Monday.com Q1 2025 Earnings Analysis

Dive into $MNDY Monday’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$282.3M rev (+30.2% YoY, +32.3% LQ) beat est by 2.5%

↗️GM* (90.2%, +0.4 PPs YoY)

↗️Operating Margin* (14.5%, +4.5 PPs YoY)

↘️FCF Margin (38.8%, -2.6 PPs YoY)🟡

↗️Net Margin (9.7%, +6.4 PPs YoY)🟢

↗️EPS* $1.10 beat est by 59.4%🟢

*non-GAAP

Net dollar retention rate

➡️NDR 112% (112% LQ)

➡️NDR 10+ users 115% (115% LQ)

↗️NDR $50k+ ARR 116% (115% LQ)

↗️NDR $100k+ ARR 117% (116% LQ)

Customers

➡️3,444 $50k+ customers (+38.3% YoY, +243)

➡️1,328 $100k+ customers (+45.8% YoY, +121)

Key Metrics

↗️31,467 CRM accounts (+13.4% QoQ, +3711)

↗️4,266 dev accounts (+24.3% QoQ, +833)🟢

↗️694 Service accounts (+83.6% QoQ, +316) 🟢

Operating expenses

↘️S&M*/Revenue 48.1% (-7.6 PPs YoY)

↗️R&D*/Revenue 19.1% (+3.0 PPs YoY)

↗️G&A*/Revenue 8.5% (+0.4 PPs YoY)

Quarterly Performance Highlights

➡️Net New ARR $57M (-0.3% YoY)

