Monday: Scalable Work OS with Expanding Market Opportunity

Deep Dive into $MNDY: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Monday: Company overview

About Monday

Monday, founded in 2012 by Roy Mann and Eran Zinman, is a cloud-based Work OS headquartered in Tel Aviv, Israel. Originally launched as “dapulse,” the company rebranded to monday in 2017. It offers customizable applications for project management, CRM, marketing, software development, and collaborative workflows. As of February 2025, monday serves over 250,000 customers globally across 200+ business verticals, with record quarterly revenue of $268 million (+32% YoY) and a net dollar retention rate of 112%.

Company Mission

Monday’s mission is to help organizations of any size improve efficiency and productivity through a customizable, intuitive platform. The company focuses on automation, collaboration, and transparency, with an emphasis on customer-centric innovation.

Sector

Monday operates in the cloud-based work management sector, categorized as a Work Operating System (Work OS). Its tools span project management, CRM, marketing automation, software development, and collaborative applications. The largest customer segments are Marketing and Advertising (9%), Information Technology (8%), and Computer Software (8%).

Competitive Advantage

Monday’s advantage lies in its visual interface, customization flexibility, and ease of use.

Its platform includes over 200 integrations with tools like Slack, Google Drive, and Microsoft Teams. It scales efficiently from small teams to large enterprises. Strong switching costs—driven by deep operational integration—enhance customer retention. These advantages drive high satisfaction ratings and competitive strength versus players like Asana and Smartsheet.

Total Addressable Market (TAM)

Monday’s TAM stands at approximately $56 billion, more than double its initial estimate of $26 billion, following expansion into CRM, Sales, Marketing, and Software Development. With a current 5.7% market share in project management, the company retains significant growth potential across its broadened market landscape.

Valuation

$MNDY is trading at a Forward EV/Sales multiple of 9.9, roughly in line with the median of 9.4. Excluding the inflated 2021 multiples, the average Forward EV/Sales would be 9.5. At the start of January 2024, the multiple was 7.6.

$MNDY trades at a Forward P/E of 77.3, with revenue growth of +32.3% YoY in the last quarter.

The EPS growth forecast for 2026 is 45%, with a P/E of 60 and a PEG ratio of 1.3.

The EPS growth forecast for 2027 is 56%, with a P/E of 45 and a PEG ratio of 1.07.

Monday became GAAP profitable at the end of 2023 and is rapidly increasing its profitability.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast +22.6% revenue growth for $MNDY next year. Considering this projection, the valuation based on the P/S multiple appears undervalued compared to other companies in the CRM sector, given the high expected revenue growth.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economies of Scale

Monday benefits significantly from economies of scale. With over 250,000 customers across diverse industries and geographies, the company achieves cost efficiencies and stable revenue streams. This scale supports a 30% free cash flow margin and a strong net revenue retention of 110%. Smaller competitors struggle to match Monday's cost structure and pricing flexibility, making economies of scale a durable competitive moat.

Network Effect

Monday exhibits a moderate but growing network effect. The platform’s multi-product strategy and integration allow seamless data flow, increasing utility as adoption expands. While not driven by user-to-user interactions like social media platforms, internal product synergies enhance retention and product stickiness. However, the network moat remains moderate, as its effects stem from integrations rather than broad network virality.

Brand

Monday has built a strong brand through an intuitive interface, customizable workflows, and collaboration tools. This is reflected in high customer satisfaction and a growing presence in both SMBs and enterprise markets. Despite this, the brand lacks global recognition or premium pricing power compared to iconic names like Apple or Coca-Cola. The brand moat is moderately strong with potential for further expansion.

Intellectual Property

As of December 2023, Monday holds 37 registered patents valued at $22.6 million. The company allocated $132.4 million to R&D in 2023, demonstrating a clear commitment to innovation. However, the overall IP portfolio remains modest, especially relative to larger tech firms with extensive proprietary assets. As a result, Monday's intellectual property moat is relatively weak in comparison.

