MercadoLibre Q1 2025 Earnings Analysis

Dive into $MELI MercadoLibre’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

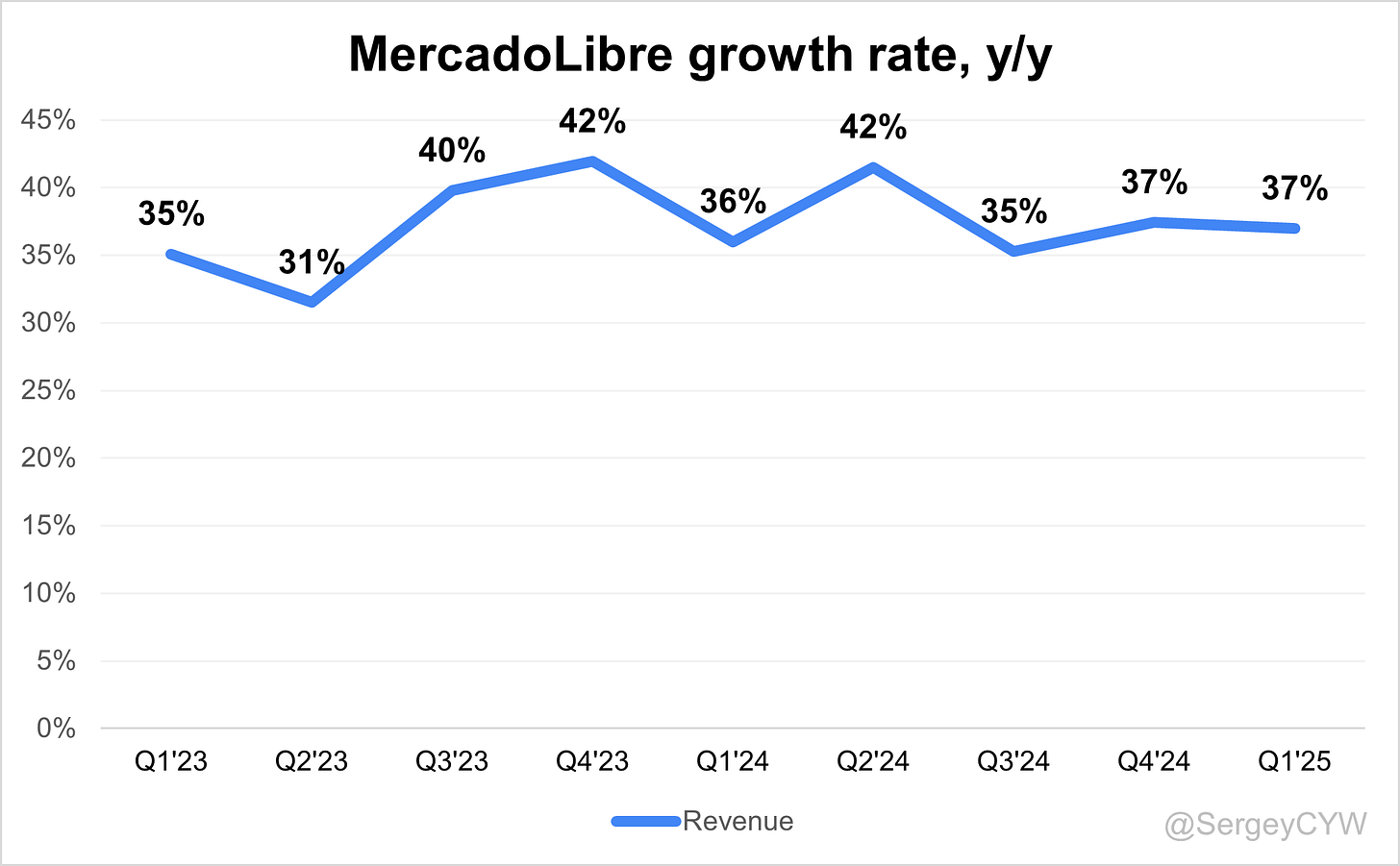

↗️$5,935M rev (+37.0% YoY, +37.4% LQ) beat est by 7.8%

↘️GM (46.7%, -0.1 PPs YoY)🟡

↗️Operating Margin (12.9%, +0.7 PPs YoY)

↘️FCF Margin (12.8%, -18.7 PPs YoY)🟡

↗️Net Margin (8.3%, +0.4 PPs YoY)

↗️EPS $9.74 beat est by 25.5%

Revenue By Segment

Commerce

➡️$3,303M Commerce Revenue (+32.3% YoY, +57.4% FX-Neutral)

