Meta Q4 2024 Earnings Analysis

Dive into $META Meta’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$48,385M rev (+20.6% YoY, +18.9% LQ) beat est by 3.0%

↗️GM (81.7%, +0.9 PPs YoY)

↗️Operating Margin (48.3%, +7.4 PPs YoY)🟢

↘️FCF Margin (28.0%, -0.7 PPs YoY)🟡

↗️Net Margin (43.1%, +8.1 PPs YoY)🟢

↗️EPS $7.98 beat est by 18.2%🟢

Segment Revenue

↗️Family of Apps $47,302M rev (+21.2% YoY, 59.9% Operating Margin)🟢

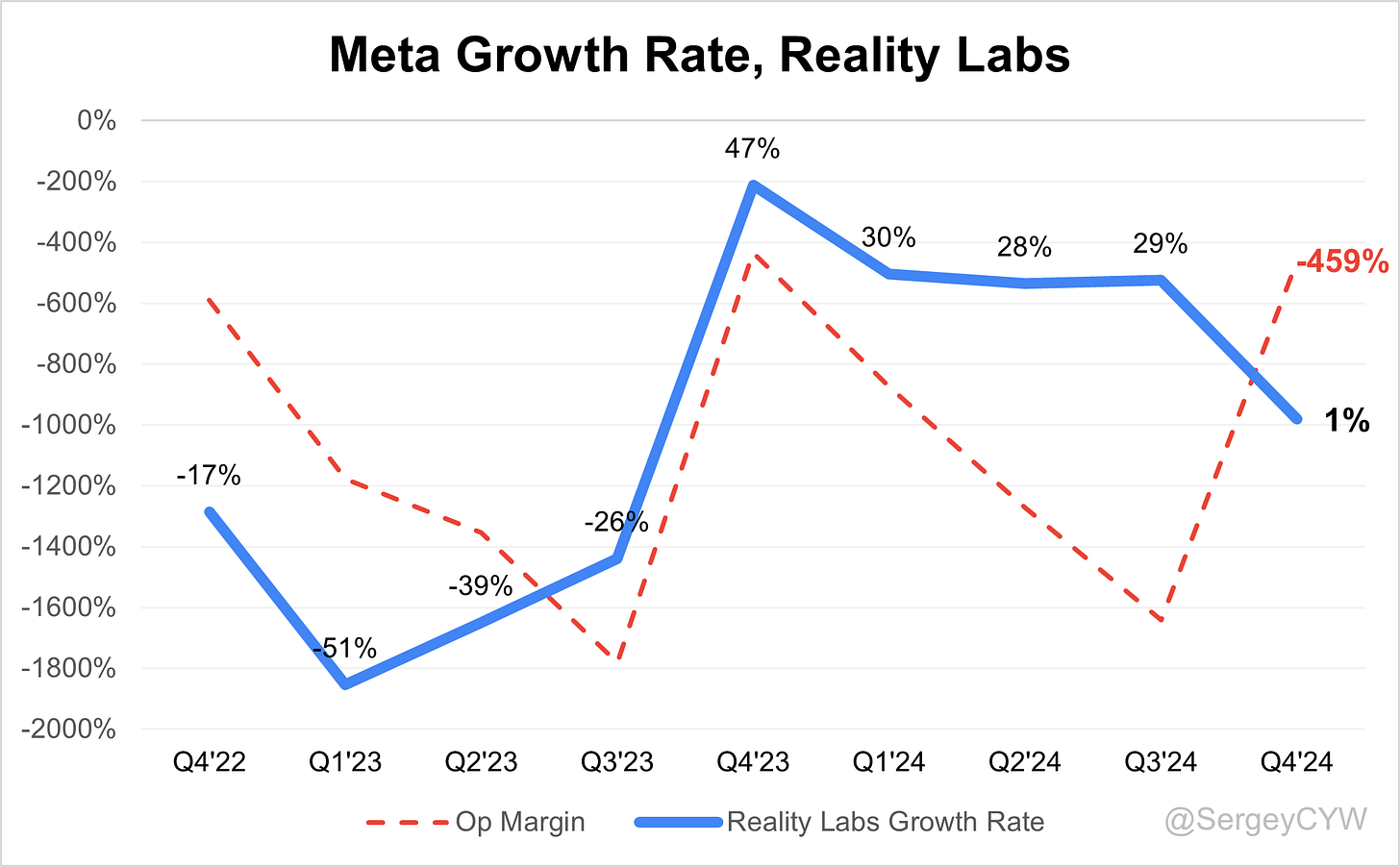

➡️Reality Labs $1,083M rev (+1.1% YoY, -458.6% Operating Margin)🟡

↗️Advertising $46,783M rev (+20.9% YoY)🟢

↗️Other revenue $519M rev (+55.4% YoY)🟢

KPI

➡️Family daily active people (DAP) $3.4B on average (+1.8% YoY)