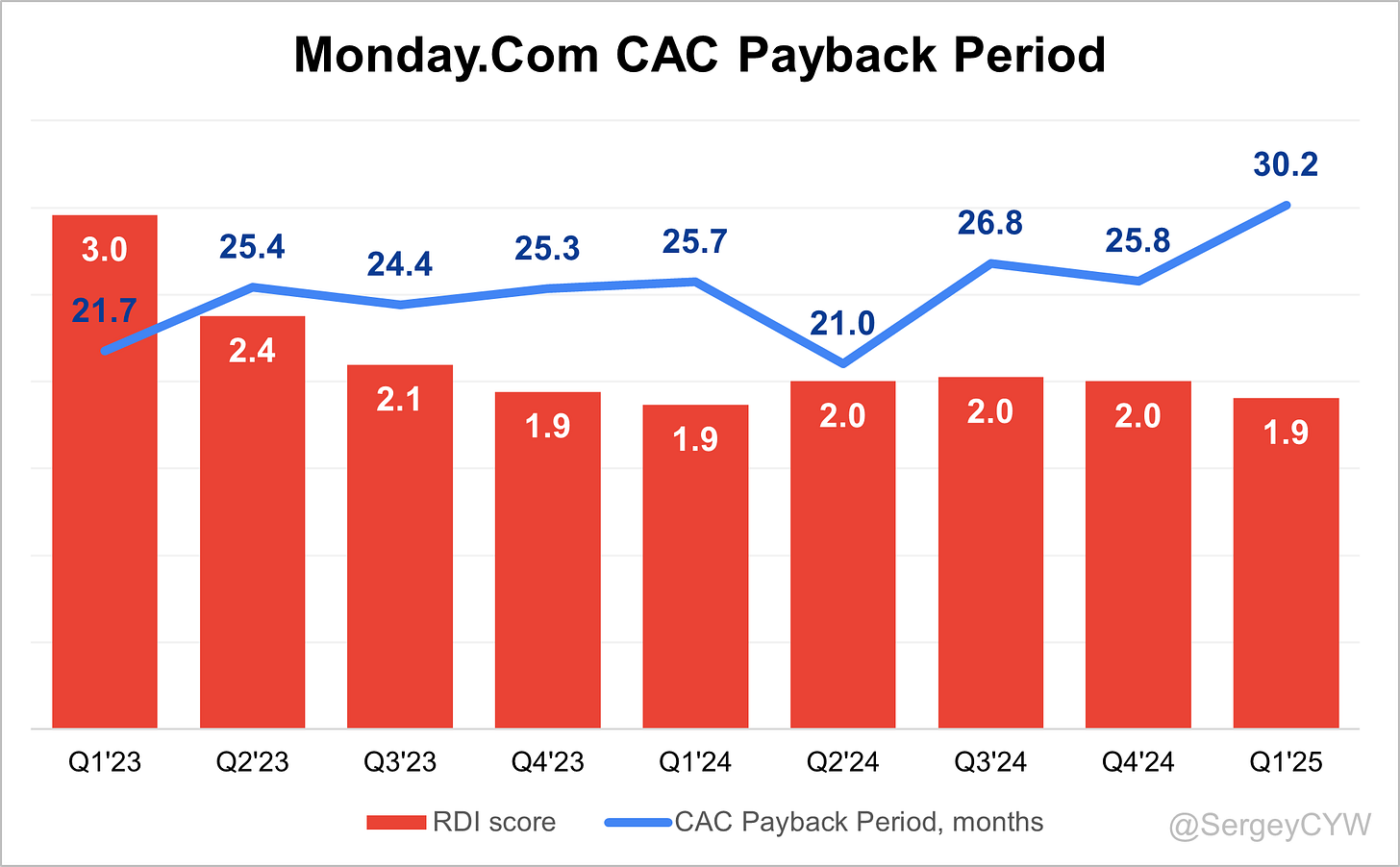

↗️CAC* Payback Period 30.1 Months (+4.3 YoY)🟡

↗️R&D* Index (RDI) 1.91 (+0.04 YoY)🟢

Dilution

↘️SBC/rev 11%, -0.5 PPs QoQ

↘️Basic shares up 3.7% YoY, -0.0 PPs QoQ

↘️Diluted shares up 2.0% YoY, -0.6 PPs QoQ

Headcount

↗️2,695 Total Headcount (+35.6% YoY, +187 added)

Guidance

↘️Q2'25 $292.0 - $294.0M guide (+24.1% YoY) missed est by -0.4%🔴

↗️$1,220.0 - $1,226.0M FY guide (+25.8% YoY) raised by 0.4% beat est by 0.5%

Key points from MondayCom’s First Quarter 2025 Earnings Call:

Financial Performance

monday.com reported Q1 FY2025 revenue of $282.3M, up +30% YoY, beating estimates by 2.5%. Non-GAAP gross margin held at 90.2%, and operating margin expanded to 14.5%, up from 10% last year. EPS was $1.10, exceeding expectations by +59.4%, while net income nearly doubled YoY to $58.4M.

Adjusted free cash flow reached a record $109.5M with an FCF margin of 38.8%, slightly down from 41.4% in Q1 FY24 due to seasonal hiring and bonuses. Cash and equivalents increased to $1.53B from $1.41B in Q4. Management reaffirmed its goal of generating $1B+ in cumulative free cash flow from FY23 to FY26.

Work Management

Work Management remains the core growth engine. The company launched AI-powered risk insights, portfolio-level reporting, managed templates, and resource planning for the Enterprise tier. These features improve cross-departmental execution and visibility, supporting enterprise-wide adoption.

Enterprise account growth is accelerating as the platform becomes more embedded across departments. The solution has been recognized as a category leader. Longer sales cycles and deeper evaluations remain a challenge, especially in a macro environment prioritizing ROI clarity.

monday CRM

monday CRM added a strong number of new accounts in Q1, driven by effective performance marketing. Adoption is strongest in SMB and lower mid-market, supported by its no-code flexibility and intuitive UI.

CRM competes most frequently with Pipedrive, Zoho, HubSpot, and SugarCRM. The product is not yet positioned for large enterprise deployments or as a major cross-sell driver. Monetization is still ramping, with growing engagement trends.

monday Dev

monday Dev showed strong Q1 growth in customer adds, driven by seasonal marketing efficiency, not strategic changes in GTM. Product usage is healthy with positive customer feedback and an active roadmap.

Dev remains concentrated in mid-market and tech-centric teams. It is not yet cross-selling into large enterprises. Broader enterprise adoption will depend on deeper product development and GTM alignment.

monday Service

monday Service has become the leading cross-sell opportunity. 70% of ARR now comes from mid-market and enterprise accounts, a notable shift from its original SMB focus.

The platform addresses internal support and ticketing needs with increasing adoption across multiple customer tiers. It is viewed as the most enterprise-ready of monday's non-core products. Success hinges on maintaining momentum and improving awareness in the ITSM space.

monday DB 2.0

monday DB 2.0 now powers the backend infrastructure, enabling scalable data structures and deeper integrations. It supports the AI Blocks framework, used in over 26M actions, up +150% since Q4 2024.

AI features help automate workflows, surface insights, and support decision-making. The rollout of LCP (Low-code Control Plane) allows seamless integration with LLMs and AI agents. AI monetization is still early, with revenue potential tied to deepening customer use cases.

Product Innovation

AI usage continues to scale among tech-forward customers. Early adopters are integrating AI into production workflows, with management noting a direct correlation between usage and pricing willingness.

The introduction of LCP and Blocks positions monday as a platform for AI-first workflow automation. Innovation pace will be critical to sustaining differentiation.

