Microsoft Q4 2024 Earnings Analysis

Dive into $MSFT Microsoft’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$69,632M rev (+12.3% YoY, +16.0% LQ) beat est by 1.3%

↗️GM (68.7%, +0.3 PPs YoY)

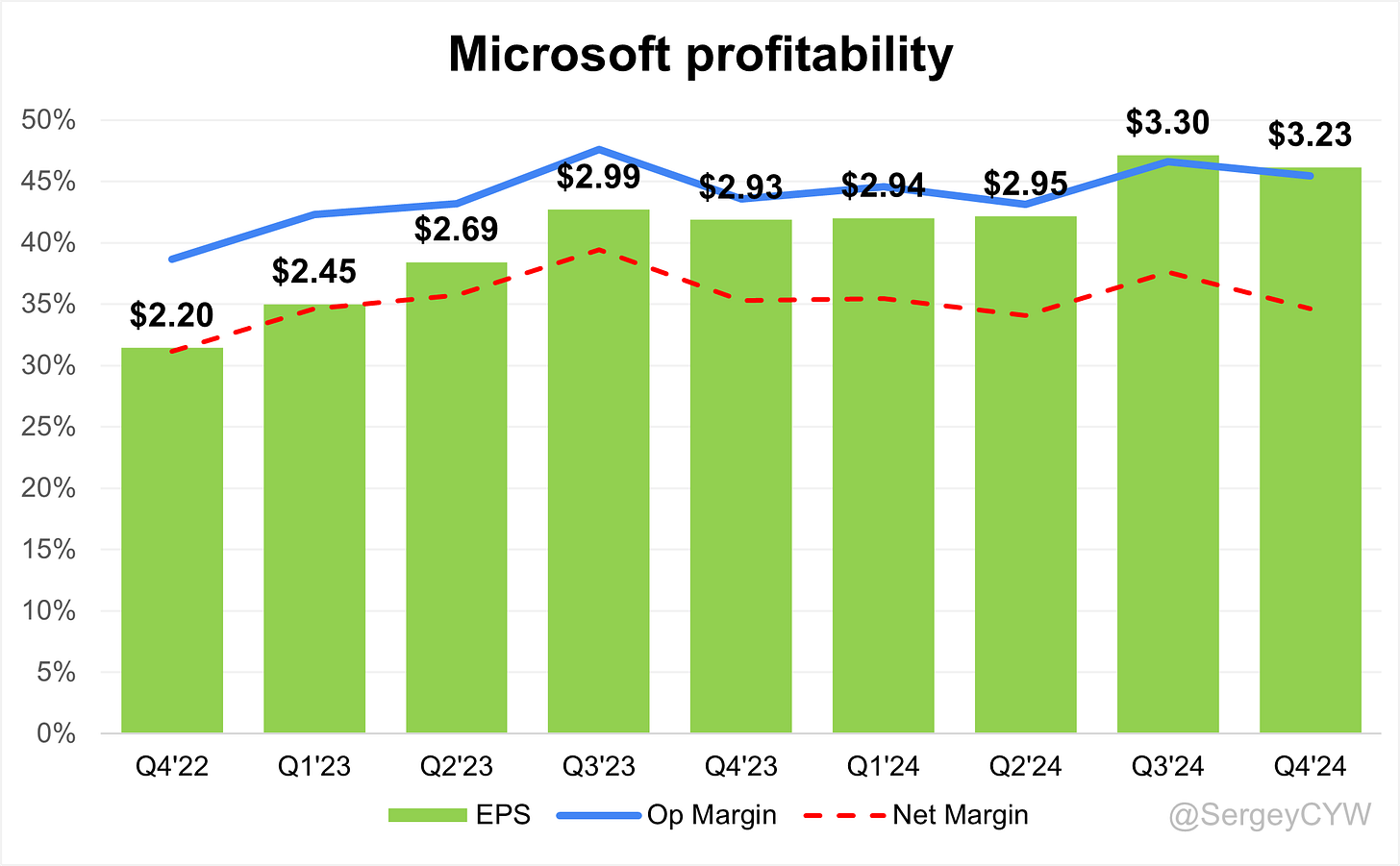

↗️Operating Margin (45.5%, +1.9 PPs YoY)

