Microsoft Q3 2024 Earnings Analysis

Dive into $MSFT Microsoft’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$65,585M rev (+16.0% YoY, +15.2% LQ) beat est by 1.7%

↘️GM (69.4%, -1.8 PPs YoY)🟡

↘️Operating Margin (46.6%, -1.0 PPs YoY)🟡

↘️Net Margin (37.6%, -1.8 PPs YoY)🟡

↗️EPS $3.30 beat est by 6.8%🟢

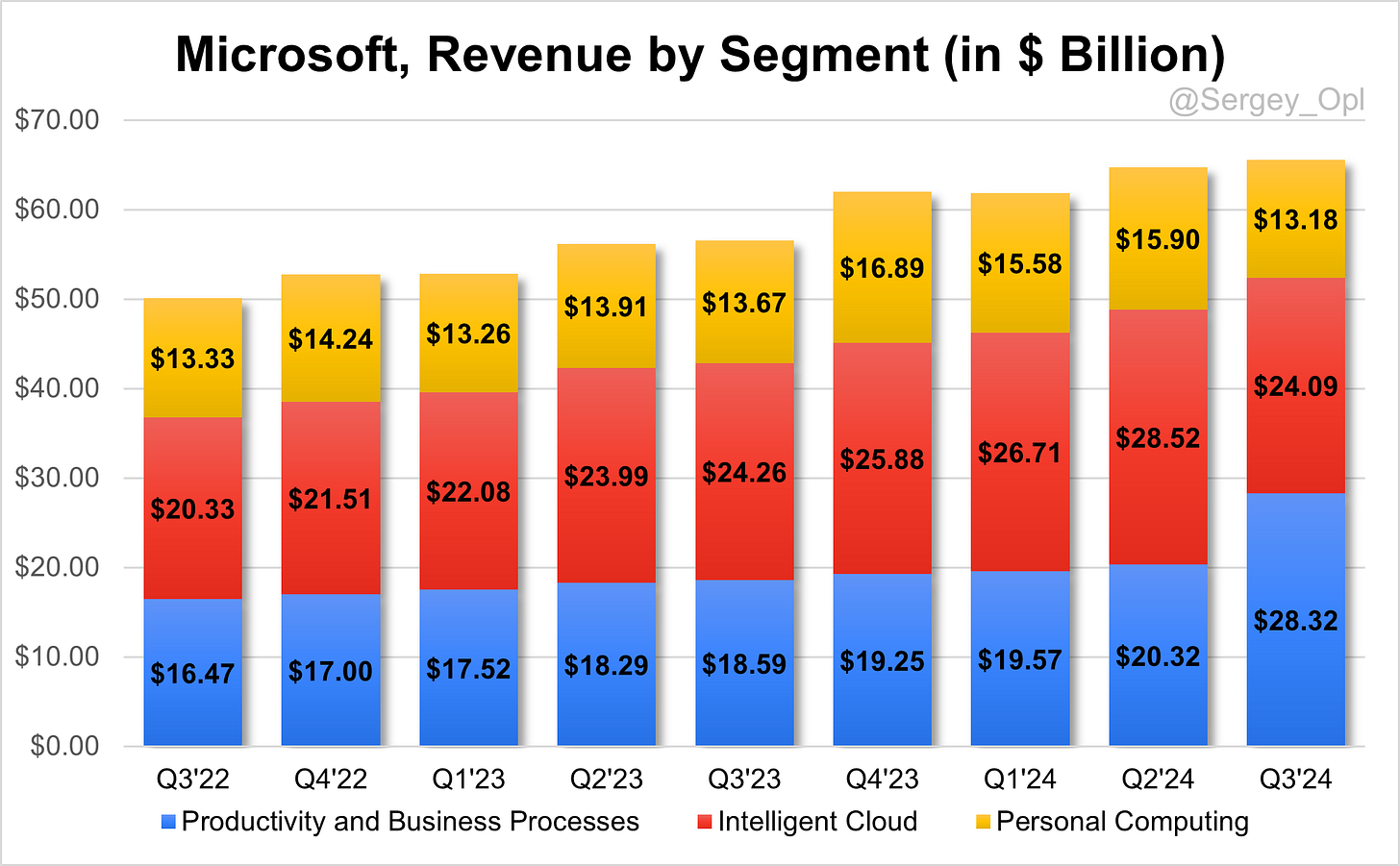

Segment Revenue

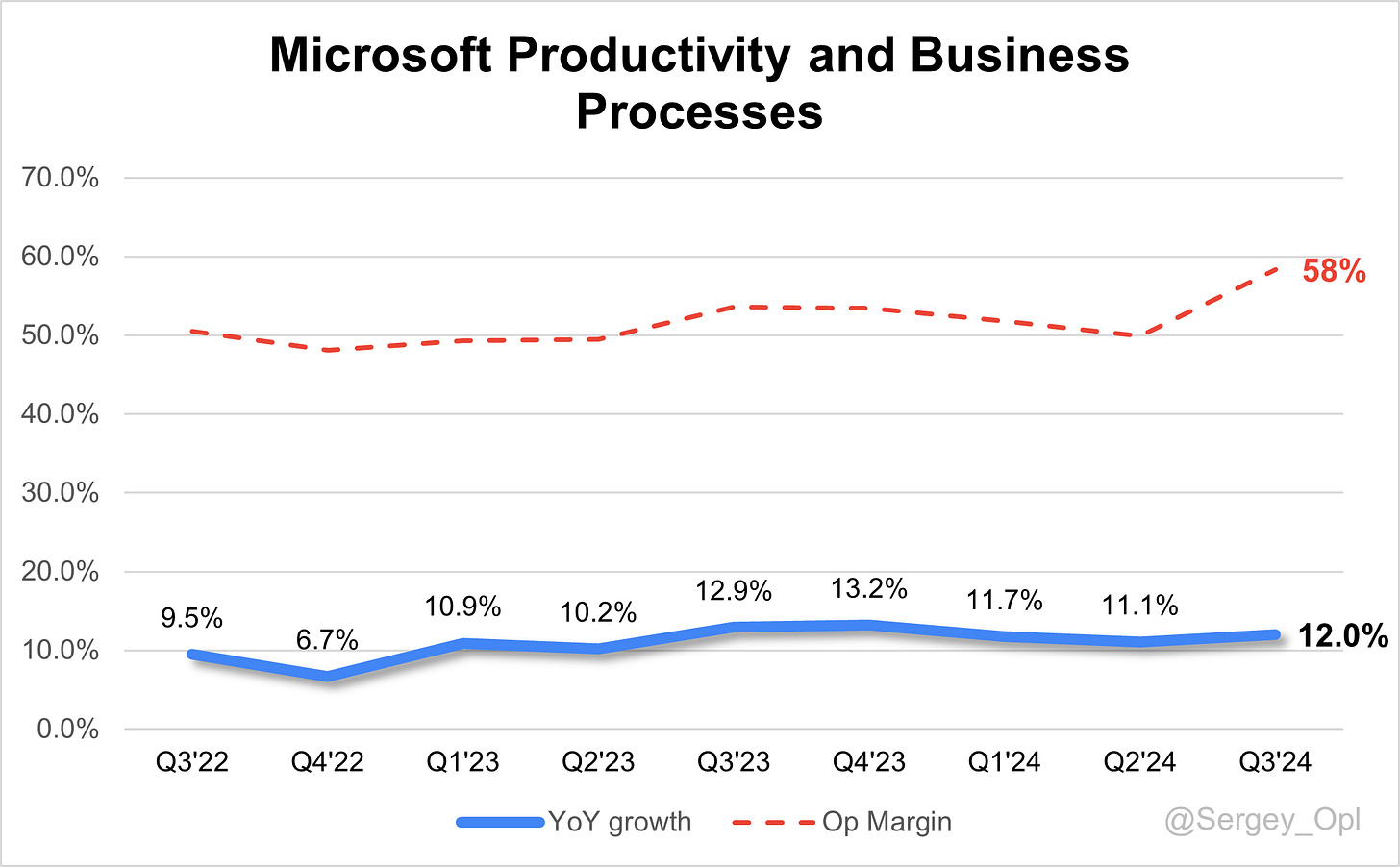

↗️Productivity and Business Processes $28,317M rev (+12.0% YoY, 58.3% Op Margin)🟡

