MercadoLibre Q4 2024 Earnings Analysis

Dive into $MELI MercadoLibre’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$6,059M rev (+37.4% YoY, +35.3% LQ) beat est by 2.4%

↘️GM (45.4%, -1.1 PPs YoY)🟡

↗️Operating Margin (13.5%, +5.9 PPs YoY)

↗️FCF Margin (43.2%, +3.5 PPs YoY)

↗️Net Margin (10.5%, +6.8 PPs YoY)🟢

↗️EPS $12.60 beat est by 66.2%

Revenue By Segment

Commerce

↗️$3,554M Commerce Revenue (+44.4% YoY, +105.9% FX-Neutral)

➡️$14,549M GMV (+8.2% YoY, +79.5% FX-Neutral)

↗️525M Successful Items Sold (+27.1% YoY, +69)

↗️67M Unique Marketplace Buyers ( +23.7% YoY, +6)🟢

↗️Commerce Take Rate (24.4%, +0.1 PPs QoQ,+6.1 PPs YoY)🟢

Fintech

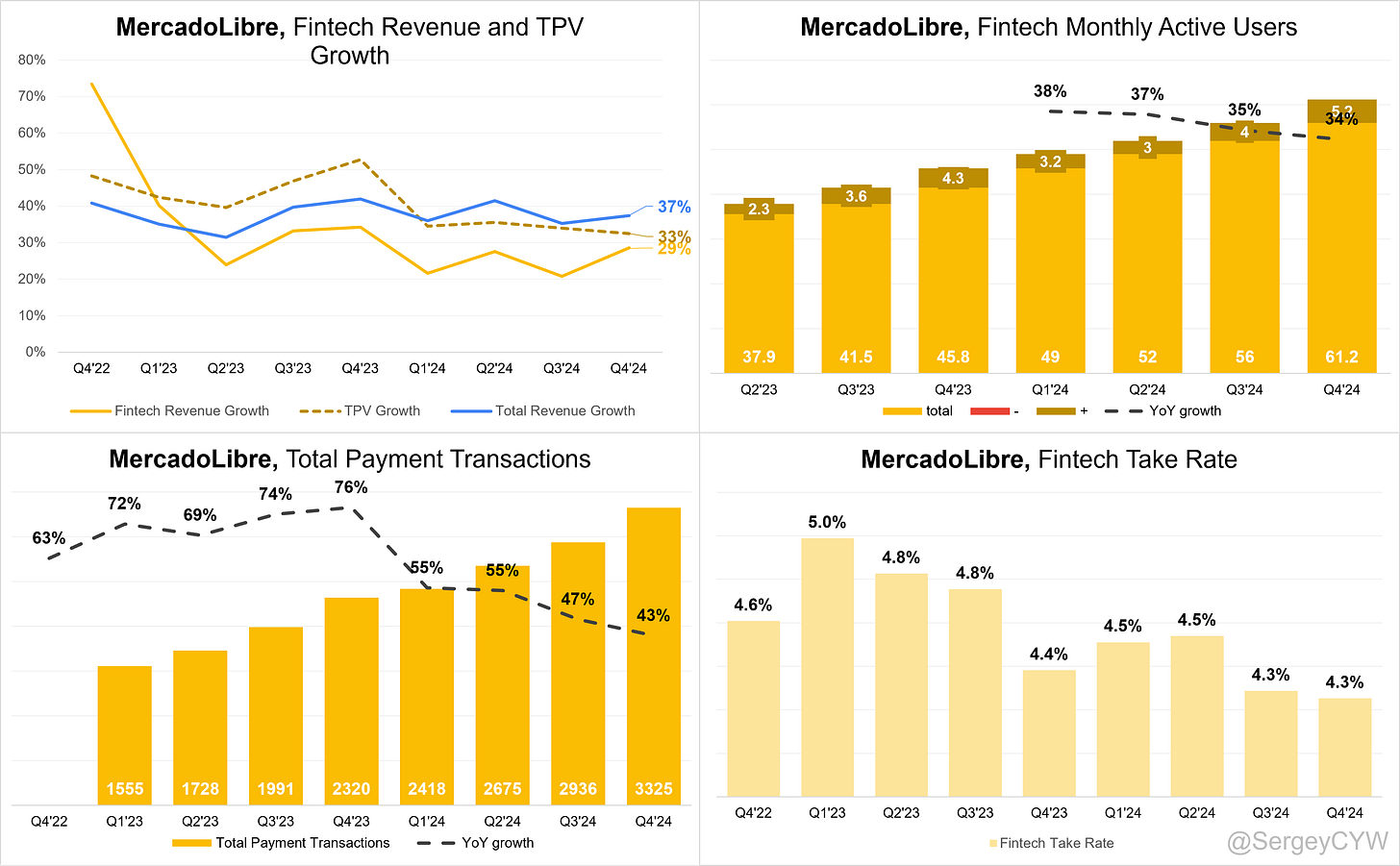

➡️$2,505M Fintech Revenue (+28.6% YoY, +83.5% FX-Neutral)

➡️$58,914M TPV (+32.5% YoY, +49.2% FX-Neutral)

↗️$3,325M Total Payment Transactions (+43.3% YoY)

↗️61 Fintech Monthly Active Users (+33.6% YoY, +5)🟢

↗️Fintech Take Rate (4.3%, -0.0 PPs QoQ,-0.1 PPs YoY)🔴

Credit Portfolio

↗️$6,573M Credit Portfolio (+74.0% YoY)

↘️Credits NPL 15-90 (7.4%, -0.4 PPs QoQ)🟢

↘️Credits NPL >90 (17.5%, -0.4 PPs QoQ)🟢

↘️Credits NPL >15 (24.9%, -0.8 PPs QoQ)🟢

↗️NIMAL 27.6%, +3.4 PPs QoQ)🟡

Regional Breakdown

↗️Brazil $3,136M rev (+37.7% YoY, 52% of Rev)

↘️Argentina $1,307M rev (+31.0% YoY, 22% of Rev)

↗️Mexico $1,347M rev (+43.0% YoY, 22% of Rev)

↗️Other Countries $269M rev (+40.1% YoY, 4% of Rev)

Operating expenses

↗️S&M+Provision for doubtful accounts/Revenue 19.2% (+0.4 PPs YoY)

↘️R&D/Revenue 8.5% (-7.1 PPs YoY)

↘️G&A/Revenue 4.2% (-0.4 PPs YoY)

Dilution

↘️Basic shares up 0.9% YoY, -0.5 PPs QoQ🟢

↘️Diluted shares down -0.6% YoY, -1.6 PPs QoQ🟢

Key points from MercadoLibre’s Fourth Quarter 2024 Earnings Call:

Financial Performance