↘️Net Margin (34.6%, -0.6 PPs YoY)🟡

↗️EPS $3.23 beat est by 3.9%

Segment Revenue

↗️Productivity and Business Processes $29,437M rev (+13.9% YoY, 57.4% Op Margin)🟢

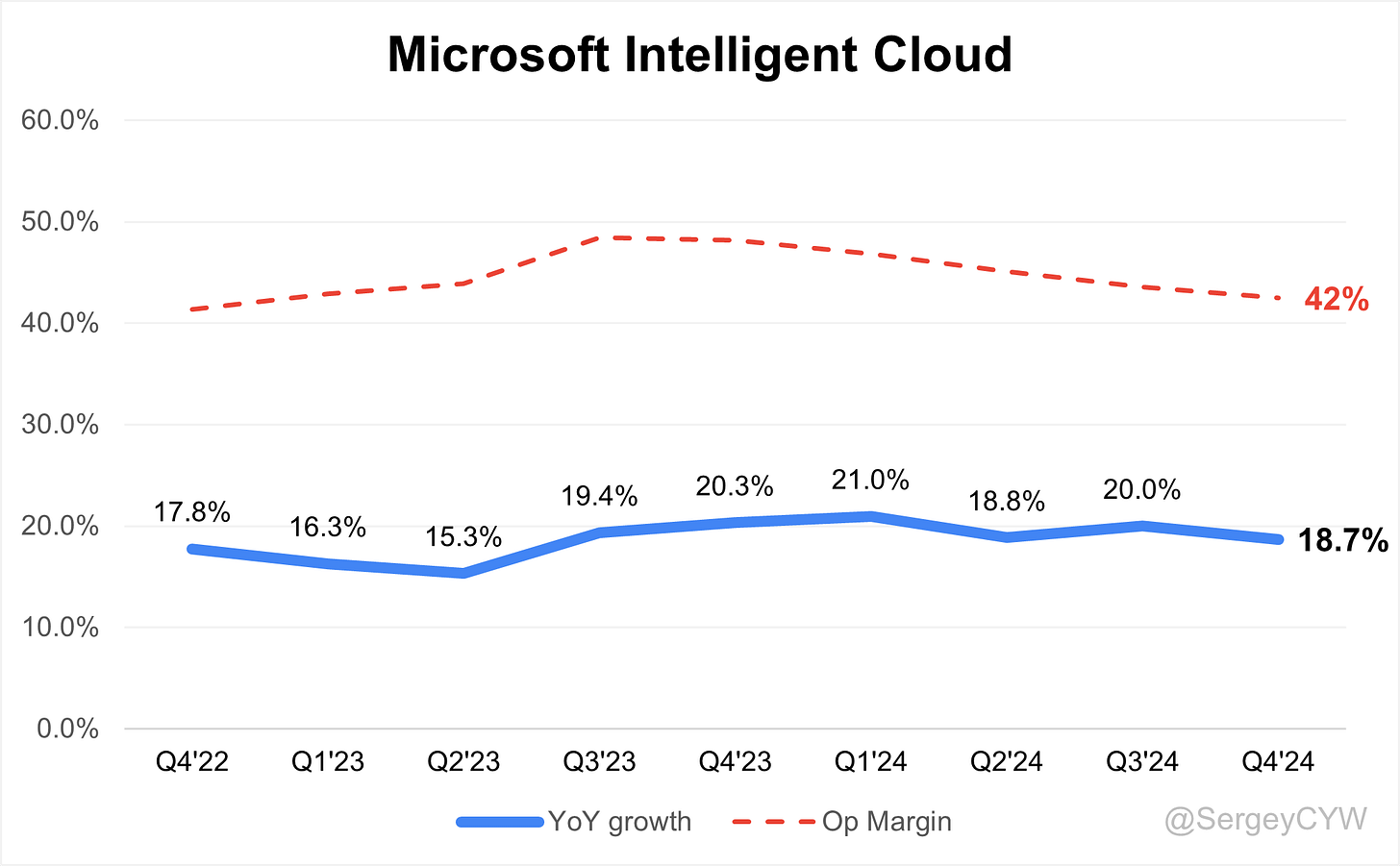

↗️Intelligent Cloud $25,544M rev (+18.7% YoY, 42.5% Op Margin)