Switching Costs

Switching costs are one of Monday’s strongest moats. The company’s multi-product ecosystem—including CRM, Service Management, and Dev tools—drives deep integration across customer workflows. Transitioning away involves high time, resource, and retraining costs, creating significant friction. This integration reduces churn and increases lifetime customer value, reinforcing customer loyalty and long-term retention.

Overall, Monday possesses robust economic moats in economies of scale and switching costs, moderate strength in brand and network effects, and relatively weaker positioning in intellectual property. These combined moats position Monday effectively against competitors within its market segment.

Revenue growth

$MNDY Monday's revenue growth remains consistently strong, reaching +32.3% YoY in Q4. Based on the guidance for the next quarter, if the company exceeds its forecast by 2.3%, as it did in Q4, Q1 growth would reach 30.2%, indicating a slight deceleration in revenue growth.

Billings growth accelerated to +34.4%, outpacing revenue growth, which suggests potential stabilization of revenue growth in the coming quarters.

Segments and Main Products

Monday CRM

Monday CRM is a fully customizable, AI-powered sales management platform that streamlines the sales process and strengthens customer relationships. It features automated task generation, smart email integrations, personalized sequences, and intuitive pipeline management. The platform consolidates lead collection, deal tracking, account management, and post-sales activities into a single interface, enabling faster sales cycles and efficient team collaboration.

Monday Dev

Monday Dev is a centralized platform for software development teams designed to manage product planning, agile sprints, bug tracking, and release workflows. It integrates with tools like GitHub and Slack, automates repetitive tasks, and offers customizable sprint boards and roadmap planning tools. Real-time collaboration and comprehensive analytics allow teams to quickly identify bottlenecks, improve productivity, and accelerate product launches.

Monday Service

Monday Service is an AI-driven Enterprise Service Management (ESM) platform built to unify service operations across IT, HR, customer support, and other departments. It automates ticket classification, routing, and resolution using advanced AI. The platform features customizable workflows, a self-service portal, integrated knowledge bases, and real-time analytics dashboards to optimize operational efficiency and proactively manage service trends.

Monday DB 2.0

Monday DB 2.0 is a scalable data infrastructure built for large-scale workflows, supporting up to 100,000 items per board and 500,000 items per dashboard. It offers real-time data processing, advanced query capabilities, and seamless integration across the monday ecosystem. This architecture removes performance constraints and enables enterprises to manage complex projects efficiently at scale.

Main Products Performance in the Last Quarter

Monday CRM

Monday CRM saw strong momentum in 2024 with record net new account additions, contributing meaningfully to ARR. It is now a more significant part of total revenue and continues expanding its presence across mid-market and enterprise customers. While Q4 additions slowed slightly due to performance marketing seasonality, the full-year trend remains robust. Growth is shifting toward higher ACV customers, supported by product maturity and a deeper move upmarket. CRM now includes Marketing Solution modules, expanding its use cases. No slowdown expected in 2025, with CRM poised to further scale with enterprise buyers.

Monday Dev

Monday Dev also achieved record new accounts added in 2024. Customer growth followed a similar seasonal slowdown in Q4 due to reduced marketing spend, a trend consistent with prior years. Focus has shifted to larger customers, with increased feature depth tailored to technical teams. Dev is positioned to see higher ACVs moving forward as the company builds more enterprise-specific features. While still early in its lifecycle, the product benefits from cross-sell opportunities within existing accounts.

