Monday: Scaling a $1B+ ARR Platform in a $101B Market

Deep Dive into $MNDY: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Monday: Company overview

About Monday

Monday is a global software company that transforms how businesses operate through its cloud-based Work OS platform. The Israeli-based company serves ~245,000 customers across more than 200 industries, making it one of the leading work management solutions worldwide. Founded in Israel with headquarters in Tel Aviv, Monday went public in June 2021 and trades on NASDAQ under the ticker MNDY.

Company Mission

Monday's mission centers on helping teams build a culture of transparency, empowering everyone to achieve more and be happier at work. The company aims to democratize the power of software by making complex work management accessible to users regardless of technical background. The mission focuses on fostering transparency through visual dashboards and empowerment through customizable workflow solutions.

The platform's low-code/no-code approach directly supports this mission by enabling users to build custom applications without technical expertise. Monday's commitment to user experience drives continuous product development, with the company investing heavily in AI-powered features to enhance workplace efficiency.

Sector and Market Position

Monday operates in the work management and productivity software sector, specifically targeting the Work OS market. The company offers a multi-product platform including work management, CRM, development tools (monday dev), and service management solutions. The platform serves diverse industries from marketing and sales to IT operations and project management.

The company competes against established players like Atlassian, Wrike, Trello, and Airtable in the collaborative work management space. Monday differentiates itself through its visual interface and customizable workflow capabilities that adapt to various business needs.

Competitive Advantage

Monday's primary competitive advantage lies in its multi-product platform that runs all core aspects of work within a single ecosystem. The company's Work OS allows organizations to build custom workflow applications without coding, providing flexibility that traditional project management tools cannot match. The platform's visual and intuitive interface reduces adoption barriers significantly.

The company's AI Vision for 2025 focuses on three strategic pillars: AI Blocks, Product Power-ups, and Digital Workforce. Monday observed a tenfold increase in AI feature usage, reaching 10 million AI-powered actions in Q4 2024. The platform's AI capabilities give SMBs and mid-market companies competitive advantages to scale without increasing resources.

Strong customer retention metrics demonstrate platform stickiness. The company maintains a net dollar retention rate above 110% with customers over $50k in annual recurring revenue showing continued growth. The platform's adaptability across 200+ industries provides significant market reach and revenue diversification.

Total Addressable Market (TAM)

Monday operates in a $101 billion total addressable market (TAM), expanding at a 14% CAGR, according to the company’s latest management presentation. The TAM is projected to reach $150 billion by 2026, signaling strong growth potential for the work management platform.

Segment breakdown includes CRM at $30 billion, Development Tools at $17 billion, and Service Management at $9 billion. The 14% annual growth rate applies across all segments, driven by sustained demand in work management, CRM, development, and service workflows.

Adjacent markets are reinforcing TAM expansion. The remote work collaboration tools market is projected to hit $24.41 billion by 2027, growing at 15.2% CAGR. AI-powered workflow management is expected to reach $19.4 billion by 2025. The productivity software partnership market is forecast to grow to $102.58 billion by 2028.

Valuation

$MNDY is trading at a Forward EV/Sales multiple of 10.4, roughly in line with the median of 9.5. At the start of January 2024, the multiple was 7.6.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$MNDY trades at a Forward P/E of 76.6, with revenue growth of +30.1% YoY in the last quarter.

The EPS growth forecast for 2026 is 21%, with a P/E of 75 and a PEG ratio of 3.5.

The EPS growth forecast for 2027 is 28%, with a P/E of 62 and a PEG ratio of 2.2.

Monday became GAAP profitable at the end of 2023 and is rapidly increasing its profitability.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast +28.4% revenue growth for $MNDY in 2025 and +23.3% in 2026. Given these projections, the EV/Sales valuation appears undervalued relative to other CRM companies, especially considering $MNDY has the highest expected revenue growth in the CRM sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

Monday demonstrates strong economies of scale that strengthen as the company grows. The platform's 89% gross margins indicate strong unit economics, where incremental revenue flows through with minimal additional costs. With current $1+ billion ARR and serving ~245,000 customers, the company benefits from spreading fixed development and infrastructure costs across a large user base. The company's global cloud infrastructure, distributed across multiple regions, enables efficient scaling without proportional cost increases. While the competitive SaaS market typically limits pricing power, the recent price increase—combined with record customer additions—indicates that Monday does, in fact, have pricing power.