➡️$13,330M GMV (+17.3% YoY, +40.3% FX-Neutral)

↘️492M Successful Items Sold (+27.8% YoY, -33)🔴

↘️67M Unique Marketplace Buyers ( +24.5% YoY, -1)

↗️Commerce Take Rate (24.8%, +0.4 PPs QoQ,+2.8 PPs YoY)🟢

Fintech

↗️$2,632M Fintech Revenue (+43.3% YoY, +73.3% FX-Neutral)

↗️$58,303M TPV (+43.2% YoY, +72.4% FX-Neutral)

↗️$3,344M Total Payment Transactions (+38.3% YoY)

➡️64.3M Fintech Monthly Active Users (+31.2% YoY, +3.1)

↗️Fintech Take Rate (4.5%, +0.3 PPs QoQ,+0.0 PPs YoY)🟢

Credit Portfolio

↗️$7,780M Credit Portfolio (+74.9% YoY)

↗️Credits NPL 15-90 (8.2%, +0.8 PPs QoQ)🟡

↗️Credits NPL >90 (18.0%, +0.5 PPs QoQ)🟡

↗️Credits NPL >15 (26.2%, +1.3 PPs QoQ)🟡

↘️NIMAL 22.7%, -4.9 PPs QoQ)🟢

Regional Breakdown

↘️Brazil $3,082M rev (+19.9% YoY, 52% of Rev)

↗️Argentina $1,382M rev (+124.7% YoY, 23% of Rev)

↘️Mexico $1,222M rev (+25.8% YoY, 21% of Rev)

↗️Other Countries $249M rev (+41.5% YoY, 4% of Rev)

Operating expenses

↗️S&M+Provision for doubtful accounts/Revenue 20.3% (+0.6 PPs YoY)

↘️R&D/Revenue 9.3% (-1.3 PPs YoY)

↗️G&A/Revenue 4.3% (+0.0 PPs YoY)

Dilution

↘️Basic shares down 0.0% YoY, -0.9 PPs QoQ🟢

↗️Diluted shares down 0.0% YoY, +0.6 PPs QoQ🟢

Key points from Mercado Libre’s First Quarter 2025 Earnings Call:

Financial Performance

MercadoLibre reported a strong Q1 2025 with net revenue up +37% YoY to $5.94B, beating estimates by +7.8%. EPS reached $9.74, exceeding consensus by +25.5%. Operating margin improved +0.7pp YoY to 12.9%, and net margin rose to 8.3%, up +0.4pp.

Despite higher reinvestment in Brazil and Mexico fintech operations, EBIT margin expanded +70bps YoY, driven by scale efficiencies and strong profitability in Argentina. Free cash flow margin declined to 12.8%, down -18.7pp YoY, due to reinvestment.

E-Commerce Growth

Gross Merchandise Volume in Argentina rose +126% YoY, with items sold up +52% YoY, driven by shipping improvements, affordability, and financing. 1P GMV across Latin America increased +100%+ YoY, supported by better selection, pricing, and automated onboarding and pricing tools.

Mexico maintained stable GMV with non-tech categories growing ~30% YoY. Weakness in the tech vertical was addressed with improved pricing tools and rebates. Commerce efficiency improved, contributing to regional margin expansion.

Automation enabled cost-effective scaling of 1P across the region. Consumer electronics led 1P GMV expansion beyond supermarkets. CPG buyers increased repeat purchases across categories, boosting marketplace engagement.

Fintech Expansion

Monthly active users reached 64M, up +30% YoY. Argentina saw the highest engagement and 4x growth in credit portfolio (USD terms). Credit card default rates in Brazil hit record lows due to refined risk models and macro stability.

A UX redesign modernized the app into a specialized digital banking experience. A visual rebrand aligned Mercado Pago with the broader ecosystem.

A new marketing campaign in Brazil included 120% CDI offers, driving product adoption. While credit growth strengthened, NIM compressed, driven by higher credit card mix and safer lending profiles.

Supermarket Growth

Supermarket became the fastest-growing vertical with GMV up +65% YoY. Enhanced navigation, repurchase features, and promotions improved user conversion.

1P penetration increased, providing better supply control, logistics efficiency, and stronger ad monetization. Partnerships with top manufacturers supported retail media expansion. Supermarket engagement drove incremental spend in other categories.

Credit Strategy

Credit card share increased +8pp YoY, and Argentina’s share of the credit book rose with improved repayment performance. NIM declined due to product and risk mix shifts.

AI-driven scoring models segmented users more accurately. Micro card issuance was scaled back in Brazil and Mexico for risk management. Credit cards in Argentina are expected to launch in H2 2025.

