Financial Results:

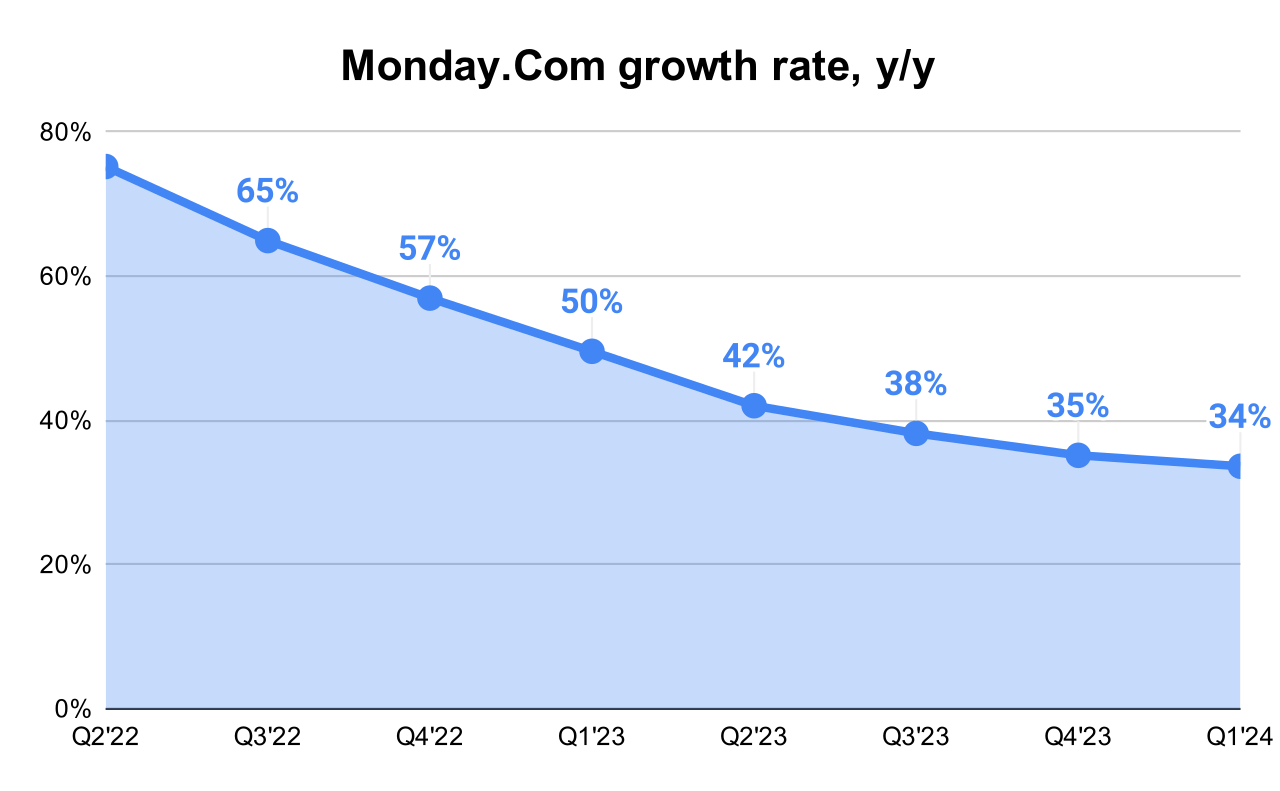

↗️$216.9M rev (+33.6% YoY, +35.2% LQ) beat est by 3.1%

↘️GM* (89.8%, -0.6%pp YoY)

↗️Operating Margin* (9.9%, +10.1%pp YoY)

↗️FCF Margin (41.4%, +17.6%pp YoY)🟢

↗️EPS* $0.61 beat est by 52.5%

*non-GAAP

Net dollar retention rate

➡️NDR 110% (110% LQ)

↘️NDR 10+ users 114% (115% LQ)

↘️NDR $50k+ ARR 114% (115% LQ)

↘️NDR $100k+ ARR 113% (114% LQ)

