Meta Q2 2024 Earnings Analysis

Dive into $META Meta’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$39,071M rev (+22.1% YoY, 27.3% LQ) beat est by 2.0%

↘️GM (81.3%, -0.1%pp YoY)

↗️Operating Margin (38.0%, +8.7%pp YoY)

↘️FCF Margin (27.9%, -6.3%pp YoY)

↗️Net Margin (34.5%, +10.1%pp YoY)

↗️EPS $5.16 beat est by 9.3%

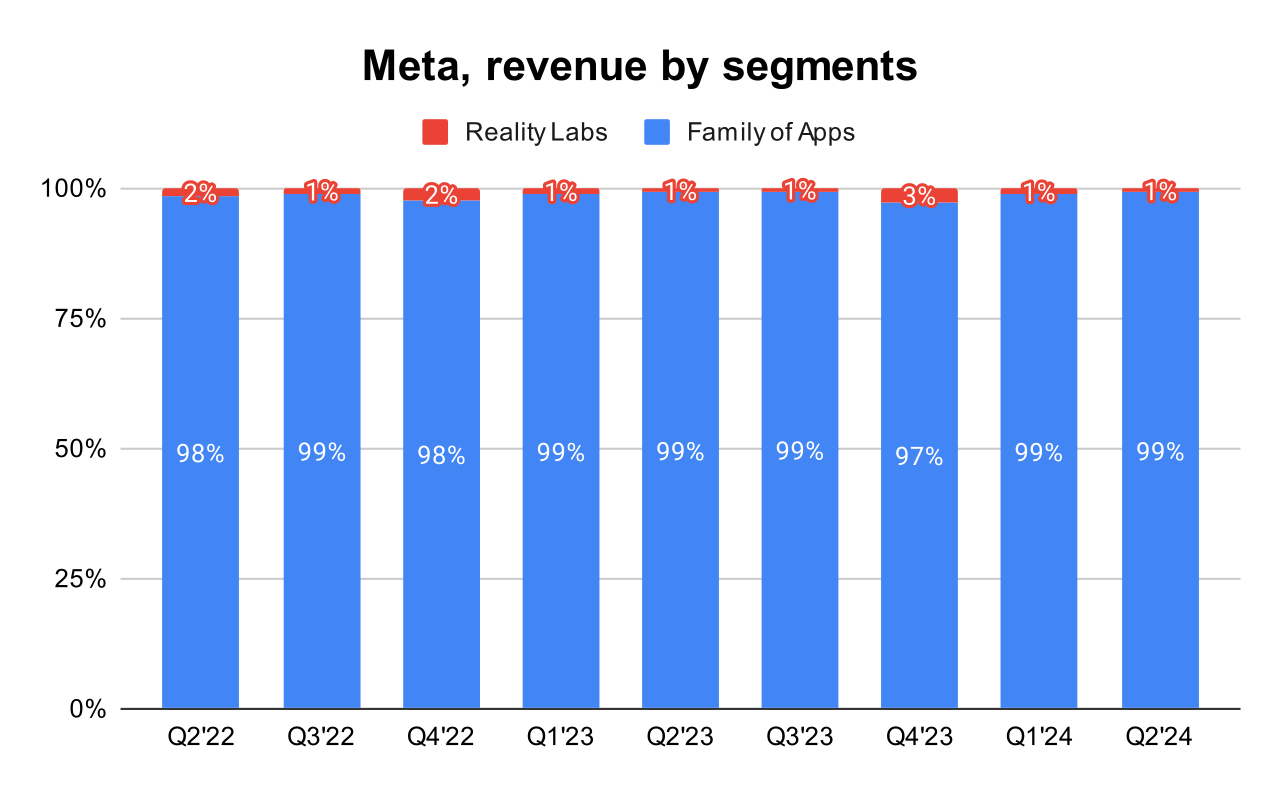

Segment Revenue

➡️Family of Apps $38,718M rev (+22.1% YoY, 49.9% Operating Margin)

↗️Reality Labs $353M rev (+27.9% YoY, -1271.4% Operating Margin)

➡️Advertising $38,329M rev (+21.7% YoY)🟡

↗️Other revenue $389M rev (+72.9% YoY)

KPI

➡️Family daily active people (DAP) $3.3B on average (+1.0% YoY)

Operating expenses

↘️S&M/Revenue 7.0% (7.0% LQ)

↘️R&D/Revenue 27.0% (27.4% LQ)

↘️G&A/Revenue 9.4% (9.5% LQ)

Headcount

➡️70,799 Total Headcount (-1% YoY, +1470 added QoQ)

Dilution

↗️SBC/rev 12%, +2.0%pp QoQ

↗️Basic shares down -1.3% YoY, +0.3%pp QoQ🟢

↘️Diluted shares down -0.1% YoY, -1.2%pp QoQ🟢

Guidance

➡️Q3'24 $38,500.0 - $41,000.0M guide (+16.4% YoY) in line with est

Key points from Meta’s Second Quarter 2024 Earnings Call:

Unified AI-driven Recommendation Systems:

Meta is working towards unifying its AI systems across all content types on its platforms. This includes integrating Reels, longer videos, and live content into a single recommendation system on Facebook, which has already shown to increase engagement more significantly than previous updates. This approach aims to optimize user experiences by delivering more relevant and personalized content across Meta's family of apps.