Network Effects

Monday exhibits moderate network effects that are emerging but not yet fully developed. The platform's Monday Apps Marketplace allows third-party developers to build integrations and workflow extensions, creating early platform dynamics. As more developers build for the ecosystem, it becomes harder for competitors to replicate and for customers to leave. The company's net dollar retention rate of 112% (115% for customers with $50k+ ARR) suggests some network benefits from increased usage and integrations. However, these network effects remain less robust than external network effects typical in consumer platforms, as Monday's value primarily derives from internal workflow optimization rather than user-to-user connections.

Brand Strength

Monday has built a strong brand through aggressive marketing investments and consistent positioning. The company famously spent over $200 million on video marketing in 2020/21, representing 95% of company revenue at the time. This investment established significant brand recognition in the work management space, with the platform being "most loved by customers on G2" and maintaining a 4.5 out of 5 rating on Gartner Peer Insights. The brand emphasizes trustworthiness, transparency, and customer-first approach with clean design and intuitive user experience. The company's traffic light color system and professional logo create strong visual recognition, while their presence across multiple marketing channels (social media, billboards, Spotify, YouTube) reinforces brand consistency.

Intellectual Property

Monday possesses limited intellectual property protection as a competitive moat. While the company owns trademarks, service marks, and proprietary technology related to its Work OS platform, the core functionality of project management and workflow automation cannot be easily patented. The company's no-code interface and modular building blocks represent proprietary implementations but face competition from similar approaches in the market. Monday's AI-powered features and planned Monday Expert AI agent may provide temporary competitive advantages, but these are difficult to patent and can be replicated by competitors. The intellectual property moat remains weak in the broader SaaS landscape where innovation and execution matter more than patent protection.

Switching Costs

Monday's strongest economic moat lies in high switching costs created by deep workflow embedding. The platform's customization capabilities allow users to configure highly specific workflows, automations, and integrations that become critical operational infrastructure. Once teams build complex processes inside Monday with custom terminologies, automated workflows, and third-party integrations (Slack, Outlook, Zoom), migration becomes time-consuming and disruptive. The platform transforms from a simple tool into a process repository containing institutional knowledge and business logic. This workflow entrenchment creates significant barriers to switching, as competitors would need to offer not just superior features but also seamless migration paths for complex, customized processes.

Monday's economic moat is moderate overall, with switching costs and brand strength providing the primary competitive advantages. The company's ability to embed itself into customers' operational workflows creates the strongest defensive position, while continued investment in ecosystem development and AI capabilities may strengthen network effects over time.

Revenue growth

$MNDY Monday's revenue growth remains consistently strong, reaching +30.1% YoY in Q1. Based on the guidance for the next quarter, if the company exceeds its forecast by 2.3%, as it did in Q1, Q2 growth would reach 27.3%, indicating a slight deceleration in revenue growth.

Billings growth slowed to +29.2%, growing slower than revenue growth.

Segments and Main Products.

Monday CRM

Monday CRM is a fully customizable, AI-powered sales management platform that streamlines the sales process and strengthens customer relationships. It features automated task generation, smart email integrations, personalized sequences, and intuitive pipeline management. The platform consolidates lead collection, deal tracking, account management, and post-sales activities into a single interface, enabling faster sales cycles and efficient team collaboration.

Monday Dev

Monday Dev is a centralized platform for software development teams designed to manage product planning, agile sprints, bug tracking, and release workflows. It integrates with tools like GitHub and Slack, automates repetitive tasks, and offers customizable sprint boards and roadmap planning tools. Real-time collaboration and comprehensive analytics allow teams to quickly identify bottlenecks, improve productivity, and accelerate product launches.

Monday Service

Monday Service is an AI-driven Enterprise Service Management (ESM) platform built to unify service operations across IT, HR, customer support, and other departments. It automates ticket classification, routing, and resolution using advanced AI. The platform features customizable workflows, a self-service portal, integrated knowledge bases, and real-time analytics dashboards to optimize operational efficiency and proactively manage service trends.

Monday DB 2.0

Monday DB 2.0 is a scalable data infrastructure built for large-scale workflows, supporting up to 100,000 items per board and 500,000 items per dashboard. It offers real-time data processing, advanced query capabilities, and seamless integration across the monday ecosystem. This architecture removes performance constraints and enables enterprises to manage complex projects efficiently at scale.

