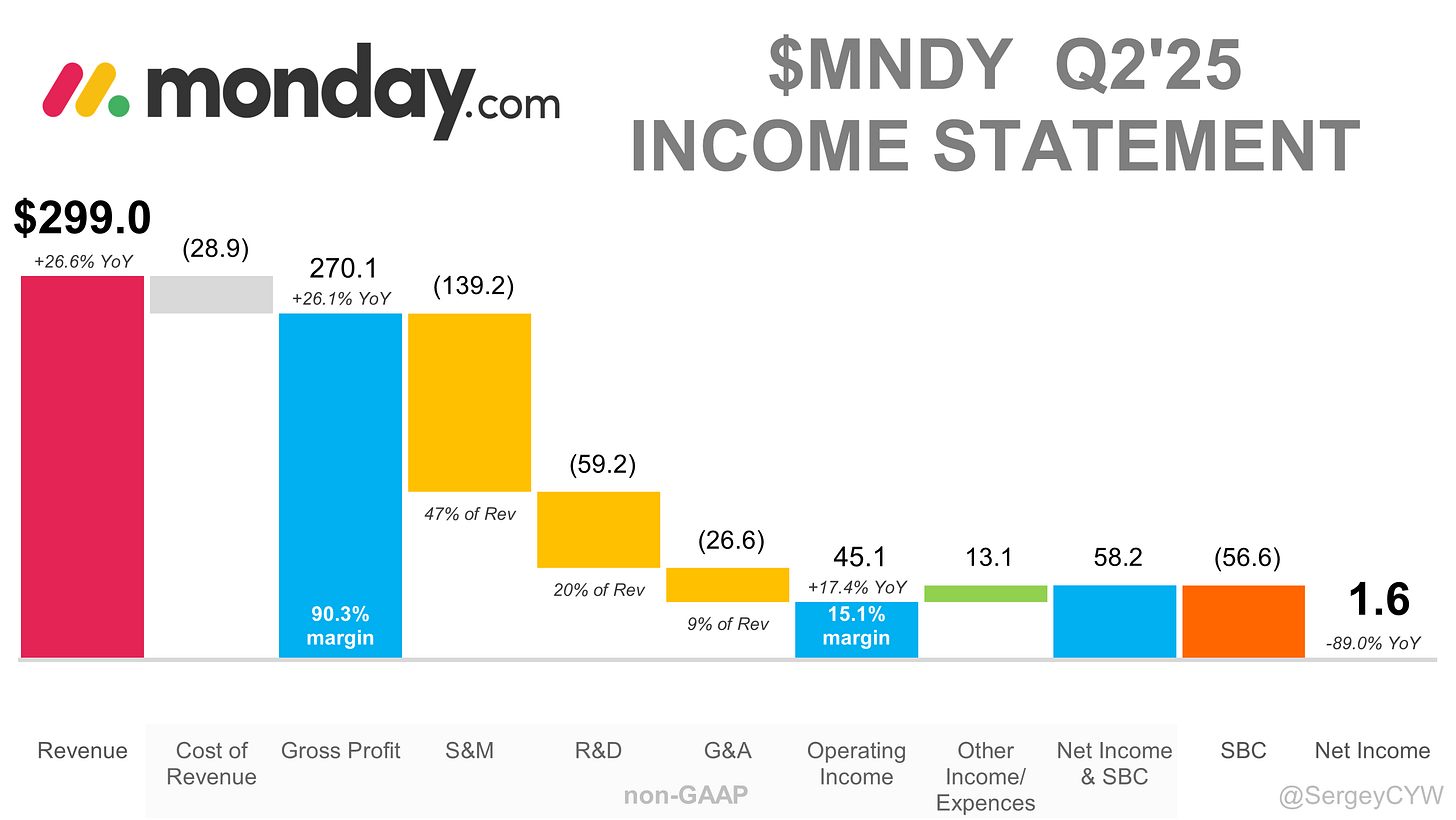

Financial Results:

↗️$299.0M rev (+26.6% YoY, +5.9% QoQ) beat est by 2.0%

↘️GM* (90.3%, -0.4 PPs YoY)🟡

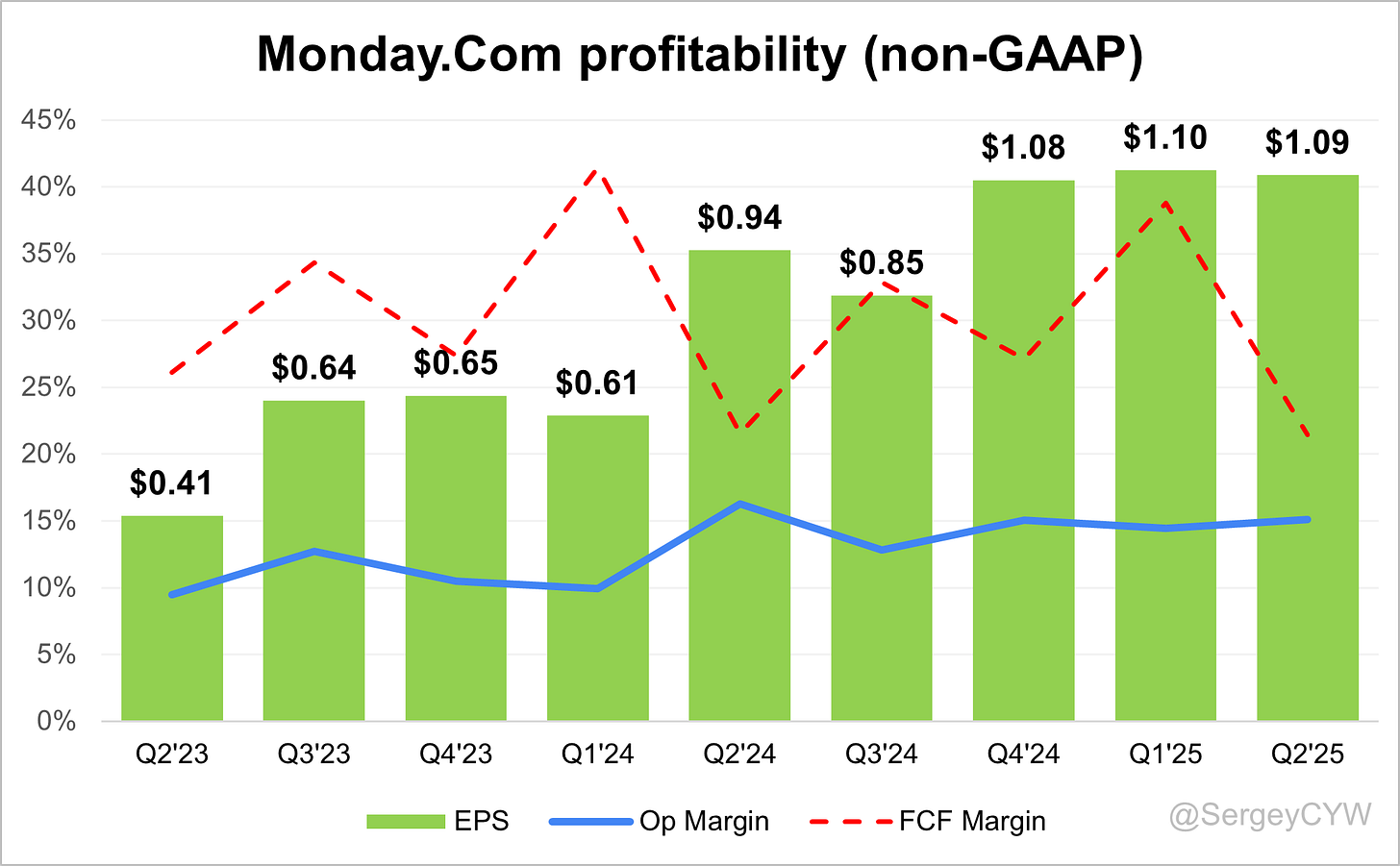

↘️Operating Margin* (15.1%, -1.2 PPs YoY)🟡

↘️FCF Margin (21.4%, -0.1 PPs YoY)🟡

↘️Net Margin (0.5%, -5.5 PPs YoY)🟡

↗️EPS* $1.09 beat est by 25.3%

*non-GAAP

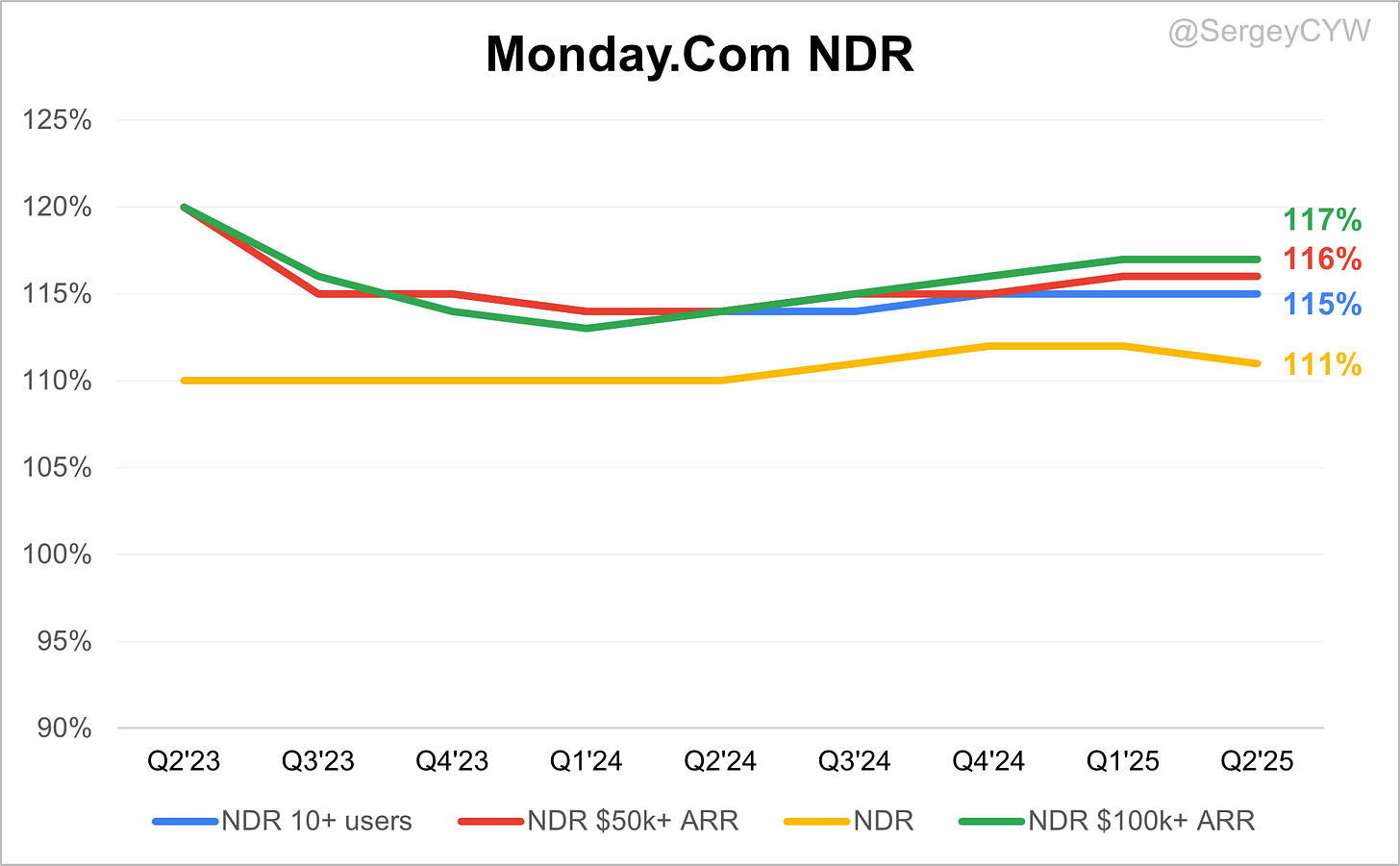

Net dollar retention rate

↘️NDR 111% (112% LQ)

➡️NDR 10+ users 115% (115% LQ)

➡️NDR $50k+ ARR 116% (116% LQ)

➡️NDR $100k+ ARR 117% (117% LQ)

Customers

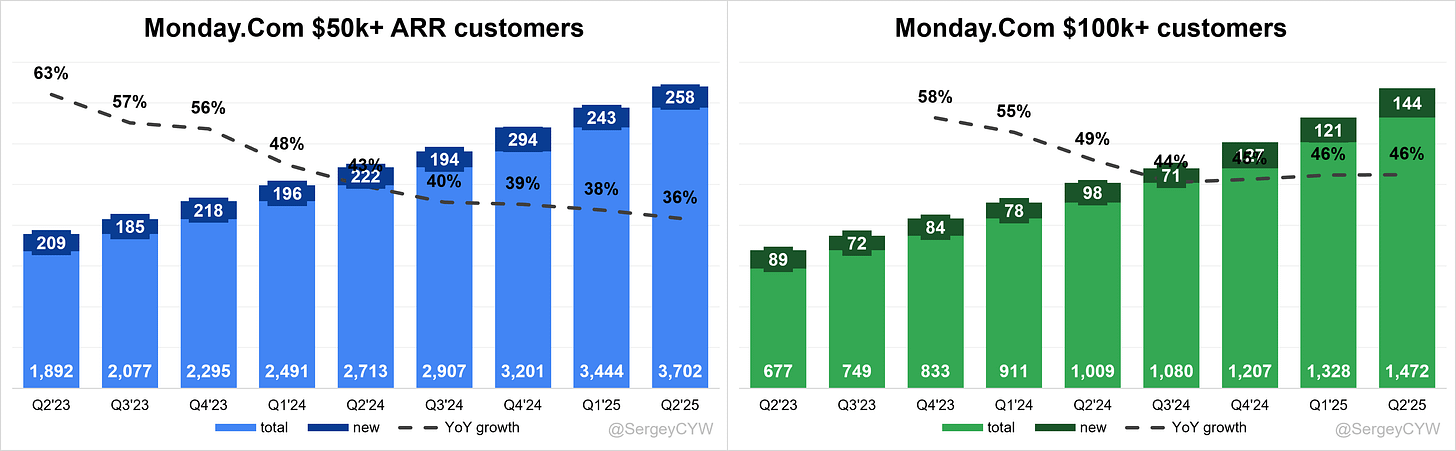

↗️3,702 $50k+ customers (+36.5% YoY, +258)