Funding structure remained stable via warehouse facilities (JPMorgan, Citi, Goldman Sachs). MELI tactically retained more loans in-house in Brazil for cost optimization.

Advertising

Ad revenue reached a $1B+ run rate, growing ~+50% YoY FX-neutral. Brand and display ads grew +100%+ YoY, driven by broader access and automation tools.

Enhanced analytics and seller targeting improved ROI. Mercado Play on TV launched, expanding inventory beyond the marketplace. Retail media remains in early scaling stages with high growth potential.

Product Innovation

Mercado Pago’s UX transitioned from a super app to a focused banking platform. Tools for automated pricing, onboarding, and campaign creation increased scalability and merchant performance.

Supermarket gained aisle-based browsing and repurchase prompts. In advertising, creative automation and full-funnel analytics drove campaign effectiveness. The ecosystem now emphasizes a win-win experience across touchpoints.

Logistics

New fulfillment center deployment slowed in Q1 due to seasonality, but long-term logistics investments continued. CapEx as a % of revenue remained stable YoY.

Brazil and Mexico expanded infrastructure to support demand. Logistics investments, FX pressure, and fintech scaling impacted margins in those regions.

Merchant Growth

Merchant base expanded with strong automation in onboarding, pricing, and operations. FMCG category growth and a broader SKU base contributed to marketplace depth.

Argentina saw high merchant efficiency; Mexico showed resilience despite tech category softness. Supermarket innovations supported merchant success.

Enterprise Growth

Enterprise sellers gained access to brand and display ad tools, previously limited to top advertisers. Display and brand ads grew +100%+ YoY.

1P supermarket expansion enabled direct partnerships with top CPGs, increasing ad revenue and fulfillment consistency. Cross-border logistics from Texas to Argentina launched after regulatory reform, enhancing U.S.-to-LatAm commerce.

Competition

New entrants like TikTok Shop in Mexico/Brazil and Temu/Amazon in Argentina are gaining traction. Management views them as accelerators of digital adoption.

MELI responded with cross-border logistics from its Texas hub to Argentina, leveraging its existing infrastructure to protect share.

Argentina

A key driver of Q1. Contribution margin expanded +11pp YoY. Share of total revenue increased from 14% to 34%.

Macro stability improved (lower inflation and interest rates). Fintech assets under management grew +69% YoY, and installment adoption rose as rates declined.

Mexico

Mexico added +25% YoY in unique buyers. Non-tech marketplace segments remained strong. Fintech adoption accelerated through yielding accounts and credit card products.

Management sees Mexico following Brazil’s digital finance curve, with positive NPS and strong MAU momentum.

Challenges

NIM compression from credit mix and lower spreads in upmarket lending. Margin pressure in Brazil and Mexico from logistics scaling, credit card growth, and FX devaluation.

Mexico's tech vertical softness required targeted price and inventory actions. Tariff shifts introduced market-by-market uncertainty.

Outlook

Management reiterated its “Grow-fit” focus—balancing growth and profitability. With only 15% of LatAm retail online, e-commerce penetration remains low.

2025 focus areas include expanding fintech products, increasing 1P in Supermarket, growing ad revenue through full-funnel solutions, and scaling logistics infrastructure.

Argentina credit card launch is planned for H2 2025, building on Brazil and Mexico experience.

Management comments on the earnings call.

Product Innovations

Ariel Szarfsztejn, Commerce President

"We are doing automatic onboarding, automatic buying, automatic pricing and that's all contributing for us to get better economics and simultaneously continue to grow."

Osvaldo Gimenez, Fintech President

"We have also updated Mercado Pago's UX, evolving the in-app experience from something that resembled a super app to a look and feel that brings a more specialized banking experience. We're raising the bar so that all of the products we offer are displayed and can be navigated in the simplest way possible."

E-Commerce Growth

Ariel Szarfsztejn, Commerce President

"In Q1, we grew +65% YoY in Supermarket. That’s faster than any other category in our marketplace and sequentially accelerated. It’s the result of an improved value proposition across the board."

"1P had a tremendous Q1 with GMV growth evolving over +100% YoY with strong performance across markets and categories. That’s the consequence of continuing to improve selection and price competitiveness."

Fintech Expansion

Osvaldo Gimenez, Fintech President

"Our aim is to transform people's relationships with financial services so that as many people as possible have access to products such as the yielding account, credit, investments, insurance, and much more."

"Part of the value proposition is that we are the account that pays the most in Brazil. We are making sure that continues to be the case. There are limits to that... but it is working nicely."