Main Products Performance in the Last Quarter

Monday CRM

Monday CRM posted a strong Q1, with customer additions accelerating meaningfully. Net adds bounced back, reflecting successful performance marketing spend and high customer engagement. The product is gaining traction primarily in the SMB and low mid-market, where it competes effectively against platforms like Pipedrive, Zoho, SugarCRM, and HubSpot. Functional flexibility and ease of use are resonating with customers. While enterprise adoption is still limited, product maturity and expanding capabilities are expected to drive future upmarket expansion.

Monday Dev

Monday Dev showed solid momentum, with customer net adds rebounding strongly in Q1. This uptick was largely tied to seasonal performance marketing efficiency, rather than structural changes in go-to-market. While the team continues to optimize strategy and build new features, monday Dev remains primarily used by smaller development teams. No major updates were announced regarding product repositioning, though customer feedback remains positive and roadmap execution is progressing well.

Monday Service

Monday Service is showing surprising strength, especially in the mid-market and enterprise segments. 70% of ARR now comes from non-SMB customers, signaling meaningful traction upmarket. Cross-sell activity with enterprise work management customers is beginning to materialize. Though revenue contribution to FY25 guidance is currently small, adoption trends suggest this product is evolving into a key pillar. Feature-rich updates, especially around support operations, position it well in the ITSM and internal support use case space.

MondayDB 2.0

The rollout of MondayDB 2.0 continues as part of a broader push to enhance monday's infrastructure. Though not deeply covered in the call, its inclusion in the Q1 shareholder letter and reference to monday code platform (MCP) highlight its role in enabling advanced automations and more scalable backend operations. The update supports deeper customizations, scalability, and integration of AI agents—crucial for future-proofing the platform, especially in enterprise deployments.

AI Adoption & Monetization

AI usage continues to scale rapidly. Over 26 million AI actions performed by users, up 150% year-over-year. Customers are leveraging AI for automations, insights, and decision acceleration. Monetization remains in early stages, with pricing experiments underway. Uptake is strongest where customers have internal champions who experiment and embed AI deeply into workflows. The introduction of AI-powered risk insights and portfolio reports is strengthening appeal in the enterprise segment.

Product Innovations

New enterprise-grade features launched under Monday Work Management Enterprise Tier include:

– AI-powered risk insights

– Portfolio reporting

– Managed templates

– Resource planning

Additionally, MCP (Monday Code Platform) was introduced, aligning with OpenAI’s tool-call standard for LLMs. It enables third-party AI agents to interact with the monday platform natively. This positions monday at the forefront of AI extensibility and developer integrations.

Market Leader

$MNDY Monday, has been recognized as a Leader in the 2024 Gartner Magic Quadrant for Adaptive Project Management and Reporting (APMR) for the third consecutive year.

Monday was evaluated based on its 'Ability to Execute' and 'Completeness of Vision,' where it was positioned furthest in both categories. The company continues to innovate, integrating AI into its platform and expanding its capabilities with new solutions like Portfolio management, mondayDB 2.0, and monday workflows, enhancing its offering for over 225,000 customers.

Monday has established itself as a Leader in the Gartner Magic Quadrant for Collaborative Work Management for the second consecutive year in 2024. The company achieved the furthest position in 'Completeness of Vision' among all evaluated vendors, demonstrating its strategic market positioning and product innovation capabilities.

Monday was named a Strong Performer in the 2025 Forrester Wave for Collaborative Work Management Tools for the Enterprise. The evaluation covered 10 leading platforms, including Asana, Airtable, and Wrike.

Monday earned a perfect score of 5.00 in three critical categories:

Go-to-market execution, reflecting a strong market strategy and efficient customer acquisition.

Customer satisfaction, indicating a high-value user experience.

Cost metrics, confirming a competitive pricing model and attractive total cost of ownership.

The Forrester report recognized Monday's low-code/no-code platform as built for enterprise scalability. Its flexible architecture enables dynamic workflow adjustments. The multi-product ecosystem supports end-to-end work management, not just task tracking. The visual interface lowers adoption barriers while preserving advanced functionality for complex enterprise environments.