MercadoLibre reported $21 billion in revenue for 2024, reinforcing its dominance in Latin America’s e-commerce and fintech markets. Free cash flow exceeded $1 billion, despite reinvesting $3 billion into fintech expansion and $900 million in capital expenditures. Adjusted EBITDA margin remained stable, balancing profitability and aggressive investment.

Product Innovations

The company optimized user experience across verticals. In fashion, standardized filters and size guides improved efficiency. A virtual try-on feature in beauty increased buyer confidence. Full Super, a grocery storefront, streamlined category navigation, enabling users to track free shipping thresholds and add items with one click.

E-Commerce Growth

With over 100 million unique buyers, MercadoLibre strengthened its position in Latin America’s marketplace. Items shipped grew 29% YoY, with consumer electronics, beauty, and apparel driving momentum. Low-ticket essential goods saw strong growth, supported by logistics improvements and free shipping expansion.

Fintech Expansion

Mercado Pago surpassed 60 million monthly active users, introducing tax-free investments in Brazil and Mexico. MELI Dollar, a stablecoin, enabled seamless transactions. Pre-approved credit card offers at checkout and 18-month installment plans enhanced customer engagement. The company tightened risk policies to navigate Brazil’s rising interest rates while continuing fintech expansion.

Credit Portfolio Growth

Total loans grew 74% YoY, with 5.9 million new credit cards issued, doubling the portfolio. MercadoLibre reduced micro-card issuance and shortened payback periods to mitigate macroeconomic risks. Brazil's first payment default rate hit a record low in December, confirming effective underwriting. In Mexico, consumers shifted from marketplace loans to credit cards.