Monday Service

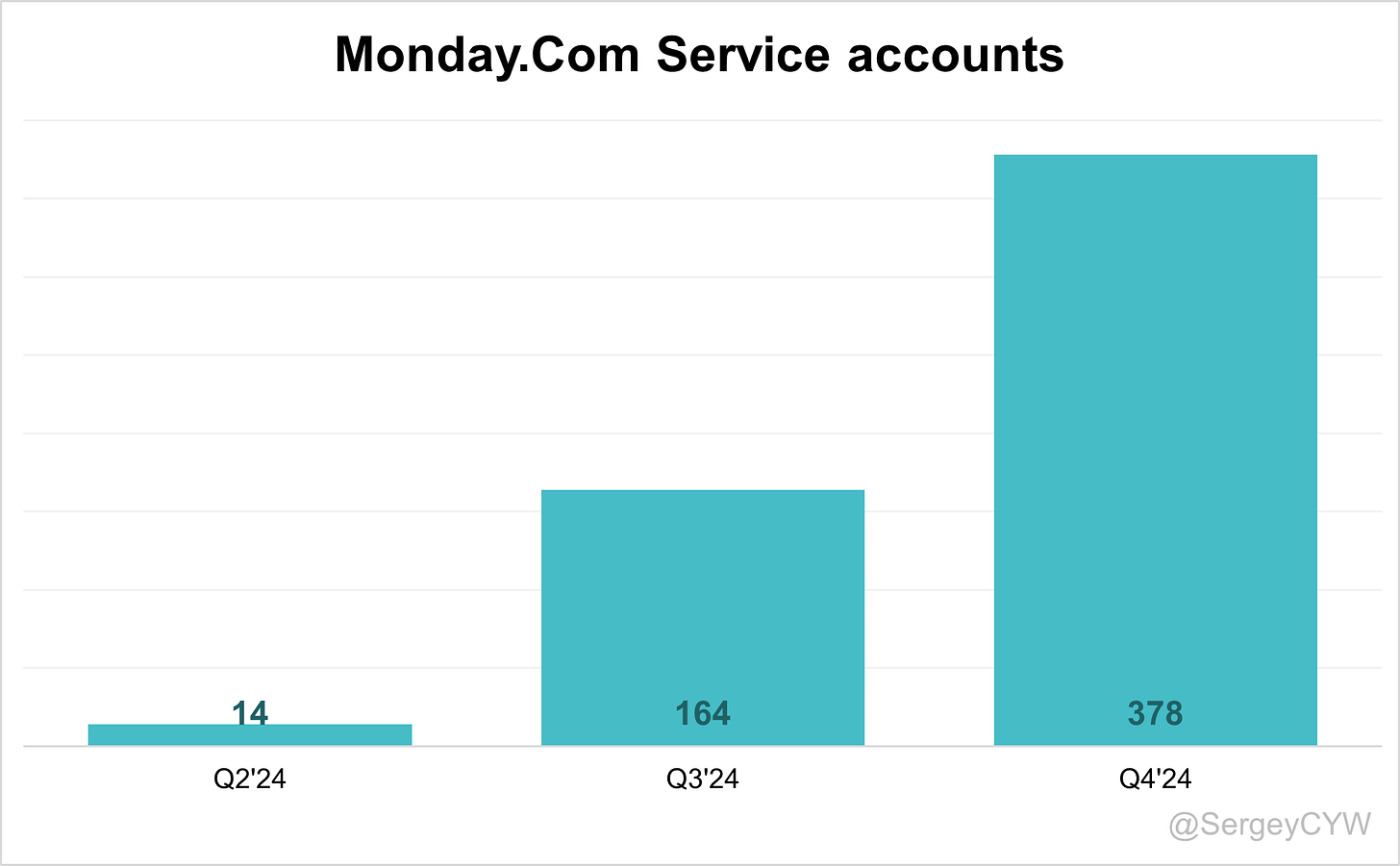

Monday Service launched in 2024 and is now available to all customers. It is an AI-first Enterprise Service Management tool. Demand has been immediate and strong. Despite being in early stages, it has the highest ACV across the product suite and the strongest cross-sell rate. Over 60% of new service deals were cross-sells from existing customers, mainly work management users. Product addresses IT, HR, finance, marketing, and ops requests—much broader than traditional ITSM. Strong synergy with Work Management unlocks workflows beyond ticketing. Still minimal revenue contribution in 2024, but growing rapidly and expected to scale in 2025.