Customers

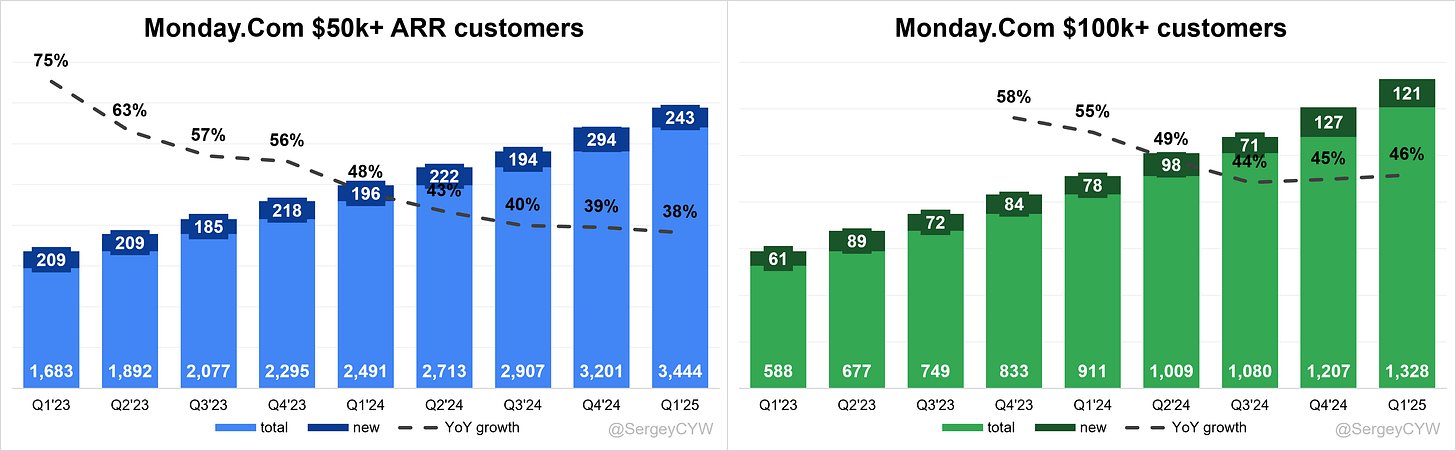

$MNDY Monday added 243 customers with ARR over $50K, representing +38% YoY growth, and 121 customers with ARR over $100K, reflecting an even stronger +46% YoY growth. New customer additions are near record levels, with customer growth outpacing revenue growth—a positive signal for future expansion and market demand.

Customer Success Stories

Enterprise and mid-market customers are deriving increasing operational value from Monday's AI features and platform flexibility. Over 26 million AI actions have been executed to date, reflecting not just usage, but embedded adoption in real workflows. Feedback suggests these features are helping teams automate complex tasks, surface business insights, and accelerate decision-making. The customer base is actively integrating AI into their operational layers, with champions inside organizations driving usage beyond experimentation. This aligns with management's view that value is being realized well before pricing is fully optimized, reinforcing the long-term monetization potential of AI within the platform.

In the Service segment, customer success is expanding beyond SMB. 70% of monday service ARR now comes from mid-market and enterprise, suggesting larger organizations are successfully deploying it for scalable support functions. These implementations are increasingly supported by partners delivering high-touch services such as data migrations, workflow customizations, and tailored industry solutions.

The company's multi-product strategy is also seeing customers deepen engagement. While most enterprise expansions today stem from seat growth on monday Work Management, there is growing appetite among these accounts to adopt additional products like monday Service. The successful rollout of features such as AI-powered risk insights, managed templates, and portfolio reporting is leading to deeper integrations within departments, indicating successful enterprise-level deployments.

Large Customer Wins

Though the company did not disclose individual customer names or logos during the earnings call, it did confirm that enterprise continues to be its fastest-growing segment. Management noted that large expansions remain the primary growth engine in this segment, with major customers growing significantly in seat count and platform usage. While most new enterprise deals still begin with monday Work Management, the cross-sell opportunity is beginning to materialize, particularly with monday Service.

The appointment of Casey George as Chief Revenue Officer, who previously managed a $1.3B ARR business at Qlik, underscores monday's focus on scaling enterprise wins. His experience selling to global organizations and aligning large go-to-market teams positions the company to accelerate high-value enterprise deals. Management expects his leadership to drive more structured top-down sales, improve win rates in strategic accounts, and increase large deal velocity.

Additionally, despite macro uncertainty, the company saw strong enterprise demand in Q1 and into April, indicating continued strength in pipeline quality. Large account engagement is described as healthy, with no change in deal conversion or linearity compared to Q4. Expansion deals remain seat-driven, but larger customers are increasingly adopting premium functionality and enterprise-exclusive features.

Retention

$MNDY Monday’s Net Dollar Retention (NDR) is 112%. For customers with ARR over $50K, it increased to 116%, and for $100K+ customers, it rose to 117%. While retention remains strong, it is slightly below the 119% median for SaaS companies I track.

