Financial Results:

⬆️$4,261M rev (+41.9% YoY, +39.8% LQ) beat est by 3.4%

↘️FCF Margin 41.0%, -6.6%pp YoY)

GAAP, including one-off expenses:

↘️GM (45.9%, -2.7%pp YoY)

↘️Operating Margin (5.6%, -6.0%pp YoY)

↘️EPS $3.25 missed est by -54.1%🔴

non-GAAP, excluding one-off expenses:

↘️GM (47.8%, -0.7%pp YoY)

⬆️Operating Margin (13.4%, +2.7%pp YoY)

⬆️EPS $7.39 beat est by 4.3% 🟢

Key Metrics

⬆️145M Unique MELI Active Users (+50.0% YoY, +24.9)🟢

Revenue By Segment

Commerce

⬆️$2,461M Commerce Revenue (+48.2% YoY, +91.3%FX-Neutral)

⬆️413M Successful Items Sold (+29.0% YoY, +56)

⬆️54M Unique Marketplace Buyers ( +18.0% YoY, +4.1)🟢

➡️$13,450M GMV (+40.0% YoY, +80.0%FX-Neutral)

⬆️Commerce Take Rate18.3%, -0.4%pp QoQ,+1.0%pp YoY)🟡

Fintech

➡️$1,800M Fintech Revenue (+34.2% YoY, +73.2%FX-Neutral)

⬆️$56,514M TPV (+57.0% YoY, +57.0%FX-Neutral)

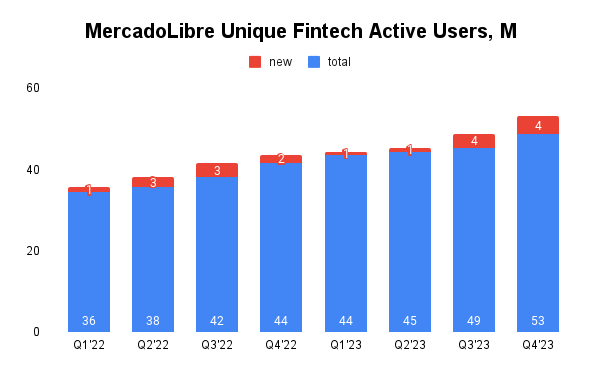

⬆️53 Unique Fintech Active Users (+22.0% YoY, +4.3)🟢

⬆️Fintech Take Rate3.2%, -0.3%pp QoQ,-0.5%pp YoY)🔴

Credit Portfolio

➡️$3,778M Credit Portfolio (+33.0% YoY)

⬆️Credits NPL 15-90 (8.2%, +0.6%pp QoQ)🟡

↘️Credits NPL >90 (18.7%, -1.6%pp QoQ)🟢

↘️Credits NPL >15 (26.9%, -1.0%pp QoQ)🟢

Operating expenses

⬆️S&M+Provision for doubtful accounts/Revenue 19.4% (19.1% LQ)

⬆️R&D/Revenue 16.1% (10.5% LQ)

↘️G&A/Revenue 4.7% (5.2% LQ)

Dilution

⬆️Dilution at 0.7% YoY, +1.3%pp QoQ🟢

Key points from MercadoLibre Fourth Quarter 2023 Earnings Call:

Financial Growth:

MercadoLibre reported a strong financial performance in the fourth quarter of 2023, with revenues growing by 42%, indicating accelerated growth in both Fintech and commerce sectors.

Operating Profit Margins:

The company achieved a 13.4% EBIT margin (excluding one-off expenses from previous years), representing an improvement from Q4 of 2022.

The company reported a one-off expense of $351 million related to withholding tax provisions, significantly impacting the quarter's financial results.

Income Decline and Challenges:

Increased logistics costs due to seasonal peak demands and investments in fulfillment centers and free shipping offers.

The impact of the 1P (first-party) business on margins due to its different revenue and cost structure compared to third-party (3P) business.

A one-off charge related to withholding tax adjustments, which significantly affected the reported margins, although it was funded and would not impact cash flow.

Sequential margin compression in Q4, influenced by peak season costs and strategic investments in value propositions, including fulfillment and 1P business growth.

Commerce Business Growth:

The commerce business saw accelerated growth and market share gains across most countries. This success was attributed to investments in product assortment, an accelerated first-party business, particularly in Brazil (which grew by 81% in 2023), and an expanded logistic network reaching almost 50% fulfillment penetration.