MondayDB 2.0

MondayDB 2.0 completed its latest rollout in 2024. The platform now supports 80,000-seat deployments, enabling high-scale enterprise use cases. It was critical in driving enterprise expansion and allowed for greater product depth and performance. Enhanced speed, scalability, and architecture improvements helped unlock larger deals and more complex implementations. The infrastructure now supports advanced AI use and broader integration across all products.

AI and Innovation

AI is central to 2025 strategy, focused on AI Blocks, Product Power-Ups, and Digital Workforce. Over 70 million AI actions performed since launch. AI Blocks now run on a flexible, consumption-based pricing model, starting with 500 free credits. Additional usage is purchased as needed. AI will integrate deeply into every product—Work Management, CRM, Dev, and Service—enhancing automation, insights, and productivity.

Upcoming AI Agents include Monday Expert, Deal Facilitator, and Service Analyzer. These are designed to provide actionable intelligence and operational efficiency.

Market Leader

$MNDY Monday, has been recognized as a Leader in the 2024 Gartner Magic Quadrant for Adaptive Project Management and Reporting (APMR) for the third consecutive year.

Monday was evaluated based on its 'Ability to Execute' and 'Completeness of Vision,' where it was positioned furthest in both categories. The company continues to innovate, integrating AI into its platform and expanding its capabilities with new solutions like Portfolio management, mondayDB 2.0, and monday workflows, enhancing its offering for over 225,000 customers.

Customers

$MNDY Monday added 294 customers with ARR over $50K, up from the previous year, representing +39% YoY growth. The company also added 127 customers with ARR over $100K, matching last year’s level, with +45% YoY growth. New customer additions reached a record high, with customer growth outpacing revenue growth.

Customer Success Stories

monday’s platform continues to deliver measurable impact across its expanding enterprise base. Integration of AI blocks, enhanced scalability from MondayDB 2.0, and product extensions into Service and CRM have significantly boosted user engagement and adoption.

Customer engagement is strong. Net Dollar Retention (NDR) reached 112%, driven by upsells, cross-sells, and sustained user retention. Monday Service shows early product-market fit, with customers across IT, HR, Finance, Marketing, and Support adopting it at scale. Most early Service users are existing WorkOS customers, highlighting platform stickiness and meaningful cross-product penetration.

Cross-sell velocity has improved, particularly where Work Management acts as the core system. Monday Service is increasingly used as a trigger point for broader workflows, converting service tickets into full project executions. Over 70 million AI actions were executed on the platform, reflecting deep AI adoption and embedded automation.

Customer expansion is increasingly sales-led, especially at the enterprise level. The company leverages internal platform signals through its Big Brain system, alongside specialized overlay roles, to identify and convert high-potential opportunities. This structure supports both volume growth and deeper product adoption.

Large Customer Wins

In FY24, monday secured its largest enterprise deployment to date, scaling to 80,000 seats. This validates the platform's scalability and reflects the benefits of MondayDB 2.0 and targeted enterprise sales investments.

Multi-thousand seat deals are accelerating. The shift from PLG to SLG is enabling broader enterprise adoption. Large customers are increasingly implementing multiple modules—CRM, Dev, and Service—raising deal sizes and reinforcing the company’s upmarket momentum.

The number of quota-carrying reps reached 395 in Q4, up 26% year over year, deepening coverage in mid-market and enterprise segments. North America remains the strongest region for large deals, supported by competitive market share gains.