➡️Personal Computing $14,651M rev (+0.1% YoY, 26.7% Op Margin)🟡

Product and Service Revenue (GAAP)

↗️Microsoft Cloud (+21% YoY)🟢

↗️Microsoft 365 Commercial products and cloud services (+15% YoY)🟢

↗️Microsoft 365 Commercial cloud (+16% YoY)🟢

➡️Microsoft 365 Consumer products and cloud services (+8% YoY)🟡

➡️Microsoft 365 Consumer cloud (+8% YoY)🟡

➡️LinkedIn (+9% YoY)🟡

↗️Dynamics products and cloud services (+15% YoY)🟢

↗️Dynamics 365 (+19% YoY)🟢

↗️Server products and cloud services (+21% YoY)🟢

↗️Azure and other cloud services (+31% YoY)🟢

➡️Windows OEM (+4% YoY)🟡

➡️Xbox content and services (+2% YoY)🟡

↗️Search and news advertising excluding traffic acquisition costs (+21% YoY)🟢

Operating expenses

↘️S&M/Revenue 9.2% (-0.8 PPs YoY)

↘️R&D/Revenue 11.4% (-0.1 PPs YoY)

↘️G&A/Revenue 2.6% (-0.6 PPs YoY)

Dilution

↗️SBC/rev 4%, +0.1 PPs QoQ

↘️Basic shares up 0.0% YoY, -0.0 PPs QoQ🟢

↘️Diluted shares down YoY, -0.1 PPs QoQ🟢

Key points from Microsoft’s Fourth Quarter 2024 Earnings Call:

Microsoft FY25 Q2 Financial Performance

Microsoft reported $69.6 billion in revenue, up 12% YoY, with operating income growing 17% and EPS reaching $3.23 (+10% YoY). Microsoft Cloud exceeded $40 billion in revenue, up 21% YoY.

Commercial bookings surged 75% YoY, driven by large-scale Azure commitments, particularly from OpenAI. Remaining Performance Obligation (RPO) hit $298 billion, up 34% YoY, with 40% expected to convert into revenue within 12 months.

Gross margin increased to 69%, while Microsoft Cloud's margin declined 2 points to 70%, reflecting AI infrastructure expansion. Free cash flow was $6.5 billion, down 29% YoY, due to higher capital expenditures. Shareholder returns reached $9.7 billion.

AI Innovations Driving Growth

Microsoft 365 Copilot adoption increased, with enterprises expanding seat purchases by 10x in 18 months. GitHub Copilot usage grew 50% in two years, reaching 150 million developers.

Microsoft Fabric became the fastest-growing analytics product, surpassing 19,000 paying customers. Power BI active users exceeded 30 million, growing 40% YoY.

Microsoft Purview now audits 2 billion Copilot interactions to ensure compliance and governance. AI-powered security tools help companies resolve incidents 30% faster.

Azure Expands AI Infrastructure

Azure revenue increased 31% YoY, with AI contributing 13 percentage points to growth. Azure AI services grew 157% YoY, exceeding expectations.

UBS migrated 2 petabytes of mainframe data to Azure. Microsoft doubled global data center capacity in three years, integrating custom Maya, Cobalt Boost, and HSM silicon, alongside AMD, Intel, and NVIDIA chips.

New hardware refreshes improve price-performance by 2x, while software optimizations deliver 10x efficiency per model generation.

SAP, Oracle, and VMware migrations continue, strengthening Azure’s position in enterprise cloud solutions.