AI-Generated Creative for Advertisers:

A significant innovation discussed was the development of AI tools that can generate creative content for advertisers. This is expected to transform how ads are created and personalized, making it easier for advertisers to achieve their business objectives with minimal input. Over time, advertisers would only need to specify their business goals and budget, and Meta's AI systems would handle the creation and optimization of ads, potentially increasing the efficacy and efficiency of ad campaigns.

Meta AI Assistant and AI Studio:

The rollout of Meta AI assistant aims to become the most used AI assistant by year-end, providing users with a range of services from information searches to role-playing conversations. Alongside this, AI Studio was launched to allow anyone to create AI agents that can interact across Meta’s apps.

Generative AI Features:

New AI capabilities are being introduced, such as "Imagine Edit," which enhances user interaction by allowing them to modify images generated by AI. These generative AI features are being integrated into various products, enhancing user engagement and creating novel interactions on Meta’s platforms.

Development of AI Agents for Businesses:

Alpha testing of business AI agents ongoing, which have received positive feedback. These agents can potentially handle a variety of tasks for businesses, from customer interaction to content creation, suggesting a future where every business could have an AI agent to streamline operations and enhance customer service.

Investment in Smart Glasses:

The partnership with EssilorLuxottica on Ray-Ban Meta smart glasses is a part of Meta’s broader vision for integrating AI into wearable technology. These glasses are outperforming expectations, signaling strong consumer interest and potential for future innovations in augmented reality wearables.

User Growth and Engagement:

Mark Zuckerberg announced a significant milestone, stating that over 3.2 billion people now use at least one of Meta’s apps daily. Special emphasis was placed on growth in the U.S., where young adults are increasingly engaging with Facebook, contradicting the prevailing narrative about the platform's waning appeal among younger demographics.

The introduction of Threads is highlighted as a success, approaching 200 million monthly active users, indicating its potential to become another major social platform. Additionally, WhatsApp has seen a rise to over 100 million monthly actives in the U.S.

CAPEX and Future Investments:

Management outlined substantial investments in infrastructure to support AI advancements, including the development of more advanced models such as Llama 4. Meta plans significant CapEx growth into 2025 to support ongoing AI research and product development efforts.

Investments are focused on ensuring sufficient compute capacity to not only support current AI initiatives but also future generative AI and foundational model enhancements.

Advertising:

Meta continues to see robust global advertising demand with improvements in ad performance thanks to AI-driven optimization of content recommendations and ad placements.

New AI capabilities are allowing for innovative advertising solutions, including AI-generated creative content that can dynamically adjust to audience reactions, potentially revolutionizing how businesses engage with potential customers.

Challenges and Regulatory:

The earnings call addressed ongoing regulatory challenges in both the EU and U.S., which could significantly impact Meta's operations and financial outcomes.

Future Outlook:

Mark Zuckerberg highlighted the potential for AI to transform existing products and introduce new user experiences. Meta's focus remains on integrating AI deeply into its product ecosystem, with plans to enhance both consumer and business applications significantly.

Management comments on the earnings call.

User Growth

Mark Zuckerberg: "This was a strong quarter for our community and business. We estimate that there are now more than 3.2 billion people using at least one of our apps each day. The growth we're seeing here in the U.S. has especially been a bright spot."

Mark Zuckerberg: "I'm particularly pleased with the progress that we're making with young adults on Facebook. The numbers we are seeing, especially in the U.S., really go against the public narrative around who's using the app."

Future Investments

Susan Li: "We continue to invest both in enhancing our core experiences in the near-term and developing technologies that we believe will transform how people engage with our services in the years ahead."

Mark Zuckerberg: "We are planning for the compute clusters and data we'll need for the next several years. The amount of compute needed to train Llama 4 will likely be almost 10 times more than what we used to train Llama 3."

Advertising

Mark Zuckerberg: "AI is also going to significantly evolve our services for advertisers in some exciting ways... Over the long term, advertisers will basically just be able to tell us a business objective and a budget, and we're going to go do the rest for them."

Susan Li: "We continue to be pleased with our progress here, with AI playing an increasingly central role. We're improving ad delivery by adopting more sophisticated modeling techniques made possible by AI advancements."

Challenges

Susan Li: "In addition we continue to monitor an active regulatory landscape, including the increasing legal and regulatory headwinds in the EU and the US that could significantly impact our business and our financial results."

Future Outlook

Mark Zuckerberg: "At the end of the day, we are in the fortunate position where the strong results that we're seeing in our core products and business give us the opportunity to make deep investments for the future."

Mark Zuckerberg: "The progress we're making on both the foundational technology and product experiences suggests that we're on the right track. I'm proud of what our team has accomplished so far, and I'm optimistic about our ability to execute on the opportunities ahead."