Customers

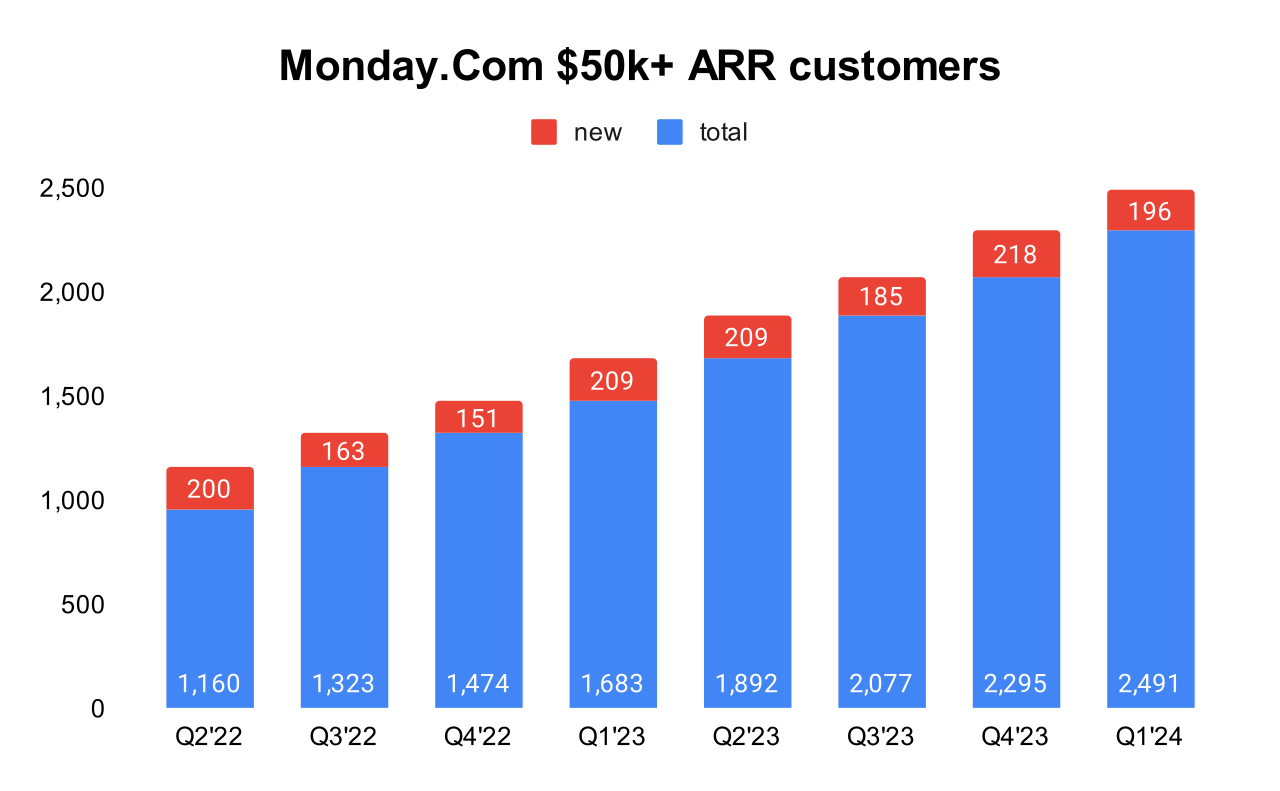

➡️2,491 $50k+ customers (+48.0% YoY, +196)

➡️911 $100k+ customers (+55.0% YoY, +78)

Key Metrics

↗️16,976 CRM accounts+27.0% QoQ, +3658)🟢

↗️2,090 dev accounts+44.0% QoQ, +642)🟢

Operating expenses

↗️S&M*/Revenue 55.7% (54.3% LQ)

↘️R&D*/Revenue 16.0% (16.4% LQ)

↘️G&A*/Revenue 8.1% (8.5% LQ)