↗️Intelligent Cloud $24,092M rev (+20.0% YoY, 43.6% Op Margin)🟢

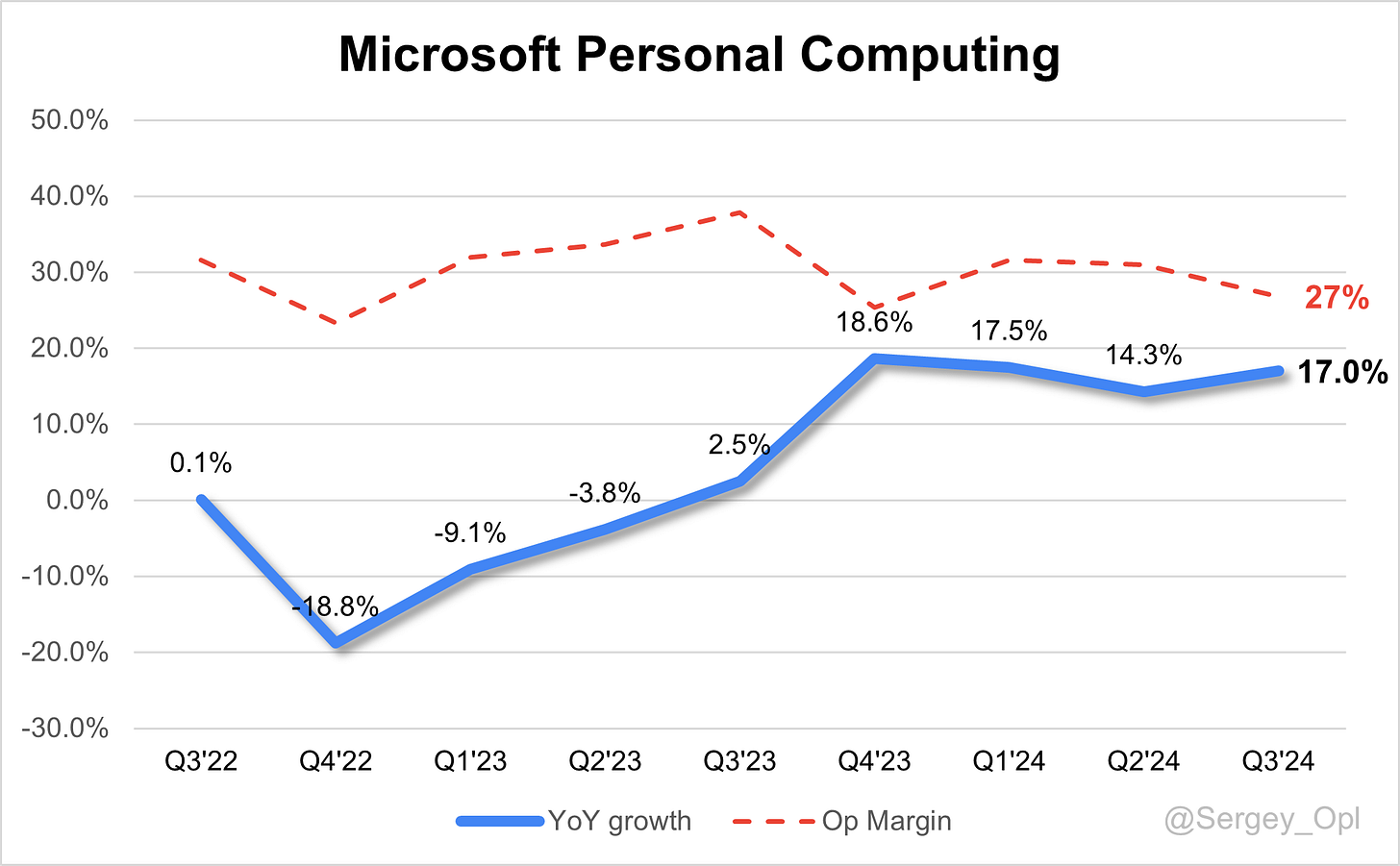

↗️Personal Computing $13,176M rev (+17.0% YoY, 26.8% Op Margin)🟢

Product and Service Revenue (GAAP)

↗️Microsoft Cloud (+22% YoY)

➡️Microsoft 365 Commercial products and cloud services (+13% YoY)

➡️Microsoft 365 Commercial cloud (+15% YoY)

➡️Microsoft 365 Consumer products and cloud services (+5% YoY)

➡️Microsoft 365 Consumer cloud (+6% YoY)

➡️LinkedIn (+10% YoY)

➡️Dynamics products and cloud services (+14% YoY)

↗️Dynamics 365 (+18% YoY)

↗️Server products and cloud services (+23% YoY)

↗️Azure and other cloud services (+33% YoY)

➡️Windows OEM (+2% YoY)

↗️Xbox content and services (+61% YoY)

↗️Search and news advertising excluding traffic acquisition costs (+18% YoY)

