MercadoLibre Q3 2024 Earnings Analysis

Dive into $MELI MercadoLibre’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$5,312M rev (+35.3% YoY, +17.1% LQ) beat est by 0.8%

↘️GM (45.9%, -7.4 PPs YoY)🟡

↘️Operating Margin (10.5%, -9.5 PPs YoY)🟡

↗️FCF Margin (25.9%, +5.2 PPs YoY)

↘️Net Margin (7.5%, -1.7 PPs YoY)🟡

↘️EPS $7.83 missed est by -26.1%🔴

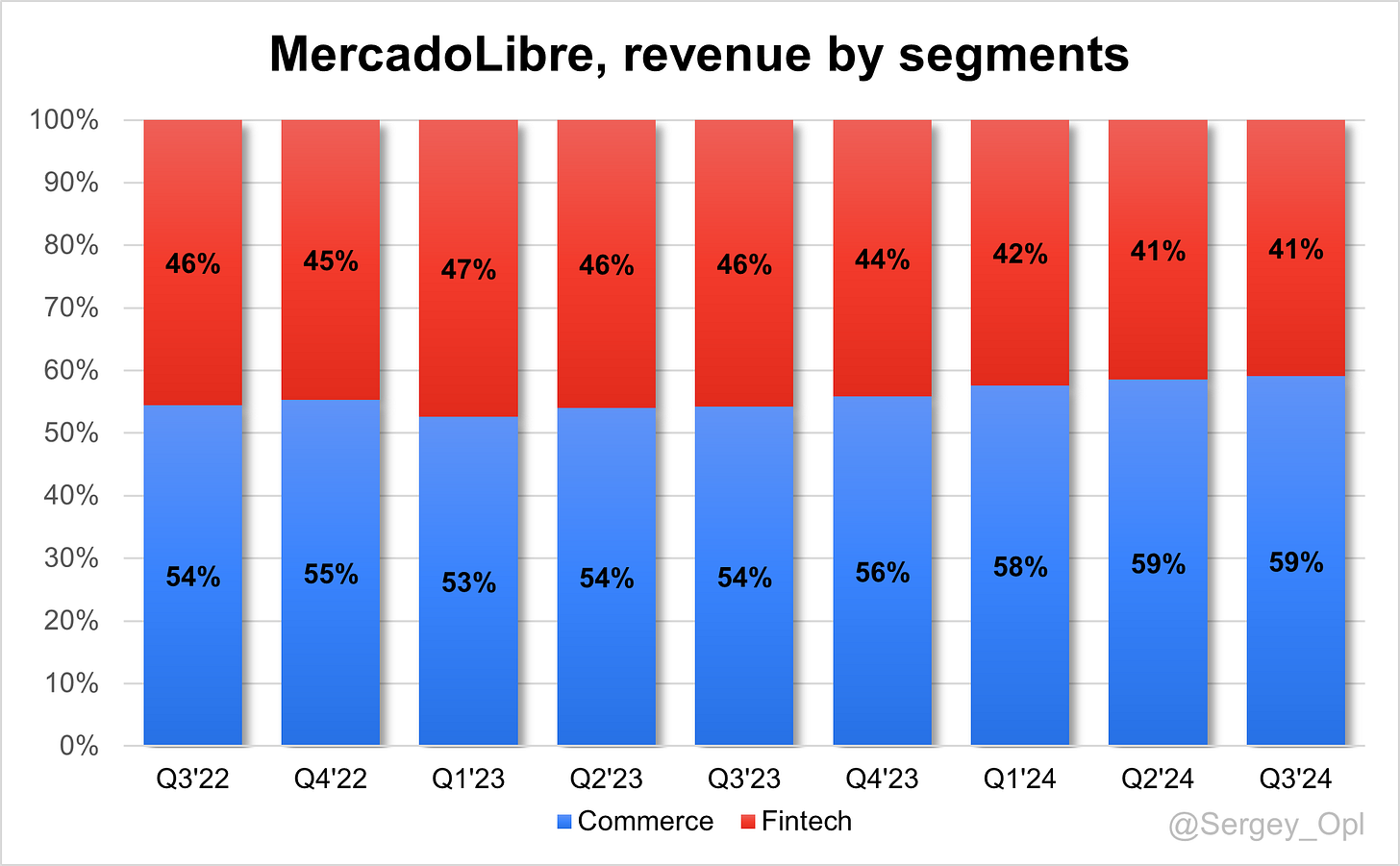

Revenue By Segment

Commerce

↗️$3,139M Commerce Revenue (+47.5% YoY, +75.7% FX-Neutral)

➡️456M Successful Items Sold (+27.7% YoY, +35)