Retention

Net Dollar Retention (NDR) held steady at 112% in Q1, with stronger trends in larger customer cohorts. Management expects full-year NDR to decline slightly below 112%, reflecting macro caution.

Pricing uplift contributed 1–2 percentage points to NDR in the prior year. Underlying behavior remains stable, with no notable change in customer expansion patterns.

Customer Growth

The customer base grew to 245,000+, with strong Q1 net adds across SMB, mid-market, and enterprise. Growth was fueled by targeted marketing, particularly for CRM and Dev.

FY25 customer growth is expected in the mid- to high-single digits YoY, with focus shifting to expansion over acquisition, especially within enterprise and upper mid-market segments.

Enterprise Accounts

The enterprise segment is the fastest-growing and a top priority. Growth is mostly from seat expansions within existing accounts, not initial large deals.

Work Management and Service are the main drivers of enterprise expansion. New Enterprise-tier features help win complex accounts requiring executional visibility.

Service now derives 70% of ARR from enterprise and mid-market, underscoring cross-sell success.

AI Adoption

AI feature usage surged to 26M+ actions, with growing application in real workflows. Customers use Blocks to automate, analyze, and optimize operations, especially in enterprise settings.

Adoption is strongest among solution-oriented champions. Broader rollout is supported through packaged templates and guided use cases.

International Performance

North America led performance in Q1. Europe showed signs of stabilization, though still lags the U.S. No abnormal activity was seen through April.

FX headwinds were minimal. FY25 assumes <1% FX drag, revised downward from initial expectations tied to tariff-related volatility earlier in the year.

GTM Execution and CRO

monday appointed Casey George as Chief Revenue Officer to scale enterprise execution. George brings experience from Qlik, Talend, IBM, and Verint, where he oversaw $1.3B+ in ARR and 1,000+ sales staff.

He will lead top-down GTM, improve efficiency, and accelerate enterprise adoption while preserving monday’s hybrid PLG and sales-led model.

Challenges

Elongated deal cycles and cautious enterprise spending persist. Seat expansion is increasingly scrutinized.

AI revenue is excluded from FY25 guidance, and monday Service's contribution is only modestly included, suggesting upside potential if adoption exceeds current assumptions.

Hiring remains aggressive, with 30% YoY headcount growth planned, focused on enterprise sales and R&D.

FY25 Outlook

Q2 revenue is guided to $292M–$294M, up +24–25% YoY, with operating income of $32M–$34M and margin of 11–12%.

Full-year revenue is forecast at $1.22B–$1.226B (+25–26% YoY), with non-GAAP operating income of $144M–$150M.

Free cash flow is expected to reach $310M–$316M, with an FCF margin of 25–26%. Guidance excludes AI monetization and is conservatively framed amid macro uncertainty.

Management comments on the earnings call.

Product Innovations

Roy Mann, Co-Chief Executive Officer

"We are thrilled to see such rapid growth and usage of AI as our customers utilize the features to automate complex tasks, extract insights, and accelerate decision making."

Roy Mann, Co-Chief Executive Officer

"With blocks, AI blocks we've released something that is a very core capability... What we are doing now is understand those use cases and then rolling them out with templates and use cases to other customers."

Roy Mann, Co-Chief Executive Officer

"MCP is a new way for LLMs to interact with the platform... It allows anyone to interact better with monday, and it's a great addition to the AI tool set."

Work Management

Roy Mann, Co-Chief Executive Officer

"Work management is going a lot upmarket. We're leading that category also in all the reviews and we're seeing a lot of deep features or capabilities that we're releasing that enterprise really need to manage things at scale."

Eran Zinman, Co-Chief Executive Officer

"Casey brings a lot of experience... I think he can help accelerate our go-to-market or upmarket motion. It's been one of our most strategic pillars and things we’re focused on as a company."

Monday CRM

Eran Zinman, Co-Chief Executive Officer

"For CRM, the power of the platform and flexibility play a major role in why we win... customers prefer to purchase monday over other solutions."

Eran Zinman, Co-Chief Executive Officer

"The players we kind of meet the most would be Pipedrive, Zoho, SugarCRM, HubSpot... mostly players that focus on SMB and mid-market."

Monday Dev

Eran Zinman, Co-Chief Executive Officer

"Overall, we're happy with the progress with monday Dev... I would say the thing that drove most of the change in terms of customer adds in Q1 was stronger performance marketing that we are able to expand efficiently."

Eran Zinman, Co-Chief Executive Officer

"There's not a major go-to-market change in monday Dev... It's more of a seasonality that skewed a little bit toward Q1."

Monday Service

Eran Zinman, Co-Chief Executive Officer

"Service is not just an SMB product. We see 70% of the ARR for monday Service coming from mid-market and enterprise segments, so also strong momentum there."