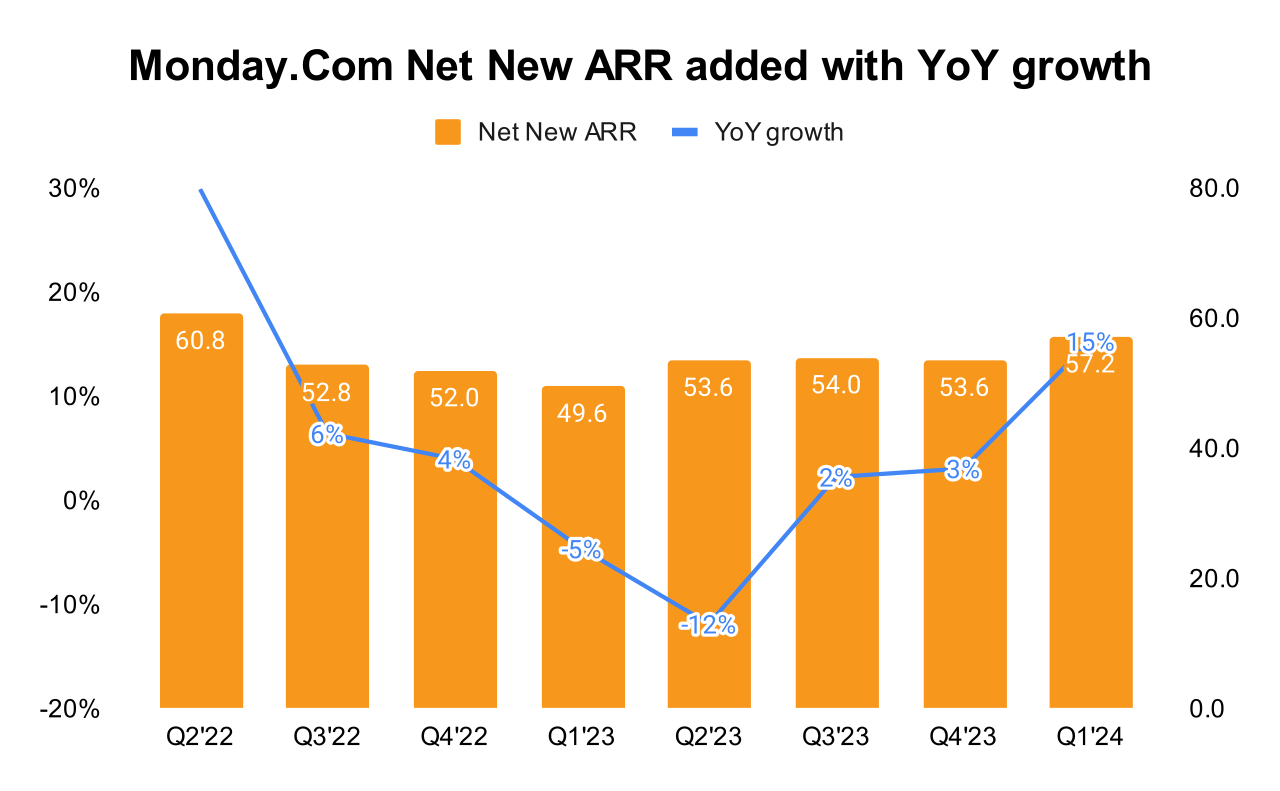

↗️Net New ARR $57M ($54 LQ)

↗️CAC* Payback Period 25.7 Months (25.3 LQ)

Dilution

↗️SBC/rev 12%, +1.2%pp QoQ

↗️Basic shares up 2.7% YoY, +0.3%pp QoQ

↗️Diluted shares up 8.6% YoY, +0.3%pp QoQ🔴

Guidance

↗️Q2'24 $226.0 - $230.0M guide (+29.8% YoY) beat est by 1.3%

↗️$942.0 - $948.0M FY guide (+29.5% YoY) raised by 1.7% beat est by 1.0%

Key points from Monday’s First Quarter 2024 Earnings Call:

Financial Performance:

Monday.com announced robust revenue growth and a record level of free cash flow for Q1, with total revenue reaching $216.9 million, a 34% increase year-over-year.

Monday Sales CRM:

This new offering was opened to all customers during Q1 2024. The CRM is designed to enhance sales management and customer relationship handling, which has seen accelerating account growth following its full rollout. The response to the Monday Sales CRM has been very positive, indicating strong initial adoption and interest from the user base.

Monday Dev:

Alongside the CRM, Monday Dev was also made available to all customers. This product aims to cater to developers by offering tools and features that facilitate software development and project tracking within the Monday.com ecosystem. Like the CRM, Monday Dev has shown accelerating account growth, signaling a successful uptake among existing and new customers.