Execution challenges in non-AI workloads impacted partner-driven and indirect sales. Microsoft adjusted sales strategies and incentives to balance AI expansion with traditional cloud growth.

GitHub Copilot Growth

GitHub Copilot adoption is accelerating, with 150 million developers using the platform, up 50% in two years.

Large enterprises, including Spotify, HP, HSBC, and KPMG, rely on GitHub Copilot to reduce development cycles, improve code quality, and accelerate digital transformation.

Azure OpenAI integration doubled the number of AI applications using GitHub services YoY, enhancing cross-platform adoption.

Microsoft 365 Copilot Expansion

Microsoft 365 Copilot is transforming workplace productivity, with enterprises rapidly expanding adoption.

Novartis reached 40,000 Copilot seats, while Barclays, Carrier, Pearson, and the University of Miami each purchased 10,000+ seats.

Daily active users doubled QoQ, and usage intensity rose 60%. Copilot Studio enabled 160,000 organizations to create 400,000+ AI agents in three months.

Power BI active users grew 40% YoY to 30 million. Microsoft Fabric adoption surpassed 19,000 paying customers, making it the company’s fastest-growing analytics product.

LinkedIn Growth and Challenges

LinkedIn revenue increased 9% YoY. Premium subscriptions surpassed $2 billion in annual revenue, growing 50% in two years.

40% of premium users engage with AI features. B2B advertising revenue remained strong, while Talent Solutions faced hiring market challenges.

LinkedIn user engagement increased. Comments rose 37% YoY, and short-form video content is expanding rapidly. AI-driven job matching and recruiter tools aim to improve hiring efficiency.

AI Cost Optimization

AI scaling laws and software advancements drive cost reductions and broader adoption. DeepSeq’s R1 model was downloaded 20 million times, showing strong demand for AI capabilities.

Optimized inference costs expand AI accessibility across consumer and enterprise markets. Investments in local AI computing bring enterprise-grade AI to Windows PCs.

Windows CoPilot Plus Adoption

Windows is emerging as an AI platform, with CoPilot Plus PCs accounting for 15% of premium laptop sales in the U.S..

AI-powered applications, including Adobe, CapCut, and WhatsApp, leverage Windows' built-in NPUs (Neural Processing Units) for local AI workloads.

DeepSeq’s R1 models will be integrated into Windows devices, further enhancing AI capabilities.

Gaming Performance

Xbox revenue declined 7% YoY, with hardware sales weakness. Content & Services revenue grew 2% YoY, led by Call of Duty: Black Ops 6 and Game Pass expansion.

Call of Duty: Black Ops 6 became the best-selling title across Xbox and PlayStation. Indiana Jones and the Great Circle reached 4 million players.

Cloud gaming hit 140 million hours streamed, a new all-time high. PC Game Pass subscribers grew 30% YoY.

Security and Compliance

Microsoft rolled out 80+ new security features. Microsoft Security Copilot is used by Intesa, NTT, and Eastman, helping companies resolve cybersecurity incidents 30% faster.

Microsoft Purview audits 2 billion AI interactions, ensuring data compliance and risk management.

OpenAI Partnership

OpenAI made a new long-term commitment to Azure. Microsoft remains its exclusive cloud provider, ensuring continued AI revenue growth.

Microsoft is balancing AI training and inference workloads, optimizing costs through Moore’s Law and software-driven advancements.

Capital Expenditures

CapEx reached $22.6 billion, with more than half allocated to long-lived AI infrastructure supporting growth for 15+ years.

Significant investments in CPUs, GPUs, and networking ensure capacity expansion, with $298 billion in RPO backlog.

CapEx levels will remain elevated in Q3 and Q4, but Microsoft expects spending to shift toward revenue-correlated short-term assets in FY26.

Challenges and Future Outlook

Execution challenges persist in non-AI Azure workloads, impacting partner-driven sales. The company is refining its go-to-market strategy to balance AI expansion with core cloud services.