GMV growth was significantly highlighted, with a 79% increase in Q4 compared to the previous quarter, driven by various factors, including market share gains in consumer electronics facilitated by 1P operations. Argentina's GMV growth was also noted, with a shift in consumer behavior due to inflationary pressures.

The sequential decline in commerce take rate, excluding the impact of 1P (First Party) operations, was mainly due to category mix and logistics.

Fintech Momentum:

Mercado Pago, the fintech arm, maintained strong momentum with solid Total Payment Volume (TPV) growth and market share gains.

The decline in Fintech take rate was attributed to a larger portion of the credit book coming from credit cards, which have a lower portion of interest-bearing loans compared to other types of loans.

Moving into SMBs (Small and Medium-sized Businesses) in the acquiring business, which typically have slightly lower take rates, albeit with significantly larger volume, also impacted the overall take rate.

Credit Business Growth:

The credit business remains a crucial part of MercadoLibre's fintech strategy.

MercadoLibre is cautious with its credit portfolio, particularly in Argentina, where it adjusted its credit issuance strategy ahead of expected economic uncertainties.

Advertising Business Expansion:

The ads business continued to grow rapidly, with the onboarding of almost 50,000 new advertisers. This underscores the value of MercadoLibre's platform for product promotion.

Strategic Investments:

MercadoLibre plans to continue investing in its logistics network, including faster delivery, more automation, and improved technology to enhance efficiency and customer experience.

Innovation and Product Launches:

MercadoLibre launched several new products and services in 2023, including the MELI Mas loyalty program, Meli delivery day, and credit cards for consumers in Mexico and businesses in Brazil. Development team growing to 16,000 engineers.

Competitive Positioning:

Despite the presence of Asian competitors in markets like Mexico, MercadoLibre remains confident in its competitive advantages, particularly in logistics and payment solutions, and its ability to sustain market share gains.

Management comments on the earnings call.

Product Innovations:

"We've launched several new products and services such as the MELI Mas loyalty program, Meli delivery day, credit cards for consumers in Mexico and businesses in Brazil, amongst many other things. We've also vastly improved our core products with several new experiences that build onto our value proposition as we continue to strive to offer our users the best experience." - Richard Cathcart

Competitors:

"In the past several years, we have been successful in competing against Asian players who were executing strategies similar to the ones that current players are executing. So we expect to continue doing so in the future, building on our strengths and successfully competing against whoever is operating in each of the markets where we are." - Ariel Szarfsztejn

Customers:

"A recent report in partnership with Euromonitor shows that MercadoLibre is the main source of income for 1.8 million families in the region and that for 54% of users in the region, Mercado Pago was the first digital payment method available to them." - Richard Cathcart

Credits NPL:

"The credit business in Argentina continues to have the lowest NPL compared to all other markets, and it continues to be extremely profitable." - Martin de los Santos

Fintech Take Rate Decline:

"With regard to the Fintech take rate, part of the impact is a larger portion of our credit book coming from credit cards, which have the portion of those loans that are interest bearing are lower than in the other kind of loans." - Ariel Szarfsztejn

"On the other part of the Fintech business, when you look at our acquiring business, as we move into SMBs, they typically have slightly lower take rate, albeit with significantly larger volume." - Ariel Szarfsztejn

"With regards to acquiring, I would say it's a business that also is very much independent of there being a recession. No, obviously, the volumes are impacted, but we are growing so much by gaining share, and the impact tends to be, could be smaller." - Ariel Szarfsztejn

Thoughts on MercadoLibre Earnings Report $MELI:

🟢 Pros:

+ The dominant LATAM e-commerce and Fintech player

+ Revenue increased by +41.7% YoY, accelerating from the previous quarter's +39.8%

+ Strong FCF margin

+ Added a record number of unique active users to the platform

+ Commerce and fintech revenues have accelerated

+ Recorded a record number of successful items sold on the Mercado Libre marketplace with a record growth rate

+ Added a record number of marketplace buyers and fintech active users

+ Credits NPL >15% is declining and <30%

🔴 Cons:

- Fintech take rate is declining

- Non-GAAP operating margin (excluding one-off expenses) declined from the previous quarter

- High currency risks and the credit portfolio may become problematic (inflation in Argentina)

🟡 Neutral:

+- Dilution at 0.7% YoY

+- Commerce take rate slightly declined from the previous quarter

+- Gross margin slightly declined from the previous quarter due to increased logistics costs from seasonal peak demands