Operating expenses

↘️S&M/Revenue 8.7% (-0.5 PPs YoY)

↘️R&D/Revenue 11.5% (-0.3 PPs YoY)

↘️G&A/Revenue 2.6% (-0.1 PPs YoY)

Dilution

↗️SBC/rev 4%, +0.2 PPs QoQ

↗️Basic shares up 0.1% YoY, +0.1 PPs QoQ🟢

↗️Diluted shares up 0.1% YoY, +0.1 PPs QoQ🟢

Key points from Microsoft’s Third Quarter 2024 Earnings Call:

Financial Results

Microsoft reported a strong start to fiscal year 2025, with Q1 revenue reaching $65.6 billion, up 16% YoY, and EPS increasing 10% to $3.30. The Microsoft Cloud segment contributed $38.9 billion, marking a 22% YoY growth. Although gross margin slightly declined to 71% due to scaling AI infrastructure, disciplined cost management helped maintain operating margins.

Microsoft 365 CoPilot Advancements and Dynamics 365 AI Integration

Microsoft 365 CoPilot is transforming productivity with AI-powered tools that drive significant time savings across enterprises. The introduction of Pages, a collaborative AI workspace, has boosted CoPilot’s adoption, with improvements in response time and quality. Key customers like Vodafone and UBS illustrate the high demand for these AI solutions. Additionally, Dynamics 365 integrates CoPilot capabilities across CRM and ERP, enhancing customer engagement and operational efficiency for clients like Evron and Heineken through new autonomous agents.

GitHub Copilot Enhancements for Developers

GitHub Copilot’s adoption grew 55% quarter-over-quarter, fueled by innovations like Copilot Workspace and Copilot Autofix. These tools streamline development workflows from specification to code and accelerate vulnerability fixes by leveraging AI. GitHub Copilot now offers a broader model catalog, making it an essential productivity tool for developers, particularly for enterprise clients like AMD.

Azure AI Platform and Global Expansion

Azure continues to drive Microsoft’s growth, reporting 34% YoY growth in constant currency, fueled by demand in AI and cloud migration services. The Azure AI platform supports custom CoPilots and agents, with usage doubling over the past six months. New industry-specific models, such as those for medical imaging, serve specialized needs for clients like GE Aerospace. Azure has expanded its data center footprint, adding regions in Brazil, Italy, Mexico, and Sweden, with capacity constraints expected to ease by H2.

Power Platform AI Capabilities

Power Platform has expanded its AI capabilities to support low-code/no-code development, enabling “citizen developers” to create applications using natural language. These advancements have driven a fourfold YoY growth, with over 600,000 organizations utilizing these tools. Enhancements in Power Automate further simplify complex workflows, appealing to both corporate and non-technical users and making automation more accessible across industries.

Windows CoPilot Plus PCs

The new CoPilot Plus PCs offer enhanced AI capabilities integrated with the Windows desktop, providing features like "Click to Do," which offers actionable insights. Microsoft anticipates that these hybrid AI-enabled devices will transform user experiences at both home and work, supporting its goal to seamlessly embed AI into daily tasks.

Gaming Growth and Strategic Expansion

Microsoft’s gaming revenue increased by 43% YoY, driven by the Activision Blizzard acquisition and the successful launch of Black Ops VI. The segment’s growth reflects a strategic focus on recurring revenue streams, with rising Game Pass subscriptions and expanded content access across platforms. This robust growth positions gaming as a significant contributor to Microsoft’s revenue diversification.

Security Initiatives

Microsoft remains committed to security, allocating resources equivalent to 34,000 full-time engineers to its Secure Future initiative. Security Copilot and Defender tools are rapidly adopted, with Defender securing over 750,000 generative AI app instances in Q1. Microsoft’s integrated security offerings within Azure and AI products reinforce its leadership in the cybersecurity space.

Strategic Partnerships and OpenAI Collaboration

Strategic partnerships with companies like NVIDIA and AMD bolster Microsoft’s AI infrastructure, supporting Azure’s global reach and enhancing AI performance with advanced GPUs. Microsoft’s investment in OpenAI has proven essential, driving innovation across GitHub Copilot, Dynamics 365, and Microsoft 365 CoPilot. This collaboration enables Microsoft to leverage leading-edge AI models while supporting OpenAI’s growth, creating long-term financial value.