Retention

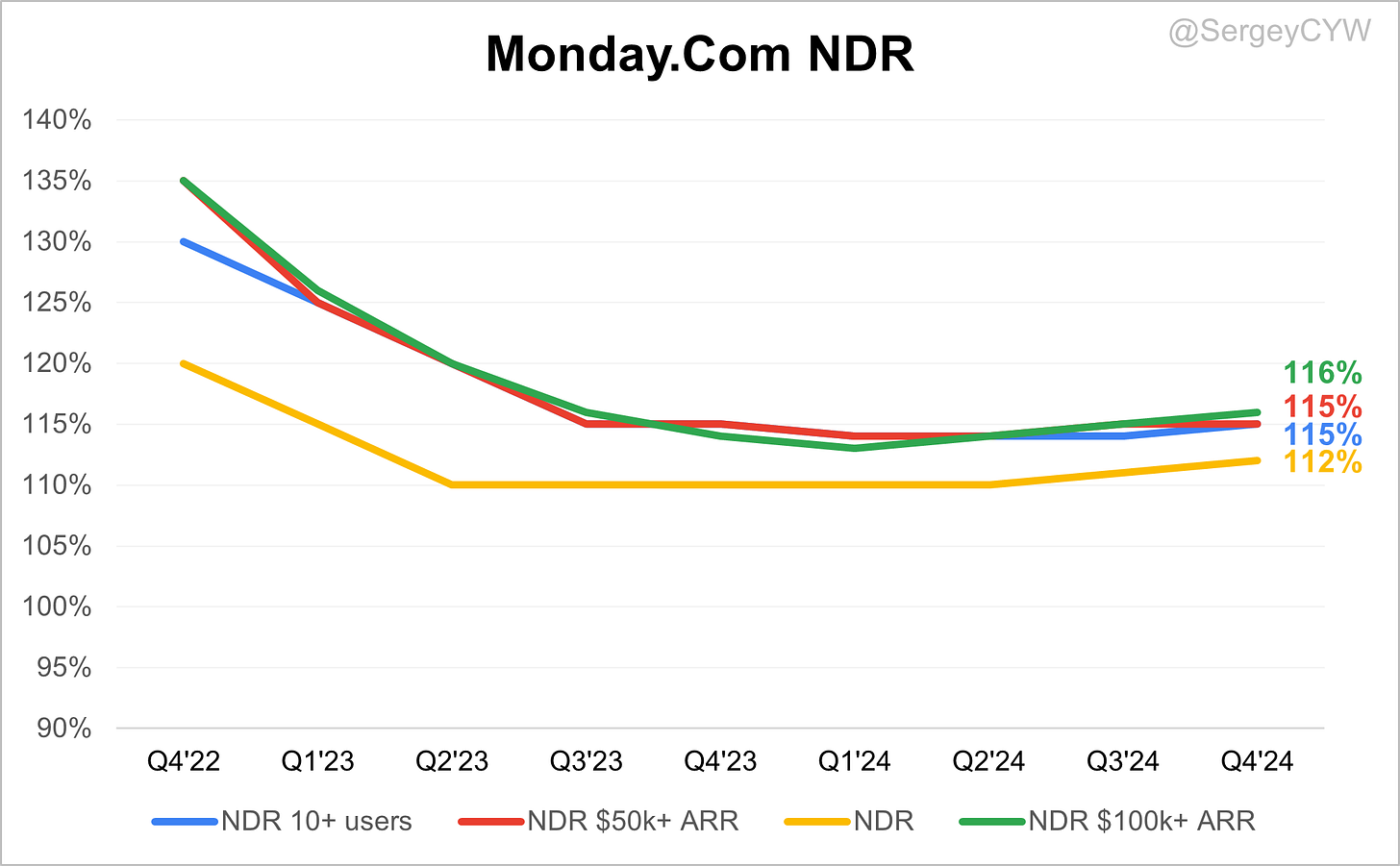

$MNDY Monday's Net Dollar Retention (NDR) is 112%. For customers with ARR over $50K and $100K, it stands at 115%. While retention remains high, it is slightly below the median of 117% for SaaS companies I track.

Net new ARR

$MNDY Monday added $68 million in net new ARR in Q4 2024, a 27% increase compared to the previous year. The addition of net new ARR is higher than the average over the past two years.

CAC Payback Period and RDI Score

$MNDY Monday's return on S&M spending is 25.8, with a CAC Payback Period above the median for SaaS companies but still at a healthy level. (The median for the SaaS companies I track is 20.8).