↗️1,472 $100k+ customers (+45.9% YoY, +144)🟢

Key Metrics

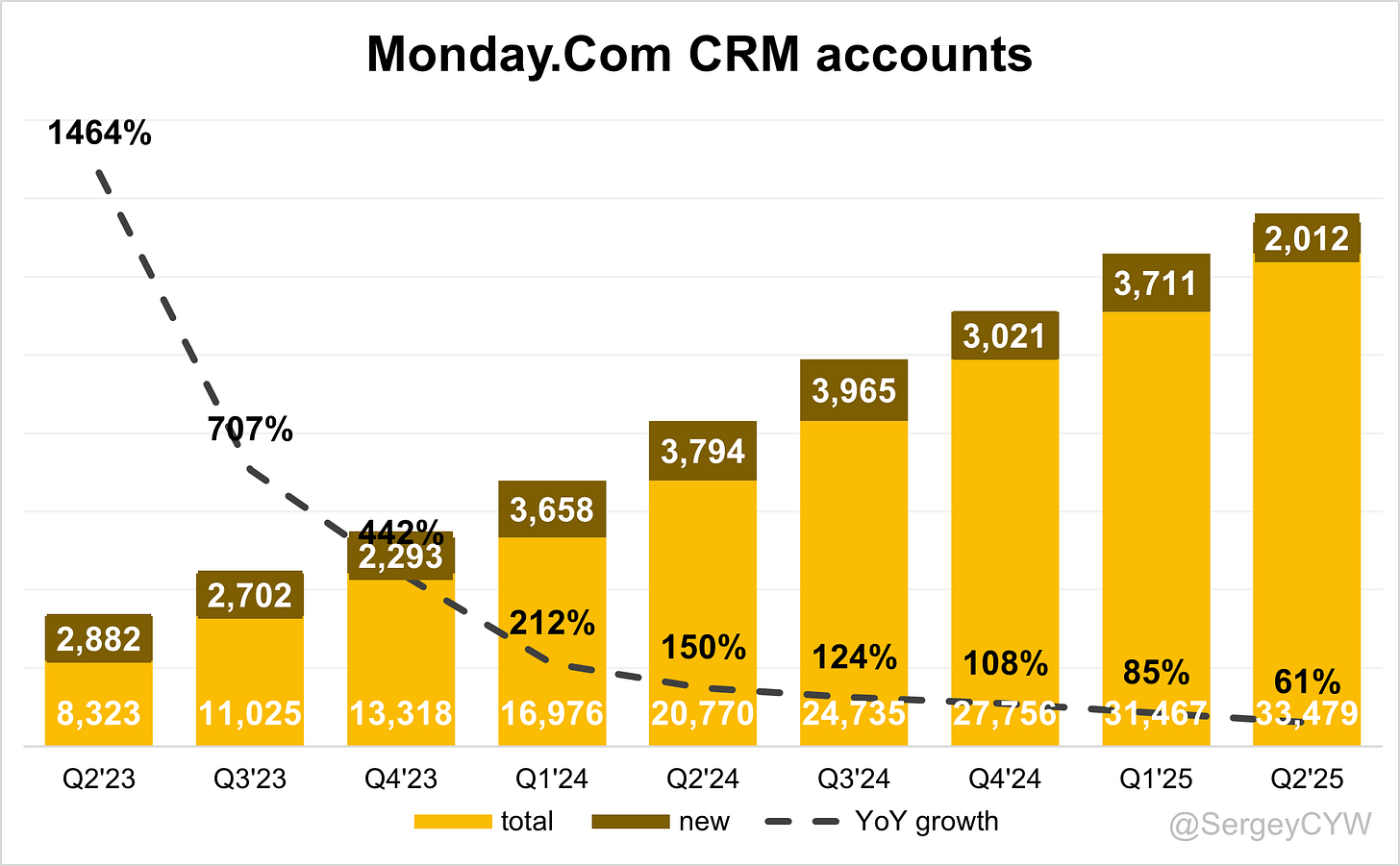

➡️33,479 CRM accounts (+6.4% QoQ, +2012)