➡️Family Average Revenue per Person (ARPP) $12.3B ( YoY)

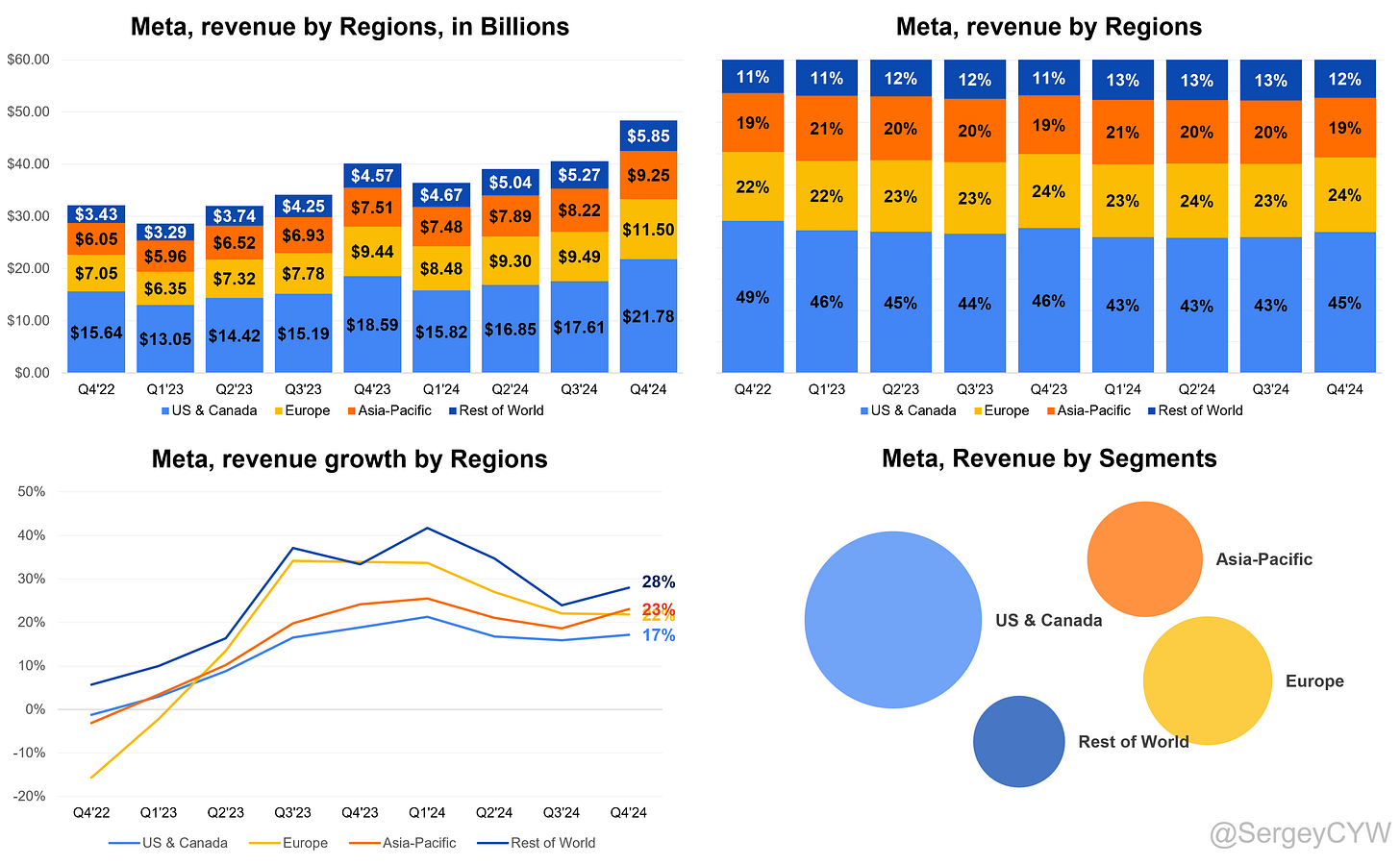

Revenue by Geography

➡️US & Canada $21,783M (+17.2% YoY, 45.0% of Rev)