AI infrastructure capacity constraints continue but are expected to ease by year-end. Azure growth is projected at 31-32% YoY in Q3, driven by AI adoption.

AI efficiency, cost reduction, and enterprise adoption will sustain long-term leadership in cloud computing and AI-driven transformation.

Management comments on the earnings call.

Azure: AI Scaling and Cloud Expansion

Satya Nadella, Chairman and Chief Executive Officer

"This quarter, we saw continued strength in Microsoft Cloud, which surpassed $40 billion in revenue for the first time, up 21% year over year. Enterprises are beginning to move from proof of concepts to enterprise-wide deployments to unlock the full ROI of AI."

"We continue to expand our data center capacity in line with both near-term and long-term demand signals. We have more than doubled our overall data center capacity in the last three years and have added more capacity last year than any other year in our history."

"Our AI business has now surpassed an annual revenue run rate of $13 billion, up 175% year over year."

Amy Hood, Chief Financial Officer

"Our AI results were better than we thought due to very good work by the operating teams pulling in some delivery dates even by weeks. When you're capacity constrained, weeks matter, and it was good execution by the team."

GitHub: AI-Driven Software Development

Satya Nadella, Chairman and Chief Executive Officer

"GitHub Copilot is increasingly the tool of choice for both digital natives like ASOS and Spotify, as well as the world's largest enterprises like HP, HSBC, and KPMG."

"We've been delighted by the early response to GitHub Copilot, and versus code, with more than 150 million developers, up 50% over the past two years."

Microsoft 365: AI-Powered Workplace Transformation

Satya Nadella, Chairman and Chief Executive Officer

"Microsoft 365 Copilot is the UI for AI. It helps supercharge employee productivity and provides access to a swarm of intelligent agents to streamline employee workflow."

"We are seeing accelerated customer adoption across all deal sizes as we win new Microsoft 365 Copilot customers and see the majority of existing enterprise customers come back to purchase more seats. Customers who purchased Copilot during the Q1 of availability have expanded their seats collectively by more than 10x over the past 18 months."

"To share just one example, Novartis has added thousands of seats each quarter over the year and now has 40,000 seats. Barclays, Carrier Group, Pearson, and the University of Miami all purchased 10,000 or more seats this quarter."

LinkedIn: Engagement and Subscription Growth

Satya Nadella, Chairman and Chief Executive Officer

"More professionals than ever are engaging in high-value conversations on LinkedIn, with comments up 37% year over year. Short-form video continues to grow on the platform, with video creation growing at twice the rate of other post formats."

"In subscriptions, LinkedIn Premium surpassed $2 billion in annual revenue for the first time this quarter. Subscriber growth has increased nearly 50% over the past two years, and nearly 40% of subscribers have used our AI features to improve their profiles."

AI Capabilities: Driving Efficiency and Adoption

Satya Nadella, Chairman and Chief Executive Officer

"As AI becomes more efficient and accessible, we will see exponentially more demand. Much as we have done with the commercial cloud, we are focused on continuously scaling our fleet globally and maintaining the right balance across training and inference, as well as geo distribution."

"With AI, how we build, deploy, and maintain code is fundamentally changing."

"Our 5 family of small language models has now been downloaded over 20 million times. And we also have more than 30 models from partners like Bayer, Page AI, Rockwell Automation, and Siemens to address industry-specific use cases."

Strategic Partnerships: Expansion and New Deals

Satya Nadella, Chairman and Chief Executive Officer

"We are thrilled OpenAI has made a new large Azure commitment. Through our strategic partnership, we continue to benefit mutually from each other's growth. And with OpenAI's APIs exclusively running on Azure, customers can count on us to get access to the world's leading models."

OpenAI: Strengthening AI Leadership

Satya Nadella, Chairman and Chief Executive Officer

"We remain very happy with the partnership with OpenAI. And as you saw, they have committed in a big way to Azure and even in the bookings what we recognize is just the first tranche of it."

"The big beneficiaries of any software cycle like this are the customers. Because at the end of the day, when token prices fall and inference computing prices fall, that means people can consume more, and there will be more apps written."