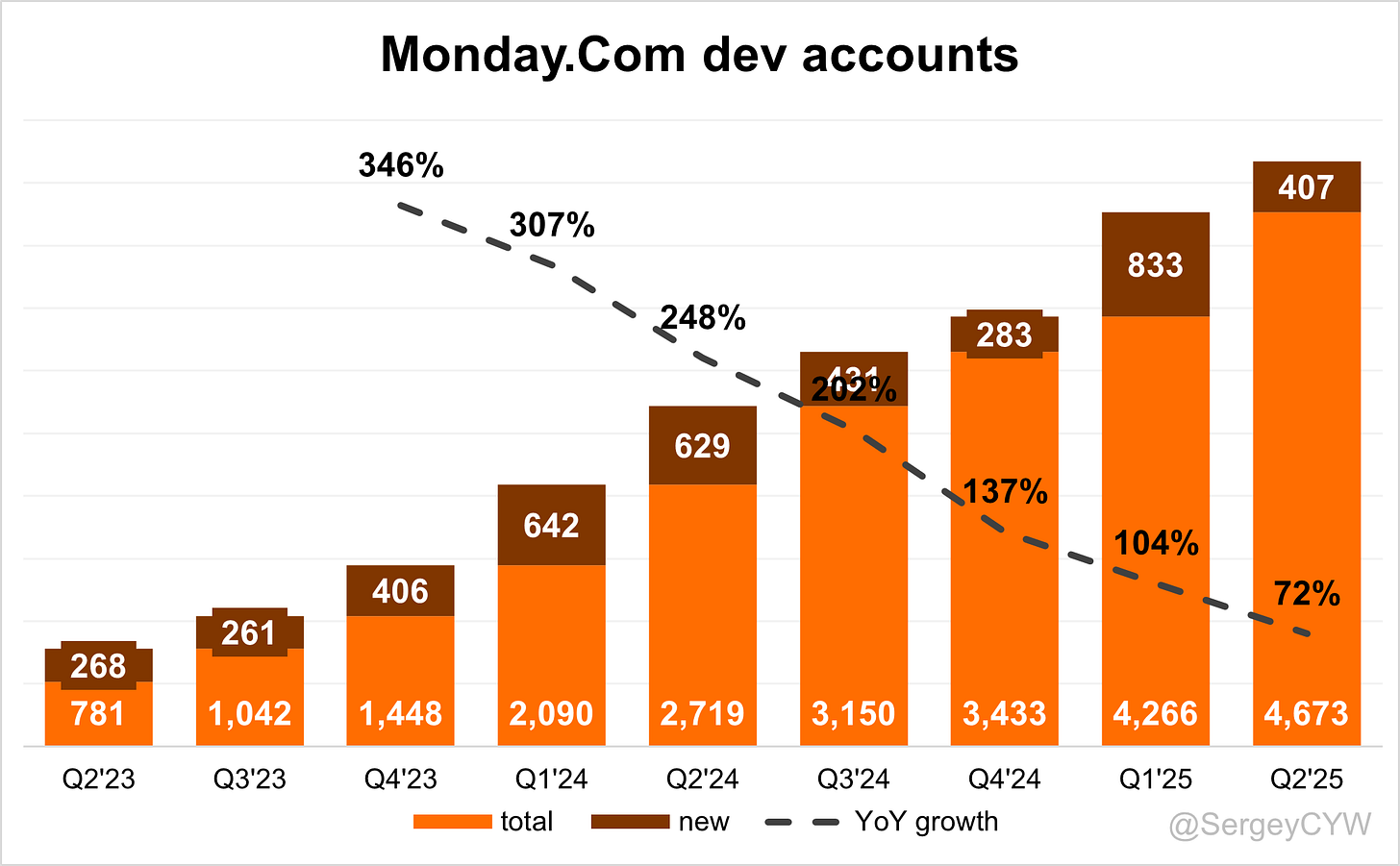

➡️4,673 dev accounts (+9.5% QoQ, +407)