Advertising Expansion

Advertising revenue as a percentage of GMV increased by 50 basis points YoY. MercadoLibre integrated display, video, and brand ads, strengthening partnerships with brands and agencies. Plans to scale ad inventory beyond its ecosystem aim to capture additional revenue opportunities.

Logistics Investment

New fulfillment centers expanded capacity and accelerated delivery. Route efficiency and cost per package improved, with expenses declining or rising below inflation in key markets. Automation, dynamic shelving, and algorithmic routing enhanced productivity, reducing reliance on third-party logistics.

Merchant Growth

Sellers gained new tools, including MyPage, allowing customization of storefronts and product groupings. A dynamic pricing tool automated price adjustments for competitive positioning. Logistics enhancements reduced delivery costs, benefiting small and medium-sized merchants.

Large Sellers & Enterprise Growth

Top-tier retailers and FMCG brands expanded their presence, leveraging MercadoLibre’s advertising and fulfillment capabilities. Integrated payment processing, credit facilities, and merchant credit lines drove further adoption among enterprises.

Argentina’s Recovery

Local credit portfolio grew 4x YoY, with items sold increasing 18% YoY, up from 10% in the prior quarter. While the company does not hold a banking license in Argentina, alternative funding strategies support credit expansion.

FX Headwinds

Currency depreciation, particularly in Argentina, impacted financial results despite local sales growth. MercadoLibre generates revenue in local currencies but incurs costs in U.S. dollars, creating gross margin and operating expense pressures. The company leveraged pricing adjustments and hedging strategies to mitigate risk.

Competitive Challenges

E-commerce faced pressure from low-cost competitors targeting ultra-low ASP products. MercadoLibre enhanced free shipping and AI-driven recommendations to maintain its advantage. In fintech, traditional banks and digital-native financial institutions intensified competition in credit and payments. The company relied on marketplace data to refine underwriting models and expand financial inclusion.

Future Outlook

MercadoLibre remains focused on logistics expansion, advertising growth, and fintech integration. Despite short-term margin fluctuations, long-term profitability is expected as investments scale. Low e-commerce penetration and financial digitalization in Latin America present significant growth opportunities.

Management comments on the earnings call.

Product Innovations

Richard Cathcart, Investor Relations Officer

"Innovation is at the core of our strategy. By refining the purchasing experience across key verticals, we are removing friction and strengthening engagement. From virtual try-ons in beauty to dynamic pricing tools for sellers, every enhancement is designed to increase customer satisfaction and conversion rates."

Martin de los Santos, Chief Financial Officer

"Our focus is on dozens of incremental improvements that compound over time. Initiatives like standardized filters in fashion and Full Super for grocery are driving repeat purchases while improving overall platform efficiency."

E-Commerce

Martin de los Santos, Chief Financial Officer

"Surpassing 100 million unique buyers reflects the strength of our ecosystem. Our marketplace continues to gain traction across multiple categories, with strong momentum in consumer electronics, beauty, and apparel."

Ariel Szarfsztejn, Commerce Senior Vice President

"Low-ticket essentials are growing rapidly as we improve logistics and delivery efficiency. New fulfillment centers and AI-driven recommendations ensure a seamless customer experience, helping us retain and expand our user base."

Fintech Services

Osvaldo Gimenez, Fintech President

"Mercado Pago’s growth to over 60 million monthly active users is a testament to our ability to integrate financial services within our marketplace. By offering credit, stablecoin transactions, and tax-free investments, we are building a comprehensive digital banking experience."

Richard Cathcart, Investor Relations Officer

"Credit card adoption is accelerating, particularly in Mexico, where we are seeing a natural shift from consumer loans to card-based payments. Our 18-month installment plans are further increasing engagement and driving higher transaction volumes."

Credit Portfolio

Osvaldo Gimenez, Fintech President

"Our disciplined approach to credit expansion ensures we maintain portfolio resilience even in challenging environments. With 5.9 million new credit cards issued and loan growth of 74% year-over-year, we remain confident in our ability to scale financial services sustainably."