Eran Zinman, Co-Chief Executive Officer

"We’re starting to see more and more cross-sell, not just for SMBs and mid-market, but also for enterprise customers."

Competitors

Eran Zinman, Co-Chief Executive Officer

"In CRM, the players we compete with most often are Pipedrive, Zoho, HubSpot, and SugarCRM. It’s mostly focused on the SMB and mid-market."

Customers

Roy Mann, Co-Chief Executive Officer

"We do see for some of them that they adopted really well and people are using and they have appetite for growth."

Eran Zinman, Co-Chief Executive Officer

"The vast majority of like the major expansions we see today are based on adding significant amount of seats and not significant cross-sells yet. But over time we think this will change."

International Growth

Eliran Glazer, Chief Financial Officer

"Demand has been healthy and consistent across all regions in Q1. We didn’t see anything that we can call out in a different manner."

Eliran Glazer, Chief Financial Officer

"North America continues to be strong... with Europe there are some challenges, but overall we are getting a more clear picture and we are stabilizing."

GTM Execution

Eran Zinman, Co-Chief Executive Officer

"It’s a machine that we built over the years that combines product-led growth with sales-led motion... and we would love to preserve our ability to do both."

Eran Zinman, Co-Chief Executive Officer

"Casey brings the knowledge of going upmarket and dealing with large enterprises, while also managing a large number of SMB and mid-market customers. That makes him the perfect fit."

Eran Zinman, Co-Chief Executive Officer

"Partners help us reach enterprise customers and scale our sales operation. They also bring a lot of technical expertise, and we continue to invest in that part of the business."

Challenges

Roy Mann, Co-Chief Executive Officer

"For larger enterprises it takes more time to buy... more decision-making and they might optimize and scrutinize usage over time."

Eliran Glazer, Chief Financial Officer

"There is more uncertainty in the macroeconomic environment... we believe NDR is going to be slightly below 112% potentially by the end of the year."

Eliran Glazer, Chief Financial Officer

"In Q2, you have the bonus payments to the salespeople, salary increases, and comp adjustments from Q1... Q1 is usually our strongest free cash flow quarter."

Future Outlook

Eliran Glazer, Chief Financial Officer

"We expect full-year adjusted free cash flow of $310M to $316M and adjusted free cash flow margin of 25% to 26%."

Eliran Glazer, Chief Financial Officer

"We are still in the base case based on current performance... We haven’t seen anything that would move us to a weakened macro case."

Eliran Glazer, Chief Financial Officer

"Our philosophy on guidance has been consistent. We took a more conservative approach due to factors like FX, NDR and customer growth moderation."

Thoughts on MondayCom Earnings Report $MNDY:

🟢 Positive

Revenue grew to $282.3M, up +30.2% YoY, beating estimates by 2.5%

EPS was $1.10, up +59.4% vs estimates

Operating margin improved to 14.5%, up +4.5pp YoY

Net margin rose to 9.7%, up +6.4pp YoY

Free cash flow hit $109.5M, with cash reserves increasing to $1.53B

Work Management adoption expanded, driven by AI-powered enterprise features

CRM accounts reached 31,467, up +13.4% QoQ

Dev accounts grew to 4,266, up +24.3% QoQ

Service accounts rose to 694, up +83.6% QoQ

$100K+ customers grew +45.8% YoY to 1,328

S&M expense ratio fell to 48.1%, down -7.6pp YoY

R&D investment increased, with RDI at 1.91, up +0.04 YoY

AI usage scaled to 26M+ actions, up +150% QoQ

FY25 revenue guidance raised to $1.220B–$1.226B (+25.8% YoY) - monday Service impact modestly included in guidance despite strong growth potential and AI revenue not yet monetized or included in FY25 outlook

🟡 Neutral

NDR stable at 112%, but full-year expected slightly below

NDR for $100K+ accounts improved to 117%, up from 116% LQ

Net new ARR flat YoY at $57M

CAC payback lengthened to 30.1 months, up +4.3 months YoY

R&D expense ratio increased to 19.1%, up +3.0pp YoY

G&A expense ratio rose to 8.5%, up +0.4pp YoY

SBC/revenue decreased slightly to 11%, down -0.5pp QoQ

Diluted shares up +2.0% YoY, with slower QoQ growth

Headcount reached 2,695, up +35.6% YoY

Europe stabilized but remains behind North America

🔴 Negative

Q2 revenue guidance of $292M–$294M implies +24.1% YoY, missing estimates by -0.4%

FCF margin declined to 38.8%, down -2.6pp YoY

Enterprise sales cycles lengthening; expansion decisions face higher scrutiny

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.