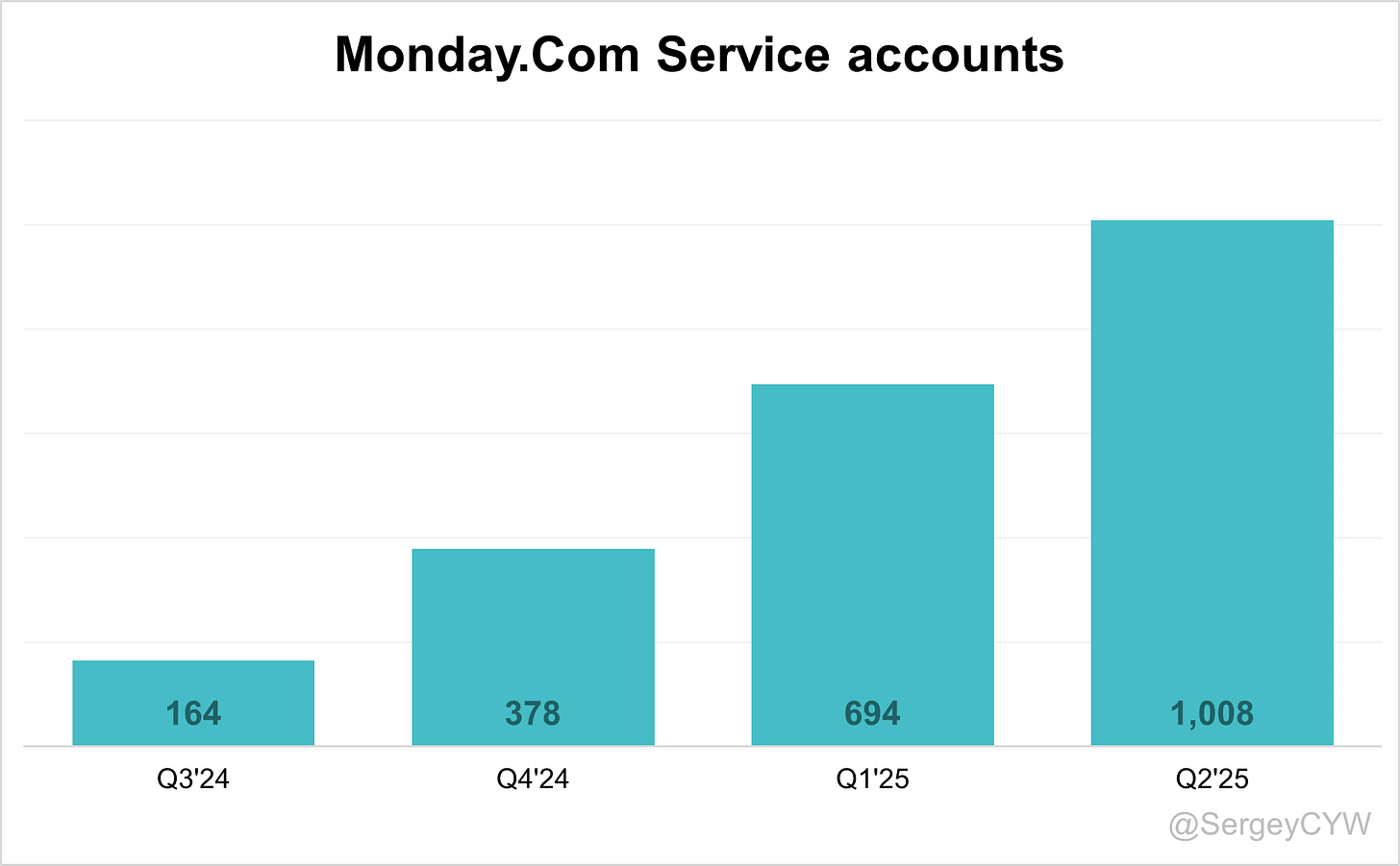

↗️1,008 Service accounts (+45.2% QoQ, +314) 🟢

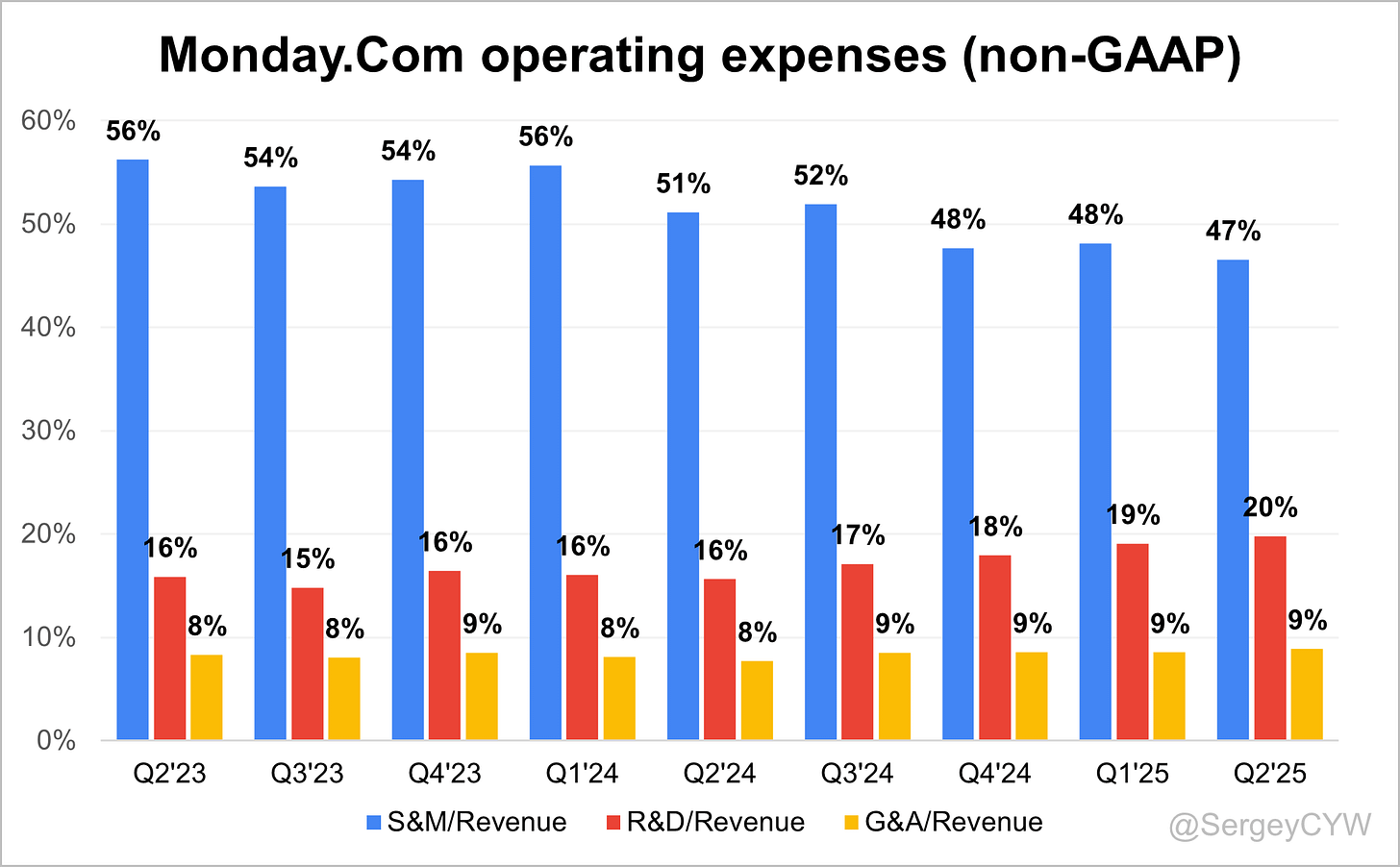

Operating expenses

↘️S&M*/Revenue 46.6% (-4.6 PPs YoY)

↗️R&D*/Revenue 19.8% (+4.2 PPs YoY)

↗️G&A*/Revenue 8.9% (+1.2 PPs YoY)

Quarterly Performance Highlights

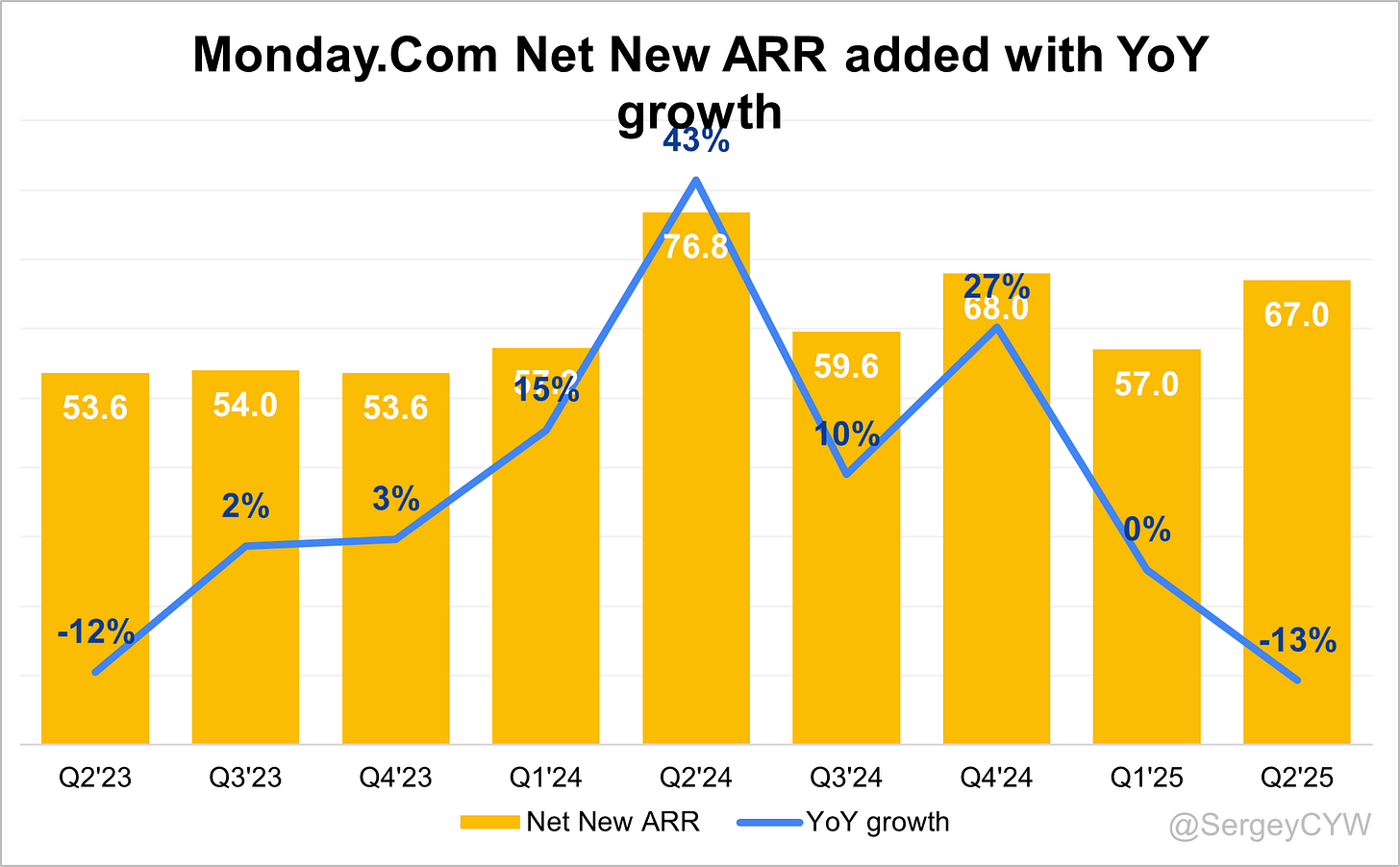

↘️Net New ARR $67M (-12.8% YoY)