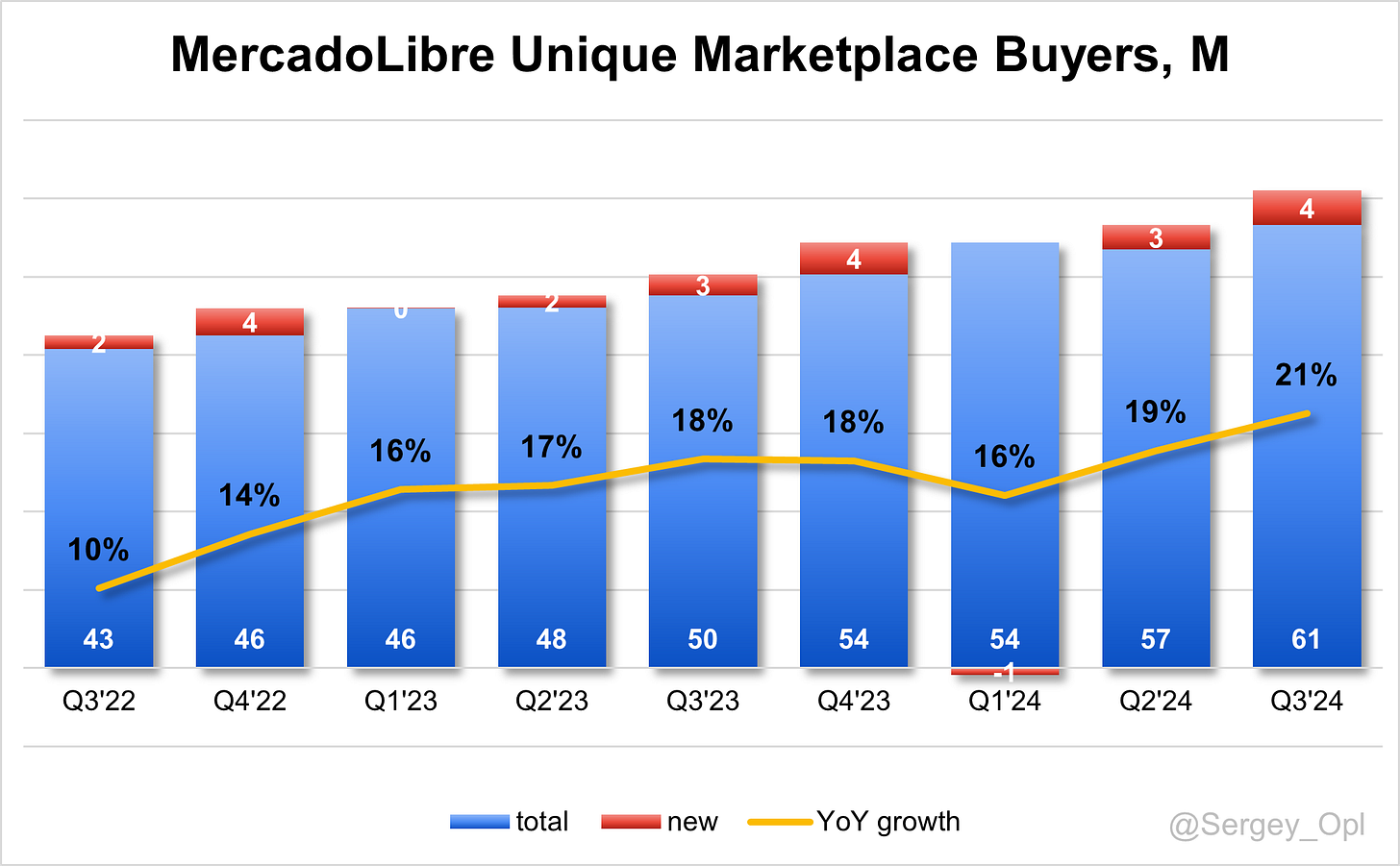

↗️61M Unique Marketplace Buyers ( +21.3% YoY, +4)🟢

➡️$12,907M GMV (+13.6% YoY, +59.3% FX-Neutral)

↗️Commerce Take Rate (24.3%, +0.8 PPs QoQ,+5.6 PPs YoY)🟢

Fintech

➡️$2,173M Fintech Revenue (+20.8% YoY, +61.1% FX-Neutral)

➡️$50,691M TPV (+34.0% YoY, +121.2% FX-Neutral)

↗️56 Fintech Monthly Active Users (+34.9% YoY, +4)