↗️Europe $11,503M (+21.8% YoY, 23.8% of Rev)

↗️Asia-Pacific $9,245M (+23.1% YoY, 19.1% of Rev)

↗️Rest of World $5,854M (+28.0% YoY, 12.1% of Rev)

Operating expenses

↘️S&M/Revenue 6.7% (-1.3 PPs YoY)

↘️R&D/Revenue 25.2% (-1.0 PPs YoY)

↘️G&A/Revenue 1.6% (-4.1 PPs YoY)

Headcount

↗️74,067 Total Headcount (+10.0% YoY, +1663 added)

Dilution

↘️SBC/rev 9%, -1.7 PPs QoQ

↗️Basic shares down -1.5% YoY, +0.3 PPs QoQ🟢

↗️Diluted shares down -0.7% YoY, +0.8 PPs QoQ🟢

Guidance

➡️Q4'24 $39,500.0 - $41,800.0M guide (+11.5% YoY) in line with est

Key points from Meta’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Meta reported Q4 2024 revenue of $48.4 billion, up 21% YoY. Net income reached $20.8 billion, with EPS of $8.02 and an operating margin of 48%.

Ad revenue from the Family of Apps was $46.8 billion, increasing 21% YoY. Online commerce was the largest driver of growth. Global ad impressions grew 6%, while the average price per ad rose 14%.

Free cash flow totaled $13.2 billion, with $77.8 billion in cash and marketable securities and $28.8 billion in debt. Meta initiated its first dividend, paying $1.3 billion in Q4.

Product Innovations

Meta AI is now integrated into WhatsApp, Instagram, and Facebook, driving personalized user experiences.

Advantage+ AI-powered advertising solutions are improving advertiser performance. Ray-Ban Meta AI glasses are gaining market traction. Edits, a standalone app for Reels content creation, has been introduced.

AI Expansion

Meta AI now has 700 million monthly active users, projected to reach 1 billion in 2025.

Advantage+ Shopping campaigns reached a $20 billion annualized revenue run rate, growing 70% YoY. Andromeda AI improved ad personalization efficiency by 10,000x.

Meta is investing in AI-powered developer tools, including coding assistants. AI engineering agents are expected to perform mid-level software tasks by 2025, reducing costs and accelerating innovation.

Llama 4 Development

Llama 4 Mini has completed pre-training, while larger models are advancing. Llama 4 will be multimodal, handling text, images, and reasoning tasks.

Meta aims for Llama 4 to be the most widely used AI model, surpassing closed-source competitors. Open-source AI reduces costs and promotes industry standardization.

Competition from China’s DeepSeq model is growing, reinforcing Meta’s strategy to establish U.S. leadership in AI. MTIA custom silicon is being developed to reduce dependency on third-party chips.

Reality Labs & Metaverse

Reality Labs Q4 revenue was $1.1 billion, while operating losses reached $5 billion. Meta continues long-term metaverse investments.

Ray-Ban Meta AI glasses are gaining traction. 5–10 million units are projected to be sold by the third generation, a key milestone for mass adoption.

Scaling adoption remains a challenge. Success depends on battery life improvements, stronger AI capabilities, and a robust app ecosystem.

WhatsApp & Threads

WhatsApp has surpassed 100 million U.S. monthly active users, solidifying its expansion in North America. Business messaging revenue grew 55% YoY, with increased adoption of WhatsApp Business tools.

Threads now has 320 million monthly active users, with 1 million+ daily sign-ups. Meta is testing ads in 2025, though meaningful revenue contribution is not expected this year.

Meta is focused on increasing engagement through customized feeds, content recommendations, and deeper AI integration.

Ad Revenue

Ad revenue increased 21% YoY. Advantage+ Shopping campaigns now exceed a $20 billion annualized revenue run rate, growing 70% YoY.

Andromeda AI enhanced ad ranking 10,000x, improving ad relevance and effectiveness. 4 million+ advertisers now use AI-generated ad creatives, a 4x increase in six months.