CAPEX: AI Infrastructure Investments

Amy Hood, Chief Financial Officer

"We expect quarterly spend in Q3 and Q4 to remain at similar levels as our Q2 spend. In FY26, we expect to continue investing against strong demand signals, including customer-contracted backlog we need to deliver against across the entirety of our Microsoft Cloud."

"More than half of our cloud and AI-related spend was on long-lived assets that will support monetization over the next 15 years and beyond."

Challenges: Execution in Non-AI Workloads

Amy Hood, Chief Financial Officer

"The challenges were in what we call the scale motions. These are customers we reach through partners and more indirect methods of selling. We are going to make some adjustments to make sure we are in balance because when you make those changes, by the time it works its way through the system, you can see the impacts."

"I feel good that the teams understand and are working through that. So while we will see some impact through H2, just because when you work through the scale motion, it can take some time for that to adjust, the only thing that's changed is really that scale motion."

Future Outlook: AI Monetization and Long-Term Growth

Satya Nadella, Chairman and Chief Executive Officer

"What we are seeing is Copilot plus agents disrupting business applications, and we are leaning into this."

"You would rather win the new than just protect the past. And that's another thing that we definitely will lean into always."

"We continue to innovate across our tech stack to help our customers in this AI era, and I'm energized by the many opportunities ahead."

Amy Hood, Chief Financial Officer

"For the full fiscal year, we continue to expect double-digit revenue and operating income growth as we focus on delivering efficiencies across both COGS and operating expense."

"We now expect FY25 operating margins to be up slightly year over year. And given the operating leverage that we've delivered throughout the year, inclusive of efficiency gains as we scale our AI infrastructure and utilize our own AI solutions, we remain well-positioned for long-term growth."

Thoughts on Microsoft Earnings Report $MSFT:

🟢 Positive

Revenue reached $69.6 billion, up 12% YoY, with operating income rising 17% and EPS hitting $3.23 (+10% YoY).

Microsoft Cloud surpassed $40 billion in revenue, growing 21% YoY.

Commercial bookings surged 75% YoY, driven by large-scale Azure commitments, particularly from OpenAI.

Azure revenue rose 31% YoY, with AI services growing 157% YoY, contributing 13 percentage points to Azure’s growth.

Microsoft 365 Copilot seat expansion increased 10x in 18 months, with Novartis reaching 40,000 seats and Barclays, Carrier, Pearson, and University of Miami each adding 10,000+ seats.

GitHub Copilot usage grew 50% in two years, now serving 150 million developers.

LinkedIn Premium subscriptions hit $2 billion in annual revenue, with subscriber growth up 50% in two years.

AI adoption in security improved efficiency, with Microsoft Purview auditing 2 billion Copilot interactions and companies resolving incidents 30% faster.

Xbox Game Pass PC subscribers grew 30% YoY, with Cloud gaming hitting 140 million hours streamed, an all-time high.

🟡 Neutral

Gross margin increased to 69%, but Microsoft Cloud's margin declined 2 points to 70% due to AI infrastructure expansion.

LinkedIn engagement grew, with comments up 37% YoY and video content adoption rising, but hiring solutions remained weak.

Windows CoPilot Plus PCs accounted for 15% of premium laptop sales in the U.S., with growing AI-powered app integrations, but wider adoption remains in early stages.

Capital expenditures (CapEx) reached $22.6 billion, with over half allocated to long-term AI infrastructure, but spending is expected to shift toward revenue-correlated assets in FY26.

🔴 Negative

Free cash flow fell 29% YoY to $6.5 billion, impacted by high CapEx.

Microsoft Cloud margin declined 2 points to 70%, reflecting cost pressures from AI infrastructure investments.

Non-AI Azure workloads faced execution challenges, affecting partner-driven and indirect sales.

Xbox hardware revenue declined 7% YoY, despite growth in content and services.

AI infrastructure capacity constraints persist, limiting short-term revenue potential, but are expected to ease by year-end.