Martin de los Santos, Chief Financial Officer

"We have tightened payback periods and reduced micro-card issuance in response to macroeconomic conditions. Despite these adjustments, Brazil’s first payment default rate on credit cards hit a record low in December, reflecting the strength of our underwriting models."

Advertising Business

Ariel Szarfsztejn, Commerce Senior Vice President

"Advertising remains an under-monetized opportunity for us. With ad revenue as a percentage of GMV increasing by 50 basis points year-over-year, we see significant potential in scaling beyond our ecosystem through brand partnerships and video ads."

Competitors

Osvaldo Gimenez, Fintech President

"Competition in fintech is intensifying, with traditional banks and digital-native players expanding their credit offerings. Our competitive advantage lies in leveraging e-commerce data to refine risk assessment, enabling us to provide better financial solutions at scale."

Merchants

Ariel Szarfsztejn, Commerce Senior Vice President

"We continue to enhance our seller ecosystem with new tools like MyPage and dynamic pricing automation. These innovations help merchants optimize their strategies, improve market positioning, and strengthen customer loyalty."

Richard Cathcart, Investor Relations Officer

"Large brands and enterprise merchants are expanding their presence on our platform. Our integrated payment processing and advertising solutions make MercadoLibre an essential partner for businesses looking to scale in Latin America."

International Growth

Martin de los Santos, Chief Financial Officer

"In Argentina, we have seen a fourfold increase in our local credit portfolio, reflecting renewed consumer confidence. With items sold growing by 18% year-over-year, we are capitalizing on economic stabilization to strengthen our foothold in the region."

Challenges

Martin de los Santos, Chief Financial Officer

"FX volatility remains a challenge, particularly in Argentina. We have adapted by leveraging localized financial solutions and pricing adjustments to mitigate margin pressures while continuing to drive operational efficiency."

Future Outlook

Osvaldo Gimenez, Fintech President

"The long-term opportunity in Latin America remains substantial. With low e-commerce penetration and increasing digitalization of financial services, we are well-positioned to drive sustained growth through strategic investments in logistics, advertising, and fintech."

Martin de los Santos, Chief Financial Officer

"We are playing the long game. Short-term margin fluctuations are a natural part of our investment cycle, but as we scale our business, we expect to see continued improvements in profitability and market share expansion."

Thoughts on MercadoLibre Earnings Report $MELI:

🟢 Positive

Revenue: $6,059M (+37.4% YoY, +35.3% LQ) beat estimates by 2.4%

Operating Margin: 13.5% (+5.9 PPs YoY)

Net Margin: 10.5% (+6.8 PPs YoY)

Free Cash Flow Margin: 43.2% (+3.5 PPs YoY)

EPS: $12.60, beating estimates by 66.2%

Commerce Revenue: $3,554M (+44.4% YoY, +105.9% FX-Neutral)

GMV: $14,549M (+8.2% YoY, +79.5% FX-Neutral)

Successful Items Sold: 525M (+27.1% YoY)

Unique Marketplace Buyers: 67M (+23.7% YoY)

Credit Portfolio Growth: $6,573M (+74.0% YoY)

NPL Improvement: 15-90 days: 7.4% (-0.4 PPs QoQ), >90 days: 17.5% (-0.4 PPs QoQ)

Regional Performance: Brazil: $3,136M (+37.7% YoY), Mexico: $1,347M (+43.0% YoY)

Dilution Control: Basic shares up 0.9% YoY, Diluted shares down 0.6% YoY

🟡 Neutral

Gross Margin: 45.4% (-1.1 PPs YoY)

Fintech Revenue: $2,505M (+28.6% YoY, +83.5% FX-Neutral)

Fintech TPV: $58,914M (+32.5% YoY, +49.2% FX-Neutral)

Fintech Monthly Active Users: 61M (+33.6% YoY)

NIMAL: 27.6% (+3.4 PPs QoQ)

Operating Expenses: S&M + Provision for doubtful accounts/revenue at 19.2% (+0.4 PPs YoY)

Argentina Revenue Growth Lag: $1,307M (+31.0% YoY) vs. stronger growth in other regions

🔴 Negative

Fintech Take Rate: 4.3% (-0.1 PPs YoY)

FX Headwinds: Argentina’s currency depreciation impacted financial results despite local sales growth