Meta is monetizing lower-yielding surfaces like video and Threads, optimizing ad placement with AI-driven personalization.

Daily Active Users

3.3 billion people use at least one Meta app daily. Facebook alone has surpassed 3 billion monthly active users.

Video engagement is rising, with double-digit growth on Facebook and Instagram. Reels are reshared over 4.5 billion times daily.

CapEx & AI Infrastructure

2025 CapEx is projected at $60–65 billion, funding AI compute, data centers, and networking. 2 gigawatts of AI data center capacity is being deployed.

Servers remain the largest CapEx component, driven by AI model training and inference demand. MTIA chips are reducing reliance on third-party GPUs.

Regulatory & Political Risks

Meta sees a more favorable U.S. regulatory environment, emphasizing American AI leadership. However, regulatory risks in Europe and U.S. litigation cases could impact business operations.

Growing open-source AI competition increases urgency for U.S. dominance in global AI standards.

Future Outlook

Q1 2025 revenue is expected to be $39.5–41.8 billion, reflecting 8–15% YoY growth. Currency-adjusted, growth would be 11–18% YoY.

Investments in AI, infrastructure, and monetization will drive long-term revenue growth. AI ads and automation are already contributing, but Meta AI monetization (premium AI services, paid recommendations) is expected beyond 2025.

AI engineering advancements will improve developer productivity and cost efficiencies, creating new commercialization opportunities.

Meta is scaling Threads, WhatsApp, and AI-powered advertising, positioning 2025 as a transformative year for the company.

Management comments on the earnings call.

Product Innovations

Mark Zuckerberg, Chief Executive Officer

"We believe that people don't all want to use the same AI. People want their AI to be personalized to their context, their interests, their personality, their culture, and how they think about the world. This is going to be one of the most transformative products we’ve made, and we have some fun surprises that I think people are going to like this year."

Susan Li, Chief Financial Officer

"We're making several product bets that are focused on setting up our platforms for long-term success. Creators are one of our central focuses, and we continue to prioritize original posts and recommendations to help smaller creators get discovered."

Artificial Intelligence (AI) Developments

Mark Zuckerberg, Chief Executive Officer

"I expect this is going to be the year when a highly intelligent and personalized AI assistant reaches more than a billion people, and I expect ours to be the leading AI assistant. Meta AI is already used by more people than any other assistant, and once a service reaches that kind of scale, it usually develops a durable long-term advantage."

Susan Li, Chief Financial Officer

"We’re seeing strong engagement with Meta AI, particularly on WhatsApp and Facebook. People are using it for information seeking, educational queries, and recommendations, with WhatsApp seeing the strongest usage. Our focus is on improving personalization so that Meta AI delivers even more relevant and intuitive interactions."

Metaverse & Reality Labs

Mark Zuckerberg, Chief Executive Officer

"This is going to be a pivotal year for the metaverse. The number of people using Quest and Horizon has been steadily growing, and we are investing in making the metaverse more visually stunning and inspiring. The trajectory of AI-powered smart glasses is becoming clearer, and we believe they could become the next major computing platform."

Susan Li, Chief Financial Officer

"Ray-Ban Meta AI glasses have seen strong adoption. Many breakout products in consumer electronics have sold 5 to 10 million units by their third generation, and this year will determine whether we’re on a path toward scaling AI glasses to hundreds of millions and eventually billions of users."

Llama AI Model Expansion

Mark Zuckerberg, Chief Executive Officer

"I think this will be the year when Llama and open source become the most advanced and widely used AI models. Our goal with Llama 3 was to make open source competitive with closed models, and our goal for Llama 4 is to lead. It will be natively multimodal, an omni-model, and will have Agentic capabilities, unlocking a lot of new use cases."

Susan Li, Chief Financial Officer

"We continue to believe open-source AI will drive industry-wide standardization, making AI more cost-effective and scalable. The more widely Llama is adopted, the more optimized third-party hardware and software providers will become in supporting its ecosystem."

WhatsApp & Threads Growth

Mark Zuckerberg, Chief Executive Officer

"Threads has more than 320 million monthly active users and has been adding more than a million sign-ups per day. Our goal is for Threads to become the leading discussion platform and eventually reach a billion users over the next several years."

Susan Li, Chief Financial Officer

"WhatsApp now has more than 100 million monthly actives in the U.S., and we see strong momentum in business messaging. Revenue growth in this area was 55% year-over-year, showing that businesses are increasingly turning to WhatsApp to interact with customers and drive transactions."