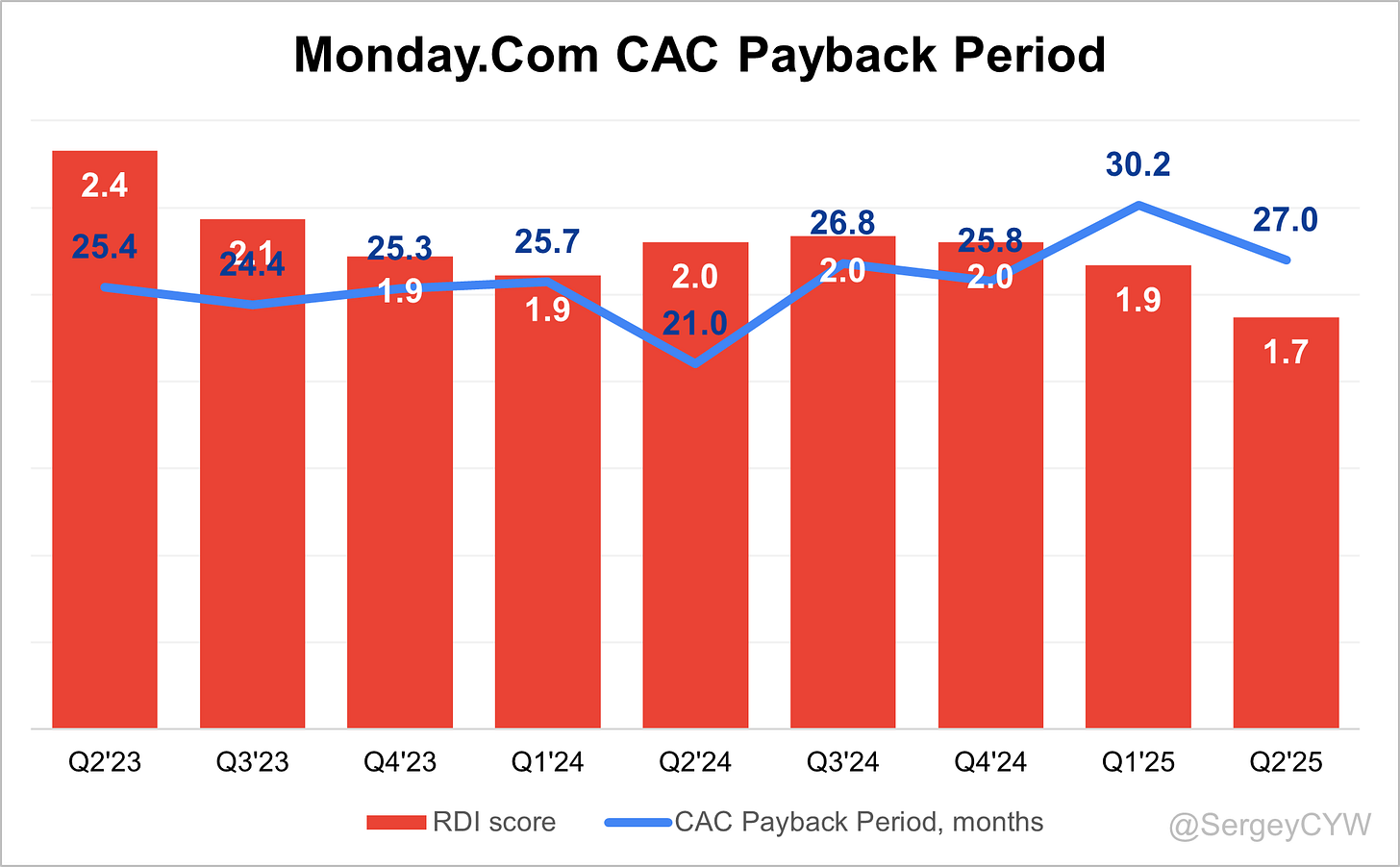

↗️CAC* Payback Period 27.0 Months (+6.0 YoY)🟡

↘️R&D* Index (RDI) 1.69 (-0.31 YoY)🟡

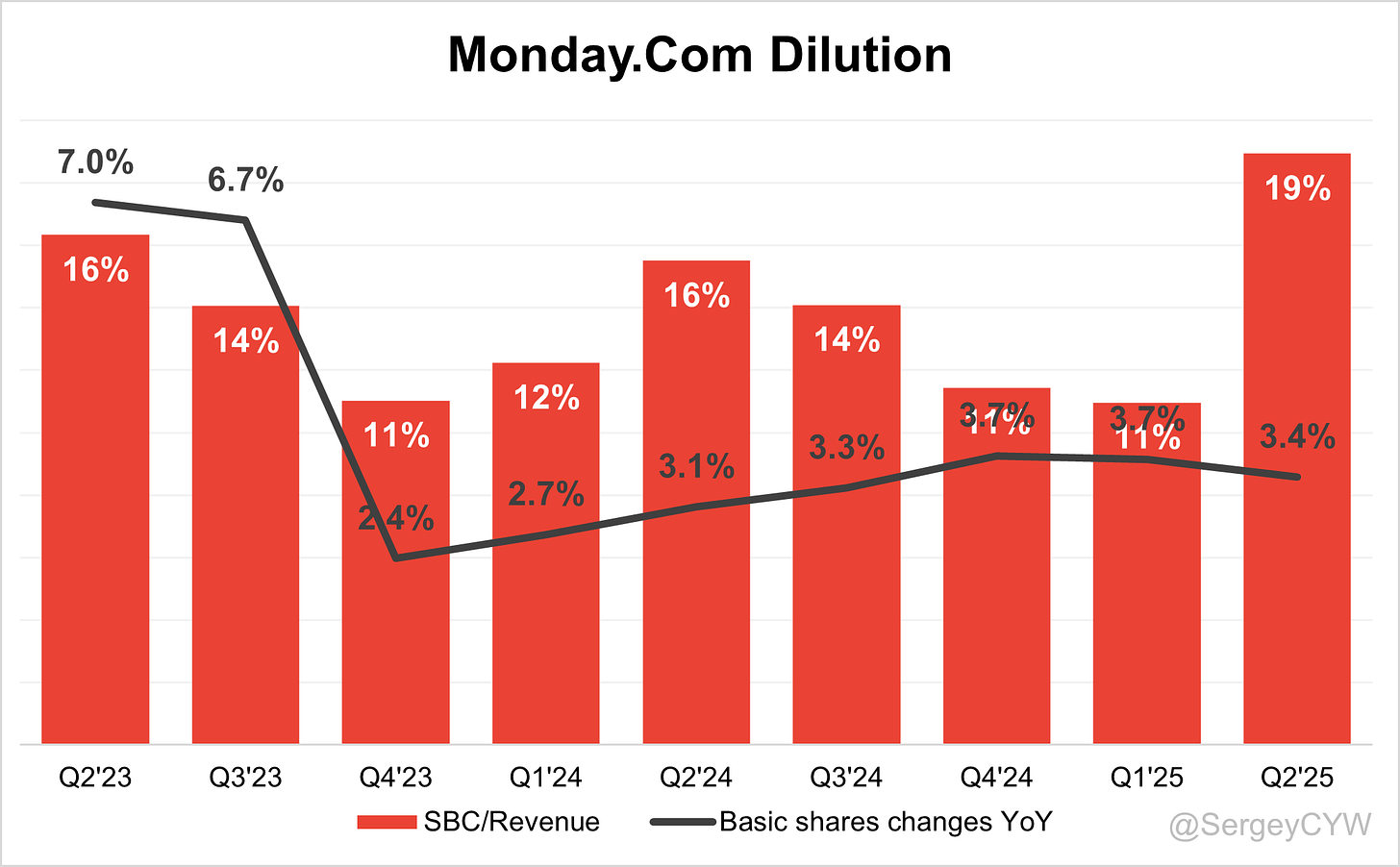

Dilution

↗️SBC/rev 19%, +8.0 PPs QoQ

↘️Basic shares up 3.4% YoY, -0.2 PPs QoQ

↗️Diluted shares up 2.0% YoY, +0.1 PPs QoQ

Headcount

↗️2,867 Total Headcount (+35.9% YoY, +172 added)

Guidance

➡️Q3'25 $311.0 - $313.0M guide (+24.3% YoY) in line with est

↗️$1,224.0 - $1,229.0M FY guide (+26.2% YoY) raised by 0.2% beat est by 0.3%

Key points from Monday’s Second Quarter 2025 Earnings Call:

Financial performance

In Q2 FY25, revenue reached $299 million, up 27% year over year. Gross margin was 90%, supported by efficient operations. Non-GAAP operating margin stood at 15%. Net income rose to $58.3 million from $49.3 million a year earlier, with diluted EPS of $1.90 on 53.3 million shares. Adjusted free cash flow was $64.1 million, a 21% margin. FY25 revenue is projected between $1.224 billion and $1.229 billion, a 26% increase.