Credit Portfolio & Credit Strategy

Osvaldo Gimenez, Fintech President

"We have not seen any deterioration in our portfolio. Both on the consumer side and on the merchant side, we continue to be very profitable and NPLs continue to be very healthy."

"In Argentina, delinquencies are the lowest. People really use Mercado Pago pretty much every day, so they tend to pay us back quickly because we are in many cases their primary account."

"And we would expect the credit card in Argentina to be interesting. Obviously, we will be cautious as we adapt the models to the local country, but we expect to start issuing cards in the second half of the year."

Advertising Momentum

Ariel Szarfsztejn, Commerce President

"We had a great quarter in brand ads. Although coming from a low base, we have seen positive acceleration coming from the extension of the product to sellers."

"Display grew this quarter above +100% YoY, similarly to brand ads... and also coming from new features in the product like automatic generation of creativity for campaigns, better analytics, etc."

"We remain optimistic. We already have a business that is the size of $1 billion in revenue per year, but we think we are just getting started."

Competitors

Ariel Szarfsztejn, Commerce President

"When there's a new entrant in the e-commerce space, particularly when they come with a different playbook, they tend to bring new users who used to shop offline into the online world—and that creates another opportunity for us."

"On TikTok, I think it’s still early days. We are paranoid, so we follow them closely... but there’s not much to be shared yet."

International Growth

Ariel Szarfsztejn, Commerce President

"Three weeks after the government opened their regulatory framework [in Argentina], we were live with our drop shipping from the U.S. into Argentina. Now we are live with shipping items from our Texas inventory."

Osvaldo Gimenez, Fintech President

"We think that what we saw happen in Brazil over the last 10 years in terms of increased use of financial services—that is happening in Mexico right now, and we want to seize that opportunity."

Challenges

Martin de los Santos, CFO

"Margins compressed ~5pp in both Mexico and Brazil compared to last year. The main reasons were credit card scaling, logistics infrastructure expansion, and FX devaluation."

Jonathan Szwarcman, Head of Credit

"As we are moving up market in both consumer and merchant lending, it impacts yield and bad debt. It’s safer with less default, but it comes with lower spreads."

Future Outlook

Martin de los Santos, CFO

"We don't manage the business to a short-term margin goal. What we want to make sure is that we do not miss the large opportunity of growth that we have ahead of us in commerce and fintech."

"We will continue to invest behind those opportunities, even if it might make some short-term pressure on margins... because opportunity continues to be enormous in Latin America."

Ariel Szarfsztejn, Commerce President

"The launch of Mercado Play on TV is another exciting step in expanding our inventory beyond the marketplace. It will definitely play a key role in our strategy in the long term."

Thoughts on Mercado Libre Earnings Report $MELI:

🟢 Positive

Revenue rose to $5.94B, up +37% YoY, beating by +7.8%

EPS reached $9.74, exceeding estimates by +25.5%

Fintech revenue grew to $2.63B, up +43.3% YoY, with TPV at $58.3B, up +43.2% YoY

Argentina revenue surged +124.7% YoY, now 23% of total revenue

Commerce take rate increased to 24.8%, up +2.8pp YoY

Fintech MAUs reached 64.3M, up +31.2% YoY

Ad revenue run rate exceeded $1B, with +100%+ YoY growth in brand/display ads

Supermarket GMV grew +65% YoY, fastest among all categories

1P GMV across LatAm grew +100%+ YoY

Mexico unique buyers increased +25% YoY

Dilution minimal, with basic shares flat YoY and down -0.9pp QoQ

Operating margin rose to 12.9%, up +0.7pp YoY

Net margin increased to 8.3%, up +0.4pp YoY

Fintech take rate stable at 4.5%, up +0.3pp QoQ

🟡 Neutral

R&D/Revenue decreased to 9.3%, down -1.3pp YoY

G&A/Revenue flat at 4.3%

Credit portfolio expanded to $7.78B, up +74.9% YoY

NPL 15–90 at 8.2%, NPL >90 at 18.0%, slight QoQ increases

NIMAL declined to 22.7%, down -4.9pp QoQ, due to credit mix

Brazil revenue growth slowed to +19.9% YoY

GMV in Commerce grew +17.3% YoY

Successful items sold down by 33M QoQ, +27.8% YoY growth

Marketplace buyers declined by 1M QoQ, though +24.5% YoY

🔴 Negative

Free cash flow margin dropped to 12.8%, down -18.7pp YoY

Margin pressure in Brazil and Mexico from FX, credit scaling, and logistics expansion

NIM compression from higher credit card mix and lower-spread lending

Mexico tech vertical underperformed, requiring pricing and inventory corrections

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.