Monday.com Q2 2024 Earnings Analysis

Dive into $MNDY Monday’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$236.1M rev (+34.4% YoY, +33.6% LQ) beat est by 3.2%

↗️GM* (90.7%, +0.8 PPs YoY)🟢

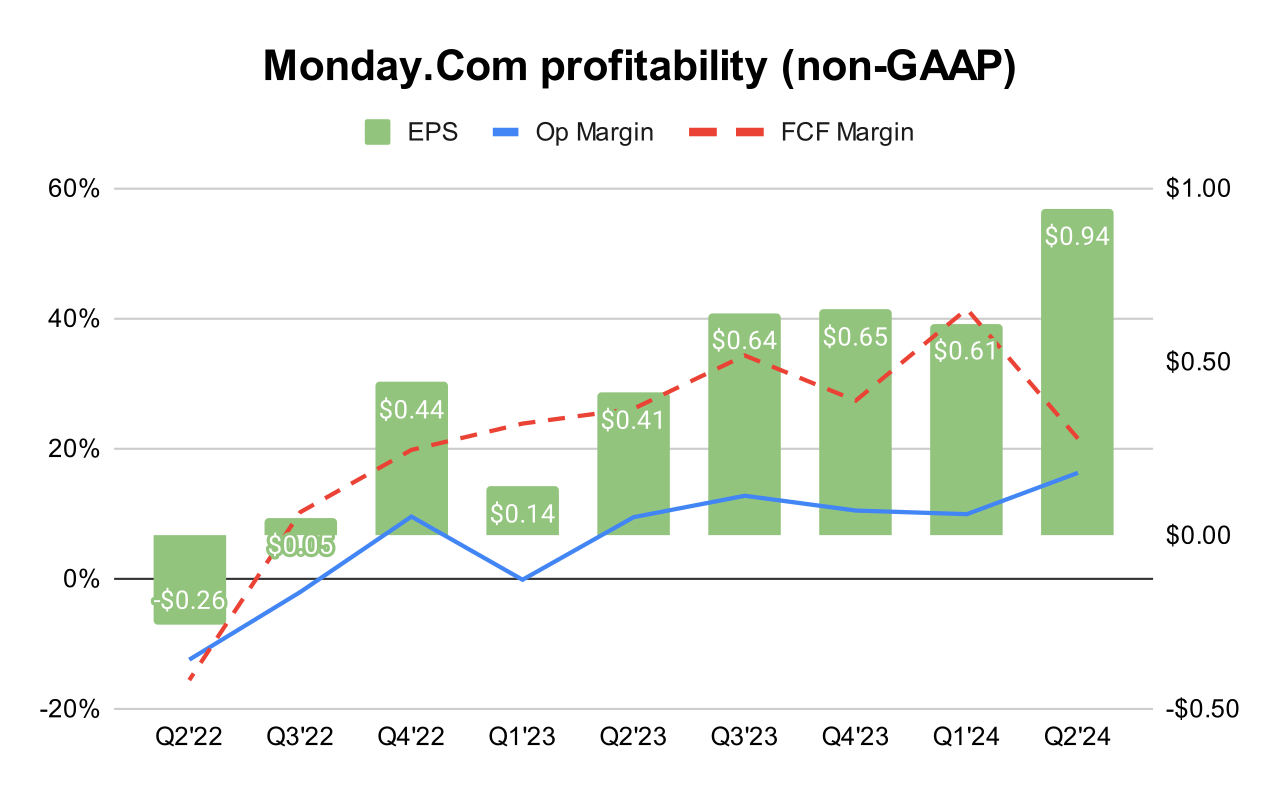

↗️Operating Margin* (16.3%, +6.8 PPs YoY)🟢

↘️FCF Margin (21.5%, -4.6 PPs YoY)🟡

↗️EPS* $0.94 beat est by 64.9%🟢

*non-GAAP

Net dollar retention rate

➡️NDR 110% (110% LQ)

↗️NDR 10+ users 120% (114% LQ)

➡️NDR $50k+ ARR 114% (114% LQ)

↗️NDR $100k+ ARR 114% (113% LQ)