Eran Zinman, Co-Chief Executive Officer “Our ability to deliver high growth while maintaining profitability demonstrates the resilience of our business model and the strength of our execution.”

Work management

Work Management remains the most established product, driving enterprise and mid-market adoption. Growth is fueled by cross-selling into large accounts rather than SMB signups. Google search algorithm changes softened SMB acquisition, but enterprise momentum offset the impact. High market penetration is being addressed through deeper AI integration and enhanced capabilities.

Roy Mann, Co-Chief Executive Officer “Our Work Management platform remains the foundation of our multi-product strategy, serving as the entry point for many enterprise customers who later expand into CRM, Service, and Dev. The maturity of this product allows us to focus on deeper integrations and AI-driven enhancements that increase its strategic value in large-scale deployments.”

Monday CRM

Monday CRM reached $100 million ARR in under three years. Average contract value grew 20% year over year, driven by a shift toward high-value enterprise deals over SMB volume. Flexibility, customization, and integration with the platform underpin growth. The priority is expanding enterprise use cases while maintaining momentum.

Eran Zinman, Co-Chief Executive Officer “Reaching $100 million in ARR for Monday CRM is a milestone that underscores the product’s rapid adoption, particularly in the enterprise market. We’ve seen average contract values increase more than 20% year over year as customers adopt CRM alongside our other products to manage mission-critical workflows.”

Monday Dev

Monday Dev is scaling steadily, targeting developers and product managers with collaborative SDLC tools. Adoption is strongest among SMBs and mid-market customers, with early enterprise traction. Differentiation from established incumbents and expanding upmarket presence remain key goals.

Eran Zinman, Co-Chief Executive Officer “Monday Dev is still early in its lifecycle but has already proven attractive to development teams seeking a customizable alternative to rigid SDLC tools. The product is increasingly being bundled into enterprise deals where collaboration between technical and non-technical teams is essential.”

Monday Service

Monday Service supports service-oriented workflows and has early momentum through cross-sell to existing accounts. Growth is less reliant on SEO-driven acquisition. The product addresses a sizable adjacent market to Work Management and CRM. Expansion of its feature set is required to meet complex enterprise needs.

Roy Mann, Co-Chief Executive Officer “Monday Service is benefiting from a cross-sell motion into our existing customer base. It’s a natural complement to Work Management, and we are seeing strong adoption in industries that require service request management at scale.”

Monday AI

Users executed 46 million AI-driven actions since launch. Monday Magic enables instant workflow creation, Monday Vibe offers no-code app building, and Monday Sidekick delivers proactive task execution. Customers are exceeding the 500-credit monthly AI limit, signaling monetization potential in FY26. AI differentiates the platform in competitive enterprise RFPs.

Eran Zinman, Co-Chief Executive Officer “Since launch, we’ve seen 46 million AI-driven actions executed on our platform, a clear signal of demand. These AI tools are deeply embedded into our products, enabling customers to automate workflows, build apps without code, and receive proactive, context-aware assistance.”

Monday DB 2.0

Monday DB 2.0 delivers faster, more scalable, and more complex data handling, enabling larger enterprise deployments. It improves AI integration and workflow performance. Early feedback highlights reduced latency and enhanced capability for complex use cases.

Eran Zinman, Co-Chief Executive Officer “With Monday DB 2.0, we’ve delivered a significant infrastructure upgrade that enhances performance, scalability, and data handling capabilities. This positions us to win more enterprise deals where speed, complexity, and integration are critical.”

Product innovation

Recent launches, including Monday Vibe, Magic, and Sidekick, shift the platform from managing work to executing tasks. Automation, no-code app building, and context-aware assistance increase productivity and deepen customer engagement.

Roy Mann, Co-Chief Executive Officer “Our pace of innovation is central to our competitive edge. Monday Vibe, Monday Magic, and Monday Sidekick are not just features—they redefine how our platform is used, shifting us from a system of work to a system of action.”

Retention

Gross retention reached an all-time high, driven by enterprise expansions. Appointment of a Chief Customer Officer strengthens focus on adoption and long-term value delivery.

Adi Dhar, Chief Customer Officer “Our gross retention rate reached an all-time high, driven by enterprise customers expanding their use of our products. This reinforces our strategy of focusing on long-term value creation and ensuring our customers achieve measurable outcomes.”

Go-to-market and pricing

Leadership hires include a Chief Revenue Officer and Chief Marketing Officer to accelerate enterprise growth. Pricing reflects value from AI capabilities and multi-product bundles. Premium AI features are positioned as a new revenue stream.

Harris Beber, Chief Marketing Officer “Our move upmarket is supported by targeted messaging and strategic pricing that reflects the value customers derive from our AI capabilities and multi-product bundles. We are optimizing our channels to drive efficiency and reach high-value accounts.”

Customer growth

The company added a record number of net new customers spending over $100,000 annually. Enterprise wins spanned technology, professional services, and manufacturing, often expanding to thousands of seats per account. Multi-product adoption is increasing account value, particularly in CRM.

Roy Mann, Co-Chief Executive Officer “This quarter we achieved a record number of net new customers spending over $100,000 annually, showing the strength of our enterprise motion and the appeal of our bundled solutions.”

International growth

The platform is expanding globally, leveraging its versatility and product breadth to serve businesses across regions.

AI agents and competitors

monday’s AI agents, particularly Monday Vibe and Monday Magic, represent a significant differentiator in the market. These tools are designed to enable users to not only manage their work but actively execute tasks with AI assistance. This shift from a traditional project management tool to a "system of action" sets monday apart from its competitors, who may still focus primarily on work management. As the AI market continues to grow, monday’s early adoption and deep integration of AI into its platform will likely give it a competitive edge.

Eran Zinman, Co-Chief Executive Officer “Our AI agents differentiate us in the market by moving beyond task management into task execution. This positions us ahead of competitors still focused on traditional work management models.”

Google algorithm impact

In Q2 FY25, monday experienced some impact on customer acquisition due to changes in Google’s search algorithm, which affected performance marketing, particularly in the SMB segment. However, this impact was not significant in terms of the enterprise or upmarket segments. The company has already taken steps to address the issue, reallocating resources to more effective channels and focusing on optimizing its marketing spend. The impact on customer growth was relatively minor, and the company remains confident that it can mitigate this disruption in the future.