Monday Service:

Scheduled for launch in late 2024, this product will address the service management needs within organizations. It is designed to handle internal ticketing systems such as IT and HR requests. Although still in the early stages of customer feedback, the initial reactions suggest that Monday Service will significantly complement the existing product suite, fulfilling a critical aspect of workflow management.

mondayDB:

mondayDB is part of their strategic development to support the scalability needs of larger enterprise customers. This infrastructure investment is aimed at maintaining high performance and reliability as the company scales up and accommodates more significant enterprise-level deployments.

AI Integration:

monday.com has introduced enhanced AI capabilities including AI Automations, smart columns, and AI-powered templates. These new features enable customers to integrate AI into their daily workflows, thereby enhancing productivity and efficiency. The AI enhancements are expected to increase adoption and make the platform more valuable and user-friendly, particularly for automating and optimizing tasks.

New Pricing Model:

The new pricing model is being implemented in phases. For new customers and those billed monthly, the new pricing took effect in Q1 2024. Existing customers will see the updated pricing upon their contract renewal.

The new pricing structure has exceeded initial projections, suggesting a strong value proposition of monday.com's products. The company has observed minimal customer churn and high retention rates, indicating acceptance of the new pricing among users.

Customer Retention and Acquisition:

Gross retention reached an all-time high, indicating strong customer loyalty. The company continues to see healthy acquisition rates, particularly in SMBs, despite a challenging macroeconomic environment.

Future Outlook:

The company plans to continue its growth trajectory by enhancing product offerings, improving customer retention, and expanding its market share across different customer segments.

Upcoming product launches, such as the new Monday service product slated for late 2024, are expected to further enhance the platform’s capabilities.

monday.com is optimistic about maintaining strong growth and financial performance, bolstered by strategic investments in product development and market expansion strategies.

Management comments on the earnings call.

Customer Retention

Eliran Glaser, CFO: "One is we continue to go up market with larger accounts and larger customers. So this is a more stabilized kind of customers with a better profile."

Eliran Glaser, CFO: "The second thing I would assume that the price increase that we did, potentially the customers that used to be the ones that did not decide they would like to continue to be Monday probably churned, and we remained with, again, better customers on the platform."

AI Integration

Roy Mann, co-CEO: "We just rolled out the initial phase of our AI building blocks... people actually use it to build new workflows and they really harness the power of AI to do a lot of stuff they would normally do themselves."

Roy Mann, co-CEO: "AI plays two parts: 1 is giving people our customers more capabilities and making them stickier and increasing automations... also adopt the platform itself and do a lot of like, harder tasks for them like creating formulas, like building boards, connecting things and also suggesting things they might do."

New Pricing Model

Eliran Glaser, CFO: "The majority of the NDR improvement for fiscal year 2024 is related to pricing... We initiated the new pricing in February, it was mostly for the monthly ones that actually benefit from the price increase. And the rest of the annual contracts are going to be throughout 2024."

Monday Service

Eran Zinman, co-CEO: "We're very excited for the service. We're going to launch it towards the end of the year, end of 2024... a lot of demand from our customer base towards the Monday service, a lot of excitement and I can share that the initial feedback from customers is very encouraging."

Monday Dev and CRM

"In Q1, our vision of becoming the go-to work platform for businesses took a significant step forward with the opening of Monday Dev to all customers. The response has been incredibly positive." — Eran Zinman, co-CEO

"In Q1, the response to our monday sales CRM has been incredibly positive, with both products showing accelerating account growth in Q1." — Eran Zinman, co-CEO

Future Outlook

Eliran Glaser, CFO: "We believe that current macroeconomy will remain choppy by the end of the year... we post our Q1 successful pricing adjustment, we have more confidence on the results that we presented when we did the Investor Day back in December, the best case scenario."

Thoughts on Monday.com ER $MNDY :

🟢Pros:

+- Revenue increased by +33.6% YoY; next quarter's guidance indicates that revenue growth will accelerate

+ DBNR for $50k+ customers at 114%, for $100k+ customers at 113%; decreased 1pp sequentially but remains healthy

+ Strong number of total and $50k+ customers added

+ Record growth in CRM and development accounts

+ Record FCF margin

+ Beat Q1 revenue guidance by 2.8%

+ FY 2024 guidance increased by 1.7%

+ New Pricing Model starts well

+ New product, Monday Service (management is very excited about this new product), is going to launch towards the end of the year

🔴Cons:

- Diluted shares up 8.6% YoY

🟡Neutral:

+- SBC/rev at 12%, increased 1.2%pp sequentially