Customers

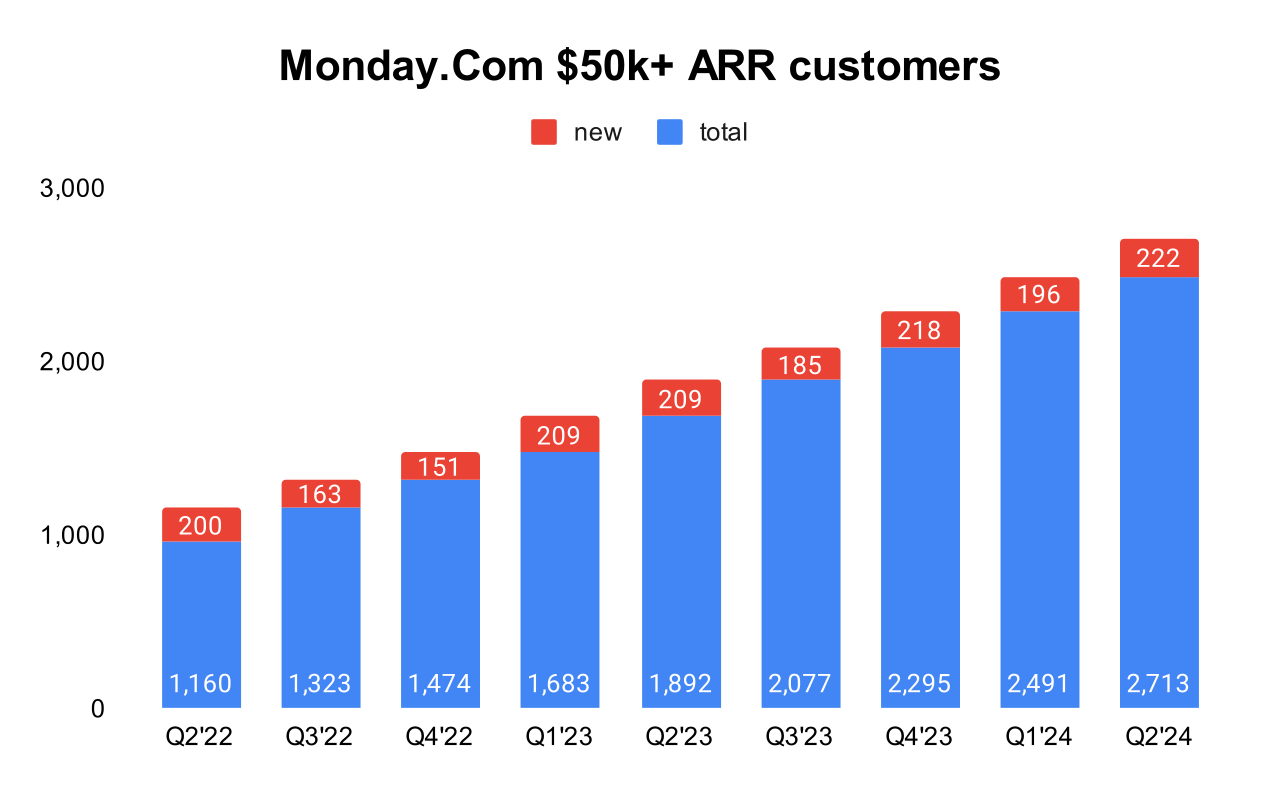

↗️2,713 $50k+ customers (+43.0% YoY, +222)🟢

↗️1,009 $100k+ customers (+49.0% YoY, +98)🟢

Key Metrics

↗️20,770 CRM accounts +22.0% QoQ, +3794)🟢

➡️2,719 dev accounts +30.0% QoQ, +629)

Operating expenses

↘️S&M*/Revenue 51.1% (-5.1 PPs YoY)

↘️R&D*/Revenue 15.6% (-0.3 PPs YoY)

↘️G&A*/Revenue 7.7% (-0.6 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $77M (+43.3% YoY)

↘️CAC* Payback Period 21.0 Months (25.7 LQ)

Dilution

↗️SBC/rev 16%, +3.3 PPs QoQ

↗️Basic shares up 3.1% YoY, +0.4 PPs QoQ

↘️Diluted shares up 8.3% YoY, -0.3 PPs QoQ🔴

Headcount

↗️2,110 Total Headcount (+28.0% YoY, +123 added)

Guidance

➡️Q3'24 $243.0 - $247.0M guide (+29.5% YoY) in line with est

↗️$956.0 - $961.0M FY guide (+31.3% YoY) raised by 1.4% beat est by 1.1%

Key points from Monday’s Second Quarter 2024 Earnings Call:

Financial Highlights:

Q2 saw a record non-GAAP operating profit and the company achieved GAAP operating profitability for the first time. Revenue for Q2 2024 was $236.1 million, up 34% from the previous year.

AI Integration:

monday.com has introduced GenAI capabilities across its platform. This includes the deployment of AI chatbots to handle customer service tickets, which now automatically resolve about 50% of such tickets. The company plans to further expand AI integration to enhance automation and task management across its product suite.