Net new ARR

$MNDY Monday added $57 million in net new ARR in Q1 2025, consistent with the same period last year. This addition is in line with the average over the past two years, reflecting steady growth.

CAC Payback Period and RDI Score

$MNDY Monday's return on S&M spending has declined, now at 30.2, which is worse than the SaaS median of 26.9.

However, the R&D Index (RDI Score) for Q1 is 1.90, which is well above the SaaS median of 1.1 and significantly higher than the industry median of 0.7. This reflects a strong and efficient investment in innovation.

An RDI Score above 1.4 is indicative of best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Key Metrics

In Q1 2025, $MNDY added 3,711 new CRM accounts, representing +85% YoY growth—a strong and near-record level of new additions. While net new customer growth slowed in Q4 2024 due to seasonal marketing adjustments, management had guided for increased CRM contribution in 2025, which is now materializing with a strong Q1 performance.

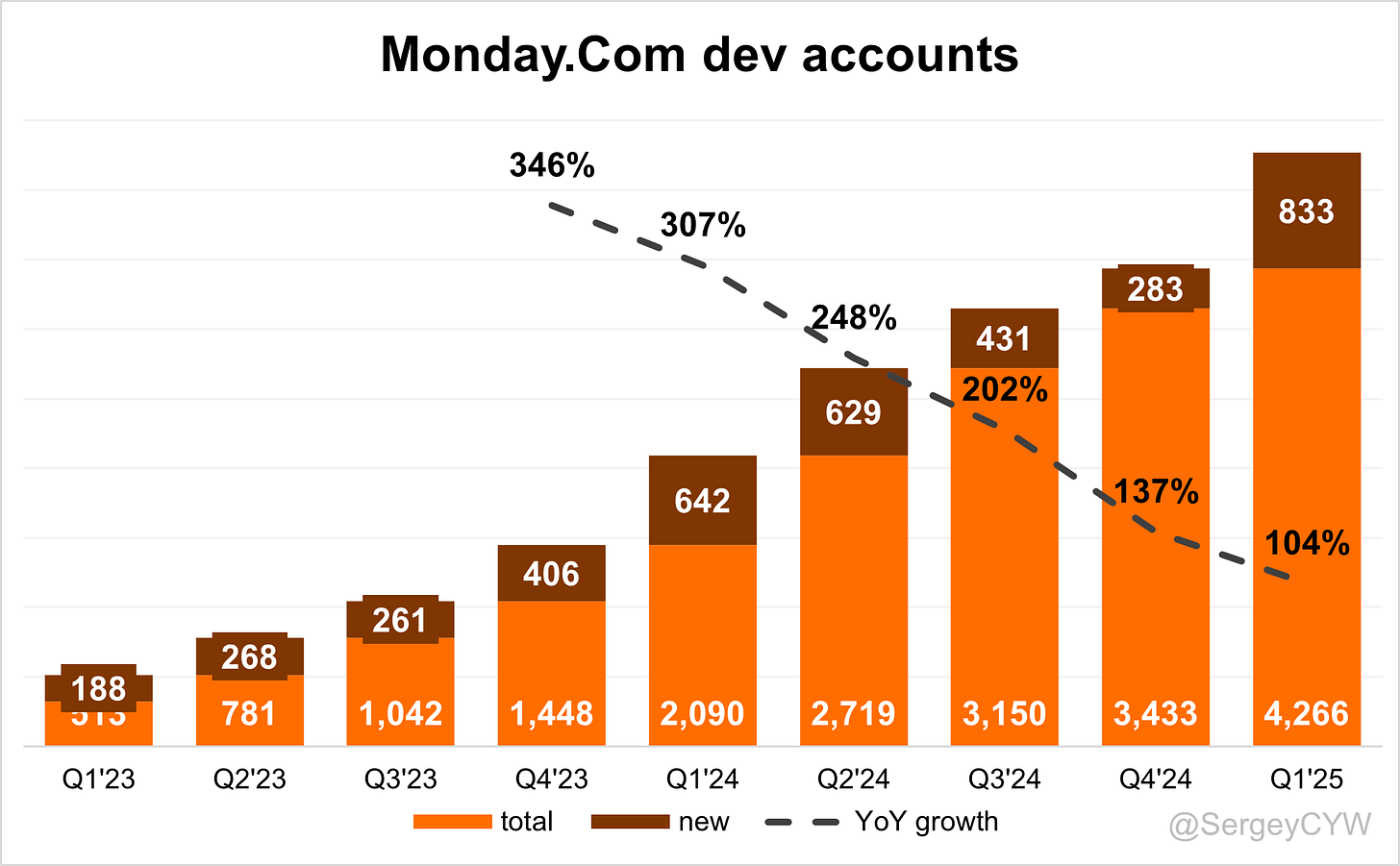

$MNDY added 833 new developer accounts—a record addition with +104% YoY growth. The Dev product remains a key long-term growth driver. Future enhancements will focus on AI integration, version control, and advanced collaboration tools, aimed at strengthening Monday’s developer offering and expanding its product depth.