↗️Fintech Take Rate (4.3%, -0.3 PPs QoQ,-0.5 PPs YoY)🔴

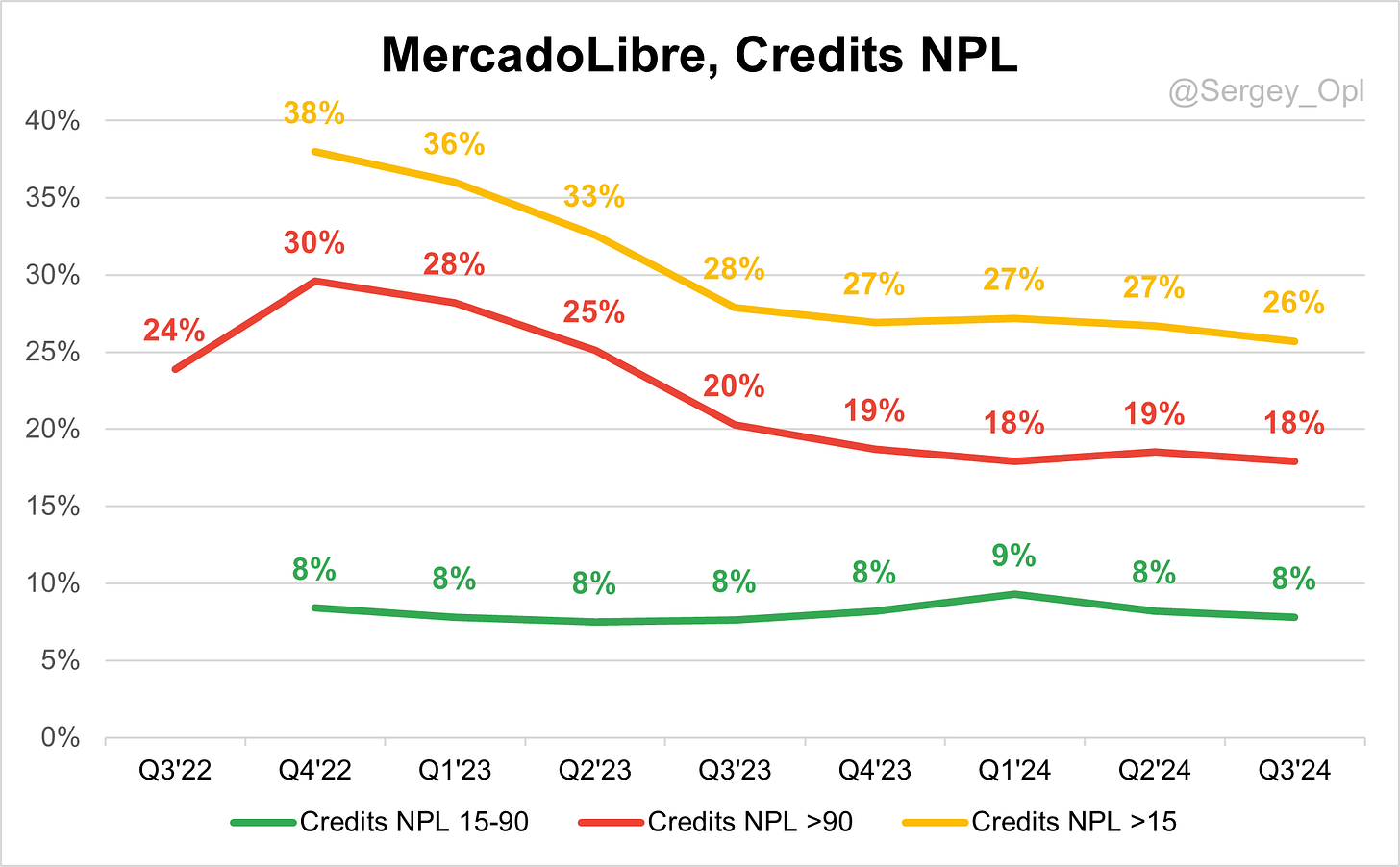

Credit Portfolio

↗️$6,016M Credit Portfolio (+76.8% YoY)

↘️Credits NPL 15-90 (7.8%, -0.4 PPs QoQ)🟢

↘️Credits NPL >90 (17.9%, -0.6 PPs QoQ)🟢

↘️Credits NPL >15 (25.7%, -1.0 PPs QoQ)🟢

↘️NIMAL 24.2%, -6.9 PPs QoQ)🟢

Operating expenses

↗️S&M+Provision for doubtful accounts/Revenue 20.2% (+1.9 PPs YoY)

↘️R&D/Revenue 9.5% (-0.6 PPs YoY)

↗️G&A/Revenue 5.7% (+0.8 PPs YoY)

Dilution

↗️Basic shares up 1.4% YoY, +0.3 PPs QoQ

↗️Diluted shares up 1.0% YoY, +1.9 PPs QoQ🟢

Key points from MercadoLibre’s Third Quarter 2024 Earnings Call:

Financial Performance

MercadoLibre reported robust financial growth in Q3 2024, with a 35% YoY increase in revenue despite FX headwinds in Mexico and Brazil. The company achieved EBIT of $557 million with a 10.5% margin, balancing revenue expansion and operational investment. Net income rose 11% to $397 million, though margin compression was noted due to intensified investments, particularly in fintech and credit card expansion. These results underscore MercadoLibre’s commitment to sustainable growth, with a focus on long-term value creation even amidst short-term strategic expenses.

Strategic Investments and Impact on Margins

MercadoLibre has placed significant emphasis on expanding logistics and fulfillment capabilities. In Q3 2024, it opened six new fulfillment centers—five in Brazil and one in Mexico—raising fulfillment penetration by 4.5 percentage points YoY. This expansion is part of a broader strategy to enhance e-commerce infrastructure across Latin America, reducing delivery times and improving user experience. While these investments temporarily pressured margins, management views them as necessary for scaling operations to meet future demand, with plans to open 11 additional centers in Brazil by 2025.

Advertising

MercadoLibre’s advertising business emerged as a key profit engine, registering 86% growth on a neutral FX basis and 37% in USD terms. Ad penetration reached record levels in Brazil and Mexico, with product ads being the primary revenue driver. To boost engagement further, MercadoLibre is expanding into display and video advertising. The company regards advertising as a critical component of its multi-channel ecosystem, aiming to enhance user experience and increase conversion rates.