Monday CRM:

Launched in 2022, Monday CRM has grown to over 20,000 accounts. Recent feature additions include email engagement tracking and timeline reminders to enhance functionality.

The CRM product continues to scale well, contributing significantly to the company's growth. The focus remains on increasing average contract values (ACV) by targeting more upmarket customers and enhancing product capabilities.

Monday Dev:

This suite offers a comprehensive set of tools for managing the entire development process.

A recent addition is the Rowman tracker, which helps users visualize company epics, track progress, and focus on key commitments, catering to the needs of development teams.

MondayDB 2.0:

MondayDB 2.0 marks a significant upgrade over its predecessor, enhancing scalability and allowing customers to manage boards with up to 100,000 items and dashboards with up to 500,000 items.

This upgrade is crucial for supporting large-scale use cases and is part of monday.com's ongoing efforts to enhance underlying architecture and scalability.

New Pricing Model:

Introduced in Q1 2024, the new pricing structure has been rolled out to about 40% of the customer base. It is expected to yield a $25 million revenue benefit for fiscal year 2024, with a total projected benefit of $75 million to $80 million by fiscal year 2026.

The reception to the price increases has been largely positive, especially among enterprise accounts. However, some impact on very small businesses and individual users has been noted, aligning with the company’s strategy to focus on higher value customers.

Customer Retention:

Net Dollar Retention (NDR): The company has observed stable NDR, which is expected to remain steady through fiscal year 2024 with a slight improvement anticipated by the year-end.

monday.com’s efforts to enhance product functionality and integrate AI capabilities are key components of its strategy to improve customer retention. The introduction of GenAI in customer service has also significantly reduced the need for human customer support agents, contributing to operational efficiencies and customer satisfaction.

Future Outlook:

For the fiscal year 2024, revenue is expected to be between $956 million to $961 million, representing a growth of 31% to 32% year over year.

Continued development and enhancement of products like Monday CRM, Monday Dev, and the upcoming Monday Service are critical. The launch of MondayDB 2.0 is a part of this initiative, improving scalability and performance.

Ongoing integration of AI across products to enhance user experience and operational efficiency. Future AI developments will likely include more sophisticated automation features within products like CRM and Monday Service.

Management comments on the earnings call.

Competitors:

Roy Mann (Co-CEO): "We see most of our deals were not up against competitors, but in some areas we do. And where we win, we win a lot because of the platform and our capabilities and the fact that companies see they can rely on us in the future as well as in a lot of other things they can do."

New Pricing Model:

Eliran Glaser (CFO): "Our new pricing structure that was introduced in Q1 2024 continues to yield positive results and has now been extended to approximately 40% of our customer base. We maintain our forecast of a $25,000,000 in revenue benefit from this new pricing structure for fiscal year 2024."

Customers:

Roy Mann (Co-CEO): "Since our debut on NASDAQ 3 years ago, we have made significant progress in realizing our vision of becoming the platform to run the core of all work for customers. This transition and our strong execution have allowed us to nearly double our customer base."

Future Outlook:

Eran Zinman (Co-CEO): "We continue to make significant progress in enhancing and expanding our product suite. Elevate is a must-attend event for monday.com's passionate customers and anyone excited about WorkTech. This year's Elevate will take place in London, New York City, and Sydney over the coming months."

Eliran Glaser (CFO): "We continue to anticipate reported NDR to remain stable throughout fiscal year 2024 with an expected small improvement by the end of the year. As a reminder, our NDR is a trailing 4 quarter weighted average calculation."

Thoughts on Monday.com ER $MNDY :

🟢Pros:

+ Revenue accelerates to +34.4% YoY growth rate; if the company similarly beats its forecast by 2.7%, next quarter's revenue growth will stabilize at 34%.

+ Dollar-Based Net Retention (DBNR) for $50k+ customers is stable at 114%, for $100k+ customers at 114%; increased by 1 PPs sequentially.

+ Record number of $100k+ and $50k+ customers added.

+ Record growth in CRM and development accounts.

+ Record net new ARR added.

+ Strong FCF margin 21.5%.

+ Non-GAAP gross margin at a record level 90.7%.

+ Beat Q2 revenue guidance by 2.7%.

+ FY 2024 guidance increased by 1.4%.

+ New Pricing Model starts well.

+ MondayDB 2.0 launched.

🔴Cons:

- Diluted shares up 8.3% YoY.

🟡Neutral:

+- SBC/rev at 15.5%, increased 3.3 PPs sequentially.

+- Billings growing at 29.3%, slower than revenue.