Harris Beber, Chief Marketing Officer “Changes to Google’s search algorithm had a temporary impact on SMB acquisition, but we’ve reallocated resources to channels where we can maintain and accelerate lead flow. The effect has been minimal in our enterprise and mid-market segments.”

Challenges

monday faces several challenges, particularly related to the ongoing changes in Google’s search algorithm, which temporarily affected customer acquisition in the SMB market. However, the company is actively managing these challenges through marketing optimizations and resource reallocation. Additionally, there are some pressures related to the growing competition in the AI and work management space, but monday’s focus on innovation and its AI-driven capabilities are expected to help maintain its competitive edge.

Roy Mann, Co-Chief Executive Officer “While the SMB market presents headwinds, particularly in digital acquisition, our enterprise growth and high retention rates give us confidence in sustaining our momentum.”

Outlook

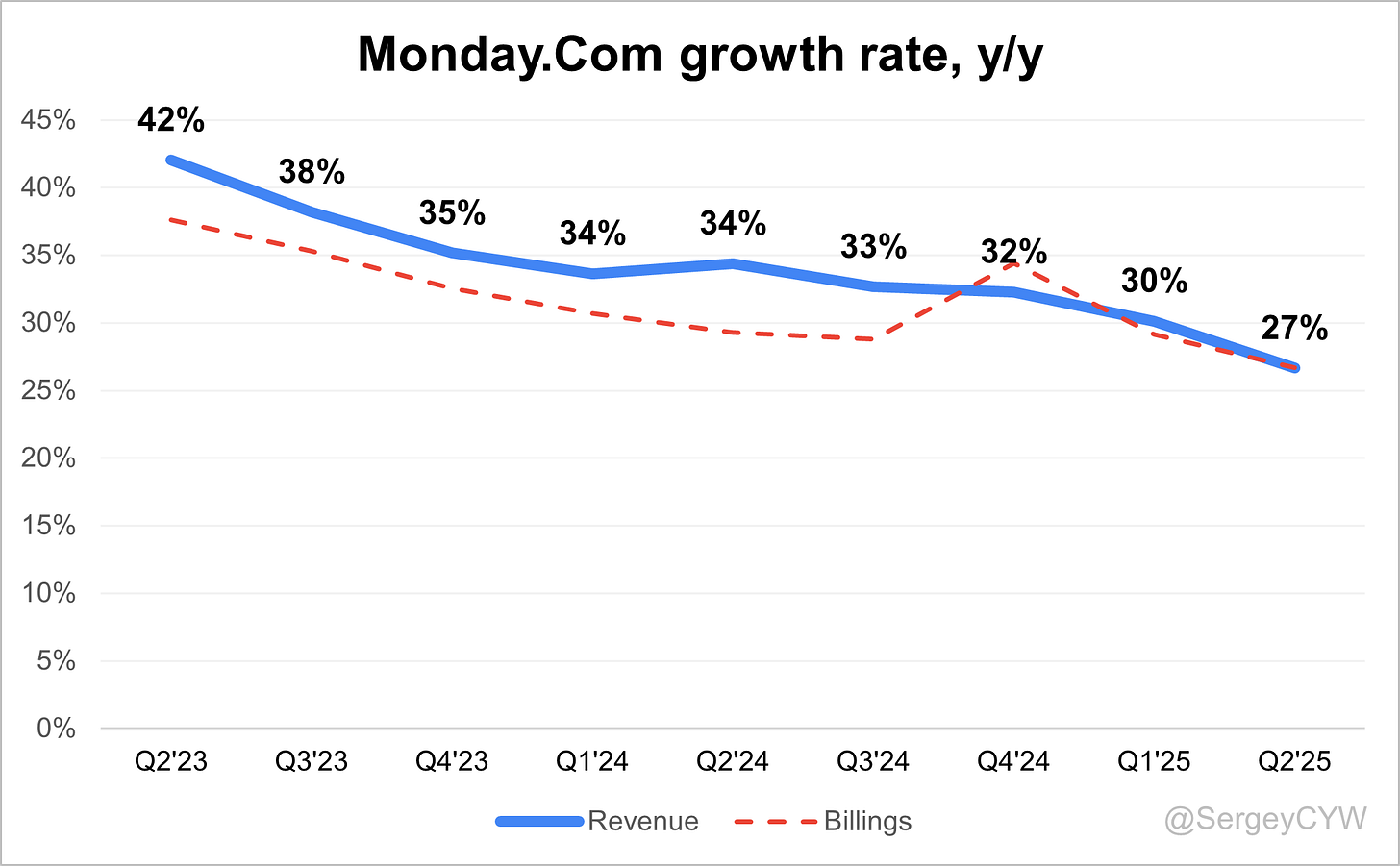

Revenue growth in the mid-20% range is expected for H2 FY25, supported by AI monetization, product expansion, and enterprise adoption. Strategic hires and global expansion underpin long-term growth and profitability.

Eran Zinman, Co-Chief Executive Officer “We expect to maintain mid-20% revenue growth into the second half of the year, supported by AI monetization, product expansion, and increased enterprise adoption. Our strategy remains focused on building a platform that scales with our customers’ ambitions.”

Thoughts on Monday Earnings Report $MNDY:

🟢 Positive

Revenue $299M (+26.6% YoY, +5.9% QoQ) beat estimates by 2%

EPS $1.09 beat by 25.3%

$100M ARR milestone for Monday CRM, +20% YoY ACV growth

Record 1,472 $100K+ customers (+45.9% YoY, +144) and 3,702 $50K+ customers (+36.5% YoY, +258)

Monday Service accounts +45.2% QoQ (+314)

S&M/Revenue down 4.6 pps YoY to 46.6%

Gross retention at all-time high

AI usage 46M actions, signaling monetization potential in FY26

Monday DB 2.0 infrastructure upgrade improving enterprise performance

🟡 Neutral

Guidance: Q3 revenue $311–313M (+24.3% YoY), FY25 revenue $1.224–1.229B (+26.2% YoY) in line with estimates

NDR 111% (112% last quarter) with stable enterprise cohorts: $50K+ ARR 116%, $100K+ ARR 117%

Monday Dev accounts +9.5% QoQ (+407), CRM accounts +6.4% QoQ (+2,012), weak new additions

R&D/Revenue up 4.2 pps YoY to 19.8%

Headcount 2,867 (+35.9% YoY)

Minimal impact from Google algorithm changes on enterprise growth

Gross margin 90.3% (-0.4 pps YoY, +0.14 pps QoQ)

🔴 Negative

Non-GAAP operating margin 15.1% (-1.2 pps YoY)

Net margin 0.5% (-5.5 pps YoY)

Net new ARR $67M (-12.8% YoY)

CAC payback period 27 months (+6 months YoY)

SBC/Revenue 19% (+8 pps QoQ)

Google search algorithm changes slowed SMB acquisition

Competitive pressure in AI and work management markets

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

You think overreaction on sell off ?