The R&D Index (RDI Score) for Q4 stands at 2.00, significantly above the median of 1.2 for the SaaS companies I monitor and higher than the industry median of 0.7.

An RDI Score above 1.4 is indicative of best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Key Metrics

In Q4 2024, $MNDY Monday added 3,021 new CRM accounts, representing +108% YoY growth. However, new additions were lower than in the previous three quarters. Net new customer growth slowed in Q4 due to seasonal marketing adjustments, but CRM’s revenue contribution is expected to grow in 2025.

In Q4 2024, $MNDY Monday added 283 new developer accounts, a slowdown compared to the previous three quarters. Management attributed the deceleration to seasonal factors and a strategic focus on larger clients. Despite the slowdown, the Dev product remains a long-term growth driver. Future enhancements will focus on AI integration, version control, and advanced collaboration tools to strengthen its developer offering.

In Q4 2024, $MNDY Monday added 214 new Service accounts. Monday Service, a new product launched in 2024, delivers AI-powered enterprise service management.

It has the highest ACV among all Monday products, and 60% of new Service customers were already using Monday Work Management, demonstrating strong cross-sell potential.

Profitability

Over the past year, $MNDY Monday margins have changed:

Gross Margin slightly decreased from 89.7% to 89.2%.

Operating Margin increased from 10.4% to 15.0%.

Free Cash Flow (FCF) Margin slightly decreased from 27.3% to 27.1%.

Operating expenses

$MNDY Monday's Non-GAAP operating expenses have gradually decreased due to a reduction in Sales & Marketing (S&M) spending, which declined from 54% two years ago to 48%.

R&D expenses have increased and remain high at 18%, reflecting the company's ongoing investment in future growth through product enhancements and updates.

General & Administrative (G&A) expenses have slightly decreased to 9% over the past two years.

Balance Sheet

$MNDY Balance Sheet: Total debt stands at $106M, while Monday holds $1,462M in cash and cash equivalents, far exceeding its debt and ensuring a healthy balance sheet with virtually no debt.

Dilution

$MNDY Shareholder Dilution: Monday's stock-based compensation (SBC) expenses decreased to 11% of revenue in the last quarter, which is relatively low compared to other high-growth SaaS companies.

Shareholder dilution remains under control, although the weighted-average number of basic common shares outstanding increased by 3.7% YoY, up from 2.4% in the previous year.

Conclusion

$MNDY Monday's revenue growth has stabilized at a high level of +32% YoY. The company has significantly improved its margins over the past two years while maintaining strong growth. Monday is strengthening its competitive position, as recognized by Gartner, further widening its lead over competitors.

Leading Indicators

Billings growth of +34.4% exceeded revenue growth.

Net new ARR increased +27% YoY in Q4.

Record number of total and large customers added.

Key Indicators

Net Dollar Retention (NDR) rose by 1 percentage point QoQ to 112%, and for large customers, NDR also increased by 1 pp QoQ to 116%.

CAC Payback Period improved to 25.8 months, slightly worse than the average.

RDI Score stood at 2.0, above the median compared to other SaaS companies I track.

Valuation based on multiples is in line with Monday’s historical Forward EV/Sales average, and appears undervalued relative to competitors considering its revenue growth forecast.

Monday CRM continues to perform well, while the new Monday Service product shows strong new account additions and promising potential. The company has also increased R&D spending, which I view as a positive signal for reinforcing its competitive edge.

The recent pricing increase was well-received, and strong customer growth suggests buyers are willing to pay higher prices.

Although the market Monday operates in is highly competitive, the company is successfully expanding into new areas, creating cross-sell opportunities. In January 2025, I slightly increased my position—$MNDY now represents 9.2% of my portfolio.

Great write-up Sergey. I’ve long believed MNDY is undervalued and has very compelling growth/optionality. Also, I believe AI can easily integrate into many aspects of the platform creating an easy upsell recurring revenue stream (like Microsoft CoPilot). What do you see as the biggest risks or the KPIs you are watching the closest?