E-commerce

The e-commerce segment demonstrated impressive growth, solidifying MercadoLibre’s position as a market leader in Latin America. GMV increased by 34% in Brazil and 27% in Mexico, supported by investments in logistics, user experience, and product variety. Argentina set a new record with over 60 million items sold, indicating strong consumer demand and improved market conditions.

Category-Specific Features and Cross-Category Shopping: MercadoLibre launched targeted features to support offline-to-online retail migration. In the auto parts category, users can now schedule mechanic appointments directly on the platform, while the beauty category introduced AR technology for virtual makeup try-ons. These solutions address traditional purchasing barriers, improving user confidence and increasing conversion rates.

Cross-Category Shopping Enhancements: MercadoLibre introduced a new tool for personalized recommendations, suggesting relevant categories based on user profiles. This, along with personalized landing pages, homepage shortcuts, and push notifications, has improved user engagement and increased transaction volume.

Overall E-Commerce Journey Improvements: The MELI Delivery Day program was expanded to include free shipping on low-value items, encouraging additional purchases and enabling efficient last-mile delivery. These improvements, combined with regional logistics investments, reflect MercadoLibre’s commitment to reducing buyer friction and enhancing the shopping experience.

Fintech Services and Credit

Loyalty Features and “Meli Dollars” Initiative: Mercado Pago expanded loyalty benefits, including cashback and extra installment options, to increase user engagement. Cashback is provided in “Meli Dollars,” a stablecoin deposited into MercadoPago accounts, which can be held, spent, or converted, enhancing the flexibility and appeal of MercadoPago as a primary financial service provider.

Strong Credit Portfolio Growth: Mercado Pago achieved significant growth in its credit offerings, with credit card transactions up 166% YoY and the overall credit portfolio expanding 77%. With stable non-performing loan (NPL) rates and advanced risk models, MercadoLibre confidently expanded its credit portfolio. Older cohorts reaching profitability have strengthened the fintech foundation, supporting long-term growth.

Credit Card Adoption

MercadoLibre’s credit card portfolio showed accelerated growth in Brazil and Mexico, with over 60% of spending occurring off-platform. This usage indicates strong engagement, with many users treating the Mercado Pago credit card as their primary card. By focusing on larger, lower-risk, and longer-term loans, MercadoLibre aims for sustainable profitability and increased user engagement across its ecosystem.

Loyalty Program

The revamped MeLi+ loyalty program is designed to drive user engagement, offering two subscription tiers: an "Essential" plan, which includes shipping and fintech benefits like cashback, and a "Total" plan that adds streaming content from Disney+. By reallocating marketing funds to loyalty incentives, MercadoLibre aims to boost retention and drive volume growth without significantly impacting margins. Early results indicate increased adoption, higher conversion rates, and improved retention, confirming the program’s role in MercadoLibre’s long-term growth strategy.

Argentina

Marketplace and Fintech Growth: Argentina’s marketplace performance improved notably in Q3, driven by favorable consumer trends and targeted platform enhancements. Initiatives such as installment plans and controlled shipping rates boosted demand, strengthening MercadoLibre’s market position. The fintech segment in Argentina also saw positive developments, with strong credit uptake and stable NPLs supported by attractive interest spreads as local rates declined.

Future Outlook

Looking ahead, MercadoLibre anticipates significant growth opportunities in both e-commerce and fintech services. Latin America’s low online shopping penetration rate of 15% suggests considerable room for expansion. MercadoLibre will continue to drive e-commerce adoption through strategic investments in fulfillment, loyalty programs, and advertising.

Expanding fulfillment infrastructure, especially in regional areas outside major cities, is expected to enhance cost efficiency and enable same-day deliveries, improving competitiveness. In fintech, MercadoLibre’s focus on expanding credit and financial services is expected to further integrate Mercado Pago into users’ daily lives, fostering long-term engagement. By strengthening both e-commerce and fintech operations, MercadoLibre aims to sustain profitable growth and increase cross-platform activity across Latin America.