$MNDY Monday added 316 new Service accounts, nearly doubling the count from the previous quarter. Monday Service, launched in 2024, offers AI-powered enterprise service management and already shows strong traction. It has the highest ACV among all Monday products, and 60% of new Service customers were existing Work Management users, highlighting strong cross-sell potential across its platform.

Profitability

Over the past year, $MNDY Monday margins have changed:

Gross Margin slightly increased from 89.7% to 90.2%.

Operating Margin increased from 9.9% to 14.4%.

Free Cash Flow (FCF) Margin slightly decreased from 41.4% to 38.8%.

Operating expenses

$MNDY Monday's Non-GAAP operating expenses have gradually decreased due to a reduction in Sales & Marketing (S&M) spending, which declined from 63% two years ago to 48%.

R&D expenses have increased and remain high at 19%, reflecting the company's ongoing investment in future growth through product enhancements and updates.

General & Administrative (G&A) expenses have slightly decreased to 9% over the past two years.

Balance Sheet

$MNDY Balance Sheet: Total debt stands at $123M, while Monday holds $1,588M in cash and cash equivalents, far exceeding its debt and ensuring a healthy balance sheet with virtually no debt.

Dilution

$MNDY Shareholder Dilution: Monday's stock-based compensation (SBC) expenses decreased to 11% of revenue in the last quarter, which is relatively low compared to other high-growth SaaS companies.

Shareholder dilution remains under control, although the weighted-average number of basic common shares outstanding increased by 3.7% YoY, up from 2.7% in the previous year.

Conclusion

$MNDY Monday’s revenue growth continued to slow, reaching +30.1% YoY, but remains at a strong level. The company has significantly improved its margins over the past two years while maintaining healthy growth. Notably, the gross margin increased to 90.2%, recovering from a dip to 89.2% last quarter. Monday is clearly strengthening its competitive position, as it's recognized as a leader in several Gartner quadrants.

Leading Indicators

Billings growth came in at +29.2%, slightly below revenue growth.

Net new ARR remained at the same level as a year ago.

Strong additions of total and large customers, close to record levels.

Record number of CRM, Dev, and Services accounts added.

Key Metrics

Net Dollar Retention (NDR) stands at 112%, with large customer NDR rising 1 pp QoQ to 117%.

CAC Payback Period worsened slightly to 30.2 months, still within a reasonable range.

RDI Score of 1.9, which is above the median among SaaS peers I track.

Management’s revenue guidance for next quarter implies +27.3% YoY growth, assuming a similar beat as in Q1 (where the company beat guidance by 2.3%). While this indicates further deceleration, the strong customer additions and surge in CRM, Dev, and Service accounts suggest there's potential for a bigger beat.

Valuation based on current multiples is roughly in line with Monday’s historical forward EV/Sales average, and appears undervalued relative to peers, especially given its top-tier revenue growth forecast. Analysts are currently expecting the highest revenue growth for Monday among CRM companies.

Monday CRM continues to perform well, while the new Monday Service product shows strong momentum, with new accounts nearly doubling compared to the previous quarter—a very promising sign. The company also increased R&D spending over the past few quarters, which I view as a positive signal for long-term competitive strength.

The recent pricing increase was well received, and robust customer growth suggests that buyers are willing to pay more—a strong indicator of pricing power and economies of scale despite sector competition.

Monday also strengthened its leadership team, appointing Harris Beber as Chief Marketing Officer, effective July 3, 2025. He’ll lead global marketing across brand, performance, demand generation, and communications.

While Monday operates in a highly competitive market, it continues to expand into new verticals, unlocking cross-sell opportunities and growing its TAM. The company now estimates its TAM at $101B, growing at a 14% CAGR, according to its latest management presentation.

In June 2025, I slightly increased my position — $MNDY now represents 9.5% of my portfolio.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.