LinkedIn and Consumer Engagement

LinkedIn’s growth remains strong, with double-digit engagement increases and expansion in markets like India and Brazil. AI-powered tools in LinkedIn drive value across sales, learning, and recruitment, highlighted by LinkedIn’s first agent hiring assistant and new personalized coaching. Consumer engagement also spans Bing, Edge, and Windows, with CoPilot experiences enhancing search and advertising revenue. The introduction of CoPilot Plus PCs further elevates the Windows platform, reinforcing Microsoft’s focus on delivering value to consumers across multiple channels.

CAPEX and AI Investments

Capital expenditures reached $20 billion, with investments directed toward long-lived assets to support Microsoft’s expanding cloud and AI infrastructure. CAPEX is expected to increase further, particularly for AI infrastructure, as demand rises. Microsoft’s AI business, set to reach a $10 billion revenue run rate next quarter, is on track to become the company’s fastest-growing segment, underscoring the high return on AI investments.

Challenges

Microsoft encountered supply chain challenges affecting Azure’s growth, including delays from third-party providers. These constraints impacted near-term performance, but Microsoft anticipates improvements in H2 with increased capacity. Environmental and power limitations are ongoing considerations as the company scales its global data center network.

Future Outlook

Looking forward, Microsoft expects continued growth across cloud, AI, and productivity solutions. Azure’s growth is projected to stabilize in Q2 with a slight deceleration due to supply constraints, followed by reacceleration in H2 as capacity expands. Enhanced Microsoft 365 and CoPilot offerings are anticipated to drive further adoption among enterprise and consumer segments. AI remains a core driver of Microsoft’s strategy, positioning the company as a leader in AI-driven business transformation.

Management comments on the earnings call.

Product Innovations

Satya Nadella, Chairman and Chief Executive Officer

"Microsoft 365 CoPilot is revolutionizing workplace productivity by integrating advanced AI that not only saves time but significantly enhances operational efficiency. Across industries, businesses are embracing tools like Pages, which foster collaboration and creativity through AI, driving increased adoption and tangible results for organizations."

Azure Expansion

Amy Hood, Chief Financial Officer

"Azure’s growth reflects the continued demand for our cloud and AI services, as we expand globally to support customers in regions like Brazil, Italy, Mexico, and Sweden. While there are near-term supply constraints, our investments are focused on long-term capacity to meet the robust demand for AI and cloud migration."

GitHub for Developer Productivity

Satya Nadella, Chairman and Chief Executive Officer

"GitHub Copilot is transforming the development experience by enabling programmers to move seamlessly from specification to code using natural language. With innovations like Copilot Autofix, developers are now able to resolve vulnerabilities at unprecedented speed, reinforcing GitHub as a core tool in enterprise productivity."

Microsoft 365 Advances

Amy Hood, Chief Financial Officer

"The momentum we’re seeing in Microsoft 365, particularly with the widespread adoption of CoPilot, demonstrates strong demand across enterprise clients. By adding new AI-driven functionalities, we are setting a new standard for productivity, making tools like CoPilot and E5 essential for modern businesses."

Gaming Growth and Expansion

Satya Nadella, Chairman and Chief Executive Officer

"Our gaming segment’s growth, fueled by the Activision Blizzard integration and strong content, is shaping gaming as a critical contributor to our revenue mix. The record-breaking success of Black Ops VI and rising Game Pass subscriptions underscore our commitment to bringing accessible content across platforms."

OpenAI Partnership

Amy Hood, Chief Financial Officer

"Our strategic partnership with OpenAI has been transformative, allowing us to build on foundational AI capabilities while fueling rapid growth in our own AI-driven products. This collaboration is essential not just for technological innovation but also as a key long-term financial asset within our ecosystem."

CAPEX and AI Investments

Amy Hood, Chief Financial Officer

"We’re committed to strategically growing our AI and cloud infrastructure to meet accelerating demand. With half of our $20 billion capital investment directed towards long-term assets, we are building a foundation that supports our vision for AI-driven growth while delivering high returns."

Challenges

Satya Nadella, Chairman and Chief Executive Officer

"As demand for Azure’s AI capabilities surges, we face certain external supply constraints. However, we’re strategically working towards aligning supply and demand, confident that increased capacity in the coming quarters will enable us to fully meet our customers’ needs."

Future Outlook

Satya Nadella, Chairman and Chief Executive Officer

"Our outlook remains robust as we continue to lead in cloud, AI, and productivity. With a clear strategy to support enterprise and consumer markets, we anticipate a positive trajectory, particularly in AI and CoPilot technologies, positioning us to drive the next wave of digital transformation for our clients."