Management comments on the earnings call.

Product Innovations

Richard Cathcart, Chief Product Officer

"Our focus on tailored product innovations, such as AR makeup try-ons in beauty and appointment scheduling for auto parts, demonstrates our commitment to enhancing category-specific experiences. These solutions address key purchasing barriers and create a more seamless shopping journey for our users."

Strategic Investments

Martin De Los Santos, Chief Financial Officer

"Our logistics and fulfillment investments are central to driving long-term growth. By opening six new centers this quarter, we’re not just expanding capacity—we’re strengthening our ability to deliver faster, more reliably, and with a better user experience. These investments are essential as we continue to scale and capture market share."

International Growth

Ariel Swarenstein, President of Commerce

"We are focused on deepening our presence in Latin America, a region with tremendous growth potential. The combination of new fulfillment centers, advertising expansion, and enhanced loyalty offerings across our core geographies helps us capture more value from increasing e-commerce adoption."

Argentina

Osvaldo Jimenez, President of Fintech

"Argentina has shown strong improvements this quarter, supported by consumer demand and a solid fintech performance. We’re seeing substantial uptake in our credit offerings with manageable NPL rates, driven by a more favorable macroeconomic environment and specific platform initiatives that resonate with local users."

Challenges

Richard Cathcart, Chief Product Officer

"Currency fluctuations in key markets like Brazil and Mexico pose ongoing challenges, especially for our advertising and fulfillment businesses. However, we’re confident that our strategic initiatives and focus on localizing the user experience will help us manage these pressures effectively."

Future Outlook

Ariel Swarenstein, President of Commerce

"As e-commerce penetration in Latin America remains around 15%, we see enormous potential for continued growth. Our investments in fulfillment infrastructure, loyalty programs, and new fintech offerings are all geared toward scaling sustainably while delivering enhanced value to our users and partners."

Thoughts on MercadoLibre Earnings Report:

Commercial Segment:

🟢 Pros:

+ The number of successful items sold on the Mercado Libre marketplace increased by 8% QoQ and +28% YoY.

+ Record number of Unique Marketplace Buyers added.

+ Commerce Take Rate significantly rose to 24.3%.

🟡 Neutral:

+- GMV growth slowed to +14% YoY, growing slower than revenue growth in the commercial segment.

Fintech Segment:

🟢 Pros:

+ TPV growth reached +34%, outpacing fintech revenue growth.

+ The fintech segment saw record growth in monthly active users.

+ Credit Portfolio reached a record growth of +76.8% YoY.

+ Non-performing loans (NPL) for credits are declining across all metrics.

+ The percentage of problematic credits (NPL >90 days) slightly decreased to 17.9%, down significantly from 20.3% a year earlier.

🟡 Neutral:

+- Fintech revenue growth slowed to 20% YoY and 3.3% sequentially. FX-neutral revenue growth was 81%, slightly slower than the previous quarter.

Overall business:

🟢 Pros:

+ MercadoLibre remains the leading e-commerce and fintech player in Latin America.

+ Revenue growth was +35.3% YoY, lower than the previous quarter's +41.5% but still at a high level. FX-neutral revenue growth was 102.7%, showing a slight slowdown.

+ Mercado Pago continues to drive growth in both Commercial and Fintech segments, making the company’s products stickier.

🟡 Neutral:

+- Dilution at 1.4% YoY.

+- Operating and Net margins decreased compared to last year.

+- Gross margin slightly declined compared to the last three quarters.

+- Revenue growth slowed in USD, but the FX-neutral revenue slowdown was significantly less, highlighting currency risks for the company due to currency devaluation in Argentina as well as fluctuations in key markets like Brazil and Mexico.