Advertising Revenue Growth

Susan Li, Chief Financial Officer

"Advantage+ Shopping campaigns surpassed a $20 billion annual revenue run rate and grew 70% year-over-year. We are also optimizing ad supply through AI-driven personalization, ensuring ads are served in the most effective time and place to maximize engagement and conversion rates."

Mark Zuckerberg, Chief Executive Officer

"We are investing heavily in AI to enhance our advertising business. Andromeda, our new machine learning system, has driven a 10,000-times increase in the complexity of our ad ranking models, leading to better personalization and advertiser performance."

International Growth

Susan Li, Chief Financial Officer

"We continue to see strong global momentum, with ad revenue growth strongest in the Rest of the World region at 27%, followed by Asia Pacific at 23%, Europe at 22%, and North America at 18%. Our video engagement is particularly strong in Asia Pacific, where impression growth has been a key driver of revenue expansion."

Challenges & Risks

Mark Zuckerberg, Chief Executive Officer

"This is going to be an intense year because we have about 48 weeks to get on the trajectory that we want to be on. We’re making massive AI infrastructure investments, with almost a gigawatt of capacity coming online this year and building a data center so large it would cover a significant portion of Manhattan if placed there."

Susan Li, Chief Financial Officer

"Regulatory and legal headwinds, particularly in the EU and U.S., remain a factor that could significantly impact our business. We are closely monitoring the evolving regulatory landscape and are prepared to adapt as needed."

Future Outlook

Mark Zuckerberg, Chief Executive Officer

"This is the most exciting and dynamic that I have ever seen our industry. Between AI-powered glasses, massive infrastructure projects, and building the future of social media, we have a lot to do. We are going to build some awesome things that shape the future of human connection."

Susan Li, Chief Financial Officer

"We expect Q1 2025 total revenue to be in the range of $39.5 billion to $41.8 billion, reflecting 8% to 15% year-over-year growth. We believe the investments we are making in our core business and AI infrastructure will drive strong revenue performance throughout the year."

Thoughts on Meta Earnings Report $META:

🟢 Positive

Revenue of $48.4 billion (+21% YoY), driven by $46.8 billion in ad revenue (+21% YoY) and strong ad pricing growth (+14%).

Net income reached $20.8 billion, with EPS at $8.02 and an operating margin of 48%, maintaining profitability despite investments.

Meta AI at 700 million MAUs, projected to exceed 1 billion by 2025, leading AI assistant adoption.

Advantage+ Shopping campaigns hit a $20 billion run rate (+70% YoY), enhancing ad efficiency.

WhatsApp surpasses 100 million U.S. MAUs, strengthening its presence in North America.

Threads reaches 320 million MAUs, adding 1 million+ users daily, with future ad monetization in development.

Reality Labs Q4 revenue of $1.1 billion, with Ray-Ban Meta AI glasses gaining traction, targeting 5–10 million units sold by the third generation.

CapEx projected at $60–65 billion, expanding AI infrastructure, with 2 gigawatts of AI data center capacity.

MTIA custom silicon in development, reducing reliance on third-party GPUs and improving AI efficiency.

Q1 2025 revenue guidance: $39.5–41.8 billion, forecasting 8–15% YoY growth.

🟡 Neutral

Threads ads will launch in 2025, but limited revenue impact expected in the short term.

Open-source AI strategy strengthens cost efficiency, but adoption pace remains uncertain.

AI-powered ad tools (Advantage+, Andromeda) improving targeting efficiency, with 4 million+ advertisers now using AI-generated creatives.

Facebook and Instagram video engagement rising, with Reels reshared 4.5 billion times daily.

Llama 4 Mini completed pre-training, but larger models are still in development.

🔴 Negative

Reality Labs reported a $5 billion operating loss, with long-term metaverse adoption still uncertain.

Scaling AI glasses adoption remains a challenge, with battery life, AI capabilities, and app ecosystem as key hurdles.

Regulatory risks in Europe and the U.S. could impact operations, despite a more favorable U.S. stance.

China’s DeepSeq AI model poses increased competition, reinforcing the urgency for U.S. AI leadership.

$28.8 billion in debt, despite $77.8 billion in cash reserves and strong free cash flow.